|

市场调查报告书

商品编码

1844625

电子发现:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Electronic Discovery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

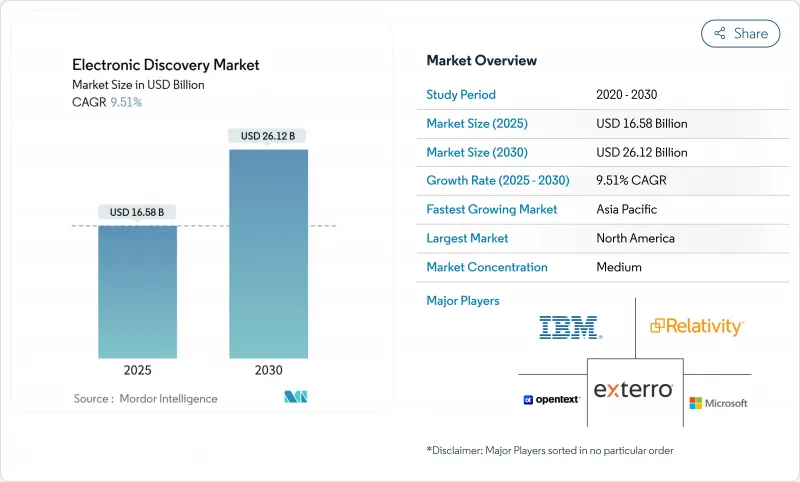

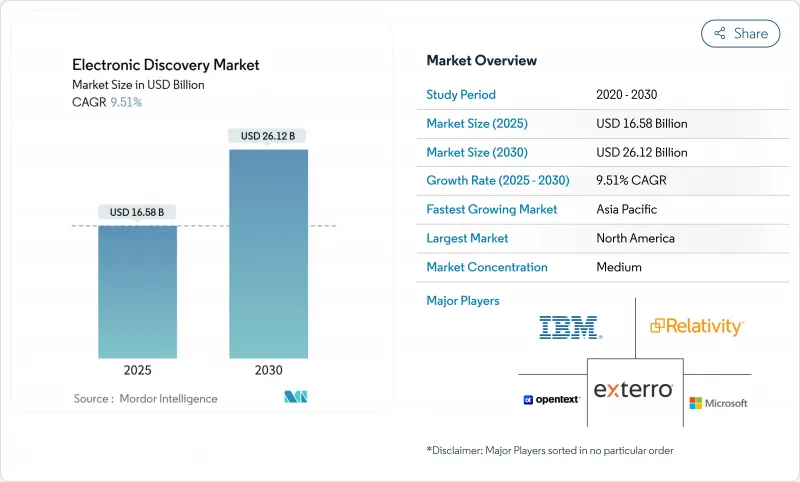

预计 2025 年电子数据展示市场规模将达到 165.8 亿美元,到 2030 年将达到 261.2 亿美元,预测期内复合年增长率为 9.51%。

高度数位化的法律流程、多格式数据的激增以及日益复杂的监管环境,迫使法律部门对取证工作流程进行现代化改造,并采用人工智慧支援的审查工具。大型律师事务所正在寻求高级分析技术来规避不断上涨的诉讼成本,而小型企业则将业务外包给託管服务专家,以便在无需承担全部基础设施成本的情况下获得类似的功能。向云端优先架构的转变,加上付费使用制的经济模式以及混合办公环境下日益增长的协作需求,正在推动技术的应用。北美在平台创新和案例法成熟度方面保持着规模优势,而亚太地区的两位数成长则反映了地方执法机制与跨境贸易的融合,为供应商创造了新的收益来源。随着云端原生企业的出现,竞争格局正在加剧,这些企业凭藉透明的定价、精简的用户体验以及可解释的人工智慧功能(以满足新的受理标准)向现有企业发起挑战。

全球电子取证市场趋势与洞察

整合人工智慧和机器学习,提高审核效率

生成式人工智慧和大规模语言建模工具已将人工审核时间缩短高达 70%,使律师事务所能够将员工重新部署到更高价值的辩护工作中。 CS Disco 的 Cecilia Assistant 解释了对话分析如何在保留审核线索的同时减少重复标记。美国707 号规则的拟议修正案要求律师在 AI 输出被采纳之前,不仅要证明其准确性,还要证明其可靠性。因此,供应商正在投资透明的模型管治框架(例如可解释的排名、校准指标和监管链日誌记录),以在不牺牲采纳度的情况下保持采用势头。随着这些保证层的成熟,在效率和防御性之间取得平衡的电子取证市场新参与企业可能会扩大其竞争优势。

行动和云端资料来源的激增

光是 Microsoft Teams 每年就要处理超过 1 兆页数据,凸显了数据发现团队面临的巨大挑战。混合工作模式正在将证据储存库扩展到个人设备和消费者应用程序,迫使公司重新思考资讯管治的基本原理。云端原生供应商正在使用 API 驱动的连接器解决复杂性,这些连接器直接从 Slack、Google Vault 和 Microsoft 365 中提取数据,从而自动化合法保留和收集工作流程。然而,随着每个新的资料管道的出现,隐私侵犯的攻击面也在扩大,导致客户要求零知识加密和特定区域的资料驻留控制。因此,电子发现市场正倾向于在单一使用者介面下统一策略实施、联合搜寻和人工智慧实体提取的平台。

中小企业整体拥有成本不断上升

入门级处理费用高达每GB 15至30美元,再加上不断增长的数据量,导致计划总支出超出了许多中小企业的预算。虽然云端许可降低了初始投资成本,但储存、进阶分析和专家评审等下游成本仍然很高。像KLDiscovery这样负债累累的服务供应商的例子表明,随着供应商试图巩固资产负债表,利润压力会如何透过定价产生连锁反应。价格合理的自动化、透明的订阅等级以及基于社区的培训资源可能会削弱市场限制,但市场两极分化依然存在,企业客户倾向于全方位服务平台,而注重成本的用户则默认使用基本的关键字搜寻。

細項分析

到2024年,託管服务将占据电子发现市场份额的46.30%,反映出企业倾向将处理、託管和人工智慧模式调优等劳动密集型任务外包。供应商透过集中基础设施和人才实现规模经济,使客户能够将固定成本转化为可变支出。预计咨询和实施后服务将以10.15%的复合年增长率成长,吸引那些寻求管治蓝图以遏制多重云端蔓延并负责任地整合人工智慧的组织。随着发现需求扩展到行动聊天、云端存檔和社交资讯流,企业将优先考虑透过单一服务等级协定实现端到端课责(法律保留、收集、分析和生产)。因此,电子发现行业正在奖励那些销售基于结果的服务包而不是按零碎任务定价的供应商。

託管专家还整合了资料最小化策略和特权审查模型等调查辅助功能。在证据采信日益严格的时代,这些差异化优势缩短了审查週期,并增强了防御能力。向高成长地区扩张的服务供应商,例如 Exterro 在清奈新设立的法医实验室,正在利用当地人才库来扩展全天候支援服务并降低交付成本。

电子取证和早期案件评估套件将在2024年引领软体类别,营收份额达34%。而人工智慧主导的审查和分析预计将以10.40%的复合年增长率在该领域保持最快成长。客户正在将采购标准从原始处理能力转向洞察速度——平台能够多快地发现託管热点、情绪枢纽和权限异常。 Relativity 云端采用率达到75%表明,SaaS 交付如何加速功能部署,并扩展运算能力以应对密集的机器学习工作负载。同时,专注于合法保留和生产的单点解决方案供应商即使其平台透过整合 API 闸道并无缝整合到更广泛的案件管理堆迭中进行整合,仍能保持其利基市场相关性。

伴随人工智慧分析的兴起,电子取证市场正日益受到可解释性仪錶板和偏见测试通讯协定的保护。买家要求可配置的置信度阈值和支持法庭陈述的叙述性摘要。将透明人工智慧与精细成本追踪工具相结合的供应商在风险和财务管理方面脱颖而出,吸引了注重预算的公司法律顾问。

区域分析

受既定法律先例、蓬勃发展的诉讼以及密集的服务供应商生态系统的推动,北美地区将在2024年贡献41.20%的收入。总部位于该地区的市场领导者——微软、IBM、OpenText和Relativity——已经制定了具有全球影响力的产品蓝图。然而,随着云端运算应用接近饱和以及律师事务所最终完成人工智慧部署,成长正在放缓。服务提供者目前正专注于预测结果模型和自动特权筛检等增值模组,以捍卫其市场份额。

预计到2030年,亚太地区的复合年增长率将达到11.40%,这得益于企业责任立法的不断扩展和跨境案件的增加。日本有限的取证条款以及律师-客户保密特权的缺失,推动了对将本地资料处理与离岸分析中心相结合的混合工作流程的需求。澳洲、印度和新加坡在监管协调方面处于领先地位,旨在使本地资讯揭露规范与全球最佳实践保持一致,从而加速平台的采用。亚太地区成功的供应商正在透过在地化使用者介面、提供区域资料中心以及培养国内事件回应团队来解决主权问题。

在欧洲,随着企业克服GDPR资料传输限制,资料采用率持续稳定提升。提供区域内託管、精细化同意管理和自动化PII编辑服务的供应商在竞标中享有优先权。英国脱欧后法规的差异化要求建立一个模组化合规引擎,以便根据司法管辖区切换保留和删除政策。拉丁美洲、中东和非洲地区仍在发展中,但与美国当局的监管合作正在加强,跨国公司更有可能在执法行动实施之前预先安装揭露基础设施。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 行动和云端资料来源的激增

- 严格的资料隐私法规(GDPR、CCPA 等)

- 加强公司内部调查

- 整合AI/ML,提高审核效率

- 协作平台(Slack、Teams)的兴起导致资料复杂性增加

- 需要跨司法管辖区证据开示的跨境诉讼增多

- 市场限制

- 中小企业整体拥有成本不断上升

- 缺乏熟练的电子取证专业人员

- 跨境资料传输的限制

- 对人工智慧模型透明度的担忧影响其法律可采性

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 按服务

- 专业服务

- 託管服务

- 咨询和实施后服务

- 按软体

- 电子取证与早期案件评估

- 合法保留和保存

- 资料处理与剔除

- 文件审查与分析

- 创作与呈现

- 按部署

- SaaS/云

- 本地部署

- 託管/混合

- 按最终用户

- 政府及公共机构

- BFSI

- 资讯科技/通讯

- 医疗保健和生命科学

- 能源与公共产业

- 运输/物流

- 媒体与娱乐

- 零售与电子商务

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Relativity ODA LLC

- Exterro Inc.

- Nuix Pty Ltd

- Micro Focus International plc

- Veritas Technologies LLC

- Logikcull.com Inc.

- CloudNine Discovery

- DISCO Inc.

- Everlaw Inc.

- ZyLAB Inc.

- FTI Consulting Inc.

- Deloitte Touche Tohmatsu Ltd.

- Kroll Ontrack LLC

- Xerox Holdings Corporation

- Catalyst Repository Systems Inc.

- Driven Inc.

- AccessData Group Inc.

- Guidance Software(OpenText)

- HaystackID LLC

第七章 市场机会与未来展望

The electronic discovery market size stood at USD 16.58 billion in 2025 and is projected to reach USD 26.12 billion in 2030, reflecting a 9.51% CAGR over the forecast period.

Heightened digitization of legal processes, the rapid rise in multi-format data, and mounting regulatory complexity are pushing legal departments to modernize discovery workflows and adopt AI-enabled review tools. Large enterprises view advanced analytics as a hedge against spiraling litigation costs, while small and mid-sized firms outsource to managed-service specialists to access comparable capabilities without bearing full infrastructure costs. Deployment preferences continue to swing toward cloud-first architectures, encouraged by pay-as-you-go economics and by heightened collaboration needs in hybrid work settings. North America retains scale advantages in platform innovation and case-law maturity, yet Asia-Pacific's double-digit expansion underscores how local enforcement regimes and cross-border commerce are converging to create fresh revenue pools for vendors. Competitive intensity is rising as cloud-native entrants challenge incumbents with transparent pricing, streamlined user experiences, and explainable AI features that address emerging admissibility standards.

Global Electronic Discovery Market Trends and Insights

AI/ML Integration Improving Review Efficiency

Generative AI and large-language-model tooling now slash human review hours by up to 70%, enabling law firms to redeploy staff toward higher-value advocacy. CS Disco's Cecilia assistant illustrates how conversational analytics curtail repetitive tagging while preserving audit trails . Courts are concurrently tightening evidentiary standards: proposed U.S. Rule 707 amendments will oblige counsel to demonstrate reliability, not just accuracy, before AI outputs become admissible. Vendors are therefore investing in transparent model governance frameworks-explainable ranking, calibration metrics, and chain-of-custody logging-to sustain adoption momentum without jeopardizing admissibility. As these assurance layers mature, electronic discovery market participants that marry efficiency with defensibility will widen their competitive moat.

Proliferation of Mobile and Cloud Data Sources

Microsoft Teams alone processes more than 1 trillion pages annually, underscoring the scale challenge facing discovery teams. Hybrid work patterns extend evidence repositories into personal devices and consumer apps, compelling enterprises to revisit information-governance baselines. Cloud-native vendors are countering complexity through API-driven connectors that pull data directly from Slack, Google Vault, and Microsoft 365, automating legal hold and collection workflows. Yet every new data pipe expands the attack surface for privacy breaches, so clients demand zero-knowledge encryption and region-specific data-residency controls. The electronic discovery market is therefore gravitating toward platforms that integrate policy enforcement, federated search, and AI-powered entity extraction under a single user interface.

Escalating Total Cost of Ownership for SMEs

Entry-level processing fees of USD 15-30 per GB intersect with rising data volumes, pushing overall project spend beyond many small-firm budgets. While cloud licensing reduces upfront capital outlay, downstream expenses-storage, advanced analytics, specialist review talent-remain material. Debt-laden service providers such as KLDiscovery illustrate how margin pressure can ripple through pricing as vendors seek to shore up balance sheets. Affordable automation, transparent subscription tiers, and community-based training resources could blunt the restraint, but market bifurcation persists, with enterprise clients gravitating to full-service platforms and cost-sensitive users defaulting to rudimentary keyword searches.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Data-Privacy Regulations (GDPR, CCPA, etc.)

- Growth in Corporate Internal Investigations

- AI Model Transparency Concerns Affecting Legal Admissibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Managed services accounted for a 46.30% electronic discovery market share in 2024, reflecting corporate preference for outsourcing labor-intensive tasks such as processing, hosting, and AI model tuning. Providers achieve economies of scale by centralizing infrastructure and talent, letting clients convert fixed costs into variable spend. Advisory and post-implementation services, forecast at a 10.15% CAGR, attract organizations that need governance roadmaps to tame multicloud sprawl and to embed AI responsibly. As discovery requests span mobile chat, cloud archives, and social feeds, enterprises value end-to-end accountability-legal hold, collection, analytics, and production-under a single service-level agreement. The electronic discovery industry therefore rewards vendors that market outcome-based service bundles over piecemeal task pricing.

Managed specialists also integrate investigation accelerators such as data-minimization playbooks and privilege-screening models. These differentiators shorten review cycles and bolster defensibility in an era of stricter admissibility scrutiny. Providers expanding into high-growth geographies, exemplified by Exterro's new forensics lab in Chennai, leverage local talent pools to scale 24/7 support and lower delivery costs.

E-discovery and early case-assessment suites led the software category with 34% revenue share in 2024, yet AI-driven review and analytics is projected to rise at 10.40% CAGR, the fastest within the segment. Customers are shifting procurement criteria from raw processing horsepower toward insight velocity-how quickly a platform can surface custodial hot spots, sentiment pivots, or privilege anomalies. Relativity's move to a 75% cloud adoption ratio illustrates how SaaS delivery accelerates feature rollout and scales compute for intensive machine-learning workloads. Meanwhile, point-solution vendors that specialize in legal hold or production are embedding API gateways to integrate seamlessly into broader case-management stacks, preserving niche relevance even as platforms consolidate.

The electronic discovery market size attached to AI analytics is increasingly defended by explainability dashboards and bias-testing protocols. Buyers demand configurable confidence thresholds and narrative summaries that support courtroom presentation. Vendors that package transparent AI with granular cost-tracking tools differentiate on both risk and financial stewardship, appealing to corporate counsel under budget oversight.

The Electronic Discovery Market Report is Segmented by Service (Professional Services, Managed Services, Advisory & Post-Implementation Services), Software (E-Discovery and Early Case Assessment, Legal Hold and Preservation, and More), Deployment (SaaS/Cloud, On-Premise, Hosted/Hybrid), End User (Government and Public Sector, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 41.20% revenue in 2024 on the strength of established case law, prolific litigation, and a dense ecosystem of service providers. Market leaders headquartered in the region-Microsoft, IBM, OpenText, and Relativity-set product roadmaps that ripple globally. Growth, however, is moderating as cloud adoption approaches saturation and law firms finalize AI rollouts. Providers now emphasize value-add modules such as predictive outcome modeling and automated privilege screening to defend wallet share.

Asia-Pacific is forecast to grow at 11.40% CAGR through 2030, buoyed by expanding corporate-liability statutes and increasing cross-border deal activity. Japan's limited discovery provisions and absence of attorney-client privilege create demand for hybrid workflows that blend local data processing with offshore analytics hubs. Australia, India, and Singapore spearhead regulatory harmonization that aligns local disclosure norms with global best practices, accelerating platform uptake. Vendors succeeding in APAC localize user interfaces, offer regional data centers, and cultivate in-country incident-response teams to satisfy sovereignty concerns.

Europe continues steady adoption while navigating GDPR-driven constraints on data transfer. Providers offering in-region hosting, fine-grained consent management, and automated PII redaction earn preference in competitive bids. Post-Brexit divergence in UK rules demands modular compliance engines capable of toggling retention and deletion policies per jurisdiction. Latin America and Middle East and Africa remain nascent, yet rising regulatory cooperation with U.S. agencies is tipping multinational corporations to pre-deploy discovery infrastructure before enforcement actions materialize.

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Relativity ODA LLC

- Exterro Inc.

- Nuix Pty Ltd

- Micro Focus International plc

- Veritas Technologies LLC

- Logikcull.com Inc.

- CloudNine Discovery

- DISCO Inc.

- Everlaw Inc.

- ZyLAB Inc.

- FTI Consulting Inc.

- Deloitte Touche Tohmatsu Ltd.

- Kroll Ontrack LLC

- Xerox Holdings Corporation

- Catalyst Repository Systems Inc.

- Driven Inc.

- AccessData Group Inc.

- Guidance Software (OpenText)

- HaystackID LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of mobile and cloud data sources

- 4.2.2 Stringent data-privacy regulations (GDPR, CCPA, etc.)

- 4.2.3 Growth in corporate internal investigations

- 4.2.4 AI/ML integration improving review efficiency

- 4.2.5 Rise of collaborative platforms (Slack, Teams) driving data complexity

- 4.2.6 Increasing cross-border litigation requiring multi-jurisdictional discovery

- 4.3 Market Restraints

- 4.3.1 Escalating total cost of ownership for SMEs

- 4.3.2 Shortage of skilled e-discovery professionals

- 4.3.3 Cross-border data-transfer restrictions

- 4.3.4 AI model transparency concerns affecting legal admissibility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service

- 5.1.1 Professional Services

- 5.1.2 Managed Services

- 5.1.3 Advisory and Post-Implementation Services

- 5.2 By Software

- 5.2.1 E-discovery and Early Case Assessment

- 5.2.2 Legal Hold and Preservation

- 5.2.3 Data Processing and Culling

- 5.2.4 Document Review and Analysis

- 5.2.5 Production and Presentation

- 5.3 By Deployment

- 5.3.1 SaaS / Cloud

- 5.3.2 On-premise

- 5.3.3 Hosted / Hybrid

- 5.4 By End User

- 5.4.1 Government and Public Sector

- 5.4.2 BFSI

- 5.4.3 IT and Telecommunication

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Energy and Utilities

- 5.4.6 Transportation and Logistics

- 5.4.7 Media and Entertainment

- 5.4.8 Retail and E-commerce

- 5.4.9 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 OpenText Corporation

- 6.4.4 Relativity ODA LLC

- 6.4.5 Exterro Inc.

- 6.4.6 Nuix Pty Ltd

- 6.4.7 Micro Focus International plc

- 6.4.8 Veritas Technologies LLC

- 6.4.9 Logikcull.com Inc.

- 6.4.10 CloudNine Discovery

- 6.4.11 DISCO Inc.

- 6.4.12 Everlaw Inc.

- 6.4.13 ZyLAB Inc.

- 6.4.14 FTI Consulting Inc.

- 6.4.15 Deloitte Touche Tohmatsu Ltd.

- 6.4.16 Kroll Ontrack LLC

- 6.4.17 Xerox Holdings Corporation

- 6.4.18 Catalyst Repository Systems Inc.

- 6.4.19 Driven Inc.

- 6.4.20 AccessData Group Inc.

- 6.4.21 Guidance Software (OpenText)

- 6.4.22 HaystackID LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment