|

市场调查报告书

商品编码

1844590

汽车诊断工具:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Diagnostic Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

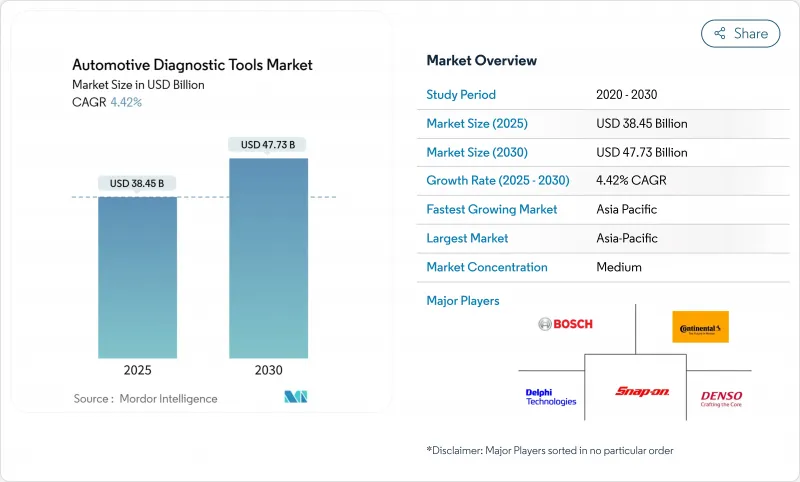

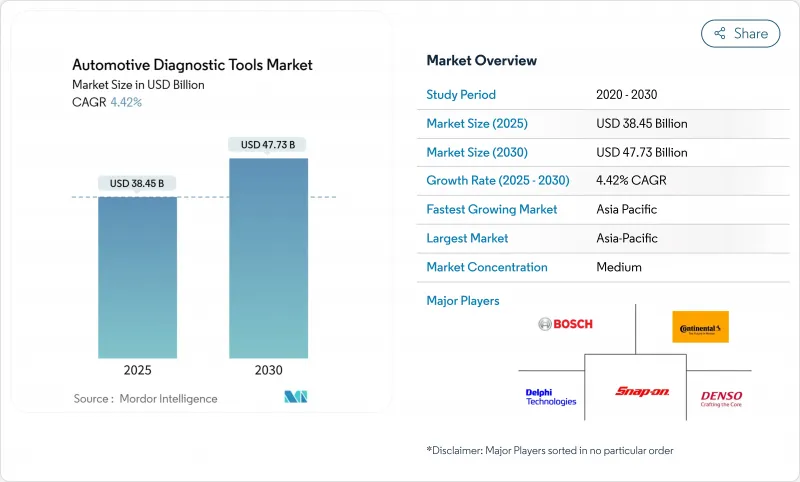

预计到 2025 年汽车诊断工具市场规模将达到 384.5 亿美元,到 2030 年将达到 477.3 亿美元,复合年增长率为 4.42%。

软体定义的汽车平臺、日益严格的网路安全标准以及电气化要求,正在推动扫描工具规格向高压安全、远端连接和云端分析方向发展。无线介面、无线更新支援以及符合 ISO/SAE 21434 标准的加密技术,如今已成为大型服务网路的采购标准。将故障码读取、ADAS 校准和预测性维护分析整合到单一萤幕的平台整合策略,正日益受到经销商和车队营运商的青睐。由于电动车产量成长和政府补贴加速了扫描工具的普及,亚太地区正呈现最强劲的销售成长动能。

全球汽车诊断工具市场趋势与见解

动力传动系统快速电气化

由于电池式电动车使用高压电路、热感包和双向充电器,因此无法使用标准 OBD-II 读取器进行诊断。加州计划到 2026 年强制实施统一的电动车诊断接口,这将迫使工具供应商必须对不同品牌的电池健康状况、绝缘电阻和充电器故障进行解码。像 Fluke FEV150 这样的充电站分析仪现在正逐渐进入维修站,用于检验电网互动。供应商也纷纷推出专用的电动车测试仪,例如 THINKTOOL CE EVD,该测试仪涵盖了 80 多个品牌。由于劳动力认证落后于车辆推广,用于指导经验不足的技术人员的数据丰富的工具正在赢得市场份额。

更严格的OBD-III/远距离诊断规则

SAE J1979-2 强制要求 2027 年后销售的内燃机车辆必须支援整合诊断服务。加州空气资源委员会 (CARB) 和欧盟监管机构也要求即时、云端基础的故障报告,将服务从维修店转移到资料中心。虽然主要工具製造商正在投资安全闸道认证和 ISO/SAE 21434 流程,但规模较小的竞争对手可能难以满足融资。根据 40 CFR 86.010-18,总重量超过 14,000 磅的大型引擎也面临并行监控义务。远端架构允许车队在故障发生前安排服务,从而减少计划外停机时间。

进阶扫描工具的初始成本高

顶级ADAS校准钻机和高压分析仪每个舱室的成本超过5万美元,这给小型维修厂带来了沉重的负担。日本对每家维修厂高达16万美元的补贴,只能抵销硬体和训练总成本的一小部分。订阅更新会增加拥有成本,但对于总合网关存取至关重要。这些经济因素正在推动独立公司转向特许经营网路和像asTech这样的远端服务平台,这些平台可以按需租赁OEM工具。

細項分析

OBD扫描器适用于1996年及以后的所有乘用车车型,并在2024年占据了汽车诊断工具市场的最大份额,达到44.58%。儘管这类汽车诊断工具的市场规模仍在不断扩大,但现代维修站需要ADAS、高压和云端同步等复杂功能,而这些功能是传统手持装置所缺乏的。 Snap-on的2025年春季程式码库为宾士增加了数百万个测试和安全网关,凸显了将OEM深度嵌入商品硬体的竞争态势。

电气系统分析仪的复合年增长率最高,达到 6.18%,依靠蓝牙 5.0 和双频 Wi-Fi 模组来维持即时遥测上传期间的吞吐量。压力洩漏测试仪和电池隔离探头与核心扫描器相辅相成,确保电动车电池组的热安全性,Redline Detection 的设备已获得 Fleet Safety 认证。供应商正在将多个感测器线束整合到一个底盘上,将成本分摊到每个作业中,并为注重预算的研讨会提供合理的溢价。

受常规排放和安全检查的推动,乘用车将在2024年占据汽车诊断工具市场份额的61.35%。然而,车队货车和卡车正在推动工具的使用趋势。到2030年,轻型商用车的复合年增长率将达到6.35%,电子商务将加快交货週期,从而减少停机时间。像国际卡车公司的OnCommand Connection这样的平台将即时性能数据输入云端仪表板,促使现役订单,从而减少路边事故。

总重超过 14,000 磅(约 6,000 公斤)的重型卡车必须遵守更严格的 CFR 诊断标准,从而扩展了多品牌设备对通讯协定的支援要求。博世车辆健康报告现在会突出显示混合负载车辆的冷却液和机油偏差,使维修经理能够在引擎损坏之前解决问题。随着电气化扩展到送货车,工具製造商必须在单一工作流程中将燃烧分析与电池分析结合起来,从而简化技术人员的学习过程并降低库存。

区域分析

到2024年,亚太地区将占据汽车诊断工具市场份额的36.41%,成长最快,复合年增长率达7.84%。预计2023年中国电动车产量将激增50%,进一步推动10兆元的汽车收益成长,进而支撑对诊断工具的强劲需求。中国政府计划在2025年前推出自动驾驶汽车,要求在车辆发出前使用支援V2X的诊断设备来检验雷达校准和雷射雷达清洁度。日本将于2024年10月开始强制执行OBD检查,并为维修厂购买扫描工具提供补贴,以确保符合规定。在印度,ASK Auto和爱信的售后市场合资企业将扩展其在南亚地区的零件和服务网络,推动扫描工具在二线城市的普及。

北美紧随其后,监管势头强劲。加州的《先进清洁汽车II》法规将在2026年前强制执行标准化电动车诊断,加州空气资源委员会(CARB)正在试行远端车载诊断系统(OBD)概念,以消除实地检查的需要。车队采用Uptake的人工智慧健康报告来优化维护预算,并增强将数据推送到云端仪表板的工具升级。原始设备製造商(OEM)经销商透过Snap-on的2025软体浪潮,为梅赛德斯-宾士等品牌添加安全网关解锁功能。

在欧洲,联合国 R155 网路安全法规正在颁布,要求对诊断介面进行型式核准审核。主要供应商正在采用 ISO/SAE 21434 框架来应对这些审核,而特许维修研讨会也受惠于法规合规覆盖。经汽车工业协会认证的培训计划正在填补技能缺口,尤其是在高压维护方面。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 动力传动系统快速电气化

- 加强OBD-III/远距离诊断法规(美国、欧盟)

- 预测性维护分析的需求不断增加

- 全球轻型车辆数量不断增加

- OTA 软体更新诊断集成

- 汽车电子产品日益复杂

- 市场限制

- 进阶扫描工具的初始成本高

- 连网工具网路安全认证的障碍

- 独立售后市场研讨会的技能差距

- 原始设备製造商之间的通讯标准分散

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按工具类型

- OBD扫描仪

- 专业扫描工具

- 电气系统分析仪

- 压力和洩漏测试仪

- 代码阅读器

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 透过促销

- 内燃机

- 纯电动车

- 混合动力和插电式混合动力

- 连结性别

- 有线

- 无线/蓝牙/Wi-Fi

- 按最终用户

- OEM经销商

- 独立售后市场车库

- 车队营运商

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Snap-on Inc.

- Continental AG

- Delphi/BorgWarner Technologies

- ACTIA Group

- Autel Intelligent Tech

- Launch Tech Co.

- Softing AG

- Vector Informatik GmbH

- KPIT Technologies Ltd.

- Hella KGaA Hueck & Co.

- Texa SpA

- Siemens Digital Industries Software

- Foxwell Tech

- OBD Solutions LLC

- Denso Corporation

- Innova Electronics

- Pico Technology Ltd.

第七章 市场机会与未来展望

The automotive diagnostic tools market size stood at USD 38.45 billion in 2025 and is forecast to reach USD 47.73 billion by 2030, growing at a 4.42% CAGR.

Software-defined vehicle platforms, tighter cybersecurity norms, and electrification mandates are steering tool specifications toward high-voltage safety, remote connectivity, and cloud analytics. Wireless interfaces, over-the-air update support, and ISO/SAE 21434-ready encryption now form baseline purchase criteria for large service networks. Platform integration strategies that bundle fault-code reading, ADAS calibration, and predictive maintenance analytics on a single screen are gaining traction with dealers and fleet operators. Asia-Pacific supplies the strongest volume pull as regional electric-vehicle output and government subsidies accelerate scan-tool adoption.

Global Automotive Diagnostic Tools Market Trends and Insights

Rapid electrification of powertrains

Battery-electric models use high-voltage circuits, thermal packs, and bidirectional chargers that standard OBD-II readers cannot interrogate. California will require a unified EV diagnostic interface by 2026, forcing tool vendors to decode battery health, insulation resistance, and charger faults across brands. Charging-station analyzers such as Fluke FEV150 now join service bays to validate grid interaction. Suppliers answer with purpose-built EV testers like THINKTOOL CE EVD, covering more than 80 brands. Workforce certification lags vehicle rollout, so data-rich tools that guide less-experienced technicians win share.

Tightening OBD-III/remote diagnostics rules

SAE J1979-2 obliges combustion-engine vehicles sold from 2027 to support unified diagnostic services, while the forthcoming J1979-3 standard targets zero-emission models. CARB and EU regulators also press for real-time, cloud-based fault reporting that shifts service from the garage to the data center. Large tool makers invest in secure-gateway credentials and ISO/SAE 21434 processes that small rivals may struggle to fund. Heavy-duty engines above 14,000 lb GVWR face parallel monitoring mandates under 40 CFR 86.010-18. Remote architecture enables fleets to schedule service before breakdowns, reducing unplanned downtime.

High up-front cost of advanced scan tools

Top-tier ADAS calibration rigs and high-voltage analyzers can exceed USD 50,000 per bay, a stretch for small garages. Japan's subsidy of up to JPY 160,000 per shop offsets only a fraction of the total hardware plus training spend. Subscription updates compound ownership cost yet remain essential for secure-gateway access. These economics push independents toward franchise networks or remote-service platforms such as asTech that rent OEM tools on demand.

Other drivers and restraints analyzed in the detailed report include:

- Growing demand for predictive maintenance analytics

- Rising global light-vehicle parc

- Cyber-security certification hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OBD scanners secured the largest slice of the automotive diagnostic tools market at 44.58% in 2024 because they work on every post-1996 passenger model. The automotive diagnostic tools market size attached to this category still grows, yet modern service bays demand combined ADAS, high-voltage, and cloud-sync features that legacy handhelds lack. Snap-on's spring 2025 code library adds millions of tests and secure gateways for Mercedes-Benz, underscoring the race to embed OEM depth inside universal hardware.

Electric-System analyzers, posting the fastest 6.18% CAGR, hinge on Bluetooth 5.0 and dual-band Wi-Fi modules that maintain throughput during live telemetry uploads. Pressure leak testers and battery insulation probes complement the core scanner by ensuring thermal safety in EV packs, with Redline Detection equipment gaining fleet-safety endorsements. Suppliers integrate multiple sensor harnesses into one chassis to spread cost across tasks and justify price premiums amid budget-sensitive workshops.

Passenger cars retained 61.35% of the automotive diagnostic tools market share in 2024, supported by routine emissions and safety inspections. Fleet-oriented vans and trucks, however, drive tool specification trends. Light commercial vehicles grow at 6.35% CAGR to 2030 as e-commerce accelerates delivery cycles that punish downtime. Platforms like International Trucks' OnCommand Connection feed real-time performance data to cloud dashboards, prompting proactive service orders that cut roadside events.

Heavy rigs over 14,000 lb GVWR comply with stricter CFR diagnostics, expanding protocol support requirements inside multi-brand devices. Bosch Vehicle Health reports now highlight coolant and oil deviations on mixed fleets, letting maintenance managers address issues before engine damage. As electrification reaches delivery vans, tool makers must bridge combustion and battery analytics in a single workflow, smoothing technician learning curves and inventory.

The Automotive Diagnostic Scan Tools Market Report is Segmented by Tool Type (OBD Scanners, Professional Scan Tools, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion (Internal Combustion Engine and More), Connectivity (Wired and Wireless and Bluetooth / Wi-Fi), End User (OEM Dealerships and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific holds 36.41% of the automotive diagnostic tools market share in 2024 and expands the fastest at 7.84% CAGR. China's 50% surge in EV production during 2023, plus a 10 trillion-yuan automotive revenue base, keeps tool demand buoyant. Beijing's push toward autonomous-mobility fleets by 2025 requires V2X-aware diagnostics that validate radar alignment and lidar cleanliness before dispatch. Japan begins obligatory OBD inspections in October 2024 and subsidizes scan-tool purchases for workshops to ensure compliance. India's aftermarket joint ventures between ASK Auto and AISIN extend parts and service networks across South Asia, lifting scan-tool penetration in tier-2 cities.

North America follows with strong regulatory momentum. California's Advanced Clean Cars II rule forces standardized EV diagnostics by 2026, and CARB pilots remote-OBD concepts that remove the need for physical inspection visits. Fleets adopt Uptake's AI health reports to optimize maintenance budgets, reinforcing tool upgrades that push data into cloud dashboards. OEM dealerships add secure-gateway unlocks for brands like Mercedes-Benz through Snap-on's 2025 software wave.

Europe aligns with UN R155 cybersecurity rules that demand type-approval audits for diagnostic interfaces. Large suppliers embed ISO/SAE 21434 frameworks to meet these audits, and franchise workshops benefit from corporate compliance coverage. Training schemes certified by the Institute of the Motor Industry close skill gaps, especially for high-voltage servicing.

- Robert Bosch GmbH

- Snap-on Inc.

- Continental AG

- Delphi/BorgWarner Technologies

- ACTIA Group

- Autel Intelligent Tech

- Launch Tech Co.

- Softing AG

- Vector Informatik GmbH

- KPIT Technologies Ltd.

- Hella KGaA Hueck & Co.

- Texa S.p.A.

- Siemens Digital Industries Software

- Foxwell Tech

- OBD Solutions LLC

- Denso Corporation

- Innova Electronics

- Pico Technology Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid electrification of powertrains

- 4.2.2 Tightening OBD-III/remote diagnostics regulations (U.S., EU)

- 4.2.3 Growing demand for predictive maintenance analytics

- 4.2.4 Rising global light-vehicle parc

- 4.2.5 Integration of OTA software update diagnostics

- 4.2.6 Escalating in-vehicle electronics complexity

- 4.3 Market Restraints

- 4.3.1 High up-front cost of advanced scan tools

- 4.3.2 Cyber-security certification hurdles for connected tools

- 4.3.3 Skills gap in independent aftermarket workshops

- 4.3.4 Fragmented communication standards across OEMs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Tool Type

- 5.1.1 OBD Scanners

- 5.1.2 Professional Scan Tools

- 5.1.3 Electric-System Analyzers

- 5.1.4 Pressure & Leak Testers

- 5.1.5 Code Readers

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.3 By Propulsion

- 5.3.1 Internal Combustion Engine

- 5.3.2 Battery-Electric Vehicle

- 5.3.3 Hybrid & Plug-in Hybrid

- 5.4 By Connectivity

- 5.4.1 Wired

- 5.4.2 Wireless / Bluetooth / Wi-Fi

- 5.5 By End User

- 5.5.1 OEM Dealerships

- 5.5.2 Independent Aftermarket Garages

- 5.5.3 Fleet Operators

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Snap-on Inc.

- 6.4.3 Continental AG

- 6.4.4 Delphi/BorgWarner Technologies

- 6.4.5 ACTIA Group

- 6.4.6 Autel Intelligent Tech

- 6.4.7 Launch Tech Co.

- 6.4.8 Softing AG

- 6.4.9 Vector Informatik GmbH

- 6.4.10 KPIT Technologies Ltd.

- 6.4.11 Hella KGaA Hueck & Co.

- 6.4.12 Texa S.p.A.

- 6.4.13 Siemens Digital Industries Software

- 6.4.14 Foxwell Tech

- 6.4.15 OBD Solutions LLC

- 6.4.16 Denso Corporation

- 6.4.17 Innova Electronics

- 6.4.18 Pico Technology Ltd.

7 Market Opportunities & Future Outlook

- 7.1 Remote Diagnostics-as-a-Service

- 7.2 ADAS & Autonomous Calibration Tools

- 7.3 Subscription-based Software Licensing