|

市场调查报告书

商品编码

1842572

簧片感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Reed Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

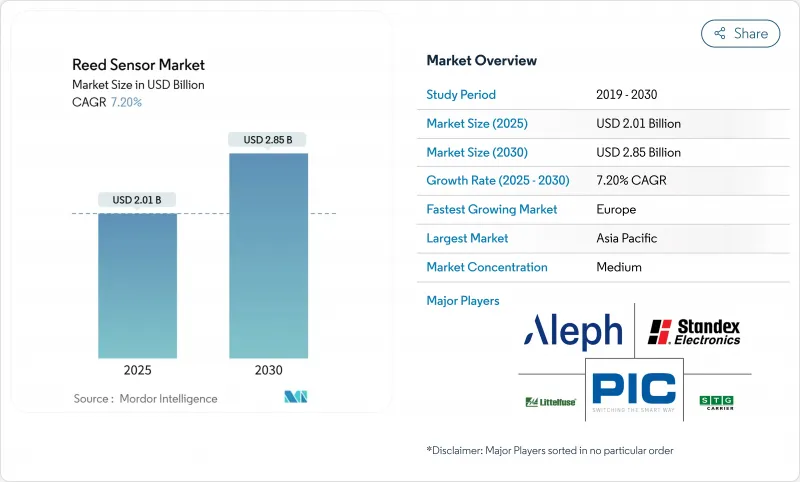

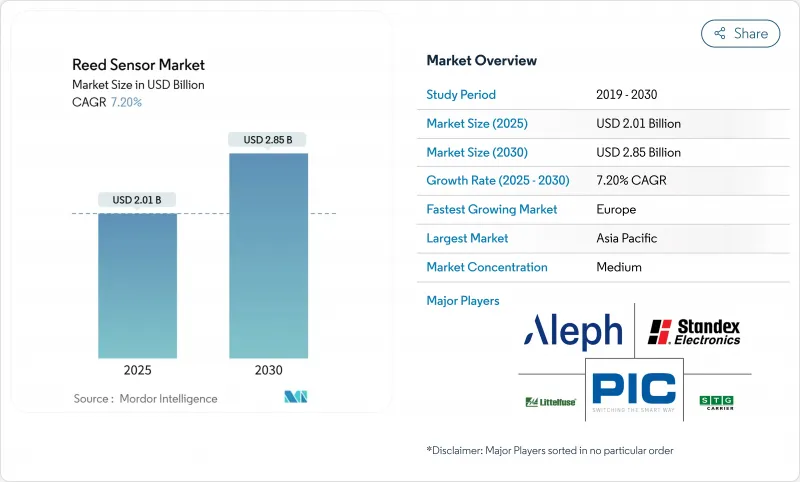

预计 2025 年簧片感测器市场规模将达到 20.1 亿美元,预计 2030 年将达到 28.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.20%。

电动车电池组、氢燃料电池堆和户外智慧电錶机壳对本质安全开关的需求不断增长,推动了这项扩张。磁簧感应器市场凭藉其无火花运作、零待机功耗以及在恶劣条件下20年久经考验的现场可靠性,继续捍卫其在固态霍尔和TMR替代品领域的市场地位。亚太地区仍然是生产领域的领导者,欧洲监管机构对可再生能源和功能安全的推动推动了该地区的快速成长。竞争强度适中,全球领导者利用规模效应、垂直整合的玻璃加工以及奈米结构触点等材料创新来延长产品寿命并降低成本。

全球磁簧感应器市场趋势与洞察

低功耗智慧电网电錶的普及

公共产业越来越多地将传统传统仪錶替换为20年免维护的智慧型设备,并指定使用簧片开关进行脉衝计数,因为磁驱动技术可实现零待机功耗。密封设计可防止室外机壳凝结,使其使用寿命从-40°C延长至+85°C。 Gridpertise等公司已大规模部署簧片开关,目前已超过1.08亿台,证明了簧片开关设计的可扩充性。波兰的Tauron Dystrybucja公司已透过依赖磁脉衝完整性的自动抄表服务为560万客户提供服务。到2030年,电网的持续数位化将持续推动对稳定可靠、独立于电池的开关的需求。

采用电动车电池管理

电动和氢动力汽车的电池组需要可靠、无火花的定位和洩漏检测。大陆集团的电动马达转子温度感测器将温度误差降低至3°C,并透过磁体优化提高效率。霍尼韦尔的电解洩漏感测器采用密封触点,避免点火源,并为热失控事件提供20分钟的预警窗口。马夸特公司将簧片元件应用于氢电池电压监测器,可在灾难性故障发生前发现氢气洩漏。电动车的加速普及将推动簧片感测器市场达到2.1个百分点的复合年增长率。

固态感测器替代品

霍尔效应和TMR IC现已配备封装内诊断功能并符合ASIL-D标准,这增加了汽车转向和踏板模组的竞争压力。电感线性感测器在12毫米范围内的精度可达±0.85%,超过了典型的引线公差。这些固态技术的进步导致磁簧感应器市场的复合年增长率下降了1.4个百分点,儘管价格敏感的警报器和液位计仍然选择使用引线元件。

細項分析

到2024年,表面黏着技术元件将占据簧片感测器市场份额的38.7%。受工业自动化趋势的推动,用于气缸的螺纹筒感测器将以8.3%的复合年增长率成长,这将推动簧片感测器市场的整体成长。簧片感测器产业仍将保留用于传统电器的通孔型感测器,而法兰封装将确保航太对密封的需求。 Firecracker封装非常适合笔记型电脑盖检测,因为高尺寸至关重要。在预测期内,SMD的采用将减少组装工作量,为穿戴式装置带来设计机会,并为主要供应商维持规模化价格优势。

螺纹筒体产品的需求,加上棕地工厂中回馈点数量的激增,正在产生持续的吸引力。圆柱形外壳可保护接触点免受油污和金属碎屑的侵蚀,从而降低保固索赔率。预计到2030年,此类重型设备的磁簧感应器市场规模将以8.3%的复合年增长率成长,新增6.3亿美元的收益。生产线製造商青睐无需更换支架即可改装的螺纹嵌件,这表明机械相容性可以保护簧片感测器市场免于被快速替代。

到2024年,A型开关将占据簧片感测器市场的41.3%,因为其常开电路可为安防和液位警报提供故障安全逻辑。然而,由于电池供电的物联网标籤需要接近零的静态电流,锁存型E型开关的复合年增长率最高,将达到8.6%。奈米结构触点的进步使其使用寿命延长了四倍,加速了其在智慧电錶和资产追踪设备中的应用。

Form B 常闭型用于暖通空调 (HVAC) 风扇防护罩,而 Form C 转换接点则由 PLC 控制的製程阀支援。预计到 2030 年,双稳态 Form E 型磁簧感应器市场规模将达到 4.2 亿美元,这将推动传统磁簧继电器向占空比无线节点的转变。由于这些设备无需通电即可保持其状态,维护团队可以降低维护频率,从而显着节省营运成本,从而增强簧片感测器行业的整体应用曲线。

簧片感测器市场按安装类型(表面黏着技术、PCB通孔等)、接触位置(A型(SPST-NO)、B型(SPST-NC)、其他)、开关能力(低压/讯号(小于30V)、中压(30-200V)、其他)、应用(汽车、家电、其他)和地区细分。市场预测以美元计算。

区域分析

受中国2,850亿元人民币感测器经济规模和高密度玻璃管製造基地的推动,到2024年,亚太地区将占据簧片感测器市场的40.4%。国家鼓励电动车在地采购和智慧工厂建设的政策,正推动汽车製造商转向国内领先供应商,但进口特殊玻璃仍然是高压等级产品的基础。日本的精密製程控制和韩国的智慧型手机组装确保了稳定的大众消费,而印度乘用车製造业则推动了新型车门敏捷功能的安装,从而提振了整体需求。

欧洲是成长最快的地区,到2030年,复合年增长率将达到8.6%,因为欧7法规加强了功能安全性,并要求离岸风力发电使用密封限位开关。 SICK和Endress+Hauser成立的合资公司拥有730名员工,是流程分析领域区域整合的典范,该公司整合了簧片触点以实现可靠的流量测量。北欧公用事业公司也将电子机械仪表替换为智慧终端,实现了销售成长。一家德国机械製造商正在将螺纹筒感测器整合到气动滑块中,从而增强了该地区工业簧片的销售量。

北美正以中等个位数的健康速度发展。公共指定户外智慧电錶的使用寿命为20年,通常依赖簧片脉衝触点。 Littelfuse 2025年第一季营收5.54亿美元,凸显了需求的韧性,因为资料中心配电和电动车服务设备推动了感测器的普及。航太对军用规格玻璃和接点的需求确保了美国利基供应商的收益。墨西哥一家轻型卡车工厂增加了车门和安全带开关,加拿大的一个可再生能源计划扩大了高压应用的机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 低功耗智慧电网电錶的普及

- 采用电动车电池管理

- 工业4.0维修和自动化

- 智慧家庭和物联网设备的兴起

- 氢燃料电池安全系统

- 用于一次性医疗设备的小型感测器

- 市场限制

- 固态(霍尔/TMR)感知器更换

- 高振动区域的可靠性问题

- 玻璃管供应链限制

- 高密度电动车动力传动系统中的EMI问题

- 产业价值链分析

- 监管状况

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章市场规模及成长预测(金额)

- 按安装类型

- 表面黏着技术(SMD)

- PCB通孔

- 螺纹筒

- 法兰/扁平封装

- 圆柱形/爆竹形

- 槓桿臂

- 浮动/水平

- 其他的

- 按接触位置

- A型(SPST-NO)

- B型(单刀单掷-常闭)

- C型(SPDT)

- E型(闭锁型)

- 其他的

- 按切换容量

- 低电压/讯号(<30 V)

- 中压(30-200 V)

- 高电压(>200 V)

- 大电流(>1A)

- 高耐热性

- 其他的

- 按用途

- 车

- 家电

- 工业自动化与机器人

- 安全与安保系统

- 医疗保健和医疗设备

- 资讯科技/通讯

- 其他应用

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 台湾

- 马来西亚

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Littelfuse Inc.

- Standex Electronics Inc.

- PIC GmbH

- Aleph Holdings Co. Ltd.

- STG Germany GmbH

- Coto Technology Inc.

- Reed Switch Developments Corp.

- ZF Friedrichshafen AG

- Reed Relays & Electronics India Ltd.

- WIKA Instruments India Pvt Ltd.

- HSI Sensing

- Magnasphere Corp.

- Hamlin Electronics(Littelfuse)

- Sensata Technologies

- Comus International

- MEDER electronic

- Schneider Electric(SE)

- SMC Corporation

- NTE Electronics Inc.

- TE Connectivity

- OKI Sensor Device Corp.

- Changjiang Electronics Tech

- Zhejiang Xurui Electronic Co.

- Shanghai Kaiyuan Microelectronics

- HOKUYO Automatic Co. Ltd.

第七章 市场机会与未来趋势

- 閒置频段和未满足需求评估

The Reed Sensor Market size is estimated at USD 2.01 billion in 2025, and is expected to reach USD 2.85 billion by 2030, at a CAGR of 7.20% during the forecast period (2025-2030).

Rising demand for intrinsically safe, hermetically sealed switching in electric-vehicle battery packs, hydrogen fuel-cell stacks, and outdoor smart-meter enclosures underpins this expansion. The reed sensor market continues to defend its niche against solid-state Hall and TMR alternatives by offering spark-free operation, zero-standby-power consumption, and proven 20-year field reliability in harsh conditions. Asia-Pacific remains the production engine, but Europe's regulatory push for renewable energy and functional safety drives the fastest regional growth. Competitive intensity is moderate: global leaders leverage scale, vertically integrated glass processing, and material innovations such as nanostructured contacts to stretch product life and lower cost.

Global Reed Sensor Market Trends and Insights

Surge in Low-Power Smart-Grid Metering

Utilities replacing legacy meters with 20-year maintenance-free smart devices increasingly specify reed switches for pulse counting because magnetic actuation draws zero standby power. Hermetic sealing prevents condensation in outdoor enclosures, extending service life across -40 °C to +85 °C. Large-scale rollouts by firms such as Gridspertise-now surpassing 108 million units-confirm the scalability of reed-based designs. Poland's Tauron Dystrybucja already manages 5.6 million customers via automated reading that depends on magnetic pulse integrity. Continued grid digitalization until 2030 sustains demand for robust, battery-independent switching.

EV Battery-Management Adoption

Battery packs in electric and hydrogen vehicles require spark-free, reliable position and leakage sensing. Continental's e-Motor Rotor Temperature Sensor trims temperature error to 3 °C, improving magnet optimization for efficiency. Honeywell's electrolyte-leak sensor offers a 20-minute warning window for thermal-runaway events, using hermetically sealed contacts to avoid ignition sources. Marquardt applies reed elements in hydrogen cell voltage monitors to catch H2 leaks before catastrophic failure. Accelerating EV adoption, therefore, adds a 2.1 percentage-point lift to the reed sensor market CAGR.

Solid-State Sensor Substitution

Hall and TMR ICs now ship with in-package diagnostics and ASIL-D compliance, raising competitive pressure in automotive steering and pedal modules. Inductive linear sensors achieve +-0.85% accuracy over 12 mm, eclipsing typical reed tolerances. These solid-state gains shave 1.4 percentage points from the reed sensor market CAGR, though price-sensitive alarms and liquid-level gauges still choose reed parts.

Other drivers and restraints analyzed in the detailed report include:

- Industrial-4.0 Retrofits and Automation

- Smart-Home and IoT Device Proliferation

- Reliability Issues in High-Vibration Zones

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surface-mount devices delivered 38.7% of the reed sensor market share in 2024, reflecting automated pick-and-place economics on high-volume consumer boards. Threaded-barrel sensors for pneumatic cylinders shape the strongest 8.3% CAGR, aligned with the industrial automation wave that lifts overall reed sensor market growth. The reed sensor industry also retains through-hole models for legacy appliances, while flange packages secure aerospace demand for hermeticity. Firecracker formats suit laptop lid detection, where profile height is paramount. Over the forecast period, SMD adoption lowers assembly labor, widens design wins in wearables, and sustains at-scale pricing advantages for leading suppliers.

Demand for threaded-barrel products pairs with a proliferation of cylinder-count feedback points in brownfield factories, creating sustained pull. Cylindrical housings safeguard contacts from oil and metal shavings, keeping warranty claims low. The reed sensor market size for these rugged units is forecast to expand at an 8.3 % CAGR to 2030, translating into USD 0.63 billion of incremental revenue. Line builders prefer threaded inserts because they retrofit without bracket changes, illustrating how mechanical compatibility protects the reed sensor market from quick substitutability.

Form A switches commanded 41.3% of the reed sensor market in 2024 because normally-open circuits provide fail-safe logic in security and liquid-level alarms. Latching Form E designs, however, log the highest 8.6% CAGR as battery-run IoT tags seek near-zero quiescent current. Advancements in nanostructured contacts quadruple life cycles, bolstering uptake in smart meters and asset trackers.

Form B normally-closed types cater to HVAC fan guards, while Form C changeover contacts find traction in PLC-controlled process valves. The reed sensor market size for bistable Form E models is set to reach USD 0.42 billion by 2030, capitalizing on the migration of legacy reed relays to duty-cycled wireless nodes. As these devices remember state without power, maintenance teams cut service frequency, adding quantifiable OPEX savings that reinforce the adoption curve across the reed sensor industry.

Reed Sensor Market is Segmented by Mounting Type (Surface Mount, PCB Through-Hole, and More), Contact Position (Form A (SPST-NO), Form B (SPST-NC), and More), Switching Capability (Low-Voltage/Signal (<30 V), Medium-Voltage (30-200 V), and More), Application (Automotive, Consumer Electronics and Home Appliances, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 40.4% of the reed sensor market revenue in 2024, powered by China's CNY 285 billion sensor economy and its dense glass-tube manufacturing base. National incentives for local content in electric vehicles and smart factories steer OEMs toward domestic reed suppliers, yet imported specialty glass still underpins high-voltage grades. Japan's precision process control and South Korea's smartphone assembly ensure steady high-volume consumption, while India's passenger-car build-out triggers new door-ajar fitments that raise overall demand.

Europe is the fastest-growing region at an 8.6% CAGR through 2030 as Euro 7 rules tighten functional safety and as offshore wind farms require hermetically sealed limit switches. SICK and Endress+Hauser's 730-staff joint venture exemplifies regional consolidation in process analytics that integrates reed contacts for reliable flow measurement. Nordic utilities swapping 100% of electromechanical meters for smart endpoints also lift volumes. German machine builders embed threaded-barrel sensors into pneumatic slides, reinforcing the region's pull on industrial-grade reed volume.

North America advances at a healthy mid-single-digit pace. Utilities specify 20-year outdoor smart meters that often rely on reed pulse contacts; state decarbonization mandates accelerate rollouts. Littelfuse's USD 554 million Q1 2025 revenue underscores demand resilience, with data-center power distribution and EV service equipment fueling sensor uptake. Aerospace requirements for Mil-Spec glass and contacts keep US niche suppliers profitable. Mexico's light-truck plants add door and seat-belt switches, while Canadian renewables projects expand high-voltage application opportunities.

- Littelfuse Inc.

- Standex Electronics Inc.

- PIC GmbH

- Aleph Holdings Co. Ltd.

- STG Germany GmbH

- Coto Technology Inc.

- Reed Switch Developments Corp.

- ZF Friedrichshafen AG

- Reed Relays & Electronics India Ltd.

- WIKA Instruments India Pvt Ltd.

- HSI Sensing

- Magnasphere Corp.

- Hamlin Electronics (Littelfuse)

- Sensata Technologies

- Comus International

- MEDER electronic

- Schneider Electric (SE)

- SMC Corporation

- NTE Electronics Inc.

- TE Connectivity

- OKI Sensor Device Corp.

- Changjiang Electronics Tech

- Zhejiang Xurui Electronic Co.

- Shanghai Kaiyuan Microelectronics

- HOKUYO Automatic Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in low-power smart-grid metering

- 4.2.2 EV battery-management adoption

- 4.2.3 Industrial-4.0 retrofits and automation

- 4.2.4 Smart-home and IoT device proliferation

- 4.2.5 Hydrogen fuel-cell safety systems

- 4.2.6 Disposable medical-device mini-sensors

- 4.3 Market Restraints

- 4.3.1 Solid-state (Hall/TMR) sensor substitution

- 4.3.2 Reliability issues in high-vibration zones

- 4.3.3 Glass-tube supply-chain constraints

- 4.3.4 EMI issues in dense EV powertrains

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Mounting Type

- 5.1.1 Surface Mount (SMD)

- 5.1.2 PCB Through-Hole

- 5.1.3 Threaded Barrel

- 5.1.4 Flange/Flat Pack

- 5.1.5 Cylindrical/Firecracker

- 5.1.6 Lever Arm

- 5.1.7 Float/Level

- 5.1.8 Others

- 5.2 By Contact Position

- 5.2.1 Form A (SPST-NO)

- 5.2.2 Form B (SPST-NC)

- 5.2.3 Form C (SPDT)

- 5.2.4 Form E (Latching)

- 5.2.5 Others

- 5.3 By Switching Capability

- 5.3.1 Low-Voltage/Signal (<30 V)

- 5.3.2 Medium-Voltage (30-200 V)

- 5.3.3 High-Voltage (>200 V)

- 5.3.4 High-Current (>1 A)

- 5.3.5 High-Temp-Resistant

- 5.3.6 Others

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Consumer Electronics and Home Appliances

- 5.4.3 Industrial Automation and Robotics

- 5.4.4 Safety and Security Systems

- 5.4.5 Healthcare and Medical Devices

- 5.4.6 Telecommunications and IT

- 5.4.7 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Taiwan

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Littelfuse Inc.

- 6.4.2 Standex Electronics Inc.

- 6.4.3 PIC GmbH

- 6.4.4 Aleph Holdings Co. Ltd.

- 6.4.5 STG Germany GmbH

- 6.4.6 Coto Technology Inc.

- 6.4.7 Reed Switch Developments Corp.

- 6.4.8 ZF Friedrichshafen AG

- 6.4.9 Reed Relays & Electronics India Ltd.

- 6.4.10 WIKA Instruments India Pvt Ltd.

- 6.4.11 HSI Sensing

- 6.4.12 Magnasphere Corp.

- 6.4.13 Hamlin Electronics (Littelfuse)

- 6.4.14 Sensata Technologies

- 6.4.15 Comus International

- 6.4.16 MEDER electronic

- 6.4.17 Schneider Electric (SE)

- 6.4.18 SMC Corporation

- 6.4.19 NTE Electronics Inc.

- 6.4.20 TE Connectivity

- 6.4.21 OKI Sensor Device Corp.

- 6.4.22 Changjiang Electronics Tech

- 6.4.23 Zhejiang Xurui Electronic Co.

- 6.4.24 Shanghai Kaiyuan Microelectronics

- 6.4.25 HOKUYO Automatic Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment