|

市场调查报告书

商品编码

1844591

间二甲苯:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Meta-Xylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

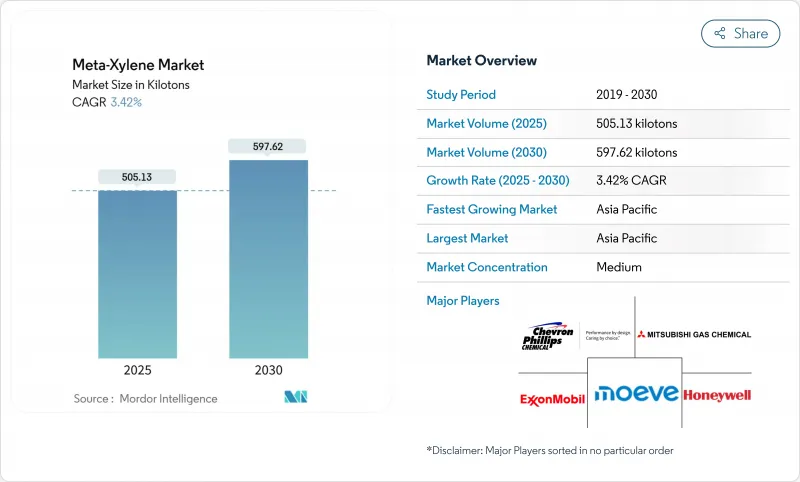

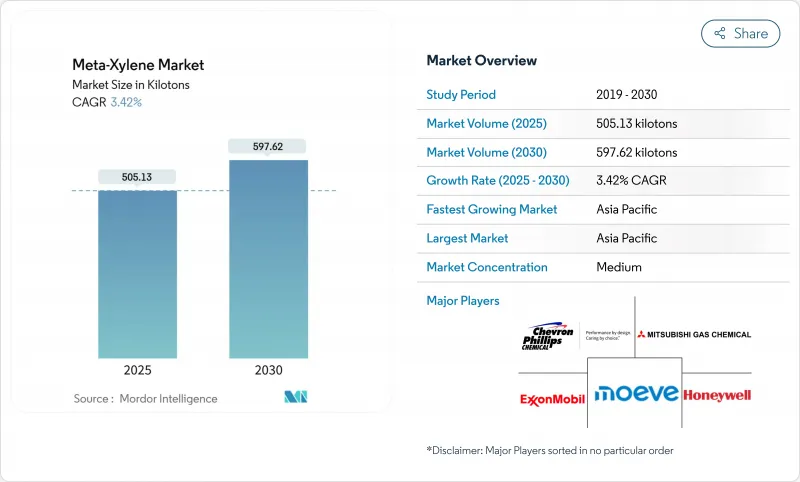

间二甲苯市场规模预计在 2025 年为 505.13 千吨,预计到 2030 年将达到 597.62 千吨,预测期内(2025-2030 年)的复合年增长率为 3.42%。

PET 和不饱和聚酯树脂 (UPR) 的持续消费以及向低 VOC 和生物基涂料原料的转变正在支撑产量增长,因为生产商利用间二甲苯作为间苯二甲酸的唯一原料。中国、印度和中东综合芳烃联合装置的产能扩张正在平衡供需,而先进的萃取技术正在降低单位成本并提高纯度阈值。在需求方面,控制溶剂排放的监管压力正在减少整体溶剂用量,同时提高间二甲苯在优质高固态涂料中的平衡蒸发率的价值。随着原油价格波动持续影响芳烃价差,跨国能源和化学巨头与地区龙头企业之间不断变化的动态正在重塑竞争格局。

全球间二甲苯市场趋势与洞察

PET 和 UPR 生产对间苯二甲酸的需求不断增长

间苯二甲酸可提高改质PET的热稳定性和气体阻隔性能,使其成为高端瓶装、薄膜和工业纤维的必需材料。当温度超过标准PET阈值时,汽车和电子产品製造商会指定使用间苯二甲酸改质PET,这增强了对间二甲苯的拉动需求。创新管道越来越依赖5-夫喃甲醇(HMF)等可再生原料,一旦达到商业规模,随着品牌所有者追求碳减排目标,生物基路线预计将在未来十年内获得市场份额。在UPR中,间苯二甲酸可为风力发电机涡轮机机舱和海洋复合材料提供高耐腐蚀性,从而支援亚太地区造船厂和欧洲海上设施结构应用的成长。因此,对PET和UPR的双重需求将对间二甲苯市场的发展轨迹产生最强烈的正面影响。

转向高固态/低VOC工业涂料

美国环保署 (EPA) 2024 年《危害通报标准》更新版收紧了二甲苯衍生物的标籤限制,促使配方设计师转向仍依赖间二甲苯有效控製黏度的高固态系统。欧洲的脱碳蓝图同样鼓励低 VOC 涂料,并敦促以间二甲苯温和的蒸发特性取代更轻、蒸发更快的溶剂。虽然水性涂料降低了总溶剂含量,但高端建筑和工业维护产品仍继续使用间二甲苯作为成膜助剂,从而在整个预测期内保持需求。

毒性和可燃性特征推动更严格的暴露限制

美国有毒物质与疾病登记署 (ATSDR) 已强调慢性二甲苯暴露可能引发神经系统问题,欧洲监管机构正在考虑降低 8 小时时间加权平均 (TWA) 职业暴露限值。加强通风、安装火花阻火系统和个人防护设备会增加生产成本,尤其是在小型或独立设施中。在可行的情况下,涂料製造商正在尝试替代溶剂,但间二甲苯独特的溶解性和加工特性使其无法完全替代,从而减少了需求,但并未消除需求。

細項分析

到2024年,间苯二甲酸产量将占间二甲苯市场规模的最大份额,达到46.17%,证实了该领域在高性能宝特瓶和耐腐蚀UPR层压板领域的强劲地位。向生物基间苯二甲酸的转变正在推进,预计到2030年,其复合年增长率将达到6.90%。欧洲和日本的早期采用者已开始认证物料平衡程序,以获取品牌商的溢价,而亚洲生产商正在毗邻生物质供应走廊建设待开发区设施。

从中期来看,儘管对2,4-二甲基苯胺和2,6-二甲基苯胺的毒性监管担忧,但其衍生的农业化学品和医药中间体仍可能维持利基市场需求。溶剂应用虽然绝对吨位下降,但由于特种电子和医药清洁领域需要间二甲苯较窄的沸程,因此表现出价值韧性。总体而言,应用结构正在从依赖大宗溶剂转向利润率更高的树脂和特种化学品应用,儘管整体成长温和,但整体盈利有所提升。

间二甲苯市场报告按用途(间苯二甲酸、2,4-二甲基苯胺和2,6-二甲基苯胺等)、终端用户行业(建筑和基础设施、包装、汽车和运输等)、纯度/等级(高纯度间二甲苯、工业级间二甲苯等)和地区(亚太地区、北美、欧洲、南美、中东和非洲)细分。市场预测以吨为单位。

区域分析

预计到2024年,亚太地区将占全球销售量的53.45%,到2030年的复合年增长率为5.50%。中国舟山芳烃中心和广东中海壳牌合资企业将分别提高区域自给率,并抑制来自美国和欧洲的进口。印度870亿美元的石化蓝图旨在2035年将国内二甲苯产能提升至550万吨,确保下游聚酯、涂料和医药原料的供应。由于来自中国的出口竞争日益激烈,日本和韩国面临结构性利润压力,迫使它们转向高纯度特殊产品和差异化配方。

北美凭藉其卓越的分离技术、丰富的页岩油资源以及接近性庞大的涂料基本客群,依然具有重要的战略意义。然而,不断上升的能源成本压力和日益严格的环保合规要求正在推高营运成本。雪佛龙可能以150亿美元收购菲利普斯66(Phillips 66)在CPChem的股份,这凸显了该地区企业追求规模和原料整合优势的整合趋势。墨西哥新兴的汽车价值链刺激了对溶剂和树脂的需求,但严重依赖从美国的进口,凸显了USMCA关税稳定的重要性。

欧洲面临最严峻的营运挑战,高昂的能源成本和严格的碳排放政策阻碍了对大宗芳烃的新投资。 《欧洲绿色新政》的碳边境调整机製或许能在一定程度上保护国内生产,但也增加了行政管理的复杂性。壳牌宣布将在2030年前退出基础化学品市场,这标誌着国际能源巨头将资本重新配置到液化天然气和可再生能源领域。剩余的欧洲生产商将专注于生物基间苯二甲酸和循环PET原料,并利用气候中性材料的监管奖励。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- PET 和 UPR 生产对间苯二甲酸的需求不断增长

- 转向高固态/低VOC工业涂料

- 提高PX-MX芳烃联合装置的产能

- 油漆和涂料行业需求增加

- 汽车产业扩张

- 市场限制

- 透过毒性和可燃性概况加强暴露监管

- 原油价格波动对芳烃价差产生连锁反应

- 资本密集型异构体分离技术阻碍新进者

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 产业竞争

第五章市场规模及成长预测(数量)

- 按用途

- 间苯二甲酸

- 2,4-和2,6-二甲基苯胺

- 溶剂

- 其他用途(农药中间体等)

- 按最终用户产业

- 建筑和基础设施

- 包装

- 汽车和运输

- 药品及农药

- 电气和电子

- 按纯度和等级

- 99.9% 或更高 MX(高纯度)

- 工业级 MX

- 混合二甲苯流

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Avantor, Inc.

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Hengli Petrochemical

- Honeywell International Inc.

- JXTG Nippon Oil & Energy

- LOTTE Chemical CORPORATION

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Moeve

- Shell Chemicals

- S-OIL CORPORATION

- Suzhou Jiutai Group Co., Ltd.

- Vizag Chemicals

第七章 市场机会与未来展望

The Meta-Xylene Market size is estimated at 505.13 kilotons in 2025, and is expected to reach 597.62 kilotons by 2030, at a CAGR of 3.42% during the forecast period (2025-2030).

Sustained PET and unsaturated polyester resin (UPR) consumption, together with a shift toward low-VOC and bio-based coating ingredients, underpins volume growth as producers leverage meta-xylene's role as the sole feedstock for isophthalic acid. Capacity additions inside integrated aromatics complexes across China, India, and the Middle East keep supply aligned with demand, while advanced extraction technologies lower unit costs and improve purity thresholds. On the demand side, regulatory pressure to curb solvent emissions is simultaneously reducing overall solvent volumes yet elevating the value of meta-xylene's balanced evaporation rate in premium, high-solids paints. As crude price volatility continues to influence aromatics spreads, the evolving dynamics among multinational energy-chemical giants and regional champions are reshaping the competitive landscape.

Global Meta-Xylene Market Trends and Insights

Growing Demand for Isophthalic Acid in PET & UPR Production

Isophthalic acid enhances thermal stability and gas-barrier performance in modified PET, making it indispensable for premium bottles, films and industrial fibers. Automotive and electronics manufacturers specify isophthalic acid-modified PET when temperatures exceed standard PET thresholds, reinforcing pull-through demand for meta-xylene. Innovation pipelines increasingly rely on renewable feedstocks such as 5-hydroxymethylfurfural (HMF); once commercial scale is reached, bio-based routes are expected to capture share within the next decade as brand owners pursue carbon-reduction goals. In UPR, isophthalic acid delivers higher corrosion resistance in wind-turbine nacelles and marine composites, supporting structural applications growth across Asia-Pacific shipyards and European offshore installations. The dual demand from PET and UPR accordingly registers the strongest positive impact on the meta-xylene market trajectory.

Shift Toward High-Solids/Low-VOC Industrial Coatings

The United States Environmental Protection Agency's 2024 Hazard Communication Standard update tightened labeling norms for xylene derivatives, pushing formulators toward higher-solids systems that still rely on meta-xylene for effective viscosity control. Europe's decarbonization roadmap similarly incentivizes low-VOC coatings, driving substitution of lighter, faster-evaporating solvents in favor of meta-xylene's more moderate evaporation profile. Although waterborne paints reduce aggregate solvent volumes, premium architectural and industrial maintenance products continue to incorporate meta-xylene as a coalescent aid, preserving demand through the forecast period.

Toxicological & Flammability Profile Driving Stricter Exposure Limits

The Agency for Toxic Substances and Disease Registry (ATSDR) underscores neurological concerns linked to chronic xylene exposure, prompting European regulators to contemplate lowering the 8-hour TWA occupational limit. Implementing enhanced ventilation, spark-proof handling systems, and personal protective equipment raises production costs, especially for small or standalone facilities. Where viable, coatings producers experiment with alternative solvents, yet meta-xylene's unique solvency and processing characteristics hinder full substitution, tempering but not eliminating demand.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Expansions in Integrated PX-MX Aromatics Complexes

- Increasing Demand from Paints and Coatings Sector

- Crude-Oil Price Volatility Cascading to Aromatics Spreads

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Isophthalic acid production accounted for the largest share of the meta-xylene market size, at 46.17% in 2024, underscoring the segment's entrenched role in high-performance PET bottles and corrosion-resistant UPR laminates. The progressive switch toward bio-based isophthalic acid, projected to grow at 6.90% CAGR to 2030, signals a structural realignment in feedstock sourcing as renewable chemistries enter commercial deployment. Early adopters in Europe and Japan already certify mass-balance routines to capture brandowner premiums, while Asian producers erect greenfield units adjacent to biomass supply corridors.

Over the medium term, pesticide and pharmaceutical intermediates derived from 2,4- and 2,6-xylidine will preserve niche demand despite regulatory concerns around toxicology. Solvent applications shrink in absolute tonnage but exhibit value resilience where specialty electronics and pharmaceutical cleaning require meta-xylene's narrow boiling range. Taken together, the application mix is migrating from bulk solvent dependency toward higher-margin resin and specialty chemical use, elevating overall profitability despite moderate headline growth.

The Meta-Xylene Market Report is Segmented by Application (Isophthalic Acid, 2, 4- & 2, 6-Xylidine, and More), End-User Industry (Construction & Infrastructure, Packaging, Automotive & Transportation, and More), Purity/Grade (High-Purity MX, Industrial-Grade MX, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific captured 53.45% of global volumes in 2024 and is forecast to clock a 5.50% CAGR through 2030, driven by vertically integrated complexes across China and India that harness feedstock flexibility and scale economics. China's Zhoushan aromatics hub and Guangdong CNOOC-Shell joint venture each broaden regional self-sufficiency, curbing import requirements from the United States and Europe. India's USD 87 billion petrochemical blueprint seeks to raise domestic xylene capacity to 5.5 million t by 2035, securing raw material availability for downstream polyester, coatings, and pharma corridors. Japan and South Korea confront structural margin pressure as Chinese exports intensify competition, spurring these economies to pivot toward high-purity specialties and differentiated formulations.

North America retains strategic significance through superior separation technologies, abundant shale-derived naphtha and proximity to a vast coatings customer base. However, upward pressure on energy costs and tightening environmental compliance increase operating expenditure. Chevron's potential USD 15 billion acquisition of Phillips 66's CPChem stake underscores the region's consolidation trajectory as companies chase scale and feedstock integration benefits. Mexico's emerging automotive value chain stimulates solvent and resin demand but relies heavily on United States imports, illustrating the importance of the USMCA's tariff stability.

Europe confronts the steepest operating challenges, with high utility costs and stringent carbon policies discouraging fresh investment in commodity aromatics. The European Green Deal's evolving carbon-border adjustment mechanism may partially shield domestic output yet adds administrative complexity. Shell's announcement to exit base chemicals by 2030 typifies how international energy majors reallocate capital toward LNG and renewables. Remaining European producers emphasize bio-based isophthalic acid and circular PET feedstocks, capitalizing on regulatory incentives for climate-neutral materials.

- Avantor, Inc.

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Hengli Petrochemical

- Honeywell International Inc.

- JXTG Nippon Oil & Energy

- LOTTE Chemical CORPORATION

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Moeve

- Shell Chemicals

- S-OIL CORPORATION

- Suzhou Jiutai Group Co., Ltd.

- Vizag Chemicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for isophthalic acid in PET and UPR production

- 4.2.2 Shift toward high-solids/low-VOC industrial coatings

- 4.2.3 Capacity expansions in integrated PX-MX aromatics complexes

- 4.2.4 Increasing demand from paints and coatings sector

- 4.2.5 Expansion of the automotive sector

- 4.3 Market Restraints

- 4.3.1 Toxicological and flammability profile driving stricter exposure limits

- 4.3.2 Crude-oil price volatility cascading to aromatics spreads

- 4.3.3 Capital-intensive isomer separation technology deterring newcomers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Isophthalic Acid

- 5.1.2 2,4- and 2,6-Xylidine

- 5.1.3 Solvents

- 5.1.4 Other Applications (Pesticide Intermediates, etc.)

- 5.2 By End-user Industry

- 5.2.1 Construction and Infrastructure

- 5.2.2 Packaging

- 5.2.3 Automotive and Transportation

- 5.2.4 Pharmaceuticals and Agrochemicals

- 5.2.5 Electrical and Electronics

- 5.3 By Purity/Grade

- 5.3.1 Greater than or equal to 99.9 % MX (High-Purity)

- 5.3.2 Industrial-Grade MX

- 5.3.3 Mixed Xylenes Stream

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avantor, Inc.

- 6.4.2 Chevron Phillips Chemical Company LLC

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 Hengli Petrochemical

- 6.4.5 Honeywell International Inc.

- 6.4.6 JXTG Nippon Oil & Energy

- 6.4.7 LOTTE Chemical CORPORATION

- 6.4.8 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.9 Moeve

- 6.4.10 Shell Chemicals

- 6.4.11 S-OIL CORPORATION

- 6.4.12 Suzhou Jiutai Group Co., Ltd.

- 6.4.13 Vizag Chemicals

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment