|

市场调查报告书

商品编码

1842444

农业抗菌药物:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Agricultural Antibacterials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

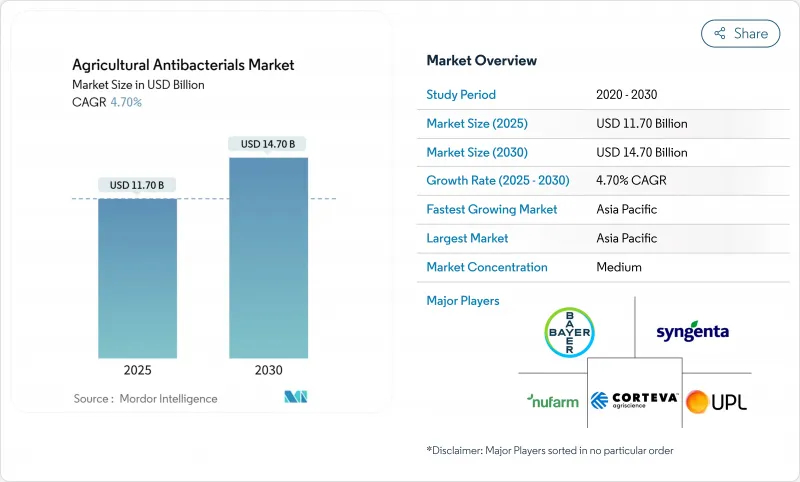

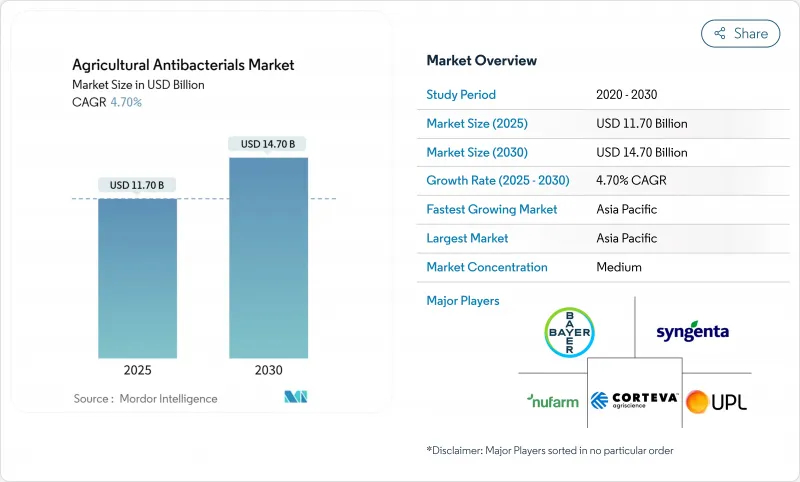

预计农业抗菌药物市场规模到2025年将达到117亿美元,到2030年将达到147亿美元,复合年增长率为4.70%。

市场成长的驱动力包括气候相关细菌病害压力的增加、保护性作物种植的增加以及奈米铜和生物杀菌剂的技术进步。虽然铜基产品继续占据市场主导地位,但监管要求和零售商的永续性需求正在加速采用针对特定宿主的生物解决方案和精准施用系统。虽然亚太地区仍然是主要需求地区,但北美和欧洲正在建立法律规范和技术标准,这些标准将决定2030年的市场发展。领先的供应商正在策略性地将其产品组合多元化,转向生物和数位解决方案,透过物联网支援的施用时机、噬菌体商业化以及以较低施用量提供最佳功效的奈米分散製剂来创造市场机会。

全球农业抗菌药物市场趋势与洞察

粮食供应压力飙升

全球粮食安全要求在2050年将粮食产量提高50%,但细菌性病原体目前每年造成超过600亿美元的作物损失。亚太地区的农业生产者正在实施系统性的抗菌项目,其中中国到2025年每年的农药消费量将维持在24万至25万吨,其中包括超过9万吨的生物製药。出口导向的水果和蔬菜种植者严格遵守零残留农药要求,并持续需求优质的抗菌解决方案,以确保最佳的作物产量和市场准入。

扩大作物保护面积

北美和欧洲的温室和隧道栽培每年的增长率为8-12%,导致植物座舱罩茂密,温度和湿度适合细菌生长。据通报,荷兰和加拿大的番茄和黄瓜种植设施中,抗菌剂的使用频率比露天栽培高出20%。为此,供应商正致力于开发奈米分散剂和低植物毒性配方,以保护水耕栽培中的养分循环。

植物病原菌抗生素抗药性不断增强

梨火疫病菌和黄单胞菌菌株会在五到七个生长季内对链霉素产生抗药性。抗药性问题在苹果和柑橘等多年生作物中尤为严重,因为这些作物的细菌种群会在整个生长季节持续存在,并透过水平转移积累抗药性基因。果园必须轮换使用多种活性成分,并实施昂贵的监测系统,这会导致投入成本增加25%到40%。噬菌体混合物和铜锌杂交剂提供了替代解决方案,但这些方案的采用需要操作员训练和专门的应用设备。

报告中分析的其他驱动因素和限制因素

- 气候相关细菌发生率上升

- 数位疾病预测和物联网感测器的快速普及

- 监管要求趋紧使新抗生素註册面临风险

細項分析

在农业抗菌剂市场,铜化合物将在2024年占据销售额的61%,显示市场对成熟的多位点化学製程的持续依赖。受农业对降低剂量和残留量的需求推动,奈米铜分散体和铜/锌混合剂的复合年增长率为13.6%。生物製药虽然市占率较小,但占据了生物农药市场的74%,并维持着强劲的成长率。欧盟计划于2025年逐步淘汰铜,这对主导的铜市场构成了重大风险,并可能加速向噬菌体和合成胜肽的转变。

由于抗药性需要多重突变同时发生,多位点方法仍然可行。然而,对环境累积和零售政策的担忧挑战了其未来的永续性。二硫代氨基甲酸和酰胺用于铜导致植物毒性的特殊应用,而传统抗生素则因抗菌素抗药性政策而逐渐衰退。奈米级递送系统可以在金属含量减少40-60%的情况下实现类似的田间性能,为生物替代品完全商业化之前提供过渡解决方案。

2024年,多位点细胞壁破坏剂将在农业抗菌市场中维持43%的主导地位。奈米颗粒载体系统增强的氧化压力诱导剂的年增长率为11.1%,这得益于测试数据,这些试验数据表明其能够改善病灶控制并降低植物毒性。蛋白质合成抑制剂,尤其是用于果园的抑制剂,由于担心抗药性菌的产生以及其与人类健康应用中通用的机制,面临监管限制。 DNA/RNA抑制剂在观赏性温室应用中价格昂贵,因为这些应用需要係统活性来满足美观要求,但其有限的核准用途限制了其在农业领域的广泛应用。

这种机制分布反映了市场向广谱频谱的转变,这种製剂避免了新型单靶点抗生素冗长的註册过程,能够在满足环保要求的同时对抗抗药性。产品类型正在从传统的铜基产品扩展到氧化奈米製剂和生物製药,用于多种作物的综合病害防治。

区域分析

预计到2024年,亚太地区将占据农业抗菌药物市场份额的33%,到2030年,复合年增长率将达到8.2%。由于绿色发展政策,中国的农药总消费量仍维持在25万吨,其中生物製药消费量达9万吨。印度的农药市场正在復苏,政府主导将有机农业覆盖面积扩大到2,600万公顷。该地区潮湿的热带气候导致水稻和柑橘类作物持续遭受细菌性病害,因此需要全年喷洒农药。日本和澳洲专注于出口高价值生鲜食品,并已推出奈米铜分散剂,以符合国际残留量要求。

在技术进步的推动下,北美市场依然成熟。在美国和加拿大,保护性种植实践正在稳步发展,这增加了对封闭系统中输注抗菌剂的需求。美国对农业抗生素的评估正在推动基于噬菌体的替代品和数位辅助系统的开发,同时也带来了市场不确定性。墨西哥继续扩大其蔬菜出口,但为了遵守美国的进口法规,仍保持较高的杀菌剂使用量。

欧洲面临监管挑战:《欧洲绿色交易》要求2030年化学农药使用量减少50%。随着2025年铜法规到期,种植者正在转向微生物替代品,研究重点是合成胜肽和基于RNA的杀菌剂。德国、法国和西班牙在生物农药应用方面处于领先地位,而中欧和东欧的种植者正在评估奈米铜溶液,以在过渡期内保持药效。英国将制定简化的新型生物製药核准,以在环境保护和作物安全之间取得平衡,同时维持欧盟监管的完整性。俄罗斯正在扩大其粮食种植面积,需要高效率的铜产品。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 粮食供应压力飙升

- 扩大保护地作物种植面积

- 气候相关细菌发生率上升

- 数位疾病预测和物联网感测器的快速普及

- 噬菌体产品的商业化

- 循环无肥栽培系统的发展

- 市场限制

- 植物病原菌抗生素抗药性不断增强

- 监管要求的提高使新抗生素面临註册风险

- 生物消毒剂的保存期限短且需要低温运输

- ESG和重金属杀菌剂零售商的下市

- 监管状况

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测(价值,美元)

- 依产品类型

- 铜基

- 二硫代氨基甲酸

- 酰胺

- 奈米铜和混合铜/锌

- 抗生素

- 生物製药

- 其他合成类型

- 按作用机制

- 多位点细胞壁破坏剂

- 蛋白质合成抑制剂

- 氧化压力诱导剂

- DNA/RNA合成抑制剂

- 按剂型

- 液体悬浮液

- 液体分散颗粒剂(WDG)

- 可湿性粉剂

- 奈米分散和封装

- 采用喷涂法

- 叶面喷布

- 种子/植物处理

- 土壤注射

- 供水系统和滴灌注入

- 按作物类型

- 粮食

- 油籽和豆类

- 水果和蔬菜

- 经济作物

- 温室作物

- 草坪和观赏作物

- 按分销管道

- 直接从製造商

- 农业零售/合作社

- 线上和电子商务平台

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- Nufarm

- Sumitomo Chemical Co., Ltd.

- AMVAC Chemical Corporation

- UPL

- Albaugh LLC

- Gowan Company, LLC

- Certis Biologicals(A Subsidiary of Mitsui & Co., Ltd.)

- Koppert

- BioWorks Inc.(Biobest)

- BioSafe Systems, LLC

- Phagelux AgriHealth, Inc

- Parijat Industries(India)Pvt. Ltd.

第七章 市场机会与未来展望

The agricultural antibacterials market size is valued at USD 11.70 billion in 2025 and is projected to reach USD 14.70 billion by 2030, registering a CAGR of 4.70%.

The market expansion is attributed to intensifying climate-related bacterial disease pressure, increased protected-crop cultivation, and technological advancements in nano-copper and biological bactericides. Although copper-based products maintain market dominance, regulatory requirements and retailer sustainability mandates are accelerating the adoption of host-specific biological solutions and precision application systems. The Asia-Pacific region remains the primary demand center, while North America and Europe establish regulatory frameworks and technological standards that will influence market development through 2030. Key suppliers are strategically diversifying their portfolios toward biological and digital solutions, generating market opportunities through IoT-enabled application timing, bacteriophage commercialization, and nano-dispersion formulations that deliver optimal efficacy at reduced application rates.

Global Agricultural Antibacterials Market Trends and Insights

Surging Food-Supply Pressure

Global food security requirements necessitate a 50% increase in food production by 2050, while bacterial pathogens currently generate annual crop losses exceeding USD 60 billion. Agricultural producers in the Asia-Pacific region implement systematic antibacterial programs, with China maintaining pesticide consumption at 240,000-250,000 metric tons annually through 2025, including over 90,000 metric tons of biologicals. Export-oriented fruit and vegetable producers comply with stringent zero-tolerance residue requirements, sustaining demand for premium antibacterial solutions that ensure optimal crop yields and market accessibility.

Expansion of Protected-Crop Acreage

Greenhouse and tunnel operations in North America and Europe experience 8-12% annual growth, resulting in dense plant canopies with temperature-humidity profiles conducive to bacterial growth.Tomato and cucumber facilities in the Netherlands and Canada report 20% higher antibacterial application frequencies compared to open-field operations. This increase drives demand for water-system compatible formulations. In response, suppliers focus on developing nano-dispersions and low-phytotoxic formulations to protect recirculating hydroponic nutrient streams.

Escalating Antibiotic Resistance in Plant-Pathogenic Bacteria

Erwinia amylovora and Xanthomonas strains develop resistance to streptomycin treatments within five to seven seasons. The resistance issue is particularly severe in perennial crops such as apples and citrus, where bacterial populations persist across growing seasons and accumulate resistance genes through horizontal transfer. Orchards face 25-40% higher input costs as growers must rotate multiple active ingredients and implement costly monitoring systems. While phage blends and copper-zinc hybrids offer alternative solutions, their adoption requires operator training and specialized spray equipment.

Other drivers and restraints analyzed in the detailed report include:

- Climate-Linked Rise in Bacterial Incidence

- Rapid Uptake of Digital Disease Forecast and IoT Sensor

- Tightening Regulatory Requirements Create Registration Risk for New Antibiotics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Copper compounds generated 61% of 2024 revenue in the agricultural antibacterial market, demonstrating the continued reliance on established multi-site chemistry. Nano-copper dispersions and hybrid Cu/Zn blends are experiencing growth at a 13.6% CAGR, driven by agricultural demands for reduced dosage and residue levels. While biologicals represent a smaller market share, they account for 74% of the biopesticide segment and maintain strong growth rates. The European Union's planned copper phase-out in 2025 presents a significant risk to the dominant copper segment and may accelerate the transition to bacteriophages and synthetic peptides.

The multi-site approach remains effective as bacterial resistance requires multiple simultaneous mutations. However, environmental accumulation concerns and retail policies challenge its future sustainability. Dithiocarbamates and amides serve specific applications where copper causes plant toxicity, while traditional antibiotics decline due to antimicrobial resistance policies. Investment flows toward nano-enabled delivery systems that achieve comparable field performance with 40-60% less metallic content, serving as transitional solutions until biological alternatives reach full commercial development.

Multi-site cell-wall disruptors maintain a dominant 43% share of the 2024 agricultural antibacterials market. Oxidative-stress inducers, enhanced by nano-particle carrier systems, demonstrate an 11.1% annual growth rate, supported by trial data showing improved lesion control and reduced phytotoxicity. Protein-synthesis inhibitors face regulatory restrictions due to resistance development and concerns over shared mechanisms with human health applications, particularly in orchard use. DNA/RNA blockers command higher prices in greenhouse ornamental applications where systemic activity meets aesthetic requirements, though limited approved uses restrict broader agricultural adoption.

The distribution of mechanisms reflects a market shift toward broad-spectrum chemistries that combat resistance while meeting environmental requirements, avoiding lengthy registration processes associated with new single-target antibiotics. Companies are integrating traditional copper-based products with oxidative nano-formulations and biological products to provide comprehensive disease control across multiple crop types.

The Agricultural Antibacterials Market is Segmented by Product Type (Copper-Based, and More), Mode of Action (Protein-Synthesis Inhibitors and More), Formulation Form (Liquid Suspensions and More), Application Method (Foliar Spray and More), Crop Type (Cereals and Grains, and More), Distribution Channel (Manufacturer Direct and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 33% of the agricultural antibacterials market share in 2024 and is projected to grow at an 8.2% CAGR through 2030. China maintains its total pesticide consumption at 250,000 metric tons, with biologicals accounting for 90,000 metric tons due to green-development policies. India's agrochemical market is boosting, with government initiatives targeting 26 million hectares for organic farming. The region's tropical humidity creates persistent bacterial blight in rice and citrus canker, necessitating year-round application programs. Japan and Australia focus on high-value fresh produce exports, implementing nano-copper dispersions to comply with international residue requirements.

North America maintains a mature market with technological advancement. The United States and Canada show steady growth in protected cultivation, increasing the need for drip-injected antibacterials in recirculating systems. EPA evaluations of agricultural antibiotics create market uncertainty while driving development in phage-based alternatives and digital support systems. Mexico continues to expand its vegetable exports, maintaining high bactericide usage to comply with United States import regulations.

Europe faces regulatory challenges with the European Green Deal mandating a 50% reduction in chemical pesticides by 2030. The 2025 copper regulation expiration drives growers toward microbial alternatives, while research focuses on synthetic peptides and RNA-based bactericides. Germany, France, and Spain lead biological adoption, while Central and Eastern European producers evaluate nano-copper solutions to maintain efficacy during transition periods. The United Kingdom maintains EU regulatory alignment while developing streamlined approvals for new biologicals to balance environmental protection with crop security. Russia increases grain production area, requiring efficient copper formulations, though Western supplier access remains limited by geopolitical factors.

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- Nufarm

- Sumitomo Chemical Co., Ltd.

- AMVAC Chemical Corporation

- UPL

- Albaugh LLC

- Gowan Company, L.L.C.

- Certis Biologicals (A Subsidiary of Mitsui & Co., Ltd.)

- Koppert

- BioWorks Inc. (Biobest)

- BioSafe Systems, LLC

- Phagelux AgriHealth, Inc

- Parijat Industries (India) Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Food-Supply Pressure

- 4.2.2 Expansion of Protected-Crop Acreage

- 4.2.3 Climate-Linked Rise in Bacterial Incidence

- 4.2.4 Rapid Uptake of Digital Disease Forecast and IoT Sensor

- 4.2.5 Commercialisation of Bacteriophage-Based Products

- 4.2.6 Growth of Recirculating Soilless Systems

- 4.3 Market Restraints

- 4.3.1 Escalating Antibiotic Resistance in Plant-Pathogenic Bacteria

- 4.3.2 Tightening Regulatory Requirements Creates Registration Risk for New Antibiotics

- 4.3.3 Short Shelf Life and Cold-Chain Requirements for Biological Bactericides

- 4.3.4 ESG and Retailer De-listing of Heavy-Metal Bactericides

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Copper-Based

- 5.1.2 Dithiocarbamates

- 5.1.3 Amides

- 5.1.4 Nano Copper and Hybrid Cu/Zn

- 5.1.5 Antibiotics

- 5.1.6 Biologicals

- 5.1.7 Other Synthetic Types

- 5.2 By Mode of Action

- 5.2.1 Multi-site Cell-wall Disruptors

- 5.2.2 Protein-Synthesis Inhibitors

- 5.2.3 Oxidative Stress Inducers

- 5.2.4 DNA/RNA Synthesis Blockers

- 5.3 By Formulation Form

- 5.3.1 Liquid Suspensions

- 5.3.2 Liquid-Dispersible Granules (WDG)

- 5.3.3 Wettable Powders

- 5.3.4 Nano-dispersions and Encapsulates

- 5.4 By Application Method

- 5.4.1 Foliar Spray

- 5.4.2 Seed/Transplant Treatment

- 5.4.3 Soil Injection

- 5.4.4 Water-System and Drip-Irrigation Injection

- 5.5 By Crop Type

- 5.5.1 Cereals and Grains

- 5.5.2 Oilseeds and Pulses

- 5.5.3 Fruits and Vegetables

- 5.5.4 Commercial Cash Crops

- 5.5.5 Greenhouse Crops

- 5.5.6 Turf and Ornamentals

- 5.6 By Distribution Channel

- 5.6.1 Manufacturer Direct

- 5.6.2 Ag-Retail/Co-ops

- 5.6.3 Online and E-commerce Platforms

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Russia

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 Australia

- 5.7.3.5 New Zealand

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Turkey

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Syngenta AG

- 6.4.3 Corteva Agriscience

- 6.4.4 Nufarm

- 6.4.5 Sumitomo Chemical Co., Ltd.

- 6.4.6 AMVAC Chemical Corporation

- 6.4.7 UPL

- 6.4.8 Albaugh LLC

- 6.4.9 Gowan Company, L.L.C.

- 6.4.10 Certis Biologicals (A Subsidiary of Mitsui & Co., Ltd.)

- 6.4.11 Koppert

- 6.4.12 BioWorks Inc. (Biobest)

- 6.4.13 BioSafe Systems, LLC

- 6.4.14 Phagelux AgriHealth, Inc

- 6.4.15 Parijat Industries (India) Pvt. Ltd.