|

市场调查报告书

商品编码

1844710

塑胶黏合剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Plastic Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

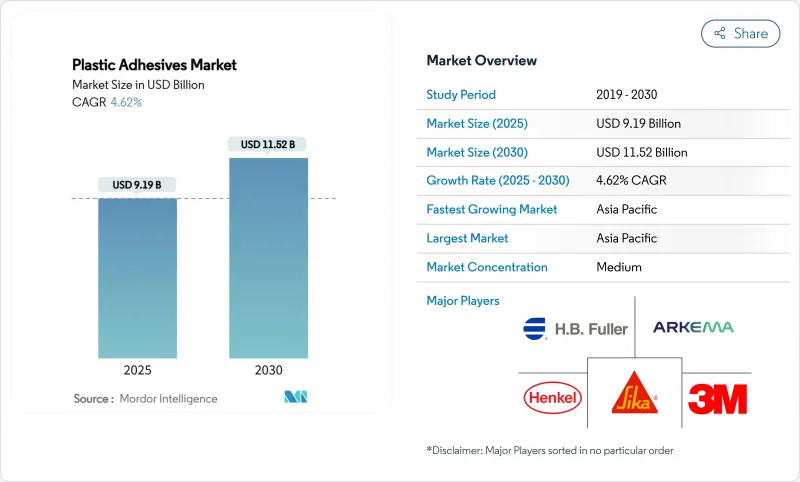

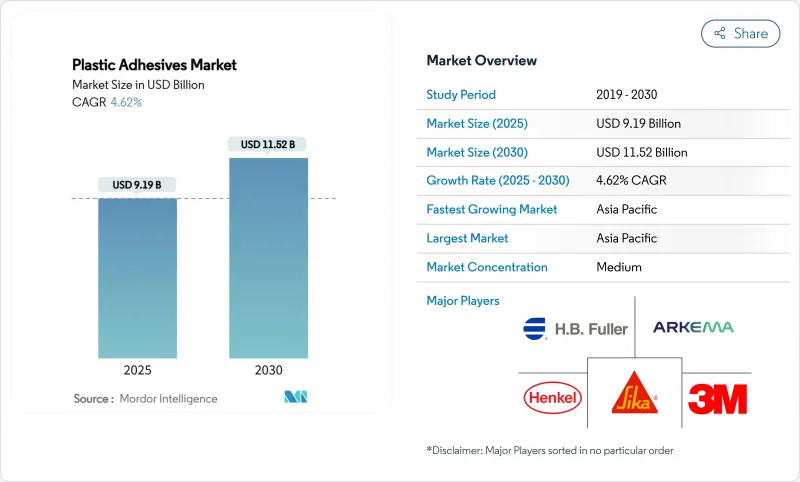

预计 2025 年塑胶黏合剂市场规模为 91.9 亿美元,到 2030 年将达到 115.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.62%。

塑胶黏合剂市场正从通用黏合剂向特种化学品转型,以支援电动车电池组、医疗穿戴式装置和下一代建筑板材。轻量化汽车需求的不断增长、医疗保健领域向生物基聚氨酯薄膜的转变以及挥发性有机化合物(VOC)法规的日益严格,正在推动其在汽车、医疗和建筑领域的应用范围不断扩大。製造商正在推出符合中国、欧盟和美国不断修订的排放法规的水性和生物基牌号产品,使塑胶黏合剂市场能够抓住永续性指令带来的机会。竞争格局仍在不断变化,製造商正在采取有针对性的併购和共同开发契约来弥补技术差距、平衡原材料成本和风险,并拓展新的市场。

全球塑胶黏合剂市场趋势与洞察

汽车产业轻量化的推动

汽车製造商正在用结构性黏着剂取代机械紧固件,以减轻车身重量并增强混合材料设计。一辆典型的2025款电动SUV如今集成了超过400线性英尺(约120米)的胶粘剂,而20年前还不到30英尺(约9米),这充分体现了胶粘剂在连接铝、碳纤维和工程塑料方面发挥的结构性作用。名古屋大学开发的一种抗衝击弹性体-环氧树脂混合物,其抗衝击强度是传统环氧树脂的22倍,因此能够製造更薄的面板和更吸能的碰撞结构,同时保持碰撞安全性。由于大多数汽车製造商都在努力减轻车身重量以延长续航里程,预计到2030年,塑胶胶合剂市场在汽车消费量中的年增长率将达到两位数。

建筑业转向高性能塑料

建筑幕墙和结构玻璃系统正朝着轻质复合板的方向发展,这需要持久耐用、高弹性的黏合剂。西卡的防护嵌装玻璃黏合剂系列能够吸收地震荷载,同时保持刚性,非常适合用于抗飓风帷幕墙。新兴经济体的高层建筑维修和亚洲的大型待开发区计划需要兼具防火、抗紫外线和快速施工性能的塑胶黏合剂。快速固化 PVC TrimWelder 产品可在 30 分钟内达到 80% 的工艺强度,使承包商能够在不牺牲法规规性的情况下加快计划週期。

石油原料价格波动

环氧树脂和聚氨酯基础树脂的成本随原油和丙烯价格走势波动。由于库存紧张,2025年1月德国液体环氧树脂价格上涨1.73%,但由于卖家在农历新年前清理过剩库存,当月亚洲合约价格下跌1.4%。在美国,聚乙烯价格上涨5美分/磅,进一步刺激了包装胶合剂的投入。科思创与HB Fuller签署了经认证的物料平衡供应协议,旨在透过ISCC-PLUS认证的生物石脑油流缓解化石原料的波动性。

細項分析

到 2024 年,环氧树脂将占塑胶胶合剂市场规模的 32.45%,用于支援汽车白车身总成和钢骨混凝土板中的结构接头。高玻璃化转变温度和耐化学性使环氧树脂适合于剪切负荷和温度峰值集中的应用。然而,由于原始设备製造商追求小型电子设备更快的黏合速度,并需要用于热敏基板的冷固化替代品,特种氰基丙烯酸酯、丙烯酸酯和混合胺甲酸乙酯将表现出 5.18% 的最快复合年增长率。因此,塑胶胶合剂市场在环氧树脂的强大份额与优先考虑速度和灵活性的新兴利基化学品之间取得平衡。氰基丙烯酸酯包装,例如 HB Fuller 的 Cyberbond 系列,可以调整黏度以用于医疗设备中的微剂量,同时满足 ISO 10993 细胞毒性要求。由生物基环状碳酸酯製成的非异氰酸酯聚氨酯正在扩大中试生产线,标誌着塑胶黏合剂市场日益转向永续树脂。

製造商正在进行研发,以优化与低表面能聚烯界面的黏合促进剂,旨在无需底涂即可获得更高的剥离强度。有机硅-环氧混合物可在高温电子模组中保持密封,为配方设计师提供一条新的差异化途径。随着环境法规禁止使用双酚A衍生物,环氧树脂製造商正在加速推出双酚A和酚醛清漆替代品,以符合欧盟即将出台的内分泌干扰物审查规定,并保护其在塑胶黏合剂市场中的重要份额。

区域分析

亚太地区仍然是工程塑胶、电子产品和鞋类的主要製造地,使其成为塑胶黏合剂市场最大的收益贡献者。中国的电动车生产、印度的高速公路和住房计画以及东协的包装工厂共同推动了消费。印度「智慧城市计画」等政府倡议持续刺激公共工程支出,而公共工程支出依赖聚合物黏合板和管道。

北美市场日趋成熟,但仍保持着稳定成长,这得益于严格的燃油经济性和建筑节能法规,这些法规促进了轻质复合材料和气密性建筑围护结构的使用。美国环保署大力推广低全球暖化潜势(GWP)建筑材料,加速了屋顶和隔热闆对低雾霾黏合剂的需求。塑胶黏合剂市场也受益于《美国-墨西哥-加拿大协定》,该协定奖励汽车黏合剂的区域采购,并使其有资格享受关税豁免。

欧洲正在利用《绿色交易》框架鼓励可回收黏合剂的创新。生产商正在调整配方,以分解消费后废物并实现封闭式塑胶流。更严格的EN 16603-20-01航太应用排气标准开闢了塑胶黏合剂市场中一个利基但有价值的细分市场,迫使供应商对航太级黏合剂进行认证。

中东和非洲正在推动海水淡化、太阳能基础设施和高层酒店业的扩建计划。豪华酒店正在采用硅胶密封条来抵御沙漠温度,从而支持经济成长。拉丁美洲的墨西哥和巴西的建筑业正在復苏,陆上电子组装也正在兴起。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 推动汽车产业轻量化

- 建筑业转向高性能塑料

- 包装和电子商务行业的需求不断增长

- 用于医疗穿戴装置的生物基聚氨酯薄膜

- 模组化电动车电池组温度控管胶

- 市场限制

- 石油原料价格波动

- 全球VOC和有害物质法规日益严格

- 建筑幕墙板防火规范升级

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 树脂类型

- 环氧树脂

- 氰基丙烯酸酯

- 胺甲酸乙酯

- 硅酮

- 其他树脂类型(丙烯酸、热熔 EVA 等)

- 科技

- 溶剂型

- 水性

- 最终用户产业

- 车

- 建筑/施工

- 电气和电子

- 医疗保健

- 包装

- 其他终端用户产业(可再生能源、消费品等)

- 地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- 3M

- Arkema

- Avery Dennison Corporation

- BASF

- Dow

- Dymax

- HB Fuller Company

- Henkel AG and Co. KGaA

- Huntsman International LLC

- INTERTRONICS

- Master Bond Inc.

- Panacol-Elosol GmbH

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

- Toyochem Co. Ltd.

第七章 市场机会与未来展望

The Plastic Adhesives Market size is estimated at USD 9.19 Billion in 2025, and is expected to reach USD 11.52 Billion by 2030, at a CAGR of 4.62% during the forecast period (2025-2030).

The plastic adhesives market is transitioning from general-purpose bonding agents toward specialized chemistries that address electric-vehicle battery packs, medical wearables, and next-generation construction panels. Rising demand for lightweight vehicles, the shift to bio-based polyurethane films in healthcare, and stricter VOC legislation are widening application scopes across automotive, medical, and building sectors. Producers are releasing water-based and bio-derived grades that comply with evolving emission ceilings in China, the European Union, and the United States, enabling the plastic adhesives market to capture opportunities created by sustainability mandates. Competitive dynamics remain fluid as manufacturers adopt targeted M&A and joint-development agreements to close technology gaps, balance feedstock cost risks, and reach new geographic pockets.

Global Plastic Adhesives Market Trends and Insights

Lightweight-vehicle push in automotive industry

Automakers are replacing mechanical fasteners with structural adhesives to eliminate excessive weight and strengthen mixed-material designs. A typical 2025 electric SUV now integrates more than 400 linear feet of adhesive compared with fewer than 30 feet two decades ago, illustrating the structural role adhesives play in joining aluminum, carbon fiber, and engineering plastics. Impact-toughened elastomer-epoxy hybrids developed at Nagoya University deliver 22-times higher impact strength than legacy epoxies, which allows thinner panels and energy-absorbing crash structures while maintaining crashworthiness. With most OEMs committing to lighter bodies for range extension, the plastic adhesives market expects automotive consumption to climb at double-digit annual rates through 2030.

Construction shift to high-performance plastics

Facade and glazing systems are moving toward lightweight composite panels that demand long-life, high-modulus bonding agents. Sika's protective glazing adhesive family can absorb seismic loads yet retain rigidity for hurricane-rated curtain walls. High-rise retrofits in developed economies and green-field megaprojects in Asia require plastic adhesives that balance fire resistance, UV durability, and fast installation. Fast-cure PVC TrimWelder products reach 80% handling strength in 30 minutes, enabling contractors to accelerate project cycles without sacrificing code compliance.

Petro-feedstock price volatility

Epoxy and polyurethane base-resin costs fluctuate with crude oil and propylene trends. German liquid epoxy prices rose 1.73% in January 2025 amid thin inventories, while Asian contracts slipped 1.4% later that month as sellers cleared surplus ahead of the Spring Festival. Polyethylene spikes of 5 ¢/lb in the United States further lifted packaging-grade adhesive inputs. Covestro signed a certified mass-balance supply agreement with H.B. Fuller to mitigate fossil feedstock swings through ISCC-PLUS-accredited bio-naphtha streams.

Other drivers and restraints analyzed in the detailed report include:

- Increasing demand from packaging and e-commerce industry

- Bio-based polyurethane films for medical wearables

- Tightening global VOC and hazard regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy grades accounted for 32.45% of the plastic adhesives market size in 2024, underpinning structural joints in automotive body-in-white assemblies and steel-reinforced concrete panels. The high glass-transition temperature and chemical resistance keep epoxies relevant where shear loads and temperature spikes converge. Specialty cyanoacrylates, acrylics, and hybrid urethanes, however, exhibit the fastest 5.18% CAGR, as OEMs pursue rapid bonding in miniature electronics and need cold-cure alternatives for heat-sensitive substrates. The plastic adhesives market therefore balances epoxy's entrenched share with emergent niche chemistries that emphasize speed and flexibility. Cyanoacrylate packages such as H.B. Fuller's Cyberbond line allow viscosity tailoring for medical device micro-dosing while meeting ISO 10993 cytotoxicity requirements. Non-isocyanate polyurethanes made from bio-derived cyclic carbonates are scaling pilot lines, signalling a broader pivot toward sustainable resins inside the plastic adhesives market.

Manufacturers layer R&D to optimise adhesion promoters that interface with low-surface-energy polyolefins, aiming to unlock higher peel strengths without primers. Silicone-epoxy hybrids maintain hermetic seals in high-temperature electronics modules, giving formulators another route to differentiate. As environmental bans curb bisphenol-A derivatives, epoxy suppliers accelerate the launch of bis-F and novolac alternatives, guarding their sizeable plastic adhesives market share while aligning with upcoming endocrine-disruptor reviews in the EU.

The Plastic Adhesives Market Report is Segmented by Resin Type (Epoxy, Cyanoacrylate, Urethane, Silicones, Other Resin Types), Technology (Solvent-Based, Water-Based), End-User Industry (Automotive, Building and Construction, Electrical and Electronics, Medical, Packaging, Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remains the principal manufacturing hub for engineering plastics, electronics, and footwear, positioning the region as the largest revenue contributor to the plastic adhesives market. China's EV output, India's highway and housing programs, and ASEAN's packaging plants collectively amplify consumption. Government initiatives such as India's Smart City Mission continue to stimulate public-works spending that relies on polymer-bonded panels and pipes.

North America, while mature, registers steady gains through stringent fuel-economy and building-energy codes that promote lightweight composites and air-tight building envelopes. The United States Environmental Protection Agency's push toward low-GWP construction materials accelerates demand for low-smog adhesives in roofing and insulation boards. The plastic adhesives market also benefits from the United States-Mexico-Canada Agreement, which incentivises regional sourcing of automotive adhesives to qualify for tariff exemptions.

Europe leverages its Green Deal framework to catalyse recyclable adhesive innovation. Producers adapt formulas to disassemble end-of-life consumer goods and enable closed-loop plastic flows. Stricter EN 16603-20-01 outgassing criteria in aerospace applications pressurise suppliers to certify space-grade adhesives, opening a niche yet valuable tier within the plastic adhesives market.

The Middle East and Africa host expansion projects in desalination, solar infrastructure, and high-rise hospitality. Premium hotel builds specify silicone weather-seals rated for desert temperatures, supporting incremental growth. Latin America's construction rebound and on-shore electronics assembly in Mexico and Brazil add diverse demand layers, albeit from a smaller base than the three dominant regions.

- 3M

- Arkema

- Avery Dennison Corporation

- BASF

- Dow

- Dymax

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- Huntsman International LLC

- INTERTRONICS

- Master Bond Inc.

- Panacol-Elosol GmbH

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

- Toyochem Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweight-vehicle push in automotive industry

- 4.2.2 Construction shift to high-performance plastics

- 4.2.3 Increasing demand from packaging and e-commerce industry

- 4.2.4 Bio-based polyurethane films for medical wearables

- 4.2.5 Thermal-management adhesives for modular electric vehicle battery packs

- 4.3 Market Restraints

- 4.3.1 Petro-feedstock price volatility

- 4.3.2 Tightening global VOC and hazard regulations

- 4.3.3 Fire-safety code upgrades for facade panels

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Resin Type

- 5.1.1 Epoxy

- 5.1.2 Cyanoacrylate

- 5.1.3 Urethane

- 5.1.4 Silicones

- 5.1.5 Other Resin Types (Acrylic, Hot-Melt EVA, etc.)

- 5.2 Technology

- 5.2.1 Solvent-based

- 5.2.2 Water-based

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Building and Construction

- 5.3.3 Electrical and Electronics

- 5.3.4 Medical

- 5.3.5 Packaging

- 5.3.6 Other End-user Industries (Renewable Energy, Consumer Goods, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Avery Dennison Corporation

- 6.4.4 BASF

- 6.4.5 Dow

- 6.4.6 Dymax

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG and Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 INTERTRONICS

- 6.4.11 Master Bond Inc.

- 6.4.12 Panacol-Elosol GmbH

- 6.4.13 Permabond LLC

- 6.4.14 Pidilite Industries Ltd.

- 6.4.15 Sika AG

- 6.4.16 Toyochem Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment