|

市场调查报告书

商品编码

1842536

抗静电剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Anti-static Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

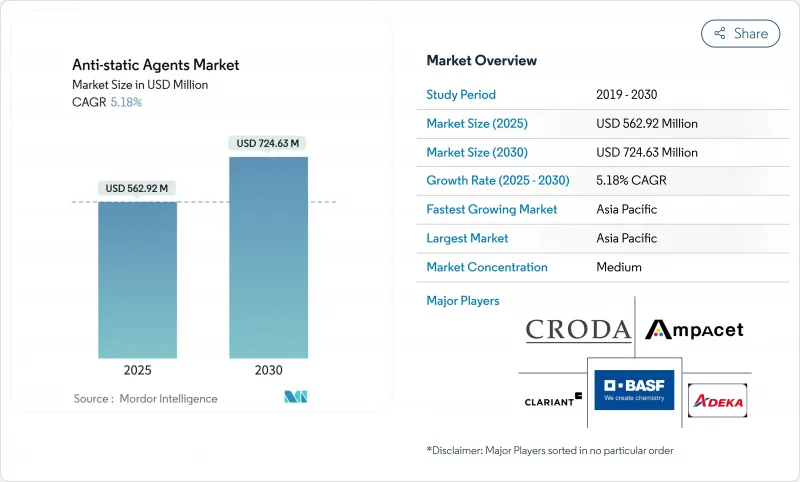

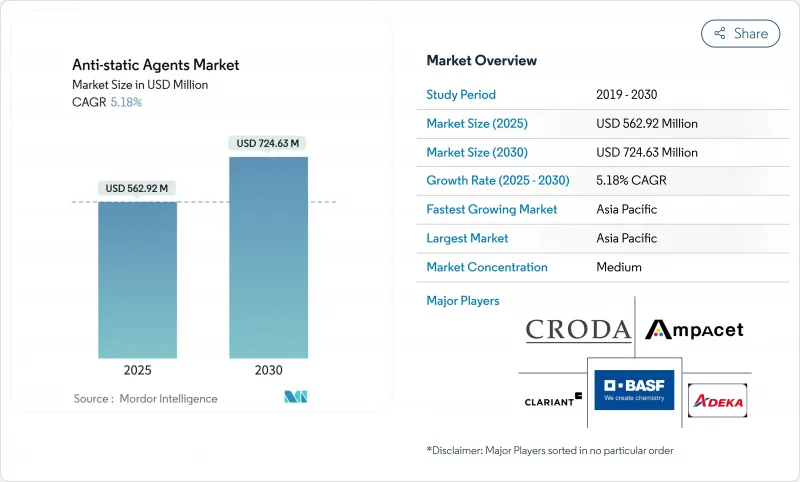

抗静电剂市场规模预计在 2025 年为 5.6292 亿美元,预计到 2030 年将达到 7.2463 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.18%。

电子产品的快速小型化以及半导体工厂和消费性电子生产线对静电放电 (ESD) 敏感性的提高,推动了对永久性和迁移性添加剂的需求。随着品牌和加工商逐渐放弃溶剂型体係以应对 PFAS 和 VOC 法规,水性母粒平台的市场份额正在不断扩大。亚太地区契约製造的优势支撑着全球产量,而生物基化学品和富含二氧化硅的混合物正在重塑竞争定位。汽车电气化、电商包装和先进医疗设备正在为抗静电添加剂市场创造一个多年的成长通道,而高温、无尘室相容和不含 PFAS 的解决方案则将推动这一市场的发展。

全球抗静电剂市场趋势与洞察

电子商务推动防静电包装需求激增

跨境电商消费性电子产品的运输速度远超实体店配送,这要求小包裹处理人员满足低密度聚乙烯 (LDPE) 薄膜和气泡袋严格的表面电阻率限制。大型物流中心正在部署高速分类机,摩擦速度通常超过 100 公尺/分钟,这加剧了静电积聚,可能导致微控制器瘫痪。因此,包装加工商正在整合符合 RoHS 和食品接触法规的永久抗静电母粒,并使用低于 3 份的添加剂来保持透明度和密封完整性。中国线上零售市占率已超过国内销售额的 50%,本土包装袋製造商正在努力认证不受湿度影响的抗静电等级。各品牌也同时追求可回收的单一材料薄膜,这需要使用不会妨碍机械回收过程的胺基化学材料。

电子设备小型化以提高 ESD 灵敏度

3nm以下的FinFET和环绕闸极节点只能承受14nm元件峰值电流的25%,因此晶圆厂现在规定托盘和晶圆盒的室内空气电阻率低于10^10欧姆。先进的系统级封装组件透过超薄中介层传输电力,这会在放电过程中放大局部热量,并需要能够承受230°C回流焊接的永久性防静电涂层。像imec这样的研究联盟已经证明,使用薄硅片可将故障电流降低20-40%,这促使添加剂供应商转向二氧化硅接枝聚醚酰胺,以避免湿度依赖性。因此,防静电添加剂市场正专注于温度稳定、无迁移等级的无尘室聚合物的研发。

牛脂衍生成分的不稳定性

生物柴油强制要求的激增加剧了来自牛脂的竞争,推高了价格,并导致油脂化学抗静电中间体的供应趋紧。欧盟炼油厂越来越多地将动植物脂肪转换为水解植物柴油,这限制了化学品的供应,并迫使化合物生产商使用棕榈脂肪酸馏分进行对冲。炼油厂满载运转,低温运输物流增加了运费溢价,削弱了相对于石化胺的成本优势。由于一些零售商限制使用动物性成分,使用食品接触抗静电剂的包装公司面临额外的限制。因此,生产商正在加强对菜籽油和废弃食用油基酯类的检测,这些产品的性能与动物脂肪相似。

細項分析

脂肪酸胺将充分发挥其在低密度聚乙烯 (LDPE) 和聚丙烯 (PP) 薄膜中久经考验的功效,预计到 2024 年其收入将成长 39.04%。乙氧基化胺等级的复合年增长率最高,达到 7.05%,这得益于其高达 250°C 的热稳定性,适用于仪表板中使用的玻璃纤维增强聚丙烯。单甘油酯是 FDA美国的食品药物管理局包装应用的主要成分,但由于其含量最高不超过 0.5 份,因此增长较慢。聚甘油酯用于医疗设备袋,其生物相容性抵消了价格溢价。新兴的季铵盐聚乙氧基化结构透过增加羟基官能基、改善高流动性聚丙烯中的分散性并减少起霜,进一步巩固了高性能汽车抗静电剂市场的发展轨迹。

此细分市场的崛起将影响聚丙烯内装件抗静电剂的市场规模,预计2025年至2030年期间的复合年增长率为6.8%。聚醚双酚A共聚物等永久性添加剂单价较高,但可在车辆的整个使用寿命期间保护仪表板免受灰尘侵害,从而刺激OEM的采用并提高乙氧基化系统抗静电剂的市场份额。

到2024年,石化原料将满足79.81%的需求,这反映了一体化裂解装置的经济效益。然而,永续性目标正在推动产能转向菜籽油、棕榈油和废弃食用油,目前这些产品的复合年增长率为7.51%。在欧洲,由于物料平衡认证和碳信用交易等法规,价格差距已缩小至12%以下。黑田公司的可生物降解Crodastat 400表明,生物基体係可以与导电材料媲美,同时减少60%的二氧化碳排放。

牛脂的波动性和消费者信心指数正在推动植物油酯在 2028 年前成为电子产品运输膜的预设材料。这种转变可能推动生物基抗静电剂市场在 2030 年前达到 2 亿美元以上,但竞争力将取决于亚洲生物炼油厂的进一步扩张。

区域分析

到2024年,亚太地区将占全球销售额的43.08%,到2030年,复合年增长率将达到6.98%。中国当地晶圆厂的扩张以及印度一级汽车零件的快速成长,将为永久性抗静电化学品创造一个密集的需求通道。区域配方商正在投资高产能双螺桿生产线:三洋化学在泰国的年产1500吨的工厂就是一个供应侧规模扩大的案例。政府对生物分解性塑胶的激励措施可能会进一步促进生物基材料的采用,从而扩大东协包装用抗静电剂的市场规模。

美国正大力发展先进的半导体封装和电动车平台。像 US-JOINT 这样的联盟计画正在将联邦津贴投入防静电材料的研发中,并支持高利润的母粒。企业永续性目标(大多数财富 500 强电子产品原始设备製造商已承诺在 2030 年实现碳中和)正在加速无 PFAS 转型,并透过水性产品重塑抗静电剂市场格局。

欧洲严格的 REACH 法规更新以及全欧洲范围内 PFAS 的逐步淘汰,正在推动向二氧化硅和生物基解决方案的快速转变。科莱恩计划于 2023 年全面淘汰 PFAS,标誌着其提前合规。作为主要汽车製造商的所在地,德国和法国青睐无 VOC 模压彩色内饰,这推动了对高温永久性抗静电剂的需求。中东/非洲和南美洲虽然仍然对价格敏感,但由于电子商务的兴起和汽车组装的增加,其销量实现了高个位数增长,使其成为成本优化过渡级材料的新战场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电子商务导致防静电包装需求激增

- 电子设备小型化增加了 ESD 敏感性

- 从溶剂母粒到水性母粒的转变

- 汽车产业需求不断成长

- 医疗保健和医疗设备产业的扩张

- 市场限制

- 牛脂衍生成分的不稳定性

- 资本密集型永久性离子导电添加剂

- 固有耗散聚合物的采用日益增多

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按类型

- 单甘油酯

- 聚甘油酯

- 二乙醇酰胺

- 乙氧化酯肪酰胺

- 按原料

- 生物基(植物来源、牛脂衍生)

- 石化基

- 按聚合物

- 聚丙烯

- 聚乙烯

- 聚氯乙烯

- 其他聚合物(聚苯乙烯等)

- 按最终用户产业

- 包装

- 电子产品

- 汽车和运输

- 其他(医疗/保健等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- 3M

- Adeka Corporation

- Ampacet Corporation

- Arkema

- Avient Corporation

- BASF

- Clariant

- Croda International plc

- Emery Oleochemicals

- Evonik Industries AG

- Italmatch Chemicals

- Kao Corporation

- Mitsubishi Chemical Group Corporation

- Palsgaard

- Sanyo Chemical Industries

- Solvay

- Tosaf

第七章 市场机会与未来展望

The Anti-static Agents Market size is estimated at USD 562.92 million in 2025, and is expected to reach USD 724.63 million by 2030, at a CAGR of 5.18% during the forecast period (2025-2030).

A sharp rise in electronics miniaturization is magnifying electrostatic-discharge (ESD) sensitivity across semiconductor fabs and consumer electronics lines, reinforcing demand for both permanent and migratory additives. Water-borne masterbatch platforms are gaining share as brands and processors pivot away from solvent systems in response to PFAS and VOC regulations. Asia-Pacific's contract manufacturing strength anchors global volume, while bio-based chemistry and silica-rich blends reshape competitive positioning. Automotive electrification, e-commerce packaging, and advanced health-care devices together create multi-year growth corridors that the antistatic agent market is gearing toward with higher-temperature, clean-room-ready, PFAS-free solutions.

Global Anti-static Agents Market Trends and Insights

Surge In E-Commerce-Led Demand For Antistatic Packaging

Cross-border e-commerce shipments of consumer electronics outpace store deliveries, obliging parcel handlers to meet tighter surface-resistivity limits in low-density polyethylene (LDPE) films and bubble bags. Large logistics centers deploy high-speed sorters whose friction often exceeds 100 m/min, exacerbating static buildup that can cripple micro-controllers. Packaging converters therefore integrate permanent antistatic masterbatches that comply with RoHS and food-contact codes, keeping additive loading below 3 phr to preserve clarity and seal integrity. China's online retail share, already above 50% of national sales, pushes local bag makers to qualify humidity-independent antistatic grades. Brands simultaneously pursue recyclable mono-material films, requiring amine-based chemistries that do not hinder mechanical-recycling streams.

Miniaturization Of Electronics Heightening ESD Sensitivity

FinFET and gate-all-around nodes below 3 nm withstand only 25% of the peak current tolerated by 14 nm devices, so fabs now specify room-air resistivity under 10^10 Ω for carrier trays and wafer boxes. Advanced system-in-package assemblies route power through ultrathin interposers, amplifying local heat during a discharge and demanding permanent antistatic coatings rated for 230 °C reflow. Research consortia such as imec document failure-current declines of 20-40% on thinned silicon, guiding additive suppliers toward silica-grafted polyether amides that avoid humidity dependence. The antistatic agent market, therefore, concentrates R&D on temperature-stable, migration-free grades for clean-room polymers.

Volatility In Tallow-Derived Feedstocks

Surging biodiesel mandates elevate competition for beef-tallow, inflating prices and tightening supply for oleochemical antistatic intermediates. EU refineries channel more animal fat toward hydro-treated vegetable-oil diesel, hindering chemical availability and forcing formulators to hedge with palm-fatty-acid distillate routes. Renderers operate near capacity, and cold-chain logistics add freight premiums that erode cost advantages over petrochemical amines. Packaging firms using food-contact antistatic agents face further constraints as certain retailers restrict animal-derived ingredients. Producers consequently intensify trials of rapeseed- and used-cooking-oil-based esters that mimic tallow performance.

Other drivers and restraints analyzed in the detailed report include:

- Transition From Solvent-Borne To Water-Borne Masterbatches

- Growing Demand From The Automotive Industry

- Capital-Intensive Permanent Ionic-Conductive Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fatty-acid amines captured 39.04% revenue in 2024, leveraging proven efficacy in LDPE and PP films. Ethoxylated amine grades now post the fastest 7.05% CAGR, propelled by thermal stability up to 250 °C that suits glass-fiber-reinforced polypropylene used in instrument panels. Monoglycerides remain staples in FDA-regulated food-packaging applications, though growth is muted because inclusion levels cap at 0.5 phr. Polyglycerol esters serve medical-device pouches where biocompatibility offsets price premiums. Emerging quaternary polyethoxylated structures add hydroxyl functionality, improving dispersion in high-flow PP and reducing bloom, further cementing the antistatic agent market trajectory in performance vehicles.

The sub-segment's ascent influences the antistatic agent market size for polypropylene interior parts, which is slated to expand at 6.8% CAGR between 2025-2030. Permanent additives such as polyether-bisphenol A copolymers command higher unit pricing but shield dashboards from dust for the full vehicle life, encouraging OEM uptake and lifting the antistatic agent market share for ethoxylated systems.

Petrochemical feedstocks supplied 79.81% of 2024 demand, a reflection of integrated cracker economics. Yet sustainability goals are steering capacity toward rapeseed-, palm-, and used-cooking-oil pathways that now clock a 7.51% CAGR. Regulatory carrots such as mass-balance certification and carbon-credit trading in Europe reduce the price delta to below 12%. Croda's biodegradable Crodastat 400 demonstrates that bio-based systems can match conductivity while cutting CO2 footprint by 60%.

Tallow volatility and consumer sentiment against animal derivatives amplify the pivot, making vegetable-oil esters the default for electronics shipping films by 2028. This shift could push the bio-based antistatic agent market size past USD 200 million by 2030, though competitive parity hinges on further scale-up in Asian bio-refineries.

The Antistatic Agent Market Report Segments the Industry by Type (Monoglycerides, Diethanolamides, and More), Source (Bio-Based and Petrochemical-Based), Polymer (Polypropylene, Polyethylene, and More), End-User Industry (Packaging, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 43.08% of global revenue in 2024 and advances at a 6.98% CAGR through 2030. Mainland China's wafer-fab expansion and India's tier-1 auto-components surge build dense demand corridors for permanent antistatic chemistries. Regional formulators invest in high-capacity twin-screw lines: Sanyo Chemical's 1,500 t/y Thai plant exemplifies supply-side scaling. Government incentives for biodegradable plastics further encourage bio-feedstock adoption, potentially bolstering the antistatic agent market size in ASEAN packaging.

North America rides advanced semiconductor packaging and electrified-vehicle platforms. Consortium programs such as US-JOINT funnel federal grants into ESD-safe materials R&D, which supports high-margin masterbatch suppliers. Corporate sustainability goals-most Fortune 500 electronics OEMs pledge carbon neutrality by 2030-accelerate PFAS-free conversions, reshaping the antistatic agent market landscape with water-borne offerings.

Europe's stringent REACH updates and the continent-wide PFAS phase-out catalyze rapid pivots to silica-based and bio-based solutions. Clariant's complete PFAS exit in 2023 exemplifies early compliance. Germany and France, housing leading auto makers, champion VOC-free molded-in-color interiors, lifting demand for heat-resistant, permanent antistatic agents. The Middle East, Africa, and South America remain price-sensitive but post high single-digit volume growth as e-commerce penetration and automotive assembly rise, making them emergent battlegrounds for cost-optimized migratory grades.

- 3M

- Adeka Corporation

- Ampacet Corporation

- Arkema

- Avient Corporation

- BASF

- Clariant

- Croda International plc

- Emery Oleochemicals

- Evonik Industries AG

- Italmatch Chemicals

- Kao Corporation

- Mitsubishi Chemical Group Corporation

- Palsgaard

- Sanyo Chemical Industries

- Solvay

- Tosaf

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in E-commerce-led demand for anti-static packaging

- 4.2.2 Miniaturisation of electronics heightening ESD sensitivity

- 4.2.3 Transition from solvent-borne to water-borne masterbatches

- 4.2.4 Growing demand from the automotive industry

- 4.2.5 Expansion in the healthcare and medical devices industry

- 4.3 Market Restraints

- 4.3.1 Volatility in tallow-derived feedstocks

- 4.3.2 Capital-intensive permanent ionic-conductive additives

- 4.3.3 Rising adoption of inherently dissipative polymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Monoglycerides

- 5.1.2 Polyglygerol Esters

- 5.1.3 Diethanolamides

- 5.1.4 Ethoxylated Fatty Acid Amines

- 5.2 By Source

- 5.2.1 Bio-based (Vegetable-, Tallow-derived)

- 5.2.2 Petrochemical-based

- 5.3 By Polymer

- 5.3.1 Polypropylene

- 5.3.2 Polyethylene

- 5.3.3 Polyvinyl Chloride

- 5.3.4 Other Polymers(Polystyrene, etc.)

- 5.4 By End-User Industry

- 5.4.1 Packaging

- 5.4.2 Electronics

- 5.4.3 Automotive and Transportation

- 5.4.4 Other End-User Industries (Medical and Healthcare, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Adeka Corporation

- 6.4.3 Ampacet Corporation

- 6.4.4 Arkema

- 6.4.5 Avient Corporation

- 6.4.6 BASF

- 6.4.7 Clariant

- 6.4.8 Croda International plc

- 6.4.9 Emery Oleochemicals

- 6.4.10 Evonik Industries AG

- 6.4.11 Italmatch Chemicals

- 6.4.12 Kao Corporation

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 Palsgaard

- 6.4.15 Sanyo Chemical Industries

- 6.4.16 Solvay

- 6.4.17 Tosaf

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment