|

市场调查报告书

商品编码

1844541

技术陶瓷:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Technical Ceramics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

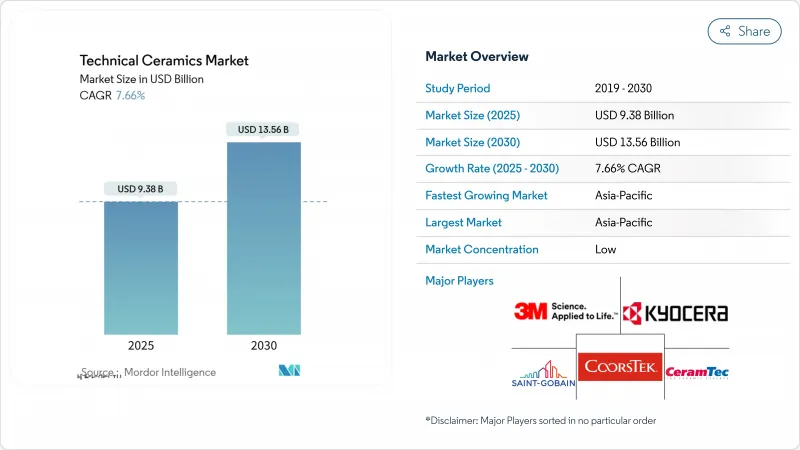

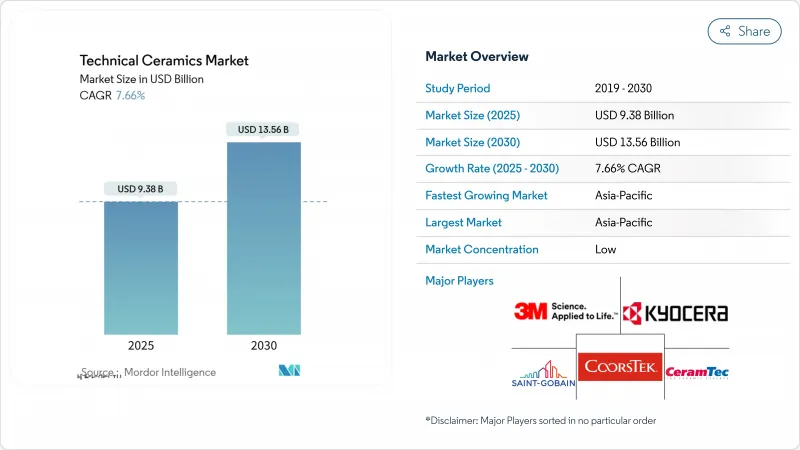

预计 2025 年技术陶瓷市场价值为 93.8 亿美元,到 2030 年将达到 135.6 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率为 7.66%。

需求主要集中在半导体基板、电动车 (EV) 热控制组件和生物相容性植入,这些产品对故障的接受度几乎为零,而材料科学是策略差异化因素。中国、日本和韩国的工厂建设正在加紧,推动氮化铝和碳化硅封装消费量的增加。同时,800V 电动车传动系统架构迫使汽车製造商指定能够散热超过 200 W/mK 且不影响电气绝缘的陶瓷散热器。虽然供应链仍然容易受到关键矿物浓度的影响,但主要製造商正在透过扩大低风险管辖区的生产能力和加强回收循环来减少原材料的暴露来应对。虽然整体配方仍然在产量中占主导地位,但陶瓷基质复合材料正经历最快的增长,因为航太和国防主要企业为更轻、耐高温的零件支付溢价,以减轻重量并提高燃油经济性。

全球技术陶瓷市场趋势与洞察

扩大亚太地区的半导体和家用电子电器生产

台湾、中国当地、日本和韩国的工厂建设正在重新设定氮化铝和碳化硅基板的需求基准,这些基板可承受超过 1,000°C 的峰值键合温度,同时确保介电完整性。追求氮化镓架构的晶片设计人员正在将热预算扩展到传统导线架的能力之外,这使得陶瓷封装成为提高产量的重要组成部分。京瓷公司正在日本投资 4.7 亿美元建造一条专用生产线,以使陶瓷基板的可用性与下一代处理器节点同步。虽然将基板生长週期与微影术坡道同步仍然具有挑战性,因为窑炉需要比半导体无尘室更长的检验循环,但一级设备製造商现在正在签署多年的承购协议以锁定供应。地方政府正在同时承销先进材料丛集,以减少对海外原材料的依赖,这项政策措施可以缩短前置作业时间并缓解价格波动。

电动车动力传动系统的温度控管需求

预计 2024 年全球电动车出货量将超过 1,500 万辆,目前几乎所有平台升级都针对 800V 电气架构,以便从更小的逆变器中榨取更多电力。碳化硅功率模组的散热速度是硅元件的三倍,但允许的结温仍然很严格,为导热率超过 200 W/mK 的陶瓷散热器创造了理想的设计窗口。 CeramTec 的晶片散热器解决方案降低了热阻,同时保持了介电隔离,这一组合延长了模组在高振动汽车环境中的使用寿命。虽然汽车製造商对价格敏感,但与热故障相关的保固责任会使购买决策倾向于更可靠的陶瓷,即使单价更高。随着中国、欧洲和美国汽车电气化进程的加速,对陶瓷基板、汇流排和凝胶涂层冷却板的需求也同步成长。

固有脆性和加工损失

硬度同时提供耐热性和耐磨性,但它会增加烧结后研磨过程中断裂的风险。 20-30%的产量比率损失会增加单位成本并延长前置作业时间。纤维增强陶瓷基质可以缓解裂纹扩展,但额外的分层和渗透步骤增加了工艺复杂性,抵消了耐久性方面的提升。积层製造提供了一种近净成形的替代方案,但材料种类和产量仍落后于传统压机,限制了其在原型製作之外的应用。

細項分析

到2024年,整体陶瓷将占据技术陶瓷市场46.68%的份额,这得益于成熟的压制烧结生产线,这些生产线能够大规模提供均匀的品质。随着工业原始设备製造商(OEM)采用比钢製陶瓷更耐用的氧化铝陶瓷体维修泵浦、喷嘴和绝缘体,该细分市场仍有望实现中等个位数成长。然而,复合材料陶瓷将以8.84%的复合年增长率成长,累计整个技术陶瓷市场的发展,因为它们吸引了航太和国防预算,这些预算要求陶瓷减重超过30%,并能耐受1500°C以上的高温。到2025年,光是引擎热端部分就将占据技术陶瓷市场的11亿美元规模。快速强制空气烧结等製程技术的突破正在将緻密化步骤从数小时缩短到数分钟,从而缩短能源成本曲线,并缩小与整体陶瓷的价格差距。随着这些效率的提高,复合材料有望减少整体材料的份额,但它们无法完全取代整体材料,因为汽车和工业工厂仍然重视可预测的收缩和低废品率。

涂层市场是一条过渡路径:原始设备製造商 (OEM) 可以透过在传统金属部件上喷涂氧化锆或碳化硅来提高热通量,而无需重新设计整个组件。这种改造方法在石化燃烧器和柴油颗粒过滤器中很受欢迎,因为这些设备的停机预算比较紧张。液化天然气运输船的货舱中正在使用 1100°C 气凝胶填充的纺织被,这再次表明,专业的性能认证在较小的细分市场中保持着较高的价格。

由于原料供应充足且製程控製完善,氧化铝、氧化锆和莫来石等氧化物系统占2024年销售额的63.37%。这些等级构成了各行业电容器电介质和耐磨板的基准。然而,碳化硅、氮化硅和新型碳化硼等非氧化物配方由于其密度较低且热导率更接近铜,订单增长速度更快。到2030年,非氧化物陶瓷的比例将达到7.86%,透过服务氧化物玻璃相无法生存的前沿设备,扩大了技术陶瓷市场。虽然成本仍然是一个障碍,但随着生产线产量比率的提高和废品率降至5%以下,非氧化物陶瓷的价格溢价正在缩小。燃油经济性监管要求和资料中心热通量的增加,都为这些高性能陶瓷等级带来了可持续的长期推动力。

复合材料和混合材料将氧化物基体与非氧化物晶鬚或纤维结合在一起,具有协同增韧和导电性的潜力。人们越来越关注掺镧氧化铝混合物,因为它能够承受高压下的介电击穿,这是电网级固体变压器计划的重点。这些交叉配方表明,未来市场份额的竞争将不再是氧化物与非氧化物的较量,而是混合材料与单相材料的较量,这拓宽了解决方案的空间,同时也增加了复杂性。

技术陶瓷市场报告按产品类型(层状陶瓷、陶瓷基质复合材料、其他)、材料类别(氧化物陶瓷、非氧化物陶瓷、其他)、最终用户行业(电气和电子、汽车、其他)、主要应用(绝缘体和基板、温度控管组件、其他)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行细分。

区域分析

到 2024 年,亚太地区将占据技术陶瓷市场的主导地位,市占率达到 43.87%,到 2030 年的复合年增长率为 7.91%。中国当地是氧化铝粉末烧结的主要产地,因此在劳动密集的表面处理工程中可以实现成本套利。京瓷长崎工厂预计 2026 年投产,使中国的精细陶瓷产量提高 10%。韩国的记忆体晶片中心正在推动对低缺陷氮化基板的需求,而印度则透过对古吉拉突邦和泰米尔纳德邦提供税收优惠来吸引电动车供应链的投资者。地方政府也正在规划回收走廊,以回收废弃的氧化锆和氧化钇,这项倡议可能会在长期内减少对原料进口的依赖。

北美是一个成熟且创新的地区,占全球陶瓷基复合材料相关研发支出的近 30%。美国占据了航太涡轮机和医疗植入订单的大部分,因此需要 ISO 级窑炉和 USP VI 级无尘室通讯协定。圣戈班在纽约投资 4,000 万美元的触媒撑体工厂将创造 100 个就业岗位,并缩短向东海岸炼油厂的交货週期。加拿大矿业公司供应矾土和稀土精矿,但大部分原料仍流向亚洲炼油厂。墨西哥正在成为电动车逆变器的组装中心,基板製造商正在考虑近岸外包,以避免 USMCA 原产地规则征收的关税。

欧洲约占全球销售额的五分之一,在商业性成功与永续性需求之间取得平衡。德国工具机製造商正在指定耐磨氧化铝导轨,以结合欧盟生态设计标准,减少60%的润滑需求。法国和西班牙即将试验氢能枢纽,需要数千平方公尺的固体氧化物电解槽板。该地区的REACH化学品安全框架要求严格的可追溯性,合规成本支持现有企业,同时减缓新企业的推出。英国脱欧后的政策倾向于“先进材料弹射器”,旨在三年内将大学实验室的突破性成果转化为试点生产线。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 扩大亚太地区的半导体和消费性电子产品生产

- 电动车动力传动系统的温度控管需求

- 在高价值医疗植入和医疗设备中的应用日益增多

- 氢电解器电堆组件

- 太空製造和卫星硬体

- 市场限制

- 资本和加工成本高

- 固有脆性和加工损失

- 对关键矿产供应链的影响

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

- 定价分析

第五章市场规模及成长预测

- 依产品类型

- 单片陶瓷

- 陶瓷基质复合材料

- 陶瓷涂层

- 其他产品

- 按材料类别

- 氧化物陶瓷

- 非氧化物陶瓷

- 其他的

- 按最终用户产业

- 电气和电子

- 车

- 能源和电力

- 医疗保健

- 航太/国防

- 其他最终用户产业

- 按主要用途

- 绝缘体和基板

- 温度控管元件

- 磨损件和轴承

- 植入和牙科

- 装甲和防护

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- 3M

- CeramTec GmbH

- CoorsTek Inc.

- Dyson Technical Ceramics

- Kyocera Corporation

- Mantec Technical Ceramics Ltd

- McDanel Advanced Ceramic Technologies

- Morgan Advanced Materials

- NGK SPARK PLUG CO., LTD.

- Ortech, inc.

- Rauschert GmbH

- Saint-Gobain

- Schott AG

- STC Material Solutions

第七章 市场机会与未来展望

The Technical Ceramics Market size is estimated at USD 9.38 billion in 2025, and is expected to reach USD 13.56 billion by 2030, at a CAGR of 7.66% during the forecast period (2025-2030).

Demand is clustering around semiconductor substrates, electric-vehicle (EV) thermal control parts, and biocompatible implants, where failure tolerance is virtually zero and material science is a strategic differentiator. Rising fab construction across China, Japan, and South Korea is lifting consumption of aluminum nitride and silicon carbide packages, while 800 V EV drive-train architectures force automakers to specify ceramic heat spreaders that can dissipate more than 200 W/mK without compromising electrical insulation. Supply chains remain vulnerable to critical-mineral concentration, yet leading producers are countering with capacity additions in lower-risk jurisdictions and tighter recycling loops that reduce virgin material exposure. Monolithic formulations still dominate volume, but ceramic-matrix composites are accelerating fastest as aerospace and defense primes pay premiums for lighter, hotter-capable components that cut mass and raise fuel efficiency.

Global Technical Ceramics Market Trends and Insights

Expanding Semiconductor & Consumer-Electronics Output in Asia Pacific

Fab build-outs across Taiwan, mainland China, Japan, and South Korea are resetting the demand baseline for aluminum nitride and silicon carbide substrates that can survive peak junction temperatures exceeding 1,000 °C while ensuring dielectric integrity. Chip designers pursuing gallium nitride architectures are widening thermal budgets faster than legacy metal lead-frames can handle, making ceramic packages an essential throughput enabler. Kyocera is funneling USD 470 million into a dedicated Japanese line to synchronize ceramic substrate availability with next-generation processor nodes. Synchronizing substrate growth cycles with lithography ramp-ups remains difficult because kilns require longer validation loops than semiconductor clean-rooms, but tier-one device makers are now signing multi-year offtake agreements to lock in supply. Regional governments are simultaneously underwriting advanced-materials clusters to reduce reliance on overseas feedstocks, a policy move that could compress lead times and moderate pricing volatility.

EV Power-Train Thermal-Management Needs

Global EV shipments surpassed 15 million units in 2024, and nearly every platform upgrade now targets 800 V electrical architectures that squeeze more power through smaller inverters. Silicon carbide power modules dissipate heat at triple the rate of silicon devices, yet the allowable junction temperature band remains tight, creating a design window ideally served by ceramic heat spreaders boasting greater than 200 W/mK conductivity. CeramTec's chip-on-heatsink solution lowers thermal resistance while maintaining dielectric separation, a combination that lengthens module life in high-vibration automotive environments. Automakers are price-sensitive, but warranty liabilities linked to thermal failures tip purchasing decisions toward high-reliability ceramics despite higher unit costs. As fleet electrification accelerates in China, Europe, and the United States, demand for ceramic substrates, busbars, and gel-coated cooling plates is scaling in parallel.

Intrinsic Brittleness & Machining Losses

Hardness that delivers heat and wear resistance simultaneously increases fracture risk during post-sinter grinding. Yield losses of 20-30% inflate unit costs and lengthen lead times. Fiber-reinforced ceramic-matrix composites mitigate crack propagation but add layer-up and infiltration steps that offset durability gains with higher process complexity. Additive manufacturing offers near-net-shape alternatives, yet material palettes and throughput still lag conventional presses, limiting adoption outside prototyping.

Other drivers and restraints analyzed in the detailed report include:

- Rising Use in High-Value Medical Implants & Devices

- Hydrogen-Electrolyzer Stack Components

- Critical-Minerals Supply-Chain Exposure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Monolithic ceramics retained 46.68% technical ceramics market share in 2024 due to mature press-and-sinter lines that deliver uniform quality at scale. The segment should still post mid-single-digit gains as industrial OEMs retrofit pumps, nozzles, and insulators with alumina bodies that outlast steel equivalents. Composite grades, however, will lift the overall technical ceramics market as their 8.84% CAGR attracts aerospace and defense budgets chasing weight savings above 30% alongside thermal ceilings beyond 1,500 °C. In 2025, the engine hot-section segment alone accounts for a USD 1.1 billion slice of the technical ceramics market size. Processing breakthroughs such as rapid forced-air sintering are collapsing densification steps from hours to minutes, trimming energy cost curves, and narrowing price spreads with monolithics. As these efficiencies propagate, composites are expected to erode monolithic share, but not displace them outright, because automotive and industrial plants still prize predictable shrinkage and low scrap rates.

The coatings niche serves as a transitional pathway: OEMs can spray zirconia or silicon carbide onto legacy metal parts, achieving incremental heat-flux gains without redesigning the entire assembly. This retrofit approach is popular in petrochemical burners and diesel particulate filters where shutdown budgets are tight. Ceramic fibers remain small in tonnage yet influential in insulation markets; aerogel-filled fiber quilts rated to 1,100 °C are seeing uptake in LNG ship cargo holds, another indicator that specialized performance credentials sustain premium pricing in smaller sub-segments.

Oxide families such as alumina, zirconia, and mullite delivered 63.37% of 2024 revenue owing to abundant raw material availability and well-documented process controls. These grades form the baseline for capacitor dielectrics and wear plates across multiple industries. Yet silicon carbide, silicon nitride, and emerging boron carbide non-oxide formulations are booking faster order growth because they combine lower density with thermal conductivities approaching copper. The non-oxide cohort is on a 7.86% trajectory through 2030, expanding the technical ceramics market by servicing frontier devices where oxide glass phases cannot survive. Cost barriers persist, but as fab line yields improve and reject rates fall below 5%, non-oxide price premiums are narrowing. Regulatory fuel-economy mandates and data-center heat-flux escalation both point to sustained long-run tailwinds for these higher-performance grades.

Composite or hybrid material classes merge oxide matrices with non-oxide whiskers or fibers, delivering synergistic toughness and conductivity. Interest is building in lanthanum-doped alumina blends that resist dielectric breakdown at elevated voltages, a property valued by grid-scale solid-state transformer projects. These cross-over formulations validate the thesis that future share battles will not be oxide versus non-oxide but hybrid versus single-phase, adding complexity yet widening solution space.

The Technical Ceramics Market Report is Segmented by Product Type (Monolithic Ceramics, Ceramic Matrix Composites, and More), Material Class (Oxide Ceramics, Non-Oxide Ceramics, Others), End-User Industry (Electrical and Electronics, Automotive, and More), Key Application (Insulators & Substrates, Thermal Management Components, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa).

Geography Analysis

Asia Pacific dominated the technical ceramics market with 43.87% share in 2024 and is tracking a 7.91% CAGR to 2030. Mainland China hosts the majority of alumina powder calcination and offers cost arbitrage in labor-intensive finishing steps, yet rising electricity tariffs and environmental compliance fees are eroding the historic savings gap. Japan is repositioning toward ultra-clean, high-value substrates that align with national semiconductor revival incentives; Kyocera's Nagasaki site will lift domestic fine-ceramic output by 10% upon its 2026 start-up. South Korea's memory-chip epicenter drives demand for low-defect silicon nitride boards, while India is luring EV supply-chain investors with tax holidays in Gujarat and Tamil Nadu. Regional governments are also mapping recycling corridors to capture scrap zirconia and yttria, an initiative that may dilute raw-material import dependencies over the long term.

North America is mature yet innovation-heavy, claiming nearly 30% of global R&D outlays tied to ceramic matrix composites. The United States accounts for the bulk of aerospace turbine and medical implant orders, justifying ISO-class kilns and USP Class VI clean-room protocols that less regulated regions bypass. Saint-Gobain's USD 40 million catalyst-carrier plant in New York will add 100 jobs and shorten delivery cycles for East-Coast petro-refiners. Canadian mining houses supply bauxite and rare-earth concentrates, but still send most feedstock to Asian refineries. Mexico is emerging as an assembly hub for EV inverters, prompting substrate suppliers to weigh near-shoring steps that sidestep USMCA rules-of-origin tariffs.

Europe claims roughly one-fifth of global revenue and aligns commercial success with sustainability mandates. Germany's machine-tool builders specify wear-resistant alumina guides that cut lubrication demand by 60%, dovetailing with EU eco-design standards. France and Spain are piloting hydrogen hubs that will soon require thousands of square meters of solid-oxide electrolyzer plates. The region's REACH chemical-safety framework compels tight traceability, a compliance cost that props up incumbents but slows new venture launches. Post-Brexit United Kingdom policy leans toward advanced materials catapults, aiming to translate university lab breakthroughs into pilot lines within three years, yet significant scale will hinge on export markets, given limited domestic demand.

- 3M

- CeramTec GmbH

- CoorsTek Inc.

- Dyson Technical Ceramics

- Kyocera Corporation

- Mantec Technical Ceramics Ltd

- McDanel Advanced Ceramic Technologies

- Morgan Advanced Materials

- NGK SPARK PLUG CO., LTD.

- Ortech, inc.

- Rauschert GmbH

- Saint-Gobain

- Schott AG

- STC Material Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding semiconductor and consumer-electronics output in Asia Pacific

- 4.2.2 EV power-train thermal-management needs

- 4.2.3 Rising use in high-value medical implants and devices

- 4.2.4 Hydrogen-electrolyser stack components

- 4.2.5 In-space manufacturing and satellite hardware

- 4.3 Market Restraints

- 4.3.1 High capital and processing cost

- 4.3.2 Intrinsic brittleness and machining losses

- 4.3.3 Critical-minerals supply-chain exposure

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Rivalry

- 4.6 Patent Analysis

- 4.7 Price Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Monolithic Ceramics

- 5.1.2 Ceramic Matrix Composites

- 5.1.3 Ceramic Coatings

- 5.1.4 Other Products

- 5.2 By Material Class

- 5.2.1 Oxide Ceramics

- 5.2.2 Non-Oxide Ceramics

- 5.2.3 Others

- 5.3 By End-user Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Automotive

- 5.3.3 Energy and Power

- 5.3.4 Medical

- 5.3.5 Aerospace and Defense

- 5.3.6 Other End-user Industries

- 5.4 By Key Application

- 5.4.1 Insulators and Substrates

- 5.4.2 Thermal Management Components

- 5.4.3 Wear-resistant Parts and Bearings

- 5.4.4 Bio-implants and Dental

- 5.4.5 Armor and Protection

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 CeramTec GmbH

- 6.4.3 CoorsTek Inc.

- 6.4.4 Dyson Technical Ceramics

- 6.4.5 Kyocera Corporation

- 6.4.6 Mantec Technical Ceramics Ltd

- 6.4.7 McDanel Advanced Ceramic Technologies

- 6.4.8 Morgan Advanced Materials

- 6.4.9 NGK SPARK PLUG CO., LTD.

- 6.4.10 Ortech, inc.

- 6.4.11 Rauschert GmbH

- 6.4.12 Saint-Gobain

- 6.4.13 Schott AG

- 6.4.14 STC Material Solutions

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Increasing Usage in Nano Technology