|

市场调查报告书

商品编码

1844678

高吸水性聚合物(SAP):市场占有率分析、产业趋势、统计、成长预测(2025-2030)Super Absorbent Polymers (SAP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

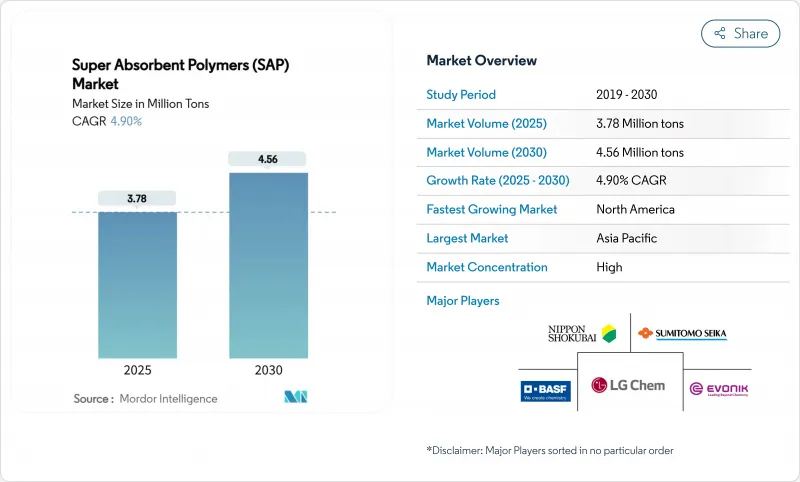

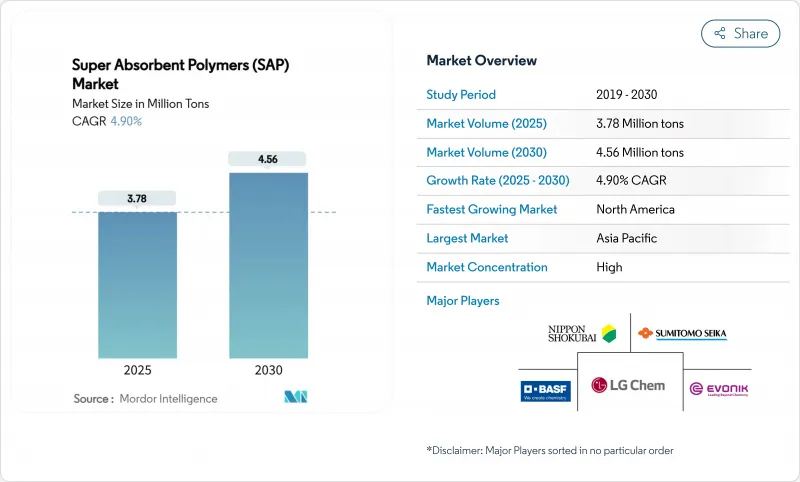

预计高吸水性聚合物 (SAP) 市场规模在 2025 年将达到 378 万吨,到 2030 年预计将达到 456 万吨,预测期内 (2025-2030 年) 的复合年增长率为 4.90%。

婴儿纸尿裤需求的不断增长、高 SAP 成人失禁垫片的迅速普及以及工业和农业应用的不断扩大是这一稳步增长的主要驱动力。欧洲法规收紧,有利于生物基化学品,加上中国和印度人均纸尿裤购买量的不断上升,正在推动产品系列向高端、高性能等级靠拢。製造商继续升级其工厂,提高能源效率和垂直整合,以缓解丙烯酸价格波动。同时,直接面向消费者的订购模式和电子商务主导的低温运输包装正在释放高利润的利基市场,抵消标准卫生产品销售的利润压力。对纤维素和淀粉基替代品的投资增加表明,永续性正在推动高吸收性聚合物 (SAP) 市场的品牌价值和製程创新。

全球高吸水性聚合物(SAP)市场趋势与洞察

中国和印度人均一次性尿布支出增加

在支持家庭规模扩大和可支配收入增加的政策推动下,中国都市区家庭自2022年以来平均尿布支出预计将增加15%。在印度,二、三线城市的通路扩张,使首次购买尿布的消费者能够轻鬆购买到先进的一次性尿布。包括高容量SAP等级和低凝胶堵塞率在内的高端SKU,正在加速高吸水性聚合物(SAP)市场的单位消费量和销售成长。本地加工商越来越多地透过长期承购协议锁定供应,以确保品质并降低运费风险。

高SAP成人失禁垫片迅速普及

日本、韩国、德国和义大利的人口老化加剧了成人失禁的流行。新型垫片提高了高达40%,并且拥有与普通内裤类似的低调设计,鼓励人们日间使用。订阅式电商通路不断扩展,捆绑了谨慎配送、失禁保险和旅游专用SKU。製造商正积极应对这项挑战,推出差异化的核壳颗粒形态,以提高负重下的吸收能力,从而在高吸水性聚合物市场中打造出一个利润丰厚的细分市场。

原物料价格不稳定

丙烯酸占生产成本的70%,季度波动高达25%,这给采购预算带来了不确定性。长虹聚合物计画于2026年投产的16亿美元丙烷-丙烯酸工厂,可能会降低可变成本曲线,并打破现有西方供应商之间的价格平价。人们对生物基路线和垂直整合的兴趣日益浓厚。

細項分析

由于其在婴儿纸尿裤领域久经考验的可靠性,到2024年,丙烯酸树脂将占据高吸水性聚合物 (SAP) 市场份额的72%。为了提高安全性,高阶品牌正在指定使用游离单体含量低的高纯度丙烯酸SAP。同时,聚丙烯酰胺牌号的复合年增长率达到6.6%,这得益于其在农业和工业干燥密封应用中的卓越保水性。预计2025年至2030年间,聚丙烯酰胺的产量将成长12.5万吨,从而抢占丙烯酸牌号的市场份额。

产品开发人员正在寻求将丙烯酸和多醣骨架混合的混合网络,以平衡成本和降解性。日本触媒的生物质SAP生产线就是此类跨化学创新的一个例子,该生产线已获得清真认证,并在印尼生产。目前的重点是生物质采购物流、杂质管理和可扩展的连续反应器设计,以确保聚合物结构的一致性。

凝胶聚合将在2024年保持60%的收入份额,这得益于优化的反应器组,以实现高吞吐量和均匀的交联密度。能源回收迴路和连续单体循环将提高成本竞争力。溶液聚合将以5%的复合年增长率成长,因为它能够生产小批量、窄分子量分布的特种等级产品,并降低能源负荷,符合永续性目标。

悬浮聚合和反相悬浮聚合在特定领域仍占有一席之地,这些领域需要独特的颗粒形貌,例如用于医用液体管理的核壳微球。製程工程师专注于精确的交联剂进料控制和线上光谱分析,以便在加载时定制吸收率,这进一步细分了高吸水性聚合物市场。

高吸水性聚合物 (SAP) 市场按产品类型(聚丙烯酰胺、丙烯酸基、其他)、聚合工艺(溶液聚合、其他)、应用(婴儿尿布、成人失禁产品、其他)、最终用户行业(个人护理和卫生製造商、农业投入品供应商、其他)和地区(亚太地区、北美、欧洲、其他)细分。

区域分析

到2024年,亚太地区将占据高吸水性聚合物 (SAP) 市场的42%,这得益于中国丙烯酸-SAP一体化丛集,该产业集群最大限度地减少了原材料物流。政府的激励措施,尤其是在江苏省和山东省,正在帮助消除产能瓶颈并扩大出口导向业务。印度将透过日益普及的一次性尿布来促进销售量成长,而日本则在特种产品和生质能产品领域保持技术领先地位。

预计到2030年,北美地区的复合年增长率将达到5.50%,位居榜首。成长的驱动因素包括:高端一次性尿布的SKU、婴儿潮世代对高吸水性树脂(SAP)成人失禁产品的采用,以及集水块和低温运输垫片等特殊工业应用。一个与赠地大学合作的研究联盟正在开创基于纤维素和蛋白质的网络,以使企业的永续性承诺与监管趋势保持一致。该地区也率先在园艺领域使用大麻基SAP,这强化了高吸水性聚合物市场的循环经济叙事。

欧洲严格的政策环境正在加速生物基和可回收包装的采用。德国的产量领先,而北欧国家则正在推动消费者对可堆肥尿布芯的偏好。合规成本促使聚合物供应商和废弃物管理公司建立合作关係,试行闭合迴路收集方案。欧盟标准对出口配方的影响日益增强,迫使全球生产商协调产品安全和标籤规范。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 中国和印度人均尿布支出增加

- 高SAP成人失禁垫片在亚洲和欧洲越来越受欢迎

- 欧盟一次性塑胶指令转向生物基SAP

- 电子商务主导吸水包装垫片(低温运输)需求快速成长

- 扩大农业用途

- 市场限制

- 原物料价格不稳定

- 婴儿纸尿裤中残留单体的安全隐患

- 生产成本高

- 生产成本概览

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争的激烈程度

第五章市场规模及成长预测

- 依产品类型

- 聚丙烯酰胺

- 丙烯酸类

- 其他的

- 按聚合工艺

- 溶液聚合

- 悬浮/反相悬浮聚合

- 凝胶聚合

- 按用途

- 婴儿尿布

- 成人失禁用品

- 女性用卫生用品

- 农业支持

- 其他用途

- 按最终用户产业

- 个人护理和卫生产品製造商

- 农资供应商

- 医疗保健提供者

- 其他终端产业(电讯和电力电缆製造商、食品和医药低温运输物流)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- ADM

- BASF

- Braskem

- Chase Corp.

- Chemtex Speciality Limited

- Evonik Industries AG

- Formosa Plastics Group

- LG Chem

- NIPPON SHOKUBAI CO., LTD.

- SANYO CHEMICAL INDUSTRIES, LTD.

- SAP SE

- Satellite Chemical

- SNF

- SONGWON

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- TOYO BOEKI Co.,Ltd.

- Wanhua

- Yixing Danson Technology

第七章 市场机会与未来展望

The Super Absorbent Polymers Market size is estimated at 3.78 Million tons in 2025, and is expected to reach 4.56 Million tons by 2030, at a CAGR of 4.90% during the forecast period (2025-2030).

Enlarging demand in baby diapers, rapid uptake of high-SAP adult incontinence pads, and a widening set of industrial and agricultural applications are the core forces behind this steady expansion. Tightening European regulations that reward bio-based chemistries, together with higher per-capita diaper spend in China and India, are reshaping product portfolios toward premium, high-performance grades. Manufacturers continue to upgrade plants for energy efficiency and vertical integration to buffer acrylic acid price swings. At the same time, direct-to-consumer subscription models and e-commerce-driven cold-chain packaging unlock high-margin niches that compensate for margin pressure in standard hygiene volumes. Rising investment in cellulosic and starch-derived alternatives signals that sustainability now drives both brand value and process innovation in the super absorbent polymers market.

Global Super Absorbent Polymers (SAP) Market Trends and Insights

Rising Per-Capita Diaper Spend in China and India

Urban households in China lifted their average diaper outlay by 15% since 2022, aided by policy changes that support larger families and rising disposable income. In India, distribution build-out in tier-2 and tier-3 cities raised penetration, bringing advanced diaper formats within reach of first-time buyers. Premium SKUs contain higher-capacity SAP grades and reduced gel blocking, accelerating unit consumption and value growth across the super absorbent polymers market. Local converters increasingly lock supply via long-term offtake deals to secure quality and mitigate freight risks.

Rapid Adoption of High-SAP Adult Incontinence Pads

Demographic aging in Japan, South Korea, Germany, and Italy has elevated adult incontinence prevalence, while social acceptance campaigns reduce stigma. New pads integrate up to 40% more SAP, enabling thinner profiles that resemble regular underwear and encourage daytime use. Subscription e-commerce channels are growing, bundling discrete delivery, leakage guarantees, and mobility-specific SKUs. Producers respond with differentiated core-shell particle morphologies that boost absorption under load, creating a high-margin sub-segment within the super absorbent polymers market.

Volatile Raw Material Prices

Acrylic acid constitutes up to 70% of production cost, and quarterly swings as wide as 25% destabilize procurement budgets. Changhong Polymer's USD 1.6 billion propane-to-acrylic-acid plant, due in 2026, could lower variable cost curves and unsettle pricing parity among established Western suppliers. Interest in bio-routes and vertical integration rises as boards prioritize feedstock security.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Bio-Based SAP in EU Driven by Packaging Rules

- Expanding Agricultural Applications

- Safety Concerns Over Residual Monomers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic fraction represented 72% of the super absorbent polymers market share in 2024, anchored by its proven reliability in baby diapers. To bolster safety perception, premium brands specify higher-purity acrylic SAPs with lower free monomer levels. In parallel, polyacrylamide grades are expanding at a 6.6% CAGR, propelled by their superior water retention in arid agriculture and industrial sealing. Within the super absorbent polymers market size context, polyacrylamide volumes are forecast to add 125 kilotons between 2025 and 2030, capturing incremental share from acrylic grades.

Product developers pursue hybrid networks that mix acrylic and polysaccharide backbones to marry cost and degradability. Nippon Shokubai's biomass-derived SAP line, certified Halal and produced in Indonesia, exemplifies such cross-chemistry innovation. Investment emphasis now tilts toward biomass sourcing logistics, impurity control, and scalable continuous reactor designs that ensure consistent polymer architecture.

Gel polymerization kept a 60% revenue share in 2024, with its reactor trains optimized for high throughput and uniform cross-link density. Energy recovery loops and continuous monomer recycling drive incremental cost competitiveness. Solution polymerization grows at 5% CAGR because it enables small-lot, specialty grades with tight molecular weight distribution and reduced energy load, aligning with sustainability targets.

Suspension and inverse-suspension routes persist in niche roles that require unique particle morphologies, such as core-shell microspheres for medical fluid management. Process engineers focus on precise cross-linker feed control and in-line spectroscopy to tune absorption under load, further segmenting supply within the super absorbent polymers market.

The Super Absorbent Polymer (SAP) Market Segments the Industry by Product Type (Polyacrylamide, Acrylic Acid Based, and Others), Polymerization Process (Solution Polymerization, and More), Application (Baby Diapers, Adult Incontinence Products, and More), End-User Industry (Personal Care and Hygiene Manufacturers, Agriculture Input Suppliers, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific held 42% of the super absorbent polymers market in 2024, powered by China's integrated acrylic acid-SAP clusters that minimize feedstock logistics. Government incentives, notably in Jiangsu and Shandong, support capacity debottlenecking and export-oriented expansions. India contributes volume growth through broader diaper penetration, while Japan retains a technology leadership niche in specialty and biomass-derived grades.

North America is projected to post the fastest 5.50% CAGR through 2030. Growth arises from premium diaper SKUs, high-SAP adult incontinence adoption among aging baby boomers, and specialized industrial uses such as fracking water blockers and cold-chain pads. Research consortia with land-grant universities pioneer cellulosic and protein-based networks, aligning corporate sustainability pledges with regulatory trends. The region also records early field use of hemp-based SAP in horticulture, reinforcing circular economy narratives within the superabsorbent polymers market.

Europe's stringent policy climate accelerates bio-based uptake and packaging recyclability. Germany leads production volume, whereas Nordic countries drive consumer preference for compostable diaper cores. Compliance costs spur alliances between polymer suppliers and waste-management firms to pilot closed-loop recovery schemes. EU standards increasingly influence export formulations, compelling global producers to harmonize product safety and labeling.

- ADM

- BASF

- Braskem

- Chase Corp.

- Chemtex Speciality Limited

- Evonik Industries AG

- Formosa Plastics Group

- LG Chem

- NIPPON SHOKUBAI CO., LTD.

- SANYO CHEMICAL INDUSTRIES, LTD.

- SAP SE

- Satellite Chemical

- SNF

- SONGWON

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- TOYO BOEKI Co.,Ltd.

- Wanhua

- Yixing Danson Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Per-Capita Diaper Spend in China and India

- 4.2.2 Rapid Adoption of High-SAP Adult Incontinence Pads Asia and Europe

- 4.2.3 Shift to Bio-based SAP in EU Driven by Single-Use Plastics Directive

- 4.2.4 E-Commerce-Led Demand Spike for Absorbent Packaging Pads (Cold Chain)

- 4.2.5 Expanding Agricultural Applications

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices

- 4.3.2 Safety Concerns Over Residual Monomers in Infant Diapers

- 4.3.3 High Production Cost

- 4.4 Production Cost Overview

- 4.5 Value Supply-Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Polyacrylamide

- 5.1.2 Acrylic Acid Based

- 5.1.3 Others

- 5.2 By Polymerization Process

- 5.2.1 Solution Polymerization

- 5.2.2 Suspension/Inverse-Suspension Polymerization

- 5.2.3 Gel Polymerization

- 5.3 By Application

- 5.3.1 Baby Diapers

- 5.3.2 Adult Incontinence Products

- 5.3.3 Feminine Hygiene

- 5.3.4 Agriculture Support

- 5.3.5 Other Application

- 5.4 By End-User Industry

- 5.4.1 Personal Care and Hygiene Manufacturers

- 5.4.2 Agriculture Input Suppliers

- 5.4.3 Healthcare Providers

- 5.4.4 Other End-use Industries (Telecom and Power Cable Makers and Food and Pharmaceutical Cold-Chain Logistics)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADM

- 6.4.2 BASF

- 6.4.3 Braskem

- 6.4.4 Chase Corp.

- 6.4.5 Chemtex Speciality Limited

- 6.4.6 Evonik Industries AG

- 6.4.7 Formosa Plastics Group

- 6.4.8 LG Chem

- 6.4.9 NIPPON SHOKUBAI CO., LTD.

- 6.4.10 SANYO CHEMICAL INDUSTRIES, LTD.

- 6.4.11 SAP SE

- 6.4.12 Satellite Chemical

- 6.4.13 SNF

- 6.4.14 SONGWON

- 6.4.15 SUMITOMO SEIKA CHEMICALS CO.,LTD.

- 6.4.16 TOYO BOEKI Co.,Ltd.

- 6.4.17 Wanhua

- 6.4.18 Yixing Danson Technology

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Commercial Scale-up of 100% Bio-Based SAP