|

市场调查报告书

商品编码

1842569

汽车显示器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

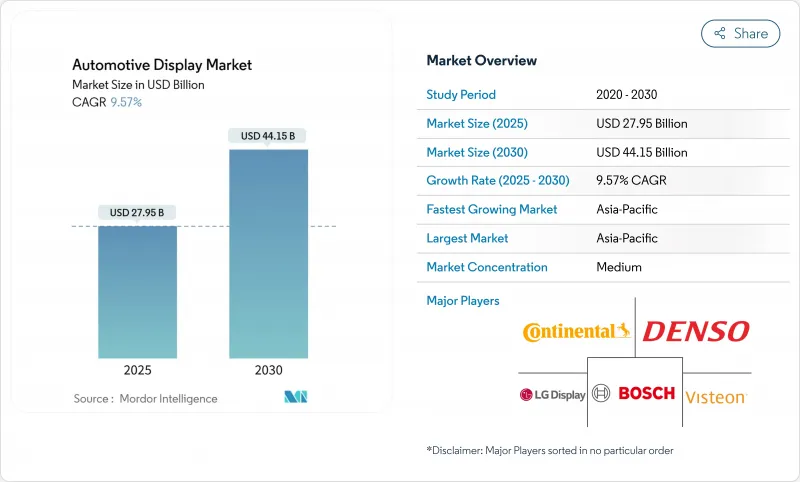

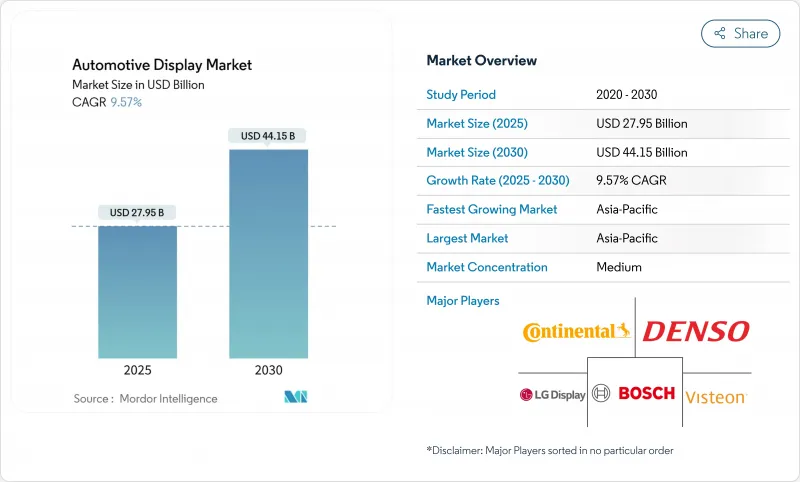

预计汽车显示器市场规模到 2025 年将达到 279.5 亿美元,到 2030 年将达到 441.5 亿美元,在此期间的复合年增长率为 9.57%。

软体定义汽车架构的扩展、身临其境型资讯娱乐需求的不断增长以及驾驶自动化水平的不断提高,正在推动显示器从简单的资讯显示逐渐成为人机介面 (HMI) 的核心资产。汽车製造商正在整合更多萤幕空间,以支援无线 (OTA) 功能的推出、远端诊断和基于订阅的内容。由于成熟的供应链,高亮度液晶显示器 (LCD) 模组继续在量产中占据主导地位,而有机发光二极体(OLED) 和 mini-LED 替代品则专注于高端车型,以证明其较高的单位成本是合理的。

全球汽车显示器市场趋势与洞察

联网汽车汽车和电动车的兴起需要丰富的 HMI

电动车动力传动系统和云端互联的车路基础设施互联的复杂性,要求图形介面能够显示电池健康状况、基于路线的续航里程预测以及Vehicle-to-Grid(V2G) 交易。现代汽车表示,买家对内建于中央显示器的充电规划工具表现出浓厚兴趣,这凸显了直觉的图形介面与降低续航里程焦虑之间的关联。

整合数位驾驶座需求激增

统一驾驶座平台将仪錶板、资讯娱乐和空调控制整合到一个共用作业系统中。哈曼基于 Linux 和 Android 的驾驶座套件可跨域传输内容,降低电子设备的复杂性,并为人工智慧主导的个人化创造空间。供应商应用数位双胞胎建模来加速实体原型製作。佛吉亚基于模型的设计缩短了开发週期,并满足了汽车製造商的上市时间目标。驾驶座内的无线 (OTA) 支援可解锁售后功能,从而建立经常性收益模式。

玻璃和半导体供应不稳定

2024-2025年,高纯度石英和传统节点半导体经历了间歇性供不应求,暴露了集中采购的脆弱性。飓风对一家大型石英工厂的破坏限制了玻璃基板的生产,而围绕镓和锗的地缘政治紧张局势加剧了显示驱动积体电路的风险状况。目前,第一线公司正在采取双重采购和区域化库存缓衝措施,以增强供应弹性。

細項分析

至2024年,主机中控台占总收入的39.61%,凸显其作为车辆指挥中心的角色。该细分市场具有可扩展萤幕大小、触控优先互动和应用商店相容性等优势,与汽车显示器市场向软体收益转型的趋势相契合。 HUD的安装率将以10.14%的复合年增长率成长,这主要得益于安全法规的推出和消费者对一目了然的导航的需求。这两条产品线的结合,展现了汽车显示器市场如何支援分层使用者体验策略。

网域控制器的日益普及将使丛集、HUD 和乘客萤幕之间的内容重新平衡成为可能。伟世通已获得价值 26 亿美元的驾驶座合同,合约有效期至 2024 年,其中许多合约将把多种显示器类型捆绑到单一硬体和软体堆迭中,从而简化检验并缩短发布时间。

2024年,LCD模组将占出货量的64.05%,这得益于成熟的晶圆厂、驱动IC价格的下降以及Mini LED增强技术的不断涌现(这些技术可在不增加价格的情况下提升对比度)。大众市场的仪錶板、数位仪錶板和车载显示器将继续依赖LCD可预测的成本蓝图,这确保了该技术在整个预测期内仍将是车载HMI的支柱。

OLED 是成长最快的技术,预计其复合年增长率将达到 10.42%,这得益于对高对比度曲面丛集、柔性中控台以及高端内装价格的关注。三星显示器的 Dolby Vision 认证面板目前峰值亮度超过 1,500 尼特,缩小了与 LCD 面板在日间可视度方面的差距,并为 OEM 升级提供了理由。 MicroLED 原型也正在涌现,但其商业性时间表将延长至 2030 年后,在此期间,LCD 和 OLED 仍将是主导技术选择。

区域分析

亚太地区将继续成为最大的汽车显示器市场,到2024年将占全球汽车显示器市场收入的45.85%,到2030年的复合年增长率为11.77%。中国是该地区的主导地位。本土品牌正在将12英寸及更大的中控萤幕标准化,并受益于半导体、面板和整车组装的一体化生态系统,从而缩短了开发週期并降低了成本。地方政府正在投资车路云端基础设施,以实现资料密集型驾驶座功能,避免延迟问题。

北美将继续成为一个技术密集市场,汽车保有量低、单车配置高、收益可观。 2024年,美国轻型汽车产量将达到1,646万辆,HUD普及率将随着L2+级驾驶辅助套件的推出而上升。硅谷软体中心正在缩短OTA更新周期,并增强消费者对类似行动应用程式的驾驶座体验的期望。

欧洲在优先考虑安全性和永续性的监管力度方面位居前三名。欧洲新车安全评鑑协会即将推出的分心指数和欧7排放气体标准将加速电动车的普及,进而推动对可视化能源使用和驾驶监控数据的先进显示器的需求。德国高端汽车在曲面OLED仪錶板和仪錶板宽玻璃层压板方面处于领先地位,使该地区成为下一代驾驶座造型的重要影响者。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场驱动因素

- 整合数位驾驶座需求激增

- 汽车高亮度液晶显示器成本快速降低

- 原始设备製造商转向更大的柱间萤幕

- 联网汽车汽车和电动车的兴起需要丰富的 HMI

- NCAP分心评分规则加速HUD安装

- 软体定义的汽车OTA UX更新周期

- 市场限制

- 汽车OLED价格昂贵

- 玻璃和半导体供应的波动

- 网路安全合规成本上升

- 大型柔性显示器的可靠性问题

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 依产品类型

- 中控台显示屏

- 仪錶群显示幕

- 抬头显示器

- 后座娱乐显示器

- 按下显示技术

- LCD

- 有机发光二极体

- Mini LED/Micro LED

- 按车辆类型

- 搭乘用车

- 商用车

- 按显示尺寸

- 小于5英寸

- 6到10英寸

- 10吋或以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Panasonic Holdings Corporation

- Nippon Seiki Co., Ltd.

- AUO Corporation

- Japan Display Inc.

- Sharp Corporation

- BOE Technology Group Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Valeo SA

- Tianma Micro-electronics Co., Ltd.

第七章 市场机会与未来展望

The automotive display market size is valued at USD 27.95 billion in 2025 and is forecast to reach USD 44.15 billion in 2030, advancing at a 9.57% CAGR during the period.

Expanding software-defined vehicle architectures, stronger demand for immersive infotainment, and rising levels of driving automation push displays from simple information read-outs to core human-machine-interface (HMI) assets. Automakers are integrating more screen real estate to support over-the-air (OTA) feature rollouts, remote diagnostics, and subscription-based content. High-brightness liquid-crystal-display (LCD) modules continue to dominate volume production thanks to mature supply chains, while organic-light-emitting-diode (OLED) and Mini LED alternatives concentrate on premium trims to justify higher unit pricing.

Global Automotive Display Market Trends and Insights

Rise of connected & electric vehicles needing richer HMI

EV powertrain complexity and cloud-linked vehicle-road-infrastructure connectivity demand graphical interfaces that surface battery health, route-based range estimates, and V2G (vehicle-to-grid) transactions. Hyundai reports strong buyer interest in charge-planning tools embedded within its central display, highlighting the link between intuitive graphics and reduced range anxiety.

Soaring demand for integrated digital cockpits

Unified cockpit platforms consolidate instrument clusters, infotainment, and climate controls onto shared operating systems. HARMAN's Linux- and Android-based cockpit suite streams content across domains, lowering electronics complexity and creating room for AI-driven personalization . Suppliers apply digital-twin modelling to cut physical prototyping time; Faurecia's model-based design shrinks development cycles, aligning with automakers' software time-to-market targets. OTA support within the cockpit enables post-sale feature unlocks, cementing recurring-revenue models.

Glass & semiconductor supply volatility

High-purity quartz and legacy-node semiconductors experienced intermittent shortages in 2024-2025, exposing the fragility of concentrated sourcing. Hurricane damage to key quartz facilities constrained glass substrate output, while geopolitical tensions around gallium and germanium sharpened risk profiles for display driver integrated circuits. Tier-1s now dual-source and regionalize inventory buffers to harden supply resilience.

Other drivers and restraints analyzed in the detailed report include:

- Software-defined vehicle OTA UX refresh cycles

- NCAP distraction-score rules accelerating HUD fitment

- Premium pricing of automotive-grade OLEDs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Center-stack consoles held 39.61% of revenue in 2024, underlining their role as the vehicle's command center. The segment benefits from scalable screen sizes, touch-first interaction, and app-store compatibility that align with the automotive display market's shift to software monetization. HUD fitment is rising fastest at a 10.14% CAGR, buoyed by safety legislation and consumer demand for glance-free navigation cues. Combined, both product lines exemplify how the automotive display market supports tiered UX strategies-comprehensive control panels for deep interaction, and windshield projections for critical driver alerts.

Increasing domain-controller adoption allows content rebalancing between clusters, HUDs, and passenger screens. Visteon secured USD 2.6 billion in cockpit contracts during 2024, many bundling multiple display types into one hardware-software stack that simplifies validation and shortens launch timelines.

LCD modules captured 64.05% of shipments in 2024 thanks to long-established fabs, falling driver-IC pricing, and a growing slate of Mini LED enhancements that elevate contrast without premium pricing. Mass-market dashboards, digital clusters, and fleet displays continue to rely on LCD's predictable cost roadmap, ensuring the technology remains the backbone of automotive HMI for the forecast window.

OLED is the fastest-growing technology, projected to advance at a 10.42% CAGR by focusing on high-contrast curved clusters, flexible center stacks, and pillar-to-pillar treatments that command premium trim pricing. Samsung Display's Dolby Vision-certified panels now reach peaks above 1,500 nits, narrowing daytime-visibility gaps versus LCD and justifying OEM upgrades. MicroLED prototypes are also emerging, yet their commercial timeline extends past 2030, leaving LCD and OLED to define mainstream technology choice in the interim.

The Automotive Display Market Report is Segmented by Product Type (Center Stack Display, Instrument Cluster Display, and More), Display Technology (LCD, OLED, and More), Vehicle Type (Passenger Cars and Commercial Vehicles), Display Size (Less Than 5-Inch, 6 To 10 Inch, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remained the largest automotive display market, accounting for 45.85% of 2024 revenue and projected to grow at an 11.77% CAGR through 2030. China anchors the region's dominance; domestic brands install 12-inch or larger center screens as standard and benefit from integrated semiconductor, panel, and vehicle-assembly ecosystems that compress development cycles and lower cost. Local governments invest in vehicle-road-cloud infrastructure, enabling data-intensive cockpit functions without latency penalties.

North America follows as a technology-rich arena where high content per vehicle drives sizable revenue despite smaller unit totals. U.S. light-vehicle production reached 16.46 million units in 2024, and HUD penetration rose alongside Level-2+ driver-assistance packages. Silicon Valley software hubs shorten OTA update cycles and reinforce consumer expectations for mobile-app-like cockpit experiences.

Europe completes the top three with a regulatory push that prioritizes safety and sustainability. Euro NCAP's forthcoming distraction metrics and Euro 7 emissions limits accelerate electric-vehicle adoption and, by extension, demand for advanced displays that visualize energy usage and driver-monitor data. German premium marques lead in curved OLED clusters and dashboard-wide glass laminates, giving the region an outsized influence on next-generation cockpit styling.

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Panasonic Holdings Corporation

- Nippon Seiki Co., Ltd.

- AUO Corporation

- Japan Display Inc.

- Sharp Corporation

- BOE Technology Group Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Valeo SA

- Tianma Micro-electronics Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Soaring demand for integrated digital cockpits

- 4.1.2 Rapid cost-down of high-brightness automotive LCDs

- 4.1.3 OEM push for larger pillar-to-pillar screens

- 4.1.4 Rise of connected & electric vehicles needing richer HMI

- 4.1.5 NCAP distraction-score rules accelerating HUD fitment

- 4.1.6 Software-defined vehicle OTA UX refresh cycles

- 4.2 Market Restraints

- 4.2.1 Premium pricing of automotive-grade OLEDs

- 4.2.2 Glass & semiconductor supply volatility

- 4.2.3 Rising cyber-security compliance costs

- 4.2.4 Reliability issues with large flexible displays

- 4.3 Value/Supply-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Product Type

- 5.1.1 Center Stack Display

- 5.1.2 Instrument Cluster Display

- 5.1.3 Head-Up Display

- 5.1.4 Rear-Seat Entertainment Display

- 5.2 By Display Technology

- 5.2.1 LCD

- 5.2.2 OLED

- 5.2.3 MiniLED / MicroLED

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Display Size

- 5.4.1 Less than equal to 5-inch

- 5.4.2 6 to 10 inch

- 5.4.3 Above 10 inch

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 LG Display Co., Ltd.

- 6.4.2 Samsung Display Co., Ltd.

- 6.4.3 Robert Bosch GmbH

- 6.4.4 Continental AG

- 6.4.5 Denso Corporation

- 6.4.6 Visteon Corporation

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Nippon Seiki Co., Ltd.

- 6.4.9 AUO Corporation

- 6.4.10 Japan Display Inc.

- 6.4.11 Sharp Corporation

- 6.4.12 BOE Technology Group Co., Ltd.

- 6.4.13 Hyundai Mobis Co., Ltd.

- 6.4.14 Valeo SA

- 6.4.15 Tianma Micro-electronics Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 Growing AR-HUD monetization potential

- 7.2 MicroLED roadmaps promise 30% power savings

- 7.3 Over-the-air subscription models for display-based features

- 7.4 China-centric cockpit-display supply chain localization

- 7.5 Aftermarket retrofit demand for Above 12-inch screens in developing markets