|

市场调查报告书

商品编码

1844586

奈米涂料和涂层:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Nano Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

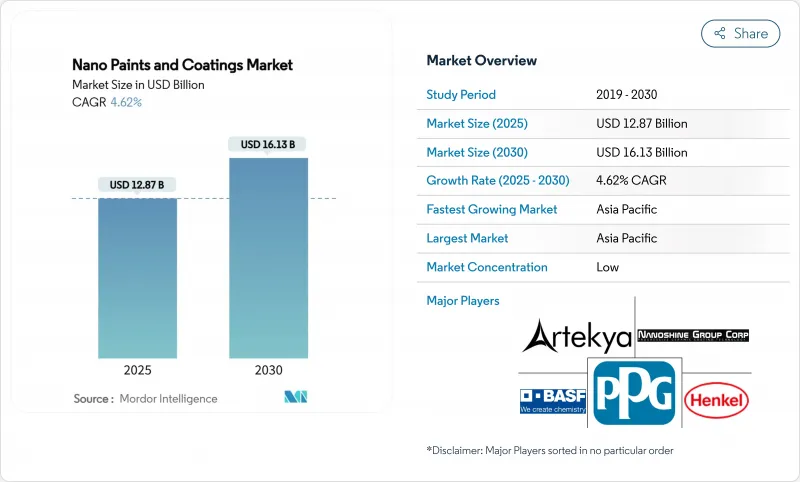

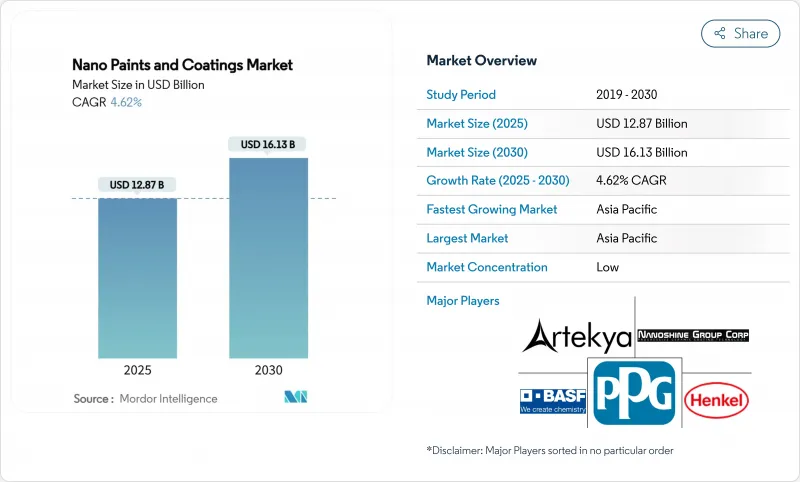

预计 2025 年奈米油漆和涂料市场规模将达到 128.7 亿美元,预计到 2030 年将达到 161.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.62%。

航太对防腐轻量化解决方案的需求不断增长,电动车的消防安全要求不断提高,基础设施的耐久性需求不断增加,这些因素推动着市场稳步上升。奈米二氧化钛占主导地位,市占率达 39.17%,加之石墨烯以 5.17% 的复合年增长率快速成长,展现了先进奈米材料在维持竞争优势的核心作用。亚太地区发展动能依然强劲,占全球销售额的近一半,是成长最快的地区。化学气相沉积 (CVD) 材料的进步以及向集防腐、温度控管和抗菌性能于一体的多功能配方的转变正在创造新的机会,而高昂的製造成本和不断变化的奈米毒性法规则阻碍了快速扩大规模。

全球奈米涂料和涂料市场趋势和洞察

航太和国防领域的腐蚀-轻量化的推动力

美国估计,军事装备的腐蚀每年对军方造成230亿美元的损失,这推动了奈米涂层的应用,兼具结构轻盈性和卓越防护性能。现场数据显示,奈米工程涂层可缩短海军飞机机身的维修週期,其防冰特性可提高飞机在极端气候条件下的战备能力。美国SBIR(小规模创新研究)计画正在从实验室研究转向舰队试验,这表明严格的认证障碍限制了新进入者,同时确保了对可靠供应商的持续需求。由于国防筹资策略倾向于降低总拥有成本的平台,因此,能够解决重量、耐久性和环境暴露挑战的一次性奈米配方的需求日益增长。

电动车隔热和防火涂料的需求不断增长

快速电气化正在推动电池系统朝向更高的能量密度和更严格的安全标准迈进。专用奈米层可快速散热并形成阻燃屏障,保护电芯和相邻组件。 Resonac 用于电动车电池组的隔热产品凸显了其积极的商业化发展。碳和石墨烯分散体在不牺牲介电强度的情况下提供导热性,符合 OEM 安全通讯协定。同时,像现代的奈米冷却膜这样的乘客舒适解决方案可将车内温度降低 10°C,展现出辅助应用的潜力。纳入热失控抑制的法律规范将加速大规模采用,尤其是在电池产能最高的亚太地区。

奈米材料製造成本高

专用CVD反应器、低产量比率批量製程以及严格的纯度要求导致单位成本居高不下。儘管技术性能优势明显,但资金需求阻碍了消费家具等价格敏感应用的采用。儘管创业投资持续注入,例如Forge Nano的4000万美元融资,但许多规模化项目仍处于试点阶段,这意味着成本下降将是渐进而非快速的。生产商正在寻求在线计量、前体回收和混合湿化学技术来降低成本,但盈亏平衡的经济效益仍依赖高端应用。

細項分析

到 2024 年,奈米二氧化钛将在奈米油漆和涂料市场保持 39.17% 的份额。其稳定的製造、光催化自清洁性能和成本效益正在推动其在建筑幕墙、汽车装饰和室内防雾板的应用。韩国一条试验生产线使用二氧化钛奈米颗粒生产超大透明萤幕,价格仅为 OLED 玻璃的十分之一,证实了该材料的扩充性。石墨烯仍然是一种适度的参与者,但随着对电池散热器和电磁屏蔽的需求增长,到 2030 年其复合年增长率将达到 5.17%。奈米碳管仍将是航太和高端消费性电子产品的利基选择,这些产品兼具结构刚性、导电性和轻量化。奈米 SiO2 将在水泥添加剂中占据突出地位,以延长基础设施的使用寿命,而奈米 ZnO 将确保医疗设备和智慧型手机的紫外线阻隔涂层。未来的成长预计将来自于结合多种奈米粒子以产生协同效应的混合配方。

预计用于二氧化钛树脂的奈米涂料和涂层市场规模将稳定成长,而由于供应链的自由化和反应器产能的扩大,石墨烯的份额也将迅速扩大。为了配合这一发展轨迹,正在同步推广使用生物基前驱物和无溶剂分散体的绿色合成路线,以减少碳排放。

区域分析

亚太地区将维持领先地位,到2024年将占全球销售额的45.43%,预计复合年增长率为4.91%。中国的电子供应链、日本的材料科学丛集以及韩国的显示器工厂将确保基准的稳定性。中国的「中国製造2025」计画和日本的「登月计画」研发目标等奖励将加速奈米生产能力的提升并缩短前置作业时间。本地CVD反应器供应商将把该技术推广到顶级企业集团之外,使中型涂层工厂能够认证奈米产品。

北美的需求集中在航太、国防和医疗设备领域。美国保障司令部和航太运载火箭主管机关将奈米涂层视为降低维修成本的战略途径。墨西哥蓬勃发展的电动车组装生态系统进口热感热膜和电池涂层系统,并与当地供应商无缝整合。欧洲对生态设计和工人安全的重视,正在推动符合 REACH 和绿色建筑标籤标准的奈米配方水性被覆剂的应用。一家德国一级汽车供应商和一家法国航太原始设备製造商已与奈米涂层专家签署了多年期框架协议。

在南美洲,巴西交通走廊和阿根廷页岩油气资源的基础设施修復工作正在蓬勃发展。盐雾、高湿度和紫外线的暴露使得高性能涂料变得至关重要,当地涂料製造商正在与日本和德国的奈米材料製造商合作,以实现涂料混合物的本地化。中东的能源产业正在地下泵浦和出口管道上试验奈米层,以抵抗酸性腐蚀。同时,非洲的成长故事在于供水网络,其中内部应用的奈米密封剂可以降低高温环境下的洩漏率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 航太和国防领域的腐蚀-轻量化的推动力

- 电动车对耐热和防火涂料的需求不断增加

- 对高性能涂料的需求不断增加

- 基础设施领域需求增加

- 电子产品和消费品的使用增加

- 市场限制

- 奈米材料製造成本高

- 奈米毒性监管的不确定性

- 石墨烯CVD反应器供应瓶颈

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依树脂类型

- 石墨烯

- 奈米碳管

- 奈米 TiO2(二氧化钛)

- 奈米SiO2(二氧化硅)

- 奈米氧化锌

- 奈米银

- 依方法

- 电洒/静电纺丝

- 化学气相沉积(CVD)

- 物理气相沉积(PVD)

- 原子层沉淀(ALD)

- 气溶胶涂层

- 自组织

- 溶胶-凝胶

- 按最终用户产业

- 航太/国防

- 车

- 电子学和光学

- 生物医学

- 食品/包装

- 海洋

- 石油和天然气

- 其他终端用户产业(能源/电力、建筑/基础设施等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Aculon

- Artekya Teknoloji

- BASF

- Europlasma NV

- Graphene NanoChem

- GVD Corporation

- Henkel AG and Co. KGaA

- I-CanNano

- Nanofilm

- Nanoshine Group Corp

- Pearl Global Ltd.

- Pellucere

- PPG Industries, Inc.

- SIA Naco Technologies

- Starshield Technologies Pvt Ltd

- Tesla NanoCoatings Inc.

第七章 市场机会与未来展望

The Nano Paints & Coatings Market size is estimated at USD 12.87 billion in 2025, and is expected to reach USD 16.13 billion by 2030, at a CAGR of 4.62% during the forecast period (2025-2030).

Growing aerospace demand for corrosion-lightweight solutions, electric vehicle fire-safety requirements, and infrastructure durability needs keep the market on a steady upward course. A dominant 39.17% nano-TiO2 share combined with graphene's rapid 5.17% CAGR underlines the core role of advanced nanomaterials in sustaining competitive advantage. Regional momentum remains firmly with Asia-Pacific, which controls almost half of global revenues and commands the fastest regional growth. Supply advances in chemical vapor deposition (CVD) and a shift toward multifunctional formulations that merge corrosion protection, thermal management, and antimicrobial performance are shaping new business opportunities, while high production costs and evolving nano-toxicity rules restrain rapid scale-up.

Global Nano Paints And Coatings Market Trends and Insights

Aerospace and defense corrosion-light-weight push

Pentagon estimates that corrosion costs USD 23 billion each year across military equipment, intensifying the adoption of nano coatings that combine structural lightness with superior protection. Field data show nano-engineered layers lowering maintenance cycles on naval airframes, while icephobic properties enhance aircraft readiness in extreme climates. Programs under the U.S. Navy SBIR banner are moving from bench research to fleet trials, illustrating that rigorous certification barriers simultaneously limit new entrants and guarantee durable demand for validated suppliers. As defense procurement strategies favor platforms with reduced total ownership cost, single-application nano formulations that solve weight, durability, and environmental exposure challenges are increasingly specified.

Increase in demand for EV thermal-fire-safety coating

Rapid electrification pushes battery systems toward higher energy density and stricter safety standards. Specialized nano layers dissipate heat swiftly and form fire-retardant barriers, protecting cells and adjacent components. Resonac's thermal insulation product for EV packs highlights active commercial development. Carbon and graphene dispersions deliver thermal conductivity without sacrificing dielectric strength, matching OEM safety protocols. In parallel, passenger-comfort solutions such as Hyundai's nano cooling film that cuts cabin temperature by 10 °C demonstrate spill-over into ancillary applications. Regulatory frameworks that incorporate thermal runaway containment accelerate volume adoption, especially in Asia-Pacific, where battery production capacity is highest.

High production cost of nanomaterials

Specialized CVD reactors, low-yield batch processes, and stringent purity requirements keep unit costs elevated. Capital requirements delay adoption in price-sensitive uses such as consumer furniture, despite technical performance benefits. Venture capital continues to inject funds-Forge Nano's USD 40 million raise underscored private backing-but many scale-up programs remain in pilot phase, pointing to gradual cost attrition rather than abrupt drops. Producers pursue inline metrology, precursor recycling, and hybrid wet-chemistry steps to cut expenses, yet breakeven economics still hinge on premium applications.

Other drivers and restraints analyzed in the detailed report include:

- Growing requirement for high performance coatings

- Increasing demand from infrastructure sector

- Nano-toxicity regulatory uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nano-TiO2 kept its 39.17% hold on the nano paints & coatings market in 2024. Stable manufacturing, photocatalytic self-cleaning performance, and cost efficiency drive its acceptance on facades, automotive trims, and indoor anti-smog panels. Korean pilot lines producing ultra-large transparent screens using TiO2 nanoparticles at one-tenth the price of OLED glass underscore this material's scalability. Graphene, although capped at a modest base, posts a 5.17% CAGR through 2030 as demand from battery heat spreaders and electromagnetic shielding intensifies. Carbon nanotubes remain a niche choice for aerospace and high-end consumer electronics where structural stiffness, conductivity, and weight savings converge. Nano-SiO2 extends its presence in cement additions that lengthen infrastructure life, and nano-ZnO secures UV-blocking coatings for medical devices and smartphones. Future growth leans on hybrid recipes pairing multiple nanoparticles to secure synergistic properties.

The nano paints & coatings market size for titanium dioxide resin applications is projected to widen steadily, while graphene's share expands faster under supply chain releases and reactor capacity additions. Complementing that trajectory is a parallel push for green synthesis routes that use bio-derived precursors or solvent-free dispersion to cut carbon footprint.

The Nano Paints & Coatings Market Report is Segmented by Resin Type (Graphene, Carbon Nanotubes, Nano-TiO2, and More), Method (Electrospray and Electrospinning, Chemical Vapor Deposition, and More), End-User Industry (Aerospace and Defense, Automotive, Biomedical, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific anchored 45.43% of global revenue in 2024, keeping the lead with a 4.91% CAGR outlook. China's electronics supply chains, Japan's materials science clusters, and South Korea's display fabs guarantee a stable baseline. Policy incentives, such as China's Made-in-China 2025 priorities and Japan's Moonshot R&D goals, accelerate nano production capability, shortening lead times. Local CVD reactor suppliers help diffuse technology beyond top-tier conglomerates, enabling mid-size coating shops to certify nano offerings.

North America's demand profile centers on aerospace, defense, and medical devices. U.S. Air Force sustainment commands and space launch primes view nano-layering as strategic maintenance cost reducers. Mexico's ascending EV assembly ecosystem imports nano thermal films and battery coating systems, integrating seamlessly with regional supply. Europe champions eco-design and worker safety, thus driving the adoption of nano-formulated water-borne coatings that satisfy REACH and green building labels. Germany's automotive Tier-1 suppliers and France's aerospace OEMs lock up multi-year framework agreements with nano-coating specialists.

South America injects momentum from infrastructure rehabilitation commitments in Brazil's transport corridors and Argentina's shale play servicing. Exposure to salt spray, high humidity, and UV intensity places a premium on high-performance coatings, and local paint majors partner with Japanese and German nanomaterial producers to localize blends. The Middle East's energy sector trials nano layers on downhole pumps and export pipelines to combat sour corrosion, while Africa's growth story lies in water networks, where internally applied nano sealants cut leak rates under high ambient heat.

- Aculon

- Artekya Teknoloji

- BASF

- Europlasma NV

- Graphene NanoChem

- GVD Corporation

- Henkel AG and Co. KGaA

- I-CanNano

- Nanofilm

- Nanoshine Group Corp

- Pearl Global Ltd.

- Pellucere

- PPG Industries, Inc.

- SIA Naco Technologies

- Starshield Technologies Pvt Ltd

- Tesla NanoCoatings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aerospace and defense corrosion-light-weight push

- 4.2.2 Increase in demand for EV thermal-fire-safety coating

- 4.2.3 Growing requirement for high performance coatings

- 4.2.4 Inceasing demand from infrastructure sector

- 4.2.5 Rise in utilization from electronics and consumer goods

- 4.3 Market Restraints

- 4.3.1 High production cost of nanomaterials

- 4.3.2 Nano-toxicity regulatory uncertainty

- 4.3.3 Graphene CVD reactor supply bottlenecks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Graphene

- 5.1.2 Carbon Nanotubes

- 5.1.3 Nano-TiO2 (Titanium Dioxide)

- 5.1.4 Nano-SiO2 (Silicon Dioxide)

- 5.1.5 Nano-ZnO

- 5.1.6 Nano Silver

- 5.2 By Method

- 5.2.1 Electrospray and Electrospinning

- 5.2.2 Chemical Vapor Deposition (CVD)

- 5.2.3 Physical Vapor Deposition (PVD)

- 5.2.4 Atomic Layer Deposition (ALD)

- 5.2.5 Aerosol Coating

- 5.2.6 Self-Assembly

- 5.2.7 Sol-Gel

- 5.3 By End-User Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Electronics and Optics

- 5.3.4 Biomedical

- 5.3.5 Food and Packaging

- 5.3.6 Marine

- 5.3.7 Oil and Gas

- 5.3.8 Other End-user Industries (Energy and Power, Construction and Infrastructure, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aculon

- 6.4.2 Artekya Teknoloji

- 6.4.3 BASF

- 6.4.4 Europlasma NV

- 6.4.5 Graphene NanoChem

- 6.4.6 GVD Corporation

- 6.4.7 Henkel AG and Co. KGaA

- 6.4.8 I-CanNano

- 6.4.9 Nanofilm

- 6.4.10 Nanoshine Group Corp

- 6.4.11 Pearl Global Ltd.

- 6.4.12 Pellucere

- 6.4.13 PPG Industries, Inc.

- 6.4.14 SIA Naco Technologies

- 6.4.15 Starshield Technologies Pvt Ltd

- 6.4.16 Tesla NanoCoatings Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment