|

市场调查报告书

商品编码

1844550

食品低温运输:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Food Cold Chain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

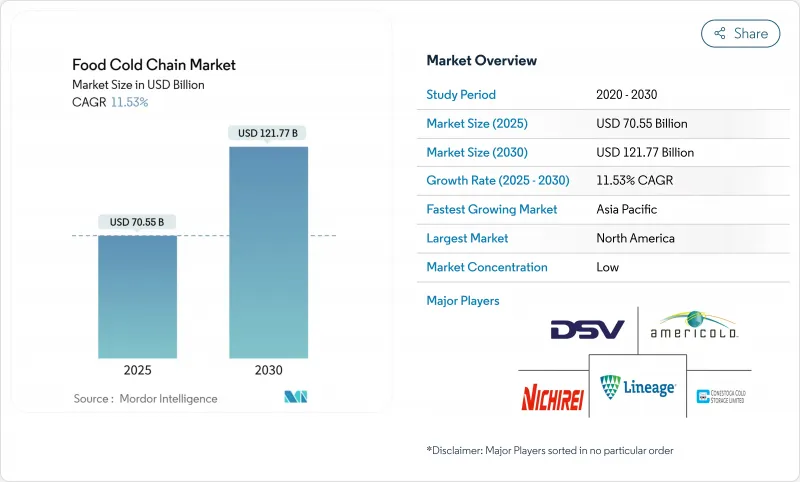

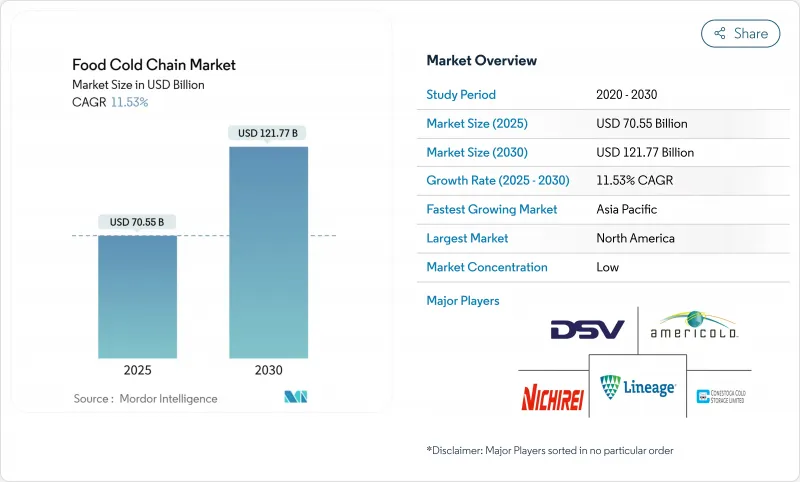

预计 2025 年全球食品低温运输市场规模将达到 705.5 亿美元,到 2030 年将扩大至 1,217.7 亿美元,预测期内复合年增长率将达到 11.53%。

这项加速反映了严格的食品安全法规、温度监控技术的突破以及已烹调简便食品,这些都要求从农场到餐桌的低温运输完整性毫不妥协。消费者食品安全意识的不断增强、生鲜产品国际贸易的不断增长以及新兴经济体有组织的零售业的快速发展进一步推动了市场扩张。 FDA 的食品安全现代化法案 (FSMA) 204 要求在 2026 年 1 月对食品可追溯性清单上列出的食品进行全面追溯,促使企业大力投资数位监控基础设施。该法规尤其影响生鲜食品、乳製品和鱼贝类等高风险食品,并要求公司在整个供应链中保存关键追踪事件的记录。这些要求的实施正在推动整个食品低温运输产业采用先进的追踪技术、物联网感测器和区块链解决方案。

全球食品低温运输市场趋势与洞察

全球对冷冻和生鲜食品的需求不断增加

冷冻食品消费的成长改变了全球低温运输容量需求,尤其对仓库、运输和配送网路产生了影响。这种成长对冷藏基础设施的需求很高,以弥补供需缺口,导致对冷藏仓库、温控车辆和先进监控系统的大量投资。疫情期间消费行为的改变使冷冻食品从方便食品变成了必需品,推动了包括已调理食品、蔬菜、肉类和鱼贝类在内的各类购买量的增加,形成了需要永久性扩建基础设施的长期需求模式。低温运输业者强调必须在整个供应链(从生产设施到配销中心和零售店)保持一致的温度控制。温度变化会导致产品损失、危及食品安全、引发代价高昂的召回,并导致不合规。温度控制的复杂性延伸到交付的最后一英里,需要专门的设备和精确的监控通讯协定来保持产品的完整性。

国际食品贸易和跨境食品运输的成长

跨境食品运输正演变成一个复杂的温控物流组织。根据《加强现代商业流通体系建设规划》,中国商务部计画在 2027 年实现水果蔬菜低温运输配送率达到 25%,肉类低温运输配送率达到 45%。这项监管措施反映了国际贸易在粮食安全中的重要作用,尤其是在气候变迁和地缘政治紧张局势扰乱传统供应链的背景下。在多个司法管辖区保持温度完整性的复杂性为专业物流供应商创造了机会,他们可以在确保产品品质的同时满足各种监管要求。区块链技术和物联网感测器的整合对于提供进口国所要求的端到端可追溯性至关重要,将跨境食品贸易从物流挑战转变为物流支援的竞争优势。温控货柜运输已成为关键瓶颈,专用冷藏货柜因其先进的监控系统而拥有更高的运费。

冷藏设施和冷藏运输车辆的初始资本投资要求高

低温运输基础设施的资本密集度构成了巨大的进入壁垒,专业的建筑材料和节能设计导致成本比传统仓库高出300-400%。建造冷藏设施需要先进的隔热系统、专用地板材料以及必须在极端温度条件下可靠运行的先进製冷设备,不仅推高了初始投资,还增加了持续的维护成本。冷藏运输车队也面临类似的成本压力,冷藏卡车和拖车的运费需要两位数的成长才能证明设施扩建的合理性。低温运输资产的专业性加剧了资金筹措挑战,其替代用途有限,并且需要专业的维护专业知识。

細項分析

到2024年,低温运输仓储将占据最大的市场份额,达到55.66%,这反映了所有食品类别对温控物流基础设施的需求。此细分市场的主导地位源自于冷藏仓库的资本密集特性,其中配备先进隔热材料、自动化货架系统和节能冷却技术的专用设施构成了低温运输生态系统中最大的成本组成部分。

儘管绝对市占率较小,但监控组件将呈现最快的成长轨迹,到2030年,其复合年增长率将达到14.45%,这得益于FSMA 204等监管要求以及曲折点:被动温度记录正被即时预测分析系统所取代,这些系统可以预测设备故障并优化能耗。像Rivercity Innovations这样的公司已经推出了物联网自动化温度监控解决方案,该解决方案具有早期灾难性故障检测(ECFD)功能,可以预测压缩机故障,从而实现及时维护并防止代价高昂的产品损失。

冷藏温度范围 (0-4°C) 将在 2024 年保持市场领先地位,市场份额达 60.15%,这反映出其在生鲜食品、乳製品和已调理食品,而这些领域占据了生鲜食品消费的大部分。然而,受消费者对冷冻方便食品偏好的转变以及全球冷冻食品生产能力的扩张推动,冷冻食品 (-18°C) 将呈现更强劲的成长势头,到 2030 年复合年增长率将达到 15.49%。

冷冻食品产业的成长轨迹正推动大型零售商投资双温区设施,以便在同一营运过程中高效管理冷藏和冷冻食品,从而优化空间利用率并降低营运复杂性。 「降温至-15°C」联盟由阿联酋航空货运部等领先物流供应商支持,是一项全行业共同努力,旨在透过将标准温度从-18°C调整至-15°C来优化冷冻食品运输,从而在保持产品品质的同时降低消费量。该倡议展示瞭如何透过优化温度范围来降低营运成本和环境影响,同时保持食品安全标准,从而创造竞争优势。

区域分析

北美2024年的市占率为40.46%,这反映了数十年来基础设施投资和监管发展,打造了全球最成熟的低温运输生态系统之一。大型零售商正积极响应,对自动化设施进行策略性投资,沃尔玛和克罗格正在开发都市区冷藏仓库,以缩短运输距离并提高永续性指标。亚太地区受益于成熟的法律规范和消费者愿意为品质保证支付溢价的意愿,但也面临基础设施老化和需要大量资本投资才能满足现代营运要求的阻力。

预计到 2030 年,亚太低温运输市场将以 16.56% 的复合年增长率成长,位居全球首位。这一市场扩张主要得益于政府旨在减少食物废弃物和简化供应链的支持性政策。中国、印度和印尼等国家的快速都市化推动了对温控储存和运输服务的需求。在印度,截至 2025 年 2 月,Pradhan Mantri Kisan Sampada Yojana 已核准394 个低温运输计划。这些计划专注于建立综合低温运输设施,包括冷藏运输、冷藏和加工中心。该计划透过更好地保存生鲜产品、减少收穫后损失和确保食品安全标准,支持了印度不断扩大的食品加工产业。该倡议还鼓励私人投资低温运输基础设施建设,创造更强大、更有效率的食品分销系统。

欧洲维持了稳定的成长,这得益于严格的食品安全法规、跨境贸易便利化以及重塑整个欧洲大陆低温运输运营的可持续发展倡议。该地区对永续性的重视正在加速排放气体冷藏拖车和先进数位化技术的采用,例如用于即时数据管理的数位孪生系统,可优化能源消耗和营运效率。该地区成熟的法规环境以及消费者偏好新鲜本地食品的永续性,并持续推动对先进低温运输解决方案的需求,这些解决方案能够在保持产品品质的同时最大限度地减少环境影响。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 全球对冷冻和生鲜食品的需求不断增长

- 国际食品贸易和跨境食品运输的成长

- 消费者对新鲜、即食的方便食品的偏好日益增长

- 有组织的零售和餐饮业的扩张

- 冷冻和温度监测系统的技术进步

- 执行严格的食品安全法规和品质标准

- 市场限制

- 冷藏设施和冷藏运输车辆的初始投资要求高

- 新兴市场的电力供应不稳定

- 运输和储存过程中的温度控制挑战

- 与其他储存方法的衝突

- 供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按类型

- 低温运输仓储

- 低温运输运输

- 监控组件

- 按温度范围

- 冷藏(0-4 度C)

- 冷冻(-18 度C)

- 深度冷冻/超低温(-40 度C以下)

- 按运输方式

- 公路 - 冷藏卡车和拖车

- 海运 - 冷藏货柜

- 铁路 - 冷藏铁路车辆

- 空运

- 按用途

- 水果和蔬菜

- 肉类和鱼贝类

- 乳製品和冷冻甜点

- 烘焙和糖果甜点

- 已调理食品

- 其他用途

- 依技术

- RFID和即时监控

- 支援物联网的远端资讯处理

- 自动储存和搜寻系统

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 荷兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市场排名分析

- 公司简介

- Lineage, Inc.

- Americold Logistics, Inc.

- Nichirei Corporation

- DSV A/S

- Conestoga Cold Storage Limited

- STEF

- RLS Logistics

- NewCold Cooperatief UA

- Burris Logistics

- Congebec Logistics Inc.

- John Swire & Sons(HK)Limited

- Frialsa Frigorificos SA de CV

- XPO, Inc

- China COSCO Shipping Corporation Limited

- AP Moller-Marsk A/S

- Gateway Distriparks Limited

- SCGJWD Logistics Public Company Limited

- Florida Freezer LP

- DP World

- Raben Group

第七章 市场机会与未来展望

The global food cold chain market size reached USD 70.55 billion in 2025 and is projected to expand to USD 121.77 billion by 2030, representing a robust compound annual growth rate (CAGR) of 11.53% during the forecast period.

This acceleration reflects the convergence of stringent food safety regulations, technological disruptions in temperature monitoring, and the explosive growth of ready-to-eat convenience foods that demand uncompromised cold chain integrity from farm to fork. The market expansion is further supported by rising consumer awareness about food safety, growing international trade of perishable goods, and the rapid development of organized retail sectors across emerging economies. Regulatory momentum is reshaping market dynamics as the FDA's Food Safety Modernization Act (FSMA) 204 mandates comprehensive traceability for foods on the Food Traceability List by January 2026, compelling operators to invest heavily in digital monitoring infrastructure . This regulation specifically impacts high-risk foods such as fresh produce, dairy products, and seafood, requiring companies to maintain records of critical tracking events throughout the supply chain. The implementation of these requirements is driving the adoption of advanced tracking technologies, IoT sensors, and blockchain solutions across the food cold chain industry.

Global Food Cold Chain Market Trends and Insights

Rising Demand for Frozen and Perishable Food Products Globally

The increase in frozen food consumption has changed cold chain capacity requirements globally, with particular impact on warehousing, transportation, and distribution networks. This growth has created high demand for cold storage infrastructure to address supply-demand gaps, leading to significant investments in refrigerated warehouses, temperature-controlled vehicles, and advanced monitoring systems. Consumer behavior changes during the pandemic transformed frozen foods from convenience items to essential products, driving increased purchases across categories including ready meals, vegetables, meat, and seafood, thereby establishing long-term demand patterns that necessitate permanent infrastructure expansion. Cold chain operators emphasize that maintaining consistent temperature controls throughout the supply chain is essential, from production facilities through distribution centers to retail locations, as temperature variations can cause product losses, compromise food safety, trigger costly recalls, and result in regulatory non-compliance. The complexity of temperature management extends to last-mile delivery, where maintaining product integrity requires specialized equipment and precise monitoring protocols.

Growth in International Food Trade and Cross-Border Food Transportation

Cross-border food transportation has evolved into a sophisticated orchestration of temperature-controlled logistics, with China's Ministry of Commerce targeting 25% cold chain circulation rates for fruits and vegetables and 45% for meat by 2027 under its modern commercial circulation system enhancement plan . This regulatory push reflects the critical role of international trade in food security, particularly as climate change and geopolitical tensions disrupt traditional supply chains. The complexity of maintaining temperature integrity across multiple jurisdictions has created opportunities for specialized logistics providers who can navigate varying regulatory requirements while ensuring product quality. The integration of blockchain technology and IoT sensors has become essential for providing end-to-end traceability required by importing countries, transforming cross-border food trade from a logistics challenge into a technology-enabled competitive advantage. Temperature-controlled container shipping has emerged as a critical bottleneck, with specialized reefer containers commanding premium rates due to their sophisticated monitoring and control systems.

High Initial Capital Investment Requirements for Cold Storage Facilities and Refrigerated Transport Vehicles

The capital intensity of cold chain infrastructure creates significant barriers to entry, with specialized construction materials and energy-efficient designs commanding premium costs that can exceed conventional warehousing by 300-400%. The construction of cold facilities requires sophisticated insulation systems, specialized flooring, and advanced refrigeration equipment that must operate reliably in extreme temperature conditions, driving up both initial investment and ongoing maintenance costs. Refrigerated transport vehicles face similar cost pressures, with reefer trucks and trailers requiring double-digit rate increases to justify equipment expansion. The financing challenge is compounded by the specialized nature of cold chain assets, which have limited alternative uses and require specialized maintenance expertise.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Consumer Preference for Fresh and Ready-to-Eat Convenience Foods

- Expansion of Organized Retail and Food Service Sectors

- Competition from Alternative Preservation Methods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cold-chain storage commands the largest market share at 55.66% in 2024, reflecting the fundamental infrastructure requirements for temperature-controlled logistics across all food categories. The segment's dominance stems from the capital-intensive nature of refrigerated warehousing, where specialized facilities with advanced insulation, automated racking systems, and energy-efficient cooling technologies represent the largest cost component in the cold chain ecosystem.

Monitoring components, despite representing a smaller absolute market share, exhibit the fastest growth trajectory at 14.45% CAGR through 2030, driven by regulatory mandates such as FSMA 204 and the increasing sophistication of IoT-enabled temperature tracking systems. The monitoring components segment's rapid expansion reflects a technological inflection point where passive temperature logging is being replaced by real-time, predictive analytics systems that can anticipate equipment failures and optimize energy consumption. Companies like Rivercity Innovations have introduced IoT automated temperature monitoring solutions featuring Early Catastrophic Failure Detection (ECFD) capabilities that predict compressor failures, allowing for timely maintenance and preventing costly product losses.

The chilled temperature range (0-4°C) maintains market leadership with a 60.15% share in 2024, reflecting the broad applicability of this temperature zone across fresh produce, dairy products, and prepared foods that constitute the majority of perishable food consumption. However, the frozen segment (-18°C) demonstrates superior growth momentum with a 15.49% CAGR through 2030, driven by changing consumer preferences toward frozen convenience foods and the expansion of frozen food manufacturing capacity globally.

The frozen segment's growth trajectory has prompted major retailers to invest in dual-temperature facilities that can efficiently manage both chilled and frozen products within the same operation, optimizing space utilization and reducing operational complexity. The Move to -15°C coalition, supported by Emirates SkyCargo and other major logistics providers, represents an industry-wide effort to optimize frozen food transportation by adjusting standard temperatures from -18°C to -15°C, potentially reducing energy consumption while maintaining product quality. This initiative demonstrates how temperature range optimization can create competitive advantages through reduced operational costs and environmental impact, while maintaining food safety standards.

The Food Cold Chain Market Report Segments the Industry Into Type (Cold-Chain Storage, and More), Temperature Range (Chilled (0-4 °C), and More), Transport Mode (Road - Reefer Trucks and Trailers, Sea - Reefer Containers, and More), Application (Fruits and Vegetables, Meat and Seafood, and More), Technology (RFID and Real-Time Monitoring, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 40.46% market share in 2024 reflects decades of infrastructure investment and regulatory development that created the world's most sophisticated cold chain ecosystem, yet the region now confronts modernization challenges as legacy facilities struggle with e-commerce demands and sustainability requirements. Major retailers are responding with strategic investments in automated facilities, exemplified by Walmart and Kroger's development of urban-centric cold storage facilities that reduce transportation distances and improve sustainability metrics. The region benefits from established regulatory frameworks and consumer willingness to pay premium prices for quality assurance, yet faces headwinds from aging infrastructure and the need for substantial capital investment to meet modern operational requirements.

The Asia-Pacific cold chain market is projected to grow at a CAGR of 16.56% through 2030, representing the highest growth rate globally. This expansion is primarily driven by supportive government policies aimed at reducing food waste and improving supply chain efficiency. The rapid urbanization across countries like China, India, and Indonesia has increased demand for temperature-controlled storage and transportation services. In India, the Pradhan Mantri Kisan Sampada Yojana has approved 394 cold chain projects as of February 2025. These projects focus on establishing integrated cold chain facilities, including refrigerated transportation, cold storage units, and processing centers. The initiative supports India's expanding food processing industry by enabling better preservation of perishable goods, reducing post-harvest losses, and ensuring food safety standards. The program also promotes private sector investment in cold chain infrastructure development, creating a more robust and efficient food distribution system.

Europe maintains steady growth supported by stringent food safety regulations, cross-border trade facilitation, and sustainability initiatives that are reshaping cold chain operations across the continent. The region's focus on sustainability has accelerated the adoption of emission-free refrigerated trailers and advanced digitalization technologies, including digital twin systems for real-time data management that optimize energy consumption and operational efficiency. The region's mature regulatory environment and consumer preferences for fresh, locally sourced foods continue to drive demand for sophisticated cold chain solutions that can maintain product quality while minimizing environmental impact.

- Lineage, Inc.

- Americold Logistics, Inc.

- Nichirei Corporation

- DSV A/S

- Conestoga Cold Storage Limited

- STEF

- RLS Logistics

- NewCold Cooperatief UA

- Burris Logistics

- Congebec Logistics Inc.

- John Swire & Sons (H.K.) Limited

- Frialsa Frigorificos S.A. de C.V.

- XPO, Inc

- China COSCO Shipping Corporation Limited

- A.P. Moller - Marsk A/S

- Gateway Distriparks Limited

- SCGJWD Logistics Public Company Limited

- Florida Freezer LP

- DP World

- Raben Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for frozen and perishable food products globally

- 4.2.2 Growth in international food trade and cross-border food transportation

- 4.2.3 Increasing consumer preference for fresh and ready-to-eat convenience foods

- 4.2.4 Expansion of organized retail and food service sectors

- 4.2.5 Technological advancements in refrigeration and temperature monitoring systems

- 4.2.6 Implementation of strict food safety regulations and quality standards

- 4.3 Market Restraints

- 4.3.1 High initial capital investment requirements for cold storage facilities and refrigerated transport vehicles

- 4.3.2 Power-supply volatility in emerging markets

- 4.3.3 Temperature control challenges during transportation and storage transitions

- 4.3.4 Competition from alternative preservation methods

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Cold-chain Storage

- 5.1.2 Cold-chain Transport

- 5.1.3 Monitoring Components

- 5.2 By Temperature Range

- 5.2.1 Chilled (0-4 °C)

- 5.2.2 Frozen (-18 °C)

- 5.2.3 Deep-Frozen/Ultra-low (<-40 °C)

- 5.3 By Transport Mode

- 5.3.1 Road - Reefer Trucks and Trailers

- 5.3.2 Sea - Reefer Containers

- 5.3.3 Rail - Refrigerated Railcars

- 5.3.4 Air Cargo

- 5.4 By Application

- 5.4.1 Fruits and Vegetables

- 5.4.2 Meat and Seafood

- 5.4.3 Dairy and Frozen Dessert

- 5.4.4 Bakery and Confectionery

- 5.4.5 Ready-to-Eat Meals

- 5.4.6 Other Applications

- 5.5 By Technology

- 5.5.1 RFID and Real-time Monitoring

- 5.5.2 IoT-Enabled Telematics

- 5.5.3 Automated Storage and Retrieval Systems

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Lineage, Inc.

- 6.4.2 Americold Logistics, Inc.

- 6.4.3 Nichirei Corporation

- 6.4.4 DSV A/S

- 6.4.5 Conestoga Cold Storage Limited

- 6.4.6 STEF

- 6.4.7 RLS Logistics

- 6.4.8 NewCold Cooperatief UA

- 6.4.9 Burris Logistics

- 6.4.10 Congebec Logistics Inc.

- 6.4.11 John Swire & Sons (H.K.) Limited

- 6.4.12 Frialsa Frigorificos S.A. de C.V.

- 6.4.13 XPO, Inc

- 6.4.14 China COSCO Shipping Corporation Limited

- 6.4.15 A.P. Moller - Marsk A/S

- 6.4.16 Gateway Distriparks Limited

- 6.4.17 SCGJWD Logistics Public Company Limited

- 6.4.18 Florida Freezer LP

- 6.4.19 DP World

- 6.4.20 Raben Group