|

市场调查报告书

商品编码

1844567

分子筛:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Zeolite Molecular Sieves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

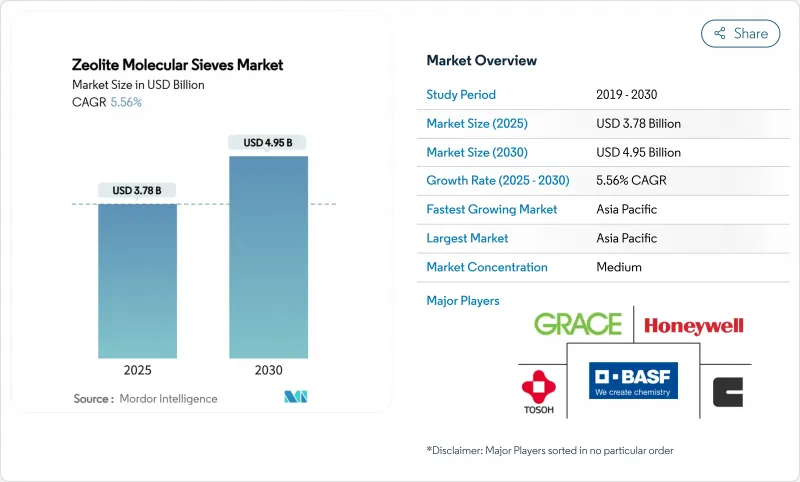

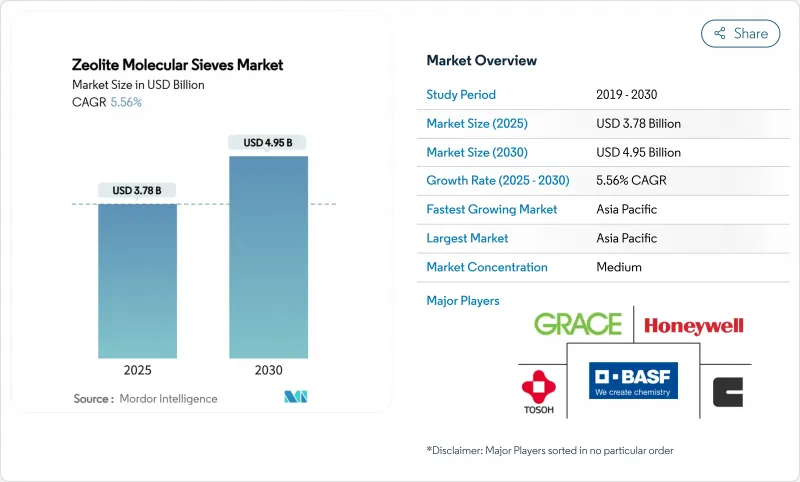

沸石分子筛市场规模预计在 2025 年达到 37.8 亿美元,预计到 2030 年将达到 49.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.56%。

需求成长受到四种结构性力量的催化作用:更严格的环境法规要求替代清洁剂中的磷酸盐,全球石化综合体的产能不断提高,新兴经济体的快速都市化推动了卫生产品的使用,以及加速追求有利于基于沸石的吸附和催化的低碳工业流程。竞争差异化依赖专有的合成技术,该技术可根据特定的分离和催化作用定制孔径、二氧化硅与氧化铝的比例以及晶体形态。虽然氧化铝和高纯度二氧化硅原料的成本波动对利润构成挑战,但循环原料策略,特别是煤飞灰和其他工业残渣的转化,正在降低原料风险,同时支持企业的永续性目标。碳捕获和 PFAS 修復的突破性进展正在拓展商业性前沿,并将先进的沸石配方定位为下一代环境系统中活性碳和胺溶剂的可行替代品。

全球沸石分子筛趋势与洞察

禁止在清洁剂中使用磷酸盐,促使建筑商转向使用沸石

由于水体富营养化风险,全球清洁剂法规禁止使用磷酸盐,助洗剂需求转向沸石 4A。欧盟 (EU) 于 2017 年禁止使用磷酸盐,导致磷酸盐年消耗量减少 250 万吨。目前,沸石以粉末和液体形式取代了其中约 60% 的消耗量。北美也有类似的法规,而印度和巴西的法规也日益严格,这使得产量维持可预测的成长。沸石 4A 比碳酸盐具有更高的钙结合能力,即使在硬水地区也能确保洗涤效果。跨国清洁剂品牌已将沸石助洗剂纳入其全球产品组合,从技术和商业性来看,这种逆转不太可能发生。新兴国家准备将无磷酸盐法规延长至 2027 年,将加强沸石分子筛市场的长期需求轨迹。

石化脱水和气体纯化繁荣

中国、印度和沙乌地阿拉伯对新乙烯和丙烯联合装置的投资超过 500 亿美元,这推动了对 3A 和 4A分子筛的需求,这些分子筛可对裂解气进行脱水并将二氧化碳去除至百万分之一的水平。单一全球规模的乙烯裂解装置会消耗 500 至 800 吨分子筛,用于初始装载和年度补充。由于传统型原料的高水分和酸性气体负荷,北美页岩气的成长正在加速这一趋势。合成技术的最新进展已经生产出具有增强的传质性能的更大的沸石晶体,将再生能源需求降低了 25%,并降低了石化运营商的生命週期成本。因此,沸石分子筛市场有望从以更高纯度规格为目标的维修绿地计画和修井作业中吸引越来越多的需求。

洗衣配方中酵素和化学品的替代品

高端清洁剂品牌越来越青睐蛋白酶和脂肪酶,它们以较低的用量提供相当的去污效果,可使液体配方中的沸石含量减少高达20%。聚羧酸盐和磷酸酯洗剂在浓缩液中易于分散,而沸石的不溶性使加工和包装变得复杂。由于液体清洁剂是新兴市场成长最快的类别,高端市场的沸石使用量面临下降的风险。然而,尤其是在新兴经济体,粉末清洁剂和低价产品仍依赖4A沸石来控制硬度,减轻了对整个沸石分子筛市场的影响。

細項分析

到2024年,合成A型沸石将占据全球销售量的57.89%,这得益于精确的硅铝比控制,从而能够设计出适用于石化脱水和分离应用的孔径。成本优化的热液合成、微波辅助合成和无模板合成技术,在持续提高产品纯度的同时,能耗降低了35%。相较之下,天然斜发沸石和丝光沸石的复合年增长率为6.12%,主要应用于农业、气味控制和低压水处理领域,这些领域的性价比优于晶体完整性。土耳其和保加利亚的天然矿床提供的矿石只需极少的离子交换即可达到规格要求,带来30%-40%的成本优势。欧盟绿色新政等法规对非合成矿物的青睐,进一步推动了它们的应用。展望未来,合成沸石将在高压脱水和催化作用保持其地位,而天然沸石将越来越多地占据环境和农业领域,在沸石分子筛市场中开闢互补的成长通道。

沸石分子筛报告按原料(天然沸石和合成沸石)、最终用户产业(清洁剂、石化和炼油、工业气体生产、废弃物和水处理、空气净化和暖通空调、农业和动物饲料、其他终端用户产业)和地区(亚太地区、北美、欧洲、南美、中东和非洲)细分。

区域分析

至2024年,亚太地区将贡献全球37.56%的收入,复合年增长率为6.21%。中国在乙烯裂解装置和煤化工联合装置的投资方面处于领先地位,每个装置都需要数百吨分子筛用于脱水。亚太地区的生产规模、日益严格的环保规范以及庞大的消费群,共同推动其在该地区的领先地位。中国浙江省和广东省的乙烯计划要求分子筛脱水装置将水分去除至1 ppm以下,而当地污水标准对氨含量有所限制,刺激了沸石三级脱水系统的推广。

北美是该技术成熟且潜力巨大的市场。德克萨斯州页岩气加工厂正在部署3A分子筛,用于在低温NGL回收之前去除水分,以期提高效率并延长床层寿命。美国关于PFAS排放的提案正在加速高硅沸石的测试,这种沸石可以捕获PPT级的全氟烷基化合物,这将为特种产品製造商创造新的收益来源。

欧洲优先考虑永续性和循环性。德国和荷兰的工厂正在商业规模检验飞灰衍生沸石,与原生矿物路线相比,实现了40%的体积碳减量。中东和非洲正在应对石化产品多样化和水资源短缺问题。沙乌地阿拉伯的「愿景2030」树脂工厂依赖大型分子筛塔进行原料製备。南非的采矿业正在采用斜发沸石净化酸性矿山废水,受益于其国内天然矿床,降低了进口成本。总而言之,这些区域发展代表着沸石分子筛市场地理范围的不断扩大。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 禁止在清洁剂中使用磷酸盐,导致助洗剂转向使用沸石

- 石化脱水和气体纯化繁荣

- 严格的污水排放法规

- 新兴国家卫生主导的清洁剂需求

- 生物精炼转向形状选择性催化剂

- 市场限制

- 洗衣配方中酵素和化学品的替代品

- 挥发性氧化铝/二氧化硅原料价格

- ESG投资者质疑高能源足迹

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按原料

- 天然沸石

- 合成沸石

- 按最终用户产业

- 清洁剂

- 石化和炼油

- 工业气体生产

- 废弃物和水处理

- 空气净化及暖通空调

- 农业和饲料

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Arkema

- Axens

- BASF

- CLARIANT

- CWK Chemiewerk Bad Kostritz GmbH

- HengYe Inc.

- Honeywell International Inc.

- JIUZHOU CHEMICALS

- KMI Zeolite Inc.

- KNT Group

- KURARAY CO., LTD.

- Luoyang Jalon Micro-Nano New Material

- Sorbchem India Pvt Ltd.

- Tosoh Corporation

- WR Grace & Co.

- Zeochem

- Zeolyst International

第七章 市场机会与未来展望

The Zeolite Molecular Sieves Market size is estimated at USD 3.78 billion in 2025, and is expected to reach USD 4.95 billion by 2030, at a CAGR of 5.56% during the forecast period (2025-2030).

Demand growth is anchored in four structural forces: tightening environmental regulations that substitute phosphates in detergents, capacity additions across global petrochemical complexes, rapid urbanization in emerging economies that drives hygiene product uptake, and the accelerated pursuit of low-carbon industrial processes that favor zeolite-based adsorption and catalysis. Competitive differentiation rests on proprietary synthesis know-how that tailors pore size, silica-to-alumina ratio, and crystal morphology to specific separation or catalytic duties. Cost volatility in alumina and high-purity silica feedstocks poses a margin challenge, but circular feedstock strategies, especially the conversion of coal fly ash and other industrial residues, are mitigating raw-material risk while supporting corporate sustainability goals. Breakthrough deployments in carbon-capture and PFAS remediation are expanding the commercial frontier, positioning advanced zeolite formulations as viable alternatives to activated carbon and amine solvents in next-generation environmental systems

Global Zeolite Molecular Sieves Market Trends and Insights

Phosphate Bans in Detergents Shifting Builders to Zeolites

Global detergent regulations prohibit phosphates because of eutrophication risks, redirecting builder demand toward zeolite 4A. The European Union's 2017 ban eliminated 2.5 million tons of phosphate consumption annually, and zeolites now replace roughly 60% of that volume in both powder and liquid formulations. Similar mandates in North America, along with phased restrictions in India and Brazil, sustain predictable volume growth. Performance advantages compound the regulatory pull: zeolite 4A exhibits higher calcium-binding capacity than carbonates, securing wash performance in hard-water regions. Multinational detergent brands have embedded zeolite builders across their global portfolios, making a reversal technically and commercially unlikely. Emerging economies are poised to expand phosphate-free regulations through 2027, reinforcing the long-run demand trajectory for the zeolite molecular sieve market.

Petrochemical Dehydration and Gas-Purification Boom

Investment exceeding USD 50 billion in new ethylene and propylene complexes across China, India, and Saudi Arabia is elevating demand for 3A and 4A molecular sieves that dehydrate cracked gas and strip CO2 to parts-per-million levels. A single world-scale ethylene cracker consumes 500-800 tons of sieves in initial charging and annual top-ups. Shale-gas growth in North America accelerates the trend, because unconventional feedstocks carry higher moisture and acid-gas loads. Recent synthesis advances have produced larger zeolite crystals with enhanced mass-transfer characteristics, cutting regeneration energy by 25% and reducing lifecycle cost for petrochemical operators. Consequently, the zeolite molecular sieve market is poised to capture incremental offtake from greenfield projects and from revamps that target higher purity specifications.

Enzyme and Chemical Substitutes in Laundry Formulations

Premium detergent brands increasingly favor protease and lipase enzymes that deliver comparable soil removal at lower builder dosage, cutting zeolite content by up to 20% in liquid formats. Polycarboxylate and phosphonate builders disperse easily in concentrated liquids, where zeolite's insolubility complicates processing and packaging. As liquid detergents represent the fastest-growing category in developed markets, zeolite volumes risk erosion in the top-tier segment. Yet powder detergents and value-priced products, particularly in emerging economies, still depend on zeolite 4A for hardness control, mitigating the overall impact on the zeolite molecular sieve market.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Wastewater Discharge Norms

- Hygiene-Driven Detergent Demand in Emerging Economies

- Volatile Alumina/Silica Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic zeolite A captured 57.89% of global volume in 2024 thanks to precise Si/Al control that engineers pore size for petrochemical dehydration and separation tasks. Cost-optimized hydrothermal, microwave-assisted, and template-free syntheses continue to elevate product purity while trimming energy consumption by 35%. In contrast, natural clinoptilolite and mordenite grades are growing at 6.12% CAGR, primarily in agriculture, odor control, and low-pressure water treatment applications where the performance-to-price ratio outranks crystal perfection. Natural deposits in Turkey and Bulgaria deliver ore that requires minimal ion-exchange to reach specification, offering a 30-40% cost edge. Regulatory drivers such as the EU's Green Deal favor non-synthetic minerals, further stimulating adoption. Looking forward, synthetic grades maintain their hold in high-pressure dehydration and catalysis, but natural zeolites increasingly claim environmental and agricultural niches, carving a complementary growth lane within the zeolite molecular sieve market.

The Zeolite Molecular Sieve Report is Segmented by Raw Material (Natural Zeolite and Synthetic Zeolite), End-User Industry (Detergents, Petrochemical and Refining, Industrial Gas Production, Waste and Water Treatment, Air Purification and HVAC, and Agriculture and Animal Feed, Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia Pacific generated 37.56% of global sales in 2024 and is set to grow at a 6.21% CAGR. China spearheads investment in ethylene crackers and coal-to-chemicals complexes, each requiring hundreds of tons of molecular sieves for dehydration duty. Asia Pacific's convergence of production scale, tightening environmental norms, and large consumer bases drives the region's leadership. China's Zhejiang and Guangdong ethylene projects require molecular-sieve dehydration units that remove moisture to below 1 ppm, while local wastewater standards enforce ammonia limits that spur zeolite tertiary systems.

North America exhibits mature but technology-rich demand. Shale-gas processing plants in Texas deploy 3A molecular sieves to strip moisture before cryogenic NGL recovery, seeking higher efficiency and longer bed life. EPA PFAS discharge proposals accelerate trials of high-silica zeolites that capture perfluoro-alkyl compounds at parts-per-trillion levels, an emerging revenue stream for specialty producers.

Europe prioritizes sustainability and circularity. Plants in Germany and the Netherlands validate fly-ash-derived zeolites at commercial scale, delivering 40% embodied-carbon reduction relative to virgin mineral routes. Middle-East and Africa capitalize on petrochemical diversification and water scarcity. Saudi Arabia's Vision 2030 resin capacities rely on large-format molecular-sieve towers for feedstock preparation. South Africa's mining sector adopts clinoptilolite for acid-mine drainage remediation, benefitting from domestic natural deposits that eliminate import costs. Collectively, these regional developments underscore the expanding geographic canvas for the zeolite molecular sieve market.

- Arkema

- Axens

- BASF

- CLARIANT

- CWK Chemiewerk Bad Kostritz GmbH

- HengYe Inc.

- Honeywell International Inc.

- JIUZHOU CHEMICALS

- KMI Zeolite Inc.

- KNT Group

- KURARAY CO., LTD.

- Luoyang Jalon Micro-Nano New Material

- Sorbchem India Pvt Ltd.

- Tosoh Corporation

- W. R. Grace & Co.

- Zeochem

- Zeolyst International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Phosphate Bans in Detergents Shifting Builders to Zeolites

- 4.2.2 Petrochemical Dehydration and Gas-Purification Boom

- 4.2.3 Stringent Wastewater Discharge Norms

- 4.2.4 Hygiene-Driven Detergent Demand in Emerging Economies

- 4.2.5 Bio-Refinery Shift Demanding Shape-Selective Catalysts

- 4.3 Market Restraints

- 4.3.1 Enzyme And Chemical Substitutes in Laundry Formulations

- 4.3.2 Volatile Alumina/Silica Feedstock Pricing

- 4.3.3 High Energy Footprint Questioned by ESG Investors

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Natural Zeolite

- 5.1.2 Synthetic Zeolite

- 5.2 By End-user Industry

- 5.2.1 Detergents

- 5.2.2 Petrochemical and Refining

- 5.2.3 Industrial Gas Production

- 5.2.4 Waste and Water Treatment

- 5.2.5 Air Purification and HVAC

- 5.2.6 Agriculture and Animal Feed

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arkema

- 6.4.2 Axens

- 6.4.3 BASF

- 6.4.4 CLARIANT

- 6.4.5 CWK Chemiewerk Bad Kostritz GmbH

- 6.4.6 HengYe Inc.

- 6.4.7 Honeywell International Inc.

- 6.4.8 JIUZHOU CHEMICALS

- 6.4.9 KMI Zeolite Inc.

- 6.4.10 KNT Group

- 6.4.11 KURARAY CO., LTD.

- 6.4.12 Luoyang Jalon Micro-Nano New Material

- 6.4.13 Sorbchem India Pvt Ltd.

- 6.4.14 Tosoh Corporation

- 6.4.15 W. R. Grace & Co.

- 6.4.16 Zeochem

- 6.4.17 Zeolyst International

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessmen

- 7.2 Increasing Demand for Using Green Technologies