|

市场调查报告书

商品编码

1842475

雷射二极体:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Laser Diode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

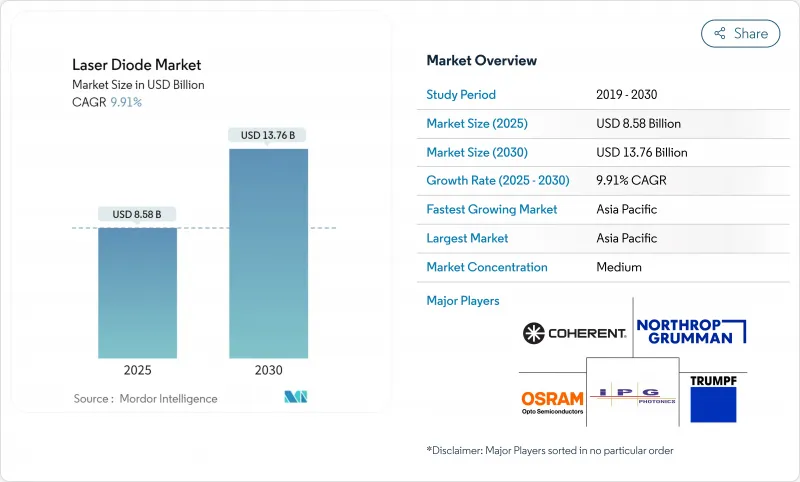

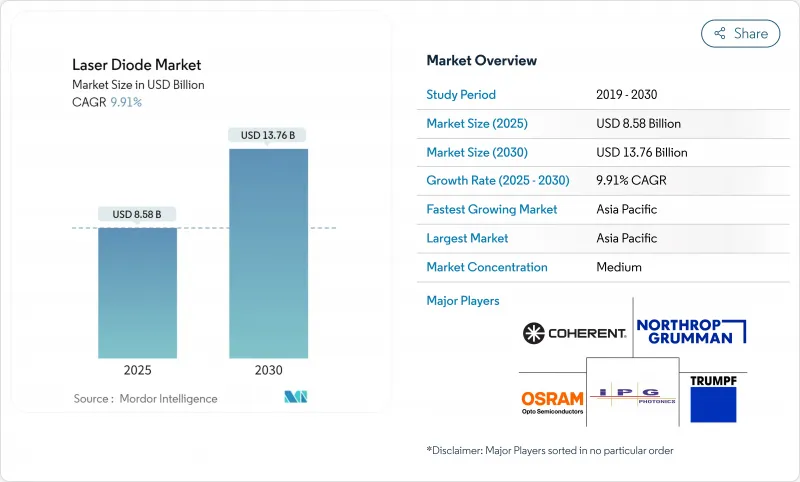

预计 2025 年雷射二极体市场价值将达到 85.8 亿美元,到 2030 年将成长至 137.6 亿美元,复合年增长率为 9.91%。

光纤通讯、汽车雷射雷达和高精度工业加工的持续需求正在推动这一扩张。结构性利好因素包括从基于灯泡的光源向高效半导体发射器的过渡、5G 和未来 6G 网路的部署,以及设备架构效率的持续提升。雷射二极体市场正转向特定应用的设计,例如用于汽车雷射雷达的 905nm 脉衝光源和用于智慧型手机 3D 感测的 VCSEL 阵列。

全球雷射二极体市场趋势与洞察

3D感测与Face-ID在智慧型手机的普及

智慧型手机製造商正在嵌入多结垂直腔面发射雷射 (VCSEL) 阵列,以支援脸部认证、手势控制和空间映射。实验室的垂直腔面发射雷射 (VCSEL) 已实现创纪录的 74% 电光转换效率,从而降低了热量和电池需求,并实现了更纤薄的行动装置设计。中国大陆、韩国和台湾的晶圆代工厂正在扩展 6 吋化合物半导体晶圆,并将背面照明和驱动 IC 整合在同一基板上。光学元件供应商正在竞相添加偏振控制和晶圆上测试功能,以提高产量比率并降低成本。

利用 1550 nm DFB 雷射快速部署 FTTH 网络

欧洲通讯业者正在将光纤延伸至服务不足的农村地区,并选择窄线宽 1550nm DFB 发射器来实现远距传输。最近的原型已实现 50kHz 线宽和 150mW 输出功率,从而实现无再生跨度,从而减少了对远端办公室设备的需求。我们在蝶形封装内内部整合了热电冷却器,从而提供了温度稳定性,使分波多工系统保持较低的位元错误率。

温度控管挑战限制 CW 功率扩展至 20W 以下

空间不均匀的热路径会升高结温,并限制电光转换效率。氧化物限制条带结构目前已实现 77.8% 的峰值效率,但装置製造商仍在降低其性能以延长使用寿命。新型钻石散热器和微通道冷却器有望进一步提升效率,但成本和封装复杂性正在减缓其应用。

細項分析

预计边缘发射装置将占2024年销售额的42%,并有望成为电信、工业和医疗领域的关键参与者。高亮度元件可达到28W的连续输出功率,得益于氧化物限制条带稳定电流,效率超过70%。每瓦成本正在下降,扩大了其在精密焊接和聚合物固化领域的应用。 VCSEL的复合年增长率为14.4%,将受益于晶圆测试,这将降低智慧型手机和汽车驾驶员监控模组的单位成本。多结VCSEL的效率超过74%,满足了行动OEM厂商的电池续航力目标。

随着航太和分析领域采用窄线宽变化,边发射雷射二极体设计的市场规模预计将进一步扩大,而一旦 200 毫米 GaAs 晶圆线投入量产,VCSEL 雷射二极体在消费、工业和汽车深度感测应用中的市场份额将会上升。

红外线光源(700-1600 nm)将占2024年收入的54%,这得益于5G回程传输和相干光链路中已部署的成熟应用。电信供应商青睐1310 nm和1550 nm分散式回馈晶片,因为它们的衰减比石英光纤更低。蓝波段雷射二极体市场将以12.3%的复合年增长率快速成长。近期平台已展现出千瓦级445 nm连续波功率和医疗级光束品质。紫外线发射器虽然是利基市场,但在灭菌和微影术领域却收益丰厚。

由于需求的多样性,雷射二极体市场不断客製化外延结构以适应与应用的吸收峰值相匹配的频谱窗口,从而实现更高的材料利用率和产量比率。

区域分析

由于中国、日本和韩国密集的电子供应链,亚太地区将占2024年销售额的46%。代工厂正在提升6吋GaAs晶圆产能,以支援VCSEL和边缘发射器的量产。各地区政府正在资助5G密集化和早期6G试验,推动1550nm连贯链路的需求。中国2023年对镓和锗的出口限制增加了采购风险,促使日本和韩国企业探索回收和替代化学品。

北美正在利用其国防和资料中心生态系统。 《晶片与科学法案》拨款500亿美元,用于支持国内半导体工厂并缩小供应链风险。加州和密西根州的雷射雷达模组製造商正在与汽车原始设备製造商合作,以缩短认证週期。

欧洲在通讯组件领域仍然至关重要,尤其是用于家用光纤的1550nm DFB发送器。德国研究机构正在与设备供应商合作,实现用于积层製造的数千瓦级蓝光阵列的工业化生产。欧盟在全球半导体产量中所占的7%份额凸显了其对亚洲晶圆製造产量的依赖。

随着海湾国家推进能源营运数位化并部署高容量光纤骨干网,中东和非洲雷射二极体市场预计将以11.2%的复合年增长率成长。当地大学与欧洲研究机构合作建立光电丛集。南美洲正在增加其海底电缆登陆,刺激了对相干转发器的需求,但购买力仍然是一个限制。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 智慧型手机中 3D 感测和 Face-ID 的兴起将推动亚洲 VCSEL 需求

- 利用 1550nm DFB 雷射在欧洲快速部署 FTTH 网络

- 北美汽车光达专案采用905nm脉衝雷射

- 德国和日本在金属增材製造中越来越多地使用高功率二极体雷射器

- 美国和以色列国防资金激增,用于使用二极体泵浦模组的定向能量武器

- 采用蓝绿色GaN雷射的医疗和美容设备的小型化

- 市场限制

- 温度控管挑战限制 CW 功率扩展至 20W 以下

- 供应链对镓和铟的依赖,导致价格波动

- 欧盟眼部暴露安全法规限制消费级产品

- 硅基氮化镓晶圆製造的产量产量比率推高了蓝光雷射的成本

- 生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模及成长预测(金额)

- 按类型

- 边射型雷射极体

- VCSEL

- 量子级联雷射

- DFB和DBR

- 法布里-珀罗雷射二极体

- 按波长

- 红外线(700-1600奈米)

- 红色(630-700奈米)

- 蓝色(400-500奈米)

- 绿色(500-570奈米)

- 紫外线(<400奈米)

- 按输出功率

- 低功率(<1 W)

- 中功率(1-10 W)

- 高功率(>10 W)

- 按运转方式

- 共波(CW)

- 脉衝

- 按包配置

- TO-CAN

- C介面

- HHL 和 Butterfly

- 模组/子系统

- 按最终用户使用

- 通讯和资料通讯

- 工业加工与製造

- 医疗保健和医学

- 车

- 家用电器和显示器

- 国防/安全

- 研究调查机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 其他亚太地区

- 南美洲

- 巴西

- 南美洲其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Coherent Corp.

- Lumentum Holdings Inc.

- Nichia Corporation

- TRUMPF SE+Co KG

- OSRAM Opto Semiconductors GmbH

- IPG Photonics Corp.

- Hamamatsu Photonics KK

- Sharp Corp.

- Sumitomo Electric Industries Ltd.

- Sony Corp.

- Mitsubishi Electric Corp.

- Ushio Inc.

- II-VI Inc.(now Coherent)

- Jenoptik AG

- Thorlabs Inc.

- Frankfurt Laser Co.

- OSI Laser Diode Inc.

- Lasea SA

- Newport Corp.

- Rohm Semiconductor

第七章 市场机会与未来展望

The laser diode market is valued at USD 8.58 billion in 2025 and is forecast to rise to USD 13.76 billion by 2030, reflecting a 9.91% CAGR.

Sustained demand from fiber-optic communications, automotive LiDAR, and high-precision industrial processing is steering this expansion. Structural tailwinds include the migration from lamp-based light sources toward efficient semiconductor emitters, the rollout of 5G and future 6G networks, and continuous efficiency gains in device architecture. Manufacturers are accelerating vertical integration to secure gallium and indium supplies,while breakthroughs in quantum cascade lasers (QCLs) have pushed room-temperature power-conversion efficiency past 20%.The laser diode market is shifting toward application-specific designs such as 905 nm pulsed sources for automotive LiDAR and VCSEL arrays for 3D sensing in smartphones.

Global Laser Diode Market Trends and Insights

Proliferation of 3D sensing and Face-ID in smartphones

Smartphone producers are embedding multi-junction VCSEL arrays to support facial authentication, gesture control, and spatial mapping. A record 74% power-conversion efficiency in laboratory VCSELs reduces heat and battery demand, allowing thinner handset designs. Foundries in China, South Korea, and Taiwan are scaling 6-inch compound-semiconductor wafers that integrate back-side illumination and driver ICs on the same substrate. Optical component suppliers are racing to add polarization control and on-wafer testing to boost yields and cut costs.

Rapid deployment of FTTH networks leveraging 1550 nm DFB lasers

European carriers are extending fiber to underserved suburbs, selecting narrow-linewidth 1550 nm DFB emitters for long-haul reach. Recent prototypes achieve 50 kHz linewidths and 150 mW output, enabling unregenerated spans that trim remote-office equipment needs.In-house integration of thermoelectric coolers inside butterfly packages provides temperature stability that keeps bit-error rates low in dense-wavelength-division multiplexing systems.

Thermal management challenges limiting CW scaling > 20 W

Spatially non-uniform heat paths raise junction temperatures, capping wall-plug efficiency. Oxidation-confinement stripe structures now deliver 77.8% peak efficiency, but device makers still derate to extend lifetime.Novel diamond heat-spreaders and micro-channel coolers promise further gains, though cost and packaging complexity slow adoption.

Other drivers and restraints analyzed in the detailed report include:

- Automotive LiDAR programs adopting 905 nm pulsed lasers

- Rising use of high-power diode lasers in metal additive manufacturing

- Supply-chain dependency on gallium and indium causing price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Edge-emitting devices accounted for 42% of 2024 revenue, confirming their status as the workhorse across telecom, industrial, and medical arenas. High-brightness variants now reach >70 % efficiency at 28 W continuous power, aided by oxidation-confinement stripes that stabilize current flow. Falling cost per watt broadens uptake into precision welding and polymer curing. VCSELs, posting a 14.4% CAGR outlook, benefit from on-wafer testing that drives down unit cost for smartphone and in-cabin driver-monitoring modules. Multi-junction VCSELs have exceeded 74 % efficiency, aligning mobile OEM goals for battery autonomy.

The laser diode market size for edge-emitting designs is projected to widen further as aerospace and analytics adopt narrow-linewidth variants. Meanwhile, the laser diode market share for VCSELs will climb in consumer, industrial, and vehicular depth-sensing once 200 mm GaAs wafer lines reach volume production.

Infrared sources (700-1600 nm) captured 54% of 2024 revenue, supported by entrenched deployment in 5G backhaul and coherent optical links. Telecom vendors favor 1310 nm and 1550 nm distributed-feedback chips for their low attenuation over silica fiber. The laser diode market size in the blue band will grow fastest at a 12.3% CAGR, propelled by copper and aluminum processing in e-mobility supply chains. Recent platforms demonstrate kilowatt-class 445 nm CW power with medical-grade beam quality. Ultraviolet emitters, though niche, gain revenue in sterilization and micro-lithography.

Demand heterogeneity ensures that the laser diode market continues tailoring epitaxial structures to spectral windows that match application absorption peaks, enabling higher material utilization and yield.

The Laser Diode Market Report is Segmented by Type (Edge-Emitting Laser Diodes, VCSEL, and More), Wavelength (Infrared, Red, Blue, Green, and More), Output Power (Low Power, Mid Power, High Power), Operating Mode (Continuous-Wave, and Pulsed), Packaging Configuration (TO-CAN, C-Mount, and More), End-User Application (Telecommunications and Datacom, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 46% of 2024 revenue due to dense electronics supply chains across China, Japan, and South Korea. Contract fabs push capacity for 6-inch GaAs wafers, supporting high-volume VCSEL and edge-emitter runs. Regional governments fund 5G densification and early 6G pilots, expanding demand for 1550 nm coherent links. Export curbs on gallium and germanium introduced by China in 2023 raised sourcing risk, prompting Japanese and Korean firms to explore recycling and alternative chemistries.

North America leverages its defense and data-center ecosystem. The CHIPS and Science Act allocates USD 50 billion to shore up domestic semiconductor fabs, narrowing supply-chain exposure. LiDAR module makers in California and Michigan co-locate with automotive OEMs, shortening qualification cycles.

Europe remains pivotal for telecom components, especially 1550 nm DFB emitters used in fiber-to-the-home rollouts. German institutes collaborate with tool vendors to industrialize blue multi-kW arrays for additive manufacturing. The European Union's 7% share of global semiconductor output underscores its dependence on Asian wafer processing publications..

The Middle East and Africa laser diode market is projected to grow 11.2% CAGR as Gulf states digitize energy operations and roll out high-capacity optical backbones. Local universities partner with European labs to establish photonics clusters. South America increases submarine-cable landings, stimulating coherent transponder demand, though purchasing power remains a constraint.

- Coherent Corp.

- Lumentum Holdings Inc.

- Nichia Corporation

- TRUMPF SE + Co KG

- OSRAM Opto Semiconductors GmbH

- IPG Photonics Corp.

- Hamamatsu Photonics K.K.

- Sharp Corp.

- Sumitomo Electric Industries Ltd.

- Sony Corp.

- Mitsubishi Electric Corp.

- Ushio Inc.

- II-VI Inc. (now Coherent)

- Jenoptik AG

- Thorlabs Inc.

- Frankfurt Laser Co.

- OSI Laser Diode Inc.

- Lasea SA

- Newport Corp.

- Rohm Semiconductor

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of 3D Sensing and Face-ID in Smartphones propelling VCSEL demand in Asia

- 4.2.2 Rapid Deployment of FTTH Networks leveraging 1550 nm DFB Lasers in Europe

- 4.2.3 Automotive LiDAR programs adopting 905 nm Pulsed Lasers across North America

- 4.2.4 Rising Use of High-Power Diode Lasers in Metal Additive Manufacturing in Germany and Japan

- 4.2.5 Defense Funding Surge for Directed-Energy Weapons utilizing Diode Pumped Modules in United States and Israel

- 4.2.6 Miniaturization of Medical Aesthetic Devices integrating Blue-Green GaN Lasers

- 4.3 Market Restraints

- 4.3.1 Thermal Management Challenges limiting CW scaling >20 W

- 4.3.2 Supply-chain Dependency on Gallium and Indium causing price volatility

- 4.3.3 Safety Regulations on eye exposure restricting consumer-grade power in EU

- 4.3.4 Yield variability in GaN-on-Si wafer fabrication raising costs for Blu-ray lasers

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Edge-Emitting Laser Diodes

- 5.1.2 VCSEL

- 5.1.3 Quantum Cascade Lasers

- 5.1.4 DFB and DBR

- 5.1.5 Fabry-Perot Laser Diodes

- 5.2 By Wavelength

- 5.2.1 Infrared (700-1600 nm)

- 5.2.2 Red (630-700 nm)

- 5.2.3 Blue (400-500 nm)

- 5.2.4 Green (500-570 nm)

- 5.2.5 Ultraviolet (<400 nm)

- 5.3 By Output Power

- 5.3.1 Low Power (<1 W)

- 5.3.2 Mid Power (1-10 W)

- 5.3.3 High Power (>10 W)

- 5.4 By Operating Mode

- 5.4.1 Continuous-Wave (CW)

- 5.4.2 Pulsed

- 5.5 By Packaging Configuration

- 5.5.1 TO-CAN

- 5.5.2 C-Mount

- 5.5.3 HHL and Butterfly

- 5.5.4 Module/Sub-system

- 5.6 By End-User Application

- 5.6.1 Telecommunications and Datacom

- 5.6.2 Industrial Processing and Manufacturing

- 5.6.3 Healthcare and Medical

- 5.6.4 Automotive

- 5.6.5 Consumer Electronics and Display

- 5.6.6 Defense and Security

- 5.6.7 Research and Academia

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Coherent Corp.

- 6.4.2 Lumentum Holdings Inc.

- 6.4.3 Nichia Corporation

- 6.4.4 TRUMPF SE + Co KG

- 6.4.5 OSRAM Opto Semiconductors GmbH

- 6.4.6 IPG Photonics Corp.

- 6.4.7 Hamamatsu Photonics K.K.

- 6.4.8 Sharp Corp.

- 6.4.9 Sumitomo Electric Industries Ltd.

- 6.4.10 Sony Corp.

- 6.4.11 Mitsubishi Electric Corp.

- 6.4.12 Ushio Inc.

- 6.4.13 II-VI Inc. (now Coherent)

- 6.4.14 Jenoptik AG

- 6.4.15 Thorlabs Inc.

- 6.4.16 Frankfurt Laser Co.

- 6.4.17 OSI Laser Diode Inc.

- 6.4.18 Lasea SA

- 6.4.19 Newport Corp.

- 6.4.20 Rohm Semiconductor

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment