|

市场调查报告书

商品编码

1844516

汽车夜视系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Night Vision System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

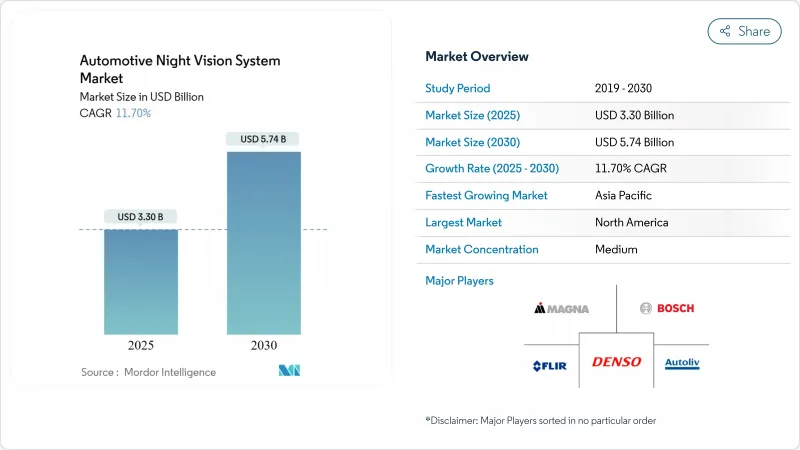

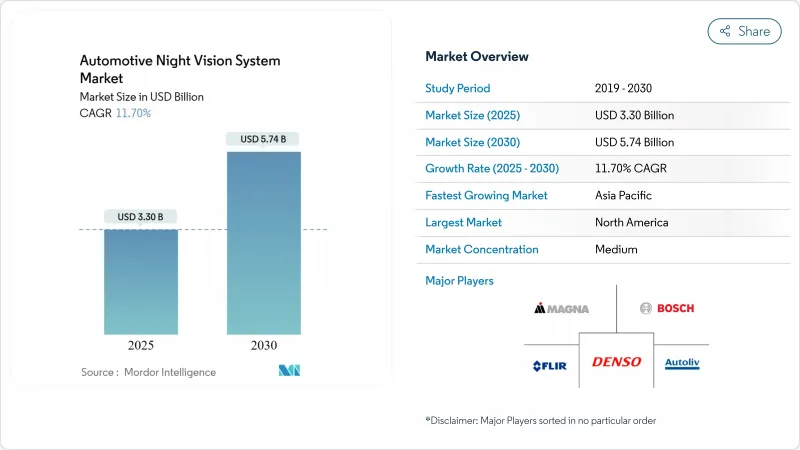

预计到 2025 年汽车夜视系统市场规模将达到 33 亿美元,到 2030 年将达到 57.4 亿美元,复合年增长率为 11.70%。

美国和欧盟强制推行行人保护规则、高端电池电动车产品组合的扩展以及热感成像组件成本的稳定下降都支持了这一前景。例如,美国国家公路交通安全管理局的联邦机动车安全标准 127 要求在 2029 年 9 月之前安装行人用自动紧急煞车系统。汽车製造商正在将热感感测器纳入其 ADAS(高级驾驶辅助系统)堆迭中,而供应商则透过利用晶圆级光学元件来减轻价格压力。随着传统的一级供应商与红外线专家合作以保护仪表板免受破坏性参与企业的侵害,竞争正在加剧。在预测期内,汽车夜视系统市场预计将从高端差异化因素转变为广泛采用的合规功能,尤其是在北美、欧洲和中国的高端平台。

全球汽车夜视系统市场趋势与洞察

美国FMVSS 111 和欧盟 GSR 2029 中的 ADAS 要求

美国联邦机动车安全标准 (FMVSS) 127 和欧盟通用安全法规 (GSR) 2029 之间的监管融合同步了合规期限,从根本上改变了汽车夜视应用的经济性。 NHTSA 要求在 2029 年 9 月之前安装行人用自动紧急煞车系统,这暴露了巨大的性能差距。在 Teledyne FLIR 和 VSI Labs 的测试中,热熔 PAEB 系统通过了所有夜间场景,而三款主要的 2024 年车型未通过多项测试。 2022 年夜间发生的 77.7% 的行人死亡事故是出于安全原因。欧盟的平行时间表确保全球汽车製造商无法在地化其方法,从而创造规模经济,加速整个热热感链的成本降低。小批量製造商将获得一年的延期至 2030 年 9 月,这可能会形成一个层级构造市场动态,有利于拥有现有热成像能力的现有製造商。

高端市场向纯电动车和豪华内燃机车型的渗透

豪华电动车如今纷纷采用热感像仪,以证明其溢价合理,并使其与传统竞争对手区分开来。梅赛德斯-奔驰的夜视辅助系统 (Night View Assist Plus) 可识别 160 公尺外的行人和野生动物,并投射聚光灯光束,且不会使对面车辆眩目。 BMW的远红外线解决方案可达 300 米,且无需外部照明即可保持有效。 Audi A6 和 Q7 等高阶内燃机车型均以 2,500 美元的选配配置提供此方案。高端买家接受高于 2,300 至 2,500 美元阈值的设备清单,这为供应链学习曲线提供了所需的种子量,并为批量细分市场中成本优化的内饰铺平了道路。

非製冷长波红外线模组与平视显示器集成,ASP 较高

与摄影机和雷达单元相比,热感核心和相关光学元件仍然价格昂贵。整合式抬头投影会增加更多成本,因为每个显示器都需要一个光学组合器并进行复杂的校准。 OEM 成本工程团队必须在全长波红外线覆盖和承诺以更少组件实现合规性的雷达-摄影机融合方案之间做出选择。新兴的无百叶窗演算法和晶圆级製造技术可以缓解压力,但在过渡期内,主流市场仍将对价格敏感。

細項分析

LWIR 解决方案占据全球汽车夜视系统市场的 63.24%。其强大的热对比度使其能够在前照灯光束之外实现可靠的行人识别,这也是其在监管测试週期中持续受欢迎的原因。随着晶圆级光电二极体突破 100 美元/个的门槛,SWIR 感测器正以 16.20% 的高复合年增长率扩张。摄影机工厂熟悉的半导体工艺提供了极具吸引力的成本曲线,而 SWIR 能够穿透雪雾和轻雾,使其在高速公路自动驾驶中具有吸引力。虽然 LWIR 在汽车夜视系统中的市场份额预计将逐渐下降,但它仍然是合规认证的标准。主动近红外线 (NIR) 感测器与不显眼的 LED发送器相结合,可在 600 英尺的范围内提供单色影像,填补了中间范围。

研发流程持续拓展频谱范围。阿尔託大学推出了锗光电二极体,其在1.55µm波长下的响应度提高了35%,非常适合汽车短波红外线(SWIR)波段。另一方面,量子点检测器的侦测率已达到18µm,为感测器设计人员展示了未来的可能性。未来五年,融合长波红外线(LWIR)和短波红外线(SWIR)并采用通用逻辑的双波段阵列有望成为高端封装的主流,在确保冗余的同时降低总体拥有成本。

抬头显示器将扩大汽车夜视系统的市场规模,2024年将占据43.68%的市场。驾驶员优先考虑保持前方视野并减少注视时间。儘管如此,由于汽车製造商已将12英寸及更大的触控萤幕用于导航和串流媒体播放,中控台显示器的预算正在增加。基于资讯娱乐的资讯流复合年增长率为18.40%,预计在2020年结束时超过HUD的安装量。因此,预计到2030年,汽车夜视系统的HUD模组市场份额将降至30%左右。

未来的驾驶座将增强扩增扩增实境迭加功能。大陆集团、博世和哈曼已预览了显示控制器,这些控制器透过彩色边框凸显温暖的车身轮廓。在低配车型上,仪錶板显示器或分割画面Widgets可能就足够了。由于投射到挡风玻璃上的数据需要严格的光学对准,因此在组件价格下降之前,一些量产车型将绕过HUD架构。双模式策略使高阶品牌能够将HUD作为主要功能,而中阶品牌则可以重复使用中央面板,以保持其整个产品线的功能一致性。

区域分析

到2024年,北美将占据汽车夜视系统市场的41.73%。清晰的监管是其关键优势。美国国家公路交通安全管理局(NHTSA)规定,行人用在2029年9月前在黑暗环境下运行,这迫使汽车製造商必须立即巩固其采购蓝图。 Teledyne FLIR和L3Harris等美国本土供应商提供成熟的热感成像核心,确保其附加价值在本土市场得以保留。 Teledyne FLIR正在与VSI Labs合作进行FMVSS No. 127合规性测试,这将使北美供应商在拓展全球市场方面占据有利地位。

预计亚太地区的复合年增长率将达到14.60%。中国在扩大自主品牌L2+高级驾驶辅助系统(ADAS)规模方面处于领先地位。广汽、蔚来和比亚迪正在整合人工智慧影像校正技术,将标准CMOS感测器提升至拟热输出,而真正的长波红外线(LWIR)主导正在旗舰车型中加速普及。为了减轻出口限制的影响,硫系透镜和低成本晶圆的在地化生产正在推进中。在日本和韩国,丰田、Lexus、现代和捷恩斯等品牌正在将夜视功能与环景显示摄影机套件相结合,以推动高端市场的渗透。

欧洲在其自身製定的《通用安全法规2029》的基础上呈现均衡成长。德国製造商在21世纪初率先部署,目前正致力于改进感测器融合技术,以实现有条件自动驾驶。法雷奥与Teledyne FLIR签订的供应协议涵盖符合ASIL B标准的量产热感像仪。法国Lynred公司正投资8,500万欧元,将其无尘室规模增加一倍,确保检测器能力能抵御地缘政治衝击。由于冬季夜间时间延长,斯堪地那维亚市场的吸收量高于平均水平,而南欧市场的销售量则依赖优质进口产品。儘管该地区的市场份额落后于北美,但法规的同步实施和供应商的投资预计将带来稳健的成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 美国FMVSS 111 和欧盟 GSR 2029 中的 ADAS 要求

- 纯电动车和豪华内燃机车型向高端市场的渗透

- 利用晶圆级光学元件和专用人工智慧解决方案降低成本

- 热成像和可见光感测器融合,实现夜间 L3 自动驾驶

- 配备红外线的车辆的保险远端资讯处理折扣

- 军用长波红外线感测器进入民用供应链

- 市场限制

- 非製冷长波红外线模组与平视显示器集成,ASP 较高

- 美国ITAR/Wassenaar 对 9Hz 以上热感磁芯的出口限制

- 消费者资料隐私遭抵制,机上热成像技术面临挑战

- 非製冷检测器中 MEMS百叶窗的可靠性漂移

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 依技术类型

- 远红外线(LWIR,非製冷)

- 近红外线(NIR)

- 短波红外线(SWIR)

- 按显示类型

- 导航系统

- 仪錶群

- 抬头显示器(HUD)

- 中央资讯娱乐/IVI萤幕

- 依组件类型

- 夜视摄影机(热感、近红外线)

- 控制/处理单元

- 显示模组

- 红外线照明光源(LED/VCSEL)

- 感测器和其他组件

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 按销售管道

- OEM工厂安装

- 售后市场改造

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Magna International Inc.

- DENSO Corporation

- Robert Bosch GmbH

- Valeo SA

- Autoliv Inc.

- FLIR Systems Inc.

- L3Harris Technologies Inc.

- Aptiv PLC

- Hella KGaA Hueck and Co.

- Visteon Corporation

- Aisin Corporation

- Raytheon Technologies

- Continental AG

- Mobileye Global Inc.

- Renesas Electronics Corp.

- Veoneer AB

- OmniVision Technologies

- Teledyne Technologies Inc.

- Nidec-ELV Automotive Vision

- Pioneer Corporation

第七章 市场机会与未来展望

The automotive night vision systems market is valued at USD 3.30 billion in 2025 and is projected to reach USD 5.74 billion by 2030, registering an 11.70% CAGR.

Mandatory pedestrian-protection rules in the United States and the European Union, expanding premium battery-electric portfolios, and steady cost reductions in thermal imaging components underpin this outlook. For instance, the National Highway Traffic Safety Administration's Federal Motor Vehicle Safety Standard No. 127, requires pedestrian automatic emergency braking systems by September 2029. Automakers respond by embedding thermal sensors into advanced driver assistance systems (ADAS) stacks, while suppliers exploit wafer-level optics to ease price pressures. Competitive momentum intensifies as traditional Tier-1 suppliers ally with infrared specialists to defend dashboards from disruptive entrants. Over the forecast window, the automotive night vision systems market is set to move from a luxury differentiator to a broadly adopted compliance feature, especially in North America, Europe, and high-tier Chinese platforms.

Global Automotive Night Vision System Market Trends and Insights

ADAS Mandates in US-FMVSS 111 and EU GSR 2029

Regulatory convergence between US Federal Motor Vehicle Safety Standard No. 127 and EU General Safety Regulation 2029 creates a synchronized compliance deadline that fundamentally reshapes automotive night vision adoption economics. The NHTSA mandate requiring pedestrian automatic emergency braking systems by September 2029 exposes a critical performance gap, as testing by Teledyne FLIR and VSI Labs demonstrated that thermal-fused PAEB systems passed all nighttime scenarios while three major 2024 vehicle models failed multiple tests. This regulatory pressure transforms night vision from luxury feature to compliance necessity, with 77.7% of pedestrian fatalities occurring at night in 2022 providing the safety justification. The EU's parallel timeline ensures global automakers cannot regionalize their approach, creating economies of scale that accelerate cost reduction across thermal imaging supply chains. Small-volume manufacturers receive a one-year extension until September 2030, creating a two-tier market dynamic that may advantage established players with existing thermal sensing capabilities.

Premium-segment Penetration in BEVs and Luxury ICE Models

High-end EVs now integrate thermal cameras to justify price premiums and differentiate against conventional rivals. Mercedes-Benz Night View Assist Plus identifies pedestrians and wildlife up to 160 m ahead and applies a spotlight beam without dazzling on-coming traffic. BMW's far-infrared solution reaches 300 m and remains effective without external illumination. Luxury ICE models such as the Audi A6 and Q7 mirror this practice, each offering a USD 2,500 option. Because premium buyers accept equipment lists that push the USD 2,300-2,500 threshold, they provide the seed volumes necessary for supply-chain learning curves, thereby paving the way for cost-optimized trims in volume segments.

High ASP of Uncooled LWIR Modules and HUD Integration

Thermal cores and associated optics remain expensive relative to camera and radar units. Integrating head-up projections adds further expense because each display demands optical combiners and elaborate calibration. OEM cost-engineering teams must choose between full LWIR coverage or radar-camera fusion pathways that promise compliance at lower bill-of-material counts. Emerging shutter-free algorithms and wafer-level manufacturing can relieve pressure, but the transition period keeps mainstream segments price-sensitive

Other drivers and restraints analyzed in the detailed report include:

- Cost Downshift via Wafer-Level Optics and AI-Only Solutions

- Thermal/visible Sensor Fusion Enabling L3 Autonomy at Night

- US ITAR / Wassenaar Export Controls on More Than 9 Hz Thermal Cores

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The automotive night vision systems for LWIR solutions contributed 63.24% of the global value. Strong thermal contrast enables reliable pedestrian recognition beyond headlight beams, explaining sustained uptake in regulatory test cycles. SWIR sensors are scaling at a high CAGR of 16.20% as wafer-level photodiodes have crossed the USD 100-per-unit threshold. Semiconductor processes familiar to camera fabs supply attractive cost curves, and SWIR's ability to see through snow spray and light fog is compelling for autonomous highway duty. The automotive night vision systems market share held by LWIR is expected to erode gradually, though it remains the benchmark for compliance certification. Active Near-Infrared occupies a middle path, supplying monochrome imagery at 600 ft ranges when paired with discreet LED emitters.

R&D pipelines continue to broaden spectral reach. Aalto University delivered germanium photodiodes with 35% higher responsivity at 1.55 µm, ideal for SWIR automotive bands. At the extreme, quantum-dot detectors have logged detectivity up to 18 µm wavelengths, demonstrating the future ceiling for sensor designers. For the next five years, dual-band arrays that blend LWIR and SWIR on common logic will likely headline premium packages, assuring redundancy while tempering total cost of ownership.

Head-up displays secured 43.68% of the market share in 2024, contributing to the market size of automotive night vision systems. Drivers value forward-view retention and reduced glance time. Even so, center-stack displays capture budget placements because automakers already embed 12-inch or larger touchscreens for navigation and streaming. A CAGR of 18.40% sets infotainment-based feeds on course to meet HUD installations by the decade's end. Therefore, the automotive night vision systems market share of HUD modules is forecast to slip to the mid-30% band by 2030.

Future cockpits will reinforce augmented-reality overlays. Continental, Bosch, and HARMAN previewed display controllers that highlight warm-body silhouettes in color-coded boundaries. In lower trims, instrument-cluster views or split-screen widgets may suffice. Because windshield-projected data demands stringent optical alignment, some mass-volume badges bypass HUD architecture until component prices fall. Dual-mode strategies allow premium marques to sustain HUD as a headline feature while mid-range nameplates repurpose center panels, preserving functional consistency across line-ups.

The Automotive Night Vision System Market Report is Segmented by Technology Type (Far Infrared, Near Infrared, and Short-Wave Infrared), Display Type (Navigation System, Instrument Cluster, and More), Component Type (Night Vision Cameras and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM Factory-Fit and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 41.73% of the 2024 automotive night vision systems market turnover. Legislative clarity is the decisive edge. The NHTSA stipulation that pedestrian AEB operate in darkness by September 2029 forces automakers to lock in sourcing roadmaps now. Domestic suppliers such as Teledyne FLIR and L3Harris furnish mature thermal cores, keeping value added onshore. Premium-SUV demand in the United States compounds volume, while Canadian assembly plants mirror U.S. specifications thanks to shared vehicle architectures.Teledyne FLIR's collaboration with VSI Labs in FMVSS No. 127 compliance testing positions North American suppliers advantageously for global market expansion.

Asia-Pacific is projected to record a 14.60% CAGR. China leads the regional charge as it scales level-2+ ADAS for domestic brands. GAC, NIO, and BYD incorporate AI-powered image enhancement that elevates standard CMOS sensors toward pseudo-thermal output, yet true LWIR adoption is accelerating in flagship trims. Local fabrication of chalcogenide lenses and low-cost wafers is underway to reduce exposure to export controls. Japan and South Korea add premium penetration via Toyota, Lexus, Hyundai, and Genesis nameplates, each pairing night vision with surround-view camera suites.

Europe exhibits balanced growth built on its own General Safety Regulation 2029. German marques led with early-2000s deployment and now refine sensor fusion for conditional autonomy. Valeo's supply agreement with Teledyne FLIR covers series production thermal cameras that meet ASIL B objectives. France's Lynred is doubling clean-room area under an EUR 85 million program to secure detector capacity against geopolitical shocks. Scandinavian markets display above-average uptake because of prolonged winter darkness, while southern European volume hinges on upscale imports. Although the region trails North America in share, synchronous regulation and supplier investments lock in dependable growth.

- Magna International Inc.

- DENSO Corporation

- Robert Bosch GmbH

- Valeo SA

- Autoliv Inc.

- FLIR Systems Inc.

- L3Harris Technologies Inc.

- Aptiv PLC

- Hella KGaA Hueck and Co.

- Visteon Corporation

- Aisin Corporation

- Raytheon Technologies

- Continental AG

- Mobileye Global Inc.

- Renesas Electronics Corp.

- Veoneer AB

- OmniVision Technologies

- Teledyne Technologies Inc.

- Nidec-ELV Automotive Vision

- Pioneer Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 ADAS mandates in US-FMVSS 111 and EU GSR 2029

- 4.2.2 Premium-segment penetration in BEVs and luxury ICE models

- 4.2.3 Cost downshift via wafer-level optics and AI-only solutions

- 4.2.4 Thermal/visible sensor fusion enabling L3 autonomy at night

- 4.2.5 Insurance telematics discounts for infrared-equipped fleets

- 4.2.6 Military-grade LWIR sensors entering civilian supply chains

- 4.3 Market Restraints

- 4.3.1 High ASP of uncooled LWIR modules and HUD integration

- 4.3.2 US ITAR/Wassenaar export controls on more than 9 Hz thermal cores

- 4.3.3 Consumer data-privacy pushback on cabin IR imaging

- 4.3.4 Reliability drift of MEMS shutters in uncooled detectors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Technology Type

- 5.1.1 Far Infrared (LWIR, uncooled)

- 5.1.2 Near Infrared (NIR)

- 5.1.3 Short-Wave Infrared (SWIR)

- 5.2 By Display Type

- 5.2.1 Navigation System

- 5.2.2 Instrument Cluster

- 5.2.3 Head-Up Display (HUD)

- 5.2.4 Central Infotainment/IVI Screen

- 5.3 By Component Type

- 5.3.1 Night Vision Cameras (Thermal, NIR)

- 5.3.2 Control/Processing Units

- 5.3.3 Display Modules

- 5.3.4 IR Illumination Sources (LED/VCSEL)

- 5.3.5 Sensors and Other Components

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Medium and Heavy Commercial Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM Factory-fit

- 5.5.2 Aftermarket Retrofit

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Magna International Inc.

- 6.4.2 DENSO Corporation

- 6.4.3 Robert Bosch GmbH

- 6.4.4 Valeo SA

- 6.4.5 Autoliv Inc.

- 6.4.6 FLIR Systems Inc.

- 6.4.7 L3Harris Technologies Inc.

- 6.4.8 Aptiv PLC

- 6.4.9 Hella KGaA Hueck and Co.

- 6.4.10 Visteon Corporation

- 6.4.11 Aisin Corporation

- 6.4.12 Raytheon Technologies

- 6.4.13 Continental AG

- 6.4.14 Mobileye Global Inc.

- 6.4.15 Renesas Electronics Corp.

- 6.4.16 Veoneer AB

- 6.4.17 OmniVision Technologies

- 6.4.18 Teledyne Technologies Inc.

- 6.4.19 Nidec-ELV Automotive Vision

- 6.4.20 Pioneer Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment