|

市场调查报告书

商品编码

1844461

溴苯:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Bromobenzene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

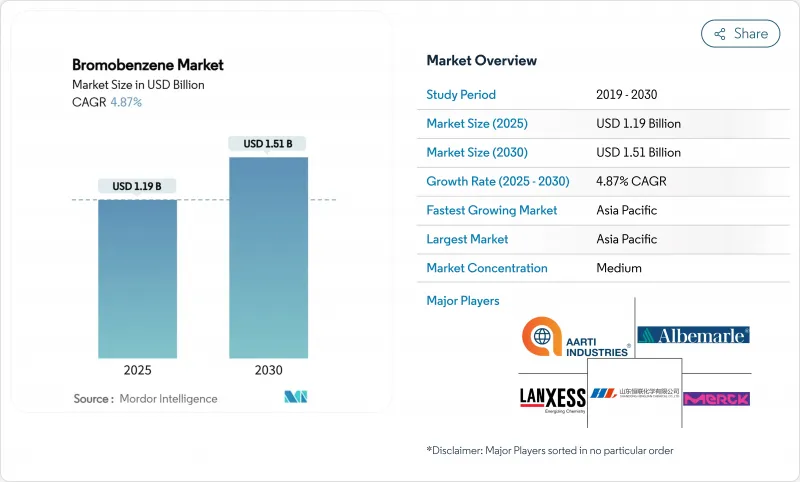

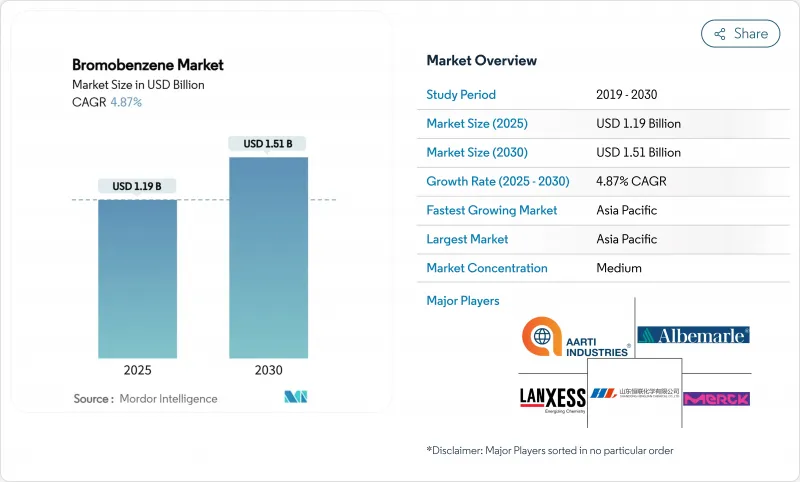

溴苯市场规模预计在 2025 年为 11.9 亿美元,预计到 2030 年将达到 15.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.87%。

这种扩张源自于溴苯作为格任亚试剂前驱物的重要作用,支持高价值医药中间体和特殊化学品。对电子级溶剂的需求正在增长,特别是在亚太地区,因为复杂的合成持续外包给合约製造组织保持了高运转率,并且持续的半导体资本投资推动了需求。将上游溴提取与下游溴苯加工相结合的公司保持了成本优势,即使在原材料价格波动的情况下也能保持净利率。虽然欧洲和北美日益严格的法规推高了合规成本,但与许多氯化类似物相比,该化合物的合成选择性和较低的挥发性支撑了稳定的需求底线。溴苯市场也受益于连续流格氏试剂生产等製程创新,这些创新提高了产量比率,最大限度地减少了废弃物,并开闢了先进材料的新应用。

全球溴苯市场趋势与洞察

亚太地区製药外包市场蓬勃发展

生命科学外包的激增正在重塑印度、中国和东南亚对溴苯的需求模式。区域合约受託製造)公司正在扩大溴化和有机金属合成生产线,并在欧洲和美国签订了精神药物和原料药的供应合约。基于 ICH 指南的监管协调正在简化技术转让,而中国丰富的溴原料正在降低物流成本,并使下游苯基溴化镁的生产更具价格竞争力。

扩大格氏碱生产,用于生产高价值中间体

製药、农业化学品和材料公司越来越多地利用格氏交叉偶联反应来获得更高通量的复杂骨架。溴苯衍生的苯基溴化镁已成为一种经济高效的亲核试剂,可用于复杂的碳碳键形成。新型铑催化自偶联反应也使溴苯能够应用于整合素抑制剂的合成和其他前沿疗法。

与氯化芳烃的价格竞争

溴苯价格较氯苯低15-20%,这对成本敏感型配方中的溴苯应用构成挑战。由于供应中断导致溴原料价格上涨,此价格差异在2024年进一步扩大,迫使一些配方製造商重新设计其氯化芳烃合成路线。生产商强调溴苯具有更高的选择性和更低的反应温度,但激进的价格匹配正在侵蚀净利率。

細項分析

2024年,苯基溴化镁将占据溴苯市场的43.22%,凸显其作为格任亚试剂在製药和特种化学品工作流程中建构碳键的广泛应用。流动化学维修提高了空间利用率,减少了溶剂用量,从而延长了这种主力原料的反应器运作。製药整合商优先采购苯基溴化镁。这种需求的稳定性保护了溴苯市场免受有机溴不稳定因素的影响。持续製程强化和能够实现90%法拉第效率的专利电化学溴化路线有望增强其竞争力,但传统的间歇製程在许多亚洲工厂中仍然占据主导地位。

其他产品,例如邻溴和对溴衍生物以及特殊研究化学品,构成了多元化的业务,涵盖农业化学品、材料科学和香料中间体。这些利基市场的销售量较低,但每公斤利润率较高,从而缓解了收益的周期性波动。儘管严格的法规限制了规模,但有效治疗方案的稳定需求使价格保持在高位。从长远来看,连续流选择性的改进可能会使小批量产品蚕食苯基溴化镁的市场份额,但更广泛的溴苯市场很可能在2030年之前仍将保持产品密集。

区域分析

亚太地区是溴苯市场的营运和需求中心,预计2024年将占据42.14%的市场份额。中国是重要的溴生产国,为週边的溴苯及下游苯基溴化镁工厂提供支援。这些工厂既服务于国内製剂製造商,也服务于出口合约。包括印度Aarti Industries在内的国内企业正在斥资15亿至18亿印度卢比用于消除瓶颈和后向整合,以确保溴供给能力,并满足欧洲买家更严格的杂质法规要求。日本和韩国的电子产业丛集正在增加超纯溶剂的产量。东南亚国家正在增加低成本的代加工产能,以支撑该全部区域复合年增长率。

儘管北美的溴苯消费量低于亚太地区,但仍是溴苯市场重要的技术中心。美国拥有先进的药物研发管线,专门用于下一代抗癌和中枢神经系统药物的溴苯衍生中间体。 Albemarle Corporation 在阿肯色州的盐水水源产业增强了当地的供应弹性,并缓解了价格波动。加拿大和墨西哥的买家透过现货进口获得当地原料,儘管国内产量仍然有限。 《有毒物质管制法》(TSCA) 下的监管措施鼓励对更环保合成的投资,但也提高了註册门槛,给小型用户带来了负担。

欧洲的管理体制最为严格,但对高价值应用的专业需求却源源不绝。儘管 REACH 註册成本高昂,但德国精细化学品製造商正在实施闭合迴路溴回收,以抑制排放并确保供应的连续性。总部位于瑞士、法国和英国的跨国製药公司正在推动用于小批量、高效价药品的 GMP 级溴苯中间体的需求。东欧的化学园区正在吸引受益于较低劳动成本和欧盟单一市场进入的合约配方商。虽然中东和非洲的消费量有限,但约旦的高溴生产能力使其成为该地区重要的原料中心,并有可能刺激未来的溴苯计划。随着巴西和阿根廷的农业化学品製造商探索芳香族溴化物作为新的活性成分,南美洲的消费量虽小但呈成长趋势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 亚太地区製药外包市场蓬勃发展

- 扩大以格氏法为基础的高价值中间体生产

- 电子领域对高纯度溶剂的需求不断增加

- 精神活性原料药契约製造快速成长

- 涂料中低VOC溶剂的转变

- 市场限制

- 与氯化芳烃的价格竞争

- 加强 REACH/TSCA 对有机溴的监管

- 死海生产商的溴供应不稳定

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按产品

- 苯基溴化镁

- 离胺酸

- 其他产品

- 按用途

- 格任亚试剂

- 溶剂

- 化学中间体

- 製药

- 电子级溶剂

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Aarti Industries Limited

- Albemarle Corporation

- Exxon Mobil Chemical

- Hawks Chemical Company

- Heranba Industries Ltd

- Lanxess AG

- Merck KGaA

- Pragna Group

- Shandong Henglian Chemical Co. Ltd

- Shanghai Wescco Chemical Co. Ltd

- Sontara Organo Industries

- Zhejiang Xieshi New Materials

第七章 市场机会与未来展望

The Bromobenzene Market size is estimated at USD 1.19 billion in 2025, and is expected to reach USD 1.51 billion by 2030, at a CAGR of 4.87% during the forecast period (2025-2030).

This expansion is rooted in bromobenzene's indispensable role as a Grignard reagent precursor that underpins high-value pharmaceutical intermediates and specialty chemicals. Continuous outsourcing of complex synthesis to contract manufacturing organizations, especially in Asia Pacific, keeps utilisation rates high while sustained semiconductor capital expenditure widens demand for electronics-grade solvent grades. Firms that integrate upstream bromine extraction with downstream bromobenzene processing maintain cost advantages that preserve margins in spite of raw-material price swings. Regulatory tightening in Europe and North America raises compliance costs, yet the compound's synthetic selectivity and lower volatility compared with many chlorinated analogues support a stable demand floor. The bromobenzene market also benefits from process innovations such as continuous-flow Grignard production that lift yields, curb waste, and open new application windows in advanced materials.

Global Bromobenzene Market Trends and Insights

Rising Pharmaceutical Outsourcing in Asia Pacific

Surging life-science outsourcing is reshaping bromobenzene demand profiles across India, China and Southeast Asia. Regional contract development and manufacturing organizations have scaled bromination and organometallic synthesis lines to secure Western supply contracts for psychoactive and oncology APIs. Regulatory harmonisation under ICH guidelines simplifies technology transfer while China's abundant bromine feedstock cuts logistics costs, reinforcing price competitiveness for downstream phenylmagnesium bromide production.

Expansion of Grignard-Based Manufacturing for High-Value Intermediates

Pharmaceutical, agrochemical, and materials firms are widening their use of Grignard cross-coupling to access complex scaffolds at higher throughput. Continuous-flow reactors raise space-time productivity and suppress side reactions, making bromobenzene-derived phenylmagnesium bromide a cost-efficient nucleophile for difficult carbon-carbon bond formations. Emerging rhodium-catalyzed homo-couplings extend bromobenzene's reach to integrin inhibitor syntheses and other frontier therapeutics.

Price Competition from Chlorinated Aromatics

Chlorobenzene's 15-20% price discount challenges bromobenzene adoption in cost-sensitive formulations. The differential widened in 2024 after bromine feedstock prices spiked on supply disruptions, prompting some formulators to redesign synthesis routes around chlorinated aromatics. Producers counter by highlighting bromobenzene's superior selectivity and lower reaction temperatures, yet aggressive price matching erodes margins.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for High-Purity Solvents in Electronics

- Surge in Contract Production of Psychoactive APIs

- Stricter REACH/TSCA Restrictions on Organobromines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Phenylmagnesium bromide represented 43.22% of the bromobenzene market in 2024, underscoring its ubiquity as a Grignard reagent for carbon-bond construction across pharmaceutical and specialty-chemical workflows. Flow-chemistry retrofits improved space utilisation and cut solvent volumes, lifting reactor uptime for this marquee product. Pharmaceutical integrators continue to prioritise phenylmagnesium bromide procurement because substitutions often compromise yield or stereochemistry. This demand stability shields the bromobenzene market from wider organobromine volatility. Continuous process intensification and a patent-protected electrochemical bromination route capable of 90% Faradaic efficiency are poised to enhance competitiveness, yet entrenched batch methods remain dominant in many Asian plants.

Other products, including ortho- and para-brominated derivatives plus specialised research chemicals, together form a diversified tail that services agrochemical, material-science and fragrance intermediates. Although these niches are smaller in volume, they command higher per-kilogram margins that temper revenue cyclicality. Phencyclidine, holding 5.11% share, illustrates the pattern: tight regulatory controls constrain scale, yet recurring demand from validated therapeutic protocols keeps price realisations elevated. Over the long run, incremental gains in continuous-flow selectivity may allow small-volume products to chip away at phenylmagnesium bromide's share, but the broader bromobenzene market will likely remain product-concentrated through 2030.

The Bromobenzene Market Report is Segmented by Product (Phenylmagnesium Bromide, Phencyclidine, Other Products), Application (Grignard Reagent, Solvent, Chemical Intermediate, Pharmaceuticals, Electronics-Grade Solvents, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific, with a 42.14% share in 2024, is the operational and demand epicentre of the bromobenzene market. China is a significant producer of elemental bromine, which supports nearby bromobenzene and downstream phenylmagnesium bromide plants. These facilities cater to both local formulators and fulfill export contracts. India's Aarti Industries and other domestic groups are spending INR 1,500-1,800 crore on debottlenecking and backward integration to secure bromine availability and meet stricter impurity limits demanded by European buyers. Japanese and Korean electronics clusters generate incremental volumes for ultra-pure solvent grades. Southeast Asian countries add low-cost tolling capacity that supports the region's overall CAGR through 2030.

North America remains a critical technology hub for the bromobenzene market, even though its consumption is lower than Asia Pacific. The United States hosts advanced pharmaceutical research pipelines that specify bromobenzene-derived intermediates for next-generation oncology and CNS actives. Albemarle Corporation's brine operations in Arkansas strengthen local supply resilience and moderate price volatility. Canadian and Mexican buyers secure regional feedstock through spot imports, though their domestic production remains limited. Regulatory momentum under TSCA encourages investment in greener synthesis but also raises registration thresholds that smaller users find burdensome.

Europe operates under the strictest regulatory regime yet sustains specialty demand streams in high-value applications. German fine-chemical producers deploy closed-loop bromine recovery to curtail emissions, ensuring continuity of supply despite REACH dossier costs. Pharmaceutical multinationals headquartered in Switzerland, France, and the United Kingdom drive demand for GMP-grade bromobenzene intermediates used in small-batch, high-potency drug substances. Eastern European chemical parks attract contract formulations that benefit from lower labour costs and EU single-market access. Despite limited consumption in the Middle East and Africa, Jordan's significant bromine production capacity positions it as a pivotal regional raw-material hub, potentially spurring future bromobenzene projects. South America remains a small but rising consumer as Brazilian and Argentine agrochemical producers explore aromatic bromides for new active ingredients.

- Aarti Industries Limited

- Albemarle Corporation

- Exxon Mobil Chemical

- Hawks Chemical Company

- Heranba Industries Ltd

- Lanxess AG

- Merck KGaA

- Pragna Group

- Shandong Henglian Chemical Co. Ltd

- Shanghai Wescco Chemical Co. Ltd

- Sontara Organo Industries

- Zhejiang Xieshi New Materials

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising pharmaceutical outsourcing in Asia Pacific

- 4.2.2 Expansion of Grignard-based manufacturing for high-value intermediates

- 4.2.3 Growing demand for high-purity solvents in electronics

- 4.2.4 Surge in contract production of psychoactive APIs

- 4.2.5 Transition to low-VOC solvents in coatings

- 4.3 Market Restraints

- 4.3.1 Price competition from chlorinated aromatics

- 4.3.2 Stricter REACH/TSCA restrictions on organobromines

- 4.3.3 Volatility in bromine supply from Dead Sea producers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Phenylmagnesium Bromide

- 5.1.2 Phencyclidine

- 5.1.3 Other Products

- 5.2 By Application

- 5.2.1 Grignard Reagent

- 5.2.2 Solvent

- 5.2.3 Chemical Intermediate

- 5.2.4 Pharmaceuticals

- 5.2.5 Electronics-grade Solvents

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aarti Industries Limited

- 6.4.2 Albemarle Corporation

- 6.4.3 Exxon Mobil Chemical

- 6.4.4 Hawks Chemical Company

- 6.4.5 Heranba Industries Ltd

- 6.4.6 Lanxess AG

- 6.4.7 Merck KGaA

- 6.4.8 Pragna Group

- 6.4.9 Shandong Henglian Chemical Co. Ltd

- 6.4.10 Shanghai Wescco Chemical Co. Ltd

- 6.4.11 Sontara Organo Industries

- 6.4.12 Zhejiang Xieshi New Materials

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

![全球苯市场评估:依衍生物[乙苯、环己烷、硝基苯、异丙苯及其他]、应用[塑胶、树脂、合成纤维及其他]、地区、机会及预测(2018-2032)](/sample/img/cover/42/default_cover_mx.png)