|

市场调查报告书

商品编码

1844502

水性涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Waterborne Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

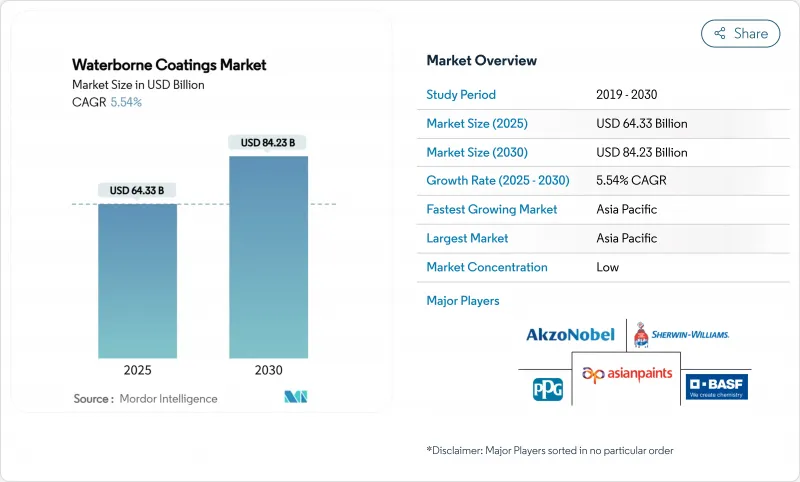

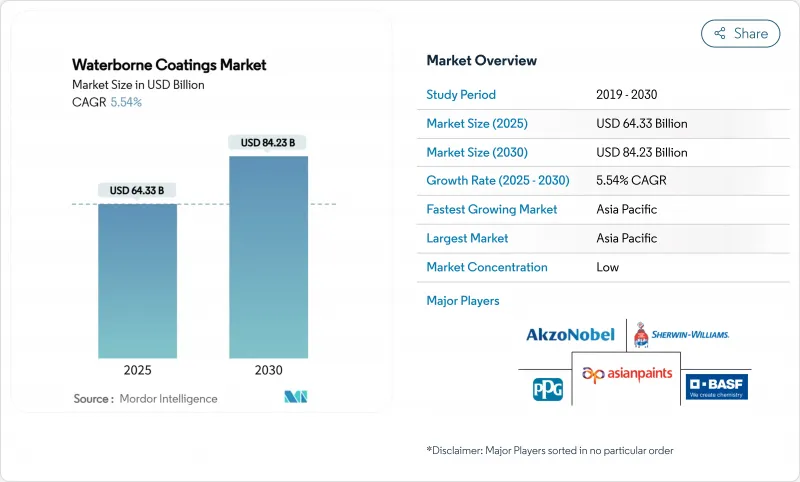

水性涂料市场规模预计在 2025 年为 643.3 亿美元,预计到 2030 年将达到 842.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.54%。

挥发性有机化合物限量收紧、大规模基础设施项目以及原始设备製造商加速转向低排放气体化学品支出,共同支撑了强劲的需求。美国环保署将气溶胶涂料法规的合规期限延长至2027年1月,显示生产者在转向更环保的配方时,必须严格遵守监管规定。亚洲建筑业的蓬勃发展、汽车修补漆的升级以及生物基树脂的兴起,进一步巩固了水性涂料市场的长期发展轨迹。竞争策略越来越多地围绕着流变学方案(以确保供应安全)、不含PFAS的耐久性增强以及数位色彩平台展开,儘管原材料成本波动,但仍为价值获取开闢了新的途径。

全球水性涂料市场趋势与洞察

加强VOC监管和脱碳

加州空气资源委员会已将工业维护涂料中的 VOC 限制为 50g/L,比联邦基准值严格近 10 倍,迫使配方师开发通过附着力、光泽度和耐久性测试的超低排放气体配方。加拿大也在推行类似的监管收紧措施,该国将于 2024 年 1 月对 130 个产品类别实施全国性限制,这增加了全球统一 SKU 的跨国公司的合规风险。在欧洲,更新后的 REACH 监管蓝图针对 PVC 添加剂和邻苯二甲酸酯,缩短了采用不含 PFAS 的多元醇的时间。随着各国司法管辖区在雄心勃勃的脱碳目标上趋于一致,能够在各大洲协调单一水性规范的公司可以降低合规开销并加快市场进入速度,而后进企业则被困在分散的传统生产线中。

亚洲和非洲基础设施快速发展

中国经济奖励策略推动的工业復苏以及印度的高速公路和地铁扩建,推动了水性涂料市场以升为单位的最大成长份额。在巴林和阿曼,超过45%的新住宅采用快干、低气味的水性底漆,随着该地区承包商追求LEED和Estidama认证,这一比例预计还将增长。亚洲开发银行的2024年关键指标强调,每年1.7兆美元的基础设施支出必须兼顾气候适应力,并将室内空气污染物较低的水性化学品列为采购清单的首位。从印尼到肯亚,在会议上的对话表明,技术顾问越来越多地向医院和学校推荐水性环氧树脂,这证实了人们根深蒂固的偏好,并将支持长期需求成长。

特殊流变添加剂的稀少性和价格波动

流变包装仅占原料重量的4%,却占其成本的13%,供应紧张影响了整体生产利润率。围绕复杂ASE和HASE化合物的製造商整合加剧了价格波动。一次停产可能会使全球每吨成本增加两位数。带状聚硅酸盐承诺在低剂量下实现pH值稳定的流动,但需要进行大量的兼容性测试,从而将创新週期延长至一年以上。中间库存缓衝是唯一的对冲手段,可以锁定可用于资助新研发的资金。

細項分析

到2024年,丙烯酸配方将占据水性涂料市场的81.20%,这反映了其抗紫外线、保色性和成本效益的优势,这些优势使其受到全球建筑商和DIY消费者的青睐。在市政重涂计画和DIY渠道扩张的推动下,丙烯酸树脂水性涂料的市场规模预计将稳定成长。

随着汽车製造商和工业维修工程师转向更小基体、单组分、水性化学品,以缩短喷涂时间并提高耐化学性,聚氨酯市场到2030年将以5.88%的复合年增长率加速成长。环氧树脂在重防腐蚀应用仍占有一席之地,但PFAS排放途径需要同步创新才能维持阻隔指标。受VOC法规的挤压,醇酸树脂正透过生物基变体寻求缓解,这些变体用石油基来源的壬二酸替代,从而减少监管审查并保持熟悉的可加工性。

水性涂料报告按树脂类型(丙烯酸、醇酸树脂、环氧树脂、聚氨酯、聚酯、聚偏二氯乙烯等)、终端用户行业(建筑施工、汽车、工业、木材、其他终端用户行业)和地区(亚太地区、北美、欧洲、南美、中东和非洲)细分。市场预测以美元计算。

区域分析

预计到2024年,亚太地区将占全球销售额的42.61%,并预计以6.01%的复合年增长率引领市场,到2030年,亚太地区将牢牢确立其作为水性涂料市场成长引擎的地位。中国的经济奖励策略预计将重振工业生产,扩大对一般工业瓷漆的基准需求,而印度混凝土密集型智慧城市的建设预计将吸引弹性屋顶和桥樑防水膜的远距订单。

北美拥有成熟的监管体系和技术领先优势。加州50克/公升的限值迫使全国范围内的SKU(库存单位)必须满足最低VOC限值,从而刺激了分销链上的快速再製造。加拿大的国家VOC规则手册协调了从魁北克省到不列颠哥伦比亚省的各省限值,简化了合规水性产品的市场准入流程。

欧洲正透过其「永续性化学品策略」引领永续性趋势,加速水性涂料在建筑、工业和DIY领域的应用。在英国,阿克苏诺贝尔在BASF的支持下,重新推出了多乐士Easycare系列产品,并承诺将其产品的碳足迹减少至少5%,从而增强其在环保消费者中的品牌影响力。东欧的都市化也推动了涂料销售的成长,尤其是在欧盟復苏计画下市政道路和铁路的维修。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 加强VOC和脱碳需求

- 亚洲和非洲基础设施快速发展

- OEM溶剂到水的转化

- 生物基树脂(木质素、藻类等)的进展

- 智慧工厂对低温固化生产线的需求

- 市场限制

- 特殊流变助剂的稀少性和价格波动

- 热带地区与湿度有关的干旱灾害

- 极端防腐蚀中不含 PFAS 的性能差距

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依树脂类型

- 丙烯酸纤维

- 醇酸

- 环氧树脂

- 聚氨酯

- 聚酯纤维

- 聚偏二氯乙烯(PVDC)

- 聚二氟亚乙烯(PVDF)

- 其他树脂类型

- 按最终用户产业

- 建筑/施工

- 车

- 工业的

- 木头

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Akzo Nobel NV

- Arkema

- Asian Paints Ltd.

- Axalta Coating Systems, LLC

- BASF

- Benjamin Moore & Co.

- Berger Paints India

- Chokwang Paint

- Dow

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- KCC Corporation

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- Tenaris

- The Sherwin-Williams Company

- Tikkurila

第七章 市场机会与未来展望

The Waterborne Coatings Market size is estimated at USD 64.33 billion in 2025, and is expected to reach USD 84.23 billion by 2030, at a CAGR of 5.54% during the forecast period (2025-2030).

Robust demand is anchored in tighter volatile-organic-compound caps, large-scale infrastructure programs, and accelerating OEM conversions that together steer spending toward low-emission chemistries. The Environmental Protection Agency's January 2027 compliance date extension under the National Aerosol Coatings Rule illustrates the regulatory tightrope producers must walk as they shift portfolios toward greener formulations. Asian construction booms, automotive refinishing upgrades, and bio-based resin breakthroughs further reinforce the long-term trajectory of the waterborne coatings market. Competitive strategies increasingly revolve around supply-secure rheology packages, PFAS-free durability improvements, and digital color platforms, creating fresh avenues for value capture despite raw-material cost volatility.

Global Waterborne Coatings Market Trends and Insights

Stricter VOC and Decarbonization Mandates

California's Air Resources Board restricts industrial-maintenance VOCs to 50 g/L, nearly a ten-fold tightening against federal thresholds, forcing formulators to engineer ultra-low emission blends that still pass adhesion, gloss, and durability tests. Similar tightening unfolds across Canada, where national limits on 130 product classes took effect in January 2024 and extend compliance risk for multinationals with globally harmonized SKUs. In Europe, the updated REACH Restrictions Roadmap targets PVC additives and ortho-phthalates, compressing the adoption window for PFAS-free polyols. As jurisdictions converge on ambitious decarbonization metrics, companies able to harmonize one waterborne specification across continents will lower compliance overhead and speed market entry, leaving laggards boxed into fragmented legacy lines.

Rapid Infrastructure Buildouts in Asia and Africa

China's stimulus-driven industrial revival and India's highway and metro expansions underpin the largest share of incremental liters for the waterborne coatings market. GCC construction pipelines add a climatic angle: quick-drying, low-odor waterborne primers now coat more than 45% of new residential stock in Bahrain and Oman, a share expected to widen as regional contractors chase LEED and Estidama credentials. The Asian Development Bank's 2024 Key Indicators emphasize that USD 1.7 trillion annual infrastructure spending must integrate climate resilience, thrusting waterborne chemistries with minimal indoor-air pollutants to the top of procurement lists. Conference dialogues from Indonesia to Kenya indicate that technical consultants increasingly recommend water-based epoxies for hospitals and schools, confirming an entrenched preference that raises the floor for long-run demand growth.

Scarcity and Price Volatility of Specialty Rheology Additives

Rheology packages, barely 4% by weight yet 13% of raw-material spend, swing overall production margins when supply tightens. Producer consolidation around complex ASE and HASE chemistries magnifies price shocks; a single outage can inflate global quarti-ton costs by double digits. Ribbon polysilicates promise pH-stable flow at lower dosages but need extensive compatibility trials, stretching innovation timelines to one year or more. Interim stock buffers remain the only hedge, locking capital that could fund new research and development.

Other drivers and restraints analyzed in the detailed report include:

- OEM One-Component Conversion from Solvent to Water Systems

- Bio-Based Resin Breakthroughs

- PFAS-Free Performance Gap for Extreme Anticorrosion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic formulations anchored 81.20% of the waterborne coatings market in 2024, reflecting a time-tested blend of UV resistance, color retention, and cost efficiency that builders and DIY consumers favor worldwide. The waterborne coatings market size for acrylic resins is projected to expand steadily, supported by municipal repaint programs and widening do-it-yourself channels.

Polyurethane, though a smaller base, is accelerating at 5.88% CAGR to 2030 as vehicle makers and industrial-maintenance engineers shift to one-component waterborne chemistries that cut booth times and raise chemical resistance. Epoxies retain their foothold in heavy anticorrosive service, though PFAS exit paths demand parallel innovation to sustain barrier metrics. Alkyds, squeezed by VOC levies, find reprieve in bio-sourced variants that swap azelaic acid for petroleum feedstocks, easing regulatory scrutiny while keeping familiar workability.

The Waterborne Coatings Report is Segmented by Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Polyvinylidene Chloride, and More), End-User Industry (Building and Construction, Automotive, Industrial, Wood, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 42.61% of global revenue in 2024 and is on track for a market-leading 6.01% CAGR to 2030, cementing its position as the growth engine for the waterborne coatings market. China's stimulus packages revive industrial output, expanding baseline demand for general-industrial enamels, while India's concrete-intensive smart-city corridors open long-haul orders for elastomeric roof and bridge membranes.

North America reflects regulatory maturity mixed with technology leadership. California's 50 g/L cap forces nationwide SKUs to align at the lowest permissible VOC, rippling through distribution chains and spurring rapid reformulation. Canada's national VOC rulebook harmonizes provincial limits, smoothing market access for compliant waterborne lines from Quebec to British Columbia.

Europe remains a sustainability trend-setter through the Chemicals Strategy for Sustainability, accelerating waterborne adoption across architectural, industrial, and DIY shelves. AkzoNobel's BASF-enabled Dulux Easycare relaunch in the UK advances its pledge to cut product carbon by 5% minimum, strengthening brand pull among eco-conscious shoppers. Eastern-European urbanization also drives incremental liters, especially in municipal road and rail renovations funded by EU recovery programs.

- Akzo Nobel N.V.

- Arkema

- Asian Paints Ltd.

- Axalta Coating Systems, LLC

- BASF

- Benjamin Moore & Co.

- Berger Paints India

- Chokwang Paint

- Dow

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- KCC Corporation

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- Tenaris

- The Sherwin-Williams Company

- Tikkurila

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter VOC and Decarbonization Mandates

- 4.2.2 Rapid Infrastructure Buildouts in Asia and Africa

- 4.2.3 OEM One-Component Conversion from Solvent to Water Systems

- 4.2.4 Bio-Based Resin Breakthroughs (eg, Lignin, Algae)

- 4.2.5 Smart Factory Demand for Low-Temperature Cure Lines

- 4.3 Market Restraints

- 4.3.1 Scarcity and Price Volatility of Specialty Rheology Additives

- 4.3.2 Humidity-Related Drying Defects in Tropical Regions

- 4.3.3 PFAS-Free Performance Gap for Extreme Anticorrosion

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Polyester

- 5.1.6 Polyvinylidene Chloride (PVDC)

- 5.1.7 Polyvinylidene Fluoride (PVDF)

- 5.1.8 Other Resin Types

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Wood

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Southeast Asia

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Arkema

- 6.4.3 Asian Paints Ltd.

- 6.4.4 Axalta Coating Systems, LLC

- 6.4.5 BASF

- 6.4.6 Benjamin Moore & Co.

- 6.4.7 Berger Paints India

- 6.4.8 Chokwang Paint

- 6.4.9 Dow

- 6.4.10 Hempel A/S

- 6.4.11 Jotun

- 6.4.12 Kansai Paint Co., Ltd.

- 6.4.13 KCC Corporation

- 6.4.14 Masco Corporation

- 6.4.15 Nippon Paint Holdings Co., Ltd.

- 6.4.16 PPG Industries, Inc.

- 6.4.17 RPM International Inc.

- 6.4.18 Sika AG

- 6.4.19 Teknos Group

- 6.4.20 Tenaris

- 6.4.21 The Sherwin-Williams Company

- 6.4.22 Tikkurila

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment