|

市场调查报告书

商品编码

1844455

汽车空气悬吊:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Air Suspension - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

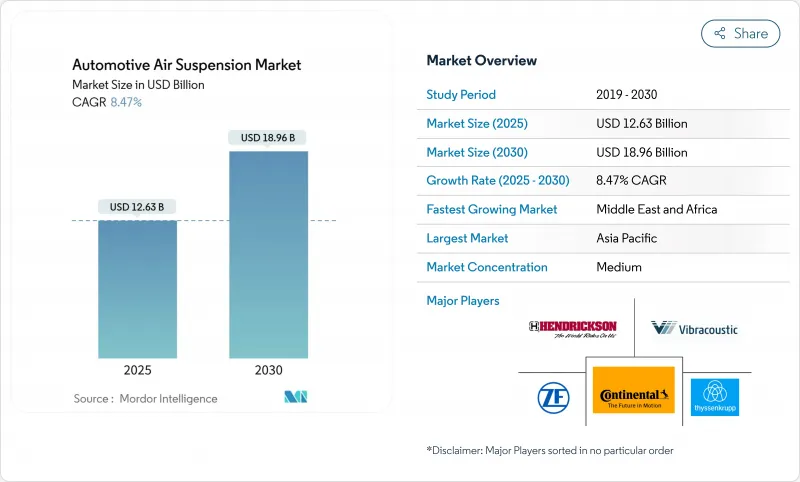

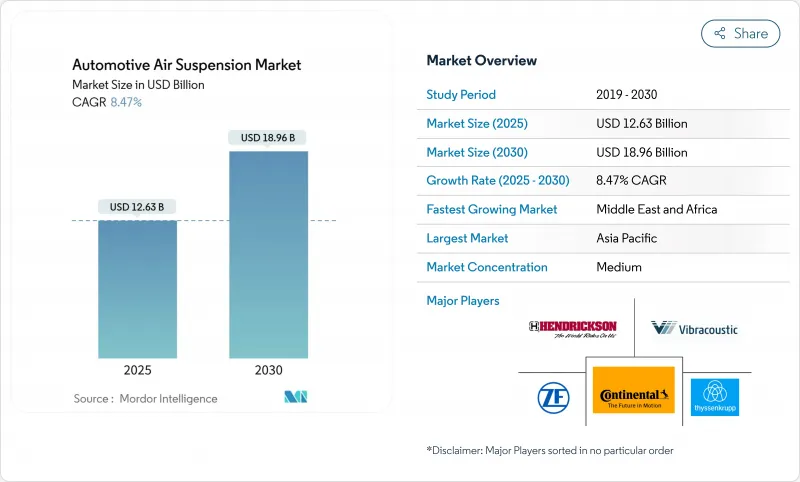

预计 2025 年空气悬吊系统市场价值将达到 126.3 亿美元,到 2030 年将达到 189.6 亿美元,复合年增长率为 8.47%。

对高端乘坐舒适性不断增长的需求、与软体定义底盘的更深层次整合以及乘用车和商用车的电气化预计将推动强劲增长。原始设备製造商的平台策略越来越多地将空气悬吊定位为自我调整动力学的核心,而一级供应商正在将电子控制、减震和感测技术整合到模组化产品中。虽然乘用车仍然是主要的销售驱动力,但电动重型卡车和 SUV 正在释放新的价值池,其中优化的重量转移和预测性车辆高度控制直接转化为节能。从区域来看,亚太地区依然强劲,得益于中国的高檔汽车销售和日本的技术创新,而中东和非洲是成长最快的地区,受到基础设施投资和豪华汽车激增的推动。

全球汽车空气悬吊市场趋势与洞察

对乘坐舒适度和乘坐品质的要求不断提高

在消费者意识和品牌差异化策略的推动下,即使在主流细分市场,人们对高端舒适性的期望也日益强烈。英菲尼迪2025款QX80的电子控制气压悬吊体现了这种转变,它可以动态调整行驶高度,方便上下车、提高越野铰接性和牵引稳定性。随着可支配收入的不断增长,亚洲买家对兼具便利性和身份地位的功能特别敏感。在纯电动SUV中,整合式双腔空气弹簧(例如探测车探测车导航系统中的eHorizon资讯预先调整减震器设定。总而言之,这些进步强化了空气悬吊作为全球市场上明显差异化因素的地位。

亚太地区和欧洲豪华和高檔汽车销量不断增长

中国仍然是高端汽车需求中心,国内外厂商都在扩大电子空气悬吊的应用,以吸引心仪的买家。 BMW的目标是到2024年,电动车在其全球销量中的占比达到17.4%,这凸显了电气化通常与可选的空气悬吊套件相辅相成,以实现更低的车内噪音和空气动力学优化的姿态控制。梅赛德斯-奔驰在上海的研发中心扩建正在加速底盘技术的本地化,包括针对当地路况设计的空气悬吊模组。为了击败西方竞争对手,中国高端电动车新兴企业正在将节省成本的空气悬吊系统引入中端价格分布,加速其区域普及。

中型车辆的系统和整合成本高

电控空气悬吊的零件成本可能比传统钢製弹簧高出数百美元,这阻碍了其在成本敏感的C级车中的应用。复杂的校准需要额外的ECU逻辑和强化的底盘支架,这进一步增加了工程成本。新兴市场的OEM厂商更重视低成交价格而非先进的底盘舒适性,减缓了其在大众市场的普及。小鹏汽车在G9上采用Vibracoustic的双腔弹簧,同时保持了具有竞争力的价格,这就是降低成本创新的一个例子。

細項分析

到2024年,NECAS解决方案将占据空气悬吊系统市场55.75%的份额。该领域在静态负载平衡已足够满足需求的客车、拖车和基本款皮卡车型中依然受欢迎。另一方面,随着原始设备製造商转向以软体为中心的架构,ECAS正以9.42%的复合年增长率快速扩张。 ECAS单元使用来自加速计、相机和地图服务的数据来预测悬吊设置,从而提升舒适性和行驶操控性。 ECAS还能实现可变行驶高度,以优化电动车的空气动力学性能,这对于即将推出的高阶跨界车至关重要。

软体定义汽车专注于无线校准和功能解锁,这些是 ECAS 独有的功能。采埃孚 (ZF) 的 sMOTION 和大陆集团的 E-Level 系列支援售后更新,例如微调弹簧曲线或添加越野模式。 NECAS 在改装和成本敏感领域仍然很重要。然而,随着 ECAS 成为中型豪华轿车、高性能 SUV 和电动送货车的标配,其份额预计会下降。阀门和压力感测器价格的持续下降可能会加速各个价值领域向 ECAS 的转变。

以高阶轿车和SUV为主导的乘用车市场,其舒适性提升是其卖点,到2024年将占据空气悬吊系统65.45%的市场份额。同时,中重型卡车的复合年增长率将达到8.32%,在所有车型中最高。电动传动系统透过实现自动负载平衡和车身高度控制,进一步提升了空气悬吊的价值,从而延长了续航里程并保护了电池组。轻型商用货车和长途客车正在分别采用该技术来提高城市配送效率和乘客舒适度,但其成长速度落后于中重型卡车。

8级电动拖拉机的空气悬吊技术透过分配轴荷并保持在法定重量限制范围内,减轻了电池重量带来的负担。虽然乘用车将继续在销售方面保持领先,但商用车领域将推动创新週期,影响零件的耐用性和预测性维护能力,并最终将影响零售车型。

由于整合复杂性以及悬吊调校与碰撞安全性和ADAS合规性之间的协调,到2024年,原厂配件将占据空气悬吊系统市场份额的74.23%。随着车辆老化以及车迷对舒适性和车身姿态的追求,售后市场将以7.72%的复合年增长率扩张。 Arnott Industries(现已被MidOcean Partners收购)正在积极扩展其针对欧洲SUV和美国肌肉车的多品牌替换套件,这表明其有意在售后市场进行整合。

当原厂气压弹簧达到使用寿命时,消费者会转向售后市场套件。即插即用型 ECAS 替换模组的日益普及,缩短了安装时间,并扩大了吸引力。 OEM 频道对于初始安装仍然至关重要,因为保固范围、认证和整合诊断至关重要。售后市场从老旧车队、性能爱好者以及寻求可调离地间隙的利基越野社区中获取增量收益。

区域分析

2024年,亚太地区将以39.26%的市占率引领气压悬吊系统市场。中国对豪华车和电动车的需求将推动大部分销量,而日本品牌将继续完善其舒适性技术。梅赛德斯-奔驰正在利用全球一级供应商的本地化研发和製造能力,缩短其供应链,并根据不同地区的乘坐舒适性偏好调整规格。政府对新能源汽车的支持也提高了先进底盘整合的标准。

随着基础建设计划和富裕消费群的融合,到2030年,中东和非洲的复合年增长率将达到7.25%,成为最快的地区。高阶SUV和皮卡将占据主导地位,买家优先考虑高度可调的悬架,以便在沙漠地形中灵活行驶。欧洲保持着较高的渗透率,因为严格的车辆二氧化碳排放法规推动了轻量化空气弹簧和基于高度的空气动力效率策略的发展。

北美市场以皮卡和重型卡车为主。 Stellantis 和其他底特律三巨头製造商正在围绕空气悬吊模组重组其车身框架平台,以满足纯电动车的牵引稳定性和空气动力学性能。南美虽然仍是一个新兴市场,但受节能零件进口关税降低的推动,巴西的高端 SUV组装正在成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 对乘坐和座舱舒适度的需求不断增加

- 扩大亚太和欧洲豪华及高级汽车的销售

- ECAS 与 ADAS 和底盘网域控制站的集成

- 电动重型卡车的燃油节省(报告不足)

- 预测性维护数位孪生降低物流的整体拥有成本(未充分通报)

- 加强对振动敏感货物(漏报)的监管

- 市场限制

- 中阶车辆的系统和整合成本高

- 对可靠性和维护复杂性的担忧

- ECU 连线 ECAS 中未充分报告的网路安全风险

- 弹性体和复合材料价格波动(未报告)

- 价值/供应链分析

- 监管状况

- 技术展望

- 转向 48V 和软体定义底盘

- 轻质复合材料空气弹簧波纹管

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按控制类型

- 电子控制空气悬吊(ECAS)

- 非电子控制空气悬吊(NECAS)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和大型卡车

- 公车和长途客车

- 按最终用户

- OEM

- 售后市场

- 按组件

- 空气弹簧

- 压缩机和储液器

- 电控系统

- 车辆高度和压力感测器

- 避震器

- 透过促销

- 内燃机汽车

- 纯电动车

- 按悬挂结构

- 被动式空气悬吊

- 半自我调整气压悬吊

- 全主动气压悬吊

- 按销售管道

- 直接销售给原始设备製造商

- 一级/模组供应商

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Continental AG

- ZF Friedrichshafen AG

- Hendrickson International

- Thyssenkrupp Bilstein

- Vibracoustic SE

- Firestone Industrial Products

- Hitachi Astemo

- Mando Corporation

- SAF-Holland SE

- Meritor(Cummins)

- AccuAir Suspension

- Air Lift Company

- Arnott Industries

- BWI Group

- KYB Corporation

- Komman Air Suspension

- Guangzhou Guomat Air Spring

- Dunlop Systems & Components

- Tenneco Inc.

第七章 市场机会与未来展望

The Air Suspension Systems Market is valued at USD 12.63 billion in 2025 and is forecast to reach USD 18.96 billion by 2030, expanding at an 8.47% CAGR.

Rising demand for premium ride quality, deeper integration with software-defined chassis, and the electrification of both passenger and commercial vehicles create a strong growth runway. OEM platform strategies increasingly position air suspension as a core enabler for adaptive dynamics, while tier-1 suppliers consolidate electronic control, damping, and sensing technologies into modular offerings. Passenger cars still anchor volume, yet electrified heavy trucks and SUVs are unlocking new value pools where optimized weight transfer and predictive height control translate directly into energy savings. Regional momentum remains strongest in Asia-Pacific, buoyed by Chinese luxury sales and Japanese innovation, whereas the Middle East and Africa are emerging as the fastest-growing arena on the back of infrastructure investment and premium vehicle uptake

Global Automotive Air Suspension Market Trends and Insights

Rising Demand for Ride Quality and Cabin Comfort

Premium comfort expectations are now evident even in mainstream segments, driven by consumer awareness and brand differentiation strategies. INFINITI's 2025 QX80 illustrates this shift with an Electronic Air Suspension that adjusts dynamic height for easy ingress, off-road articulation, and towing stability. Asian buyers, supported by rising disposable incomes, are particularly responsive to features that marry convenience with perceived status. In battery-electric SUVs, integrating two-chamber air springs, such as Vibracoustic's system for XPeng's G9, allows simultaneous ride compliance and battery thermal management. Predictive algorithms using road-surface data further enhance comfort and handling; Land Rover's latest Range Rover employs navigation-fed eHorizon information to pre-condition damper settings. Collectively, these advances reinforce air suspension as a tangible differentiator across global markets.

Growing Luxury and Premium Vehicle Sales in Asia-Pacific and Europe

China remains the epicenter of premium demand, with domestic and imported marques expanding electronic air suspension fitment to secure aspirational buyers. BMW achieved a 17.4% EV mix in 2024 global deliveries, underscoring how electrification often coincides with optional air suspension packages for cabin tranquility and aero-optimized stance control. Mercedes-Benz's enlarged R&D footprint in Shanghai accelerates the localization of chassis technologies, including air suspension modules designed for local road conditions. Chinese premium EV startups, keen to undercut Western rivals, are bringing cost-controlled air systems to mid-tier price points, quickening regional adoption.

High System and Integration Cost for Mid-Segment Vehicles

The electronic air suspension bill of material can exceed conventional steel springs by several hundred USD, discouraging inclusion in cost-sensitive C-segment cars. Complex calibration work added ECU logic and reinforced chassis mounts, further inflating engineering spending. Emerging-market OEMs prioritize lower transaction prices over advanced chassis comfort, delaying penetration in mass segments. Nonetheless, localized sourcing in China and leaner component designs are narrowing the gap; XPeng's decision to deploy Vibracoustic's two-chamber springs while keeping the G9's price competitive exemplifies cost-down innovation.

Other drivers and restraints analyzed in the detailed report include:

- Integration of ECAS with ADAS and Chassis Domain Controllers

- Fleet Fuel-Saving Benefits for Electric Heavy-Duty Trucks

- Reliability & Maintenance Complexity Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

NECAS Solutions retained a 55.75% share of the air suspension systems market in 2024, mainly because fleet buyers value proven simplicity and lower acquisition costs. The segment remains prevalent in buses, trailers, and basic pickup models where static load leveling suffices. In contrast, ECAS is scaling fast at a 9.42% CAGR as OEMs migrate toward software-centric architectures. ECAS units harvest data from accelerometers, cameras, and map services to predict suspension settings, improving both comfort and handling on the fly. ECAS also supports variable ride height for EV aero optimization, making it indispensable for forthcoming premium crossovers.

Software-defined vehicles emphasize over-the-air calibration and feature unlocks, capabilities inherent to ECAS. ZF's sMOTION and Continental's E-Level families allow post-sale updates that fine-tune spring curves or add off-road modes. NECAS remains relevant in retrofit and cost-driven regions. Yet, its share is projected to decline as ECAS becomes standard on mid-size luxury sedans, performance SUVs, and electric delivery vans. The ongoing price erosion of valves and pressure sensors will accelerate the pivot toward ECAS across value segments.

Passenger cars captured 65.45% of the air suspension systems market share in 2024 through luxury sedans and SUVs, where heightened comfort is a selling point. Medium and Heavy trucks, however, are on track for an 8.32% CAGR, the highest among all vehicle categories. Electrified drivelines amplify the value of air suspension by enabling automated load balancing and ride-height control that extend the range and protect battery packs. Light commercial vans and coaches adopt the technology for urban delivery efficiency and passenger comfort, respectively, although their growth profile lags medium and heavy trucks.

Air suspension technology in Class 8 electric tractors mitigates battery mass penalties by distributing axle loads while preserving legal weight limits. Passenger cars will keep leading in volume terms, yet commercial segments drive innovation cycles, influencing component durability and predictive maintenance capabilities that later cascade into retail models

OEM fitment accounted for 74.23% of the air suspension systems market share in 2024 revenue because of integration complexity and the need to align suspension tuning with crash safety and ADAS calibration. The aftermarket expands at 7.72% CAGR as vehicle parc ages and enthusiasts seek comfort or stance upgrades. Arnott Industries, now under MidOcean Partners, is aggressively expanding multi-brand replacement kits for European SUVs and American muscle cars, signaling consolidation intent within the retrofit domain.

Consumers turn to aftermarket kits when factory air springs reach end-of-life, often after eight years. Increased availability of plug-and-play ECAS replacement modules reduces installation time, broadening appeal. OEM channels remain indispensable for first-fitment, where warranty coverage, homologation, and integrated diagnostics are paramount. The aftermarket will capture incremental revenue from aging fleets, performance enthusiasts, and niche off-road communities seeking adjustable ground clearance.

Automotive Air Suspension Market Report is Segmented by Control Type (ECAS and NECAS), Vehicle Type (Passenger Cars and More), End User (OEM and Aftermarket), Component (Air Springs and More), Propulsion (ICE and BEV), Suspension Architecture (Passive Air Suspension and More), Sales Channel (Direct To OEM and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific led the air suspension systems market with a 39.26% share in 2024. Chinese luxury and electric vehicle demand fuels most of the volume, while Japanese brands continue to refine comfort technologies. Mercedes-Benz's localized R&D and manufacturing footprints by global tier-1 suppliers shorten supply chains and adapt specifications for regional ride-comfort preferences. Government support for new energy vehicles also raises the ceiling for advanced chassis integration.

As infrastructure projects and affluent consumer bases converge, the Middle East and Africa will deliver the fastest CAGR at 7.25% through 2030. Premium SUVs and pickups dominate the mix, and buyers value height-adjustable suspensions for desert terrain versatility. Europe retains high penetration because stringent fleet CO2 limits encourage lightweight air springs and height-based aero efficiency strategies.

North America's dynamics hinge on pickup and heavy-truck adoption. Stellantis and other Detroit-Three manufacturers are reorganizing body-on-frame platforms around air suspension modules to satisfy towing stability and BEV aerodynamics. South America remains emergent but shows rising uptake in Brazilian premium SUV assembly, aided by import-duty reductions on components that enhance fuel economy.

- Continental AG

- ZF Friedrichshafen AG

- Hendrickson International

- Thyssenkrupp Bilstein

- Vibracoustic SE

- Firestone Industrial Products

- Hitachi Astemo

- Mando Corporation

- SAF-Holland SE

- Meritor (Cummins)

- AccuAir Suspension

- Air Lift Company

- Arnott Industries

- BWI Group

- KYB Corporation

- Komman Air Suspension

- Guangzhou Guomat Air Spring

- Dunlop Systems & Components

- Tenneco Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for ride quality & cabin comfort

- 4.2.2 Growing luxury & premium vehicle sales in Asia-Pacific & Europe

- 4.2.3 Integration of ECAS with ADAS & chassis domain controllers

- 4.2.4 Fleet fuel-saving benefits for electric heavy-duty trucks (under-reported)

- 4.2.5 Predictive-maintenance digital twins lowering TCO for logistics fleets (under-reported)

- 4.2.6 Vibration-sensitive cargo regulations tightening (under-reported)

- 4.3 Market Restraints

- 4.3.1 High system & integration cost for mid-segment vehicles

- 4.3.2 Reliability & maintenance complexity concerns

- 4.3.3 Cyber-security risks in ECU-connected ECAS (under-reported)

- 4.3.4 Elastomer & composite price volatility (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Transition to 48-V & software-defined chassis

- 4.6.2 Lightweight composite air-spring bellows

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Control Type

- 5.1.1 Electronically Controlled Air Suspension (ECAS)

- 5.1.2 Non-Electronically Controlled Air Suspension (NECAS)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Trucks

- 5.2.4 Buses & Coaches

- 5.3 By End User

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Component

- 5.4.1 Air Springs

- 5.4.2 Compressors and Reservoirs

- 5.4.3 Electronic Control Units

- 5.4.4 Height & Pressure Sensors

- 5.4.5 Shock Dampers

- 5.5 By Propulsion

- 5.5.1 ICE Vehicles

- 5.5.2 Battery-Electric Vehicles

- 5.6 By Suspension Architecture

- 5.6.1 Passive Air Suspension

- 5.6.2 Semi-Active / Adaptive Air Suspension

- 5.6.3 Fully Active Air Suspension

- 5.7 By Sales Channel

- 5.7.1 Direct to OEM

- 5.7.2 Tier-1 / Module Supplier

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Rest of North America

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 Japan

- 5.8.4.3 India

- 5.8.4.4 South Korea

- 5.8.4.5 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Saudi Arabia

- 5.8.5.2 United Arab Emirates

- 5.8.5.3 South Africa

- 5.8.5.4 Nigeria

- 5.8.5.5 Rest of Middle East and Africa

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Hendrickson International

- 6.4.4 Thyssenkrupp Bilstein

- 6.4.5 Vibracoustic SE

- 6.4.6 Firestone Industrial Products

- 6.4.7 Hitachi Astemo

- 6.4.8 Mando Corporation

- 6.4.9 SAF-Holland SE

- 6.4.10 Meritor (Cummins)

- 6.4.11 AccuAir Suspension

- 6.4.12 Air Lift Company

- 6.4.13 Arnott Industries

- 6.4.14 BWI Group

- 6.4.15 KYB Corporation

- 6.4.16 Komman Air Suspension

- 6.4.17 Guangzhou Guomat Air Spring

- 6.4.18 Dunlop Systems & Components

- 6.4.19 Tenneco Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment