|

市场调查报告书

商品编码

1842465

挤压涂布:市场份额分析、行业趋势、统计数据和成长预测(2025-2030)Extrusion Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

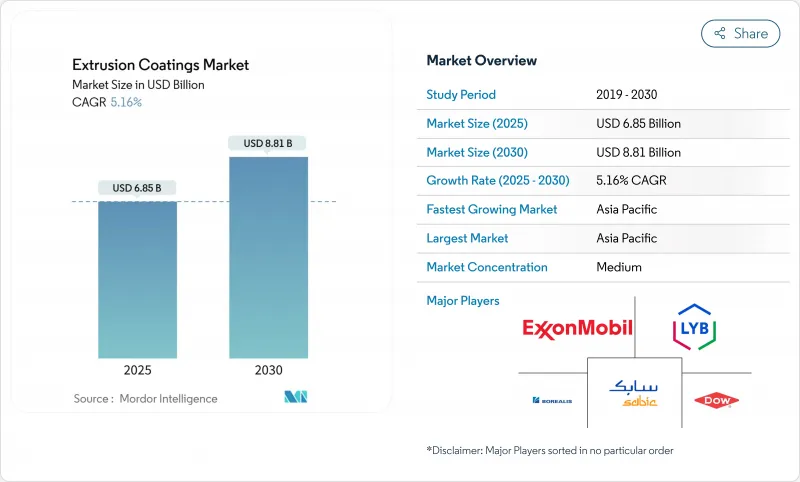

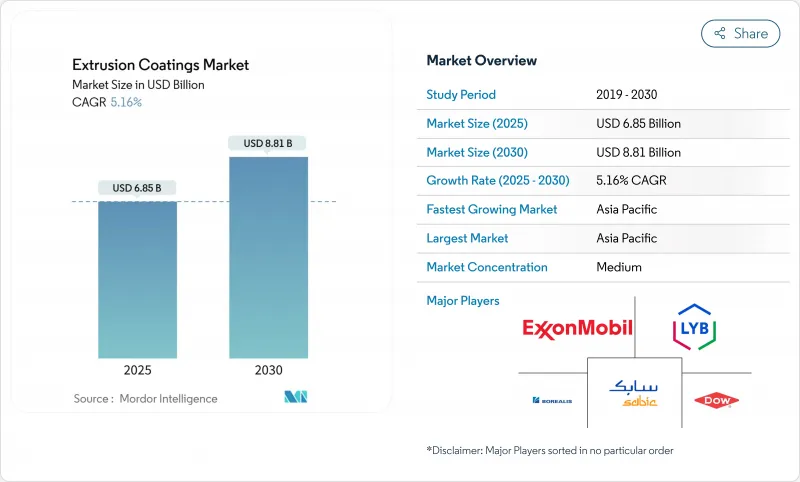

挤压涂布市场预计在 2025 年达到 68.5 亿美元,在 2030 年达到 88.1 亿美元,预测期内复合年增长率为 5.16%。

目前的需求基础是由流质食品、电商邮寄袋和无菌药品包装等应用中对阻隔性增强聚合物的快速应用所驱动。从欧盟包装废弃物法规到各国对再生材料含量的强制要求,一系列监管利好正在加速向单一材料结构的转变,而亚太地区稳步推进的都市化则推动着终端市场销售的成长。儘管聚烯原料价格波动和该行业的碳足迹仍然是不利因素,但对生物基树脂和先进机械回收的持续投资正在缓解这些风险。市场领导正在透过垂直整合、长期供应协议以及在商业规模上检验可回收涂层结构的中试生产线来应对成本压力。

全球挤压涂布市场趋势与洞察

液体和软质食品包装的需求不断增长

到2024年,流质食品纸盒和轻质袋将占据挤压涂布市场的48.95%。新兴经济体低温运输基础设施有限,以及品牌商对耐储存包装的偏好,将进一步提升此市场占有率。 2024年即将推出的新型生物质基LDPE和EVA将减少20%的化石原料用量,同时维持与传统材料相当的阻隔性能。包装加工商正在利用这些树脂来减少层压板厚度和物流重量,同时又不牺牲热封的完整性。随着植物来源乳製品替代品的上市,预计亚洲和拉丁美洲的销售量将稳定成长。

电子商务保护性包装需求激增

履约中心需要能够承受自动成型、高速密封和最后一英里处理的涂层。茂金属催化聚乙烯具备这些工作流程所需的透明度、滑爽性和抗穿刺性,因此品牌拥有者要求薄膜的可回收率达到30-50%,同时也要满足ASTM运输跌落测试的要求。虽然该领域缺乏全球产量数据,订单订单显示,从2023年起,其产量将实现两位数成长,证实了电子商务将成为挤压涂布市场参与企业强劲的需求来源。

聚烯原料价格上涨

2024年第一季季至第四季度,中国聚烯平均合约价格波动超过120美元/吨,挤压了加工商的利润,并导致采购转向现货采购。虽然一体化製造商能够透过内部乙烯供应来缓解波动,但规模较小的涂料公司正面临营运资金压力,并可能推迟新生产线的投资。虽然远期合约和策略性储备可以部分缓解这种影响,但原材料的不确定性仍然是挤压涂布市场短期内的限制因素。

其他驱动因素和限制因素分析

- 扩大无菌医疗和药品包装

- 可回收的单一材料结构

- 加强碳足迹监管

細項分析

到 2024 年,聚乙烯将占据挤压涂布市场份额的 42.65%,继续支援大容量液体和软包装。茂金属催化剂的进步提高了韧性和光学性能,而化学回收计划有望提供可扩展的再生原料。一条商业生产线目前每年供应 3 万吨,目标是到 2026 年每年供应 50 万吨。乙酸乙酯的复合年增长率为 5.78%,凭藉其优异的附着力和低温柔韧性,在医疗和特殊食品领域占有一席之地。将 EVA 与 LDPE 混合还可实现与机械回收流相容的单一材料层压结构。聚丙烯、PET 和特殊丙烯酸酯满足耐久性、阻隔性和耐高温要求,但仅占体积的次要地位。持续的树脂创新凸显了为什么挤压涂布涂层市场即使在循环经济要求下也能保持多样化的聚合物品种。

第二波成长明显体现在工程共混物上,这些共混物可以降低密封起始温度,减少能耗,并适应基于乙二醇的生技药品灭菌循环。这些改进正在推高加工商的转换成本,并巩固聚乙烯作为挤压涂布行业首选树脂的地位。相较之下,EVA产量的不断增长正在推动亚太地区供应商之间的后向整合,以确保VA含量的一致性和食品接触合规性。

到 2024 年,纸板和瓦楞纸板将占挤压涂布市场规模的 52.58%,这反映了其在无菌纸盒和外带食品服务中的根深蒂固的地位。 2025 年推出的特殊生物聚合物添加剂可在保持耐油性的同时将刨槽量降低高达 50%,帮助品牌所有者实现其纤维回收目标。聚合物薄膜的复合年增长率为 6.50%,将受益于高速生产线、减薄厚度以及整理收缩膜和邮寄膜等应用的扩展。流延 PP 薄膜正在加速渗透到干粮和个人护理包装中,因为它具有与 BO-PP 薄膜相当的透明度和製袋效率,但成本却降低了高达 15%。儘管面临可回收性挑战,金属箔对于对湿气敏感的药品包装仍然不可或缺。特种纤维和不织布填补了耐化学腐蚀的工业空白,但其应用受到成本和製程复杂性的限制。

最初为薄膜开发的无溶剂底漆正在重新配方以适用于纸板,为加工商提供了一套通用基材平台的通用套件。在挤压涂布市场必须同时兼顾阻隔性能、可回收性和成本控制的当下,这种融合凸显了基材弹性的策略价值。

区域分析

受树脂产能扩张和可支配收入成长的推动,到2024年,亚太地区将占据全球挤压涂布市场的57.19%,到2030年,复合年增长率将达到6.25%。中国持续的聚合物自给自足策略以及印度870亿美元的石化产业将提供充足的原料,而快速的都市化正在加速包装食品和电子商务的普及。沙乌地基础工业公司(SABIC)在福建省的合资乙烯装置计画于2024年动工,到2027年将增强当地的树脂供应。

北美将保持其技术领先地位,利用先进的回收测试和严格的FDA包装标准。陶氏将在2024年底剥离非核心黏合剂资产,以释放资本,扩大循环聚合物的生产以满足未来的需求。欧洲将透过回收和碳排放目标来维持政策影响力,鼓励快速再製造,同时也为合规的阻隔解决方案提供溢价。墨西哥新增产能,例如阿克苏诺贝尔投资360万美元的挤压涂布线,标誌着北美正在重新调整布局,以服务区域加工商。

南美洲、中东及非洲地区实现了稳健成长,基数较低。沙乌地阿拉伯耗资1.5兆美元的基础设施管道将推动对防腐包装材料的需求,预计到2027年海湾合作委员会(GCC)的油漆和涂料行业规模将达到45亿美元。这些地区为寻求多角化发展、突破饱和西方市场的中型企业提供了策略性待开发区机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 液体和软质食品包装的需求不断增长

- 电子商务保护性包装的激增

- 扩大无菌医疗和药品包装

- 可回收的单一材料结构

- 在建筑应用的使用日益增多

- 市场限制

- 聚烯原料价格上涨

- 加强碳足迹监管

- 转向水性屏障

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模与成长预测(美元)

- 按材质

- 聚乙烯

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他聚乙烯(如LLDPE和m-LLDPE)

- 乙酸乙酯(EVA)

- 丙烯酸乙丁酯(EBA)

- 聚丙烯

- 聚对苯二甲酸乙二酯

- 其他成分

- 聚乙烯

- 按基材

- 纸板和硬纸板

- 聚合物薄膜

- 金属箔

- 其他基材(织布、不织布等)

- 按用途

- 液体包装

- 软包装

- 医疗包装

- 个人护理和化妆品包装

- 摄影胶卷

- 工业包装/包装

- 其他用途(防腐蚀等)

- 按最终用户产业

- 饮食

- 医疗保健和製药

- 个人护理和化妆品

- 工业/化工

- 其他终端使用者产业(出版、摄影)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Akzo Nobel NV

- Axalta Coating Systems, LLC

- Borealis AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Davis-Standard

- Dow

- DuPont

- Eastman Chemical Company

- Exxon Mobil Corporation

- LyondellBasell Industries Holdings BV

- Optimum Plastics

- PPG Industries, Inc.

- Qenos Pty Ltd

- SABIC

- SCG Chemicals Public Company Limited

- The Lubrizol Corporation

- The Sherwin-Williams Company

- Transcendia

- Westlake Corporation

第七章 市场机会与未来展望

The extrusion coatings market stands at USD 6.85 billion in 2025 and is projected to reach USD 8.81 billion by 2030, registering a 5.16% CAGR over the forecast period.

Rapid uptake of barrier-enhanced polymers in liquid food formats, e-commerce mailers, and sterile pharmaceutical packs anchors the current demand base. Regulatory tailwinds-from the European Union's Packaging and Packaging Waste Regulation to national recycled-content mandates-are accelerating shifts toward mono-material structures, while steady urbanization in Asia-Pacific expands end-market volumes. Volatility in polyolefin feedstock pricing and the sector's carbon footprint remain headwinds, yet sustained investments in bio-based resins and advanced mechanical recycling temper these risks. Market leaders are countering cost pressure through vertical integration, long-term supply contracts, and pilot lines that validate recyclable coating architectures at commercial scale.

Global Extrusion Coatings Market Trends and Insights

Growing Demand for Liquid & Flexible Food Packaging

Liquid food cartons and lightweight pouches capture 48.95% of the extrusion coatings market in 2024, a share reinforced by limited cold-chain infrastructure in emerging economies and brand owner preference for shelf-stable formats. New biomass-derived LDPE and EVA grades launched in 2024 match incumbent barrier performance yet cut fossil feedstock by 20%. Packaging converters are leveraging these resins to downgauge laminate thickness and reduce logistics weight without sacrificing heat-seal integrity. Combined with plant-based dairy alternatives gaining shelf space, the outlook affirms steady volume gains across Asia and Latin America.

Surge in E-commerce Protective Packaging Volumes

Fulfilment centers require coating layers that withstand automated forming, high-speed sealing and last-mile handling. Metallocene-catalyzed PE delivers the clarity, slip, and puncture resistance needed for this workflow, prompting brand owners to specify films with 30-50% recycled content that still meet ASTM shipping drop tests. Although the sector lacks definitive global volume data, converter order books reveal double-digit growth since 2023, confirming e-commerce as a resilient demand pillar for extrusion coatings market participants.

High Polyolefin Feedstock Price Volatility

Average PE contract prices in China swung by more than USD 120/ton between Q1 and Q4 2024, compressing converter margins and triggering procurement shifts toward spot purchases. Integrated producers buffer volatility through internal ethylene supply, yet small and midsized coaters face working-capital stress, occasionally delaying new line investments. While futures contracts and strategic stockpiling offer partial relief, raw-material uncertainty remains a near-term drag on the extrusion coatings market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Sterile Medical & Pharma Packaging

- Recyclable Mono-material Structures Adoption

- Increasing Carbon-Footprint Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene captured 42.65% of the extrusion coatings market share in 2024 and continues to anchor high-volume liquid and flexible packaging. Advancements in metallocene catalysis lift toughness and optics, while chemical-recycling initiatives promise circular feedstock at scale; one commercial line already delivers 30,000 t/y and targets 500,000 t/y by 2026. Ethyl vinyl acetate, expanding at 5.78% CAGR, secures medical and specialty food niches due to superior adhesion and low-temperature flexibility. Blending EVA with LDPE also enables mono-material laminate architectures that fit mechanical recycling streams. Polypropylene, PET, and specialty acrylates fill durability, high-barrier, or high-heat slots but remain secondary volume contributors. Continuous resin innovation underscores why the extrusion coatings market maintains a diversified polymer slate even as circular-economy mandates tighten.

A second wave of growth is evident in engineered blends that lower seal initiation temperature, cut energy use, and meet glycol-based sterilization cycles for biologics. These functional enhancements raise switching costs for converters, cementing polyethylene's role as the workhorse resin within the broader extrusion coatings industry. By contrast, EVA's rising volume encourages backward-integration moves among Asia-Pacific suppliers keen to ensure consistent VA content and food-contact compliance.

Paperboard and cardboard accounted for 52.58% of the extrusion coatings market size in 2024, reflecting their entrenched role in aseptic cartons and take-out foodservice. Specialty biopolymer additives launched in 2025 allow downgauging up to 50% while maintaining grease resistance, helping brand owners align with fibre-recycling goals. Polymer films, growing at 6.50% CAGR, benefit from high line speeds, downgauged thickness, and expanding applications in collation shrink and mailer films. Cast PP variants now match BO-PP clarity and bag-making efficiency yet cost up to 15% less, accelerating their penetration into dry food and personal-care wraps. Metal foils remain indispensable for moisture-critical pharma packs despite recyclability challenges. Specialty fabrics and non-wovens fill chemical-resistant industrial slots, but their adoption is tempered by cost and process complexity.

Technological cross-pollination is notable: solvent-less primer chemistries originally developed for film lines are being re-formulated for paperboard, giving converters a common toolkit across substrate platforms. This convergence emphasizes the strategic value substrate agility provides in an era where the extrusion coatings market must balance barrier performance, recyclability, and cost discipline simultaneously.

The Extrusion Coatings Market Report Segments the Industry by Material (Polyethylene, Ethyl Vinyl Acetate (EVA), and More), Substrate (Paperboard and Cardboard, Polymer Films, and More), Application (Liquid Packaging, Flexible Packaging, and More), End-User Industry (Food and Beverage, Healthcare and Pharma, and More) and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 57.19% of the extrusion coatings market size in 2024 and is poised to compound at 6.25% CAGR through 2030 on the back of large-scale resin expansion and rising disposable incomes. China's sustained polymer self-sufficiency strategy and India's USD 87 billion petrochemical build-out furnish abundant raw materials, while rapid urbanization intensifies packaged-food and e-commerce penetration. SABIC's joint venture ethylene unit in Fujian, breaking ground in 2024, reinforces localized resin supply circa 2027.

North America leverages advanced recycling pilots and stringent FDA packaging norms to sustain technology leadership. Dow's divestment of non-core adhesive assets in late 2024 frees capital for circular-polymer scale-ups aimed at future demand. Europe maintains policy influence via recycling and carbon targets that compel rapid reformulation but also unleash premium pricing for compliant barrier solutions. Capacity additions in Mexico-such as AkzoNobel's USD 3.6 million extrusion-coatings line-signal North American realignment to serve regional converters.

South America, the Middle East, and Africa expand from a lower base yet post robust gains. Saudi Arabia's USD 1.5 trillion infrastructure pipeline lifts demand for corrosion-resistant wraps, while the GCC paints and coatings sector is projected to reach USD 4.5 billion by 2027. These regions offer strategic greenfield opportunities for mid-tier players aiming to diversify beyond saturated Western markets.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- Borealis AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Davis-Standard

- Dow

- DuPont

- Eastman Chemical Company

- Exxon Mobil Corporation

- LyondellBasell Industries Holdings B.V.

- Optimum Plastics

- PPG Industries, Inc.

- Qenos Pty Ltd

- SABIC

- SCG Chemicals Public Company Limited

- The Lubrizol Corporation

- The Sherwin-Williams Company

- Transcendia

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for liquid & flexible food packaging

- 4.2.2 Surge in e-commerce protective packaging volumes

- 4.2.3 Expansion of sterile medical & pharma packaging

- 4.2.4 Recyclable mono-material structures adoption

- 4.2.5 Increasing usage in construction applications

- 4.3 Market Restraints

- 4.3.1 High polyolefin feedstock price volatility

- 4.3.2 Increasing carbon-footprint regulations

- 4.3.3 Shift toward water-based barrier alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (USD)

- 5.1 By Material

- 5.1.1 Polyethylene

- 5.1.1.1 Low Density Polyethylene (LDPE)

- 5.1.1.2 High Density Polyethylene (HDPE)

- 5.1.1.3 Other Polyethylenes (LLDPE & m-LLDPE, etc.)

- 5.1.2 Ethyl Vinyl Acetate (EVA)

- 5.1.3 Ethyl Butyl Acrylate (EBA)

- 5.1.4 Polypropylene

- 5.1.5 Polyethylene Terephthalate

- 5.1.6 Other Materials

- 5.1.1 Polyethylene

- 5.2 By Substrate

- 5.2.1 Paperboard and Cardboard

- 5.2.2 Polymer Films

- 5.2.3 Metal Foils

- 5.2.4 Other Substrates (Woven Fabrics and Non-wovens, etc.)

- 5.3 By Application

- 5.3.1 Liquid Packaging

- 5.3.2 Flexible Packaging

- 5.3.3 Medical Packaging

- 5.3.4 Personal-Care and Cosmetics Packaging

- 5.3.5 Photographic Film

- 5.3.6 Industrial Packaging/Wrapping

- 5.3.7 Other Applications (Corrosion Protection, etc.)

- 5.4 By End-User Industry

- 5.4.1 Food and Beverage

- 5.4.2 Healthcare and Pharma

- 5.4.3 Personal-Care and Cosmetics

- 5.4.4 Industrial and Chemical

- 5.4.5 Other End-User Industries (Publishing, Photographic)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 Borealis AG

- 6.4.4 Celanese Corporation

- 6.4.5 Chevron Phillips Chemical Company LLC

- 6.4.6 Davis-Standard

- 6.4.7 Dow

- 6.4.8 DuPont

- 6.4.9 Eastman Chemical Company

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Optimum Plastics

- 6.4.13 PPG Industries, Inc.

- 6.4.14 Qenos Pty Ltd

- 6.4.15 SABIC

- 6.4.16 SCG Chemicals Public Company Limited

- 6.4.17 The Lubrizol Corporation

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 Transcendia

- 6.4.20 Westlake Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Development of Bio-based Polymers as Raw Material