|

市场调查报告书

商品编码

1844576

汽车玻璃:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

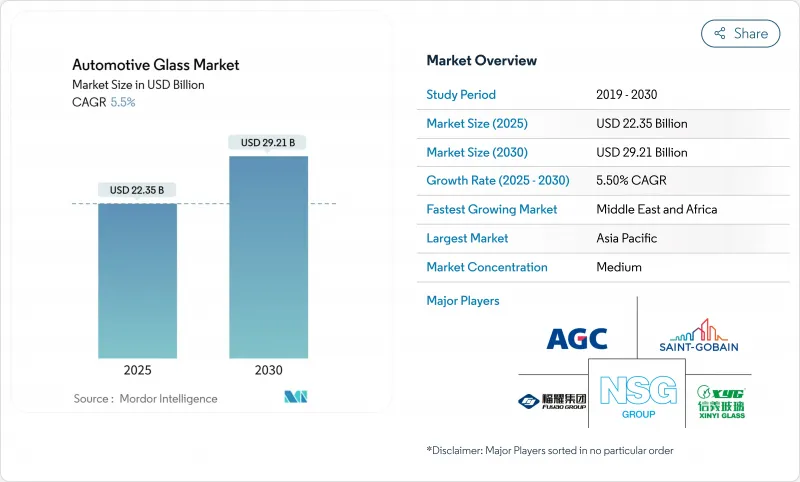

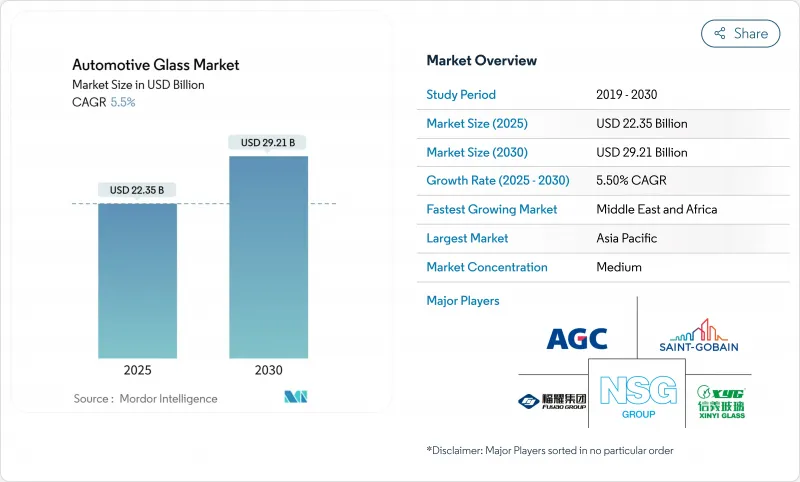

预计汽车玻璃市场规模在 2025 年将达到 223.5 亿美元,在 2030 年将达到 292.1 亿美元,在预测期内(2025-2030 年)的复合年增长率将达到 5.5%。

儘管原材料价格和物流成本波动,但汽车产量的不断增长、更严格的安全法规以及向电动车的转变仍保持着强劲势头。全景天窗、轻质夹层挡风玻璃和电致变色嵌装玻璃的需求不断增长,促使製造商拓展专业产品线并深化与原始设备製造商 (OEM) 的伙伴关係。 SUV 车型对更大玻璃表面的重视,加上减少二氧化碳排放的监管压力,正在加速涂层和多功能产品的采用。这些综合因素很可能在未来十年推动汽车玻璃市场强劲的技术主导成长。

全球汽车玻璃市场趋势与洞察

电动车平台转向全景玻璃

电动车製造商正在采用更大的车顶玻璃来提升车内氛围和品牌形象。特斯拉的 Cybertruck 和梅赛德斯-奔驰的 Vision V 概念车均配备了可调节色调的电致变色车顶,可将车内温度降低高达 -5°C,并减少空调负载。预计每辆车的玻璃面积将大幅增加,促使供应商投资宽弯玻璃、低辐射镀膜和红外线吸收中间膜。这些高端规格,加上不断下降的生产成本,预计将逐渐渗透到中等价格分布的电动车中,从而支持汽车玻璃市场的持续成长。

OEM对轻质夹层玻璃的需求以满足二氧化碳排放目标

欧洲法规设定了2030年全车平均二氧化碳排放目标,即每公里100克,迫使汽车製造商每行驶一公斤就减少排放。根据美国环保署对2017款福特GT的研究,夹层玻璃对车辆减重30%做出了显着贡献。采用离子塑胶中间膜的薄规格夹层玻璃可在不影响抗衝击性能的情况下,可减轻高达30%的重量。 AGC和圣戈班已将一款兼具轻量化和减震性能的1.6毫米挡风玻璃商业化,增强了汽车玻璃市场的长期前景。

特种中间膜(PVB、离子性塑胶)供应链紧缩

KURARAY CO. LTD.的PVB产能扩充未能跟上隔音和HUD级薄膜日益增长的需求,导致前置作业时间延长和限量供应。欧洲贴合机报告称,供不应求时有发生,迫使他们优先考虑OEM生产,而非售后市场订单。实验性生物基中间膜的机械优势可望达到53.1%,但规模化生产仍面临挑战。短期供应压力可能会在新厂投产前抑制汽车玻璃市场的成长。

細項分析

受成本效益和现有生产设备的推动,到2024年,普通玻璃将占据汽车玻璃市场的82.70%。夹层玻璃的市场份额正在超过强化玻璃,因为它在撞击时不易破碎,并且符合全球安全标准。这种转变正在导致特种中间膜的供应趋紧,但随着原始设备製造商对更薄更轻的结构的需求,夹层玻璃贴合机将获得更高的价值。智慧玻璃目前仍是少数市场,预计将以12.8%的复合年增长率成长,在豪华车和高端电动车领域占有一席之地。

电致变色车顶正处于早期应用阶段,而悬浮颗粒装置 (SPD) 则具有快速切换和耐用性,正如梅赛德斯-奔驰 Vision V 原型车所展示的那样。聚合物分散液晶 (PDLC) 车窗旨在实现隐私隔间,而感温变色薄膜尚未商业化。随着规模经济的提升,智慧玻璃将扩展到旗舰车型以外的领域,从而增强汽车玻璃市场。

受强制安装和ADAS感测器搭载率上升的推动,挡风玻璃将在2024年占据汽车玻璃市场规模的44.60%。复杂性推高了单位成本,并加剧了供应商和原始设备製造商之间的共同开发週期。然而,随着SUV车型标配更大的全景天窗,天窗成为成长最快的应用,复合年增长率达到10.2%。

背光玻璃采用隔音层压板,市场发展势头强劲,但保固问题阻碍了其发展。为了满足防跳法律法规,侧灯正在转向层压结构,尤其是在欧洲和日本。后视镜和三角窗正在整合电致变色防眩光涂层,从而增加了无需大面积覆盖的功能。这些应用组合正在支持汽车玻璃市场的稳定扩张。

区域分析

受中国庞大的产量和强劲的国内需求推动,亚太地区将在2024年占据汽车玻璃市场的49.20%。政府的奖励措施在很大程度上维持了工厂产能,而印度的产量成长正成为新的需求驱动力。此次上海会议将重点关注智慧嵌装玻璃、光达透明度和扩增实境-抬头显示器 (AR-HUD) 集成,展示持续的技术创新。日本和韩国为高端汽车製造商 (OEM) 提供先进的夹层和镀膜产品,在整个汽车玻璃市场中占据着利润丰厚的利基市场。

生产商正透过转向智慧玻璃和永续性项目来应对来自中国进口玻璃的利润压力。 AGC 和圣戈班共同开发的 Volta 熔炉代表着降低二氧化碳排放强度的策略性倡议。同时,北美市场正受到 SUV 需求的影响。美国的售后市场正在蓬勃发展,像 Auto Glass Now 这样的品牌正在扩大在全国的影响力,并抓住更换需求。

预计中东和非洲将成长最快,到2030年的复合年增长率将达到7.1%。沙乌地阿拉伯富含硅的矿床吸引了旨在满足当地供应的浮法玻璃投资。与更广泛的行业多元化议程相符的补贴鼓励了汽车零件的生产,并扩大了该地区在汽车玻璃市场的地位。南美的前景主要与巴西的组装量有关,而非洲的成长中心是南非相对成熟的汽车玻璃产业。邻近策略可以帮助全球供应商平衡这些不同地区的运费和准时预期。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电动车平台转向全景嵌装玻璃

- OEM对轻质夹层玻璃的需求以满足二氧化碳排放目标

- SUV天窗的快速普及

- 法规要求侧窗必须使用安全玻璃

- 高阶 OEM 厂商配备 HUD 功能的挡风玻璃数量增加

- 用于 ADAS 功能的嵌入式感测器集成

- 市场限制

- 特殊中间膜(PVB、离子性塑胶)供不应求

- 中国浮法玻璃产能过剩导致利润率下降,衝击欧盟市场

- SUV 隔音层压背光灯的保固成本高昂

- 成熟的售后市场通路更换週期缓慢

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- OEM和售后市场趋势分析

第五章市场规模及成长预测

- 按玻璃类型

- 普通玻璃

- 夹层玻璃

- 强化玻璃

- 智慧玻璃

- 电致变色

- 悬浮颗粒物检测装置(SPD)

- 聚合物分散液晶(PDLC)

- 感温变色

- 普通玻璃

- 按用途

- 挡风玻璃

- 背光(后窗)

- 侧光

- 天窗

- 后视镜和侧视镜

- 其他玻璃(四分之一玻璃和通风玻璃)

- 按车辆类型

- 搭乘用车

- 掀背车

- 轿车

- SUV与跨界车

- 奢侈品与运动

- 轻型商用车

- 中大型商用车

- 搭乘用车

- 透过促销

- 内燃机(ICE)

- 纯电动车(BEV)

- 混合动力电动车(HEV/PHEV)

- 燃料电池电动车(FCEV)

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- AGC Inc.(Asahi Glass)

- Saint-Gobain SA

- Nippon Sheet Glass Co. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- Xinyi Glass Holdings Ltd.

- Guardian Automotive(Koch Industries)

- Webasto SE

- Carlex Glass America LLC

- Magna International Inc.

- Vitro Automotive

- Corning Incorporated

- Sisecam Automotive

- Shanghai Yaohua Pilkington Glass

- Gentex Corporation

- AGP Group

第七章 市场机会与未来展望

The automotive glass market size stands at USD 22.35 billion in 2025 and is projected to reach USD 29.21 billion by 2030, reflecting a steady 5.5% CAGR during the forecast period (2025-2030).

Rising vehicle production, stricter safety mandates, and the shift toward electric mobility are sustaining momentum even as raw-material prices and logistics costs fluctuate. Growing demand for panoramic roofs, lightweight laminated windshields, and electrochromic glazing is encouraging manufacturers to scale specialized lines and deepen partnerships with OEMs. The emphasis on larger glass surfaces in SUVs, coupled with regulatory pressure to cut CO2 emissions, is accelerating the adoption of coated and multi-functional products. Together, these forces position the automotive glass market for resilient, technology-led growth through the decade.

Global Automotive Glass Market Trends and Insights

Shift Toward Panoramic Glazing In EV Platforms

Electric-vehicle makers are installing larger roof panes to enhance cabin ambience and brand identity. Tesla's Cybertruck and Mercedes-Benz's Vision V concept integrate electrochromic roofs that modulate tint levels, cutting cabin temperatures by up to 18°F and lowering HVAC loads. Glass area per vehicle is forecast to surge, prompting suppliers to invest in wide-format bending, low-E coatings, and infrared-absorbing interlayers. This premium specification is expected to permeate mid-priced EVs as production costs fall, supporting sustained growth in the automotive glass market.

OEM Demand For Lightweight Laminated Glass To Meet CO2 Targets

European regulations set a 100 g/km fleet-average CO2 goal for 2030, pushing automakers to shave every kilogram. EPA studies of the 2017 Ford GT show laminated glazing contributed materially to a 30% mass drop. Thin-gauge laminates using ionoplast interlayers now trim weight by up to 30% without compromising impact performance. AGC and Saint-Gobain are commercializing 1.6-mm windshield constructions that pair weight savings with acoustic damping, reinforcing long-term prospects for the automotive glass market.

Supply-Chain Crunch Of Specialty Interlayers (PVB, Ionoplast)

Kuraray's PVB capacity expansions have not kept pace with rising demand for acoustic and HUD-grade films, extending lead times and forcing allocation programs. European laminators report spot shortages, compelling them to prioritize OEM production over aftermarket orders. Experimental bio-based interlayers deliver promising mechanical gains of 53.1% but remain years from scale. Short-term supply stress may temper automotive glass market growth until new plants start up.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Sunroof Penetration In SUVs

- Regulation-Led Mandatory Safety Glazing For Side Windows

- Margin Erosion From Chinese Float-Glass Overcapacity Flooding EU Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Regular glass commanded 82.70% of the automotive glass market share in 2024, thanks to cost efficiency and entrenched production assets. Laminated variants are gaining against tempered formats because they keep shards intact on impact, satisfying global safety norms. The shift tightens the supply of specialty interlayers, yet it positions laminators for higher value capture as OEMs demand thinner, lighter constructions. Smart glass, though only a minority today, is projected to post a 12.8% CAGR, carving out niches in luxury vehicles and high-end EVs.

Electrochromic roofs dominate early adoption; suspended particle devices (SPD) deliver faster switching and durability, as shown in Mercedes-Benz's Vision V prototype. Polymer-dispersed liquid crystal (PDLC) windows target privacy partitions, while thermochromic films remain pre-commercial. As economies of scale improve, smart glass will expand beyond flagships, bolstering the automotive glass market.

Windshields held 44.60% of the automotive glass market size in 2024, underpinned by mandatory fitment and rising ADAS sensor content. Complexity drives up unit value, reinforcing supplier-OEM co-development cycles. Sunroofs, however, are the fastest-growing application at 10.2% CAGR as SUVs standardize large openings for panoramic vistas.

Backlites see modest traction from acoustic laminates, though warranty issues temper speed. Sidelites transition to laminated construction to meet ejection-prevention laws, especially in Europe and Japan. Rear-view mirrors and quarter windows integrate electrochromic anti-glare coatings, adding feature content without large area demand. Collectively, the application mix underpins steady expansion in the automotive glass market.

The Automotive Glass Market Report is Segmented by Glass Type (Regular Glass and Smart Glass), Application (Windshield, Sunroof and More), Vehicle Type (Passenger Cars, and More), Propulsion (Internal Combustion Engine, Battery Electric Vehicle (BEV), and More), Sales Channel (OEM, and Aftermarket), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the automotive glass market, with 49.20% of the revenue in 2024, anchored by China's vast output and rapid domestic uptake. Government incentives have kept plants near capacity, while India's production climb adds a fresh demand axis. Conferences in Shanghai spotlight intelligent glazing, LiDAR transparency, and AR-HUD integration, showcasing continual innovation. Japan and South Korea supply advanced laminated and coated products for premium OEMs, preserving high-margin niches as part of the broader automotive glass market.

Producers combat margin squeeze from Chinese imports by pivoting into smart glass and sustainability programs. AGC and Saint-Gobain's joint Volta furnace evidences a strategic move to slash CO2 intensity. Meanwhile, North America remains influential due to the demand for SUVs. The United States features vibrant aftermarket activity; brands such as Auto Glass Now scale national footprints to capture replacement revenue.

The Middle East and Africa are expected to be the fastest climbers at 7.1% CAGR through 2030. Saudi Arabia's silica-rich deposits attract float-glass investments intended to localize supply. Subsidies aligned with broader industrial-diversification agendas incentivize auto-component production, broadening the region's stake in the automotive glass market. South America's outlook is tied chiefly to Brazilian assembly volumes, while Africa's growth centers on South Africa's relatively mature sector. Proximity production strategies help global suppliers balance freight costs and just-in-time expectations across these varied geographies.

- AGC Inc. (Asahi Glass)

- Saint-Gobain S.A.

- Nippon Sheet Glass Co. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- Xinyi Glass Holdings Ltd.

- Guardian Automotive (Koch Industries)

- Webasto SE

- Carlex Glass America LLC

- Magna International Inc.

- Vitro Automotive

- Corning Incorporated

- Sisecam Automotive

- Shanghai Yaohua Pilkington Glass

- Gentex Corporation

- AGP Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift Toward Panoramic Glazing In EV Platforms

- 4.2.2 OEM Demand For Lightweight Laminated Glass To Meet CO2 Targets

- 4.2.3 Rapid Sunroof Penetration In SUVs

- 4.2.4 Regulation-Led Mandatory Safety Glazing For Side Windows

- 4.2.5 Growing Retrofit Of HUD-Compatible Windshields By Premium OEMs

- 4.2.6 Integration Of Embedded Sensors For ADAS Functionality

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Crunch Of Specialty Interlayers (PVB, Ionoplast)

- 4.3.2 Margin Erosion From Chinese Float-Glass Overcapacity Flooding EU Market

- 4.3.3 High Warranty Costs Linked To Acoustic Laminated Backlights In SUVs

- 4.3.4 Slow Replacement Cycles In Mature Aftermarket Channels

- 4.4 Value-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 OEM vs. Aftermarket Trend Analysis

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Glass Type

- 5.1.1 Regular Glass

- 5.1.1.1 Laminated Glass

- 5.1.1.2 Tempered Glass

- 5.1.2 Smart Glass

- 5.1.2.1 Electrochromic

- 5.1.2.2 Suspended Particle Device (SPD)

- 5.1.2.3 Polymer Dispersed Liquid Crystal (PDLC)

- 5.1.2.4 Thermochromic

- 5.1.1 Regular Glass

- 5.2 By Application

- 5.2.1 Windshield

- 5.2.2 Backlite (Rear Window)

- 5.2.3 Sidelite (Side Windows)

- 5.2.4 Sunroof

- 5.2.5 Rear-view & Side-view Mirrors

- 5.2.6 Other Glazing (Quarter & Vent)

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.1.1 Hatchback

- 5.3.1.2 Sedan

- 5.3.1.3 SUV & Crossover

- 5.3.1.4 Luxury & Sports

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.1 Passenger Cars

- 5.4 By Propulsion

- 5.4.1 Internal Combustion Engine (ICE)

- 5.4.2 Battery Electric Vehicle (BEV)

- 5.4.3 Hybrid Electric Vehicle (HEV/PHEV)

- 5.4.4 Fuel Cell Electric Vehicles (FCEV)

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 AGC Inc. (Asahi Glass)

- 6.4.2 Saint-Gobain S.A.

- 6.4.3 Nippon Sheet Glass Co. Ltd.

- 6.4.4 Fuyao Glass Industry Group Co. Ltd.

- 6.4.5 Xinyi Glass Holdings Ltd.

- 6.4.6 Guardian Automotive (Koch Industries)

- 6.4.7 Webasto SE

- 6.4.8 Carlex Glass America LLC

- 6.4.9 Magna International Inc.

- 6.4.10 Vitro Automotive

- 6.4.11 Corning Incorporated

- 6.4.12 Sisecam Automotive

- 6.4.13 Shanghai Yaohua Pilkington Glass

- 6.4.14 Gentex Corporation

- 6.4.15 AGP Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment