|

市场调查报告书

商品编码

1844527

装饰混凝土:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Decorative Concrete - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

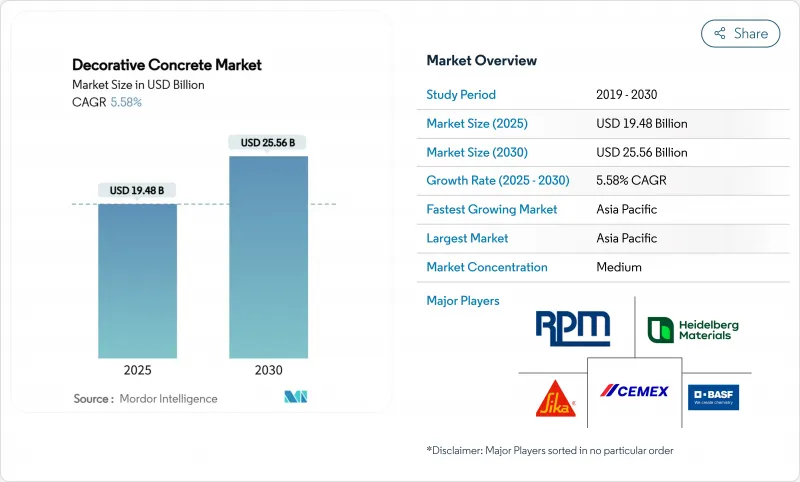

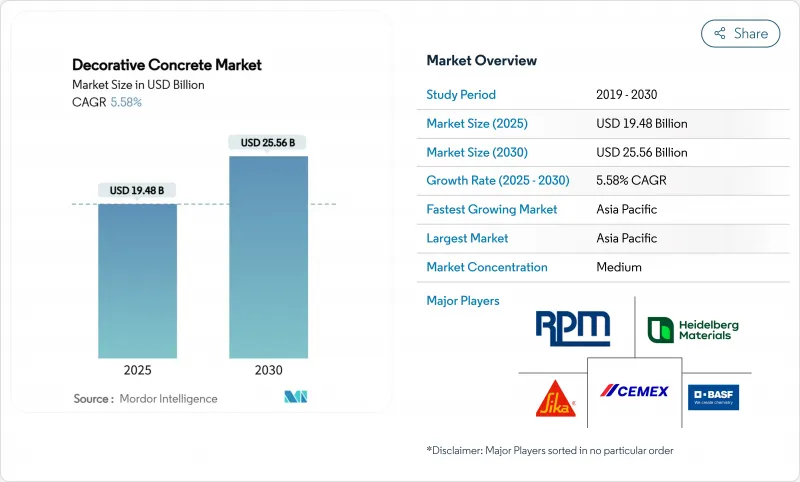

预计 2025 年装饰混凝土市场规模为 194.8 亿美元,到 2030 年将达到 255.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.58%。

这种持续的成长反映了全球建筑业重点转向兼具长期耐用性和设计多功能性的材料的重要转变,尤其是在住宅装修预算持续高企和商业建筑现代化升级的背景下。疫情过后,住宅维修支出增加、住宅存量老化(平均房龄为41年)以及人们对低维护表面日益增长的偏好,这些因素都提振了需求。同时,商业维修正在采用抛光混凝土和压印混凝土,以满足人流量大区域的耐久性偏好。进口水泥的关税,加上颜料供应的不确定性,加剧了成本压力,但也为垂直整合的供应商和减碳配方创新者带来了机会。

全球装饰混凝土市场趋势与洞察

疫情过后家居装修整修支出增加

不断增长的房屋改造预算正转向数量更少、价值更高的计划,这推动了兼具美观与耐用性的表面维修需求。儘管整体计划数量暂时下降,但到2023年,平均房主支出将增加12%,这表明他们愿意为高端装修付费,以提升房产价值并满足居家养老的需求。装饰混凝土具有很高的完整性,因为其20-30年的使用寿命优于许多铺装方案,并缩短了未来的维修週期。老化住宅存量将推动大规模的外部和地下室维修,而压印板和抛光地板将带来快速的视觉衝击。房屋抵押贷款利率预计在2025年中期达到5.5%,这将进一步增加维修资金,并在整个预测期内推动需求。

压印混凝土是新户外生活空间的首选

印花垫和整合着色技术的进步打破了人们对印花表面的过时认知,带来令人信服的自然纹理,经适当密封后可持续使用20多年。安装成本与采石场石材相比仍具有竞争力,使承包商能够覆盖更广泛的人群。冷色调颜料和几何模板与现代景观设计趋势相呼应,而渗透性的变化则满足了密集城市计划中的雨水需求。整合LED灯槽和金属亮点使高端安装脱颖而出,提高了安全性,尤其是在泳池甲板周围,这些地方表面温度较低且防滑。

特种颜料、模具和密封剂的初始成本高昂

装饰混凝土每立方码的成本为200至300美元,而标准混凝土每立方码的成本为100至150美元,差异主要在于昂贵的氧化铁颜料、硅胶模具和多层密封系统。开发商将这些成本转嫁给房主和小型开发商,限制了其在价格敏感地区的应用。压印抛光饰面施工速度较慢,需要专门的精加工技术,导致人事费用更高。小型承包商不愿购买自己的压印库和钻石抛光设备,这限制了其在二线城市的服务,并减缓了其在农村地区的应用。

細項分析

到 2024 年,压印混凝土将在装饰混凝土市场中保持 40.21% 的份额,这得益于它适用于车道、露台和商业广场。增强型工具库提供石板、木材甚至整合标誌广告曝光率,使承包商能够与饭店和品牌零售连锁店合作。到 2030 年,抛光混凝土的复合年增长率预计将达到 6.19%,这得益于设施管理人员对抛光混凝土小底座、耐叉车磨损的能力以及方便清洁的无缝地板的欣赏。装饰混凝土市场规模将受益于无需拆除结构即可延长表面寿命的覆盖层的出现,以及释放石灰以密封微裂纹并延长服务间隔的自癒胶囊。总而言之,多样化的类型有助于供应商同时满足预算和性能要求,从而增强装饰混凝土市场的弹性。

正在进行的研发重点是防褪色染料和快速固化密封剂,以缩短旋转週期。颜色混合利用更精细的颜料分散体来避免条纹,而半透明染料系统则可以实现精品场所青睐的艺术渐变效果。纤维增强设计可减少收缩开裂,抗紫外线面漆可防止露天娱乐场所的褪色。这些进步拓宽了应用场景,并深入渗透到高可见度的建筑元素中,从而推动装饰混凝土市场的长期成长。

区域分析

到2024年,亚太地区将占全球水泥销售额的37.83%,到2030年,复合年增长率将达到6.53%,这将巩固其作为市场领导和关键成长动力的双重角色。光是中国在2011年至2013年间就消耗了66亿吨水泥,超过了美国在20世纪的水泥使用量,并且仍占全球产量的一半以上。大规模的住房搬迁计画和像印尼耗资50亿美元的工业这样的计划凸显了对水泥结构的需求,而透水装饰板则解决了快速都市化城市中严格的雨水排放法规。当地製造商正在扩大低熟料黏合剂的生产,以配合该国的脱碳承诺,拓宽产品结构并减少对进口的依赖。

2025年进口关税上调后,北美面临巨大的成本波动,但在抵押贷款利率下调和公共部门支出持续增加的支撑下,北美仍保持成长潜力。老旧房屋抵押贷款住宅存量将推动住宅翻新,两党共同製定的基础设施立法将扩大公共广场和交通枢纽的建设机会。随着供应链逆风的出现,综合供应商正在扩大采石场和码头,以确保原料供应,并稳定装饰混凝土市场的价格。

严格的欧洲碳排放指令正在重新调整规范,以支持低排放材料,并鼓励使用生物基外加剂和再生骨材。投资余热回收窑和生物炭混烧的生产商可享有欧盟分类规则下的优先采购,从而增强其区域竞争优势。同时,中东、非洲和南美洲在城市人口成长的推动下呈现强劲成长,但外汇波动和建筑商产能有限限制了短期内的成长潜力。在所有地区,装饰混凝土市场都保持着广泛的需求基础,展现出其能够与区域政策要求和建筑行业週期保持一致的能力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 疫情过后房屋装修整修成本增加

- 新建户外生活空间偏好压印混凝土

- 净零排放和绿色建筑认证推动彩色/低VOC混合材料的发展

- 快速维修计划中装饰混凝土覆盖层的成长

- 采用生物基外加剂减少体积碳足迹

- 市场限制

- 特种颜料、模具和密封剂的初始成本高昂

- 水泥和颜料的供应链不稳定,导致价格高。

- 认证装饰混凝土承包商短缺

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按类型

- 压印混凝土

- 抛光混凝土

- 覆盖混凝土

- 染色混凝土

- 彩色混凝土

- 混凝土染色

- 其他类型

- 按用途

- 人行道和道路

- 露臺

- 泳池甲板

- 地面

- 墙

- 其他用途

- 按最终用户产业

- 住房

- 非住宅

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- 3M

- BASF

- Boral

- CEMEX SAB de CV

- Dex-O-Tex

- Elite Crete Systems

- Heidelberg Materials

- Holcim

- Palermo Concrete Inc

- Parchem Construction Supplies

- PPG Industries Inc

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Subana Technologies Pvt. Ltd.

- Tarmac

- The Euclid Chemical Company

- The Sherwin-Williams Company

- UltraTech Cement Ltd.

第七章 市场机会与未来展望

The Decorative Concrete Market size is estimated at USD 19.48 billion in 2025, and is expected to reach USD 25.56 billion by 2030, at a CAGR of 5.58% during the forecast period (2025-2030).

This sustained expansion reflects a decisive shift in global construction priorities toward materials that marry long-term durability with design versatility, especially as residential remodeling budgets remain elevated and commercial facilities continue to modernize. Heightened post-pandemic home-improvement outlays, an aging housing stock with a median age of 41 years, and growing preference for low-maintenance surfaces are reinforcing demand. In parallel, commercial refurbishments are adopting polished and stamped concrete to meet foot-traffic durability targets, while net-zero building mandates push producers toward bio-based admixtures and low-VOC mixes. Tariffs on imported cement, coupled with volatile pigment supply, amplify cost pressures but also open opportunities for vertically integrated suppliers and innovators in carbon-reduced formulations.

Global Decorative Concrete Market Trends and Insights

Rising Residential Remodeling and Refurbishment Spend Post-Pandemic

Elevated remodeling budgets have shifted toward fewer but higher-value projects, strengthening demand for surface upgrades that combine aesthetics with long service life. Average homeowner spend increased 12% in 2023 despite a brief dip in overall project volume, signaling a willingness to pay for premium finishes that raise property value and support aging-in-place needs. Decorative concrete aligns well because its 20-30-year life span outperforms many alternative pavements, limiting future repair cycles. An aging housing stock motivates extensive outdoor and basement renovations where stamped slabs and polished floors deliver quick visual impact. Mortgage rates trending toward 5.5% by mid-2025 should further unlock renovation funding, amplifying demand throughout the forecast window.

Preference for Stamped Concrete in New-Build Outdoor Living Spaces

Advances in stamping mats and integral coloring have dispelled dated perceptions of stamped surfaces and now enable convincingly natural textures that last beyond two decades when properly sealed. Unit installation costs retain a favorable spread versus quarried stone, enabling contractors to target broader demographic segments. Cool-tone pigments and geometric templates resonate with modern landscaping trends while permeable variants address storm-water mandates in dense urban projects. Integrated LED channels and metallic highlights differentiate premium installations, particularly around pool decks where cooler surface temperatures and slip resistance improve safety.

High Upfront Cost of Specialty Pigments, Molds and Sealers

Decorative concrete commands USD 200-300 per cubic yard against USD 100-150 for standard mixes, a gap driven by expensive iron-oxide pigments, silicone molds, and multi-layer sealing systems. Contractors pass these costs to homeowners and small developers, curbing uptake in price-sensitive regions. Labor premiums also arise because stamped or polished finishes require slower placement rates and specialized finishing skills. Smaller contractors hesitate to purchase proprietary stamp libraries or diamond-polishing equipment, limiting service availability in secondary cities and slowing rural penetration.

Other drivers and restraints analyzed in the detailed report include:

- Net-Zero and Green-Building Certification Pushing Colored/Low-VOC Mixes

- Growth of Decorative Concrete Overlays in Fast-Track Renovation Projects

- Volatility in Cement and Pigment Supply Chains Inflating Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Stamped concrete retained a 40.21% decorative concrete market share in 2024, underpinned by its adaptability across driveways, patios, and commercial plazas. Enhanced tool libraries offer slate, timber, and even integrated logo impressions, enabling contractors to court hospitality and branded retail chains. Polished concrete, while holding a smaller base, is forecast to grow at a 6.19% CAGR to 2030 as facility managers appreciate seamless floors that resist forklift abrasion and ease cleaning protocols. Decorative concrete market size benefits from overlays that extend surface life without structural demolition, and from emerging self-healing capsules that release lime to seal microcracks and prolong service intervals. Overall, diversified type options help suppliers meet both budget and performance briefs, reinforcing the decorative concrete market's resilience.

Continued R&D targets color-fast dyes and rapid-cure sealers that shorten turnover cycles. Colored mixes leverage finer pigment dispersions to avoid streaking, whereas translucent dye systems permit artistic gradients favored in boutique venues. Fiber-reinforced designs alleviate shrinkage cracking, while UV-resistant topcoats guard against fade in open-air entertainment spaces. Collectively, these advances widen use cases and deepen penetration into high-visibility architectural elements, bolstering long-term decorative concrete market growth.

The Decorative Concrete Market Report is Segmented by Type (Stamped Concrete, Polished Concrete, Concrete Overlay, Stained Concrete, Colored Concrete, Concrete Dye, Other Types), Application (Footpath and Driveway, Patio, and More), End-User Industry (Residential, Non-Residential), and Geography (Asia-Pacific, North America, Europe, and More ). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 37.83% of 2024 revenue and posts a leading 6.53% CAGR to 2030, reinforcing its dual role as market leader and primary growth driver. China alone consumed 6.6 gigatons of cement between 2011-2013, dwarfing 20th-century U.S. usage, and still accounts for more than half of global output. Massive housing-relocation schemes and megaprojects such as Indonesia's USD 5 billion industrial park underscore structural demand, while permeable decorative slabs respond to stringent storm-water ordinances in rapidly urbanizing cities. Local producers are scaling low-clinker binders to align with national decarbonization pledges, broadening the product mix and tempering import dependence.

North America faces pronounced cost volatility after 2025 import tariffs but retains growth potential supported by mortgage-rate easing and continued public-sector outlays. An aging housing stock boosts residential resurfacing, while the Bipartisan Infrastructure Law extends opportunities in public plazas and transit hubs. Supply-chain headwinds encourage integrated suppliers to expand captive quarry and terminal capacity, securing raw materials and stabilizing decorative concrete market pricing.

Europe's stringent carbon directives recalibrate specifications toward low-embodied materials, catalyzing uptake of bio-based admixtures and recycled aggregates. Producers investing in waste-heat recovery kilns and bio-char co-firing earn procurement preference under EU Taxonomy rules, reinforcing regional competitive advantages. Meanwhile, Middle East, Africa, and South America register steady gains anchored by urban population growth, though currency volatility and limited installer capacity temper immediate upside potential. Across all regions the decorative concrete market demonstrates capacity to align with local policy imperatives and construction-sector cycles, sustaining a broad demand base.

- 3M

- BASF

- Boral

- CEMEX S.A.B. de C.V.

- Dex-O-Tex

- Elite Crete Systems

- Heidelberg Materials

- Holcim

- Palermo Concrete Inc

- Parchem Construction Supplies

- PPG Industries Inc

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Subana Technologies Pvt. Ltd.

- Tarmac

- The Euclid Chemical Company

- The Sherwin-Williams Company

- UltraTech Cement Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising residential remodeling and refurbishment spend post-pandemic

- 4.2.2 Preference for stamped concrete in new-build outdoor living spaces

- 4.2.3 Net-zero and green-building certification pushing colored/low-VOC mixes

- 4.2.4 Growth of decorative concrete overlays in fast-track renovation projects

- 4.2.5 Adoption of bio-based admixtures to cut embodied-carbon footprint

- 4.3 Market Restraints

- 4.3.1 High upfront cost of specialty pigments, molds and sealers

- 4.3.2 Volatility in cement and pigment supply chains inflating prices

- 4.3.3 Shortage of certified decorative concrete installers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Stamped Concrete

- 5.1.2 Polished Concrete

- 5.1.3 Concrete Overlay

- 5.1.4 Stained Concrete

- 5.1.5 Colored Concrete

- 5.1.6 Concrete Dye

- 5.1.7 Other Types

- 5.2 By Application

- 5.2.1 Footpath and Driveway

- 5.2.2 Patio

- 5.2.3 Pool Deck

- 5.2.4 Floor

- 5.2.5 Wall

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 BASF

- 6.4.3 Boral

- 6.4.4 CEMEX S.A.B. de C.V.

- 6.4.5 Dex-O-Tex

- 6.4.6 Elite Crete Systems

- 6.4.7 Heidelberg Materials

- 6.4.8 Holcim

- 6.4.9 Palermo Concrete Inc

- 6.4.10 Parchem Construction Supplies

- 6.4.11 PPG Industries Inc

- 6.4.12 RPM International Inc.

- 6.4.13 Saint-Gobain

- 6.4.14 Sika AG

- 6.4.15 Subana Technologies Pvt. Ltd.

- 6.4.16 Tarmac

- 6.4.17 The Euclid Chemical Company

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 UltraTech Cement Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment