|

市场调查报告书

商品编码

1844508

惯性测量单元:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Inertial Measurement Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

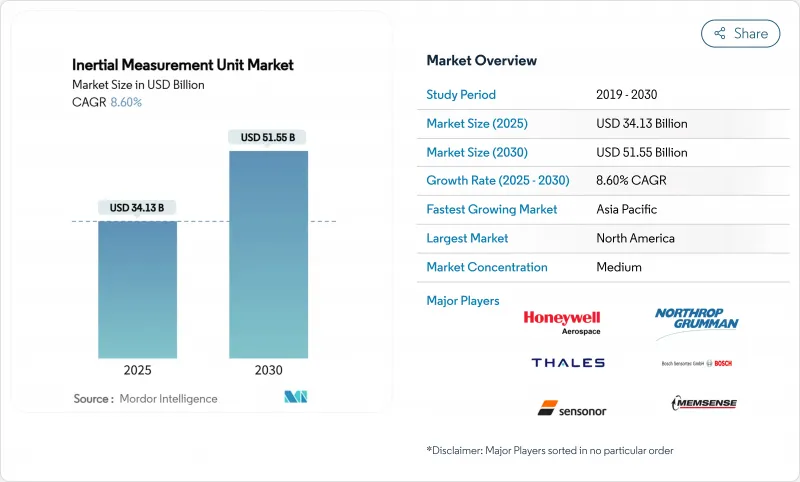

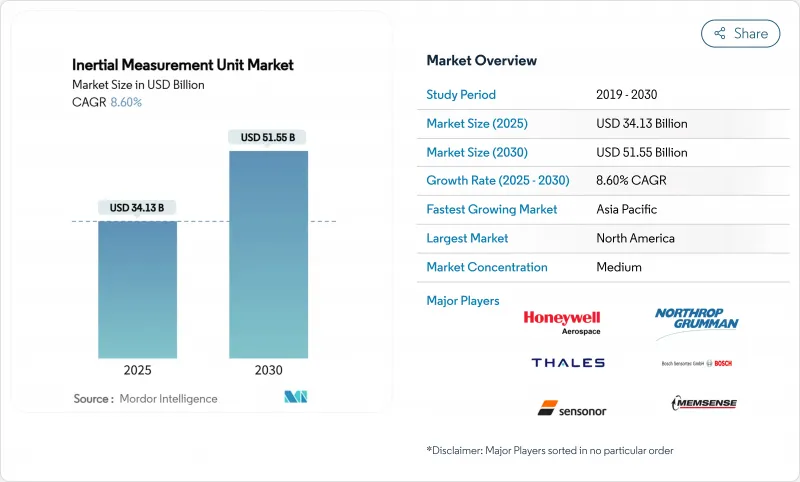

惯性测量单元市场规模预计在 2025 年达到 341.3 亿美元,到 2030 年将达到 515.5 亿美元,复合年增长率为 8.60%。

混合量子 MEMS 感测器融合推动了需求的成长,它正在重塑飞机、航太和自主平台的精确导航。波音公司 2024 年的量子 IMU 飞行测试透过将无辅助 GPS 导航误差从数十公里减少到数十公尺证明了这一转变。地缘政治风险的上升、无人系统的扩散以及量子光电的成熟都加强了惯性测量单元市场的近期成长前景。消费者的吸引力同样强劲。 2025 年第一季,中国智慧眼镜出货量为 494,000 副,年增 116.1%,显示对平衡精度和电池寿命的经济型 6 轴感测器的需求达到创纪录水准。航运、采矿和液化天然气营运商正在添加战术级 MEMS IMU,以满足亚度动态定位公差,从而拓宽了惯性测量单元市场的潜在市场基础。

全球惯性测量单元市场趋势与洞察

中东无人机入侵加速反无人机平台部署

在中东部分地区,低成本无人机的表现优于传统防空系统。北欧防空公司的克鲁格 100 拦截飞弹依靠简化的纯惯性测量单元 (IMU) 飞行计算机,速度可达 270 公里/小时,并降低了集群作战的单位成本。美国选择了 Epirus 微波系统,该系统将灵活的惯性测量单元 (IMU) 与可停用无人机电子设备的软体定义发送器相结合。这些措施标誌着采购方向转向模组化、以软体为中心的武器,这些武器以惯性核心为核心,而非昂贵的雷达或光学导引。随着军队向大规模反无人机系统 (CMAS) 理论过渡,提供可扩展 IMU 模组和开放 API 的供应商将从中受益。

欧洲液化天然气油轮越来越多地采用 MEMS 战术级 IMU 实现动态定位

欧洲液化天然气运输商面临严峻的港口排队和大西洋的猛烈海浪。 Bourbon 的船舶现已配备基于光纤陀螺仪的 Exail Octans AHRS,以便在起重机操作期间保持横摇、纵摇和升沈的对准。 MEMS 设计也在船舶改装应用中取代了环形雷射陀螺仪,以亚度级的精度和一半的购买价格。 Advanced Navigation 的 Hydrus AUV 将海底勘测成本降低了 75%,并消除了团队潜水任务的需求。这些成本的节省正在推动整个船队的感测器升级,并扩大商用船舶惯性测量单元的市场。

不到 7 年的设计週期限制了民航机供应商的转换

认证风险迫使飞机製造商采取保守做法。波音公司对其量子惯性测量单元 (IMU) 进行了四小时的飞行测试,但必须完成数年的认证才能将其用于Line-Fit。Honeywell在火星探勘上飞行的小型IMU凸显了航太买家更青睐经过验证、能够持续数十年可靠性的设计。漫长的检验时间会锁定现有供应商,并减缓单位成本的下降,这限制了商用航空惯性测量单元 (IMU) 市场的成长率。

細項分析

到2024年,陀螺仪将占惯性测量单元市场收入的40%,并将继续成为实现死点追踪精度的基础。磁力计虽然绝对值较小,但随着扩增实境开发者将数位罗盘整合到所有头戴装置中,其复合年增长率高达10.9%。加速计在振动和ADAS领域保持稳定的市场规模。惯性测量单元市场目前倾向于单封装感测器融合。意法半导体的LSM6DSV16X增加了一个用于手势识别的机器学习核心,同时降低了待机功耗并延长了电池寿命。儘管面临商品化压力,提供片上分析功能的组件供应商仍可获得溢价。

加速计正在将陀螺仪、加速计和磁力计资料整合到安全隔离区微控制器中。整合时序消除了感测器之间的延迟,增强了系统抵御伪造讯号的能力。随着设计团队采用这些模组,物料清单 (BOM) 的简洁性(而非物料成本)正成为主要的选择因素。儘管出货量不断增长,但这种转变仍支持惯性测量单元市场价格的稳定性。

在智慧型手机和自动驾驶ADAS规模的推动下,商用级设备将在2024年占据惯性测量单元市场的35%。航太级设备的出货量虽然规模较小,但预计在低地球轨道(LEO)卫星群的普及推动下,复合年增长率将达到12.4%。诺斯罗普·格鲁曼公司的LR-450采用毫米级半球谐振陀螺仪,该陀螺仪已在轨运行超过7000万小时,无故障运行时间比环形雷射器减少了一半,体积、重量和功率也减少了一半。其可靠性吸引了那些需要发射数百颗相同卫星的卫星群营运商。

随着商用MEMS精度的提升,等级界限正在变得模糊。汽车零件製造商如今要求战术级零偏稳定性,而无人机製造商则采购航太级零件以增强辐射抗扰度。拥有灵活生产线、能够从商用扩展到国防应用的供应商在经济低迷时期更具韧性,并在惯性测量单元市场中占据更大的份额。

区域分析

2024年,北美占据惯性测量单元市场收益的38%。美国国防预算资助海军研究实验室的量子干涉测量研究,以延长无漂移导航的运行时间。波音公司的量子IMU飞行检验了民航机的使用案例,使本土原始设备製造商能够超越欧洲竞争对手。 2024年的出口管制改革放宽了对澳洲、加拿大和英国的转让,使北美供应商能够优先参与盟军的航太计画。

到2030年,亚太地区的复合年增长率将达到11.8%,位居榜首。在国内补贴的推动下,中国智慧玻璃製造商每季订购数千万个六轴MEMS感测器。澳洲的偏远矿场成为光子惯性测量单元(IMU)的运作平台,鼓励当地大学衍生出导航新创公司。印度、日本和韩国的新型太空船发射新兴企业正在寻求不受《国际武器贸易条例》(ITAR)约束的航太零件,培育本土供应链,以在成本敏感型任务领域挑战美国现有企业。

欧洲在海事、能源和高精度卫星有效载荷领域占据战略优势。欧空局的GENESIS卫星使用冷原子惯性测量单元(IMU)进行厘米级海面监测。 Exile公司赢得了「波旁号」(Bourbon)船舶的光纤陀螺仪动态定位升级合同,体现了该地区在恶劣水域感测器封装方面的专业技术。Honeywell于2024年斥资2亿欧元收购Civitanavi,增强了其欧洲生产基地,确保其飞机项目在跨大西洋贸易紧张局势下的连续性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 中东无人机坠毁事件加速反无人机系统平台部署

- 欧洲液化天然气运输船越来越多地采用基于 MEMS 的战术级 IMU 进行动态定位

- 将冷原子IMU整合到ESA卫星星系中

- 扩展澳洲自动采矿车辆的光子 IMU

- 美国第二代战斗机改装需求激增

- 亚洲XR耳机竞争推动家用电子电器产品IMU订单激增

- 市场限制

- 七年以上的设计週期限制了民航机供应商的更换

- 《国际武器贸易条例》限制美国向亚太地区新兴航太企业出口航太级惯性测量单元

- 在远距海上航线上,MEMS 阵列的累积偏压漂移超过每小时 +-0.3°

- 耐辐射 ASIC 短缺导致 LEO 卫星 IMU 的 BOM 成本上升

- 价值/供应链分析

- 监管和技术展望

- 技术简介 - MEMS、FOG、RLG、HRG、冷原子、光子学

- 标准化蓝图(SAE、RTCA/DO-334、NATO STANAG 4671)

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章市场规模及成长预测

- 按组件

- 陀螺仪

- 加速计

- 磁力仪

- 按年级

- 海洋级

- 导航等级

- 战术级

- 太空级

- 商业级

- 依技术

- MEMS

- 光纤陀螺仪(FOG)

- 环形雷射陀螺仪(RLG)

- 半球谐振陀螺仪(HRG)

- 机械陀螺仪

- 按最终用户

- 航太/国防

- 汽车(ADAS 和自动驾驶)

- 工业自动化与机器人

- 消费性电子产品和XR

- 海洋/近海

- 能源(石油和天然气、风力发电机)

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Honeywell International Inc.

- Northrop Grumman Corp.

- Bosch Sensortec GmbH

- Analog Devices Inc.

- Safran Sensing Technologies

- Thales Group

- STMicroelectronics NV

- ACEINNA Inc.

- Sensonor AS

- Silicon Sensing Systems Ltd.

- KVH Industries Inc.

- Xsens Technologies BV

- VectorNav Technologies LLC

- SBG Systems SAS

- Gladiator Technologies

- Trimble Inc.

- Moog Inc.

- EMCORE Corp.

- TDK-InvenSense

- Murata Manufacturing Co. Ltd.

- Continental AG

- Raytheon Technologies Corp.

第七章 市场机会与未来展望

The inertial measurement unit market size stood at USD 34.13 billion in 2025 and is forecast to reach USD 51.55 billion by 2030, reflecting an 8.60% CAGR.

Demand gains stem from hybrid quantum-MEMS sensor fusion, which is reshaping precision navigation for defines, aerospace, and autonomous platforms. Boeing validated this shift when its 2024 flight test of a quantum IMU cut unaided-GPS navigation error from tens of kilometres to tens of meters. Escalating geopolitical risk, the spread of unmanned systems, and the maturity of quantum photonics all reinforce the near-term growth outlook for the inertial measurement unit market. Consumer pull is equally strong. China shipped 494,000 smart-glass units in Q1 2025, up 116.1% year over year, signalling record demand for low-cost six-axis sensors that balance accuracy and battery life. Maritime, mining, and LNG operators are adding tactical-grade MEMS IMUs to meet sub-degree dynamic-positioning tolerances, widening the addressable base for the inertial measurement unit market.

Global Inertial Measurement Unit Market Trends and Insights

Accelerated deployment of counter-UAS platforms amid Middle East drone incursions

Low-cost drones now outnumber legacy air defenses across several Middle East theatres. Nordic Air Defence's Kreuger 100 interceptor relies on a simplified IMU-only flight computer, reaches 270 km/h, and cuts unit costs for swarm engagements. The U.S. Marine Corps selected Epirus microwave systems that couple agile IMUs with software-defined emitters to disable drone electronics. These moves signal a procurement pivot toward modular, software-centric weapons built around inertial cores rather than expensive radar or optical guidance. Suppliers that offer scalable IMU modules and open APIs stand to gain as militaries transition to volume-deployment counter-UAS doctrine.

Rising adoption of MEMS tactical-grade IMUs in European LNG tankers for dynamic positioning

European LNG shippers face tighter port queues and harsher Atlantic swells. Bourbon vessels now carry Exail Octans AHRS, based on fiber-optic gyros, to maintain roll, pitch, and heave integrity during crane operations. MEMS designs are also displacing ring-laser gyros on retrofit jobs because they slash purchase price by half while meeting sub-degree accuracy. Advanced Navigation's Hydrus AUV lowered subsea survey costs 75% and removed the need for team-based diving missions. Such savings encourage fleet-wide sensor upgrades, expanding the inertial measurement unit market across commercial shipping.

Design-in cycles less than 7 years limiting supplier switch-over in commercial aircraft

Certification risk makes air-framers conservative. Boeing flight-tested quantum IMUs for four hours but must still complete multi-year qualification before line-fit adoption. Honeywell's miniature IMU that flew on Mars probes underscores how aerospace buyers favour proven designs that demonstrate multi-decade reliability. Lengthy validation locks in incumbent vendors and slows unit-price erosion, tempering the inertial measurement unit market growth rate in commercial aviation.

Other drivers and restraints analyzed in the detailed report include:

- Integration of cold-atom IMUs in ESA small-satellite constellations

- Expansion of photonic IMUs for autonomous mining vehicles in Australia

- ITAR restrictions curtailing U.S. space-grade IMU exports to APAC new-space players

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gyroscopes contributed 40% of inertial measurement unit market revenue in 2024 and remain foundational for dead-reckoning accuracy. Magnetometers, though smaller in absolute value, compound at 10.9% CAGR as augmented-reality developers embed digital compasses inside every headset. Accelerometers maintain consistent volume in vibration and ADAS roles. The inertial measurement unit market now leans toward single-package sensor fusion. STMicroelectronics' LSM6DSV16X adds a machine-learning core that recognizes gestures while lowering standby power to extend battery life. Component vendors that offer on-chip analytics can charge premiums despite commoditization pressure.

Emerging packages combine gyro, accelerometer, and magnetometer data inside secure enclave micro-controllers. Integrated timing eliminates inter-sensor latency and hardens systems against spoof signals. As design teams adopt these modules, bill-of-materials simplicity overtakes raw component cost as the main selection factor. That transition supports steady pricing in the inertial measurement unit market despite rising shipment volumes.

Commercial-grade devices captured 35% of inertial measurement unit market size in 2024 thanks to smartphone and auto-ADAS scale. Space-grade shipments, though smaller, are projected to climb 12.4% CAGR on the back of proliferated low-Earth-orbit (LEO) constellations. Northrop Grumman's LR-450 uses milli-HRG gyros that log more than 70 million fault-free hours in orbit while halving size, weight, and power over ring-laser counterparts. That reliability attracts constellation operators who must launch hundreds of identical satellites.

Grade boundaries blur as commercial MEMS precision improves. Automotive suppliers now request tactical-grade bias stability, while drone makers procure space-qualified parts for radiation robustness. Vendors that master flexible production lines able to pivot from consumer to defense volumes gain resilience during sector downturns, reinforcing their share within the inertial measurement unit market.

Inertial Measurement Unit Market Report is Segmented by Component (Gyroscopes, Accelerometers, and More), Grade (Marine, Navigation and More), Technology (MEMS, FOG, and More), End User (Aerospace & Defense, Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38% of inertial measurement unit market revenue in 2024. U.S. defense budgets fund quantum interferometer research at the Naval Research Laboratory, extending navigation run-time without drift. Boeing's quantum-IMU flight validated commercial-aviation use cases and keeps local OEMs ahead of European rivals. Export-control reforms in 2024 eased transfers to Australia, Canada, and the United Kingdom, giving North American vendors privileged access to allied aerospace programs.

Asia-Pacific posts the strongest 11.8% CAGR through 2030. Chinese smart-glass makers, buoyed by domestic subsidies, order tens of millions of six-axis MEMS sensors each quarter. Australia's remote mines serve as live testbeds for photonic IMU trucks, encouraging regional universities to spin out navigation start-ups. New-space launch firms across India, Japan, and South Korea seek ITAR-free space-grade parts, fostering indigenous supply chains that challenge U.S. incumbents in cost-sensitive missions.

Europe retains strategic niches in marine, energy, and high-precision satellite payloads. The ESA GENESIS satellite will use cold-atom IMUs to underpin centimeter-level sea-level monitoring. Exail won Bourbon vessel contracts for fiber-optic gyro dynamic-positioning upgrades, reflecting regional expertise in harsh-sea sensor packaging. Honeywell's EUR 200 million purchase of Civitanavi in 2024 gives the firm a deep European production base, ensuring continuity for aircraft programs even amid trans-Atlantic trade frictions.

- Honeywell International Inc.

- Northrop Grumman Corp.

- Bosch Sensortec GmbH

- Analog Devices Inc.

- Safran Sensing Technologies

- Thales Group

- STMicroelectronics N.V.

- ACEINNA Inc.

- Sensonor AS

- Silicon Sensing Systems Ltd.

- KVH Industries Inc.

- Xsens Technologies B.V.

- VectorNav Technologies LLC

- SBG Systems SAS

- Gladiator Technologies

- Trimble Inc.

- Moog Inc.

- EMCORE Corp.

- TDK-InvenSense

- Murata Manufacturing Co. Ltd.

- Continental AG

- Raytheon Technologies Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Deployment of Counter-UAS Platforms amid Middle-East Drone Incursions

- 4.2.2 Rising Adoption of MEMS-based Tactical-Grade IMUs in European LNG Tankers for Dynamic Positioning

- 4.2.3 Integration of Cold-Atom IMUs in ESA Small-Satellite Constellations

- 4.2.4 Expansion of Photonic IMUs for Autonomous Mining Vehicles in Australia

- 4.2.5 Demand Spike for Retrofit Navigation Upgrades in U.S. Gen-II Fighter Fleet

- 4.2.6 High-volume Consumer-Electronics IMU Orders Driven by Asia's XR Headset Race

- 4.3 Market Restraints

- 4.3.1 Design-in Cycles >7 Years Limiting Supplier Switch-Over in Commercial Aircraft

- 4.3.2 ITAR Restrictions Curtailing U.S. Space-grade IMU Exports to APAC New-Space Players

- 4.3.3 Cumulative Bias Drift in MEMS Arrays Exceeding +-0.3°/hr for Long-haul Maritime Routes

- 4.3.4 Scarcity of Radiation-Hardened ASICs Raising BOM Costs in LEO Satellite IMUs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Technology Snapshot - MEMS, FOG, RLG, HRG, Cold-Atom, Photonic

- 4.5.2 Standardization Roadmap (SAE, RTCA/DO-334, NATO STANAG 4671)

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Gyroscopes

- 5.1.2 Accelerometers

- 5.1.3 Magnetometers

- 5.2 By Grade

- 5.2.1 Marine Grade

- 5.2.2 Navigation Grade

- 5.2.3 Tactical Grade

- 5.2.4 Space Grade

- 5.2.5 Commercial Grade

- 5.3 By Technology

- 5.3.1 MEMS

- 5.3.2 Fiber-Optic Gyro (FOG)

- 5.3.3 Ring-Laser Gyro (RLG)

- 5.3.4 Hemispherical Resonator Gyro (HRG)

- 5.3.5 Mechanical Gyro

- 5.4 By End User

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive (ADAS and Autonomous)

- 5.4.3 Industrial Automation and Robotics

- 5.4.4 Consumer Electronics and XR

- 5.4.5 Marine and Offshore

- 5.4.6 Energy (Oil and Gas, Wind Turbines)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Northrop Grumman Corp.

- 6.4.3 Bosch Sensortec GmbH

- 6.4.4 Analog Devices Inc.

- 6.4.5 Safran Sensing Technologies

- 6.4.6 Thales Group

- 6.4.7 STMicroelectronics N.V.

- 6.4.8 ACEINNA Inc.

- 6.4.9 Sensonor AS

- 6.4.10 Silicon Sensing Systems Ltd.

- 6.4.11 KVH Industries Inc.

- 6.4.12 Xsens Technologies B.V.

- 6.4.13 VectorNav Technologies LLC

- 6.4.14 SBG Systems SAS

- 6.4.15 Gladiator Technologies

- 6.4.16 Trimble Inc.

- 6.4.17 Moog Inc.

- 6.4.18 EMCORE Corp.

- 6.4.19 TDK-InvenSense

- 6.4.20 Murata Manufacturing Co. Ltd.

- 6.4.21 Continental AG

- 6.4.22 Raytheon Technologies Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment