|

市场调查报告书

商品编码

1842694

关节机器人:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Articulated Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

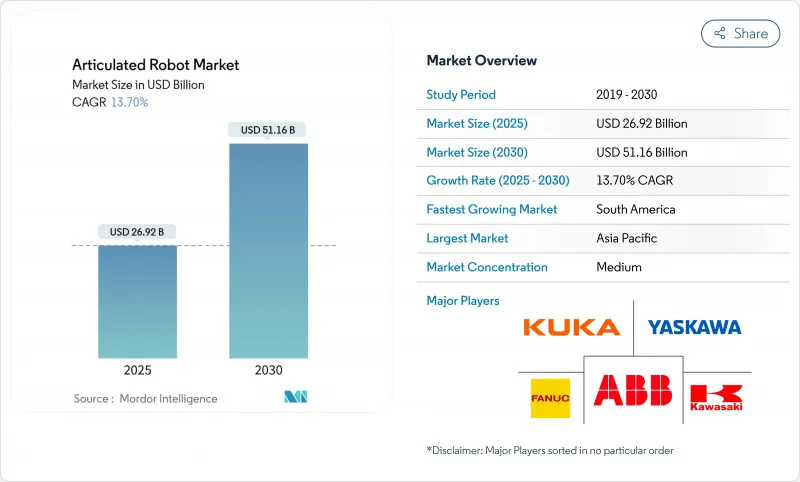

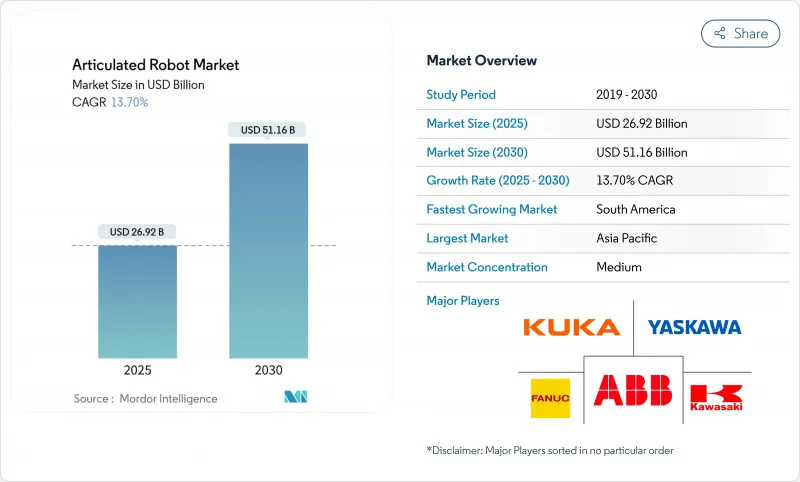

2025年关节机器人市场规模预计为269.2亿美元,预计到2030年将达到511.6亿美元,预测期内(2025-2030年)的复合年增长率为13.70%。

对智慧製造解决方案、自主生产政策以及人工智慧协作系统的需求激增,是这项扩张的基石。电动车生产资本投入的加强、电商巨头持续推广仓库自动化以及精准食品应用的扩展,进一步推动了这一发展势头。同时,零件製造商正在透过垂直整合策略解决半导体和伺服马达的瓶颈问题,而随着用户寻求降低营运成本,节能机器人设计也越来越受到青睐。竞争策略正在分化:像ABB这样的老牌公司正在寻求结构性分拆以增强专注力,而新兴企业则正在利用云端连接平台来缩短部署时间。

全球关节机器人市场趋势与洞察

向工业 4.0主导的自动化转变

製造商正将多关节机器人与人工智慧分析和物联网感测器结合,打造封闭回路型生产生态系统,以实现品质、运作和能耗的自我最佳化。富士康的无人值守工厂将预测性维护演算法融入其机器人运作单元,在维持产量的同时减少了15万名员工。小米全天候智慧型手机工厂则展现了这种黑暗工厂模式的扩充性。此类部署将自动化的经济效益从劳动力替代转向产品组合敏捷性,从而能够快速切换,以适应客製化批次和变体的引入。

人事费用上升和技术工人短缺

机器人营业成本目前为每小时1.60-2美元,低于人类工资(在许多地区,人类工资超过5.50美元),投资回报率计算明显倾向于自动化。通用汽车和约翰迪尔在采用机器人焊接单元后,焊接人事费用降低了50%,废品率降低了25%。像GXO 物流这样的仓库业者正在转向使用Apollo机器人来填补人员缺口,同时提高安全指标。欧洲和东亚的人口老化将是这一趋势的长期驱动因素。

初始部署和整合成本高

如果将整合、安全设备和培训等成本考虑在内,铰接式机器人单元的总成本可能会翻倍,这阻碍了中小企业的采用。拉丁美洲的中小企业认为,获得整合商和金融机构的管道有限是采用该技术的主要障碍。 Formic 报告称,其合约生产小时数为 20 万小时,运转率99.8%,凸显了投资者对使用驱动型自动化的热情。

細項分析

由于采用电子、製药和协作机器人的普及,预计16公斤以下机器人的复合年增长率将达到16.1%,而16-60公斤机器人的市占率将在2024年维持32.6%。用户更青睐更轻的平台,因为它速度更快、更节能,而且更安全。 Freedom Fresh Australia的澳洲坚果生产线采用轻量级SCARA单元,实现了0.39秒的循环週期,凸显了食品包装生产效率的提升。

在汽车车身修理厂和铸造厂,60-225 公斤及以上重量的机器人需求保持稳定,但由于原始设备製造商希望减少而非扩大其安装基数,成长正在放缓。大容量机械手臂越来越多地与形状记忆合金夹爪集成,将气动能耗降低 90%。

2025年至2030年间,重型关节机器人的市场规模预计将以个位数成长,主要受提升电动车电池组和处理风力发电机组件等应用的推动。

到2024年,六轴机器人将占总收益的51.8%,而关节机器人市场已成为焊接、喷漆和精密组装事实上的主力。就成本而言,可供选择的型号多种多样,从5,000美元以下的小型机器到售价超过500,000美元的洁净室相容机器。

七轴和超灵巧型机器人是成长最快的细分市场,复合年增长率达16.5%。Yamaha的YA系列弯头机器人可围绕有限的夹具旋转,从而缩短密集生产单元的节拍时间。 MDPI正在研究的并联拓朴机器人有望在拾放循环中实现更高的刚度重量比。随着汽车内装日益复杂,家用电器趋于小型化,对在更狭窄范围内移动的附加轴的需求可能会增长。

关节机器人市场承重能力(最高16公斤、16-60公斤及其他)、轴类型(4轴、5轴及其他)、应用领域(物料输送、焊接/锡焊、组装、喷漆/应用及其他)、终端用户产业(汽车、电气/电子、金属/机械、製药/医疗设备及其他)及地区细分。市场预测以美元计算。

区域分析

受中国市场规模和日本创新生态系统的推动,亚太地区将在2024年继续保持主导地位,占全球机器人总收入的42.4%。各地区政府正在资助「灯塔计划」,鼓励中小企业采用这些技术,即使国内工资上涨抑制了成本优势,也能稳定关节机器人市场的扩张。日本的机器人税额扣抵和韩国的人工智慧代金券计画将使机器人市场保持强劲成长。

预计到2030年,南美洲的复合年增长率将达到15.3%,是该地区成长最快的地区,这得益于汽车电气化和农业自动化领域的外国直接投资。巴西的SOLIX田间机器人展示了人工智慧视觉如何将铰接式设计扩展到露天作物管理。凯斯纽荷兰公司斥资2000万美元对索罗卡巴的升级改造,将人工智慧应用于90%的收割机功能,展现了该地区对先进机器人技术的巨大需求。

在联邦政府回流奖励和电动车供应链计划的支持下,预计2024年,北美的机器人安装量将年增12%,达到44,303台。到2027年,安川电机在斯洛维尼亚投资3,150万欧元的机器人生产中心将实现其欧洲、中东和非洲地区80%的机器人交付在当地生产。中东和非洲地区虽然仍在发展中,但已吸引了建筑和石化维护领域的试点项目,为关节型机器人的长期市场应用奠定了基础。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 向工业 4.0主导的自动化转变

- 人事费用上升和技术纯熟劳工短缺

- 政府对智慧製造的奖励

- 电动车资本投资蓬勃发展

- 支援人工智慧的自适应关节协作机器人

- 电子商务巨头将履约中心自动化

- 市场限制

- 前期投资和整合成本高

- 系统整合人员短缺

- 联网机器人控制器的网路安全风险

- 伺服马达和半导体供应瓶颈

- 产业价值链分析

- 监管状况

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章市场规模及成长预测(金额)

- 按有效载荷容量

- 16公斤以下

- 16-60 kg

- 60-225 kg

- 225公斤以上

- 按轴类型

- 第四轴

- 5轴

- 6轴

- 7个或更多轴

- 按用途

- 物料输送

- 焊接和焊焊

- 组装

- 油漆和涂料

- 包装和堆迭

- 检验和品质保证

- 其他的

- 按最终用户产业

- 车

- 电气和电子

- 金属和机械

- 药品和医疗设备

- 食品和饮料

- 电子商务与物流

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 马来西亚

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corp.

- KUKA AG

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Electric Corp.

- Nachi-Fujikoshi Corp.

- DENSO Corp.

- Seiko Epson Corp.

- Staubli International AG

- Hyundai Robotics Co., Ltd.

- Comau SpA

- Omron Adept Technology Inc.

- Universal Robots A/S

- Durr AG(Paint Robots)

- Estun Automation Co., Ltd.

- SIASUN Robot & Automation Co.

- JAKA Robotics Ltd.

- Techman Robot Inc.

- Precise Automation Inc.

- CMA Robotics SpA

- Gudel Group AG

- IAI Corporation

- Aubo Robotics Inc.

- Robot Industrial Association(RIA)

第七章 市场机会与未来趋势

The Articulated Robot Market size is estimated at USD 26.92 billion in 2025, and is expected to reach USD 51.16 billion by 2030, at a CAGR of 13.70% during the forecast period (2025-2030).

Surging demand for smart manufacturing solutions, sovereign production policies, and AI-enabled collaborative systems underpin this expansion. Intensifying capital expenditure in electric-vehicle production, sustained warehouse automation roll-outs by e-commerce majors, and growing precision-oriented food applications further reinforce momentum. Meanwhile, component makers are responding to semiconductor and servo-motor bottlenecks with vertical-integration strategies, and energy-efficient robotic designs are gaining traction as users chase lower operating costs. Competitive strategies are bifurcating: incumbents such as ABB pursue structural spin-offs to sharpen focus, while start-ups leverage cloud-connected platforms to shorten deployment times.

Global Articulated Robot Market Trends and Insights

Shift toward Industry 4.0-led automation

Manufacturers are linking articulated robots with AI analytics and IoT sensors to create closed-loop production ecosystems that self-optimise quality, uptime, and energy consumption. Foxconn's lights-off sites cut headcount by 150,000 yet sustained output by embedding predictive-maintenance algorithms in robotic workcells. Xiaomi's 24/7 smartphone facility demonstrates the scalability of such dark-factory models. These deployments shift automation economics from manpower substitution to product-mix agility, enabling rapid re-tooling for customised lots and variant introductions.

Rising labor cost and skilled-worker shortage

Robot operating costs of USD 1.60-2.00 per hour now undercut human wages exceeding USD 5.50 in many regions, tilting ROI calculations decisively toward automation. General Motors and John Deere trimmed welding labor expenses by 50% and defects by 25% after adopting robotic welding cells. Warehouse operators such as GXO Logistics have turned to Apollo humanoids to bridge head-count gaps while improving safety metrics. Ageing demographics in Europe and East Asia anchor this driver for the long term.

High upfront acquisition and integration cost

Total cost of an articulated robot cell can double once integration, safety equipment, and training are included, discouraging smaller enterprises. Latin American SMEs cite limited access to integrators and finance as key barriers to adoption. Robots-as-a-Service models mitigate this restraint by converting cap-ex into opex; Formic reported 200,000 contracted production hours at 99.8% uptime, highlighting investor appetite for pay-per-use automation.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for smart manufacturing

- Automotive e-mobility cap-ex boom

- Servo-motor and semiconductor supply bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The <= 16 kg class is projected to outpace all others at a 16.1% CAGR on the back of electronics, pharma, and collaborative deployments, whereas the 16-60 kg segment retained 32.6% of articulated robot market share in 2024. Users favour lighter platforms for speed, energy thrift, and human-adjacent safety. Freedom Fresh Australia's macadamia line runs 0.39-second cycles with a lightweight SCARA unit, underscoring productivity gains in food packing. Energy-efficiency pressures are driving material innovations: carbon-fibre arms from Cognibotics cut consumption by 90% while maintaining rigidity.

Demand for 60-225 kg and > 225 kg robots remains stable in automotive body-shop and foundry tasks, yet growth decelerates as OEMs sweat installed assets rather than expand footprint. High-payload arms increasingly integrate shape-memory alloy grippers that slash pneumatic energy use by 90%. Over 2025-2030, the articulated robot market size for heavy-duty classes is forecast to expand at single-digit rates, supported by EV battery pack lifting and wind-turbine component handling.

Six-axis models captured 51.8% of revenue in 2024, anchoring the articulated robot market as the de-facto workhorse for welding, painting and precision assembly. Cost points now span under USD 5,000 for light units to beyond USD 500,000 for clean-room variants. Modular controllers are shrinking installation footprints, a boon for SMEs with space constraints.

Seven-axis and hyper-dexterous formats are the fastest-rising niche, charting a 16.5% CAGR. Yamaha's YA series elbows rotate around confined fixtures, enabling shorter takt times in dense production cells. Parallel-topology robots studied by MDPI promise higher stiffness-to-weight ratios for pick-and-place cycles. As automotive interiors grow more complex and consumer electronics trend toward miniaturisation, demand for extra axes to navigate tight envelopes will intensify.

Articulated Robot Market is Segmented by Payload Capacity (Up To 16 Kg, 16 - 60 Kg, and More), Axis Type (4-Axis, 5-Axis, and More), Application (Material Handling, Welding and Soldering, Assembly, Painting and Dispensing, and More), End-User Industry (Automotive, Electrical and Electronics, Metals and Machinery, Pharmaceutical and Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained its dominance with 42.4% revenue in 2024, propelled by China's scale and Japan's innovation ecosystems. Regional governments fund lighthouse projects that accelerate SME uptake, stabilising articulated robot market size gains even as domestic wage growth tempers cost advantages. Japan's Robot Tax Credit and Korea's AI Voucher Scheme keep pipeline activity robust.

South America is forecast to grow the fastest at 15.3% CAGR through 2030, underwritten by foreign direct investments in automotive electrification and agri-automation. Brazil's SOLIX field robot shows how AI vision extends articulated design into open-field crop management. Case IH's USD 20 million Sorocaba upgrade embeds AI to command 90% harvester functions, demonstrating regional appetite for advanced robotics.

North America posted 12% year-on-year installation growth in 2024-totaling 44,303 units-supported by federal reshoring incentives and EV supply-chain projects. Europe faces energy-price headwinds yet invests in local capacity; Yaskawa's EUR 31.5 million Slovenian hub will localise 80% of EMEA robot deliveries by 2027. The Middle East and Africa remain nascent but attract pilots in construction and petrochemical maintenance, laying the groundwork for long-run articulated robot market adoption.

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corp.

- KUKA AG

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Electric Corp.

- Nachi-Fujikoshi Corp.

- DENSO Corp.

- Seiko Epson Corp.

- Staubli International AG

- Hyundai Robotics Co., Ltd.

- Comau SpA

- Omron Adept Technology Inc.

- Universal Robots A/S

- Durr AG (Paint Robots)

- Estun Automation Co., Ltd.

- SIASUN Robot & Automation Co.

- JAKA Robotics Ltd.

- Techman Robot Inc.

- Precise Automation Inc.

- CMA Robotics SpA

- Gudel Group AG

- IAI Corporation

- Aubo Robotics Inc.

- Robot Industrial Association (RIA)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward Industry 4.0-led automation

- 4.2.2 Rising labor cost and skilled-worker shortage

- 4.2.3 Government incentives for smart manufacturing

- 4.2.4 Automotive e-mobility cap-ex boom

- 4.2.5 AI-enabled adaptive articulated cobots

- 4.2.6 Fulfilment-center automation by e-commerce majors

- 4.3 Market Restraints

- 4.3.1 High upfront acquisition and integration cost

- 4.3.2 Scarcity of system-integration talent

- 4.3.3 Cyber-security risk in connected robot controllers

- 4.3.4 Servo-motor and semiconductor supply bottlenecks

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Payload Capacity

- 5.1.1 Up to 16 kg

- 5.1.2 16 - 60 kg

- 5.1.3 60 - 225 kg

- 5.1.4 Above 225 kg

- 5.2 By Axis Type

- 5.2.1 4-Axis

- 5.2.2 5-Axis

- 5.2.3 6-Axis

- 5.2.4 7-Axis and Above

- 5.3 By Application

- 5.3.1 Material Handling

- 5.3.2 Welding and Soldering

- 5.3.3 Assembly

- 5.3.4 Painting and Dispensing

- 5.3.5 Packaging and Palletizing

- 5.3.6 Inspection and Quality Assurance

- 5.3.7 Others

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Electrical and Electronics

- 5.4.3 Metals and Machinery

- 5.4.4 Pharmaceutical and Medical Devices

- 5.4.5 Food and Beverages

- 5.4.6 E-commerce and Logistics

- 5.4.7 Other End-User Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corporation

- 6.4.3 Yaskawa Electric Corp.

- 6.4.4 KUKA AG

- 6.4.5 Kawasaki Heavy Industries Ltd.

- 6.4.6 Mitsubishi Electric Corp.

- 6.4.7 Nachi-Fujikoshi Corp.

- 6.4.8 DENSO Corp.

- 6.4.9 Seiko Epson Corp.

- 6.4.10 Staubli International AG

- 6.4.11 Hyundai Robotics Co., Ltd.

- 6.4.12 Comau SpA

- 6.4.13 Omron Adept Technology Inc.

- 6.4.14 Universal Robots A/S

- 6.4.15 Durr AG (Paint Robots)

- 6.4.16 Estun Automation Co., Ltd.

- 6.4.17 SIASUN Robot & Automation Co.

- 6.4.18 JAKA Robotics Ltd.

- 6.4.19 Techman Robot Inc.

- 6.4.20 Precise Automation Inc.

- 6.4.21 CMA Robotics SpA

- 6.4.22 Gudel Group AG

- 6.4.23 IAI Corporation

- 6.4.24 Aubo Robotics Inc.

- 6.4.25 Robot Industrial Association (RIA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment