|

市场调查报告书

商品编码

1842518

拉床:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Broaching Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

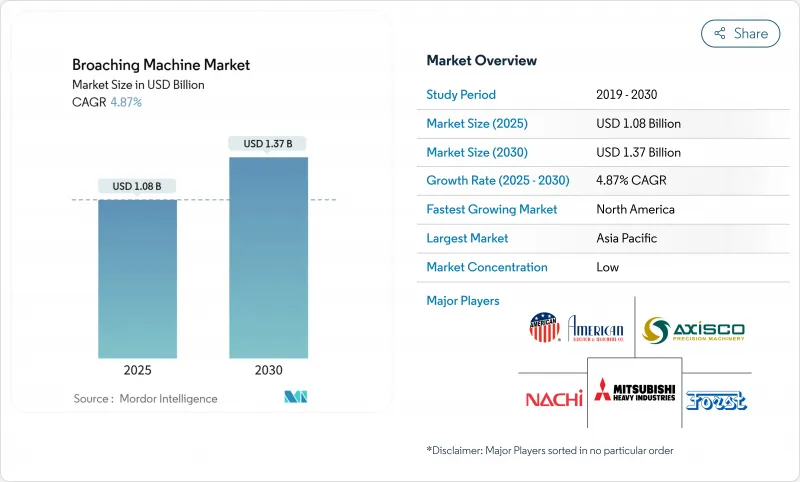

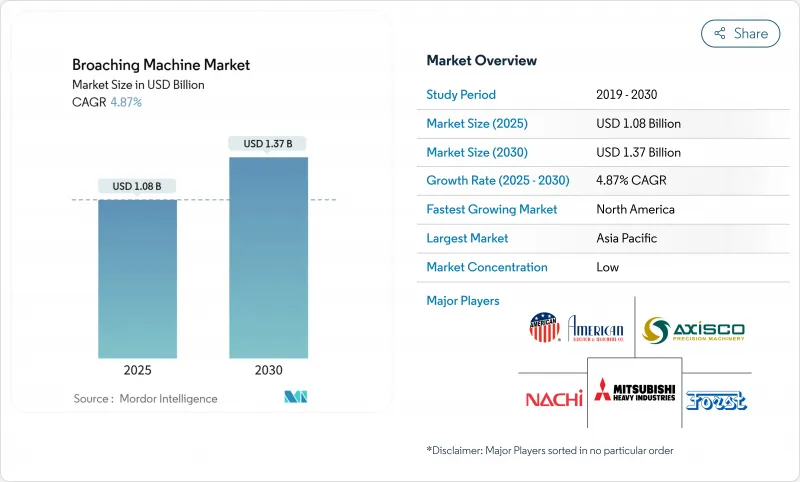

预计 2025 年拉床市场价值将达到 10.8 亿美元,到 2030 年将达到 13.7 亿美元,复合年增长率为 4.87%。

电动车变速箱对亚微米公差的需求不断增长,民航机生产计划的復苏以及国防本土化要求将推动先进拉削生产线的资本投资。随着工厂将传统数控单元与高速拉拉床结合以缩短生产节拍时间,水平拉床的订单拉床不断增长。设备订阅即服务、远端诊断和预测性维护模组扩大了前期投资资本有限的中小型供应商的存取权限。劳动力短缺和碳化钨价格波动对利润率造成压力,但区域对智慧工厂维修的奖励支撑了投资环境。这些因素加在一起,应该能够支持拉床市场在2030年之前保持稳定的中个位数成长轨迹。

全球拉床市场趋势与洞察

电动车动力传动系统零件精密加工需求激增(亚洲)

目前,电动车变速箱要求齿的精度为 +/-0.0005 英寸,这样的公差水平对于大规模铣削来说是不切实际的。一家中国製造商利用政策贷款和税额扣抵抵免安装了带有全封闭伺服驱动的水平拉削单元,在 20 小时的运作中实现了小于 2 微米的尺寸漂移。整合式电桥旨在将多个齿轮、花键和键槽折迭到单一外壳中,这推动了对能够按顺序加工内径和表面光洁度的柔性拉削线的需求。一份在亚洲生产的电动动力传动系统出口到北美组装厂的合约增强了生产能力并扩大了这两个地区的拉床市场。随着产品生命週期的缩短,供应商越来越青睐具有快速更换导轨的模组化拉削头,这种拉削头可将设定时间缩短 40%,进一步巩固了技术的应用。

中国二级工厂主动自动化维修

中国政府的「装备升级倡议」旨在2027年实现工具机投资实质成长25%,关键工序数值控制普及率达75%。地方津贴计画将为中小企业提供高达30%的CNC拉床生产线成本补贴。自动化维修整合了机器人上料机、基于视觉的基准点检查和闭合迴路刀具磨损感测器,可在多品种生产环境中实现无人值守作业。试点工厂报告称,单位成本节省了18%,废品率降低了32%,从而增强了复购订单。继向东协供应商推广技术后,中国天华工具机有限公司已将生产套件转移给区域合作伙伴,扩大了其在东南亚拉床市场的影响力。

欧盟和美国熟练拉削工人短缺

製造业预测,到 2030 年将有 210 万名技术工人退休,产生大量空缺职位。拉削刀具设计需要前角排序和剪切区温度控管等专业知识,而这些技能在标准 CNC 课程中很少涉及。芬兰坦佩雷地区的机械师毕业率仅为需求的一半,这与德国和美国的情况类似。在学徒管道改善之前,车间不愿安装新的拉削生产线。虽然供应商正在透过混合实境模拟器和云端基础的应用程式支援来应对,但人才缺口依然存在,成为产量的结构性天花板,限制了拉削拉床市场的上行空间。

細項分析

水平机型将在2024年占据45.1%的收入,这反映了它们在传动轴和重型设备生产线(零件长度超过1米)中的主导地位。最新机型采用铸铁底座,配备双伺服液压驱动,可达到高达300 kN的无振推力。表面拉床儘管出货量较低,但其复合年增长率将达到6.8%,是最快的。航太和整形外科应用需要在杉木和骨板上拉床出无法透过研磨实现的轮廓。表面平台拉床市场预计将从2025年的2.1亿美元成长到2030年的2.92亿美元。

旋转工作台附件扩展了多品种变速箱工厂的使用范围。它安装在标准数控加工中心上,加工速度比铣削快10倍,同时保持±0.0005英吋的加工精度。快速更换的导向组件可在三分钟内完成程序切换,这对于200件以下的批量加工来说极具吸引力。拉床产业正持续向垂直/水平混合框架发展,这些框架可互换铣头进行成型和开槽,从而提供灵活的单元,无需重新定位即可完成三种不同的切削工艺,从而提高设备运转率。

区域分析

受中国到2027年实现25%的资本支出成长目标的推动,亚太地区将在2024年维持55.86%的全球份额。中国原始设备製造商将根据其「中国製造2025」策略,将拉削线整合到智慧製造单元中,而日本将升级长行程机械,以促进精密机械出口。韩国和东南亚国协将投资半导体和汽车供应链,刺激需求成长。儘管日本数控系统的进口关税提高了成本门槛,但印度仍将透过其国防偏压齿轮系工厂为新订单做出贡献。

预计到2030年,北美将经历最快的复合年增长率,达到7.3%,这得益于美国机身生产率的復苏和国防项目的扩大。回流政策将津贴那些增加拉削加工以缩短零件前置作业时间的小型机械加工厂。加拿大将受益于对普惠涡轮扇发动机和矿用卡车零件的需求,而墨西哥的巴希奥走廊将拥有新的推进和航太加工中心。北美拉床市场预计将从2025年的1.73亿美元成长到2030年的2.47亿美元。

随着德国汽车供应链更新其卧式拉床产能,以及英国加速航太航太模具升级,欧洲维持稳定成长。法国和义大利利用能源效率税额扣抵抵免来升级设备,北欧工厂则利用自动化来弥补劳动力短缺。熟练劳动力短缺仍然是一个限制因素,预计到2024年,整个欧盟将有367个职位空缺。儘管如此,供应商管理服务和虚拟培训正在缓解瓶颈,使拉床市场保持缓慢但可预测的成长态势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电动车动力传动系统精密加工零件的快速成长(亚洲)

- 民用航太业建设率回升(北美和欧洲)

- 国防补偿授权推动当地对齿轮滚刀和拉刀的需求(中东)

- 中国二级工厂主动自动化维修

- OEM 厂商将各种变速箱的加工方式从滚齿加工转向旋转工作台拉削加工

- 短坡道原型的快速模具即即服务模式

- 市场限制

- 欧盟和美国熟练拉削工人短缺

- 碳化钨价格波动扰乱拉削刀具供应

- 冻结油田服务公司资本(2024-25年)

- 印度对日本产数控系统征收进口税

- 价值/供应链分析

- 监理展望

- 技术展望

- 产业吸引力—五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 全球製造业概况

- 金属加工产业概况

- 拉削刀具聚焦

第五章市场规模及成长预测

- 依产品类型

- 立式拉床

- 卧式拉床

- 平面拉床

- 其他(旋转、CNC拉床、液压拉床)

- 按运转方式

- 手动型

- 半自动

- 全自动

- 按最终用户产业

- 车

- 加工和工业机械

- 航太/国防

- 石油、天然气和能源

- 施工机械

- 电子及精密零件

- 医疗设备

- 其他(农业机械、枪械/国防等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 秘鲁

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- Nordix(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东协(印尼、泰国、菲律宾、马来西亚、越南)

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、合资、技术许可)

- 市占率分析

- 公司简介

- Mitsubishi Heavy Industries Ltd.

- American Broach & Machine Co.

- Apex Broaching Systems

- Nachi-Fujikoshi Corp.

- Arthur Klink GmbH

- Axisco Precision Machinery Co. Ltd.

- Colonial Tool Group Inc.

- Forst Technologie GmbH & Co. KG

- Pioneer Broach Co.

- Steelmans Broaches Pvt Ltd.

- The Ohio Broach & Machine Co.

- Hoffmann Raumtechnik GmbH

- Accu-Cut Diamond Tool Co.

- General Broach Company

- Hexagon Manufacturing Intelligence

- Phoenix Broach Co.

- VW Broaching Service Inc.

- Fuji Seiko Ltd.

- Suzhou HXM Broaching Machine Ltd.

- Shanghai Machine Tool Works Co. Ltd.*

第七章 市场机会与未来展望

The Broaching Machines Market was valued at USD 1.08 billion in 2025 and is expected to reach USD 1.37 billion by 2030, registering a 4.87% CAGR.

Rising demand for sub-micron tolerances in electric-vehicle gearboxes, the rebound of commercial aviation production schedules, and defense localization mandates lift capital spending on advanced broach lines. Orders for horizontal and surface machines expand as factories pair legacy CNC cells with high-speed broaching units to compress takt times. Equipment-as-a-service subscriptions, remote diagnostics, and predictive-maintenance modules widen access for small and mid-sized suppliers that lack upfront capital. Labor scarcity and tungsten-carbide price swings weigh on profit margins, yet regional incentives for smart-factory retrofits maintain a supportive investment climate. Collectively, these elements sustain a steady, mid-single-digit growth path for the broaching machines market through 2030.

Global Broaching Machine Market Trends and Insights

Surge in Precision-Machined EV Power-train Components (Asia)

Electric-vehicle gearboxes now require tooth accuracy of +-0.0005 inches, a tolerance level impractical for milling at scale. Chinese manufacturers leverage policy loans and tax credits to install horizontal broach cells with fully enclosed servo drives that hold dimensional drift below 2 microns for 20-hour runs. Integrated e-axle designs fold multiple gears, splines, and keyways into a single housing, pushing demand toward flexible broaching lines able to complete internal and surface cuts sequentially. Export contracts for Asia-manufactured e-power-trains into North American assembly plants reinforce capacity additions, amplifying the broaching machines market across both regions. As product life cycles compress, suppliers favor modular broach heads with quick-change guides that cut setup times by 40%, further entrenching technology adoption.

Aggressive Automation Retrofits in Chinese Tier-2 Job Shops

Beijing's equipment-upgrade initiative seeks 25% real growth in machine-tool investment by 2027 and targets 75% numerical-control penetration across key processes. Provincial grant programs reimburse up to 30% of CNC broach-line spend for small and mid-sized firms. Automation retrofits integrate robot loaders, vision-based datum checking, and closed-loop tool-wear sensors, enabling lights-out operation in high-mix environments. Pilot plants report 18% unit-cost savings and 32% scrap reduction, reinforcing repeat orders. Technology diffusion to ASEAN vendors follows, as Chinese tier-ones transfer production packages to regional partners, expanding the broaching machines market footprint across Southeast Asia.

Shortage of Broach-Skilled Toolmakers in EU & U.S.

The manufacturing sector forecasts 2.1 million unfilled roles by 2030 as senior machinists retire. Broach-tool design demands expertise in rake-angle sequencing and shear-zone heat management, skills rarely covered in standard CNC curricula. Finland's Tampere region reports machinist graduation rates at half replacement demand, mirroring shortages across Germany and the United States. Factories hesitate to install new broaching lines until apprenticeship pipelines improve. Vendors respond with mixed-reality simulators and cloud-based application support, yet the talent gap persists as a structural cap on throughput, limiting upside for the broaching machines market.

Other drivers and restraints analyzed in the detailed report include:

- Revival of Commercial Aerospace Build-Rates (North America & Europe)

- Defence Offset Mandates Fueling Local Gear-Hob & Broach Demand (Middle East)

- Volatile Tungsten-Carbide Pricing Disrupting Broach Tool Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Horizontal models generated 45.1% of 2024 revenue, reflecting their dominance in drive-shaft and heavy-equipment lines where components exceed 1 m length. Built on cast-iron bases, modern units integrate dual-servo hydraulic drives that boost push forces to 300 kN without chatter. Surface broach systems, though smaller in unit shipments, post the fastest 6.8% CAGR as aerospace and orthopedic applications require fir-tree and bone-plate contours unachievable with grinding. The broaching machines market size for surface platforms is projected to climb from USD 210 million in 2025 to USD 292 million by 2030.

Rotary-table attachments expand reach into high-mix gearbox shops. Mounted on standard CNC centers, they cut 10 times faster than milling while holding +-0.0005 inches. Quick-change guide packs enable programed switch-over in under 3 minutes, attractive for batch sizes below 200 pieces. The broaching machines industry continues to evolve toward hybrid vertical-horizontal frames that swap out heads for shaping or slotting, delivering a flexible cell capable of three distinct cutting processes without repositioning, thereby deepening equipment utilization.

The Broaching Machine Market is Segmented by Product Type (Vertical Broaching Machines, Horizontal Broaching Machines, Surface Broaching Machines, and Others), by Operation Mode (Manual, Semi-Automatic, and Fully Automatic), by End-User Industry (Automotive, and Others), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 55.86% global share in 2024, buoyed by China's 25% equipment-investment growth target through 2027. Chinese OEMs integrate broach lines into intelligent-manufacturing cells under the "Made in China 2025" strategy, while Japan upgrades long-stroke machines for precision machinery exports. South Korea and ASEAN nations invest in semiconductor and automotive supply chains, spurring incremental demand. India contributes fresh orders via defense-offset gear-train plants, though import tariffs on Japanese CNC systems raise cost hurdles.

North America is projected to post the fastest 7.3% CAGR to 2030 as US air-frame build-rates rebound and defense programs expand. Reshoring policies funnel grants toward small machine shops that add broaching to shorten component lead times. Canada benefits from Pratt & Whitney turbofan offsets and mining-truck component demand, while Mexico's Bajio corridor hosts new propulsion and aerospace machining centers. The broaching machines market size for North America is estimated to climb from USD 173 million in 2025 to USD 247 million in 2030.

Europe maintains stable growth as Germany's automotive supply chain refreshes horizontal broach capacity, and the United Kingdom accelerates aerospace tooling upgrades. France and Italy renew equipment under energy-efficiency tax credits, and Nordic plants leverage automation to offset labor scarcity. Skilled-worker shortages remain a limiting factor, with 367 occupations flagged as in deficit across the EU in 2024. Nonetheless, vendor managed-services and virtual training mitigate bottlenecks, sustaining a modest yet predictable expansion of the broaching machines market.

- Mitsubishi Heavy Industries Ltd.

- American Broach & Machine Co.

- Apex Broaching Systems

- Nachi-Fujikoshi Corp.

- Arthur Klink GmbH

- Axisco Precision Machinery Co. Ltd.

- Colonial Tool Group Inc.

- Forst Technologie GmbH & Co. KG

- Pioneer Broach Co.

- Steelmans Broaches Pvt Ltd.

- The Ohio Broach & Machine Co.

- Hoffmann Raumtechnik GmbH

- Accu-Cut Diamond Tool Co.

- General Broach Company

- Hexagon Manufacturing Intelligence

- Phoenix Broach Co.

- V W Broaching Service Inc.

- Fuji Seiko Ltd.

- Suzhou HXM Broaching Machine Ltd.

- Shanghai Machine Tool Works Co. Ltd.*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Precision-Machined EV Power-train Components (Asia)

- 4.2.2 Revival of Commercial Aerospace Build-Rates (North America & Europe)

- 4.2.3 Defence Offset Mandates Fueling Local Gear-Hob & Broach Demand (Middle East)

- 4.2.4 Aggressive Automation Retrofits in Chinese Tier-2 Job-Shops

- 4.2.5 OEM Shift from Hobbing to Rotary-Table Broaching for High-Mix Gearboxes

- 4.2.6 Rapid Tooling-as-a-Service Models for Short-Run Prototyping

- 4.3 Market Restraints

- 4.3.1 Shortage of Broach-Skilled Toolmakers in EU & U.S.

- 4.3.2 Volatile Tungsten-Carbide Pricing Disrupting Broach Tool Supply

- 4.3.3 Cap-Ex Freeze at Oil-field Service Firms (2024-25)

- 4.3.4 Import Tariffs on Japanese CNC Systems in India

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Global Manufacturing Sector Snapshot

- 4.9 Metal-working Industry Snapshot

- 4.10 Spotlight on Broach Tools

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Product Type

- 5.1.1 Vertical Broaching Machines

- 5.1.2 Horizontal Broaching Machines

- 5.1.3 Surface Broaching Machines

- 5.1.4 Others (Rotary, CNC Broaching, Hydraulic Broaching Machines)

- 5.2 By Operation Mode

- 5.2.1 Manual

- 5.2.2 Semi-Automatic

- 5.2.3 Fully Automatic

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Fabrication & Industrial Machinery

- 5.3.3 Aerospace & Defense

- 5.3.4 Oil & Gas / Energy

- 5.3.5 Construction Equipment

- 5.3.6 Electronics & Precision Components

- 5.3.7 Medical Devices

- 5.3.8 Others (Agricultural Equipment, Firearms & Defense, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Peru

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Kuwait

- 5.4.5.5 Turkey

- 5.4.5.6 Egypt

- 5.4.5.7 South Africa

- 5.4.5.8 Nigeria

- 5.4.5.9 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Tech-Licensing)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Mitsubishi Heavy Industries Ltd.

- 6.4.2 American Broach & Machine Co.

- 6.4.3 Apex Broaching Systems

- 6.4.4 Nachi-Fujikoshi Corp.

- 6.4.5 Arthur Klink GmbH

- 6.4.6 Axisco Precision Machinery Co. Ltd.

- 6.4.7 Colonial Tool Group Inc.

- 6.4.8 Forst Technologie GmbH & Co. KG

- 6.4.9 Pioneer Broach Co.

- 6.4.10 Steelmans Broaches Pvt Ltd.

- 6.4.11 The Ohio Broach & Machine Co.

- 6.4.12 Hoffmann Raumtechnik GmbH

- 6.4.13 Accu-Cut Diamond Tool Co.

- 6.4.14 General Broach Company

- 6.4.15 Hexagon Manufacturing Intelligence

- 6.4.16 Phoenix Broach Co.

- 6.4.17 V W Broaching Service Inc.

- 6.4.18 Fuji Seiko Ltd.

- 6.4.19 Suzhou HXM Broaching Machine Ltd.

- 6.4.20 Shanghai Machine Tool Works Co. Ltd.*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet Need Assessment