|

市场调查报告书

商品编码

1842585

SMS 防火墙:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)SMS Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

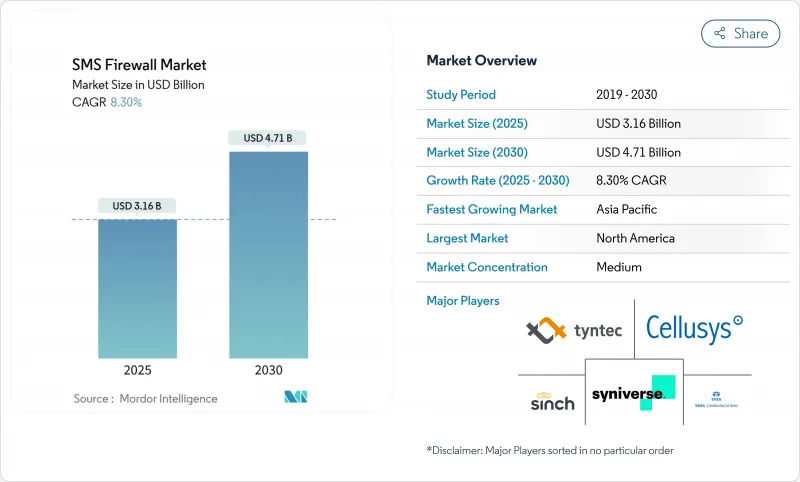

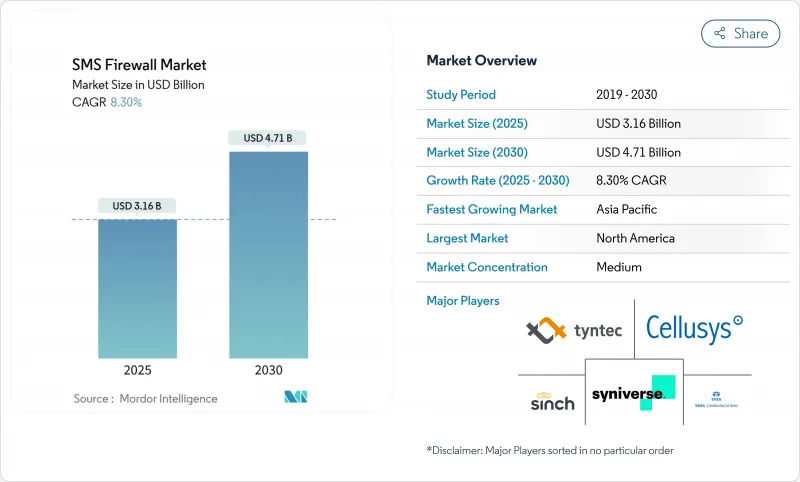

预计 2025 年简讯防火墙市场规模为 31.6 亿美元,到 2030 年将达到 47.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.30%。

通讯业者正在投资下一代防火墙,以确保A2P收益,履行新的可追溯性义务,并保护5G网路切片免受信令威胁。由于从SS7到Diameter防火墙的过渡、早期采用者国家5G部署的加速以及国家资料主权规则强制要求在岸过滤,资本支出只会持续成长。同时,CPaaS整合正在挤压供应商的利润空间,供应商们正透过人工智慧驱动的分析和託管服务产品脱颖而出。适度的供应商碎片化为利基专家留下了发展空间,他们利用云端原生、基于订阅的工具,瞄准三、四级行动网路营运商。

全球简讯防火墙市场趋势与洞察

A2P流量收益激增

随着营运商面临语音收入下滑的困境,经过身份验证的A2P通讯对于恢復收益至关重要。印度的分散式帐本框架已帮助Airtel客户减少了40%的洩漏和98%的垃圾邮件。巴西和奈及利亚的类似收益计画依靠先进的流量分析技术,将合法的企业声明与灰色管道区分开来。此模式还允许通讯业者转售内建安全性的优质递送服务。虽然经济上可行,但部署需要基于机器学习的侦测工具,而小型通讯业者无法在传统基础架构上部署这些工具。

移动诈骗和灰色路由损失不断增加

SIM 卡盒诈骗每年造成 31.1 亿美元的损失,占所有通讯诈骗的 7.8%。人为夸大的流量和利用语音、简讯和社交应用程式进行的网路宣传活动正迫使监管机构采取行动。印度一个基于人工智慧的反诈骗平台在三个月内将诈骗电话减少了 90%。此类成功案例促使其他监管机构要求将简讯防火墙功能整合到更广泛的诈骗防制堆迭中,从而扩大简讯防火墙市场。

Tier 3/4 行动网路业者的技术意识较低

成千上万的小型企业正在致力于DLT註册和规则优化,同时,印度有2.7万家企业正在寻求合规援助。机器学习规则的持续调整和即时威胁来源的集成,正在推动这些企业转向託管服务,但预算限制减缓了其采用速度。

細項分析

到2024年,A2P通讯将占据简讯防火墙市场份额的65.3%,这得益于金融、医疗保健和公共服务领域强制实施的身份验证规则。随着企业为保证送达和垃圾邮件防护付费,A2P领域的简讯防火墙市场规模预计将以8.3%的复合年增长率成长。企业也投资安全的P2P警报,推动P2P企业类别的复合年增长率达到10.2%。 Jack Henry目前已透过Twilio每月发送1,200万至1,500万条安全警报,预计发送量将增加50倍。

A2P 的成长加速了防火墙的升级,以过滤灰色路由;而 P2A 用例(例如入境客户咨询)则依赖身分验证来保护企业免受欺骗攻击。 RCS 等竞争管道正在减缓 P2A 的发展势头,但受监管的行业仍然依赖简讯服务 (SMS)。动态密码和服务通知的兴起使安全的 A2P 流量成为营运商收益策略的核心,从而增强了简讯防火墙市场。

由于一级营运商更倾向于本地资料控制,本地部署在2024年的收入份额将维持在53.22%。儘管如此,云端部署的复合年增长率预计将达到13.1%,这反映了小型营运商的强劲需求。随着允许跨境处理的区域监管机构青睐威胁共用来源,云端部署的简讯防火墙市场规模预计将大幅成长。

在实施资料本地化法律的地区,混合架构正日益受到青睐,它允许营运商在陆地上储存讯息内容,同时在云端分析元资料。位于通讯业者设施内的边缘节点可提供近乎即时的分析,而无需将敏感资料迁移异地。这种灵活性正在刺激额外的投资,简讯防火墙市场在传统和新兴部署模式下均持续成长。

区域分析

由于严格的隐私法规、5G 的早期普及以及将防火墙纳入企业通讯堆迭的庞大 CPaaS 生态系统,北美在 2024 年将以 37.8% 的收入份额领先。 2025 年,由于与加拿大和墨西哥的跨境通讯触发了新的审核追踪要求,通讯业者支出将保持强劲。联邦政府对语音自动电话和简讯网路钓鱼诈骗的关注将进一步推动需求,巩固北美在简讯防火墙市场的领导地位。

亚太地区是成长最快的地区,到2030年,复合年增长率将达到12.5%。印度的分散式帐本技术(DLT)框架增强了端到端讯息可追溯性,为该地区树立了蓝图。而中国积极推动的5G切片部署正在加速下一代防火墙的采用。东南亚的业者也纷纷效法印度,采取垃圾资讯减少措施,扩大了简讯防火墙市场的整体规模。

在欧洲,GDPR合规性与泛欧盟跨境交通规则(要求精细的同意记录)之间的平衡正在不断加强。资料主权条款正推动营运商转向在岸过滤,而共用威胁来源则推动低风险类别的云端应用。在中东和非洲,行动优先经济体正在采用云端原生防火墙以降低资本成本,但认知差距正在减缓小型行动通讯业者的采用速度。在南美,与印度一样,讯息的KYC身份验证正成为强制性要求,这推动了对低成本、符合法规的解决方案的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- A2P流量收益激增

- 移动诈骗和灰色路由损失加剧

- SS7 → Diameter 防火墙升级週期

- 国家资料主权条款强制实施境内过滤

- 优先考虑用户品质和品牌信任的营运商

- 5G切片开闢了新的攻击面

- 市场限制

- Tier 3/4 行动网路业者的技术意识较低

- CPaaS整合带来的定价压力

- RCS部署延迟导致资本投资时机不确定

- 跨境讯息检查监理模糊性

- 产业价值链分析

- 监管状况

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章市场规模及成长预测(金额)

- 按简讯类型

- A2P

- P2A

- P2P(企业快讯/警报)

- 依部署类型

- 本地部署

- 云

- 按服务类型

- 专业服务(咨询、整合)

- 託管服务(全天候监控、SOC)

- 按最终用户产业

- BFSI

- 政府/公共

- 资讯科技和电讯

- 医疗保健和生命科学

- 零售与电子商务

- 媒体与娱乐

- 教育

- 製造业

- 其他最终用户产业

- 网路生成

- 2G/3G

- 4G/LTE

- 5G

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 新加坡

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Cellusys Telecommunications

- Tyntec GmbH

- Tata Communications Ltd.

- Syniverse Technologies LLC

- Sinch AB

- Omobio(Pvt)Ltd.

- Route Mobile Ltd.

- AMD Telecom SA

- BICS SA/NV

- SAP SE

- Monty Mobile

- NewNet Communication Technologies

- Mahindra Comviva

- Infobip Ltd.

- Twilio Inc.

- Anam Technologies

- Mobileum Inc.

- Mavenir Systems Inc.

- Proofpoint Inc.

- AdaptiveMobile Security(Enea)

- NetNumber Global Data Services

- Openmind Networks

- HORISEN AG

- Sparkle(Telecom Italia)

- Orange Wholesale International

- VOX Solutions

- Global Message Services AG

第七章 市场机会与未来趋势

The SMS Firewall Market size is estimated at USD 3.16 billion in 2025, and is expected to reach USD 4.71 billion by 2030, at a CAGR of 8.30% during the forecast period (2025-2030).

Operators are investing in next-generation firewalls to secure A2P revenues, comply with new traceability mandates, and guard 5G network slices from signaling threats. Migration from SS7 to Diameter firewalls, accelerated 5G rollouts in early-adopter countries, and national data-sovereignty rules that force on-shore filtering keep capital spending elevated. At the same time, CPaaS consolidation is compressing vendor margins, prompting suppliers to differentiate with AI-driven analytics and managed services offers. Moderate fragmentation among suppliers leaves space for niche specialists that target tier-3 and tier-4 mobile network operators with cloud-native, subscription-based tools.

Global SMS Firewall Market Trends and Insights

Surge in A2P Traffic Monetisation

Operators face declining voice income, so authenticated A2P messaging has become pivotal for revenue recovery. India's distributed ledger framework showed a 40% cut in leakage and a 98% spam drop for Airtel customers. Similar monetisation programs in Brazil and Nigeria rely on advanced traffic analytics that separate legitimate enterprise messages from grey routes. The model also lets carriers resell premium delivery services with embedded security. Although profitable, rollout demands machine-learning inspection tools that smaller carriers cannot host on legacy infrastructure.

Intensifying Mobile Fraud and Grey-Route Losses

SIM-box fraud causes USD 3.11 billion in yearly losses and represents 7.8% of total telecom fraud. Artificially inflated traffic and phishing campaigns now combine voice, SMS, and social apps, pressuring regulators to act. India's AI-based anti-spoofing platform cut fraudulent calls by 90% in three months. Such successes push other regulators to demand integrated SMS firewall capability within wider fraud-prevention stacks, expanding the SMS firewall market.

Low Technical Awareness Among Tier-3/4 MNOs

Thousands of smaller operators grapple with DLT registration and rule optimization, as seen when 27,000 entities in India sought compliance assistance. Continuous tuning of machine-learning rules and integration of live threat feeds push these operators toward managed services, yet budget limits slow adoption.

Other drivers and restraints analyzed in the detailed report include:

- SS7 to Diameter Firewall Upgrade Cycle

- 5G Slicing Opening New Attack Surfaces

- Pricing Pressure from CPaaS Consolidations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

A2P messaging held 65.3% of the SMS firewall market share in 2024, underpinned by mandatory authentication rules across finance, healthcare, and public services. The SMS firewall market size for A2P segments is set to expand at an 8.3% CAGR as enterprises pay for guaranteed delivery and spam control. Enterprises also invest in secure P2P alerts, pushing the P2P enterprise category to a 10.2% CAGR. Jack Henry already moves 12-15 million secured alerts each month through Twilio and plans a fifty-fold volume growth.

A2P growth accelerates firewall upgrades that filter grey routes, while P2A use cases such as inbound customer queries hinge on authentication that shields enterprises from impersonation attacks. Competing channels like RCS slow P2A momentum, yet regulated sectors still rely on SMS for universal reach. The rising volume of one-time passwords and service notifications keeps security-rich A2P traffic central to operator revenue strategies, fortifying the SMS firewall market.

On-premise deployments retained 53.22% revenue share in 2024 because tier-1 carriers favor local data control. Even so, cloud options are projected to record a 13.1% CAGR, reflecting strong demand from smaller operators. The SMS firewall market size for cloud deployments is forecast to rise sharply as regulators in regions that allow cross-border processing endorse shared-threat feeds.

Hybrid architectures gain traction where data localization laws exist, letting operators analyze metadata in the cloud while storing message content on shore. Edge nodes positioned inside carrier facilities provide near-real-time analytics without moving sensitive data off-site. This flexibility spurs additional investment, ensuring that the SMS firewall market continues to grow in both traditional and emerging deployment models.

The SMS Firewall Market is Segmented by SMS Type (A2P, P2A, and P2P), Deployment Mode (On-Premise and Cloud), Service Type (Professional Services and Managed Services), End-User Industry (BFSI, Government and Public Safety, and More), Network Generation (2G/3G, 4G/LTE, and 5G), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with a 37.8% revenue share in 2024, thanks to stringent privacy rules, early 5G adoption, and large CPaaS ecosystems that embed firewalls into enterprise communication stacks. Carrier spending stays strong in 2025 as cross-border messaging with Canada and Mexico triggers new audit trail mandates. Federal attention on robocalls and smishing scams further boosts demand, anchoring North American leadership within the SMS firewall market.

Asia-Pacific is the fastest-growing region at a 12.5% CAGR to 2030. India's DLT framework enforces end-to-end message traceability and functions as a regional blueprint, while China's aggressive 5G slicing deployment accelerates next-generation firewall uptake. Southeast Asian operators follow with spam-reduction drives that mirror India's performance gains, collectively enlarging the SMS firewall market.

Europe balances GDPR compliance with pan-EU cross-border traffic rules that require granular consent logs. Data-sovereignty clauses push operators toward on-shore filtering, yet shared threat feeds encourage cloud adoption in low-risk categories. In the Middle East and Africa, mobile-first economies adopt cloud-native firewalls to reduce capital expenses, though awareness gaps among smaller MNOs slow penetration. South America mirrors India by mandating KYC verification on messages, fueling demand for low-cost, regulation-ready solutions.

- Cellusys Telecommunications

- Tyntec GmbH

- Tata Communications Ltd.

- Syniverse Technologies LLC

- Sinch AB

- Omobio (Pvt) Ltd.

- Route Mobile Ltd.

- AMD Telecom S.A.

- BICS SA/NV

- SAP SE

- Monty Mobile

- NewNet Communication Technologies

- Mahindra Comviva

- Infobip Ltd.

- Twilio Inc.

- Anam Technologies

- Mobileum Inc.

- Mavenir Systems Inc.

- Proofpoint Inc.

- AdaptiveMobile Security (Enea)

- NetNumber Global Data Services

- Openmind Networks

- HORISEN AG

- Sparkle (Telecom Italia)

- Orange Wholesale International

- VOX Solutions

- Global Message Services AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in A2P traffic monetisation

- 4.2.2 Intensifying mobile fraud and grey-route losses

- 4.2.3 SS7 -> Diameter firewall upgrade cycle

- 4.2.4 National data-sovereignty clauses forcing on-shore filtering

- 4.2.5 Operator focus on subscriber QoE and brand trust

- 4.2.6 5G slicing opening new attack surfaces

- 4.3 Market Restraints

- 4.3.1 Low technical awareness among Tier-3/4 MNOs

- 4.3.2 Pricing pressure from CPaaS consolidations

- 4.3.3 Delayed RCS roll-outs blurring capex timing

- 4.3.4 Regulatory ambiguity on cross-border message inspection

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By SMS Type

- 5.1.1 A2P

- 5.1.2 P2A

- 5.1.3 P2P (Enterprise Flash/Alert)

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Service Type

- 5.3.1 Professional Services (Consulting, Integration)

- 5.3.2 Managed Services (24X7 Monitoring, SOC)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Government and Public Safety

- 5.4.3 IT and Telecom

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Retail and E-Commerce

- 5.4.6 Media and Entertainment

- 5.4.7 Education

- 5.4.8 Manufacturing

- 5.4.9 Other End-user Industries

- 5.5 By Network Generation

- 5.5.1 2G / 3G

- 5.5.2 4G / LTE

- 5.5.3 5G

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cellusys Telecommunications

- 6.4.2 Tyntec GmbH

- 6.4.3 Tata Communications Ltd.

- 6.4.4 Syniverse Technologies LLC

- 6.4.5 Sinch AB

- 6.4.6 Omobio (Pvt) Ltd.

- 6.4.7 Route Mobile Ltd.

- 6.4.8 AMD Telecom S.A.

- 6.4.9 BICS SA/NV

- 6.4.10 SAP SE

- 6.4.11 Monty Mobile

- 6.4.12 NewNet Communication Technologies

- 6.4.13 Mahindra Comviva

- 6.4.14 Infobip Ltd.

- 6.4.15 Twilio Inc.

- 6.4.16 Anam Technologies

- 6.4.17 Mobileum Inc.

- 6.4.18 Mavenir Systems Inc.

- 6.4.19 Proofpoint Inc.

- 6.4.20 AdaptiveMobile Security (Enea)

- 6.4.21 NetNumber Global Data Services

- 6.4.22 Openmind Networks

- 6.4.23 HORISEN AG

- 6.4.24 Sparkle (Telecom Italia)

- 6.4.25 Orange Wholesale International

- 6.4.26 VOX Solutions

- 6.4.27 Global Message Services AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment