|

市场调查报告书

商品编码

1844537

美国汽车感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)US Automotive Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

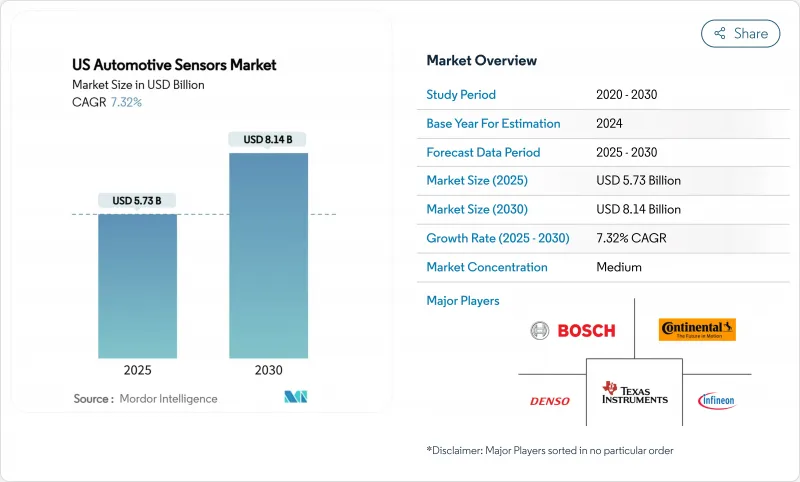

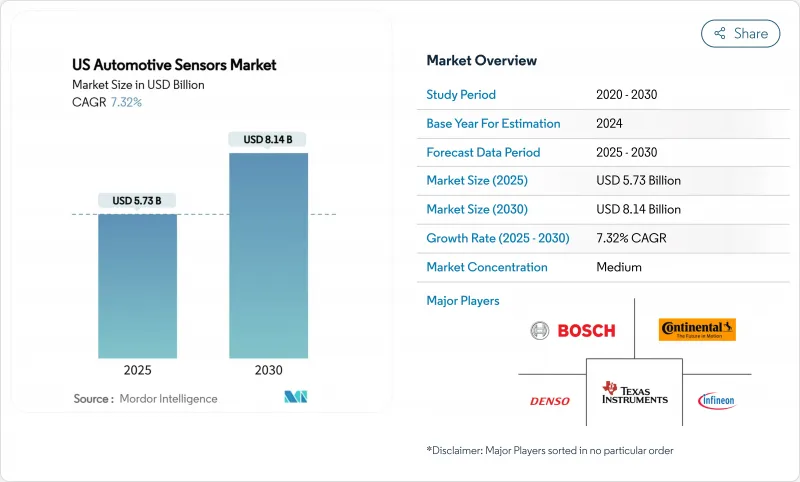

预计 2025 年美国汽车感测器市场规模为 57.3 亿美元,到 2030 年将达到 81.4 亿美元,市场估计和预测期(2025-2030 年)的复合年增长率为 7.32%。

汽车製造商正在每辆车上嵌入更多感测器,以满足轮胎压力、稳定性控制和自动煞车方面的要求。同时,车队营运商正在采用富含感测器的远端资讯处理系统来管理保险费和排放。雷达、光达和基于MEMS的设备在成本和性能方面不断取得突破,为传统供应商和新兴企业在美国汽车感测器市场开闢了新的差异化途径。

美国汽车感测器市场趋势与洞察

《CHIPS法案》鼓励在岸MEMS晶圆厂建设

联邦政府新拨款390亿美元,正引导晶圆厂计划在亚利桑那州、德克萨斯和纽约州北部落地,确保当地能够提供用于支援引擎、电池和底盘控制的MEMS压力、惯性和磁感测器。 Rogue Valley Microdevices公司已为其佛罗里达工厂获得670万美元的融资,使其汽车MEMS产能几乎翻了三倍。新增产能缩短了前置作业时间,降低了运输风险,并支援准时交付到底特律及沿海地区的组装厂。一所大学已获得一项研究津贴,用于开发下一代微加工工艺,进一步推动美国汽车感测器市场的创新。这些倡议将增强市场韧性,并将未来的生产从海外工厂转移回美国。

随着电动车变得越来越普遍,每辆车安装的感测器数量将会增加。

电动车整合的半导体数量是内燃机汽车的两到三倍,到2030年,感测器的价值占比将更大。仅电池管理系统就需要多个温度、电流和电压节点来防止热失控。位置和磁感测器监控马达转速,高压隔离装置则保障安全。政府税额扣抵和覆盖全国的充电补贴正在加速交付,促使供应商扩大基于碳化硅的压力和温度晶片的规模,以应对更严苛的引擎盖下环境。因此,即使整体汽车产量保持平稳,美国汽车感测器市场仍受益于平均售价的上涨。

缺水限制硅供应

亚利桑那州的下一代工厂每天可能要耗费数公升水,这将使本已饱受干旱压力的蓄水层雪上加霜。社区的反对和授权的延误可能会限制当地晶圆的生产,并限制汽车晶粒感测器和惯性晶粒的输送。为了降低风险,製造商正在实施封闭式回收,以回收超过70%的製程用水,但资本支出需要较长的投资回收期。如果更多工厂的建设未获核准,缺水状况可能会持续,从而限制美国汽车感测器市场的成长。

細項分析

到2024年,压力设备将占汽车收入的29.35%,支援燃油喷射、煞车辅助和胎压监测等应用。美国汽车感知器压力设备市场规模将随着燃油效率和排放目标的实现而稳定成长。目前规模较小的雷达模组到2030年将以8.23%的复合年增长率增长,这得益于77GHz晶片组价格的下降以及新车安全评估计划(NCAP)增加盲点、前方碰撞和交叉路口警报的压力。一级製造商目前正在将四角4D雷达捆绑到主流SUV车型中,这表明感测器融合正在从高端市场转向量产市场。

第二代毫米波架构将数位波束成形和AI物体分类整合到单一CMOS晶粒上。这减少了元件数量并简化了热设计,有助于雷达蚕食仅使用摄影机的ADAS市场份额。雷达和惯性参考单元组合供应商承诺即使在GPS受阻的情况下也能提供高精度里程计,这为美国汽车感测器产业创造了新的价值池。

2024年,动力传动系统系统将占总支出的36.56%,其中包括气流感知器、爆震感知器、冷却液温度感知器和电池组感知器。符合Tier 3排放气体法规将使动力传动系统总成系统在汽车感测器中的占比保持在高位。同时,到2030年,ADAS和自动驾驶功能的复合年增长率将达到8.71%,这将显着提升其在美国汽车感测器市场的份额。超音波、摄影机、雷达和雷射雷达的组合将实现L2+等级的自动驾驶功能,而美国国家公路交通安全管理局(NHTSA)新颁布的自动紧急煞车规定将奠定其基准。

为了实现冗余目标,OEM 指定了两条独立的感测路径,用于横向和纵向控制。到 2029 年,这将使每辆车的半导体总数超过 1,000 个,使 ADAS 成为成长最快的感测器预算线。持续的无线功能升级可以在车辆售出数年后,透过收益尚未开发的计算余量来进一步延长生命週期收益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 《CHIPS法案》鼓励在岸MEMS晶圆厂建设

- 随着电动车变得越来越普遍,每辆车安装的感测器数量将会增加。

- Federal TPMS、ESC 和 NCAP 升级

- 引入互联保险远端资讯处理

- 软体定义的汽车架构

- 车队脱碳目标(企业)

- 市场限制

- 缺水限制硅供应

- 成本和价格下降对一级供应商的利润率带来压力

- 恶劣环境下的可靠性和校准问题

- 感测器级网路安全责任

- 价值/供应链分析

- 监管状况

- 技术展望

- 永续性和能源足迹分析

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 依感测器类型

- 温度感测器

- 压力感测器

- 速度/速率感测器

- 液位/位置感知器

- 磁性感应器

- 气体/化学感测器

- 惯性感测器(加速度计/陀螺仪)

- LiDAR感测器

- 雷达感测器

- 超音波感测器

- 影像/相机感光元件

- 电流感测器

- 按用途

- 动力传动系统

- 车身电子与舒适性

- 安全保障

- ADAS 与自动驾驶系统

- 远端资讯处理和连接

- 电池管理(电动车)

- 按车辆类型

- 摩托车

- 搭乘用车

- 轻型商用车

- 大型商用车

- 按销售管道

- OEM

- 售后市场

- 透过促销

- 内燃机汽车

- 油电混合车

- 纯电动车

- 燃料电池电动车

- 透过感测器技术

- MEMS

- 非MEMS/巨集感测器

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- DENSO Corporation

- Continental AG

- HELLA GmbH & Co. KGaA

- Valeo SA

- Texas Instruments Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- Analog Devices Inc.

- Hitachi Astemo Americas Inc.

- Sensata Technologies

- TE Connectivity

- Aptiv PLC

- STMicroelectronics NV

- onsemi

- BorgWarner Inc.

- Renesas Electronics Corp.

- Honeywell International Inc.

- Allegro MicroSystems LLC

- Microchip Technology Inc.

第七章 市场机会与未来展望

The US Automotive Sensors Market size is estimated at USD 5.73 billion in 2025, and is expected to reach USD 8.14 billion by 2030, at a CAGR of 7.32% during the forecast period (2025-2030).

Automakers are embedding more sensors per vehicle to comply with tire-pressure, stability-control, and automated-braking mandates. At the same time, fleet operators adopt sensor-rich telematics to control insurance costs and emissions. Radar, lidar, and MEMS-based devices continue to achieve cost and performance breakthroughs, giving legacy suppliers and start-ups new avenues for differentiation in the United States automotive sensors market.

US Automotive Sensors Market Trends and Insights

CHIPS Act Incentivises On-Shore MEMS Fabs

New federal grants worth USD 39 billion are steering wafer-fab projects to Arizona, Texas and upstate New York, ensuring a local pipeline of MEMS pressure, inertial and magnetic sensors that underpin engine, battery and chassis controls. Rogue Valley Microdevices has already secured USD 6.7 million for a Florida plant that will nearly triple its automotive MEMS capacity, illustrating how smaller foundries can scale under the program. The added capacity reduces lead-times, cuts shipping risk and supports just-in-time delivery for Detroit and coastal assembly plants. Universities gain research grants that seed next-gen micromachining processes, further anchoring innovation inside the United States automotive sensors market. Combined, these actions lift resilience and pull future production back from overseas fabs.

EV Adoption Pushes Sensor Content per Vehicle

Electric models integrate two to three times more semiconductors than ICE cars, pushing sensor value toward a greater share by 2030. Battery-management systems alone require multiple temperature, current and voltage nodes to prevent thermal runaway. Position and magnetic sensors monitor e-motor speed, while high-voltage isolation devices maintain safety. Government tax credits and coast-to-coast charging grants accelerate delivery volumes, so suppliers are scaling SiC-based pressure and temperature dies to meet harsher under-hood environments. As a result, the United States automotive sensors market is benefiting from higher average selling prices even when overall vehicle production remains flat.

Silicon-Supply Water-Stress Constraints

Next-generation fabs in Arizona may each draw significant liters of water daily, straining aquifers already under drought pressure. Community opposition or permitting delays could cap local wafer output, tightening the flow of automotive pressure and inertial dies. To mitigate risk, manufacturers are installing closed-loop recycling that recovers more than 70% of process water, yet capital outlays lengthen payback. Prolonged shortages could temper growth for the United States automotive sensors market if additional sites are not approved.

Other drivers and restraints analyzed in the detailed report include:

- Connected-Insurance Telematics Retrofits

- Software-Defined Vehicle Architectures

- Cost & Price-Erosion Squeeze Tier-1 Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pressure devices delivered 29.35% of 2024 revenue, anchoring applications such as fuel injection, brake boost and mandated tire-pressure monitoring. The United States automotive sensors market size for pressure units is set to expand steadily in line with fuel-efficiency and emissions targets. Radar modules, although smaller today, will grow at a 8.23% CAGR through 2030 thanks to falling 77 GHz chipset prices and NCAP pressure to add blind-spot, front-collision and cross-traffic alerts. Tier-1s now bundle four-corner 4D radar into mainstream SUVs, signalling that sensor fusion is shifting from premium to volume segments.

Second-generation millimetre-wave architectures integrate digital beam-forming and AI-enhanced object classification on a single CMOS die. This reduces bill-of-materials and simplifies thermal design, helping radar to erode camera-only ADAS share. Suppliers that combine radar with inertial reference units promise high-accuracy odometry even when GPS is blocked, creating new value pools within the United States automotive sensors industry.

Powertrain systems accounted for 36.56% of 2024 spend, covering air-flow, knock, coolant-temperature and battery pack sensors. Compliance with Tier 3 emissions rules keeps powertrain allocations high. At the same time, ADAS and autonomous functions will expand at an 8.71% CAGR to 2030, raising their portion of the United States automotive sensors market size considerably. Ultrasonic, camera, radar and lidar combinations enable Level-2+ functions, while NHTSA's new automatic emergency-braking mandate locks in baseline volumes.

To meet redundancy targets, OEMs specify dual independent sensing paths for lateral and longitudinal control. This pushes total semiconductor count per vehicle past thousand mark by 2029, cementing ADAS as the fastest-growing budget line for sensors. Continuous over-the-air feature upgrades further stretch lifecycle revenue because dormant compute headroom can be monetised years after vehicle sale.

The United States Automotive Sensors Market Report is Segmented by Sensor Type (Temperature Sensors and More), Application (Powertrain and More), Vehicle Type (Motorcycles and More), Sales Channel (OEM and More), Propulsion (Internal Combustion Vehicles and More), and Sensor Technology (MEMS and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Robert Bosch GmbH

- DENSO Corporation

- Continental AG

- HELLA GmbH & Co. KGaA

- Valeo SA

- Texas Instruments Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- Analog Devices Inc.

- Hitachi Astemo Americas Inc.

- Sensata Technologies

- TE Connectivity

- Aptiv PLC

- STMicroelectronics NV

- onsemi

- BorgWarner Inc.

- Renesas Electronics Corp.

- Honeywell International Inc.

- Allegro MicroSystems LLC

- Microchip Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 CHIPS Act Incentivizes On-Shore MEMS Fabs

- 4.2.2 EV Adoption Pushes Sensor Content per Vehicle

- 4.2.3 Federal TPMS, ESC & NCAP Upgrades

- 4.2.4 Connected-Insurance Telematics Retrofits

- 4.2.5 Software-Defined Vehicle Architectures

- 4.2.6 Fleet Decarbonisation Targets (Corporate)

- 4.3 Market Restraints

- 4.3.1 Silicon-Supply Water-Stress Constraints

- 4.3.2 Cost & Price-Erosion Squeeze Tier-1 Margins

- 4.3.3 Harsh-Duty Reliability & Calibration Issues

- 4.3.4 Sensor-Level Cyber-Security Liabilities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Sustainability & Energy-Footprint Analysis

- 4.8 Porter's Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Sensor Type

- 5.1.1 Temperature Sensors

- 5.1.2 Pressure Sensors

- 5.1.3 Speed / Velocity Sensors

- 5.1.4 Level / Position Sensors

- 5.1.5 Magnetic Sensors

- 5.1.6 Gas / Chemical Sensors

- 5.1.7 Inertial Sensors (Accel/Gyro)

- 5.1.8 LiDAR Sensors

- 5.1.9 Radar Sensors

- 5.1.10 Ultrasonic Sensors

- 5.1.11 Image / Camera Sensors

- 5.1.12 Current Sensors

- 5.2 By Application

- 5.2.1 Powertrain

- 5.2.2 Body Electronics & Comfort

- 5.2.3 Vehicle Security & Safety

- 5.2.4 ADAS & Autonomous Systems

- 5.2.5 Telematics & Connectivity

- 5.2.6 Battery-Management (EV)

- 5.3 By Vehicle Type

- 5.3.1 Motorcycles

- 5.3.2 Passenger Cars

- 5.3.3 Light Commercial Vehicles

- 5.3.4 Heavy Commercial Vehicles

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Propulsion

- 5.5.1 Internal-Combustion Vehicles

- 5.5.2 Hybrid Electric Vehicles

- 5.5.3 Battery Electric Vehicles

- 5.5.4 Fuel-Cell Electric Vehicles

- 5.6 By Sensor Technology

- 5.6.1 MEMS

- 5.6.2 Non-MEMS / Macro Sensors

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 DENSO Corporation

- 6.4.3 Continental AG

- 6.4.4 HELLA GmbH & Co. KGaA

- 6.4.5 Valeo SA

- 6.4.6 Texas Instruments Inc.

- 6.4.7 Infineon Technologies AG

- 6.4.8 NXP Semiconductors NV

- 6.4.9 Analog Devices Inc.

- 6.4.10 Hitachi Astemo Americas Inc.

- 6.4.11 Sensata Technologies

- 6.4.12 TE Connectivity

- 6.4.13 Aptiv PLC

- 6.4.14 STMicroelectronics NV

- 6.4.15 onsemi

- 6.4.16 BorgWarner Inc.

- 6.4.17 Renesas Electronics Corp.

- 6.4.18 Honeywell International Inc.

- 6.4.19 Allegro MicroSystems LLC

- 6.4.20 Microchip Technology Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment