|

市场调查报告书

商品编码

1844475

苯甲酸:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Benzoic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

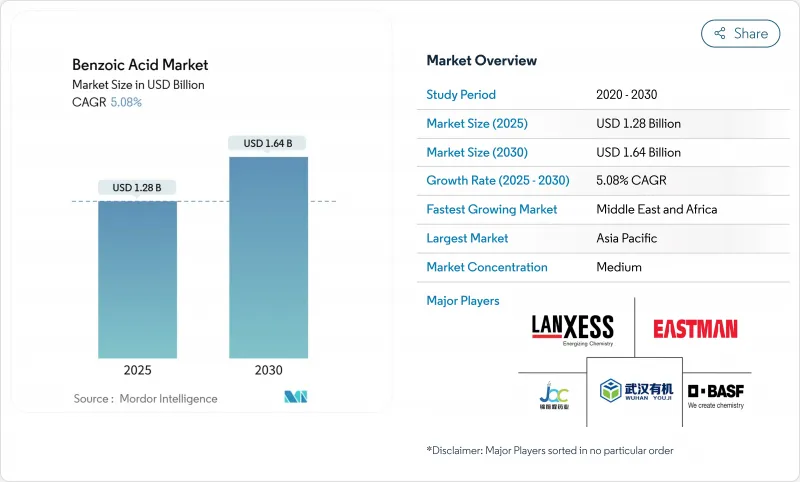

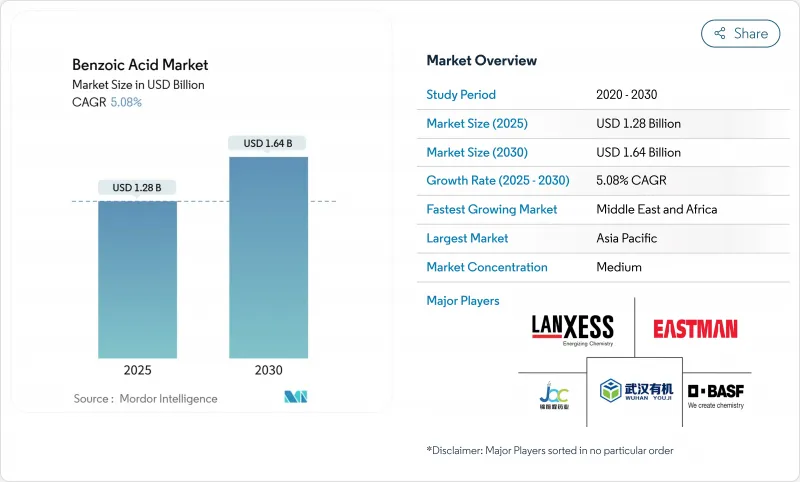

预计苯甲酸市场规模到 2025 年将达到 12.8 亿美元,到 2030 年将成长至 16.4 亿美元,复合年增长率为 5.08%。

市场成长受到专注于延长保质期要求、邻苯二甲酸酯替代品和高纯度製造流程的法规的推动。欧盟 (EU) 加强食品接触法规,美国食品药物管理局(FDA) 禁止使用 25 种邻苯二甲酸酯塑化剂,为食品、製药和塑化剂应用创造了新的机会。虽然亚太地区保持了生产优势,但中东和非洲由于食品加工工业化而显示出最高的成长率。由于易于处理、药品品质要求和监管支持,市场越来越多地采用液体配方、超纯级和苯甲酸酯塑化剂。竞争格局适中,全球公司和区域供应商共用市场影响,从而推动绿色化学和连续加工的进步。

全球苯甲酸市场趋势与见解

新兴国家对长保质期药品的监管更加严格

新兴市场的药品监管机构正在实施更严格的保质期要求,这增加了对苯甲酸的需求。延长产品稳定性是液体製剂的关键,苯甲酸透过抑制微生物生长、抑制细菌和真菌污染来延长保存期限。这些监管趋势推动了製药业需求的持续成长,尤其是在中国、印度和巴西等医疗保健法规日益严格的国家。亚太市场一致的监管规定使苯甲酸成为关键的防腐剂,尤其是在口服和肠外製剂中,这些製剂需要与活性药物成分相容。这些製剂包括口服溶液、混悬液、注射剂和其他液体药物。新生儿用药安全要求推动了对符合纯度规格的高纯度等级产品的需求,从而支持了超高纯度市场的成长。此外,对儿科药物日益增长的关注、敏感药物应用中对污染防腐剂的需求以及苯甲酸在新型药物输送系统中日益广泛的应用,进一步推动了这一需求。製药业对品管和法规遵循的重视正在推动对先进净化技术和测试方法的投资增加,以确保苯甲酸符合这些严格的要求。

扩大苯甲酰氯在农药合成上的应用

苯甲酰氯是一种苯甲酸衍生物,是生产除草剂和杀菌剂(尤其是草灭平类似物)的关键成分,可用于控制抗性杂草并提高作物产量。这种化合物的特性使製造商能够开发特定的配方,以应对害虫抗性,同时确保作物安全。为了满足全球农化公司对特定杂质特征产品的需求,印度配方师和中国合约製造商正在透过实施改进的製程控制和品质系统来扩大其生产能力。这些生产改进包括更好的过滤系统、自动化监控和全面的品质检测通讯协定。鑑于农业部门对永续性的关注,对含酰胺磺酸盐衍生物的研究正在日益增加。永续性在保持害虫防治效果的同时降低施用量。市场成长取决于实现成本效益,并在农化供应链中维持对苯甲酸的稳定需求,同时满足环境法规和安全要求。该行业持续投资基于苯甲酰氯的解决方案,以开发新的作物保护产品。

洁净标示防腐剂的普及限制了合成苯甲酸酯的采用

消费者对天然成分的偏好日益增长,这迫使食品製造商寻求合成防腐剂(包括苯甲酸钠)的替代品。欧洲市场数据显示,随着消费者越来越严格地审查产品标籤并寻求天然替代品,对成分来源和生产过程透明的清洁标籤产品的需求日益增长。天然抗菌化合物,例如植物萃取物、精油和微生物代谢物,是合成防腐剂的潜在替代品。这些天然化合物已被证明能够有效控制食源性病原体,同时符合消费者对洁净标示产品的偏好。肉类产业对天然防腐剂表现出浓厚的兴趣,并正在探索包括噬菌体、细菌素和抗菌肽在内的多种选择,作为合成化学物质的替代品。这些替代品在实验室和商业环境中都已显示出良好的效果。然而,标准化、高生产成本以及不同食品应用中抗菌效果的差异等挑战限制了天然替代品的广泛应用。法规环境,特别是在欧盟,正在透过对合成防腐剂更严格的指导方针和核准流程转向青睐天然成分,为苯甲酸製造商创造了市场适应和产品开发的机会和挑战。

細項分析

预计到2024年,无水级苯甲酸市场将占据53.21%的主导市场份额,这得益于整体的广泛应用。无水粉末吸湿性低,易于散装储存,非常适合用于干混食品、聚合物催化剂和颗粒状动物饲料混合物。这些特性有助于在整个保质期内维持产品稳定性和品质。在加工效率和营运效益的推动下,液体产品细分市场的复合年增长率为6.34%。药用糖浆製造商正在使用液体苯甲酸溶液来简化其生产流程,省去了现场溶解步骤,保持了精确的检测公差,降低了批次差异,并提高了产品一致性。工业涂料製造商正在高剪切反应器中使用液体来实现更快的均质化,从而缩短生产时间并提高效率。

製程强化显着提高了液体在生产过程中的吸收能力。全面的实验室筛检表明,液体苯甲酸作为醇酸树脂的链终止剂,其性能更加高效,从而提高了保光性和表面光洁度。这些显着的性能改进,加上处理和加工过程中粉尘排放的减少,支撑了该细分市场相对于苯甲酸整体市场更强劲的成长轨迹。此外,液体苯甲酸效率的提升缩短了加工时间,使其能够更好地融入各种工业应用,进一步巩固了其市场地位。

到2024年,纯度等级为99.5-99.9%的药物将占据市场主导地位,市场份额达62.78%,这主要归功于其在关键製造过程中的广泛应用。到2030年,99.9%以上的超高纯度药物将以7.22%的复合年增长率增长,这主要得益于对特种涂料和严格品质规范的製药应用日益增长的需求。製药业对纯度等级的要求更高,尤其是对于必须符合严格的药典标准以确保病人安全和合规性的肠外製剂。在膜分离和层析法技术等先进纯化技术的支持下,生物基生产方法的研究正在开发创新工艺,以实现超高纯度水平,同时保持成本效益。

纯度为 99.0-99.5% 的等级满足食品保鲜和基本工业应用的基本要求,性能可靠,价格分布极具竞争力。此等级广泛应用于对超高纯度要求不高的一般製造工艺。製造商正在采用先进的分析方法和全面的品管系统,以持续达到更高的纯度规格,以支援高端市场的成长,同时优化营运效率和产量。

区域分析

到2024年,亚太地区将占全球市场的42.19%,其中,中国大型芳烃联合装置(包括浙江石化1,180万吨的装置)将提供大量的甲苯原料供应。该地区的加工企业正在利用出口导向法规和综合物流网络来优化通路并降低营运成本。印度不断扩张的製药和食品加工行业正透过防腐剂和中间体等多种应用推动需求,而日本的技术能力则使其能够生产用于电子涂料和特种工业应用的高品质产品。东南亚国协正在利用免税贸易协定建立配销中心,以出口到欧洲和北美,将苯甲酸市场融入区域供应链,并为当地製造商创造增值机会。

预计中东和非洲地区的复合年增长率最高,为6.83%,这得益于都市化加快推动了对保存食品、食品饮料和个人护理用品的需求,以及政府透过税收优惠和基础设施建设吸引聚合物製造商的倡议。沙乌地阿拉伯的一家测试机构正在评估苯甲酸酯塑化剂用于生产PVC电缆绝缘材料的效果,以支持国内製造需求并减少对进口的依赖。

北美受惠于美国食品药物管理局(FDA)的法律规范,以及食品、饮料和消费品产业製造商对不含邻苯二甲酸酯的包装解决方案的偏好。欧洲市场正在适应关于限制双酚A的欧盟2024/3190号法规,鼓励包装製造商在食品接触材料和消费品包装中采用苯甲酸酯替代品,同时回收要求也影响着成本考量和材料选择过程。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 新兴国家对长保质期药品的监管更加严格

- 扩大苯甲酰氯在农药合成上的应用

- 以苯甲酸酯替代品取代邻苯二甲酸酯塑化剂

- 特种涂料对高纯度苯甲酸的需求不断增加

- 包装食品和方便食品的需求不断增加

- 生产技术的进步

- 市场限制

- 转向洁净标示防腐剂,限制合成苯甲酸酯的采用

- 原物料价格波动

- 健康和安全问题

- 与天然防腐剂的竞争

- 供应链分析

- 监理展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按形式

- 液体

- 无水

- 粉末/晶体

- 按纯度等级

- 99.0-99.5%

- 99.5-99.9%

- 超过99.9%

- 透过导数

- 苯甲酸钠

- 苯甲酸钾

- 苯甲酸芐酯

- 苯甲酰氯

- 苯甲酸塑化剂

- 其他衍生性商品

- 按用途

- 饮食

- 麵包店

- 糖果甜点

- 乳製品

- 饮料

- 调味酱料

- 其他的

- 製药

- 化学品

- 个人护理和化妆品

- 餵食

- 其他的

- 饮食

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市场排名分析

- 公司简介

- Lanxess AG

- Eastman Chemical Company

- Wuhan Youji Industry Co., Ltd.

- JQC(Huayin)Pharmaceutical Co., Ltd.

- BASF SE

- IG Petrochemicals Ltd.

- Chemcrux Enterprises Ltd.

- Ganesh Benzoplast Ltd.

- FUSHIMI Pharmaceutical Co., Ltd.

- Jiangsu Sanmu Group Co., Ltd.

- Thermo Fisher Scientific Inc.

- The Merck Group

- Smart Chemicals Group Co., Ltd.

- San Fu Chemical Co., Ltd.

- Mitsui Bussan Chemicals Co., Ltd.

- Spectrum Laboratory Products, Inc.

- Tokyo Chemical Industry Co., Ltd

- Sisco Research Laboratories Pvt Ltd

- Central Drug House(P)Ltd

- Otto Chemie Pvt. Ltd.

第七章 市场机会与未来展望

The benzoic acid market size is expected to reach USD 1.28 billion in 2025 and is expected to grow to USD 1.64 billion by 2030, growing at a CAGR of 5.08%.

The market growth is driven by regulations that focus on extended shelf-life requirements, phthalate replacement, and high-purity manufacturing processes. The European Union's stricter food-contact regulations and the United States Food and Drug Administration's removal of 25 ortho-phthalate plasticizers create new opportunities in food, pharmaceutical, and plasticizer applications. The Asia-Pacific region maintains its production dominance, while the Middle East and Africa show the highest growth rate due to food processing industrialization. The market sees increasing adoption of liquid formulations, ultra-high purity grades, and benzoate plasticizers, driven by ease of handling, pharmaceutical quality requirements, and regulatory support. The competitive landscape remains moderate, with global companies and regional suppliers sharing market presence, leading to advancements in green chemistry and continuous processing.

Global Benzoic Acid Market Trends and Insights

Regulatory push for longer shelf-life pharmaceuticals in emerging economies

Pharmaceutical regulators in emerging markets are implementing stricter shelf-life requirements, increasing the demand for benzoic acid. The focus on extended product stability is significant in liquid formulations, where benzoic acid prevents microbial growth and extends shelf life by inhibiting bacterial and fungal contamination. This regulatory trend drives consistent demand growth in the pharmaceutical sector, particularly in countries like China, India, and Brazil, where healthcare regulations are becoming more stringent. The alignment of regulations across Asia-Pacific markets positions benzoic acid as a key preservative, particularly in oral and parenteral formulations that require compatibility with active pharmaceutical ingredients. These formulations include oral solutions, suspensions, injectable medications, and other liquid pharmaceutical products. The safety requirements for neonatal applications are increasing demand for higher purity grades, with specifications of purity, supporting growth in ultra-high purity segments. This demand is further driven by the growing focus on pediatric medications, the need for contamination-free preservatives in sensitive pharmaceutical applications, and the increasing adoption of benzoic acid in novel drug delivery systems. The pharmaceutical industry's emphasis on quality control and regulatory compliance has led to increased investment in advanced purification technologies and testing methods to ensure benzoic acid meets these stringent requirements.

Expansion of benzoyl chloride usage in agrochemical synthesis

Benzoyl chloride, a benzoic acid derivative, is a key component in manufacturing herbicides and fungicides, particularly chloramben analogs that control resistant weeds and improve crop yields. The compound's properties allow manufacturers to develop specific formulations that address pest resistance while maintaining crop safety. Indian formulators and Chinese contract manufacturers are expanding their production capabilities by implementing improved process controls and quality systems to meet global agrochemical companies' requirements for products with specific impurity profiles. These manufacturing enhancements include better filtration systems, automated monitoring, and comprehensive quality testing protocols. Research into amide-bearing sulfonate derivatives has increased due to the agricultural sector's sustainability focus. Laboratory studies show these derivatives achieve higher lethal-concentration effectiveness against target organisms compared to conventional active ingredients, potentially reducing application rates while maintaining pest control efficiency. The market growth depends on achieving cost-effectiveness while meeting environmental regulations and safety requirements, and maintaining consistent demand for benzoic acid in the agricultural chemical supply chain. The industry continues to invest in benzoyl chloride-based solutions for developing new crop protection products.

Shift towards clean-label preservatives limiting synthetic benzoate adoption

The growing consumer preference for natural ingredients is compelling food manufacturers to seek alternatives to synthetic preservatives, including sodium benzoate. European market data indicates rising demand for clean-label products that offer transparency in ingredient sourcing and manufacturing processes, with consumers increasingly scrutinizing product labels and demanding natural alternatives. Natural antimicrobial compounds, including plant extracts, essential oils, and microbial metabolites, have emerged as potential replacements for synthetic preservatives. These natural compounds demonstrate effectiveness in controlling foodborne pathogens while aligning with consumer preferences for clean-label products. The meat industry has shown significant interest in natural preservatives, extensively exploring options such as bacteriophages, bacteriocins, and antimicrobial peptides as substitutes for synthetic chemicals. These alternatives have demonstrated promising results in laboratory and commercial settings. However, the widespread adoption of natural alternatives faces limitations due to standardization challenges, higher production costs, and varying antimicrobial efficacy across different food applications. The regulatory environment, particularly in the EU, is shifting toward favoring natural ingredients through stricter guidelines and approval processes for synthetic preservatives, which presents both opportunities and challenges for benzoic acid manufacturers in terms of market adaptation and product development.

Other drivers and restraints analyzed in the detailed report include:

- Substitution of phthalate plasticizers with benzoate-based alternatives

- Growing demand for high-purity benzoic acid for specialty coatings

- Price volatility of raw materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The benzoic acid market for anhydrous grades held a dominant 53.21% market share in 2024, supported by its extensive applications across industries. Anhydrous powders serve as the preferred choice for dry-mix foods, polymer catalysts, and granular animal-feed blends, owing to their low moisture absorption and efficient bulk storage properties. These characteristics help maintain product stability and quality during storage periods. The liquid forms segment is growing at a 6.34% CAGR, driven by processing efficiency and operational benefits. Pharmaceutical syrup manufacturers use liquid benzoic acid solutions to streamline production processes by eliminating on-site dissolution steps and maintaining precise assay tolerances, which reduces batch variations and improves product consistency. Industrial coating manufacturers achieve faster homogenization by using liquids in high-shear reactors, reducing production time and improving efficiency.

Process intensification has significantly improved liquid uptake capabilities in manufacturing processes. Comprehensive laboratory tests indicate that liquid benzoic acid functions more effectively as a chain-stop agent in alkyd resins, resulting in enhanced gloss retention and surface finish quality. These substantial performance improvements, combined with reduced dust emissions during handling and processing, support the segment's stronger growth trajectory compared to the overall benzoic acid market. The improved efficiency in liquid form has also led to reduced processing times and better integration in various industrial applications, further strengthening its market position.

The 99.5-99.9% purity segment dominates with 62.78% market share in 2024, primarily due to its widespread use in critical manufacturing processes. Ultra-high purity grades above 99.9% are growing at 7.22% CAGR through 2030, driven by increasing demand from specialty coating and pharmaceutical applications requiring stringent quality specifications. The pharmaceutical industry requires higher purity grades, especially for parenteral formulations that must meet strict pharmacopeial standards for patient safety and regulatory compliance. Research into bio-based production methods is developing innovative processes for ultra-high purity levels while maintaining cost efficiency, supported by advanced purification technologies including membrane separation and chromatographic techniques.

The 99.0-99.5% purity grade meets essential requirements for food preservation and basic industrial applications, offering reliable performance at competitive price points. This grade finds extensive use in general manufacturing processes where ultra-high purity is not critical. Manufacturers are implementing sophisticated analytical methods and comprehensive quality control systems to achieve higher purity specifications consistently, supporting premium segment growth while optimizing operational efficiency and production yields.

The Benzoic Acid Market Report is Segmented by Form (Liquid, Anhydrous, and More), Purity Grade (99. 0-99. 5%, 99. 5-99. 9%, and More), Derivative (Sodium Benzoate, Potassium Benzoate, and More), Application (Food and Beverage, Pharmaceuticals, Chemicals, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 42.19% of the global market in 2024, with China's large-scale aromatic complexes, including Zhejiang Petroleum & Chemical's 11.8 million-ton facility, providing substantial toluene feedstock supply. The region's processors utilize export-oriented regulations and integrated logistics networks to optimize distribution channels and reduce operational costs. India's expanding pharmaceutical and food-processing sectors increase demand through multiple applications, including preservatives and intermediates, while Japan's technological capabilities enable the production of high-quality grades for electronic coatings and specialized industrial applications. ASEAN countries utilize duty-free trade agreements to establish distribution centers for exports to Europe and North America, integrating the benzoic acid market into regional supply chains and creating value-added opportunities for local manufacturers.

The Middle East and Africa region exhibits the highest growth rate at 6.83% CAGR, supported by increasing urbanization driving demand for preserved food products, beverages, and personal care items, alongside government initiatives attracting polymer manufacturers through tax incentives and infrastructure development. Saudi Arabia's test facilities assess benzoate plasticizers for PVC cable insulation production, supporting domestic manufacturing requirements and reducing import dependency.

North America benefits from FDA regulatory framework and manufacturer preferences for phthalate-free packaging solutions across food, beverage, and consumer goods sectors. Europe's market adapts to Regulation (EU) 2024/3190 on bisphenol limitations, encouraging packaging manufacturers to adopt benzoate alternatives in food contact materials and consumer packaging, while recycling requirements affect cost considerations and material selection processes.

- Lanxess AG

- Eastman Chemical Company

- Wuhan Youji Industry Co., Ltd.

- JQC(Huayin) Pharmaceutical Co., Ltd.

- BASF SE

- I G Petrochemicals Ltd.

- Chemcrux Enterprises Ltd.

- Ganesh Benzoplast Ltd.

- FUSHIMI Pharmaceutical Co., Ltd.

- Jiangsu Sanmu Group Co., Ltd.

- Thermo Fisher Scientific Inc.

- The Merck Group

- Smart Chemicals Group Co., Ltd.

- San Fu Chemical Co., Ltd.

- Mitsui Bussan Chemicals Co., Ltd.

- Spectrum Laboratory Products, Inc.

- Tokyo Chemical Industry Co., Ltd

- Sisco Research Laboratories Pvt Ltd

- Central Drug House (P) Ltd

- Otto Chemie Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory push for longer shelf-life pharmaceuticals in emerging economies

- 4.2.2 Expansion of benzoyl chloride usage in agrochemical synthesis

- 4.2.3 Substitution of phthalate plasticizers with benzoate-based alternatives

- 4.2.4 Growing demand for high-purity benzoic acid for specialty coatings

- 4.2.5 Rise in demand for packaged and convenience foods

- 4.2.6 Technological advancements in production

- 4.3 Market Restraints

- 4.3.1 Shift towards clean-label preservatives limiting synthetic benzoate adoption

- 4.3.2 Price volatality of raw materials

- 4.3.3 Healh and safetu concerns

- 4.3.4 Competition from natural preservatives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Liquid

- 5.1.2 Anhydrous

- 5.1.3 Powder/Crystal

- 5.2 By Purity Grade

- 5.2.1 99.0-99.5%

- 5.2.2 99.5-99.9%

- 5.2.3 Above 99.9%

- 5.3 By Derivative

- 5.3.1 Sodium Benzoate

- 5.3.2 Potassium Benzoate

- 5.3.3 Benzyl Benzoate

- 5.3.4 Benzoyl Chloride

- 5.3.5 Benzoate Plasticizers

- 5.3.6 Other Derivatives

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.1.1 Bakery

- 5.4.1.2 Confectionery

- 5.4.1.3 Dairy

- 5.4.1.4 Beverage

- 5.4.1.5 Sauces and Dressings

- 5.4.1.6 Others

- 5.4.2 Pharmaceuticals

- 5.4.3 Chemicals

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Animal Feed

- 5.4.6 Others

- 5.4.1 Food and Beverage

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Italy

- 5.5.2.6 Spain

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Lanxess AG

- 6.4.2 Eastman Chemical Company

- 6.4.3 Wuhan Youji Industry Co., Ltd.

- 6.4.4 JQC(Huayin) Pharmaceutical Co., Ltd.

- 6.4.5 BASF SE

- 6.4.6 I G Petrochemicals Ltd.

- 6.4.7 Chemcrux Enterprises Ltd.

- 6.4.8 Ganesh Benzoplast Ltd.

- 6.4.9 FUSHIMI Pharmaceutical Co., Ltd.

- 6.4.10 Jiangsu Sanmu Group Co., Ltd.

- 6.4.11 Thermo Fisher Scientific Inc.

- 6.4.12 The Merck Group

- 6.4.13 Smart Chemicals Group Co., Ltd.

- 6.4.14 San Fu Chemical Co., Ltd.

- 6.4.15 Mitsui Bussan Chemicals Co., Ltd.

- 6.4.16 Spectrum Laboratory Products, Inc.

- 6.4.17 Tokyo Chemical Industry Co., Ltd

- 6.4.18 Sisco Research Laboratories Pvt Ltd

- 6.4.19 Central Drug House (P) Ltd

- 6.4.20 Otto Chemie Pvt. Ltd.