|

市场调查报告书

商品编码

1844562

汽车摄影机:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

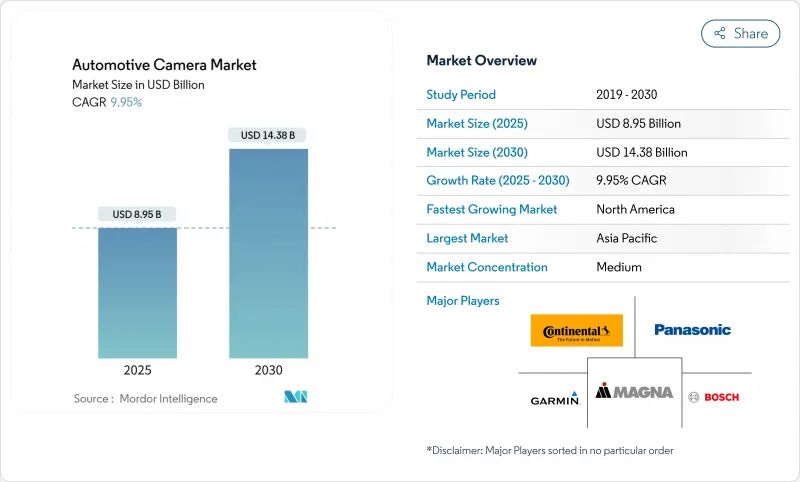

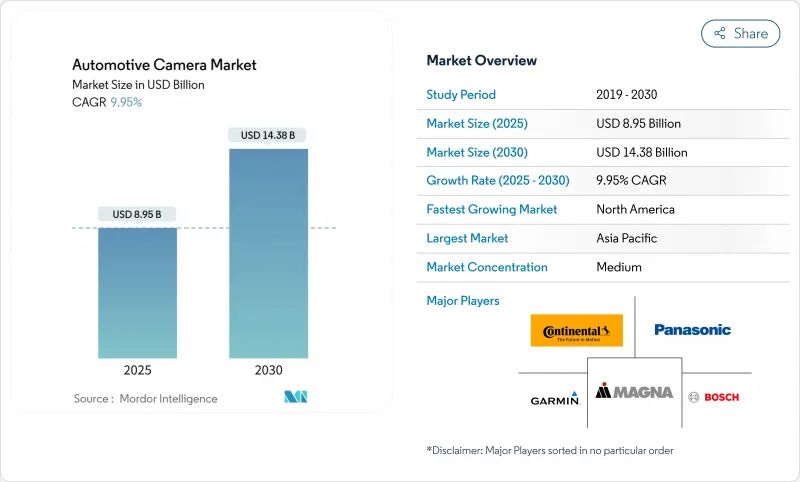

预计汽车摄影机市场规模在 2025 年将达到 89.5 亿美元,在 2030 年将达到 143.8 亿美元,2025 年至 2030 年的复合年增长率为 9.95%。

更严格的法规、汽车自动化以及不断下降的 CMOS 感测器成本共同推动了单位产量和平均售价的成长,推动汽车摄影机市场达到两位数成长。欧盟、美国和中国的安全法规越来越严格,要求摄影机具备自动紧急煞车、智慧速度辅助和驾驶员监控等功能,这使得摄影机成为现代汽车设计中不可或缺的核心元素。汽车製造商也将多摄影机阵列视为实现 2 级以上自动驾驶的最低成本途径,从而加速了中价格分布车型的全平台采用。同时,热成像和近红外线技术将性能范围扩展到夜间和恶劣天气场景,为高端升级创造了机会。最后,预计到 2024 年和 2025 年晶圆成本将下降,这将降低材料成本,使原始设备製造商能够在车辆中安装更多摄影机而不会提高标价。

全球汽车摄影机市场趋势与洞察

美国、欧盟和中国的安全摄影机强制要求

安全法规趋同迫使原始设备製造商将多摄影机套件整合到所有新车平台中。欧盟的《通用安全法规 II》将于 2024 年 7 月生效,要求车辆配备前置摄像头,用于车道维持、智慧速度辅助和紧急煞车。中国 2024 年新车安全评鑑协会 (NCAP) 将根据驾驶员监控的准确性对车辆进行评级,实际上要求配备红外线座舱摄影机。在美国,NHTSA 于 2024 年最终确定的规则将要求在时速高达 90 英里的情况下进行行人侦测的自动紧急制动,并明确要求配备可在黑暗中看清的红外线感测器。因此,汽车製造商正在寻求能够同时满足这三项法规的摄影机架构,以加快全球设计週期。拥有可扩展参考设计的供应商正在从大量生产平台赢得新的 RFQ。这种监管协调使安全摄影机成为一种基本商品而非差异化因素,从而推高了汽车摄影机的整体出货量。

ADAS 和自动驾驶的普及

2级以上驾驶能力正从高端豪华车向大众市场的C级车迈进。 Mobileye的SuperVision平台目前已搭载于大众的MQB平台,使用多达11个摄影机进行环景感知和高解析度道路参考。SONY预测,到2027财年,每辆车将配备12个摄影机,高于目前的8个。 AI感测器内建功能允许即时视觉演算法在边缘晶片上运行,从而降低系统延迟和布线复杂性。自动化程度的提高允许投资更多摄影机,从而形成成本效益循环。最终结果是,随着车辆数量的增加,摄影机的平均售价也将随之上涨,到2030年,汽车摄影机市场的复合年增长率将达到2.1个百分点。

多摄像头 BOM 成本

目前,一套完整的ADAS系统需要8-12个摄像头,单位成本根据解析度不同,在20美元到500美元之间。对于注重价值的品牌而言,摄影机的成本可能高达车辆材料成本的3%,从而挤压利润空间。福特汽车公司于2025年因后置摄影机软体缺陷召回了107.5万辆汽车,凸显了复杂性的增加可能导致净利率失效。一级供应商正在采用整合视觉ECU和单线缆架构来应对这项挑战,但短期内成本压力将使汽车摄影机市场的复合年增长率降低1.8个百分点。

細項分析

预计到2024年,乘用车摄影机市场规模将达到60亿美元,占全球销售额的67.23%。目前规模较小的轻型商用车市场,预计到2030年将以11.51%的复合年增长率成长,超过整体成长速度。车队车主正在采用摄影机来降低保险成本、减少碰撞事故,并支援基于远端资讯处理的驾驶员评分。沃尔沃卡车报告称,摄影机监控系统取代传统后视镜可节省2%的燃油。因此,能够量化投资报酬率的物流公司对汽车摄影机市场的采购量正在增加。

乘用车凭藉其大规模生产和消费者对安全套件的付费意愿,继续保持主导地位。到2025年,ADAS在新型轻型车辆的普及率将超过90%,确保稳定的安装基数。在重型卡车领域,摄影机的普及与欧盟GSR II盲点侦测规则等监管里程碑相吻合。 Stoneridge的MirrorEye系统已安装在Freightliner Cascadia重型卡车上,并展示了八个摄影机的冗余功能。节省成本的模组和经过验证的车队成本节省相结合,正在推动整个商用领域的车载摄影机市场实现两位数成长。

2024年,全景摄影机的收入份额将维持57.33%,其中倒车影像、环视摄影机和后视镜替换功能将推动车载摄影机市场份额的成长。然而,由于OEM厂商更重视感知而非显示,感测和立体摄影机的复合年增长率将达到13.44%。斯巴鲁的下一代EyeSight系统采用了安森美半导体的Hyperlux AR0823AT感测器,可提供先前仅限于光达的车道居中精度。目前,日本正在对深度感知立体钻机检验,以用于L3级自动驾驶系统(ADS),从而支援其更广泛的应用。随着感测摄影机逐渐普及到价格更实惠的车型,感知细分市场中的车载摄影机市场规模预计将缩小与传统全景摄影机类别的差距。

传统的视觉系统也将不断发展,配备更高的 HDR 和即使在路面污垢中也能保持清晰度的显示涂层。汽车製造商正在整合鸟瞰计算马赛克技术,这需要四个摄影机之间实现帧精度同步,这迫使供应商提供低偏斜的成像仪。 Foresight 的立体演算法套件能够在低于 0.05 勒克斯的光照条件下实现物体侦测,这使得感测摄影机成为雷射雷达的经济高效的替代方案。总体而言,基于影像的感知优势和更低的物料清单成本正在推动汽车摄影机市场朝向智慧化方向发展。

车载摄影机市场报告按车辆类型(乘用车、轻型商用车等)、类型(视野(环/后视/前视/内视等))、技术(数位(CMOS等))、应用(泊车辅助等)、销售管道(OEM安装等)和地区进行细分。以上所有细分市场的市场规模和预测均以价值(美元)为单位提供。

区域分析

受中国生产规模和日本半导体领先地位的推动,到2024年,亚太地区将占据汽车摄影机市场的40.32%。SONY的目标是到2026财年大幅扩大其全球汽车影像感测器市场份额,并正在加强其区域供应链的竞争力。北京的智慧汽车蓝图支援L2+系统,并将多摄影机套件作为经济型电动车的标准配备。韩国汽车厂商正在为其所有新SUV配备先进的环景显示,并由本地生产的感测器和镜头提供支援。这些政策和产业深度巩固了亚太地区在汽车摄影机市场的地位。

受消费者对高端安全功能需求与美国国家公路交通安全管理局(NHTSA)强制要求的整合所推动,北美将在2024年占据26.22%的市场份额。美国已颁布法规,要求在2029年之前实现自动紧急制动,鼓励儘早采用摄像头,以便将检验成本分摊到更长的周期内。加拿大各省正在为行车记录器提供车辆保险回扣,并扩大改装池。硅谷晶片公司正在提供边缘AI参考设计,以加速国内OEM厂商的上市时间。这些因素正在推动该地区汽车摄影机市场的强劲扩张。

欧洲占23.29%的市场份额,这得益于GSR II颁布的首部基于摄影机的综合安全法规。德国豪华品牌正在安装多达10个摄像头,以在欧洲新车安全评价协会(Euro NCAP)中获得五星级评级。欧盟的电子后视镜认证为电动车製造商采用虚拟后视镜以达到减阻效果带来了一股清流。然而,GDPR实施了严格的资料处理规则,限制了更广泛的分析,导致其成长速度略低于亚太地区。

受波湾合作理事会国家强制安全设备和都市化进程的推动,中东和非洲地区将在2024年占据6.76%的销售额。沙乌地阿拉伯新兴的汽车分视摄影机生态系统正在推动国内组装。南美的份额将维持在5%,但巴西计划在2026年达到联合国欧洲经济委员会(ECE)后视摄影机标准,从而设定一个多年的升级週期。整体而言,由于监管时间安排不同,汽车摄影机市场在地理上呈现分散性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 美国、欧盟和中国的安全摄影机强制要求

- ADAS和自动驾驶的普及

- 停车/360 度视角消费者拉动

- CMOS-AI成本通货紧缩

- 利用电子后视镜减少电动车的阻力

- 加强驾驶员监控规定

- 市场限制

- 多摄像头 BOM 成本

- 网路安全和隐私风险

- 红外线玻璃供不应求

- CMS规则制定的不确定性

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测(单位:美元)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 按相机类型

- 观看(环绕/后方/前方/内部)

- 感测/立体摄影机

- 依技术

- 数位(CMOS)

- 红外线(NIR)

- 红外线(长波红外线)

- 按用途

- 停车辅助系统

- ADAS(进阶驾驶辅助系统)

- 驾驶员监控和车厢安全

- 按销售管道

- OEM安装

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Continental AG

- Magna International Inc.

- Valeo SA

- ZF Friedrichshafen AG

- Gentex Corporation

- Autoliv Inc.

- Hella GmbH & Co KGaA

- Panasonic Corp.

- Garmin Ltd

- Denso Corp.

- Mobileye NV

- Aptiv PLC

- onsemi(Semiconductor Components Industries LLC)

- Ambarella Inc.

- Mitsubishi Electric Corp.

- Hyundai Mobis

第七章 市场机会与未来展望

The automotive camera market size is valued at USD 8.95 billion in 2025 and is forecast to reach USD 14.38 billion by 2030, advancing at a 9.95% CAGR during 2025-2030.

A synchronized wave of regulatory mandates, rising vehicle automation, and falling CMOS sensor costs is lifting both unit volumes and ASPs, pushing the automotive camera market size toward double-digit growth. Tightened safety rules in the European Union, the United States, and China now require camera-enabled functions such as automated emergency braking, intelligent speed assistance, and driver monitoring, making cameras a non-negotiable core of modern vehicle design. Automakers also view multi-camera arrays as the lowest-cost path to Level 2+ autonomy, which is accelerating platform-wide adoption across mid-priced models. At the same time, thermal and near-infrared technologies are broadening the performance envelope into night and bad-weather scenarios, opening premium upgrade opportunities. Finally, wafer cost deflation throughout 2024 and expected through 2025 is shrinking the bill-of-materials, letting OEMs fit more cameras per vehicle without inflating sticker prices.

Global Automotive Camera Market Trends and Insights

Safety-camera mandates in US, EU & China

A convergence of safety regulations is forcing OEMs to integrate multi-camera suites in every new vehicle platform. The European Union's General Safety Regulation II, effective July 2024, compels forward-facing cameras for lane keeping, intelligent speed assistance, and emergency braking. China's 2024 NCAP now scores driver-monitoring accuracy, effectively requiring infrared cabin cameras. In the United States, the NHTSA rule finalized in 2024 obliges automatic emergency braking with pedestrian detection up to 90 mph, creating a clear pull for thermal sensors that can see in darkness. Automakers, therefore, seek camera architectures that meet all three regimes simultaneously, accelerating global design cycles. Suppliers equipped with scalable reference designs are winning new RFQs from volume platforms. Regulatory alignment is thus turning safety cameras into a baseline commodity rather than a differentiator, lifting overall shipment volumes across the automotive camera market.

ADAS & autonomy penetration

Level 2+ driving functions are shifting from premium nameplates to mass-market C-segment vehicles. Mobileye's SuperVision platform now powers Volkswagen's MQB models, using up to 11 cameras for surround sensing and high-definition road referencing. Sony forecasts each vehicle will embed 12 cameras by fiscal 2027, up from 8 today. AI-on-sensor capabilities let real-time vision algorithms run on edge silicon, trimming system latency and wiring complexity. In turn, higher automation creates a payback for more cameras, closing the cost-benefit loop. The net effect is an upward shift in camera ASPs alongside ballooning unit counts, underpinning an incremental 2.1-percentage-point lift in the automotive camera market CAGR through 2030.

Multi-camera BOM cost

Comprehensive ADAS stacks now need 8-12 cameras, yet unit prices range from USD 20 to USD 500, depending on resolution. For value-oriented nameplates, cameras can consume up to 3% of vehicle material cost, squeezing margins. Ford's 2025 recall of 1.075 million vehicles over rear camera software faults underscores the warranty exposure linked with added complexity. Tier 1 suppliers are responding with consolidated vision ECUs and single-cable architectures, but near-term cost headwinds still trim 1.8 percentage points from the automotive camera market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Parking/360-view consumer pull

- Driver-monitoring regulation momentum

- Cyber-security & privacy risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The automotive camera market size for passenger vehicles stood at USD 6 billion in 2024, equal to 67.23% of global revenue. Light commercial vehicles, while smaller today, are expanding at an 11.51% CAGR through 2030, outpacing overall growth. Fleet owners embrace cameras to trim insurance costs, curb collisions, and support telematics-based driver scoring. Volvo Trucks reports fuel savings of 2% when camera monitor systems replace traditional mirrors. The automotive camera market, therefore, sees rising procurement from logistics firms that can quantify ROI.

Passenger cars keep leadership because of scale production and consumer willingness to pay for safety packs. ADAS penetration exceeded 90% in new light-duty vehicles in 2025, ensuring a stable installed base. In heavy trucks, camera adoption aligns with regulatory milestones such as the EU's GSR II blind-spot detection rule. Stoneridge's MirrorEye system on Freightliner Cascadia heavy trucks has demonstrated 8-camera redundancy that may later cascade to consumer SUVs. The blend of cost-down modules and proven fleet savings sustains a double-digit rise in the automotive camera market across commercial segments.

Viewing cameras retained a 57.33% revenue share in 2024, anchoring the automotive camera market share around reversing, surround, and mirror replacement functions. Yet, sensing and stereo units are scaling at 13.44% CAGR as OEMs prioritize perception over display. Subaru's next-gen EyeSight leverages onsemi Hyperlux AR0823AT sensors to offer lane-centering precision previously limited to lidar setups. Depth-perception stereo rigs are now validated to Automated Driving Systems (ADS) Level 3 in Japan, driving broader uptake. As sensing cameras migrate into affordable trims, the automotive camera market size within perception sub-segments will narrow the gap against legacy viewing categories.

Traditional viewing systems evolve too, with higher HDR and de-spray coatings that maintain clarity in road grime. Automakers are integrating bird-eye computational mosaics that require frame-accurate synchronization across four cameras, pushing suppliers to deliver low-skew imagers. Foresight's stereo algorithm bundles deliver object detection at sub-0.05 lux, positioning sensing cameras as a cost-effective alternative to lidar. Overall, image-based perception advantages and falling BOMs are pivoting growth toward the intelligence end of the automotive camera market.

The Automotive Camera Market Report is Segmented by Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, and More), Type (Viewing (Surround/Rear/Front/Interior) and More), Technology (Digital (CMOS), and More), Application (Park Assist and More), Sales Channel (OEM-Installed and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD) and for all the Above Segments.

Geography Analysis

Asia-Pacific dominated the automotive camera market with a 40.32% share in 2024, buoyed by China's production scale and Japan's semiconductor leadership. Sony targets a significant global share in automotive imagers by fiscal 2026, reinforcing regional supply-chain competitiveness. Beijing's smart-vehicle roadmap subsidizes Level 2+ systems, making multi-camera packages standard even in economy EVs. South Korea's OEMs embed advanced surround-view on every new SUV, underpinned by local sensor and lens fabrication. Such a policy and industrial depth secure APAC's anchor position in the automotive camera market.

North America held a 26.22% share in 2024 as consumer demand for high-end safety features dovetailed with NHTSA mandates. The U.S. rule obliging automatic emergency braking by 2029 incentivizes early camera adoption to spread validation costs over longer cycles. Canadian provinces offer fleet insurance rebates for dash-cams, expanding the retrofit pool. Silicon Valley chip firms provide edge-AI reference designs that reduce time-to-market for domestic OEMs. These factors keep the region's automotive camera market on a firm expansion track.

Europe captured 23.29% share, driven by being first to legislate comprehensive camera-based safety under GSR II. German luxury brands equip vehicles with up to 10 cameras to secure 5-Star Euro NCAP scores. The bloc's e-mirror approval delivers a fresh windfall as EV makers adopt drag-cutting virtual mirrors. However, GDPR imposes strict data processing rules that limit broader analytics, slightly moderating growth relative to APAC.

The Middle East and Africa region accounted for 6.76% of 2024 revenue, thanks to safety-equipment mandates in Gulf Cooperation Council states and expanding urbanization. Saudi Arabia's emerging automotive split-view camera ecosystem underpins domestic assembly ambitions. South America remained at 5% share, yet Brazil's 2026 plan to align with UN ECE rearview camera standards sets a multi-year upgrade cycle. Overall, differential regulation timing drives geographic dispersion within the automotive camera market.

- Robert Bosch GmbH

- Continental AG

- Magna International Inc.

- Valeo SA

- ZF Friedrichshafen AG

- Gentex Corporation

- Autoliv Inc.

- Hella GmbH & Co KGaA

- Panasonic Corp.

- Garmin Ltd

- Denso Corp.

- Mobileye N.V.

- Aptiv PLC

- onsemi (Semiconductor Components Industries LLC)

- Ambarella Inc.

- Mitsubishi Electric Corp.

- Hyundai Mobis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Safety-camera mandates in US, EU & China

- 4.2.2 ADAS & autonomy penetration

- 4.2.3 Parking/360-view consumer pull

- 4.2.4 CMOS-AI cost deflation

- 4.2.5 EV drag-reduction via e-mirrors

- 4.2.6 Driver-monitoring regulation momentum

- 4.3 Market Restraints

- 4.3.1 Multi-camera BOM cost

- 4.3.2 Cyber-security & privacy risks

- 4.3.3 IR-glass supply crunch

- 4.3.4 CMS rule-making uncertainty

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.2 By Camera Type

- 5.2.1 Viewing (Surround/Rear/Front/Interior)

- 5.2.2 Sensing / Stereo Cameras

- 5.3 By Technology

- 5.3.1 Digital (CMOS)

- 5.3.2 Infra-red (NIR)

- 5.3.3 Thermal (LWIR)

- 5.4 By Application

- 5.4.1 Park Assist

- 5.4.2 Advanced Driver Assistance Systems (ADAS)

- 5.4.3 Driver Monitoring & Cabin Safety

- 5.5 By Sales Channel

- 5.5.1 OEM-Installed

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Saudi Arabia

- 5.6.4.2 United Arab Emirates

- 5.6.4.3 South Africa

- 5.6.4.4 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Magna International Inc.

- 6.4.4 Valeo SA

- 6.4.5 ZF Friedrichshafen AG

- 6.4.6 Gentex Corporation

- 6.4.7 Autoliv Inc.

- 6.4.8 Hella GmbH & Co KGaA

- 6.4.9 Panasonic Corp.

- 6.4.10 Garmin Ltd

- 6.4.11 Denso Corp.

- 6.4.12 Mobileye N.V.

- 6.4.13 Aptiv PLC

- 6.4.14 onsemi (Semiconductor Components Industries LLC)

- 6.4.15 Ambarella Inc.

- 6.4.16 Mitsubishi Electric Corp.

- 6.4.17 Hyundai Mobis

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment