|

市场调查报告书

商品编码

1842520

吊扇:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Ceiling Fan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

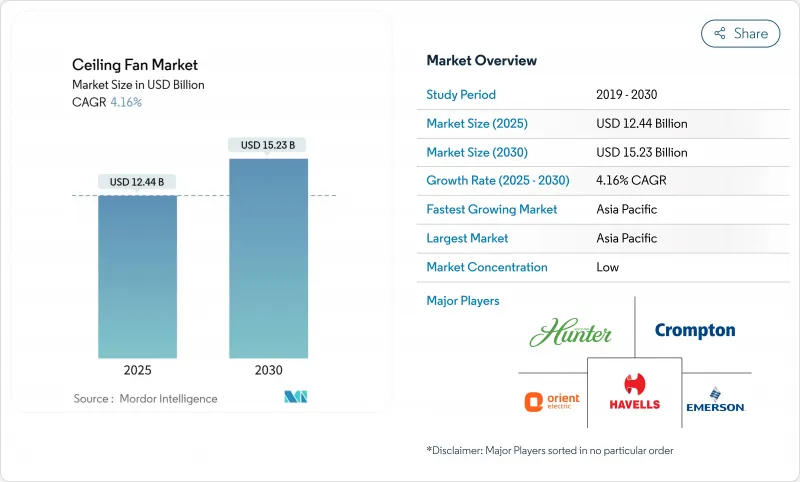

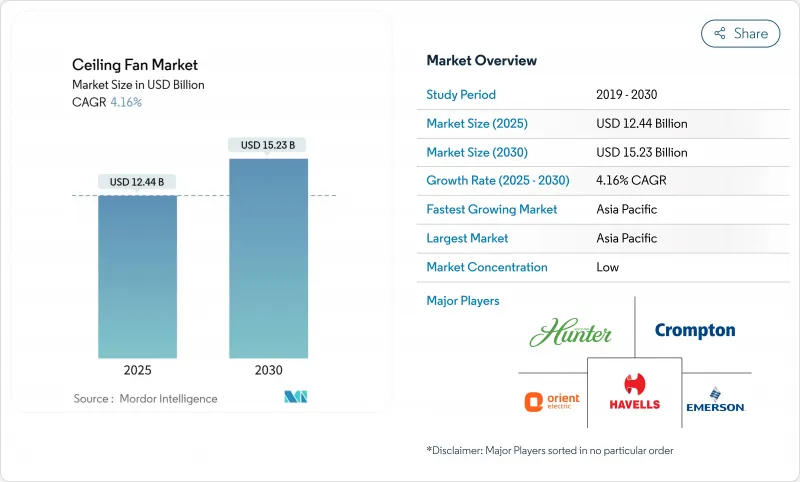

预计吊扇市场规模到 2025 年将达到 124.4 亿美元,到 2030 年将达到 152.3 亿美元,复合年增长率为 4.16%。

这项发展轨迹反映出,随着全球能源效率法规、智慧家庭应用和都市区降温策略提高产品设计和功能的标准,竞争方式从价格主导转向性能主导型差异化。美国能源局的吊扇能源指数 (CFEI) 已在收紧合规标准,加州 2025 年能源法规和欧洲新的生态设计法规正在协调主要经济体的能源效率目标,加速 BLDC 马达的采用。亚太地区以其低成本的零件生态系统仍是生产中心,但中国于 2025 年 4 月实施的稀土出口限制对磁铁价格造成上行压力,凸显了供应链对冲的必要性。在需求方面,ASHRAE 55 和 90.1 等智慧建筑标准正在加强与 BACnet、KNX 和其他自动化通讯协定整合的连网吊扇的商业案例。同时,低温运输物流的成长正在创造 HVLS 解决方案的专业技术,这些解决方案可以对仓库进行除湿并实现两位数的节能。

全球吊扇市场趋势与洞察

能源效率法规推动 BLDC 风扇的采用

CFEI 取代了传统的立方英尺每分钟 (CFM) 测试,使吊扇市场中低效率交流电设计的合规性更加严格。加州的新标准提高了家用和商用风扇的基准效率值,欧盟的生态设计更新目标是到 2030 年减少 31 TWh 的电力。加拿大在 2025 年 3 月透过第 18 号修正案扩大了类似的基准值,隐性地形成了有利于 BLDC 技术的三方集团。由于 BLDC 架构比传统交流电架构节省 50-70% 的功耗,因此在 2024 年之前加强了磁铁采购和逆变器设计的 OEM 现在可以将其产品无缝地纳入这些新规则手册。早期受益者包括印度的 Atom Berg,它销售通过 STAR 标籤认证的 28W 风扇,以及美国的 Hunter Fan,它将其高端产品线转换为具有 SureSpeed动态的 BLDC 马达。因此,监管势头仍将是未来四年吊扇市场最强大的催化剂。

支援物联网的智慧吊扇的普及

ASHRAE 55 的透过将吊扇定位为可控的舒适设备,随后的智慧家庭创新也为高端产品带来了 Wi-Fi 模组和语音助理相容性。 Hunter Fan 的 SIMPLEconnect 平台连接 Alexa、HomeKit 和 Google Home 生态系统,可根据恆温器资料自动调整转速。商业建筑正在利用 BACnet 和 KNX 闸道实现相同的连接,以优化混合模式暖通空调 (HVAC) 方案中的散热负荷。美国和欧洲的维修需求最为强劲,因为这些地区的建筑业主正在寻求能够快速获得回报的能源升级。从长远来看,低功耗蓝牙晶片成本的下降和支援 Matter 的韧体预计将使中价格分布产品具备连网功能,从而提升整个吊扇市场的平均售价和业务收益潜力。

扩大低成本室内空调的普及

2024 年,印度的空调销售将达到创纪录的 1,400 万台,凸显了消费者负担能力的转变,使消费支出从大众市场电风扇转移。 PLI 激励措施有效降低了国内组装成本,使 Voltas 和 LG 等品牌实现了显着的两位数出货量成长。都市区热岛效应的加剧,加上气候变迁导致的气温升高,正在加速消费者对基于冷气的冷却解决方案的需求。这种偏好的转变给吊扇市场带来了下行压力,特别是在东南亚人口稠密的都市区。虽然未来碳定价和关税结构的调整可能会平衡市场动态,但目前的趋势表明,替代效应越来越有利于空调系统。因此,空调的普及率正在超过传统的冷冻替代品,重塑这些地区的竞争格局。

細項分析

到2024年,标准型号将占据吊扇市场份额的38.34%,而节能风扇将经历最快的成长,复合年增长率为6.94%。在监管意识较强的地区,消费者在购买前越来越多地以CFEI标籤为基准,这促使原始设备製造商重新考虑叶片的气动设计并采用变频驱动。装饰性SKU在豪华住宅室内装饰中仍将占据重要地位,而HVLS平台将取代仓库和健身房中许多小型风扇。太阳能风扇仍将是一个小众市场,受制于面板成本和安装复杂性,但它们正受益于加州等市场层层递进的绿色建筑激励措施。所有产品均配备整合式LED照明和遥控器套件,从而增加了购物量并保持了客户忠诚度。

预计节能吊扇市场将迎来显着成长,这得益于亚洲供应链的最佳化。同时,高效能超大节能 (HVLS) 和物联网 (IoT) 产品线将提升製造商的利润率,因为马达电子元件、行动通讯模组和云端服务附加元件将捆绑到更高的平均售价中。策略性 SKU 合理化正在进行中,传统AC马达产品目录正在缩减,转而支援可升级平台。

虽然无刷直流电机的出货量在绝对数量上落后于AC马达,但其8.56%的复合年增长率清楚地表明了结构性转变。由于价格敏感地区的马达更换週期超过七年,且经销商库存仍偏向传统型号,交流马达设计仍维持56.56%的份额。儘管如此,印度自愿为无刷直流风扇提供五星认证以及美国能源之星v4.1基准值,为零售商提供了明显的差异化优势。DC马达由于驱动电路更简单且对磁铁的依赖性更低,已在中端市场获得采用,但效率在IE2水平上停滞不前。

随着变频驱动器的成本效益不断提升,由无刷直流马达 (BLDC) 系统驱动的吊扇市场预计将迎来显着成长。稀土材料供应持续受限,或将促使原始设备製造商 (OEM) 加速向同步磁阻马达 (SynRM) 技术转型,该技术无需依赖钕铁硼即可提供同等性能。这项转型或将重塑竞争格局,重点在于转子几何形状和控制演算法的创新。专注于独特的设计和先进的控制系统,将为製造商带来超越传统绕线业务的策略优势。因此,投资这些领域的製造商有望在不断发展的市场中占据竞争优势。

全球吊扇市场按类型(标准型、装饰型、节能型、其他)、技术(AC马达、DC马达、无刷直流电机)、终端用户(住宅、商业、工业)、分销渠道(线下、线上)和地区(北美、南美、欧洲、亚太地区、其他)细分。市场预测以美元计算。

区域分析

亚太地区占全球收益的近一半,预计到2030年将经历最高的复合年增长率。印度自2020年以来的都市化显着推动了对经济高效、节能的空调控制解决方案的需求。儘管空调的普及率不断提高,但由于预算限制和电网可靠性不稳定,吊扇在二线地区和农村地区仍然不可或缺。中国对磁铁出口的限制带来了潜在的成本压力,但该地区的竞争地位得益于成熟的零件生态系统和ODM丛集。此外,东南亚的基础设施扩张,包括购物中心、物流中心和智慧城市发展,持续刺激对商用风扇的需求。

北美是一个以法规主导的地区,CFEI 合规性与智慧家庭的普及密不可分。加州在其 2025 年法规中提高了标准性能,有效地逐步淘汰了低能效 SKU。加拿大也紧随其后,通过了第 18 号修正案,为北美地区制定了统一的标准。智慧风扇正享受着强大的维修奖励,并受益于语音控制生态系统的普及,从而增强了平均售价的弹性。

欧洲以碳减排目标为中心。欧盟《生态设计更新》计画在2030年将工业通风机的消费量减少31太瓦时,成员国的补贴框架正在指导住宅通风机的更换。在地中海气候地区,自2022年以来能源价格大幅上涨,被动式和混合模式通风策略正日益受到青睐。相较之下,中东和非洲地区优先考虑大众住宅的入门级吊扇,而豪华别墅则青睐装饰性强、造型时尚的吊扇,以适应高高的天花板。在南美洲,随着巴西和哥伦比亚建筑业的復苏,对吊扇的需求正在稳步增长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 能源效率法规推动 BLDC 风扇的采用

- 支援物联网的智慧吊扇的普及

- 亚洲低成本 BLDC 马达製造的扩张

- 绿建筑标准青睐被动冷却解决方案

- 低温运输仓库对HVLS除湿的需求

- 市场限制

- 扩大低成本室内空调的普及

- 需求的季节性波动影响库存计划

- 稀土元素磁铁短缺导致马达成本上升

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察最新市场趋势与创新

- 深入了解市场的最新发展(新产品发布、策略性倡议、投资、合作伙伴关係、合资企业、扩张、併购等)

- 深入了解重点地区的法规结构和能源效率标准

第五章市场规模及成长预测

- 依产品类型

- 标准

- 装饰

- 节能

- 高速

- 整合灯

- HVLS

- 智慧/物联网

- 太阳能发电

- 依技术

- AC马达

- DC马达

- 无刷直流电机

- 按最终用户

- 住宅

- 商业的

- 工业的

- 按分销管道

- B2C/零售通路

- 多品牌店

- 独家品牌经销店

- 在线的

- 其他分销管道

- B2B/计划通路(厂商直销)

- B2C/零售通路

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- Nordix(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚(新加坡、马来西亚、泰国、印尼、越南、菲律宾)

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Hunter Fan Company

- Crompton Greaves Consumer Electricals Ltd.

- Orient Electric Ltd.

- Havells India Ltd.

- Emerson Electric Co.

- Panasonic Corporation

- Midea Group

- Minka Group

- Haier Group

- Usha International

- Superfan(Versa Drives)

- Atomberg Technologies

- Fanimation Inc.

- Westinghouse Lighting

- Vent-Axia(CEME Group)

- Casablanca Fan Company

- Delta Electronics

- LG Electronics

- Bajaj Electricals Ltd.

- Khind Holdings Berhad

第七章 市场机会与未来展望

The ceiling fan market stands at USD 12.44 billion in 2025 and is forecast to reach USD 15.23 billion by 2030, advancing at a 4.16% CAGR.

This trajectory reflects a shift from price-led competition to performance-led differentiation as global energy-efficiency rules, smart-home adoption, and urban heat-mitigation strategies raise the bar for product design and functionality. The U.S. Department of Energy's Ceiling Fan Energy Index (CFEI) has already tightened compliance thresholds, while California's 2025 Energy Code and new European eco-design mandates align efficiency targets across major economies and accelerate BLDC motor penetration. Asia-Pacific remains the production nerve center thanks to low-cost component ecosystems, yet rare-earth export curbs from China in April 2025 have put upward pressure on magnet prices, underscoring the need for supply-chain hedging. On the demand side, smart-building standards such as ASHRAE 55 and 90.1 reinforce the business case for connected ceiling fans that integrate with BACnet, KNX, and other automation protocols. Meanwhile, cold-chain logistics growth has created a specialized pocket for HVLS solutions that deliver destratification gains and double-digit energy savings in warehouses .

Global Ceiling Fan Market Trends and Insights

Energy-efficiency regulations boosting BLDC fan adoption

CFEI has replaced the legacy cubic-feet-per-minute-per-watt test, making it tougher for low-efficiency AC designs to stay compliant in the ceiling fan market. California's new code raises baseline efficacy values for residential and commercial fans, while the EU's eco-design update targets 31 TWh in power savings by 2030. Canada extended similar thresholds through Amendment 18 in March 2025, forming a tri-national block that implicitly favours BLDC technology. Because BLDC architectures draw 50-70% less power than legacy AC rivals, OEMs that ramped up magnet sourcing and inverter design ahead of 2024 now slot products seamlessly into these new rulebooks. Early beneficiaries include Atom Berg in India, which markets a 28-W fan validated by STAR labelling, and Hunter Fan in the U.S., which migrated its premium lines to BLDC motors with Sure Speed aerodynamics. As a result, regulatory momentum remains the most potent catalyst for the ceiling fan market over the next four years.

Proliferation of IoT-enabled smart ceiling fans

The passage of ASHRAE 55 positioned ceiling fans as controllable comfort devices, and subsequent smart-home innovation layered Wi-Fi modules and voice-assistant compatibility onto premium SKUs. Hunter Fan's SIMPLEconnect platform links Alexa, HomeKit, and Google Home ecosystems, allowing automatic speed shifts based on thermostat data . Commercial buildings leverage the same connectivity via BACnet and KNX gateways, optimizing heat-removal loads in mixed-mode HVAC schemes. Demand is highest in the U.S. and European retrofits, where building owners seek quick-payback energy upgrades. Over the long term, falling costs of Bluetooth Low Energy chips coupled with matter-ready firmware are expected to embed networked capability even in mid-priced products, raising the average selling price and service revenue potential across the ceiling fan market.

Growing penetration of low-cost room air-conditioners

Record sales of 14 million AC units in India during 2024 revealed an affordability inflection that diverts spend from mass-market fans . PLI incentives have effectively reduced domestic assembly costs, allowing brands like Voltas and LG to achieve notable double-digit shipment growth. The rising prevalence of urban heat islands, coupled with climate change-driven temperature increases, is accelerating consumer demand for refrigeration-based cooling solutions. This shift in preference is exerting downward pressure on the ceiling fan market, particularly in densely populated Southeast Asian metropolitan areas. While future adjustments in carbon pricing and tariff structures could potentially rebalance market dynamics, the current trend indicates a growing substitution effect favoring air conditioning systems. As a result, air conditioning adoption is outpacing traditional cooling alternatives, reshaping the competitive landscape in these regions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of low-cost BLDC motor manufacturing in Asia

- HVLS demand in cold-chain warehouses for destratification

- Seasonal demand swings impacting inventory planning

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy-saving fans represent the fastest-growing slice, clocking a 6.94% CAGR, even though standard models held 38.34% of the ceiling fan market share in 2024. Consumers in regulation-centric regions now benchmark CFEI labels before purchase, nudging OEMs to redesign blade aerodynamics and adopt inverter drives. Decorative SKUs maintain relevance in premium residential interiors, while HVLS platforms serve warehouses and gymnasiums where one unit displaces many smaller fans. Solar-powered fans remain niche, limited by panel cost and mounting complexity, yet benefit from green-building incentive stacking in markets like California. Across all variants, integrated LED lighting and remote-control kits elevate basket size and retain customer loyalty.

The energy-efficient ceiling fan market is anticipated to witness substantial growth, supported by supply chain optimization in Asia, which is expected to drive down retail premiums to below. Meanwhile, performance-rich HVLS and IoT lines improve manufacturer margins because motor electronics, wireless modules, and cloud-service add-ons bundle into higher ASPs. Strategic SKU rationalization is underway, with heritage AC-motor catalogues shrinking in favour of fewer, upgrade-ready platforms.

BLDC motor shipments trail AC motors in absolute volume, yet their 8.56% CAGR underscores structural change. AC designs retain 56.56% share because replacement cycles in price-sensitive regions exceed seven years and because distributor inventories still skew toward legacy SKUs. Nevertheless, India's voluntary 5-Star labeling for BLDC fans and ENERGY STAR v4.1 thresholds in the U.S. grant visible differentiation cues at retail. DC motors carved out mid-tier adoption owing to simpler driver circuitry and reduced magnet dependence, but efficiency plateaus at IE2 levels.

The ceiling fan market, driven by BLDC systems, is anticipated to grow significantly as variable-frequency drivers become more cost-effective. Persistent constraints in the supply of rare-earth materials may prompt OEMs to expedite their shift toward SynRM technologies, which deliver comparable performance without relying on NdFeB. This transition could reshape the competitive landscape, emphasizing innovation in rotor geometry and control algorithms. The focus on proprietary designs and advanced control systems offers a strategic edge over traditional winding operations. As a result, manufacturers investing in these areas are likely to gain a competitive advantage in the evolving market.

The Global Ceiling Fan Market and the Market Segmented by Type (Standard, Decorative, Energy Saving Fan, and More), by Technology (AC Motor, DC Motor, and BLDC Motor), by End-User (Residential, Commercial, and Industrial), by Distribution Channel (Offline and Online), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region accounts for nearly half of the global revenue and is projected to register the highest CAGR through 2030. Urbanization in India since 2020 has significantly driven the demand for cost-effective and energy-efficient climate control solutions. Despite the growing adoption of air conditioners, ceiling fans remain essential in tier-2 and rural areas due to budget limitations and inconsistent grid reliability. China's restrictions on magnet exports create potential cost pressures; however, its well-established parts ecosystem and ODM clusters sustain the region's competitive edge. Additionally, Southeast Asia's infrastructure expansion, including shopping malls, logistics centers, and smart-city developments, continues to fuel commercial fan demand.

North America represents a regulation-driven landscape where CFEI compliance and smart-home adoption intertwine. California's 2025 code revision raises baseline performance, effectively phasing out low-efficiency SKUs. Canada followed with Amendment 18, forming a harmonized North American standard. Smart fans enjoy pull-through from robust retrofit incentives and the popularity of voice-controlled ecosystems, reinforcing average selling-price resilience.

Europe is oriented around carbon-reduction targets. The EU's eco-design update will slash 31 TWh from industrial-fan consumption by 2030, and member-state subsidy frameworks guide residential fan replacement. Passive and mixed-mode ventilation strategies gain traction in Mediterranean climates where energy prices spiked post-2022. In contrast, the Middle East and Africa prioritize entry-price ceiling fans for mass housing, though premium villas incorporate decorative and smart models tailored for high ceilings. South America shows steady incremental demand tied to construction sector rebounds in Brazil and Colombia.

- Hunter Fan Company

- Crompton Greaves Consumer Electricals Ltd.

- Orient Electric Ltd.

- Havells India Ltd.

- Emerson Electric Co.

- Panasonic Corporation

- Midea Group

- Minka Group

- Haier Group

- Usha International

- Superfan (Versa Drives)

- Atomberg Technologies

- Fanimation Inc.

- Westinghouse Lighting

- Vent-Axia (CEME Group)

- Casablanca Fan Company

- Delta Electronics

- LG Electronics

- Bajaj Electricals Ltd.

- Khind Holdings Berhad

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency regulations boosting BLDC fan adoption

- 4.2.2 Proliferation of IoT-enabled smart ceiling fans

- 4.2.3 Expansion of low-cost BLDC motor manufacturing in Asia

- 4.2.4 Green-building codes favoring passive cooling solutions

- 4.2.5 HVLS demand in cold-chain warehouses for destratification

- 4.3 Market Restraints

- 4.3.1 Growing penetration of low-cost room air-conditioners

- 4.3.2 Seasonal demand swings impacting inventory planning

- 4.3.3 Rare-earth magnet shortages inflating motor costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Suppliers

- 4.5.3 Bargaining Power Of Buyers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights Into The Latest Trends And Innovations In The Market

- 4.7 Insights On Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, Etc.) In The Market

- 4.8 Insights on Regulatory Framework and Energy-Efficiency Standards in Key Geographies

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Standard

- 5.1.2 Decorative

- 5.1.3 Energy-Saving

- 5.1.4 High-Speed

- 5.1.5 With Integrated Light

- 5.1.6 HVLS

- 5.1.7 Smart / IoT

- 5.1.8 Solar-Powered

- 5.2 By Technology

- 5.2.1 AC Motor

- 5.2.2 DC Motor

- 5.2.3 BLDC Motor

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail Channels

- 5.4.1.1 Multi-Brand Stores

- 5.4.1.2 Exclusive Brand Outlets

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Project Channels (direct from the manufacturers)

- 5.4.1 B2C/Retail Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Hunter Fan Company

- 6.4.2 Crompton Greaves Consumer Electricals Ltd.

- 6.4.3 Orient Electric Ltd.

- 6.4.4 Havells India Ltd.

- 6.4.5 Emerson Electric Co.

- 6.4.6 Panasonic Corporation

- 6.4.7 Midea Group

- 6.4.8 Minka Group

- 6.4.9 Haier Group

- 6.4.10 Usha International

- 6.4.11 Superfan (Versa Drives)

- 6.4.12 Atomberg Technologies

- 6.4.13 Fanimation Inc.

- 6.4.14 Westinghouse Lighting

- 6.4.15 Vent-Axia (CEME Group)

- 6.4.16 Casablanca Fan Company

- 6.4.17 Delta Electronics

- 6.4.18 LG Electronics

- 6.4.19 Bajaj Electricals Ltd.

- 6.4.20 Khind Holdings Berhad

7 Market Opportunities & Future Outlook

- 7.1 Growing demand for sustainable materials and less toxic coatings

- 7.2 Increasing penetration of e-commerce and omni-channel presence