|

市场调查报告书

商品编码

1842477

汽车电动驱动桥:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Electric Drive Axle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

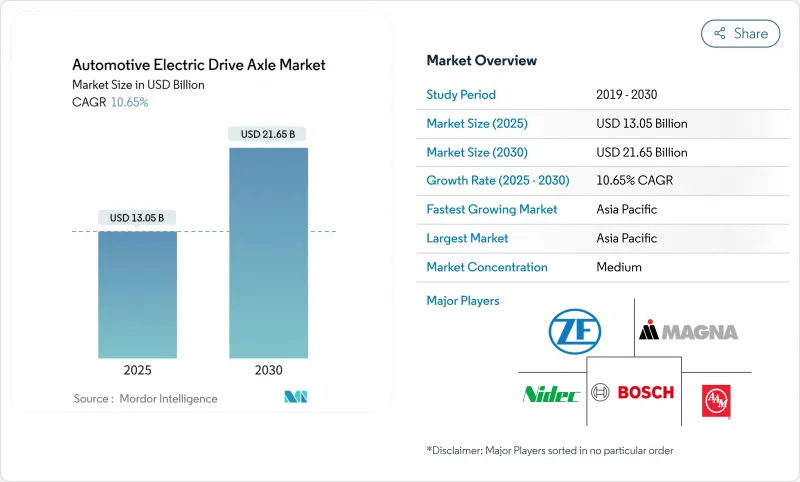

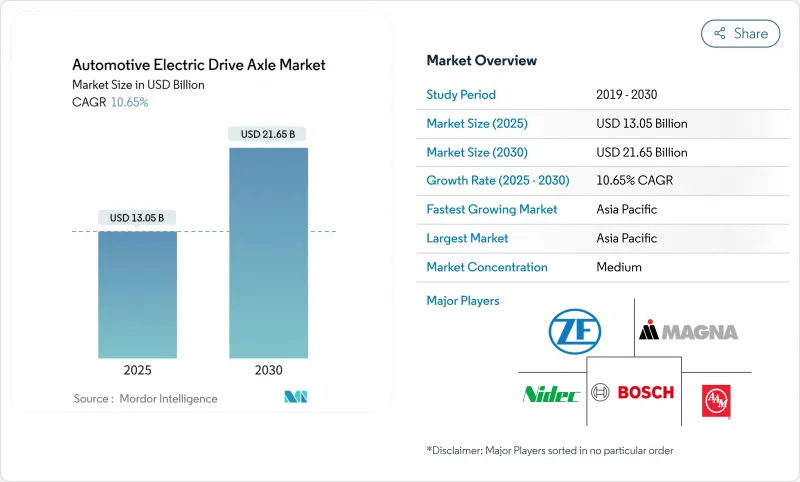

预计汽车电动驱动桥市场规模到 2025 年将达到 130.5 亿美元,到 2030 年将达到 216.5 亿美元,复合年增长率为 10.65%。

向零排放出行的加速转型、强制性的车辆二氧化碳排放目标以及电池成本的加速下降,推动了电力驱动桥供应商销售的稳定成长。 800V 系统的兴起、整合式四合一解决方案以及亚太地区製造业务的扩张,正在压缩成本曲线并扩大潜在需求。竞争优势取决于整合温度控管技术、稀土元素磁铁替代品以及软体定义扭力向量控制功能的能力。在用车辆改装套件、SUV 和皮卡的高利润双电机布局以及政府对国产动力传动系统产品的补贴,正在为汽车电驱动桥市场创造新的收益来源。

全球汽车电动驱动桥市场趋势与洞察

原始设备製造商的电气化蓝图将推动电子轴的需求

全球汽车製造商制定的多年期生产目标使一级供应商能够清楚地了解订单量,促使其在专用电力驱动桥生产线和本地采购方面进行大量资本投资。 BMW为 Neue Klasse 车型配备的第六代 eDrive 系统将传动系统效率提高了 20%,同时支援轿车、SUV 和紧凑型跨界车的后轮和全轮驱动配置。采埃孚 (ZF) 已订单310 亿欧元的高压电动车订单,这表明锁定的蓝图可以转化为供应商具有约束力的银行合约。

政府零排放强制规定和购买激励措施

具有约束力的销售配额和严厉的违规处罚,正在将电动车的采用从一项自由裁量权选择转变为一项监管强制要求。英国的零排放汽车(ZEV)规定从2024年电动车销量占比22%开始生效,到2035年将上升至100%,每辆不合规车辆将被处以1.5万英镑的罚款,这远远超过了动力传动系统的成本溢价。加州的「先进清洁汽车II」法规要求,到2035年,轻型汽车的销售将实现100%零排放,到2036年,中型和重型汽车将全面实现零排放转换,无论短期燃料价格如何波动,都将增强电动车的需求。

稀土磁铁价格波动

钕和镝价格的剧烈波动正在侵蚀利润的可预测性,并促使製造商转向替代磁铁化学成分和励磁技术。日产汽车公司的目标是透过改用钐铁磁体,降低马达成本30%,从而减少对单一地区集中供应链的依赖。通用电气航空航太公司的23kW两相磁铁马达在提高功率密度的同时,无需使用镝,这证明了从稀土材料过渡到新材料时,性能的妥协已不再是不可避免的。

报告中分析的其他驱动因素和限制因素

- 电池组成本低于 80 美元/千瓦时,使电子轴更加经济实惠

- 纯电动SUV和皮卡销量激增

- 与传统传动系统的初始成本差异

細項分析

预计电池电动车桥将主导汽车电动驱动桥市场,到2024年将占销售量的74.05%。大规模生产、快速充电桩部署以及有利于零废气排放的政策支撑了这一领先地位。混合动力电动车桥解决了过渡工作週期问题,而燃料电池车桥虽然仍处于起步阶段,但在重型卡车和公车的试点支持下,预计复合年增长率将达到11.24%。燃料电池平台汽车电动驱动桥的市场规模预计将随着氢能基础设施的建设而扩大,这主要得益于Symbio为8级卡车开发的400kW StackPack等计划。加州对公车部署的支持,证实了其在远距运输领域的潜力。

原始设备製造商对燃料电池增程器和国家氢能策略的兴趣日益浓厚,这意味着动力传动系统的多样性将随着时间的推移而提升。能够提供模组化外壳以容纳电池电堆和燃料电池堆的供应商,可以在车队营运商试用这两种技术的同时规避其产量风险。

三合一单元(集马达、齿轮和逆变器于一体)仍占据42.85%的市场份额,在目前冷却范围内实现了经济高效的封装。然而,热感询价(RFQ)越来越青睐整合热迴路的四合一布局,推动该细分市场的复合年增长率达到11.50%。随着宽能带隙半导体降低散热并实现更小的冷却迴路,采用四合一设计的汽车电驱动桥市场规模预计将进一步扩大。舍弗勒的解决方案将所有元件整合到一个70公斤的模组中,适用于紧凑型C级车。

对于需要持续功率负载的高性能电动车,热复杂性仍然是采用的障碍,供应商投资相变材料和分环架构以在不增加品质的情况下延长峰值功率窗口。

区域分析

亚太地区是汽车电驱动桥市场的重心,预计2024年将占全球电动车总销量的45.11%,复合年增长率达12.33%。到2024年,中国将生产全球70%以上的电动车,这将为本土电力驱动桥製造商带来无与伦比的规模优势。国家补贴、国内电池材料开采以及严格的配额目标,使工厂使用率。汇丰银行预测,2030年,该地区将占新电动车销量的60%以上。日本的第一线企业正在迅速转型:日本电产正在优化紧凑型电动机,以用于低成本超紧凑型电动车,而中端供应商则正在集中研发力量,以填补技术空白。

北美正围绕着电动皮卡和政策主导的在地采购规则蓬勃发展。 《通膨削减法案》将消费者回馈与本地采购的动力传动系统挂钩,并引导对车桥组装的新投资。博格华纳报告称,2025年第一季其电子产品销量较去年同期成长47%,反映出美国OEM工厂的强劲推出。美国车桥公司(American Axle)的e-Beam系统瞄准了这波卡车浪潮,其输出为150千瓦,适用于非承载式车身平台。

在严格的车辆二氧化碳排放法规的支持下,欧洲在高端电动车工程领域保持领先地位。 2024年,欧洲电动车销售目标将达到22%,到2035年达到100%。儘管宏观经济环境疲软,车桥需求仍保持稳定。采埃孚(ZF)正与依维柯巴士(IVECO BUS)合作开发整合式传动系统解决方案,同时吸引富士康(Foxconn)参与其数位底盘系统业务。寻求延长德国高速公路续航里程的品牌正在透过温度控管创新和800V电压的采用来提升竞标。同时,预计到2035年,新兴东协市场的电动车复合年增长率将达到16%至39%,但资金筹措和充电基础设施必须成熟,大规模车桥组装才能向南转移。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 原始设备製造商电气化蓝图推动电动轴需求

- 政府零排放强制措施和购买奖励

- 电池组成本降至 80 美元/度以下,使电力驱动桥更经济实惠

- 纯电动SUV和皮卡上市数量激增

- 向 800V 架构过渡需要下一代车轴设计

- 利用电子轴资讯服务实现软体定义扭力向量控制的收益

- 市场限制

- 稀土磁铁价格波动

- 与传统传动系统相比的领先成本差异

- 由于 OEM内部资源,一级市场萎缩

- 四合一整合层级的温度控管限制

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测:价值(美元)

- 依推进类型

- 电池电动车轴

- 油电混合车桥

- 燃料电池电动车轴

- 按集成级别

- 二合一(马达、齿轮)

- 三合一(马达、齿轮、逆变器)

- 四合一(马达、齿轮、逆变器、热感)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 非公路/特殊(建筑/农业)

- 按销售管道

- OEM 适配

- 售后改装套件

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Magna International Inc.

- Nidec Corporation

- American Axle & Manufacturing

- Dana Inc.

- GKN Automotive

- Schaeffler AG

- BorgWarner Inc.

- Aisin Corporation

- Cummins Inc.

- Valeo SA

- Hitachi Astemo

- BYD Co. Ltd.

- Hyundai Mobis

第七章 市场机会与未来展望

The automotive electric drive axle market size is valued at USD 13.05 billion in 2025 and is forecast to reach USD 21.65 billion by 2030, advancing at a 10.65% CAGR.

The accelerating move to zero-emission mobility, mandated fleet CO2 targets, and faster battery cost declines are anchoring steady volume visibility for e-axle suppliers. Model launches built on 800 V systems, the rise of integrated 4-in-1 solutions, and expanded production footprints in Asia-Pacific are compressing cost curves and widening addressable demand. Competitive positioning now hinges on thermal-management know-how, rare-earth magnet alternatives, and the ability to package software-defined torque-vectoring features. Conversion kits for in-service vehicles, higher-margin dual-motor layouts for SUVs and pickups, and public subsidies for domestic drivetrain content are opening additional revenue pools across the automotive electric drive axle market.

Global Automotive Electric Drive Axle Market Trends and Insights

OEM Electrification Road-maps Accelerate E-axle Demand

Firm multi-year production targets from global automakers are giving Tier-1 suppliers unusually clear visibility into order volumes, encouraging larger capital outlays for dedicated e-axle lines and localized component sourcing. BMW's sixth-generation eDrive for the Neue Klasse raises drivetrain efficiency by 20% while supporting both rear- and all-wheel layouts across sedans, SUVs, and compact crossovers. ZF has already booked EUR 31 billion in high-voltage e-mobility orders, demonstrating how locked-in road maps convert directly into binding, bankable contracts for suppliers.

Government Zero-emission Mandates and Purchase Incentives

Binding sales quotas and steep non-compliance penalties are turning e-axle adoption from a discretionary choice into a regulatory requirement. The UK ZEV mandate starts with 22% electric sales in 2024 and climbs to 100% by 2035, backed by GBP 15,000 fines per non-compliant vehicle that materially exceed drivetrain cost premiums. California's Advanced Clean Cars II rule compels 100% zero-emission light-duty sales by 2035 and full medium- and heavy-duty fleet conversion by 2036, cementing demand irrespective of short-term fuel-price swings .

Rare-earth Magnet Price Volatility

Sharp swings in neodymium and dysprosium pricing are eroding margin predictability and pushing manufacturers toward alternative magnet chemistries or excitation technologies. Nissan targets a 30% motor-cost cut by substituting samarium-iron magnets, reducing exposure to supply chains concentrated in one geography. GE Aerospace's 23 kW dual-phase magnetic motor eliminates dysprosium yet improves power density, proving that performance compromises are no longer inevitable when moving away from rare-earth materials .

Other drivers and restraints analyzed in the detailed report include:

- Battery-pack Cost Falls Below USD 80/kWh, Widening E-axle Affordability

- Surge in Battery-electric SUV and Pickup Launches

- Up-front Cost Gap vs. Conventional Drivelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery-electric axles delivered 74.05% of 2024 volumes, underscoring their centrality in the automotive electric drive axle market. Mass-production scale, rapid charger rollouts, and policy preference for zero-tailpipe emissions anchor this lead. Hybrid e-axles address transitional duty cycles, while fuel-cell axles, though nascent, are pacing at an 11.24% CAGR on the back of heavy-duty truck pilots and bus trials. The automotive electric drive axle market size for fuel-cell platforms is projected to rise alongside hydrogen infrastructure, aided by projects such as Symbio's 400 kW StackPack for Class 8 trucks. California's support for bus deployments validates long-haul promise.

Growing OEM interest in fuel-cell range extenders and national hydrogen strategies suggests a gradual broadening of powertrain diversity. Suppliers that can tailor modular housings to either battery-electric or fuel-cell stacks will hedge volume risk as fleet operators experiment with both technologies.

A 42.85% share still resides with 3-in-1 units that merge motor, gear, and inverter, offering cost-effective packaging within current cooling envelopes. Yet customer RFQs now favor 4-in-1 layouts that also integrate thermal loops, lifting that segment at an 11.50% CAGR. The automotive electric drive axle market size attached to 4-in-1 designs is forecast to compound as wide-bandgap semiconductors reduce heat rejection and enable smaller cooling circuits. Schaeffler's solution combines all elements into a 70 kg module that fits compact C-segment vehicles.

Thermal complexity still caps adoption in high-performance EVs where sustained power loads demand separate chillers. Suppliers are investing in phase-change materials and split-loop architectures to extend peak-power windows without raising mass.

The Automotive Electric Drive Axle Market Report is Segmented by Propulsion Type (Battery-Electric Axle, Hybrid Axle, and More), Integration Level (2-In-1 (Motor, and Gear), 3-In-1 (Motor, Gear, and Inverter), and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM-Fitted and Aftermarket Retrofit Kits), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 45.11% of 2024 revenue and is expanding at a 12.33% CAGR, making it the gravitational center of the automotive electric drive axle market. China produced more than 70% of global EVs in 2024, giving local e-axle makers unmatched scale advantages. State subsidies, domestic mining of battery materials, and aggressive quota targets sustain high plant-utilization rates. HSBC forecasts the region will represent over 60% of new EV sales by 2030. Japanese Tier-1s are pivoting quickly: Nidec is optimizing smaller e-motors tailored to low-cost micro EVs, while midsize suppliers are pooling R&D to close technology gaps.

North America is building momentum around electric pickups and policy-driven local content rules. The Inflation Reduction Act ties consumer rebates to regionally sourced drivetrains, steering fresh investment into axle assembly lines. BorgWarner reported a 47% year-on-year rise in e-product sales for Q1 2025, reflecting strong ramp-ups at US OEM plants. American Axle's e-Beam targets this truck wave with 150 kW output for body-on-frame platforms.

Europe maintains a lead in premium EV engineering underpinned by stringent fleet CO2 rules. The 22% electric sales mandate in 2024, moving to 100% by 2035, ensures steady axle demand despite a softer macro backdrop. ZF is partnering with IVECO BUS for integrated driveline solutions while courting Foxconn for digital chassis systems. Thermal-management innovation and 800 V adoption shape tenders as brands strive for extended range on high-speed German motorways. Meanwhile, emerging ASEAN markets eye a 16-39% EV CAGR through 2035, though financing and charging infrastructure must mature before large-scale axle assembly shifts south.

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Magna International Inc.

- Nidec Corporation

- American Axle & Manufacturing

- Dana Inc.

- GKN Automotive

- Schaeffler AG

- BorgWarner Inc.

- Aisin Corporation

- Cummins Inc.

- Valeo SA

- Hitachi Astemo

- BYD Co. Ltd.

- Hyundai Mobis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OEM electrification road-maps accelerate e-axle demand

- 4.2.2 Government zero-emission mandates and purchase incentives

- 4.2.3 Battery-pack cost falls below USD 80/kWh, widening e-axle affordability

- 4.2.4 Surge in battery-electric SUV and pickup launches

- 4.2.5 Shift to 800 V architectures requiring next-gen axle designs

- 4.2.6 Monetization of software-defined torque-vectoring via e-axle data services

- 4.3 Market Restraints

- 4.3.1 Rare-earth magnet price volatility

- 4.3.2 Up-front cost gap vs. conventional drivelines

- 4.3.3 OEM insourcing squeezing Tier-1 addressable market

- 4.3.4 Thermal-management limits at 4-in-1 integration level

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Propulsion Type

- 5.1.1 Battery-Electric Axle

- 5.1.2 Hybrid Axle

- 5.1.3 Fuel-Cell Electric Axle

- 5.2 By Integration Level

- 5.2.1 2-in-1 (Motor, and Gear)

- 5.2.2 3-in-1 (Motor, Gear, and Inverter)

- 5.2.3 4-in-1 (Motor, Gear, Inverter, and Thermal)

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Off-Highway and Specialty (Construction and Agriculture)

- 5.4 By Sales Channel

- 5.4.1 OEM-Fitted

- 5.4.2 Aftermarket Retrofit Kits

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 ZF Friedrichshafen AG

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Magna International Inc.

- 6.4.4 Nidec Corporation

- 6.4.5 American Axle & Manufacturing

- 6.4.6 Dana Inc.

- 6.4.7 GKN Automotive

- 6.4.8 Schaeffler AG

- 6.4.9 BorgWarner Inc.

- 6.4.10 Aisin Corporation

- 6.4.11 Cummins Inc.

- 6.4.12 Valeo SA

- 6.4.13 Hitachi Astemo

- 6.4.14 BYD Co. Ltd.

- 6.4.15 Hyundai Mobis

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment