|

市场调查报告书

商品编码

1844701

疏水性涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Hydrophobic Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

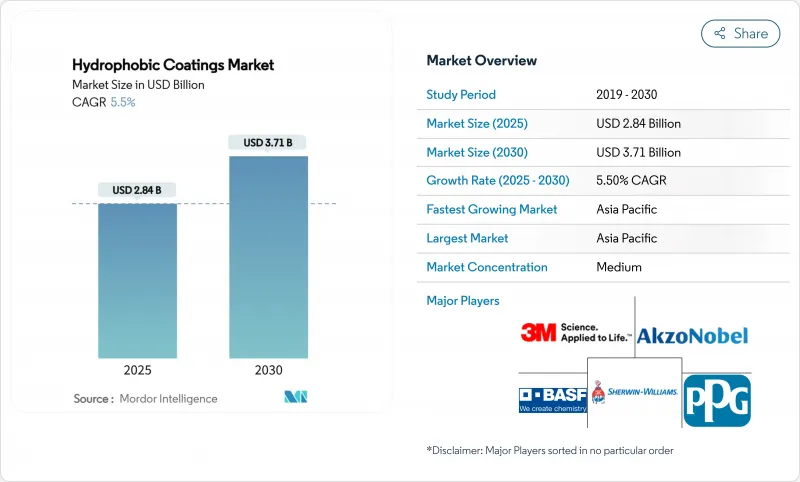

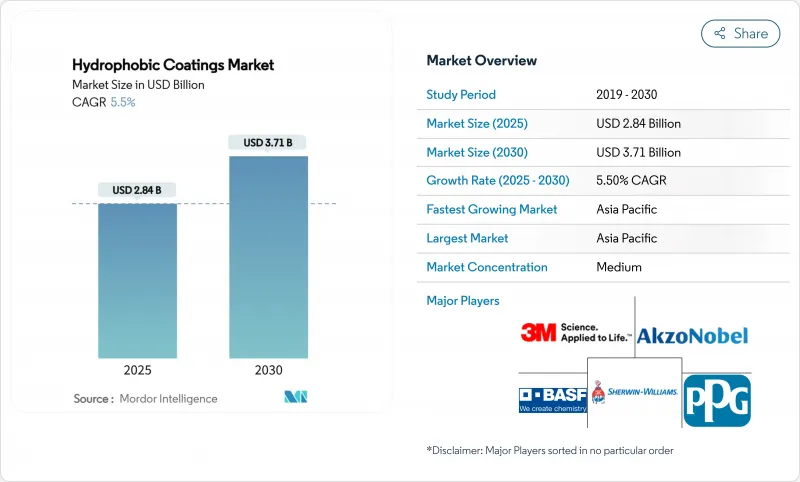

疏水性涂料市场规模预计在 2025 年为 28.4 亿美元,预计到 2030 年将达到 37.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.5%。

监管压力正在加速向无氟化学的转变,而持续的基础设施投资、电子产品的小型化以及日益增长的医疗保健需求都在推动产量成长。如今,技术差异化主要集中在硅基、生物基和奈米结构解决方案上,这些解决方案的性能堪比甚至超越了传统的氟聚合物。大型买家优先考虑兼具防水性、防腐、抗菌和防冻等特性的多功能产品,这一趋势有利于拥有丰富配方专业知识的供应商。竞争较为温和,全球工巨头正透过资产剥离、策略联盟和快速专利申请等方式,与敏捷的奈米涂层专家争夺市场份额。

全球疏水性涂料市场趋势与洞察

建筑业强劲成长

持续的都市化和基础设施更新继续支撑疏水涂料的需求。硅烷和硅氧烷基混凝土浸渍已成为桥樑、隧道和沿海结构中氯离子防护的标准,可延长其使用寿命并降低维护成本。符合绿色建筑认证的生物基疏水处理技术已成为注重永续性的公共计划的首选解决方案。亚太地区的智慧城市规划明确规定并越来越多地使用防水屏障来防止天气引起的劣化。建筑业在2024年的收入份额将达到29.64%,这反映了防护涂层在大型土木工程项目中的重要性,因为这些项目的资产寿命直接影响国家基础设施预算。

汽车产业需求增加

汽车製造商正在转向疏水多功能涂料,以提供漆面保护、自清洁和防腐功能。自修復奈米复合材料可提高涂层的耐久性,这对于渴望保留剩余价值的高阶汽车品牌来说至关重要。电气化为机壳和电力电子设备机壳增加了新的保护点,这些外壳必须能够承受湿气侵入和热循环。挥发性有机化合物(VOC)排放法规正在加速水性疏水化学品的发展,迫使供应商在不牺牲产量的情况下复製溶剂型产品的性能。高级驾驶辅助感应器和资讯娱乐显示器的整合进一步拓展了车内超薄、光学透明防水层的应用前景。

流程复杂,初始投资成本高

製造超疏水层需要精确控製表面粗糙度和化学性质,通常涉及多步骤纹理化、功能化以及在惰性气体中固化。等离子反应器、雷射图形化设备和精密品质控制设备的资本投资可能会对中小型公司的财务带来巨大压力。下游用户也面临学习曲线:必须优化基板清洁、环境湿度和固化曲线,才能达到已发表的接触角规格。这种复杂性可能会限制新参与企业的扩张速度,限制市场竞争,并减缓成本敏感型终端应用领域对技术创新的采用。

細項分析

到2024年,防腐剂将占据疏水涂料市场份额的39.18%,这反映了海洋、石油天然气和运输业长期以来对保护钢铁和铝资产的需求。桥樑维修和离岸风力发电安装计划的强劲需求将进一步支撑该领域的收益。相较之下,「其他产品类型」丛集中的自清洁防冰产品预计将以6.92%的复合年增长率增长,这得益于太阳能运维公司的支持,这些公司已检验在光伏组件上应用奈米涂层后,能源产量可提高高达15%。航太原始设备製造商也在评估低冰黏附表面,以减少除冰液的使用。

防腐子子部门的价格竞争依然激烈,但由于监管部门对高锌底漆和溶剂型面漆的压力,采购方正转向嵌入石墨烯和陶瓷薄片的水性混合涂料。专用自清洁产品透过减少干旱地区太阳能发电厂的人工清洁工作,获得了高净利率。同时,疏水性涂料产业正在兴起光热疏水涂料,这种涂料将被动防水与主动太阳能加热结合。

区域分析

受中国製造业规模、印度基础建设规划以及日本材料科学实力的推动,亚太地区将在2024年维持48.15%的收入份额。政府要求公共建筑符合绿建筑标准,这推动了低VOC疏水产品的采用。该地区的专业电子代工製造商正在指定亚微米防水层,以确保获得全球智慧型手机品牌的出口订单。东南亚的太阳能模组工厂持续扩大产能,持续对可延长工厂运作的自清洁光伏涂层的需求。

北美是技术先锋。美国正在开拓高性能航太和国防应用,其中超疏水防冰层可降低航空公司和军用飞机的营运成本。加拿大逐步淘汰PFAS将刺激国内对无氟化学品的需求,并鼓励区域供应商加速有机硅和聚氨酯替代品的认证。墨西哥的汽车出口中心将把疏水处理技术融入电动车电池机壳,加强原料和应用设备的跨境供应链。

欧洲正在平衡严格的环境政策与产业竞争力。欧洲化学品管理局提案限制超过10,000种PFAS物质,促使配方师加快对生物基替代品的检验。一家德国一级汽车供应商共同开发了一种石墨烯增强型水性面漆,既符合耐腐蚀性能,也满足了喷漆车间的排放目标。北欧国家对循环经济模式的偏好刺激了包装领域对可生物降解疏水屏障的需求,并推动了纤维素基解决方案的创新。因此,疏水涂料市场拥有多元化的区域驱动力,这些驱动力正在维持其全球成长动能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 建筑业强劲成长

- 汽车产业需求增加

- 在家电领域采用率不断提高

- 3D列印超防水錶面

- 公共基础设施对抗病毒涂层的需求不断增加

- 市场限制

- 流程复杂,初始投资成本高

- 磨蚀环境中的耐久性问题

- 禁止使用长链氟树脂迫在眉睫

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

- 定价分析

第五章市场规模及成长预测

- 依产品类型

- 防锈

- 抗菌

- 防污

- 防潮

- 其他产品类型(自清洁、防冰等)

- 按基材

- 金属

- 陶瓷

- 玻璃

- 具体的

- 塑胶和聚合物

- 其他基材(纺织品、纸张、纸板等)

- 按最终用户产业

- 建造

- 车

- 航太

- 电子产品

- 卫生保健

- 海洋

- 其他终端用户产业(石油和天然气、可再生能源等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- 3M

- AccuCoat Inc.

- Aculon Inc.

- Advanced Nanotech Lab

- AkzoNobel NV

- Arkema

- Artekya Teknoloji

- BASF SE

- COTEC GmbH

- Cytonix, LLC

- Nanofilm

- NeverWet, LLC.

- Nukote Coating Systems International

- P2i Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- UltraTech International, Inc.

第七章 市场机会与未来展望

The Hydrophobic Coatings Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 3.71 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Regulatory pressure has accelerated the transition toward fluorine-free chemistries, while sustained infrastructure investment, electronics miniaturization, and growing healthcare demand collectively reinforce volume growth. Technology differentiation now centers on silicone-, bio-based, and nanostructured solutions that match or exceed legacy fluoropolymer performance. Large buyers are prioritizing multifunctional products that combine water-repellency with anti-corrosion, antimicrobial, and anti-icing attributes, a trend that favors suppliers with broad formulation expertise. Competitive intensity is moderate as global chemical majors defend share against agile nanocoating specialists through divestment, strategic partnerships, and rapid patent filings.

Global Hydrophobic Coatings Market Trends and Insights

Robust Growth of Construction Sector

Sustained urbanization and infrastructure renewal continue to anchor demand in the hydrophobic coatings market. Silane- and siloxane-based concrete impregnation has become standard for chloride-ion protection of bridges, tunnels, and coastal structures, extending service life and lowering maintenance costs. Alignment with green-building certifications positions bio-based hydrophobic treatments as preferred solutions for public projects that emphasize sustainability. Asia-Pacific smart-city programs are amplifying volumes by specifying water-repellent barriers against climate-induced deterioration. The construction segment's 29.64% 2024 revenue share reflects the indispensability of protective coatings in large civil works, where asset longevity directly influences national infrastructure budgets.

Rising Demand from Automotive Industry

Automotive manufacturers have shifted toward hydrophobic multifunctional coatings that deliver paint protection, self-cleaning, and anti-corrosion benefits. Self-healing nanocomposites improve finish durability, an attribute valued by luxury car brands keen on residual-value preservation. Electrification adds new protection points as battery enclosures and power-electronics housings must resist moisture ingress and thermal cycling. Regulatory caps on VOC emissions accelerate water-borne hydrophobic chemistries, pressing suppliers to replicate solvent-based performance without sacrificing throughput. Integration of advanced driver-assistance sensors and infotainment displays further widens opportunities for ultra-thin, optically clear waterproof layers inside vehicles.

Complex Process and High Initial Investment Cost

Producing superhydrophobic layers demands precise control of surface roughness and chemistry, often involving multi-step texturing, functionalization, and curing in inert atmospheres. Capital expenditure on plasma reactors, laser patterning units, and sophisticated QC instrumentation strains the finances of small and mid-size enterprises. Down-line users also face learning curves: substrate cleaning, ambient humidity, and cure profiles must all be optimized to achieve published contact-angle specifications. These complexities restrict the pace at which new entrants can scale, limiting market competition and potentially slowing innovation diffusion in cost-sensitive end-use sectors.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption in Consumer Electronics

- 3-D Printed Retro-fit Superhydrophobic Surfaces

- Durability Challenges Under Abrasive Environments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anti-corrosion formulations maintained a 39.18% hydrophobic coatings market share in 2024, reflecting the perennial need to safeguard steel and aluminum assets in marine, oil-and-gas, and transport sectors. Robust demand from bridge refurbishment and offshore wind installation projects further anchored segment revenues. In contrast, self-cleaning and ice-phobic products within the "Other Product Types" cluster are forecast to post a 6.92% CAGR, buoyed by solar O&M firms that have validated up to 15% energy-yield gains after applying nanocoatings to PV modules. Aerospace OEMs likewise value low-ice-adhesion surfaces that cut anti-icing fluid usage.

The anti-corrosion sub-sector remains price competitive, yet regulatory pressure on zinc-rich primers and solvent-borne top-coats is shifting procurement toward water-borne hybrids with embedded graphene or ceramic flakes. Specialty self-cleaning products command higher margins due to their ability to reduce manual cleaning labor for solar farms located in arid regions. Meanwhile, the hydrophobic coatings industry is witnessing the emergence of photothermal ice-phobic layers that combine passive water repellence with active sunlight-driven heating, a hybrid approach that resonates with airlines pursuing fuel-saving de-icing strategies.

The Hydrophobic Coatings Market Report is Segmented by Product Type (Anti-Corrosion, Anti-Microbial, Anti-Fouling, Anti-Wetting, and More), Substrate (Metals, Ceramics, Glass, Concrete, and More), End-User Industry (Construction, Automotive, Aerospace, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 48.15% revenue share in 2024, driven by China's manufacturing scale, India's infrastructure pipeline, and Japan's material-science prowess. Government mandates that public buildings meet green-construction benchmarks have boosted uptake of low-VOC hydrophobic products. Electronics contract manufacturers across the region specify sub-micron waterproof layers to secure export contracts from global smartphone brands. Continued capacity additions in Southeast Asian solar module plants sustain demand for self-cleaning PV coatings that increase plant uptime.

North America stands as a technological bellwether. The United States cultivates high-performance aerospace and defense applications, where superhydrophobic anti-icing layers reduce operational costs for airlines and military fleets. Canada's phased PFAS prohibition elevates domestic demand for fluorine-free chemistries, compelling regional suppliers to accelerate the qualification of silicone and polyurethane alternatives. Mexico's automotive export hubs integrate hydrophobic treatments in electric-vehicle battery enclosures, reinforcing cross-border supply chains for raw materials and application equipment.

Europe balances strict environmental policy with industrial competitiveness. The European Chemicals Agency proposal to restrict over 10,000 PFAS substances has triggered a rush among formulators to validate bio-based replacements. Germany's automotive Tier-1 suppliers co-develop graphene-reinforced water-borne top-coats that satisfy both corrosion-resistance and paint-shop emission targets. Nordic nations' preference for circular-economy models stimulates demand for biodegradable hydrophobic barriers in packaging, pushing innovation toward cellulose-based solutions. The hydrophobic coatings market is thus experiencing geographically diverse pull factors that collectively sustain global growth momentum.

- 3M

- AccuCoat Inc.

- Aculon Inc.

- Advanced Nanotech Lab

- AkzoNobel N.V.

- Arkema

- Artekya Teknoloji

- BASF SE

- COTEC GmbH

- Cytonix, LLC

- Nanofilm

- NeverWet, LLC.

- Nukote Coating Systems International

- P2i Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- UltraTech International, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust growth of construction sector

- 4.2.2 Rising demand from automotive industry

- 4.2.3 Increasing adoption in consumer electronics

- 4.2.4 3-D printed retro-fit superhydrophobic surfaces

- 4.2.5 Increasing demand for anti-viral public-infrastructure coatings

- 4.3 Market Restraints

- 4.3.1 Complex process and high intial investment cost

- 4.3.2 Durability challenges under abrasive environments

- 4.3.3 Impending bans on long-chain fluoropolymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Patent Analysis

- 4.7 Pricing Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Anti-corrosion

- 5.1.2 Anti-microbial

- 5.1.3 Anti-fouling

- 5.1.4 Anti-wetting

- 5.1.5 Other Product Types (Self-cleaning, Ice-phobic, etc.)

- 5.2 By Substrate

- 5.2.1 Metals

- 5.2.2 Ceramics

- 5.2.3 Glass

- 5.2.4 Concrete

- 5.2.5 Plastics and Polymers

- 5.2.6 Other Substrates (Textiles, Paper and Cardboard, etc.)

- 5.3 By End-user Industry

- 5.3.1 Construction

- 5.3.2 Automotive

- 5.3.3 Aerospace

- 5.3.4 Electronics

- 5.3.5 Healthcare

- 5.3.6 Marine

- 5.3.7 Other End-user Industries (Oil and Gas, Renewable Energy, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AccuCoat Inc.

- 6.4.3 Aculon Inc.

- 6.4.4 Advanced Nanotech Lab

- 6.4.5 AkzoNobel N.V.

- 6.4.6 Arkema

- 6.4.7 Artekya Teknoloji

- 6.4.8 BASF SE

- 6.4.9 COTEC GmbH

- 6.4.10 Cytonix, LLC

- 6.4.11 Nanofilm

- 6.4.12 NeverWet, LLC.

- 6.4.13 Nukote Coating Systems International

- 6.4.14 P2i Ltd.

- 6.4.15 PPG Industries, Inc.

- 6.4.16 The Sherwin-Williams Company

- 6.4.17 UltraTech International, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment