|

市场调查报告书

商品编码

1844447

铝复合板(ACP):市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Aluminum Composite Panel (ACP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

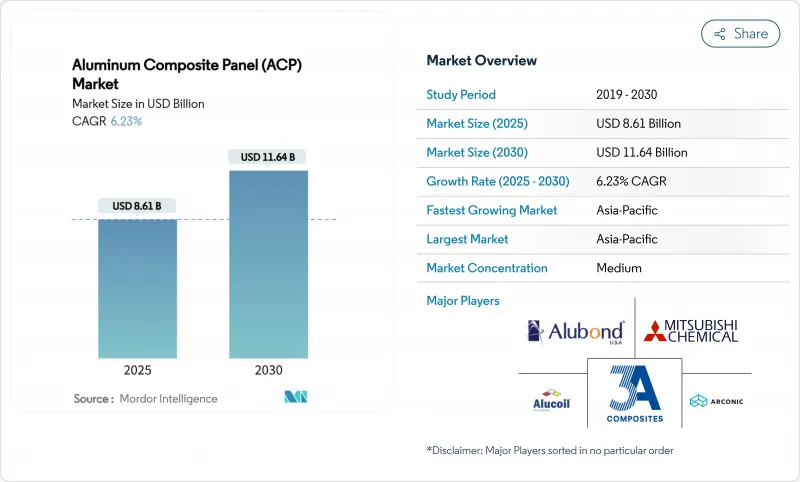

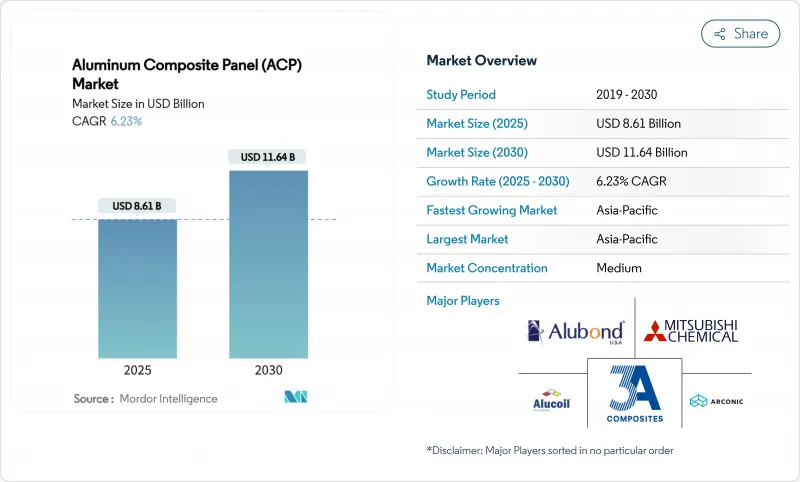

铝复合板 (ACP) 市场规模预计在 2025 年为 86.1 亿美元,预计到 2030 年将达到 116.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.23%。

轻量化建筑幕墙的强劲需求、全球消防安全标准的不断加强以及模组化建筑产品线的不断拓展,共同支撑着这一成长轨迹。亚洲製造商的竞争性定价使初始成本保持吸引力,而PVDF涂层产品则延长了建筑幕墙的使用寿命并降低了终身维护成本。铁路、船舶和商用车领域对轻量化的需求正在开闢建筑以外的新途径。同时,原生铝价格的波动以及替代覆层材料的兴起将限制铝复合板 (ACP) 整体市场近期利润率的扩张。

全球铝复合板(ACP)市场趋势与洞察

扩大采用 PVDF 涂层 ACP 打造长寿命建筑幕墙

PVDF 技术占据了涂料市场的 65.89%,凭藉其氟聚合物涂层,该技术以 6.70% 的复合年增长率增长,该涂层具有抗紫外线、保色性和 20-25 年的使用寿命。业主将这种溢价视为其生命週期价值,因为它无需重新涂装。 PVDF 还能减少火灾期间的有毒气体排放,并符合北美和欧洲的法规。因此,公共基础设施、机场和甲级商业大楼越来越多地将 PVDF 作为性能标准。能够大量生产均匀 PVDF 涂层的供应商能够获得高净利率,并与建筑师建立持久的规范关係。

建筑和运输业对轻质板材的需求不断增加

与传统钢结构相比,铝复合板可将铁路车辆结构负荷降低30-50%,从而提高营运效率和载客量。建筑业主同样青睐轻质覆层,以减轻抗震设计限制并缩短安装週期。由于每减轻一公斤重量,电池续航里程和负载容量都会增加,铝复合板在电动公车和渡轮上的应用正在加速。这些跨产业的轻量化优势支撑了铝复合板在铁路车辆、船舶上层建筑和冷藏拖车外皮领域的稳定渗透,巩固了铝复合材料板市场的中期成长势头。

低成本替代覆层材料的可用性

纤维水泥、高压层压板和工程木板能够以较低的材料成本复製多种视觉效果。承包商通常会选择这些替代方案来建造防火要求较低的中层住宅计划,这迫使铝塑复合板供应商专注于生命週期优势和快速施工以保持市场份额。而产量高、利润率低的新兴市场建筑商则透过要求大幅降价,进一步加剧了这种压力。

細項分析

到2024年,PVDF涂层产品将占销售额的65.89%,成为铝复合板 (ACP) 市场的最大份额。其优异的紫外线稳定性可将使用寿命延长至25年,进而降低建筑幕墙的全生命週期支出。这种耐用性对商业高层建筑劣化的标准, PVDF的兼容性将使其价格比聚酯基材高出20-30%。

因此,当计划采用PVDF时,利润率会有所提升,投资于高产能线圈涂布线和严格配色控制的加工商将获得丰厚回报。同时,注重预算的住宅建筑继续使用聚酯涂料,在铝复合板市场中保持高性价比的地位。这种层级构造使企业能够根据性能需求和区域购买力对产品进行细分,从而最大限度地满足总需求,同时又不会蚕食其核心PVDF产品的销售量。

区域分析

预计到2024年,亚太地区将以38.15%的市占率引领铝复合板市场,到2030年,复合年增长率将达到6.97%。中国拥有超过4,127家製造商,销售超过41,000种不同的产品,价格从每平方公尺7美元到20美元不等。印度的需求与价值112.8亿美元的铝挤型产业同步成长,在政府实施经济适用房和城市轨道交通建设的措施下,该产业年增率达7.6%。东南亚都市化的进一步加快,使该地区的成本竞争力成为铝复合板市场的全球定价驱动力。

北美排名第二,这得益于严格的消防安全标准,这些标准奖励获得 ASTM E-84 和 NFPA 285 组件认证的供应商。 2024 年《国际建筑规范》修正案正在推动矿物芯材的采用,并维持合规产品的利润溢价。像圣荷西希尔顿花园酒店这样的模组化连锁饭店正在展示板式 ACP 型材如何在满足 A 级火灾蔓延限制的同时缩短装修时间。包括世纪铝业公司美国冶炼厂扩建在内的区域性冶炼厂正在部分抵销对进口的依赖,并缓解关税不确定性。

欧洲着重永续性,强调无碳冶炼和消费后铝的可回收性。 Novelis 正在将其铝回收率从 33% 提高到 63%,增强其合金的循环可信度,并支持寻求绿色建筑认证的建筑师。格伦费尔大火之后正在进行的改革加速了矿物芯授权,并鼓励欧洲加工商迅速升级其产品线。虽然南美和中东及非洲的产量落后,但由于基础建设和安全标准的提高,它们的成长高于趋势。例如,阿联酋的酒店管道透过使用 ACP 包覆的模组化房间,将计划交付时间缩短了数月。然而,有限的承包商专业知识和高昂的资本成本减缓了采用速度,使这些地区处于铝复合板市场的发展阶段。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 扩大采用 PVDF 涂层 ACP 打造长寿命建筑幕墙

- 建筑和运输业对轻质板材的需求不断增加

- 透过数位印刷扩展招牌和标誌的应用

- 全球消防安全标准日益严格,推动 A2/矿物芯 ACP 的采用

- 异地模组化建筑幕墙製造推动了对ACP面板的需求

- 市场限制

- 低成本替代覆层的可用性

- 铝价波动挤压转炉利润

- 高层建筑维修中禁止使用PE芯ACP

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 透过面漆

- PE(聚酯)

- PVDF(聚二氟亚乙烯)

- 其他涂料

- 按用途

- 室内装潢

- 防腐防白蚁

- 隔热材料

- 覆层

- 铁路生涯

- 柱盖和梁包裹

- 其他用途

- 按最终用户产业

- 建筑/施工

- 交通运输(铁路、公车、拖车、船)

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- 3A Composites GmbH

- ALSTONE

- Alstrong Enterprises India Pvt. Ltd

- Alubond USA

- Alucoil(Grupo Aliberico)

- Aludecor Lamination Pvt. Ltd

- Arconic Inc.

- Eurobond

- Fairview Architectural(Vitrabond)

- GUANGZHOU XINGHE ACP Co. Ltd

- Interplast(Harwal)

- Mitsubishi Chemical Corporation

- Mulford ACP

- Multipanel UK(Alupanel)

- Qatar National Aluminium Panel Co.

- Viva

- Yaret Industrial Group

- YingJia Aluminium Co. Ltd

第七章 市场机会与未来展望

The Aluminum Composite Panel Market size is estimated at USD 8.61 billion in 2025, and is expected to reach USD 11.64 billion by 2030, at a CAGR of 6.23% during the forecast period (2025-2030).

Robust demand for lightweight facades, tightening global fire-safety codes, and expanding modular construction pipelines underpin this growth trajectory. Competitive pricing from Asia-based manufacturers keeps upfront costs attractive, while PVDF-coated variants extend facade life cycles and lower lifetime maintenance spending. Weight-reduction imperatives in rail, marine, and commercial vehicle segments open fresh avenues beyond buildings. Meanwhile, volatility in primary aluminum prices and emerging substitute cladding materials temper near-term margin expansion across the aluminum composite panel market.

Global Aluminum Composite Panel (ACP) Market Trends and Insights

Growing Adoption of PVDF-Coated ACPs for Long-Life Facades

PVDF technology commands 65.89% coating share and is rising at a 6.70% CAGR as its fluoropolymer layer delivers ultraviolet resistance, color retention, and 20-25-year service life. Owners view the premium as life-cycle value, because mid-life recoating is unnecessary. PVDF formulations also exhibit limited toxic fume evolution under fire load, a key attribute for code compliance in North America and Europe. Consequently, public infrastructure, airports, and Grade-A commercial towers increasingly specify PVDF as a performance baseline. Suppliers able to mass-produce uniform PVDF finishes capture higher margins and build durable specification relationships with architects.

Rising Demand for Lightweight Panels in Building & Transport Sectors

Aluminum composite panels reduce structural load by 30-50% in rail carriages versus conventional steel, boosting operating efficiency and passenger capacity. Building owners likewise favor lighter cladding to ease seismic design constraints and shorten installation cycles. Adoption accelerates in electric buses and ferries, where every kilogram saved extends battery range or payload. These cross-industry weight benefits underpin steady penetration into rolling-stock, marine superstructure, and refrigerated trailer skins, cementing medium-term upside for the aluminum composite panel market.

Availability of Lower-Cost Cladding Alternatives

Fiber cement, high-pressure laminates, and engineered wood panels replicate many visual effects at lower material cost. In residential mid-rise projects with modest fire requirements, contractors often select these substitutes, forcing ACP suppliers to lean on lifecycle advantages and faster installation to preserve share. Emerging-market builders, operating on thin margins, amplify this pressure by demanding aggressive price concessions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Digital-Printing Hoardings & Signage Applications

- Tightening Global Fire-Safety Codes Boosting A2/Mineral-Core Uptake

- Volatile Aluminum Price Trends Squeezing Converter Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PVDF-coated products held 65.89% revenue in 2024, the largest slice of the aluminum composite panel market. Superior ultraviolet stability extends service life to 25 years, trimming whole-life facade expenditure. That durability attracts commercial skyscrapers and coastal infrastructure where harsh sun, salt, and temperature swings accelerate aging. Fire-safety regulations further consolidate PVDF's position because the coating withstands higher ignition temperatures while emitting lower smoke density. As mineral-core substrates become the high-rise standard, PVDF's compatibility sustains premium price realisation of 20-30% over polyester rivals.

Margins thus expand when projects specify PVDF, rewarding converters that invest in high-capacity coil-coating lines and tight colour-match control. Simultaneously, budget-focused residential builds still rely on polyester coatings, keeping a value tier alive within the aluminum composite panel market. That two-tier structure allows firms to segment offerings by performance need and regional purchasing power, maximising total addressable demand without cannibalising flagship PVDF sales.

The Aluminum Composite Panel Market Report is Segmented by Top Coating (PE (Polyester), PVDF (Polyvinylidene Fluoride), and More), Application (Interior Decoration, Hoarding, and More), End-User Industry (Building and Construction, Transportation, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific led the aluminum composite panel market with a 38.15% share in 2024 and is advancing at a 6.97% CAGR to 2030. China hosts over 4,127 manufacturers offering more than 41,000 product variants priced between USD 7-20 per m2, enabling scale economics that underpin both domestic megaprojects and export supply. Indian demand climbs in tandem with its USD 11.28 billion aluminum extrusions sector, expanding 7.6% annually as government drives affordable housing and metro rail rollouts. Southeast Asian urbanisation adds further uplift, and the region's competitive cost base positions it as the global price setter for the aluminum composite panel market.

North America ranks second, defined by stringent fire-safety codes that reward suppliers certified to ASTM E-84 and NFPA 285 assemblies. The 2024 International Building Code revision reinforces mineral-core adoption and sustains margin premiums for compliant products. Modular hotel chains such as the Hilton Garden Inn in San Jose illustrate how panelised ACP sections speed fit-out times while meeting Class A flame-spread limits. Regional mills, including Century Aluminum's expanded U.S. smelter, partially offset import reliance and dampen tariff uncertainty.

Europe follows with a sustainability lens, spotlighting decarbonised smelting and end-of-life recyclability. Novelis lifted recycled content from 33% to 63% across its aluminium portfolio, reinforcing the alloy's circular credentials and supporting architects striving for green-building certification. Ongoing post-Grenfell fire reforms accelerate mineral-core mandates, prompting rapid line upgrades among European converters. South America plus the Middle East & Africa trail in volume but display above-trend growth where infrastructure buildout intersects with rising safety standards. The UAE's hospitality pipeline, for instance, leverages ACP-clad modular rooms to cut project delivery schedules by months. Nonetheless, limited installer expertise and high capital costs slow wider penetration, keeping these regions in a developmental stage of the aluminum composite panel market.

- 3A Composites GmbH

- ALSTONE

- Alstrong Enterprises India Pvt. Ltd

- Alubond USA

- Alucoil (Grupo Aliberico)

- Aludecor Lamination Pvt. Ltd

- Arconic Inc.

- Eurobond

- Fairview Architectural (Vitrabond)

- GUANGZHOU XINGHE ACP Co. Ltd

- Interplast (Harwal)

- Mitsubishi Chemical Corporation

- Mulford ACP

- Multipanel UK (Alupanel)

- Qatar National Aluminium Panel Co.

- Viva

- Yaret Industrial Group

- YingJia Aluminium Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of PVDF-coated ACPs for long-life facades

- 4.2.2 Rising demand for lightweight panels in building & transport sectors

- 4.2.3 Expansion of digital-printing hoardings & signage applications

- 4.2.4 Tightening global fire-safety codes boosting A2/mineral-core ACP uptake

- 4.2.5 Off-site modular facade fabrication accelerating ACP panelization demand

- 4.3 Market Restraints

- 4.3.1 Availability of lower-cost cladding alternatives

- 4.3.2 Volatile aluminum price trends squeezing converter margins

- 4.3.3 Regulatory bans on PE-core ACPs in high-rise retrofits

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Top Coating

- 5.1.1 PE (Polyester)

- 5.1.2 PVDF (Polyvinylidene Fluoride)

- 5.1.3 Other Coatings

- 5.2 By Application

- 5.2.1 Interior Decoration

- 5.2.2 Hoarding

- 5.2.3 Insulation

- 5.2.4 Cladding

- 5.2.5 Railway Carrier

- 5.2.6 Column Cover and Beam Wrap

- 5.2.7 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Building and Construction

- 5.3.2 Transportation (Rail, Bus, Trailer, Marine)

- 5.3.3 Other End-User Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 3A Composites GmbH

- 6.4.2 ALSTONE

- 6.4.3 Alstrong Enterprises India Pvt. Ltd

- 6.4.4 Alubond USA

- 6.4.5 Alucoil (Grupo Aliberico)

- 6.4.6 Aludecor Lamination Pvt. Ltd

- 6.4.7 Arconic Inc.

- 6.4.8 Eurobond

- 6.4.9 Fairview Architectural (Vitrabond)

- 6.4.10 GUANGZHOU XINGHE ACP Co. Ltd

- 6.4.11 Interplast (Harwal)

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Mulford ACP

- 6.4.14 Multipanel UK (Alupanel)

- 6.4.15 Qatar National Aluminium Panel Co.

- 6.4.16 Viva

- 6.4.17 Yaret Industrial Group

- 6.4.18 YingJia Aluminium Co. Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Large-scale Investments on Hotels in ASEAN Countries