|

市场调查报告书

商品编码

1844626

无晶片 RFID:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Chipless RFID - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

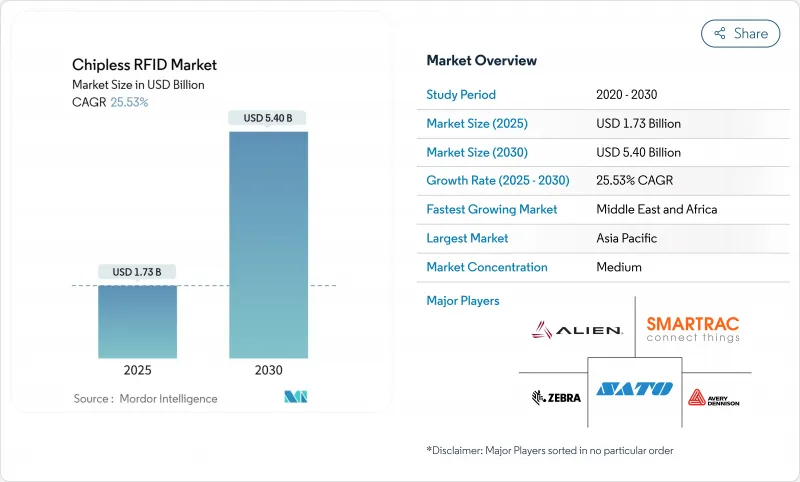

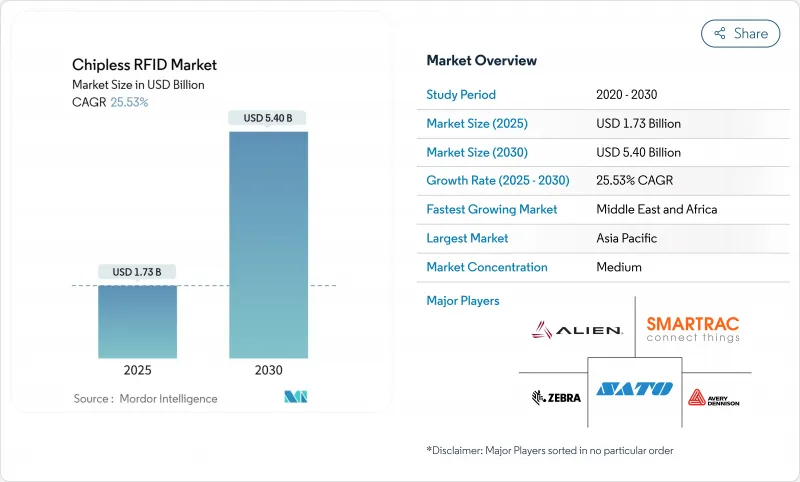

无晶片 RFID 市场预计在 2025 年达到 17.3 亿美元,在 2030 年达到 54 亿美元,复合年增长率为 25.53%。

亚洲快速消费品包装的蓬勃发展、欧洲和中东地区更严格的身份验证法规以及可印刷导电油墨的进步(使每个标籤的製造成本降至0.05美元以下)推动了需求的增长。低成本的身份验证解决方案、更长的读取距离天线设计以及领先的被动温度感测技术正在再形成竞争优势。供应商正在垂直扩展至油墨、基板和中间件领域,以保护利润并提供一站式解决方案。区块链与低温运输监控平台的整合正在为受监管产业开闢新的收益来源。

全球无晶片 RFID 市场趋势与洞察

低成本批量生产用于亚洲快速消费品包装的无 IC 标籤

中国和东南亚的製造商正在将软式电路板与银奈米浆料结合,以实现低于五美分的标籤,从而为无晶片RFID市场在消费品多包装中的大规模应用奠定了基础。合约印刷商正在运作多通道柔版印刷生产线,速度超过120公尺/分钟,每家工厂每年可印製超过20亿张标籤。更快的维修投资回报以及与包装加工商的地理位置优势正在加速其应用。供应商正在试用可回收的纤维素基材,以符合品牌的永续性目标。随着成本下降,一次性标籤也正在扩展到一次性电子产品和药品单剂量包装领域。

政府消费税/印花税义务

欧盟因仿冒品造成的损失估计高达160亿欧元(173亿美元),促使欧盟出台了2024/1640号指令,该指令支持使用具有独特射频签名的防篡改标识符。义大利、西班牙和沙乌地阿拉伯财政部目前正在为酒类和烟草印花税票指定无晶片格式,允许印刷商将安全机制融入单张通行证中。长期合约鼓励建立端到端可追溯平台,并开放高解析度读取器的更换週期。东协正在考虑类似的立法,这意味着到2028年将出现第二波需求。

读取范围和晶片有限的超高频系统

无晶片标籤在自由空气中的峰值覆盖范围通常为3米,而晶片式超高频标籤的覆盖范围可达10米或更远,这迫使仓库必须提高读取器密度,并可能使基础设施预算翻倍。目前正在研发的多层超材料天线可增加40%的覆盖范围,但金属货架和液体物品仍会衰减讯号。整合商正在采用基于区域的门户和混合部署方案来应对这一挑战,将无晶片标籤保留用于包裹级物品,同时继续在托盘上使用晶片式嵌体。

細項分析

这凸显了标籤在无晶片RFID市场所有部署场景中的重要性。亚洲合约印表机正利用其规模优势来降低单位成本,而欧洲安全印表机则专注于高价值的身份验证器。中介软体收入目前规模较小,但将以26.4%的复合年增长率快速成长,因为企业需要云端连接器、资料清理和分析功能,将原始射频回波转换为可操作的仪表板。

中间件的加速成长正在改变市场议价能力。软体供应商如今正在影响硬体设计蓝图,并推动开放 API 的发展。因此,标籤製造商正在投资资讯服务团队,以维护其市场份额。这一趋势将中间件定位为未来功能的安全隔离网闸,例如预测性维护和基于人工智慧的签章匹配。

到2024年,网版印刷将占据38%的市场份额,这得益于其长期的生产力和成熟的供应链,尤其是在食品和饮料包装领域。在无晶片RFID市场,喷墨列印製程正以27.7%的复合年增长率扩张,因为按需喷墨印表机可以製造出适用于高密度签章编码的细线天线。

采用喷墨技术也支援现场客製化。品牌商可以在产品发布前几天印製限量版真品标识,从而降低产品过时的风险。对于大批量SKU来说,网版印刷生产线仍然占据主导地位,因为模具摊销可以抵消转换成本。从用于接地层的网版印刷到用于微天线的喷墨印刷的混合生产线正日益普及,但这反映出一个过渡时期,而非彻底的替代。

区域分析

亚太地区将引领无晶片RFID市场,预计到2024年将占到总营收的40%。中国加工商正在运作整合式网版印刷和柔版印刷生产线,为国内外快速消费品品牌提供服务。澳洲邮政正在跨境小包裹上试用无晶片标籤,以减少申报诈骗。地方政府正在共同资助可生物降解基材的研究,以符合「零塑胶指令」。

北美也紧随其后,凭藉强大的智慧财产权组合以及医疗保健和航太的早期采用者基本客群。大学正在与新兴企业合作,将石墨烯油墨商业化;联邦政府津贴支持生技药品和关键备件的安全供应链;超级市场正在引入无晶片标籤,以减少生鲜产品的浪费,并将单品级数据与 ESG 报告挂钩。

欧洲则位居第三,但在防伪法规的推动下,欧洲正经历稳定成长。义大利和波兰的税票计画规定了无晶片射频安全层。北欧包装公司正在整合纸质嵌体以实现循环经济目标,德国机器製造商正在向亚洲原始设备製造商提供模组化喷墨头。中东和非洲地区目前规模较小,但成长速度最快,海湾合作委员会各国央行已将纸币的射频认证标准化,南非海关正在对高价值出口商品引入无晶片封条。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 低成本批量生产用于亚洲快速消费品包装的无 IC 标籤

- 政府消费税/税票强制令(欧盟防伪)

- 北美标籤加工产业可印刷导电油墨的进展

- 低温运输医疗物流中的被动式感测器

- 纸币和安全文件认证需求(中东)

- 市场限制

- 与晶片式超高频系统相比,读取范围有限

- ISO/IEC 编码标准不一致

- 领导基础设施维修费用

- 印刷天线易受潮湿和磨损的影响

- 价值/供应链分析

- 技术展望

- 印刷技术

- 喷墨

- 萤幕

- 柔版印刷

- 凹版印刷

- 印刷技术

- 监理展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 依产品类型

- 标籤

- 领导者

- 中介软体

- 按运作频率

- LF(125-134 kHz)

- HF(13.56 MHz)

- UHF(860-960 MHz)

- 按材质

- 银奈米墨水

- 铜基油墨

- 石墨烯/碳墨水

- 按用途

- 智慧卡

- 智慧票

- 品牌和文件认证

- 资产追踪

- 按最终用户产业

- 零售与电子商务

- 医疗保健和製药

- 物流/运输

- 银行、金融服务和保险(BFSI)

- 政府及公共机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Alien Technology

- Avery Dennison

- Zebra Technologies

- SATO Holdings

- Smartrac Technology

- NXP Semiconductors

- Thinfilm Electronics ASA

- PragmatIC Semiconductor

- Impinj Inc.

- Stora Enso

- Spectra Systems Corp.

- Linxens

- TagSense

- Tageos SA

- Variuscard GmbH

- IDTRONIC GmbH

- SML Group

- Toppan Printing Co.

第七章 市场机会与未来展望

The chipless RFID market size is valued at USD 1.73 billion in 2025 and is forecast to grow to USD 5.40 billion by 2030, advancing at a 25.53% CAGR.

Demand acceleration stems from fast-moving consumer-goods packaging in Asia, stricter authentication regulations in Europe and the Middle East, and advances in printable conductive inks that have cut per-tag manufacturing costs below USD 0.05. Leadership in low-cost authentication solutions, longer read-range antenna designs, and passive temperature-sensing features is reshaping competitive priorities. Suppliers are expanding vertically into inks, substrates, and middleware in order to safeguard margins and offer one-stop solutions. Convergence with blockchain and cold-chain monitoring platforms is opening additional revenue streams in regulated industries.

Global Chipless RFID Market Trends and Insights

Lower-cost Mass Production of IC-less Tags in Asian FMCG Packaging

Manufacturers in China and Southeast Asia have combined flexible substrates with silver-nano paste to reach sub-5-cent tags, positioning the chipless RFID market for high-volume adoption in consumer-goods multipacks. Contract printers are running multi-lane flexographic lines at speeds above 120 m/min, allowing over 2 billion units per plant annually. Fast payback on retrofits and geographic proximity to packaging converters accelerate uptake. Suppliers are piloting recyclable cellulose substrates to align with brand sustainability targets. As costs fall, single-use tags are extending into disposable electronics and unit-dose pharmaceutical packs.

Government Excise / Tax-stamp Mandates

EU loss estimates of EUR 16 billion (USD 17.3 billion) in counterfeited goods prompted Directive 2024/1640, which endorses tamper-evident identifiers with unique RF signatures. Ministries of finance in Italy, Spain, and Saudi Arabia now specify chipless formats for alcohol and tobacco stamps so printers can embed security in a single press pass. Long-run contracts incentivise end-to-end traceability platforms and open replacement cycles for high-resolution readers. Similar legislation is under review in ASEAN, suggesting a second wave of demand by 2028.

Limited Read Range versus Chipped UHF Systems

Chipless tags typically peak at 3 m in free air, compared with over 10 m for chipped UHF tags, forcing warehouses to increase reader density, which can double infrastructure budgets. Multi-layer metamaterial antennas now in prototype add 40% range, yet metallic racks and liquid contents still attenuate signals. Integrators respond with zone-based portals and hybrid deployments, reserving chipless tags for package-level items while pallets continue to carry chipped inlays.

Other drivers and restraints analyzed in the detailed report include:

- Printable Conductive-Ink Advances in North American Label Converting

- Passive Sensor Adoption for Cold-chain Healthcare Logistics

- Absence of Harmonised ISO / IEC Encoding Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tag sales generated 71% of 2024 revenue, underscoring their indispensability across every deployment scenario in the chipless RFID market. Asian contract printers leverage scale to drive unit costs down, while European security printers focus on high-value authenticators. Middleware revenues, although smaller today, are set to climb faster at a 26.4% CAGR because enterprises require cloud connectors, data cleansing, and analytics to turn raw RF echoes into actionable dashboards.

Accelerated middleware growth alters bargaining power; software vendors now influence hardware design road maps and push for open APIs. As a result, tag manufacturers invest in data-services teams to defend share. The trend positions middleware as a gatekeeper for future functionality such as predictive maintenance and AI-based signature matching.

Screen printing held a 38% share in 2024 thanks to long-run productivity and mature supply chains, especially within food and beverage packaging. The chipless RFID market now sees ink-jet processes expanding at 27.7% CAGR because droplet-on-demand heads create fine-line antennas suitable for high-density signature encoding.

Ink-jet adoption also supports on-site customisation. Brand owners can print limited-edition authenticity marks days before product launch, cutting obsolescence risk. Screen lines keep their advantage in very high-volume SKUs where tooling amortisation offsets changeover costs. Hybrid lines that start with screen for ground planes and finish with ink-jet for micro-antennas are gaining traction, reflecting a transition phase rather than outright displacement.

The Chipless RFID Market is Segmented by Product Type (Tag, Reader, Middleware), Printing Technology (Ink-Jet, Screen, and More), Operating Frequency (LF 125-134 KHz, and More), Material (Silver-Nano Ink, Copper-Based Ink, and More), Application (Smart Cards, Smart Tickets, and More), End-User Industry (Retail and E-Commerce, Healthcare and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific led the chipless RFID market with 40% revenue in 2024. China's converters run integrated screen and flexographic lines, serving domestic and export FMCG brands, while Japanese rail operators extend RFID-enabled fare systems to rural routes. Australia's postal service is trialling chipless tags on cross-border parcels to cut declaration fraud. Regional governments co-fund research into biodegradable substrates, aligning with zero-plastic directives.

North America follows with strong intellectual-property portfolios and an early-adopter customer base in healthcare and aerospace. Universities collaborate with start-ups to commercialise graphene inks, and federal grants support secure supply chains for biologics and critical spare parts. Supermarket chains deploy chipless tags to reduce perishables wastage and tie item-level data into ESG reporting.

Europe ranks third yet posts steady gains driven by anti-counterfeiting mandates. Tax-stamp programs in Italy and Poland stipulate chipless RF security layers. Nordic packaging firms integrate paper inlays to meet circular-economy targets, and German machine builders ship modular ink-jet heads to Asian OEMs. The Middle East & Africa region, while smaller today, is the fastest growing; GCC central banks standardise banknote RF authentication and South African customs rolls out chipless seals on high-value exports.

- Alien Technology

- Avery Dennison

- Zebra Technologies

- SATO Holdings

- Smartrac Technology

- NXP Semiconductors

- Thinfilm Electronics ASA

- PragmatIC Semiconductor

- Impinj Inc.

- Stora Enso

- Spectra Systems Corp.

- Linxens

- TagSense

- Tageos SA

- Variuscard GmbH

- IDTRONIC GmbH

- SML Group

- Toppan Printing Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lower-cost Mass-production of IC-less Tags in Asian FMCG Packaging

- 4.2.2 Government Excise/Tax-stamp Mandates (EU Counter-feiting)

- 4.2.3 Printable Conductive-Ink Advances in North American Label Converting

- 4.2.4 Passive Sensor Adoption for Cold-chain Healthcare Logistics

- 4.2.5 Banknote and Secure-Document Authentication Demand (Middle East)

- 4.3 Market Restraints

- 4.3.1 Limited Read Range vs. Chipped UHF Systems

- 4.3.2 Absence of Harmonised ISO/IEC Encoding Standards

- 4.3.3 Retrofit Cost of Reader Infrastructure

- 4.3.4 Moisture and Abrasion Vulnerability of Printed Antennas

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.5.1 Printing Technologies

- 4.5.1.1 Ink-jet

- 4.5.1.2 Screen

- 4.5.1.3 Flexographic

- 4.5.1.4 Gravure

- 4.5.1 Printing Technologies

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Tag

- 5.1.2 Reader

- 5.1.3 Middleware

- 5.2 By Operating Frequency

- 5.2.1 LF (125-134 kHz)

- 5.2.2 HF (13.56 MHz)

- 5.2.3 UHF (860-960 MHz)

- 5.3 By Material

- 5.3.1 Silver-nano Ink

- 5.3.2 Copper-based Ink

- 5.3.3 Graphene/Carbon Ink

- 5.4 By Application

- 5.4.1 Smart Cards

- 5.4.2 Smart Tickets

- 5.4.3 Brand and Document Authentication

- 5.4.4 Asset Tracking

- 5.5 By End-user Industry

- 5.5.1 Retail and E-commerce

- 5.5.2 Healthcare and Pharmaceuticals

- 5.5.3 Logistics and Transportation

- 5.5.4 Banking, Financial Services and Insurance (BFSI)

- 5.5.5 Government and Public Sector

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alien Technology

- 6.4.2 Avery Dennison

- 6.4.3 Zebra Technologies

- 6.4.4 SATO Holdings

- 6.4.5 Smartrac Technology

- 6.4.6 NXP Semiconductors

- 6.4.7 Thinfilm Electronics ASA

- 6.4.8 PragmatIC Semiconductor

- 6.4.9 Impinj Inc.

- 6.4.10 Stora Enso

- 6.4.11 Spectra Systems Corp.

- 6.4.12 Linxens

- 6.4.13 TagSense

- 6.4.14 Tageos SA

- 6.4.15 Variuscard GmbH

- 6.4.16 IDTRONIC GmbH

- 6.4.17 SML Group

- 6.4.18 Toppan Printing Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment