|

市场调查报告书

商品编码

1844582

汽车温度感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Temperature Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

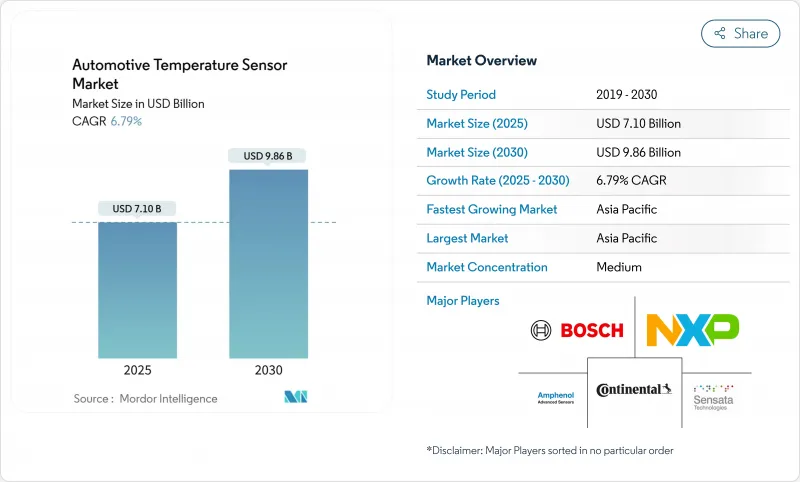

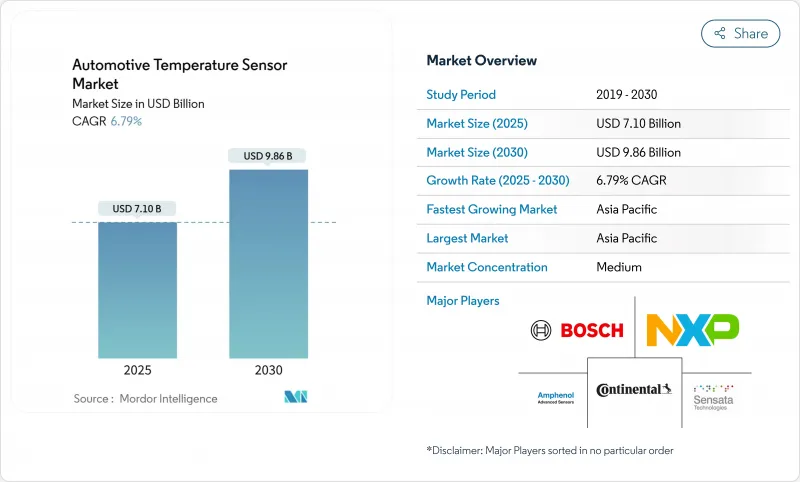

预计2025年汽车温度感测器市场价值将达到71亿美元,到2030年将达到98.6亿美元,复合年增长率为6.79%。

快速的电气化正在推动成长,每辆纯电动车 (BEV) 都采用近 150 个感测点。区域电子架构压缩了布线,并推动了对能够透过车载乙太网路报告的多点测量节点的需求。基于碳化硅 (SiC) 逆变器建构的 800V 高压传动系统需要能够在 600°C 以上保持稳定性能的高精度感测器,而随着内燃机车型的淘汰,欧7 和国六 b 法规扩大了排气温度监测窗口。高阶内装座舱健康功能、固态电池试点以及向晶圆级感测器封装的转变,正在刺激原始设备製造商和服务管道的销售进一步增长。

全球汽车温度感测器市场趋势与洞察

SiC 基电力电子装置的采用正在加速,对电动车逆变器的热精度要求也不断提高

SiC 开关使驱动模组能够维持接近 600°C 的结温,同时与硅相比,转换效率提高 30%。因此,每个 SiC 半桥增加了两到三个温度检测点,以防止热失控,并优化 800V 快速充电的降额曲线。安森美半导体和其他供应商的代工扩张表明,热数据对于闸极驱动器校准和逆变器保固延长至关重要。

区域架构ECU的普及推动多点温度监控

基于区域控制器建构的车辆网路取代了数十个独立的ECU,减少了30%的布线量,同时提高了密封铝製外壳内的热密度。设计人员现在透过本地I3C链路分布微型数位感测器,使韧体能够即时平衡负载、风扇转速和冗余度。在欧洲高端平台上的初步部署已证明其现场可靠性,足以说服量产车型OEM在2026年后进行迁移。

一级NTC热敏电阻器标准化降低价格

一级线束製造商正在围绕1 kΩ至100 kΩ的曲线製定标准化规格,从而实现批量采购,使价格每年下降3%至5%。纯热敏电阻器供应商正采取相应措施,将输出功率转换为适用于250 度C温度范围的更高阻值环氧涂层磁珠,或将市场转向内建校准表的数位IC,以保持利润率。

細項分析

由于热敏电阻器在冷却液、暖通空调和入门级电池模组中成本低廉且可靠性得到验证,到2024年,其在汽车温度感测器市场中的份额将达到43%。每辆纯电动车(BEV)已采用超过100个NTC元件,即使单位价格下降,由热敏电阻器驱动的汽车温度感测器市场规模也必将稳定成长。这项传统技术的强大影响力迫使高阶汽车将NTC与区域运算中心的线性化演算法结合,以弥补精度差距。

至2030年,基于半导体的IC感测器将以8.8%的复合年增长率发展。其±0.4°C的精度和直接的I3C/I^2C输出简化了其在轮毂马达等受限区域的应用。随着系统设计人员逐步淘汰笨重的补偿表,汽车温度感测器市场将受益于性能和材料清单效率的同步提升。热电偶仍将嵌入涡轮增压器外壳中,温度高于900 度C。

乘用车仍将是汽车温度感测器的主导市场,到2024年将占其销售额的68.5%。高阶车型中先进的座舱舒适度演算法利用多个感测节点来调节微喷射、加热座椅和分区暖通空调百叶窗。大陆集团的工厂试验报告显示,由于在生产线上配备了额外的温度诊断装置,整体设施效率提高了15%,证明了上游工程也是感测器的消费载体。

纯电动车是成长最快的产品领域,复合年增长率为 10.3%。所有电池模组均在汇流排上安装热敏电阻器,在电池极耳下嵌入薄膜电阻式温度检测器 (RTD),并采用晶粒进行非接触式监控。轻型商用电动厢型车现已配备气体逸出感测器,可将预警资料传送至车辆仪錶板,从而将热安全性与资产可用性指标结合。在亚洲人口稠密的城市中,使用小型抗振环氧密封负温度係数 (NTC) 磁珠的两轮车正在不断普及。

区域分析

到了2024年,亚太地区将占据汽车温度感测器市场的41.6%,这反映其全球最大汽车生产基地的地位。预计到2030年,中国组装商的先进电子元件本地产量将从15%提高到60%,这将为国内热敏电阻器和积体电路工厂提供更多的设计中标机会。日本和韩国将继续大力投资于采用高密度感测阵列的固态电池试点项目,这将在未来十年内增加其对该地区汽车温度感测器市场规模的贡献。

欧洲则位居第二,这得益于欧盟七国严格的法规,这些法规强制要求进行即时排放分析,以及一系列注重车内温度调节的高阶车型。德国原始设备製造商在分区架构部署方面处于领先地位,每个新的控制器丛集都拥有独立的环境、电路板边缘温度和MOSFET背面晶片晶粒,从而将需求扩展到多个产品系列。莱茵河谷附近的供应商正在推出镍薄膜RTD生产线的产能,以规避铂金短缺,从而增强区域自给自足能力。

北美保持强劲地位,这得益于皮卡和SUV广泛采用基于SiC的驱动模组,这些车型更倾向于使用800V推进系统来牵引拖车。当地电池製造的立法激励措施正推动感测器采购转向垂直整合的美国工厂。中东地区目前规模较小,但随着利雅德和杜拜自动驾驶专区的建立,以及配备冗余热感节点以保护计算丛集免受沙漠高温影响的L4级穿梭巴士成为常态,预计该地区的复合年增长率将达到9.2%。在南美,成长主要由灵活燃料动力传动系统(此类动力系统仍需要排放感测器)以及巴西特大城市营运的新兴电动公车所推动。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义研究范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- SiC 基电力电子装置的采用正在加速,对电动车逆变器的温度精度要求也越来越高

- 区域架构ECU的快速成长,促进了多点温度监控

- EU7 和中国 VI-b排放气体法规要求废气温度感测器的工作范围更广

- 固态电池组温度控管的必要性

- 高级汽车对座舱健康感知器(暖通空调空气品质和座椅舒适度)的需求不断增加

- 半导体封装转向汽车级晶圆级感测器

- 市场限制

- 一级製造商NTC热敏电阻器标准化导致价格下降

- RTD 中使用的高纯度镍和铂的供应链波动

- 商用车改装率落后

- 低成本 MEMS 感测器的交叉敏感度和漂移问题限制了其在售后市场的采用

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 依感测器类型

- 热敏电阻器(NTC/PTC)

- 电阻温度检测器(RTD)

- 热电偶

- 半导体IC感测器

- MEMS和红外线感测器

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车

- 摩托车和微型交通工具

- 按用途

- 动力传动系统(内燃机、混合动力)

- 电池和电力传动系统

- 底盘和安全系统

- 车身和舒适电子设备

- 远端资讯处理和连接模组

- 按销售管道

- OEM安装

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 法国

- 义大利

- 西班牙

- 英国

- 北欧的

- 其他欧洲国家

- 中东

- 波湾合作理事会

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN-5

- 其他亚太地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- NXP Semiconductors NV

- Sensata Technologies, Inc.

- Amphenol Advanced Sensors

- Robert Bosch GmbH

- Continental AG

- Texas Instruments Inc.

- TE Connectivity Ltd.

- Panasonic Holdings Corp.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- STMicroelectronics NV

- Denso Corporation

- BorgWarner Inc.(Delphi Technologies)

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Littelfuse, Inc.

第七章 市场机会与未来展望

The automotive temperature sensor market is valued at USD 7.1 billion in 2025 and is forecast to reach USD 9.86 billion by 2030, advancing at a 6.79% CAGR.

Growth is anchored by rapid electrification, with battery-electric vehicles (BEVs) installing close to 150 sensing points per car, nearly triple the requirement in combustion platforms. Zonal electronic architectures are compressing wiring looms and pushing demand for multi-point measurement nodes that can report through automotive Ethernet. High-voltage 800 V drivetrains built around silicon-carbide (SiC) inverters need precision sensors that remain stable above 600 °C, while EU7 and China VI-b regulations widen exhaust temperature monitoring windows as internal-combustion models sunset. Cabin health features in premium trims, solid-state battery pilots, and the migration to wafer-level sensor packaging are catalyzing additional volume in both OEM and service channels.

Global Automotive Temperature Sensor Market Trends and Insights

Accelerating Adoption of SiC-Based Power Electronics Intensifying Thermal Accuracy Requirements in EV Inverters

SiC switches enable drive modules to sustain junction temperatures near 600 °C while boosting conversion efficiency by 30% compared with silicon. Each SiC half-bridge therefore integrates two to three extra temperature sensing points to guard against thermal runaway and to optimise derating curves during 800 V fast charging. Foundry expansions at Onsemi and other suppliers underline how thermal data has become mission-critical for gate-drive calibration and extended inverter warranties.

Rapid Growth of Zonal-Architecture ECUs Driving Multi-Point Temperature Monitoring

Vehicle networks built on zone controllers replace dozens of standalone ECUs, trimming wiring mass by 30% yet raising heat density inside sealed aluminium housings. Designers now distribute small digital sensors on local I3C links so that firmware can balance load, fan speed and redundancy in real time. Early deployments across premium European platforms are demonstrating field reliability that is convincing volume-segment OEMs to transition from 2026 onward.

Price-Erosion from Standardisation of NTC Thermistors among Tier-1s

Tier-1 harness builders have harmonised specifications around 1 kΩ to 100 kΩ curves, allowing large volume buys that drive annual price concessions of 3%-5%. Pure-play thermistor vendors are responding by shifting output to higher-value epoxy--coated beads for 250 °C zones or by moving up-market into digital ICs that embed calibration tables to secure margins.

Other drivers and restraints analyzed in the detailed report include:

- EU7 and China VI-b Emission Norms Mandating Exhaust Gas Sensors with Wider Range

- Thermal Management Imperatives in Solid-State Battery Packs

- Supply-Chain Volatility of High-Purity Nickel & Platinum Used in RTDs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermistors retained a 43% share of the automotive temperature sensor market in 2024 owing to their low cost and proven reliability in coolant, HVAC and entry-level battery modules. Each BEV already deploys more than 100 NTC elements, and the automotive temperature sensor market size attributable to thermistors is on course to rise steadily even as unit prices drift lower. The firm grip of this legacy technology has forced higher-end vehicles to pair NTCs with linearisation algorithms inside zonal compute hubs to reconcile accuracy gaps.

Semiconductor-based IC sensors are advancing at an 8.8% CAGR through 2030. Their +-0.4 °C accuracy and direct I3C/I^2C output simplify harnessing in confined zones such as in-wheel power electronics, where every millimetre counts. As system designers phase out bulky compensation tables, the automotive temperature sensor market benefits from simultaneous gains in performance and bill-of-materials efficiency. RTDs continue serving precision exhaust feedback loops despite metal volatility, while thermocouples stay embedded in turbo housings that exceed 900 °C.

Passenger cars commanded 68.5% of 2024 revenue and remain the anchor for the automotive temperature sensor market. Sophisticated cabin comfort algorithms in premium trims exploit multiple sensing nodes to modulate micro-jets, seat heaters and zoned HVAC louvers. Continental's factory trials reported a 15% uplift in overall equipment effectiveness after equipping production lines with additional thermal diagnostics - evidence that upstream manufacturing is also a consumption vector for sensors.

BEVs represent the fasting-growing cohort at a 10.3% CAGR. Every battery module clips thermistors to bus bars, embeds thin-film RTDs under cell tabs, and situates infrared die for non-contact monitoring-collectively doubling the automotive temperature sensor market size per vehicle relative to hybrids. Light commercial e-vans now integrate gas-generation detection sensors that relay early warning data to fleet dashboards, aligning thermal safety with asset-availability metrics. Two-wheelers in dense Asian cities add scale, leveraging compact, epoxy-sealed NTC beads resistant to vibration.

Automotive Temperature Sensor Manufacturers and the Market is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application (Powertrain, Body Electronics, Alternative Fuel Vehicles, and More), Sensor Type (Thermistor, Thermocouple, and More), Sales Channel(OEM-Fitted and More) and Geography). The Market Sizes and Forecasts are Provided in Terms of Value in (USD).

Geography Analysis

Asia-Pacific held 41.6% of automotive temperature sensor market share in 2024, reflecting its status as the world's largest vehicle production hub. Chinese assemblers are localising advanced electronic content from 15% to 60% by 2030, funnelling additional design-win opportunities to domestic thermistor and IC fabs. Japan and South Korea continue to invest heavily in solid-state battery pilots, which embed denser sensing arrays and lift the region's contribution to automotive temperature sensor market size through the decade.

Europe ranks second, propelled by stringent EU7 rules that require real-time exhaust gas analytics and by a strong premium vehicle pipeline that emphasises in-cabin climate refinement. German OEMs spearhead zonal architecture rollouts; each new controller cluster carries its own ambient, board-edge, and MOSFET backside die, spreading demand across multiple product families. Suppliers located near the Rhine valley are setting up nickel-film RTD lines to navigate platinum scarcity, reinforcing regional self-sufficiency.

North America maintains a robust position thanks to high uptake of SiC-based drive modules in pickup trucks and SUVs that favour 800 V propulsion for trailer towing. Legislative incentives for local battery manufacturing are steering sensor sourcing toward vertically integrated US facilities. The Middle East, although small today, is forecast to clock a 9.2% CAGR as purpose-built autonomous mobility zones in Riyadh and Dubai standardise L4 shuttles loaded with redundant thermal nodes to safeguard compute clusters against desert heat. South America's incremental growth is linked to flex-fuel powertrains that still need exhaust gas sensors alongside emergent electric buses operating in Brazilian megacities.

- NXP Semiconductors N.V.

- Sensata Technologies, Inc.

- Amphenol Advanced Sensors

- Robert Bosch GmbH

- Continental AG

- Texas Instruments Inc.

- TE Connectivity Ltd.

- Panasonic Holdings Corp.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Denso Corporation

- BorgWarner Inc. (Delphi Technologies)

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Littelfuse, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Adoption of SiC-based Power Electronics Intensifying Thermal Accuracy Requirements in EV Inverters

- 4.2.2 Rapid Growth of Zonal-Architecture ECUs Driving Multi-Point Temperature Monitoring

- 4.2.3 EU7 and China VI-b Emission Norms Mandating Exhaust Gas Temperature Sensors with Wider Operating Range

- 4.2.4 Thermal Management Imperatives in Solid-State Battery Packs

- 4.2.5 Rising Demand for Cabin Health Sensors (HVAC Air Quality and Seat Comfort) in Premium Vehicles

- 4.2.6 Semiconductor Packaging Shift to Automotive-Grade Wafer-Level Sensors

- 4.3 Market Restraints

- 4.3.1 Price-Erosion from Standardization of NTC Thermistors among Tier-1s

- 4.3.2 Supply-Chain Volatility of High-Purity Nickel and Platinum Used in RTDs

- 4.3.3 Slow Retrofit Rates in Commercial Vehicle Fleets

- 4.3.4 Cross-Sensitivity and Drift Issues in Low-Cost MEMS Sensors Limiting Aftermarket Adoption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Thermistor (NTC/PTC)

- 5.1.2 Resistance Temperature Detector (RTD)

- 5.1.3 Thermocouple

- 5.1.4 Semiconductor-Based IC Sensor

- 5.1.5 MEMS and Infra-Red Sensor

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers and Micro-Mobility

- 5.3 By Application

- 5.3.1 Powertrain (ICE, Hybrid)

- 5.3.2 Battery and Electric Drive-Train

- 5.3.3 Chassis and Safety Systems

- 5.3.4 Body and Comfort Electronics

- 5.3.5 Telematics and Connectivity Modules

- 5.4 By Sales Channel

- 5.4.1 OEM-Fitted

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 Italy

- 5.5.3.4 Spain

- 5.5.3.5 United Kingdom

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 Gulf Cooperation Council

- 5.5.4.2 Turkey

- 5.5.4.3 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Nigeria

- 5.5.5.3 Rest of Africa

- 5.5.6 Asia-Pacific

- 5.5.6.1 China

- 5.5.6.2 Japan

- 5.5.6.3 India

- 5.5.6.4 South Korea

- 5.5.6.5 ASEAN-5

- 5.5.6.6 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 NXP Semiconductors N.V.

- 6.4.2 Sensata Technologies, Inc.

- 6.4.3 Amphenol Advanced Sensors

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Continental AG

- 6.4.6 Texas Instruments Inc.

- 6.4.7 TE Connectivity Ltd.

- 6.4.8 Panasonic Holdings Corp.

- 6.4.9 Murata Manufacturing Co., Ltd.

- 6.4.10 TDK Corporation

- 6.4.11 Honeywell International Inc.

- 6.4.12 Infineon Technologies AG

- 6.4.13 STMicroelectronics N.V.

- 6.4.14 Denso Corporation

- 6.4.15 BorgWarner Inc. (Delphi Technologies)

- 6.4.16 Vishay Intertechnology, Inc.

- 6.4.17 Microchip Technology Inc.

- 6.4.18 Analog Devices, Inc.

- 6.4.19 Renesas Electronics Corporation

- 6.4.20 Littelfuse, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment