|

市场调查报告书

商品编码

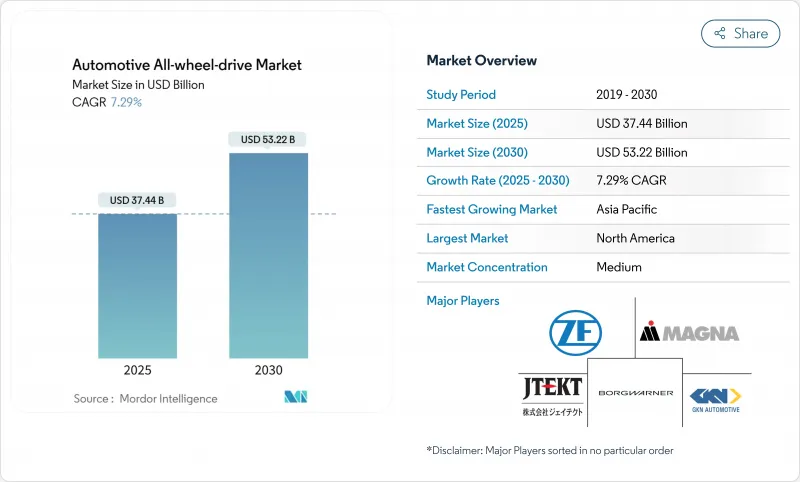

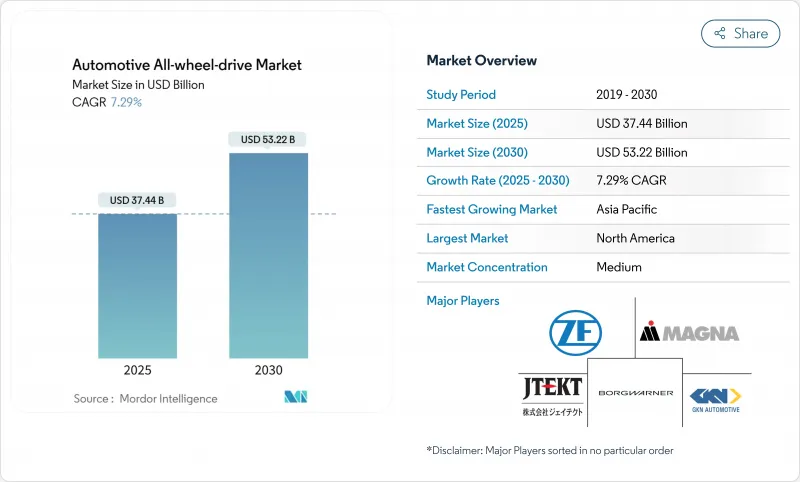

1844605

汽车 AWD(全轮驱动):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive All-wheel-drive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计汽车AWD(全轮驱动)市场规模将在2025年达到374.4亿美元,2030年达到532.2亿美元。

安全要求的加强、SUV 和跨界车的快速普及以及双电机电传动系统经济性的日趋成熟,都在推动这一扩张。由于高级驾驶辅助系统 (ADAS) 依赖可预测的扭力输出来优化防撞性能,因此原始设备製造商 (OEM) 现在从平台的早期阶段优先考虑牵引力管理整合。电气化也透过软体控制的马达取代分动箱和传动轴,减轻了长期存在的机械成本负担。随着每辆车中全轮驱动 (AWD) 车辆比例的增加,围绕稀土磁铁和功率半导体体重组供应链变得至关重要。竞争动态越来越有利于那些将传动系统硬体与无线软体服务结合的垂直整合供应商,将全轮驱动从一次性硬体功能转变为资料驱动效能升级的经常性收益管道。

全球汽车全轮驱动 (AWD) 市场趋势与洞察

全球SUV和CUV需求激增

预计到2030年,全球SUV和跨界车产量将达到2,800万辆,随着牵引系统从选配过渡到标配,全轮驱动(AWD)的比例预计将从2025年的45%上升至65%。即使在主要在铺装路面上行驶时,买家也越来越多地将AWD视为一种心理安全保障。中国品牌目前正将AWD捆绑到具有市场竞争力的基础价格中,降低了新兴市场的历史成本障碍。原始设备製造商通常将AWD与ADAS套件捆绑销售,以增强安全性并提高净利润率。消费者註重实用性的心态维持了全年需求,使得汽车AWD市场对冬季季节性的依赖程度降低。

透过电动化普及双马达e-AWD

SAE 测试表明,双马达纯电动车 (BEV) 比单马达布局附加元件机械式全轮驱动 (AWD) 的车辆能源效率高出 9%。省去传动轴和分动箱,不仅减轻了重量,还实现了精准的扭力控制。商用车运营商将受益于维护成本的降低和所有车桥上的再生煞车。现代汽车的全新混合动力平台展示了 e-AWD 如何在降低成本的同时,弥合内燃机 (ICE) 和纯电动车 (BEV) 架构之间的差距。

与两轮驱动相比,零件成本高,燃油/能源成本高

根据阿贡国家实验室的模拟数据,传统的全轮驱动系统会增加1,500至3,000美元的製造成本,并使内燃机车的燃油经济性降低约1至2英里/加仑。双马达版本的纯电动车续航里程会下降10%至15%,如同现代Ioniq 5的数据表所示。製造商通常会将全轮驱动系统作为标配以降低成本,但这会提高注重价值的细分市场的入门价格。儘管电池价格持续下降,但短期惩罚性措施仍是新兴市场销售的障碍。

細項分析

到2024年,乘用车将占据全轮驱动市场65.77%的份额,而搭载全轮驱动系统的SUV、跨界车和轿车的兴起,将标誌着牵引力管理从小众选择转变为主流期望。原始设备製造商正在将全轮驱动系统与捆绑的安全和资讯娱乐套件搭配使用,这推高了交易价格,同时满足了监管测试週期,这些测试週期奖励可预测的扭矩输出。消费者重视全轮驱动系统在湿滑和结冰路面上提供的全年可靠性,而保险公司通常会将其转化为更低的保费,从而推动即使在温暖的气候条件下也采用全轮驱动系统。高阶汽车还使用软体定义的扭力向量控制来区分不同装饰等级的驾驶动态,并将全轮驱动功能转化为体验式卖点,从而支援更高的残值。

商用车将以最快的速度成长,到2030年复合年增长率达到7.96%,因为包裹车、多用途车和紧急车辆将采用全轮驱动系统,以确保在各种负载容量和天气条件下都能保持关键运作正常运作。电力驱动桥透过消除分动箱简化了安装,减少了维护停机时间,并满足了主要城市中心普遍实施的零排放要求。车队远端资讯处理证实,儘管初始价格较高,但电动全轮驱动系统可减少与车轮空转相关的轮胎磨损,提高再生煞车效率,并降低整体拥有成本。政府对低排放气体商用运输的激励措施和更严格的安全审核将使全轮驱动系统成为未来车辆采购週期的核心要求,进一步加快其规格化速度。

虽然到2024年,内燃机仍将占据汽车全轮驱动(AWD)市场规模的84.25%,但随着双马达布局降低分动箱成本并提高扭力精度,电池电动动力传动系统的复合年增长率将达到10.11%。以内燃机为中心的平台越来越多地整合前部或后部电动模组,以提供混合动力全轮驱动,这进一步增强了日益严格的排放气体法规带来的投资前景。电池价格的下降,加上政府的奖励,正在缩小整体拥有成本差距,鼓励原始设备製造商以主流价格分布推出配备全轮驱动系统的纯电动车。

燃料电池技术的应用带来了新的商业性可能性:BMW与丰田合作,将于2028年推出氢动力SUV,旨在将远距性能与电动全轮驱动相结合,适用于重型车辆和寒冷气候应用。双马达架构也为软体收益铺平了道路,使汽车製造商能够以低价出售性能升级。在碳排放惩罚导致内燃机汽车运行成本上升的市场中,这些电动系统将获得更大的吸引力,而电动全轮驱动将成为牵引力、效率和合规性的新基准。

区域分析

2024年,北美将占据汽车AWD(全轮驱动)市场的43.17%,这得益于皮卡、SUV和车队细分市场的强劲需求,这些细分市场面临着雪地、混合地形和优惠保险政策的挑战。美国监管机构正在将AWD与强制性安全技术结合,以推动其普及。加拿大是轻型车辆中AWD普及率最高的国家,冬季牵引力是这些车辆的基本要求。

亚太地区是成长最快的地区,复合年增长率高达 8.55%。中国主机厂正在将全轮驱动系统融入主流出口车型,其价格优势超越了传统的两轮驱动竞争对手,重塑了全球对高性价比牵引力的认知。印度首款针对大众市场的全轮驱动电动车-玛鲁蒂铃木 e-Vitara 的推出,凸显了先进传动系统功能的普及。韩国继续在现代和起亚的产品组合中扩展电动全轮驱动系统,而日本则利用其混合动力全轮驱动系统的优势进行全球扩张。

欧洲市场成长平稳,但成长幅度较小,电动四驱系统是满足欧7排放标准并维持性能的主流途径。欧洲大陆的高阶车型正透过整合ADAS的精细扭力向量控制系统(符合通用安全法规II)来脱颖而出。南美和非洲的四驱跨界车采用率也较低,原因是基础设施的改善和进口关税的降低降低了四驱跨界车的零售价格。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 全球对 SUV 和 CUV 的需求不断增长

- 透过电气化采用双马达 e-AWD

- 更严格的防撞和牵引安全法规

- 消费者转向高阶市场的高性能操控

- 气候变迁促使原始设备製造商标准化全轮驱动

- 支援 OTA 的软体扭矩矢量架构

- 市场限制

- 与两轮驱动相比,零件成本和燃料/能源成本更高

- 电动致动器磁铁和半导体供应瓶颈

- 对纯电动车续航里程损失的担忧

- 自动驾驶转向效率优化的传动系统

- 价值/供应链分析

- 技术展望

- 监管状况

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争的激烈程度

第五章市场规模及成长预测

- 按车辆类型

- 搭乘用车

- 掀背车和轿车

- SUV与跨界车

- 商用车

- 轻型商用车

- 大型卡车和公共汽车

- 搭乘用车

- 依推进类型

- 内燃机(ICE)

- 混合动力电动车(HEV)

- 纯电动车(BEV)

- 燃料电池电动车(FCEV)

- 依系统类型

- 兼职/手动全轮驱动

- 全时/自动AWD

- 电动式/电子控制全轮驱动(双马达、四马达)

- 主动扭力向量全轮驱动

- 按组件

- 分动箱

- 差速器(中央、前部、后部)

- 联轴器和离合器组

- 螺旋桨轴和驱动轴

- 控制单元软体

- 按销售管道

- OEM安装

- 售后市场改装

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- BorgWarner Inc.

- GKN Automotive(Melrose)

- ZF Friedrichshafen AG

- Magna International Inc.

- JTEKT Corporation

- Toyota Motor Corporation

- Nissan Motor Co. Ltd

- Continental AG

- Eaton Corporation PLC

- American Axle & Manufacturing

- Dana Inc.

- Haldex AB

- Hyundai Motor Company

- Audi AG

- BMW Group

- Mercedes-Benz Group AG

- Schaeffler AG

- Mahle GmbH

- Stellantis NV

第七章 市场机会与未来展望

The automotive all-wheel drive market size reached USD 37.44 billion in 2025 and is expected to reach USD 53.22 billion by 2030, reflecting a steady 7.29% CAGR.

Strengthening safety mandates, rapid SUV and crossover uptake, and the maturing economics of dual-motor electrified drivelines together underpin this expansion. OEMs now prioritize traction management integration from the earliest platform stages because advanced driver-assistance systems depend on predictable torque delivery for optimal crash-avoidance performance. Electrification also removes long-standing mechanical cost penalties by replacing transfer cases and shafts with software-controlled e-motors. Supply-chain re-engineering around rare-earth magnets and power semiconductors is becoming pivotal as AWD content per vehicle rises. Competitive dynamics increasingly reward vertically integrated suppliers that fuse driveline hardware with over-the-air software services, transforming AWD from a one-time hardware feature into a recurring revenue channel for data-driven performance upgrades.

Global Automotive All-wheel-drive Market Trends and Insights

Soaring SUV and CUV Demand Worldwide

Global SUV and crossover output is forecast to hit 28 million units by 2030, and the share fitted with AWD is expected to climb from 45% in 2025 to 65% as traction systems shift from optional to default packaging. Buyers increasingly view AWD as a psychological safety premium even when driving predominantly on paved roads. Chinese brands now bundle AWD with competitive base pricing, lowering the historical cost barrier in emerging markets. OEMs frequently pair AWD with bundled ADAS suites, reinforcing safety credentials and boosting net margins. The utility mindset of consumers sustains year-round demand, making the automotive all-wheel drive market less dependent on winter seasonality.

Electrification-Driven Adoption of Dual-Motor e-AWD

Dual-motor BEVs achieve 9% better energy efficiency than single-motor layouts using add-on mechanical AWD according to SAE testing . Eliminating shafts and transfer cases cuts weight and unlocks precise torque control. Commercial operators benefit from lower maintenance and regenerative braking on all axles. Hyundai's new hybrid platform illustrates how e-AWD bridges ICE and full BEV architecture while containing costs.

Higher BOM Cost and Fuel/Energy Penalty vs 2WD

Traditional AWD adds USD 1,500-3,000 to build cost and reduces ICE fuel economy by roughly 1-2 mpg according to Argonne simulations . BEV range drops 10-15% in dual-motor versions, as demonstrated by the Hyundai Ioniq 5 data sheet. Manufacturers often convert AWD into standard equipment to dilute cost, yet this raises entry prices in value-focused segments. Battery prices continue to fall, but the near-term penalty remains a sales hurdle in emerging markets.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Crash-Avoidance and Traction Safety Mandates

- Consumer Shift to Performance Handling in Premium Segments

- Magnet and Semiconductor Supply Bottlenecks for e-Actuators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars captured 65.77% of the automotive all-wheel drive market share in 2024, illustrating how SUVs, crossovers, and increasingly AWD-equipped sedans have moved traction management from niche option to mainstream expectation. OEMs pair AWD with bundled safety and infotainment packages, boosting transaction prices while satisfying regulatory test cycles that reward predictable torque delivery. Consumers value the year-round confidence AWD offers on wet or icy roads, and insurers often reflect that benefit in lower premiums, reinforcing adoption even in temperate regions. Premium marques also use software-defined torque vectoring to differentiate ride dynamics across trim levels, turning AWD capability into an experiential selling point that supports higher residual values.

Commercial vehicles post the fastest expansion at a 7.96% CAGR through 2030 as parcel, utility, and emergency fleets adopt AWD to ensure mission-critical uptime under varied payloads and weather conditions. Electrified axles simplify installations by eliminating transfer cases, lowering maintenance downtime, and meeting zero-emission mandates spreading across large urban centers. Fleet telematics confirm that electric AWD reduces wheel-spin-related tire wear and enhances regenerative braking efficiency, improving total cost of ownership despite higher upfront prices. Government incentives for low-emission commercial transport and stricter safety audits further accelerate specification rates, positioning AWD as a core requirement for future fleet procurement cycles.

Internal combustion engines still represented 84.25% of the automotive all-wheel drive market size in 2024, but battery-electric powertrains are rising at a 10.11% CAGR as dual-motor layouts erase transfer-case costs and sharpen torque accuracy. ICE-centric platforms increasingly embed electric front or rear modules to offer hybrid AWD, future-proofing investments against tightening emissions rules. Reduced battery prices and government incentives jointly narrow the total-cost-of-ownership gap, prompting OEMs to launch AWD-equipped BEVs across mainstream price bands.

Fuel-cell initiatives indicate fresh commercial potential: BMW's collaboration with Toyota on a 2028 hydrogen SUV aims to pair long-range capability with electric AWD for heavy-duty or cold-weather routes. Dual-motor architectures also open software monetization paths, letting automakers sell performance upgrades over the air. In markets where carbon penalties inflate ICE running costs, these electrified systems gain further momentum, positioning e-AWD as the new baseline for traction, efficiency, and compliance.

The Automotive All-Wheel Drive Market Report is Segmented by Vehicle Type (Passenger Cars and Commercial Vehicles), Propulsion Type (Internal-Combustion Engine (ICE), Hybrid Electric Vehicle (HEV), and More), System Type (Part-Time/Manual AWD, Full-Time/Automatic AWD, and More), Component (Transfer Case, and More), Sales Channel, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 43.17% of the automotive all-wheel drive market in 2024 with robust demand from pickups, SUVs, and fleet segments that confront snow, mixed terrain, and insurance rating incentives. U.S. regulators coupling AWD with mandated safety technologies reinforce uptake. Canada exhibits the highest AWD penetration among light vehicles because winter traction is a baseline expectation.

Asia Pacific is the fastest-growing region at an 8.55% CAGR. Chinese OEMs embed AWD into mainstream exports that undercut traditional two-wheel-drive competitors on price, reshaping global perceptions of cost-effective traction. India's introduction of the Maruti Suzuki e-Vitara, the country's first mass-market AWD EV, highlights the democratization of advanced driveline capability. South Korea continues to scale e-AWD across Hyundai and Kia portfolios, while Japan leverages hybrid AWD heritage for global deployments.

Europe shows steady but less dramatic growth, with electrified AWD as a favored route to meet Euro 7 emission goals while preserving performance. The continent's premium marques differentiate through fine-grained torque vectoring, integrated with ADAS aligned to General Safety Regulation II. South America and Africa remain smaller today yet illustrate rising adoption on the back of infrastructure upgrades and import duty reductions that lower retail prices for AWD crossovers.

- BorgWarner Inc.

- GKN Automotive (Melrose)

- ZF Friedrichshafen AG

- Magna International Inc.

- JTEKT Corporation

- Toyota Motor Corporation

- Nissan Motor Co. Ltd

- Continental AG

- Eaton Corporation PLC

- American Axle & Manufacturing

- Dana Inc.

- Haldex AB

- Hyundai Motor Company

- Audi AG

- BMW Group

- Mercedes-Benz Group AG

- Schaeffler AG

- Mahle GmbH

- Stellantis N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring SUV and CUV demand worldwide

- 4.2.2 Electrification-driven adoption of dual-motor e-AWD

- 4.2.3 Tightening crash-avoidance and traction safety mandates

- 4.2.4 Consumer shift to performance handling in premium segments

- 4.2.5 Climate-volatility prompting OEM AWD standardisation

- 4.2.6 OTA-enabled software torque-vectoring architectures

- 4.3 Market Restraints

- 4.3.1 Higher BOM cost and fuel/energy penalty vs 2WD

- 4.3.2 Magnet and semiconductor supply bottlenecks for e-actuators

- 4.3.3 Range-loss concern in battery-EVs

- 4.3.4 Autonomous-driving shift toward efficiency-optimised drivelines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchbacks and Sedans

- 5.1.1.2 SUVs and Crossovers

- 5.1.2 Commercial Vehicles

- 5.1.2.1 Light Commercial Vehicles

- 5.1.2.2 Heavy Trucks and Buses

- 5.1.1 Passenger Cars

- 5.2 By Propulsion Type

- 5.2.1 Internal-Combustion Engine (ICE)

- 5.2.2 Hybrid Electric Vehicle (HEV)

- 5.2.3 Battery Electric Vehicle (BEV)

- 5.2.4 Fuel-Cell Electric Vehicle (FCEV)

- 5.3 By System Type

- 5.3.1 Part-Time/Manual AWD

- 5.3.2 Full-Time/Automatic AWD

- 5.3.3 Electric/e-AWD (Dual-Motor, Quad-Motor)

- 5.3.4 Active Torque-Vectoring AWD

- 5.4 By Component

- 5.4.1 Transfer Case

- 5.4.2 Differential (Center, Front, Rear)

- 5.4.3 Coupling and Clutch Pack

- 5.4.4 Prop-Shaft and Drive Shaft

- 5.4.5 Control Unit and Software

- 5.5 By Sales Channel

- 5.5.1 OEM-Installed

- 5.5.2 Aftermarket Retrofit

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 BorgWarner Inc.

- 6.4.2 GKN Automotive (Melrose)

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Magna International Inc.

- 6.4.5 JTEKT Corporation

- 6.4.6 Toyota Motor Corporation

- 6.4.7 Nissan Motor Co. Ltd

- 6.4.8 Continental AG

- 6.4.9 Eaton Corporation PLC

- 6.4.10 American Axle & Manufacturing

- 6.4.11 Dana Inc.

- 6.4.12 Haldex AB

- 6.4.13 Hyundai Motor Company

- 6.4.14 Audi AG

- 6.4.15 BMW Group

- 6.4.16 Mercedes-Benz Group AG

- 6.4.17 Schaeffler AG

- 6.4.18 Mahle GmbH

- 6.4.19 Stellantis N.V.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment