|

市场调查报告书

商品编码

1844716

纺织涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Textile Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

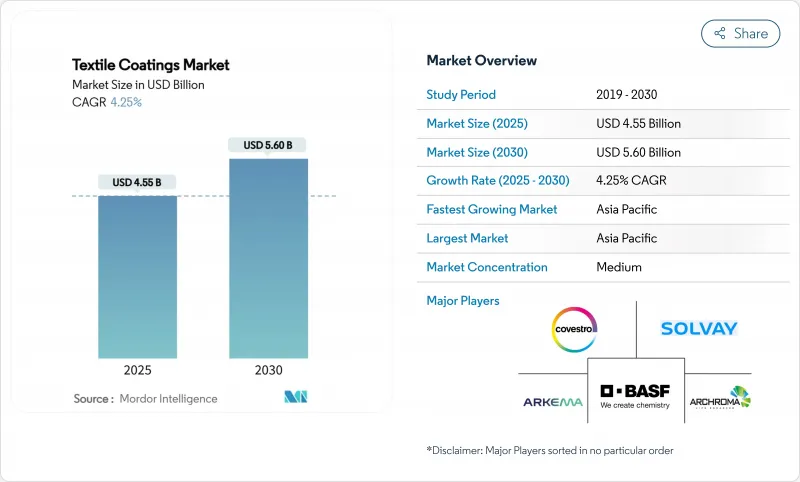

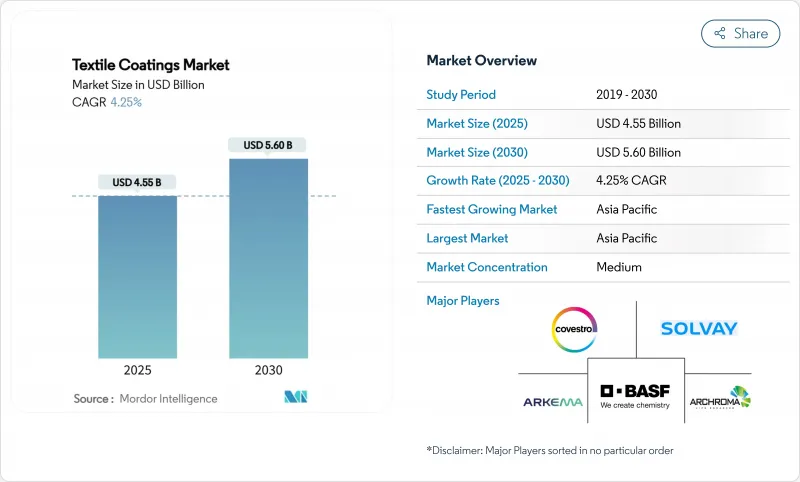

纺织涂料市场规模预计在 2025 年达到 45.5 亿美元,预计到 2030 年将达到 56 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.25%。

这是因为製造商寻求在不牺牲耐用性或美观性的前提下降低 VOC 含量。虽然亚太地区保持其成本优势并将吸收大部分新增产能,但北美和欧洲正在推动性能化学和法律规范,影响全球配方选择。医疗、汽车和基础设施产业正在重新评估抗菌、耐候性和阻燃性等性能标准,促使供应商摆脱传统的 PFAS 化学品,以实现产品多元化。对有机硅乳液、等离子表面处理和数位应用生产线的投资突显了竞争格局,各方愿意以产量换取专业性能和利润弹性。在此背景下,纺织涂料市场将继续平衡成本、合规性和客製化压力,塑造其 2030 年的技术蓝图。

全球纺织涂料市场趋势与洞察

提高防护纺织品标准

全球监管机构正在加强性能和安全标准,迫使製造商开发阻燃、耐化学腐蚀和防潮的解决方案,以消除PFAS,同时满足NFPA 1971-2018等更新标准。美利肯推出了非PFAS替代品,其耐久性超过了先前的阈值,从而刺激了竞争性创新,并加速了对竞争对手测试实验室的投资。欧洲供应商正专注于生物基化学品,以配合绿色交易的目标,其需求正从消防装备扩展到工业工作服,从而扩大了合规化学品在纺织涂料市场的商业性可行性。

汽车和交通座椅内装的需求不断增长

随着电动车和自动驾驶汽车对更轻量化、更高端内装的需求不断增长,对单层兼具耐磨性、温度控管和抗菌性能的涂料的需求也日益增长。主流媒体报告了对传统阻燃剂的健康担忧,这促使人们改进配方,选择更安全的替代品,并寻求既能满足原始设备製造商的永续性目标,又能满足严格的室内空气品质指标的采购平台。亚洲的加工商正利用其成本和规模优势赢得内饰合同,巩固了亚太地区作为纺织涂料市场供需中心的地位。

主要原料聚合物价格波动

聚乙烯醇、棉花和石油基合成树脂的价格波动频繁,扰乱了计划週期,并导致大量依赖现货市场的涂料商的利润率下降。虽然聚乙烯醇价格在2025年初有所下跌,但预计合成纤维成本将因油价波动而上涨10-15%,这将导致复杂的投入成本状况,需要谨慎的库存管理和长期供应合约。这些波动为纺织涂料市场带来了短期收益的不确定性。

細項分析

到2024年,热塑性聚合物将以51.23%的市场份额主导纺织涂料市场,这反映了其在成本效益、机械强度和可回收性方面的平衡。需求集中在汽车内饰、防护衣和柔性建筑膜领域,这些领域需要耐磨性和尺寸稳定性。终端用户青睐热塑性塑料,是因为它们与符合更严格VOC法规的水性和无溶剂涂料相容。轻量化电动车内装和模组化基础设施计划进一步推动了需求的增加。这些因素共同作用,使热塑性塑胶成为主要消费地区高性能涂料的首选基材。

到2030年,热塑性聚合物的复合年增长率将达到6.34%,成为最快的材料,在规模和发展动能方面都将主导纺织涂料市场。天然纤维、纤维素纤维和热固性纤维等竞争材料的成长率将落后,因为它们无法匹敌热塑性塑胶的加工速度、耐热性和可回收性优势。共聚物共混物和表面处理的渐进式创新,在不牺牲环保合规性的前提下,不断突破性能极限。随着下游品牌扩大其循环经济计划,涂层热塑性纤维的再熔化和再加工能力长期来看将更具吸引力。因此,新涂层生产线的资本投资将瞄准热塑性友善配方,以确保该细分市场持续扩张所需的产能。

到2024年,编织基材将占据纺织涂料市场份额的45.18%,并以6.01%的复合年增长率保持主导地位。在汽车、建筑和安全领域,由于结构完整性不容妥协,编织结构因其长期性能而备受青睐。不织布的进步开始在一次性医疗抛弃式和过滤介质领域获得关注,这得益于其多孔性,从而提高了涂层的渗透性和功能均匀性。

针织布料在需要弹性和悬垂性的领域占据着一席之地,但由于黏合性和保形性方面的局限性,限制了其在大批量技术应用中的渗透。将机织布料的稳定性与针织布料的舒适性相结合的混合多层布料正在运动和医疗矫正器具领域兴起,这表明基材创新仍然是纺织涂层市场差异化的关键槓桿。

区域分析

到2024年,亚太地区将占全球销售额的53.12%,对纺织涂料市场的定价和供应分配产生越来越大的影响。到2024年,中国的纺织品和服饰将达到3,010亿美元,其中纺织品出口额为1,420亿美元。印度的政策工具,例如生产挂钩奖励计划和PM MITRA公园,旨在到2030年将国内产量提高到3500亿美元,鼓励国内配方商儘早采用水性化学品并将其纳入新的生产能力。孟加拉和越南凭藉具有竞争力的人事费用和贸易协定站稳了脚跟,但美国对某些类别的关税可能会改变筹资策略,并鼓励当地供应商差异化其能力。

北美仍然是一个以技术为中心的地区,监管压力将转化为无PFAS、低VOC系统的机会。加州和纽约州将于2025年1月实施全球最严格的纺织化学品禁令,为已提供合规产品组合的公司提供先发优势。路博润在加斯托尼亚斥资2000万美元扩建丙烯酸乳液工厂,加强了该地区对增值细分市场的关注,并支持了家用纺织品和汽车内饰技术性能面料的需求丛集。加拿大与美国汽车生产的整合支持了跨境需求,但其受原物料价格週期的影响,意味着其必须不断调整筹资策略。

欧洲在永续化学和先进加工领域中保持领先地位。来自德国、法国和北欧的创新企业正在推动水性聚氨酯和生物聚合物的前沿发展,同时投资等离子和数位应用生产线,以大幅减少水和能源投入。科德宝斥资1亿欧元收购Haytex资产等收购,扩大了其技术纺织品产品组合,并标誌着整合的持续进行。欧盟循环经济立法正在加速人们对可回收涂料和闭合迴路基础设施的兴趣,使纺织涂料市场既受益于该地区气候变迁目标,也成为其推动者。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 提高防护纺织产品的标准

- 汽车和交通运输内部装潢建材的需求不断增加

- 建筑和基础设施领域对耐用、耐候布料的需求日益增加

- 转向水性、无溶剂聚合物以符合 VOC 法规

- 抗菌和抗病毒奈米涂层在医疗纺织品中的出现

- 市场限制

- 主要原料聚合物价格波动

- 涂装机和生产线的资本成本高

- 与等离子和其他干法整理替代品的竞争

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按聚合物类型

- 热塑性塑料

- 聚氯乙烯(PVC)

- 聚氨酯(PU)

- 丙烯酸纤维

- 其他的

- 热固性树脂

- 橡皮

- 天然橡胶

- 苯乙烯-丁二烯橡胶

- 其他的

- 其他聚合物

- 热塑性塑料

- 按布料类型

- 织物

- 针织

- 不织布

- 按功能

- 防水透气

- 阻燃剂

- 抗菌抗病毒

- 抗紫外线和红外线

- 按用途

- 衣服

- 运输

- 医疗保健

- 建筑学

- 其他用途(工业、防护设备等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Archroma

- Arkema

- BASF

- Clariant

- Continental AG

- Covestro AG

- Daikin Industries Ltd.

- Formulated Polymer Products Ltd

- Impreglon UK Limited

- Seyntex

- Solvay

- SRF Limited

- Tanatex Chemicals BV

- The Lubrizol Corporation

- Toray Industries Inc.

- Trelleborg Group

第七章 市场机会与未来展望

The Textile Coatings Market size is estimated at USD 4.55 billion in 2025, and is expected to reach USD 5.60 billion by 2030, at a CAGR of 4.25% during the forecast period (2025-2030).

Accelerated migration toward waterborne and solvent-free polymer systems sits at the center of this shift, as manufacturers seek lower VOC profiles without compromising durability or aesthetics. Asia-Pacific retains cost-leadership advantages and absorbs a majority of new capacity, while North America and Europe propel high-performance chemistry and regulatory frameworks that influence global formulation choices. Medical, automotive, and infrastructure segments are reframing performance benchmarks around antimicrobial, weather-resistant, and flame-retardant properties, prompting suppliers to diversify away from legacy PFAS chemistries. Investments in silicone-based emulsions, plasma surface treatment, and digital application lines reveal a competitive field willing to trade volume for specialty performance and margin resilience. Against this backdrop, the textile coatings market continues to balance cost, compliance, and customization pressures that collectively shape technology road maps through 2030.

Global Textile Coatings Market Trends and Insights

Increasing Standards for Protective Textiles

Global regulators are tightening performance and safety benchmarks, prompting manufacturers to develop flame-resistant, chemical-resistant, and moisture-barrier solutions that eliminate PFAS while meeting updated norms such as NFPA 1971-2018. Milliken introduced non-PFAS alternatives that surpass earlier durability thresholds, stimulating competitive innovation and accelerating test-lab investments among rivals. European suppliers extend the focus to bio-based chemistries to align with Green Deal ambitions, and demand extends from firefighting ensembles to industrial workwear, broadening commercial potential for compliant chemistries within the textile coatings market.

Growing Demand in Automotive and Transportation Upholstery

Lightweighting agendas and premium cabin expectations in electric and autonomous vehicles translate into coatings that deliver abrasion resistance, thermal management, and antimicrobial properties all in one layer. Health concerns about legacy flame retardants reported in mainstream media spur reformulations toward safer alternatives, steering procurement toward platforms that satisfy both OEM sustainability goals and stringent interior-air-quality metrics. Asian converters leverage cost and scale advantages to win upholstery contracts, reinforcing Asia-Pacific's role as demand and supply nucleus for the textile coatings market.

Fluctuating Prices of Key Raw Polymers

Polyvinyl alcohol, cotton, and oil-derived synthetics exhibit recurrent price swings that distort planning cycles and erode margins among coaters heavily exposed to spot markets. Polyvinyl alcohol price declines in early 2025, yet synthetic fiber costs climbed 10-15% on oil volatility, producing a mixed input-cost picture that forces cautious inventory management and long-term supply contracts. Such volatility introduces near-term earnings uncertainty in the textile coatings market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Need for Durable and Weather-Resistant Fabrics in Construction and Infrastructure

- Shift Toward Waterborne and Solvent-Free Polymers Complying With VOC Regulations

- High Capital Cost of Coating Machinery and Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoplastic polymers dominate the segment with 51.23% of textile coatings market share in 2024, reflecting their balance of cost efficiency, mechanical strength, and recyclability. Demand concentrates in automotive upholstery, protective apparel, and flexible construction membranes where abrasion resistance and dimensional stability are mandatory. End-users favor thermoplastics for compatibility with waterborne and solvent-free coating chemistries that align with tightening VOC limits. Lightweight electric-vehicle interiors and modular infrastructure projects further elevate volume requirements. These combined drivers anchor thermoplastics as the preferred substrate for high-performance coatings across major consumption regions.

Thermoplastic polymers will also deliver the fastest 6.34% CAGR through 2030, underscoring their dual leadership in both scale and momentum within the textile coatings market size. Competitive materials such as natural, cellulose-based, and thermoset fibers trail in growth because they struggle to match the processing speed, thermal tolerance, and recyclability advantages of thermoplastics. Incremental innovations in copolymer blends and surface treatments continue to raise the performance ceiling without sacrificing environmental compliance. As downstream brands expand circular-economy commitments, the prospect of re-melting and re-processing coated thermoplastic fabric reinforces long-term attractiveness. Consequently, capital expenditure in new coating lines increasingly targets thermoplastic-friendly configurations to secure capacity for the segment's sustained expansion.

Woven substrates achieved 45.18% textile coatings market share in 2024 and pair that dominance with a 6.01% CAGR, reflective of their inherent tensile strength, dimensional stability, and superior coating anchorage. Automotive, architectural, and safety segments, which cannot compromise on structural integrity, prefer woven constructions for long-term performance. Non-woven advancements begin gaining traction in medical disposables and filtration media, aided by engineered porosity that improves coating penetration and functional uniformity.

Knitted fabrics occupy niches demanding stretch and drape, yet adhesion and shape-retention limits constrain penetration in large technical applications. Hybrid multilayer fabrics combining woven stability with knitted comfort emerge in sports and medical braces, indicating that substrate innovation remains a critical lever for differentiation within the textile coatings market.

The Textile Coatings Market Report Segments the Industry by Polymer Type (Thermoplastics, Thermosets, and More), Fabric Type (Woven, Knitted, Non Woven), Functionality (Waterproof and Breathable, Flame Retardant, and More) Application (Clothing, Transportation, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 53.12% of global revenue in 2024, cementing its influence on price formation and supply allocation across the textile coatings market. China shipped USD 301 billion in textiles and garments in 2024, of which USD 142 billion stemmed from textiles, underscoring capacity depth even amid diversification moves toward Vietnam, India, and Bangladesh. Indian policy tools such as the Production Linked Incentive program and PM MITRA parks seek to elevate national production value to USD 350 billion by 2030, encouraging domestic formulators to embrace water-based chemistries early and embed them in new capacity. Bangladesh and Vietnam cement footholds via competitive labor costs and trade agreements, but the imposition of US tariffs on certain categories could reorder sourcing strategies and push local suppliers toward greater functional differentiation.

North America remains a technology-centric region, channeling regulatory fervor into commercial opportunities for PFAS-free, low-VOC systems. California and New York enact some of the world's most stringent textile chemical bans effective January 2025, prompting early-mover advantage for firms already equipped to supply compliant portfolios . Lubrizol's USD 20 million acrylic-emulsion expansion in Gastonia supports demand clusters in home textiles and technical performance fabrics for automotive interiors, reinforcing the region's tilt toward value-added niches. Canada's integration with US vehicle production sustains cross-border demand, though exposure to raw-material price cycles forces constant recalibration of sourcing strategies.

Europe sustains leadership in sustainable chemistry and advanced processing. German, French, and Nordic innovators push waterborne polyurethane and bio-polymer frontiers while investing in plasma and digital-application lines that dramatically cut water and energy inputs. Acquisitions such as Freudenberg's EUR 100 million takeover of Heytex assets expand technical-textile portfolios and signal ongoing consolidation. EU circular-economy legislation accelerates interest in recyclable coatings and closed-loop infrastructures, positioning the textile coatings market as both beneficiary and enabler of regional climate objectives.

- Archroma

- Arkema

- BASF

- Clariant

- Continental AG

- Covestro AG

- Daikin Industries Ltd.

- Formulated Polymer Products Ltd

- Impreglon UK Limited

- Seyntex

- Solvay

- SRF Limited

- Tanatex Chemicals B.V.

- The Lubrizol Corporation

- Toray Industries Inc.

- Trelleborg Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Standards for Protective Textiles

- 4.2.2 Growing Demand in Automotive and Transportation Upholstery

- 4.2.3 Rising Need for Durable and Weather-Resistant Fabrics in Construction and Infrastructure

- 4.2.4 Shift Toward Waterborne and Solvent Free Polymers Complying with VOC Regulations

- 4.2.5 Emergence of Antimicrobial and Antiviral Nano-Coatings in Healthcare Textiles

- 4.3 Market Restraints

- 4.3.1 Fluctuating Prices of Key Raw Polymers

- 4.3.2 High Capital Cost of Coating Machinery and Lines

- 4.3.3 Competition from Plasma and other Dry Finishing Alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Polymer Type

- 5.1.1 Thermoplastics

- 5.1.1.1 Polyvinyl Chloride (PVC)

- 5.1.1.2 Polyurethane (PU)

- 5.1.1.3 Acrylic

- 5.1.1.4 Others

- 5.1.2 Thermosets

- 5.1.3 Rubber

- 5.1.3.1 Natural Rubber

- 5.1.3.2 Styrene butadiene Rubber

- 5.1.3.3 Others

- 5.1.4 Other Polymer Types

- 5.1.1 Thermoplastics

- 5.2 By Fabric Type

- 5.2.1 Woven

- 5.2.2 Knitted

- 5.2.3 Non-woven

- 5.3 By Functionality

- 5.3.1 Waterproof and Breathable

- 5.3.2 Flame-retardant

- 5.3.3 Anti-microbial and Anti-viral

- 5.3.4 UV and IR Resistant

- 5.4 By Application

- 5.4.1 Clothing

- 5.4.2 Transportation

- 5.4.3 Medical

- 5.4.4 Construction

- 5.4.5 Other Applications (Industrial and Protective Equipment, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Archroma

- 6.4.2 Arkema

- 6.4.3 BASF

- 6.4.4 Clariant

- 6.4.5 Continental AG

- 6.4.6 Covestro AG

- 6.4.7 Daikin Industries Ltd.

- 6.4.8 Formulated Polymer Products Ltd

- 6.4.9 Impreglon UK Limited

- 6.4.10 Seyntex

- 6.4.11 Solvay

- 6.4.12 SRF Limited

- 6.4.13 Tanatex Chemicals B.V.

- 6.4.14 The Lubrizol Corporation

- 6.4.15 Toray Industries Inc.

- 6.4.16 Trelleborg Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment