|

市场调查报告书

商品编码

1844713

亲水性涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Hydrophilic Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

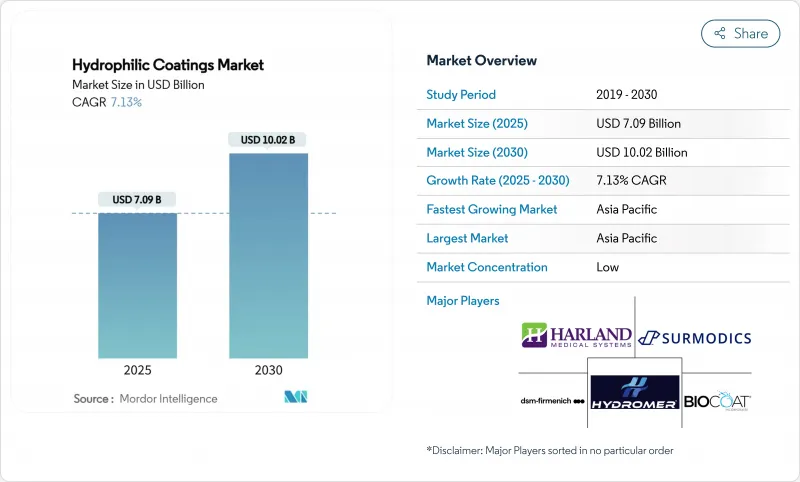

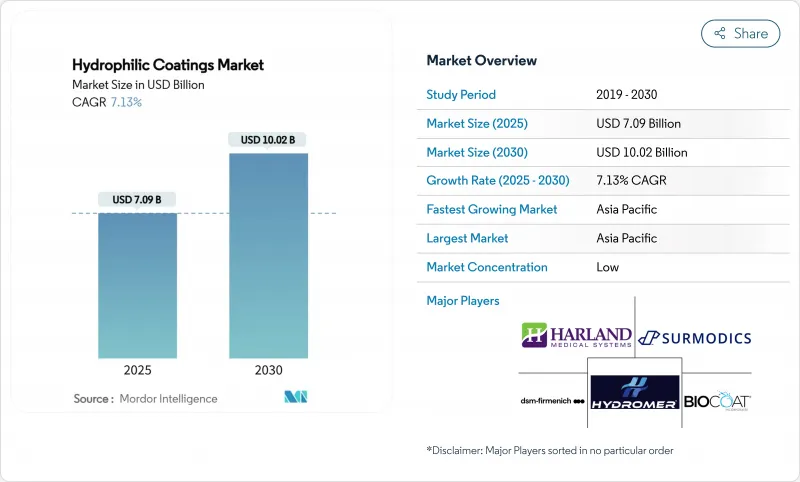

亲水性涂料市场规模预计在 2025 年为 70.9 亿美元,预计到 2030 年将达到 100.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.13%。

医疗、光学和汽车应用领域的快速应用,加上严格的永续性要求,支撑了这一成长。聚合物基板仍占据主导地位,但奈米颗粒表面正在蚕食其领先地位,而亚太地区正透过地理飞轮效应重塑全球供应链。医疗设备价格压力的增加、PFAS法规的收紧以及对耐用性的担忧继续制约着其扩张,但持续的材料创新、精简的沉积技术以及日益壮大的无PFAS解决方案生态系统正在释放机会。

全球亲水性涂料市场趋势与洞察

医疗保健应用需求不断增长

医疗设备设计师依靠亲水性涂层来减少微创手术中的插入力和血栓症。临床证据表明,它们可以将导管摩擦降低高达70%,从而实现更顺畅的血管导航和更短的手术时间。兼具润滑性、抗菌和抗血栓剂的涂层正日益普及,尤其是在神经血管支架领域。表面改质的导流片可以减少血小板黏附,并减少双重抗血小板治疗的需求。医院目前优先使用具有此类多功能层的支架。同时,产学合作正在加速临床前检验,进一步促进其应用。

涂层材料创新

奈米颗粒基底材料集高亲水性、耐磨性和控制释放功能于一身,重新定义了性能上限。二氧化硅-聚丙烯酸配方即使在轻微磨损下也能保持超亲水性,解决了长期存在的耐久性问题。像starPEG-肝素这样的响应性水凝胶能够承受导管置入过程中的剪切力,同时提供按需抗凝血。这些进展开启了全新的产品架构,涂层在不影响机械完整性的情况下,兼具表面润滑和治疗功能的双重作用。

製造成本高

与标准涂层相比,多步骤合成、无尘室沉积和严格的品质测试使製造成本增加了30-40%,从而挤压了对价格敏感的导管和导管导引线线的净利率。专业知识集中在少数几家供应商手中,限制了规模经济,并增加了原始设备製造商(OEM)的转换成本。製程自动化和卷对捲紫外线固化系统正在缩短週期时间,但资金需求限制了小型公司的进入。

細項分析

奈米粒子基板的复合年增长率达7.80%,侵蚀了聚合物48%的收益份额。埃洛石奈米管增强环氧丙烯酸酯乳化的耐久性显着提升,经盐雾暴露16天后仍保持无銹,而传统聚合物仅为9天。玻璃上接触角达162°的超疏水性二氧化硅涂层,展现了奈米技术优势在不同基板间的转移。

儘管製造商继续青睐聚合物,因为它们经济高效、易于量产,但将奈米二氧化硅和层状硅酸盐嵌入聚合物基质的混合设计正在重塑基材的层级结构。这些混合材料将灵活的加工窗口与增强的耐磨性相结合,模糊了类别界限。金属和玻璃基板继续填补生物相容性和光学透明度至关重要的细分领域,但奈米级中间层也正在增强其附着力和耐腐蚀性能。

至2024年,浸涂技术将维持42%的收入份额。然而,等离子体和紫外光接枝製程的年增长率为7.7%,这些製程越来越多地能够在复杂的几何形状上实现客製化的表面化学,且不会产生溶剂残留。引发气相沉积(iCVD)技术可以形成梯度聚合物层,从而提高疏冰性能,并在不同温度下保持亲水性。

喷涂和狭缝模头生产线缩短了週期时间,并提高了导管产量。化学气相沉积技术可实现协同组成的共沉淀,将水接触角降低至43.2°,并提高涂层的均匀性和生命週期稳定性。

区域分析

到2024年,亚太地区将占全球销售额的32%,年增率将达7.90%。中国政府的医疗保健支出以及中国中高端导管製造的扩张将支撑强劲的设备需求。日本公司正在完善其精密沉淀,而韩国电子巨头则正在为影像感测器采用亲水涂层,巩固其在该地区的领先地位。

北美占据关键的市场地位,拥有强大的医疗设备产品线和严格的美国要求,这些要求鼓励优质涂料的发展。 EPA对PFAS的分类为快速再製造带来了压力,这使得拥有合规、高润滑性化学品的国内供应商成为先行者。

永续性要求是欧洲市场的核心。即将推出的 PFAS 法规 REACH 正在加速向水性和紫外光固化系统的转型,推动低 VOC 聚氨酯和环氧分散体的创新。当地原始设备製造商正在与材料专家合作,以在合规期限之前检验接触角和细胞毒性性能。

拉丁美洲和中东及非洲正在兴起,但仍在发展中,巴西导管製造商采用承包涂层模组来扩大出口,沙乌地阿拉伯根据「2030愿景」投资先进材料,以促进区域对医学认可涂层技术的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 医疗保健应用需求不断增长

- 涂层材料创新

- 光学和电子工业的进步

- 永续涂料的监管支持

- 符合欧洲 VOC 标准的水性和紫外线固化配方

- 市场限制

- 製造成本高

- 耐用性和性能问题

- 原物料价格波动

- 价值链分析

- 监理展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测(金额)

- 透过基板

- 聚合物

- 玻璃/陶瓷

- 金属

- 奈米颗粒相容

- 透过成膜技术

- 浸涂

- 喷雾和狭缝式

- 等离子和紫外线接枝

- 化学沉淀

- 其他技术

- 按用途

- 导管和导管导引线

- 支架和植入

- 光学镜片和眼镜镜片

- 汽车感测器和摄影机

- 建筑和太阳能玻璃

- 其他(海洋、纺织、航太)

- 按最终用户产业

- 医疗设备

- 光学和光电

- 车

- 运输/海运

- 其他行业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Aculon

- Applied Medical Coatings

- AST Products Inc.

- Biocoat Incorporated

- Coatings2Go

- dsm-firmenich

- Formacoat

- Harland Medical Systems, Inc.

- Hydromer

- Mitsubishi Chemical America, Inc.

- PPG Industries Inc.

- Specialty Coating Systems Inc.

- Surface Solutions Group LLC

- Surmodics Inc.

- Teleflex Incorporated

第七章 市场机会与未来展望

The Hydrophilic Coatings Market size is estimated at USD 7.09 billion in 2025, and is expected to reach USD 10.02 billion by 2030, at a CAGR of 7.13% during the forecast period (2025-2030).

Surging adoption across medical, optical and automotive applications, coupled with stricter sustainability mandates, underpins this growth. Polymer substrates still dominate but nanoparticle-enabled surfaces are eroding that lead, while Asia-Pacific delivers a geographic flywheel effect that is redrawing global supply chains. Intensifying price pressure on medical devices, tightening PFAS regulations and durability concerns continue to temper expansion; nevertheless, continuous materials innovation, streamlined deposition techniques and an expanding eco-system of PFAS-free solutions are widening commercial opportunities.

Global Hydrophilic Coatings Market Trends and Insights

Rising Demand in Healthcare Applications

Medical device designers rely on hydrophilic coatings to lower insertion forces and mitigate thrombosis in minimally invasive procedures. Clinical evidence shows up to 70% reduction in catheter friction, enabling smoother vascular navigation and shorter procedure times. Coatings that blend lubricity with antimicrobial or antithrombotic agents are gaining traction, especially for neurovascular stents, where surface-modified flow diverters reduce platelet adhesion and may lessen dual-antiplatelet therapy requirements. Hospitals now prioritize devices with such multifunctional layers because they shorten recovery and curb infection risk. In parallel, academic-industry collaborations are accelerating pre-clinical validation, further lifting adoption.

Technological Innovations in Coating Materials

Nanoparticle-enabled substrates redefine performance ceilings by combining high hydrophilicity, abrasion resistance, and controlled-release capability. Silica-poly(acrylic-acid) formulations retain super-hydrophilicity under mild wear, tackling a long-standing durability gap. Responsive hydrogels such as starPEG-heparin withstand shear forces during catheter deployment while delivering on-demand anticoagulation. These advances open new product architectures where coatings deliver dual roles-surface lubricity plus therapeutic functionality-without compromising mechanical integrity.

High Production Costs

Multi-step synthesis, clean-room deposition and intensive quality testing add 30-40% to manufacturing costs versus standard coatings, squeezing margins in price-sensitive catheter and guidewire lines. Specialized know-how remains concentrated among a handful of suppliers, limiting economies of scale and elevating switching costs for OEMs. Although process automation and roll-to-roll UV-cure systems are trimming cycle times, capital requirements deter smaller entrants.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Optical and Electronics Industries

- Regulatory Support for Sustainable Coatings

- Durability and Performance Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nanoparticle-enabled substrates posted 7.80% CAGR and are eroding polymer's 48% revenue stronghold. Halloysite nanotube-reinforced epoxy acrylate emulsions showed zero rusting after 16 days of salt-spray exposure compared with 9 days for conventional polymers, signalling a clear durability leap. Superhydrophobic silica coatings with 162° contact angles on glass illustrate cross-substrate migration of nanotechnology benefits.

Manufacturers continue to favor polymers for cost-effective volume output, but hybrid designs that embed nano-silica or layered silicates within polymer matrices are reshaping the substrate hierarchy. These hybrids merge flexible processing windows with enhanced abrasion resistance, blurring category lines. Metal and glass substrates retain niche roles where biocompatibility or optical clarity are critical, yet even here, nanoscale interlayers are elevating adhesion and corrosion performance.

Dip-coating retained 42% revenue share in 2024. However, plasma and UV-graft routes, growing 7.7% annually, increasingly allow tailor-made surface chemistries on complex geometries without solvent carryover. Initiated Chemical Vapor Deposition (iCVD) creates gradient polymer layers that improve ice-phobicity and maintain hydrophilicity across temperature swings.

Spray and slot-die lines shrink cycle times, meeting rising catheter output targets. Chemical vapor deposition methods enable co-deposition of synergistic components, driving water contact angles down to 43.2°, thereby boosting coating uniformity and lifecycle stability.

The Hydrophilic Coatings Market Report Segments the Industry by Substrate (Polymer, Glass/Ceramic, and More), Deposition Technology (Dip-Coating, Spray and Slot-Die, and More), Application (Catheters and Guidewires, Stents and Implantables, and More), End-User Industry (Medical Devices, Optics and Photonics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 32% of global revenue in 2024 and will accelerate at 7.90% a year. Government healthcare spending and mid- to high-end catheter manufacturing expansion in China underpin robust device demand. Japanese firms refine precision deposition, and Korean electronics giants deploy hydrophilic coatings in image sensors, cementing regional leadership.

North America has a significant position in the market, buoyed by deep medical-device pipelines and strict FDA performance expectations that reward premium coatings. EPA's PFAS classification forces rapid reformulation; domestic suppliers that secure compliant, high-lubricity chemistries gain early mover status.

Europe's market centres on sustainability mandates. Imminent REACH curbs on PFAS accelerate migration toward water-borne and UV-cure systems, fostering innovation in low-VOC polyurethane and epoxy dispersions. Local OEMs partner with materials specialists to validate contact-angle and cytotoxicity performance ahead of compliance deadlines.

Latin America and the Middle East & Africa remain nascent but rising. Brazil's catheter producers incorporate turnkey coating modules as they scale exports, while Saudi Arabia invests in advanced materials under Vision 2030, nurturing regional demand for medically approved coating technologies.

- Aculon

- Applied Medical Coatings

- AST Products Inc.

- Biocoat Incorporated

- Coatings2Go

- dsm-firmenich

- Formacoat

- Harland Medical Systems, Inc.

- Hydromer

- Mitsubishi Chemical America, Inc.

- PPG Industries Inc.

- Specialty Coating Systems Inc.

- Surface Solutions Group LLC

- Surmodics Inc.

- Teleflex Incorporated

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand in Healthcare Applications

- 4.2.2 Technological Innovations in Coating Materials

- 4.2.3 Advancements in Optical and Electronics Industries

- 4.2.4 Regulatory Support for Sustainable Coatings

- 4.2.5 VOC-Compliant Water-borne and UV-Cure Formulations in Europe

- 4.3 Market Restraints

- 4.3.1 High Production Costs

- 4.3.2 Durability and Performance Concerns

- 4.3.3 Volatility in Raw Material Prices

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value )

- 5.1 By Substrate

- 5.1.1 Polymer

- 5.1.2 Glass / Ceramic

- 5.1.3 Metal

- 5.1.4 Nanoparticle-Enabled

- 5.2 By Deposition Technology

- 5.2.1 Dip-Coating

- 5.2.2 Spray and Slot-Die

- 5.2.3 Plasma and UV-Graft

- 5.2.4 Chemical Vapor Deposition

- 5.2.5 Other Technologies

- 5.3 By Application

- 5.3.1 Catheters and Guidewires

- 5.3.2 Stents and Implantables

- 5.3.3 Optical and Eyewear Lenses

- 5.3.4 Automotive Sensors and Cameras

- 5.3.5 Architectural and Solar Glass

- 5.3.6 Others (Marine, Textile, Aerospace)

- 5.4 By End-User Industry

- 5.4.1 Medical Devices

- 5.4.2 Optics and Photonics

- 5.4.3 Automotive

- 5.4.4 Transportation and Marine

- 5.4.5 Other Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Aculon

- 6.4.2 Applied Medical Coatings

- 6.4.3 AST Products Inc.

- 6.4.4 Biocoat Incorporated

- 6.4.5 Coatings2Go

- 6.4.6 dsm-firmenich

- 6.4.7 Formacoat

- 6.4.8 Harland Medical Systems, Inc.

- 6.4.9 Hydromer

- 6.4.10 Mitsubishi Chemical America, Inc.

- 6.4.11 PPG Industries Inc.

- 6.4.12 Specialty Coating Systems Inc.

- 6.4.13 Surface Solutions Group LLC

- 6.4.14 Surmodics Inc.

- 6.4.15 Teleflex Incorporated

7 Market Opportunities and Future Outlook

- 7.1 Development of Eco-Friendly Coatings

- 7.2 White-space and Unmet-need Assessment