|

市场调查报告书

商品编码

1844709

汽车安全系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Safety Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

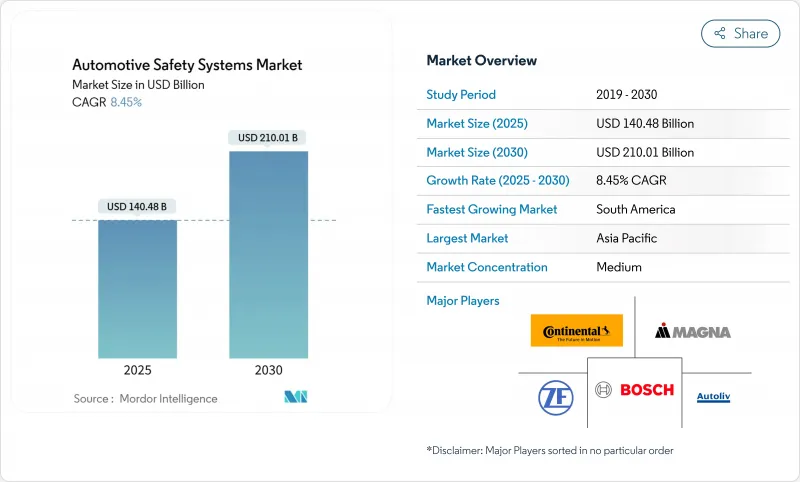

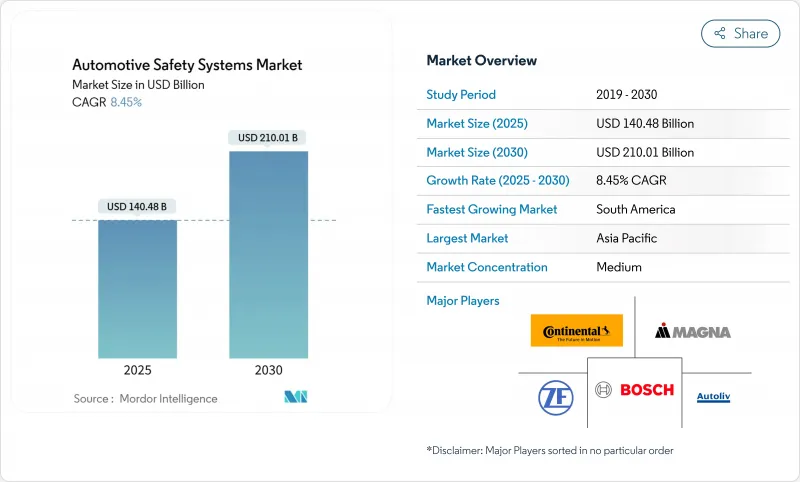

预计 2025 年汽车安全系统市场规模为 1,404.8 亿美元,到 2030 年将达到 2,100.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.45%。

需求反映了全球安全法规的同步演变、感测器成本的快速下降以及可透过无线升级的软体定义汽车的兴起。从纯硬体约束系统到整合感测器和软体平台的转变,使汽车能够即时预测、避免和减轻碰撞。汽车製造商现在已将主动煞车、车道维持、驾驶员监控和网路安全更新路径作为标准配备。

全球汽车安全系统市场趋势与洞察

加强全球NCAP和联合国欧洲经济委员会的安全义务

2026 年欧洲新车安全评估协会 (Euro NCAP)通讯协定将强制所有车型配备行人自动紧急煞车和驾驶员监控功能,从而建立通用的合规基准。中国工业和资讯化部于 2025 年出台法规,要求对涉及安全功能的每次软体更新进行型式核准。欧盟通用安全法规 II 将于 2024 年 7 月生效,要求所有新车配备智慧速度援助和紧急车道维持功能。美国国家公路交通安全管理局 (NHTSA) 更新了其新车评估程序,将盲点警告、车道维持辅助和行人 AEB 纳入 2026 年车型。全球协调使製造商能够将开发成本分摊到更多车辆上,从而促进先进功能的快速采用。

感测器成本快速下降推动ADAS标准化

汽车雷达价格每年下降近 18%,而处理器性能每 18 个月翻一番,从而能够以入门级价格分布实现高性能感知。 4D 成像雷达以接近传统3D装置的成本提供公分级的侦测精度,将应用范围扩展到主动式车距维持定速系统之外。影像感测器受益于智慧型手机供应链:带有 HDR 的 8 兆像素汽车晶片售价不到 10 美元。 NITI Aayog 预测,在 ADAS 内容的推动下,到 2030 年每辆汽车的半导体价值将翻一番,达到 1,200 美元。成本下降将使汽车安全系统市场能够将 1 级和 2 级功能扩展到在亚洲和拉丁美洲销售的小型车。

为满足多个国家法规,验证和认证成本高昂

製造商必须将中国C-NCAP 2024的测试矩阵与欧洲NCAP 2026的要求进行协调,通常在类似场景下重复进行检验和软体检验。 TÜV南德意志集团目前根据欧盟法规执行强制性渗透测试,并在上市前增加数月的网路安全审查。 ISO/SAE 21434要求在车辆的整个生命週期内进行威胁分析,这延长了开发週期,并增加了小型汽车製造商的成本。这些因素减缓了成本敏感型市场对尖端功能的采用,并在协调性改善之前限制了部分汽车安全系统市场的发展。

細項分析

主动式安全系统预计将占据汽车安全系统市场的最大份额,到2024年将占市场规模的67.13%。随着欧洲新车安全评估协会(Euro NCAP)和美国国家公路交通安全管理局(NHTSA)的通讯协定日益严格,自动紧急煞车、自我调整巡航、车道维持和驾驶员监控等功能现已开始应用于中阶车型。随着供应商透过即时运行机器学习模型的网域控制器整合雷达、摄影机和雷射雷达数据,竞争将更加激烈。该领域也受益于车队需求,保险公司为配备防撞技术的卡车提供保费折扣。

车载生物辨识平台是成长最快的细分市场,到2030年复合年增长率将达到8.11%。这些解决方案可以追踪驾驶者的警觉性、心率甚至血氧饱和度,以便在危险情况出现之前发出预警。座舱感知器与主动煞车控制器相连,为乘客提供可预测外部和内部威胁的闭合迴路安全保护。被动安全领域仍然很重要,例如智慧安全气囊和自我调整安全带,它们可以适应自动驾驶汽车的新座椅布局,但成长速度较慢。

雷达模组采用经济高效的77GHz晶片组,可在雨雪和雾天可靠运行,到2024年将占据汽车安全系统市场的34.36%。转向4D成像雷达将透过提高角度解析度、降低物料清单成本来实现物体分类,缩小与光达的性能差距。相机系统将继续利用智慧型手机的经济性,使OEM能够为停车和低速操控添加360度全景视野。

光达 (LiDAR) 成长最快,复合年增长率达 8.75%,这得益于固态架构,可减少移动部件并降低单一感测器的成本。高端轿车的 L3 级高速公路自动驾驶依靠前向光达进行冗余深度感知和道路碎片检测,从而加速了其普及。控制单元将煞车、转向和感知数据整合到单一晶片上,从而减少了布线并减轻了重量。随着汽车安全系统市场朝向预测性安全迈进,将自学习演算法应用于边缘处理器的软体创新将使供应商脱颖而出。

区域分析

到2024年,亚太地区将以39.84%的市占率继续保持在汽车安全系统市场的最大地位。中国工信部法规要求每次ADAS软体更新都必须核准,从而建构了一个强大的合规生态系统,加速了功能的部署。科技与汽车的融合体现在华为和小鹏汽车等伙伴关係中,他们共同开发了一款网域控制器,将雷达、摄影机和雷射雷达整合在一个通用软体堆迭上。日本正在培育人工智慧主导的新兴企业,在城市中心试运行自动驾驶班车;而印度日益严格的碰撞法规则推动了紧凑型汽车对成本优化的安全气囊和自动紧急煞车系统(AEB)的需求。

南美洲将达到最高成长,到2030年复合年增长率将达到8.77%。 Stellantis将在2025年至2030年期间投资56亿欧元,在当地工厂推出40多款符合欧洲新车安全评鑑协会(Euro NCAP)测试通讯协定的车款。巴西、阿根廷及其周边市场的安全法规将实现协调,允许全球供应商复製高效的感测器套件,而无需进行客製化调校。生物混合动力传动系统将结合乙醇引擎和电池组,其热安全系统和电气安全系统将迎来新的整合工作。

北美和欧洲凭藉较高的单车配置率和软体定义汽车法规,保持成熟的市场地位。虽然这些地区的汽车安全系统市场份额保持稳定,但由于联合国欧洲经济委员会第155号法规要求全面网路安全,并要求所有安全电子控制单元(ECU)符合反骇客标准,其单位价值正在上升。在基础设施扩张的推动下,中东和非洲地区正从低基准迈进,而当地极端气候条件也推动了对坚固耐用的感测器外壳和防尘雷达外壳的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 加强全球NCAP和UNECE安全指令

- 感测器成本快速下降推动ADAS标准化

- 软体定义汽车的繁荣(OTA安全功能升级)

- 商用车辆转向 2 级以上自动驾驶(车队 TCO Play)

- 基于人工智慧的车载生物安全分析(疲劳、生命征象)的兴起

- 将车辆安全资料捆绑到应用程式中

- 市场限制

- 为符合各国法规,验证及认证成本高昂

- 晶片组供应不确定性延后OEM安全推出

- 安全 ECU 和感测器汇流排遭受网路物理攻击的风险

- 800V电池电力中的高压电磁干扰(EMI)与热负荷

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 依系统类型

- 主动安全系统

- 防撞(AEB、FCW)

- 驾驶员监控和 HMI 警报

- 底盘控制(ESC、ABS)

- 被动安全系统

- 安全气囊(前部、侧面、窗帘、远端)

- 安全带和预张力器

- 主动安全系统

- 按下技术组件

- 感应器

- 雷达

- 相机

- 光达/超音波

- 控制单元和网域控制器

- 软体和演算法

- 按最终用户

- OEM工厂适配

- 售后市场/改装

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车和公车

- 透过推进力

- 内燃机(ICE)

- 纯电动车(BEV)

- 混合动力电动车(HEV)

- 燃料电池电动车(FCEV)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Autoliv Inc.

- Denso Corporation

- Aptiv PLC

- Magna International Inc.

- Joyson Safety Systems

- Mobileye NV

- Valeo SA

- Hitachi Astemo

- Hyundai Mobis

- NXP Semiconductors

- Infineon Technologies AG

- Texas Instruments Inc.

- Renesas Electronics Corp.

- Veoneer AB

- WABCO(ZF CV Systems)

- Bendix Commercial Vehicle Systems

- Lear Corporation(E-Systems)

第七章 市场机会与未来展望

The Automotive Safety Systems Market size is estimated at USD 140.48 billion in 2025, and is expected to reach USD 210.01 billion by 2030, at a CAGR of 8.45% during the forecast period (2025-2030).

Demand reflects simultaneous progress in global safety regulation, rapid sensor price erosion, and the rise of software-defined vehicles that permit over-the-air upgrades. The shift from hardware-only restraint devices toward integrated sensor-plus-software platforms allows vehicles to predict, avoid, and mitigate collisions in real time. Automakers now package active braking, lane keeping, driver monitoring, and cyber-secure update pathways as standard content, especially in markets where star-rating programs influence buying behavior.

Global Automotive Safety Systems Market Trends and Insights

Tightening Global NCAP & UNECE Safety Mandates

Euro NCAP protocols for 2026 require pedestrian automatic emergency braking and driver monitoring across all model classes, creating a common compliance baseline. China's Ministry of Industry and Information Technology introduced rules in 2025 that obligate type approval for every software update touching safety functions. The EU General Safety Regulation II, in force since July 2024, obliges intelligent speed assistance and emergency lane keeping on every new vehicle. NHTSA updated its New Car Assessment Program to add blind-spot warning, lane keeping assistance, and pedestrian AEB for 2026 models, signaling a decade-long push for active safety. Global alignment lets manufacturers spread development cost across larger volumes and catalyzes faster diffusion of advanced functions.

Rapid Sensor-Cost Deflation Enabling ADAS Standardisation

Automotive radar prices now fall nearly 18% each year, while processor capability doubles every 18 months, permitting high-performance perception at entry-segment price points. Four-dimensional imaging radar brings centimeter-grade detection accuracy at cost levels close to legacy 3-D units, broadening use beyond adaptive cruise control. Image sensors benefit from smartphone supply chains: 8-megapixel automotive chips with HDR are available below USD 10. NITI Aayog projects semiconductor value per vehicle to double to USD 1,200 by 2030, led by ADAS content. The declining cost curve allows the automotive safety system market to extend Level-1 and Level-2 features to compact cars sold in Asia and Latin America.

High Validation & Homologation Cost for Multicountry Compliance

Manufacturers must reconcile China's C-NCAP 2024 test matrix with Euro NCAP 2026 requirements, often repeating crash and software validation for similar scenarios. TUV SUD now runs mandatory penetration testing under EU rules, adding months of cybersecurity reviews before market release. ISO/SAE 21434 demands threat analysis across the full vehicle lifecycle, lengthening development schedules and raising costs for small automakers. These factors slow the spread of cutting-edge features in cost-sensitive markets, restraining part of the automotive safety system market until harmonisation improves.

Other drivers and restraints analyzed in the detailed report include:

- Boom in Software-Defined Vehicles (OTA Safety Feature Upgrades)

- Shift Toward Level-2+ Autonomy in Commercial Vehicles (Fleet TCO Play)

- Chip-Set Supply Volatility Delaying OEM Safety Roll-Outs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Active Safety Systems generated the largest slice of the automotive safety system market size at 67.13% in 2024. Automated emergency braking, adaptive cruise, lane keeping, and driver monitoring now appear in mid-range trims as Euro NCAP and NHTSA protocols grow stricter. Competitive intensity rises as suppliers integrate radar, camera, and LiDAR data through domain controllers that run machine-learning models in real time. The segment also benefits from fleet demand, with insurers offering premium discounts for trucks equipped with crash-avoidance technology.

In-cabin biometric platforms stand out as the fastest subsegment, advancing at an 8.11% CAGR to 2030. These solutions track driver alertness, heart rate, and even oxygen saturation, issuing proactive warnings before dangerous conditions emerge. As cabin sensors link with active braking controllers, occupants receive a closed-loop safety envelope that anticipates both external and internal threats. Passive safety remains relevant through smart airbags and adaptive seat belts that fit new seat layouts in autonomous vehicles, yet growth stays moderate.

Radar modules accounted for 34.36% of the automotive safety system market in 2024, underpinned by cost-effective 77-GHz chipsets that function reliably in rain, snow, and fog. The move to 4-D imaging radar sharpens angle resolution and permits object classification, narrowing the performance gap with LiDAR at a lower bill of materials. Camera systems continue to leverage smartphone economics, letting OEMs add 360-degree vision for parking and low-speed manoeuvres.

LiDAR registers the quickest expansion at an 8.75% CAGR, supported by solid-state architectures that trim moving parts and cut price per sensor. Level-3 highway-pilot launches in premium sedans rely on forward-facing LiDAR for redundant depth perception and road debris detection, accelerating adoption. Control units merge braking, steering, and perception data into single chips, reducing wiring and weight. Software innovations that apply self-learning algorithms on edge processors differentiate suppliers as the automotive safety system market transitions toward predictive safety.

The Automotive Safety System Market Report is Segmented by System Type (Active Safety Systems and Passive Safety Systems), Technology Component (Sensors, Radar, Camera, and More), End User (OEM and Aftermarket), Vehicle Type (Passenger Car, Light Commercial Vehicle, and More), Propulsion (ICE, Battery-Electric Vehicles, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific retained the largest regional position with 39.84% share of the automotive safety system market in 2024. China's MIIT rules compelling approval for every ADAS software update foster a robust compliance ecosystem that speeds feature rollout. Technology - auto convergence appears in partnerships such as Huawei and Xpeng, which co-develop domain controllers integrating radar, camera, and LiDAR on a common software stack. Japan nurtures AI-driven start-ups that pilot autonomous shuttles for urban centres, while India's tighter crash regulations boost demand for cost-optimised airbags and AEB in compact cars.

South America posts the highest growth, advancing at an 8.77% CAGR through 2030. Stellantis committed EUR 5.6 billion between 2025 and 2030 to launch more than 40 models from local plants, each aligned with Euro NCAP test protocols. Brazil, Argentina, and neighbouring markets harmonise safety laws, letting global suppliers replicate validated sensor suites without custom tuning. Bio-hybrid powertrains that blend ethanol engines with battery packs open fresh integration tasks for thermal and electrical safety systems.

North America and Europe uphold mature positions with high per-vehicle content and software-defined vehicle regulations. The automotive safety system market share in these regions remains stable, yet value per unit rises as UNECE Regulation 155 enforces full cybersecurity, obliging every safety ECU to meet anti-hacking standards. The Middle East and Africa progress from low baselines, stimulated by infrastructure expansion, yet local climate extremes drive demand for robust sensor housings and dust-proof radar enclosures.

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Autoliv Inc.

- Denso Corporation

- Aptiv PLC

- Magna International Inc.

- Joyson Safety Systems

- Mobileye N.V.

- Valeo SA

- Hitachi Astemo

- Hyundai Mobis

- NXP Semiconductors

- Infineon Technologies AG

- Texas Instruments Inc.

- Renesas Electronics Corp.

- Veoneer AB

- WABCO (ZF CV Systems)

- Bendix Commercial Vehicle Systems

- Lear Corporation (E-Systems)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening global NCAP & UNECE safety mandates

- 4.2.2 Rapid sensor-cost deflation enabling ADAS standardisation

- 4.2.3 Boom in software-defined vehicles (OTA safety feature upgrades)

- 4.2.4 Shift toward Level-2+ autonomy in commercial vehicles (fleet TCO play)

- 4.2.5 Rise of AI-based in-cabin biometric safety analytics (fatigue, vitals)

- 4.2.6 Bundling of vehicle-safety data into Usage

- 4.3 Market Restraints

- 4.3.1 High validation & homologation cost for multicountry compliance

- 4.3.2 Chip-set supply volatility delaying OEM safety roll-outs

- 4.3.3 Cyber-physical attack risk on safety ECUs & sensor buses

- 4.3.4 High-voltage electromagnetic interference (EMI) and thermal loads in 800-V battery-electric

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By System Type

- 5.1.1 Active Safety Systems

- 5.1.1.1 Collision-Avoidance (AEB, FCW)

- 5.1.1.2 Driver Monitoring & HMI Alerts

- 5.1.1.3 Chassis Control (ESC, ABS)

- 5.1.2 Passive Safety Systems

- 5.1.2.1 Airbags (Frontal, Side, Curtain, Far-side)

- 5.1.2.2 Seat-belt & Pretensioners

- 5.1.1 Active Safety Systems

- 5.2 By Technology Component

- 5.2.1 Sensors

- 5.2.2 Radar

- 5.2.3 Camera

- 5.2.4 LiDAR/Ultrasonic

- 5.2.5 Control Units and Domain Controllers

- 5.2.6 Software & Algorithms

- 5.3 By End-User

- 5.3.1 OEM Factory-Fit

- 5.3.2 Aftermarket / Retrofit

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial Vehicles & Buses

- 5.5 By Propulsion

- 5.5.1 Internal Combustion Engine (ICE)

- 5.5.2 Battery-Electric Vehicles (BEV)

- 5.5.3 Hybrid Electric Vehicle (HEV)

- 5.5.4 Fuel-Cell Electric Vehicle (FCEV)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Autoliv Inc.

- 6.4.5 Denso Corporation

- 6.4.6 Aptiv PLC

- 6.4.7 Magna International Inc.

- 6.4.8 Joyson Safety Systems

- 6.4.9 Mobileye N.V.

- 6.4.10 Valeo SA

- 6.4.11 Hitachi Astemo

- 6.4.12 Hyundai Mobis

- 6.4.13 NXP Semiconductors

- 6.4.14 Infineon Technologies AG

- 6.4.15 Texas Instruments Inc.

- 6.4.16 Renesas Electronics Corp.

- 6.4.17 Veoneer AB

- 6.4.18 WABCO (ZF CV Systems)

- 6.4.19 Bendix Commercial Vehicle Systems

- 6.4.20 Lear Corporation (E-Systems)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment