|

市场调查报告书

商品编码

1844717

聚乙烯醇(PVA):市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Polyvinyl Alcohol (PVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

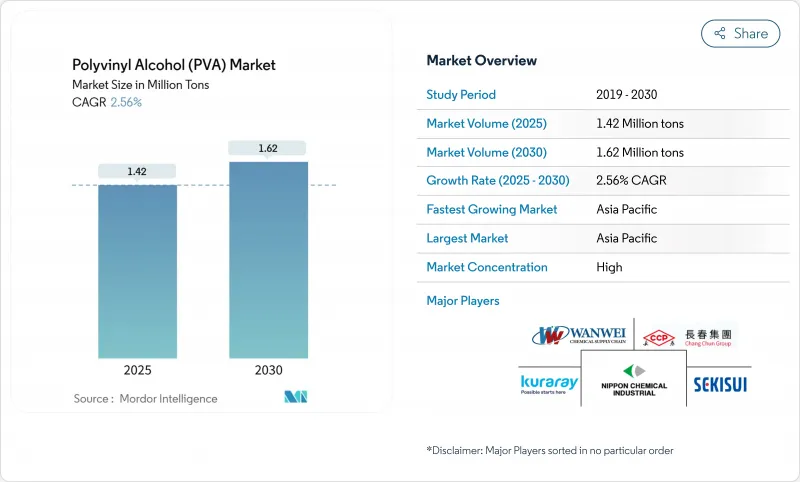

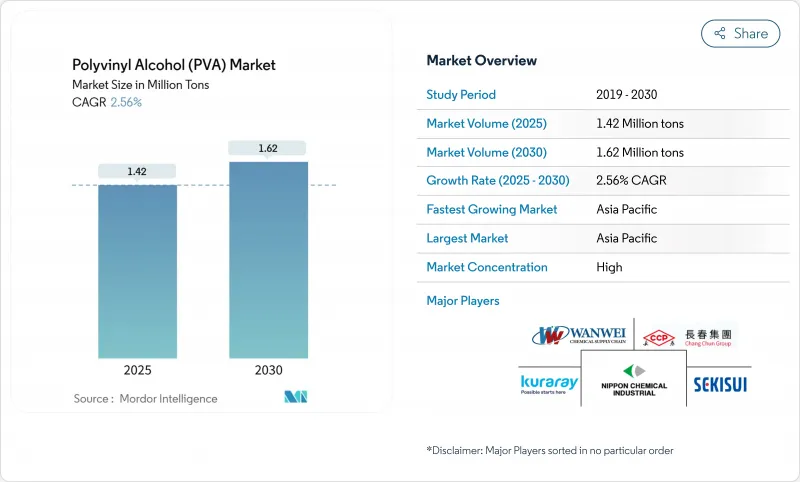

聚乙烯醇市场规模预计在 2025 年为 142 万吨,预计到 2030 年将达到 162 万吨,预测期内(2025-2030 年)的复合年增长率为 2.56%。

包装行业的永续性要求、建设活动的蓬勃发展以及清洁剂凝珠、乳化聚合物和技术纺织品的稳步普及,共同支撑了市场需求。随着品牌商逐步取代传统塑料,水溶性薄膜的增速最为迅猛,而部分水解销售量凭藉其在溶解性和机械强度方面的平衡,占据了主导地位。亚太地区凭藉其强大的产能、接近性原料地段以及强大的下游製造基地,保持了领先地位。醋酸乙烯单体(VAM) 的价格波动持续对生产商的利润带来压力,促使其采取策略性倡议,转向更高附加价值的 PVA 和供应链整合。

全球聚乙烯醇(PVA)市场趋势与洞察

食品包装产业的需求不断增长

为了满足更严格的永续发展目标和消费者对环保包装的偏好,品牌所有者越来越多地转向使用基于PVA的材料。这种聚合物具有优异的阻氧和阻隔性,可延长保质期并减少食物废弃物。最近的多层PVA-纤维素复合材料无需依赖PFAS即可满足TAPPI T 559 cm-12耐油性标准,展现了其在监管方面的优势。 PVA与循环经济回收流程的兼容性进一步使其有别于传统塑胶。这些优势使PVA成为生鲜食品包装、微波炉薄膜、轻质阻隔结构等产品的首选基材。

扩大建设产业的应用

PVA纤维越来越多地被加入混凝土中,使其抗拉强度提高高达38%,抗弯强度提高66%,从而提高了桥樑、隧道和高层建筑的结构耐久性。在高温固化条件下使用PVA,可以生产出密度仅为1.0 g/cm³的轻质混凝土混合物,从而减少运输负荷和体积碳足迹。亚洲的基础设施支出和北美政府的绿色建筑激励措施正在支持混凝土的长期成长。建商重视PVA的裂缝修復能力,认为它可以降低结构生命週期内的维护成本。

中国醋酸乙烯单体价格波动

需求波动导致产能快速扩张,导致VAM价格难以预测,并侵蚀了商品级生产商的净利率。占全球产量大部分的中国PVA工厂正面临成本上升的局面,其成本上涨正蔓延至出口市场。多元化化工企业正透过在其他地区增加乙酰基链产能来应对这种波动,例如塞拉尼斯在德克萨斯州的130万吨醋酸计划。然而,短期内对成本的担忧阻碍了产能瓶颈的消除,并促使企业转向利润率更高的特种级产品。

細項分析

部分水解等级预计将占据聚乙烯醇市场的最大份额,到2024年将占销售量的37.34%,并有望实现最快的2.96%的复合年增长率。其均衡的溶解性使加工商能够微调黏合剂、纸张被覆剂和纺织品上浆剂中的黏度。完全水解等级则用于需要更高结晶度的利基电子和医药黏合剂。低发泡、细颗粒产品在对无缺陷涂层和高表面积至关重要的领域越来越受欢迎。

聚乙烯醇市场受益于生产商根据特定最终用途客製化聚合度和水解度。特用化学品可控制湿敏性,实现高固态加工,并加速成膜速度。在原料价格波动的背景下,利润弹性取决于差异化等级,这些等级能够解决客户痛点,并提供一致的批次间品质。

粉末仍将是主导产品,占2024销售量的54.15%。粉末保质期长、易于再分散且运费低,使其非常适合散装应用,例如建筑外加剂和纸张表面施胶。然而,由于永续性的压力有利于水溶性单剂量产品和不含PFAS的阻隔包装,预计薄膜市场将成长最快,复合年增长率为3.31%。随着电子商务和便利包装的日益普及,聚乙烯醇薄膜市场预计将大幅扩张。

同时,纤维在水泥加固、绳索和过滤材料等领域具有较高的利润率。KURARAY CO. LTD.的维尼纶是一种领先的技术纤维,可增强混凝土和地工织物的抗拉强度、耐碱性和黏合性。透过多样化产品形态,并在通用产品和特殊用途产品之间取得平衡,增强了其产品组合的韧性。

区域分析

到2024年,亚太地区将占全球PVA需求的47.51%,复合年增长率为2.89%。儘管VAM价格波动带来利润压力,但中国的乙酰基产业链整合和大规模建设活动将巩固其在该地区的主导地位。日本将供应优质树脂和纤维,而韩国和东南亚将增加产能以满足出口市场的净利率。

在北美,美国受惠于页岩衍生原料、高涨的建筑维修活动以及特种薄膜生产的持续回流。欧洲市场受到严格的环保法规的影响,这些法规要求使用可回收和可生物降解的材料。德国凭藉蓬勃发展的化学和汽车工业引领薄膜消费,而英国、法国和义大利则优先考虑医疗和特种薄膜应用。

儘管规模较小,但在基础建设正在加速的巴西和正在与石化多元化计划相协调的沙乌地阿拉伯,PVA 的投资正在逐渐增加。由于原料经济、法律规范和下游一体化方面的区域差异,形成了多样化的需求格局,熟练的生产商可以透过区域供应链和技术服务中心来满足这些需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 食品包装产业的需求不断增长

- 在建设产业的应用日益广泛

- 清洁剂凝珠和水溶性薄膜的需求不断增长

- 乳化聚合物的需求不断增长

- 在纺织业的应用日益广泛

- 市场限制

- 中国醋酸乙烯单体价格波动对PVA利润造成压力

- 缺乏合适的替代品

- 新兴国家 PVA 薄膜回收基础设施有限

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测(数量)

- 按年级

- 完全水解

- 部分水解

- 部分水解

- 低发泡等级

- 其他等级(改质等级、细颗粒等级)

- 按形状

- 粉末

- 颗粒

- 薄片

- 薄膜(水溶性)

- 纤维

- 按用途

- 聚合添加剂

- 聚乙烯丁醛

- 胶水

- 纤维

- 纸浆和涂料

- 开发用途

- 其他用途

- 按最终用途行业

- 食品包装

- 造纸

- 建造

- 电子产品

- 纤维

- 其他行业(清洁剂、杀虫剂等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Astrra Chemicals

- Chang Chun Group

- JAPAN VAM & POVAL CO.,LTD.

- KURARAY CO., LTD.

- Mitsubishi Chemical Corporation

- Nippon Chemical Industrial CO., LTD.

- Polysciences

- SEKISUI CHEMICAL CO., LTD.

- Shandong Tiancheng Chemical Co., Ltd.

- Shuangxin PVA Tech Co., Ltd.

- WANWEI CHEMICAL SUPPLY CHAIN CO.,LTD

第七章 市场机会与未来展望

The Polyvinyl Alcohol Market size is estimated at 1.42 Million tons in 2025, and is expected to reach 1.62 Million tons by 2030, at a CAGR of 2.56% during the forecast period (2025-2030).

Demand is underpinned by sustainability mandates in packaging, expanding construction activity, and steady uptake in detergent pods, emulsion polymers, and technical textiles. Water-soluble films are accelerating most rapidly as brand owners replace legacy plastics, while partially hydrolyzed grades dominate volumes by balancing solubility with mechanical strength. Asia-Pacific retains its leadership position thanks to large-scale capacity, proximity to raw materials, and a robust downstream manufacturing base. Price volatility in vinyl acetate monomer (VAM) continues to pressure producer margins, prompting strategic moves toward higher-value PVA formats and supply-chain integration.

Global Polyvinyl Alcohol (PVA) Market Trends and Insights

Growing Demand from the Food Packaging Industry

Brand owners are switching to PVA-based materials to meet stricter sustainability targets and consumer preferences for low-impact packaging. The polymer provides excellent oxygen and grease barriers, extending shelf life and reducing food waste. Recent multi-layer PVA-cellulose composites meet TAPPI T 559 cm-12 for oil resistance without relying on PFAS, showcasing their regulatory advantage. PVA's compatibility with circular-economy recycling streams further differentiates it from conventional plastics. These strengths position the material as a preferred substrate in fresh-produce wraps, microwave-safe films, and lightweight barrier structures.

Increasing Usage in the Construction Industry

PVA fibers are increasingly blended into concrete, where they raise tensile strength by up to 38% and flexural strength by 66%, improving structural durability in bridges, tunnels, and high-rise projects. Lightweight concrete formulations as low as 1.0 g/cm3 density have been achieved using PVA under high-temperature curing, cutting transport loads and embodied carbon. Infrastructure spending in Asia and government green-building incentives in North America support long-term growth. Contractors value PVA's crack-bridging ability, which lowers maintenance costs over a structure's life cycle.

Volatile Vinyl Acetate Monomer Prices in China

Rapid capacity additions alongside demand swings have made VAM pricing unpredictable, eroding margins for commodity-grade producers. Chinese PVA plants, responsible for a large share of global output, face cost spikes that ripple through export markets. Integrated chemical majors are countering volatility by adding acetyl-chain capacity in other regions, such as Celanese's 1.3-million-ton acetic acid project in Texas. Still, near-term cost instability deters capacity debottlenecking and prompts a shift toward higher-margin specialty grades.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand in Detergent Pods and Water-Soluble Films

- Increasing Demand for Emulsion Polymers

- Availability of Suitable Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Partially hydrolyzed grades captured 37.34% of the 2024 volume, giving them the largest polyvinyl alcohol market share and the fastest 2.96% CAGR outlook. Their balanced solubility lets converters fine-tune viscosity in adhesives, paper coatings, and textile sizing. Fully hydrolyzed variants serve niche electronic and pharmaceutical binders that require higher crystallinity. Low-foaming and fine-particle products are gaining popularity where defect-free coatings and high surface area are essential.

The polyvinyl alcohol market benefits from producers tailoring degree-of-polymerization and hydrolysis to specific end uses. Specialty chemistries provide moisture sensitivity control, permit higher solids processing, and enable faster film formation. As raw-material prices fluctuate, margin resilience hinges on differentiated grades that solve customer pain points and deliver consistent batch-to-batch quality.

Powder remains the workhorse with 54.15% of the 2024 volume. Its long shelf life, easy re-dispersion, and lower freight costs suit bulk applications such as construction admixtures and paper surface sizing. Films, however, are the fastest growing at 3.31% CAGR as sustainability pressures favor water-soluble unit doses and PFAS-free barrier wraps. The polyvinyl alcohol market size for film formats will expand substantially as e-commerce and convenience packaging proliferate.

Granules provide dust-free handling in automated compounding lines, while fibers open high-margin routes in cement reinforcement, ropes, and filtration media. Kuraray's KURALON exemplifies technical fibers that deliver tensile strength, alkali resistance, and bonding capability to concrete and geotextiles. Form diversification improves portfolio resilience by balancing commodity volumes with specialty niches.

The Polyvinyl Alcohol (PVA) Market Report Segments the Industry by Grade (Fully Hydrolyzed, Partially Hydrolyzed, and More), Form (Powder, Granules, and More), Application (Polymerization Additives, Polyvinyl Butyral, Adhesives, and More), End-Use Industry (Food Packaging, Paper Manufacturing, Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific generated 47.51% of global PVA demand in 2024 and is growing at a 2.89% CAGR. China anchors regional dominance with integrated acetyl chains and large construction activity, even though VAM price swings squeeze margins. Japan supplies premium resins and fibers, while South Korea and Southeast Asia add incremental capacity aimed at export markets.

In North America, the United States benefits from shale-derived feedstocks, high building-renovation activity, and ongoing reshoring of specialty film production. Europe's market is shaped by strict environmental directives demanding recyclable or biodegradable materials. Germany leads consumption thanks to its chemical and automotive base, while the United Kingdom, France, and Italy prioritize medical and specialty film uses.

Smaller but growing adoption is seen in Brazil, where infrastructure repair is accelerating, and Saudi Arabia, which aligns PVA investments with broader petrochemical diversification plans. Regional differences in feedstock economics, regulatory frameworks, and downstream integration create a diverse demand map that seasoned producers navigate through localized supply chains and technical service hubs.

- Astrra Chemicals

- Chang Chun Group

- JAPAN VAM & POVAL CO.,LTD.

- KURARAY CO., LTD.

- Mitsubishi Chemical Corporation

- Nippon Chemical Industrial CO., LTD.

- Polysciences

- SEKISUI CHEMICAL CO., LTD.

- Shandong Tiancheng Chemical Co., Ltd.

- Shuangxin PVA Tech Co., Ltd.

- WANWEI CHEMICAL SUPPLY CHAIN CO.,LTD

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand From the Food Packaging Industry

- 4.2.2 Increasing Usage in the Construction Industry

- 4.2.3 Growing Demand in Detergent Pods and Water-Soluble Films

- 4.2.4 Increasing Demand for Emulsion Polymers

- 4.2.5 Rising Utilziation from Textile Industry

- 4.3 Market Restraints

- 4.3.1 Volatile Vinyl Acetate Monomer Prices in China Pressuring PVA Margins

- 4.3.2 Availability of Suitable Alternatives

- 4.3.3 Limited Recycling Infrastructure for PVA Films in Emerging Economies

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 Fully Hydrolyzed

- 5.1.2 Partially Hydrolyzed

- 5.1.3 Sub-Partially Hydrolyzed

- 5.1.4 Low-Foaming Grades

- 5.1.5 Other Grades (Tactified Grades, Fine Particle Grades)

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Granules

- 5.2.3 Flakes

- 5.2.4 Films (Water-Soluble)

- 5.2.5 Fibers

- 5.3 By Application

- 5.3.1 Polymerization Additives

- 5.3.2 Polyvinyl Butyral

- 5.3.3 Adhesives

- 5.3.4 Textile

- 5.3.5 Paper Pulp and Coating

- 5.3.6 Developing Application

- 5.3.7 Other Application

- 5.4 By End-Use Industry

- 5.4.1 Food Packaging

- 5.4.2 Paper Manufacturing

- 5.4.3 Construction

- 5.4.4 Electronics

- 5.4.5 Textile

- 5.4.6 Other Industries (Detergent, Agrochemicals, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Spain

- 5.5.3.6 Nordic Countries

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Qatar

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Astrra Chemicals

- 6.4.2 Chang Chun Group

- 6.4.3 JAPAN VAM & POVAL CO.,LTD.

- 6.4.4 KURARAY CO., LTD.

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Nippon Chemical Industrial CO., LTD.

- 6.4.7 Polysciences

- 6.4.8 SEKISUI CHEMICAL CO., LTD.

- 6.4.9 Shandong Tiancheng Chemical Co., Ltd.

- 6.4.10 Shuangxin PVA Tech Co., Ltd.

- 6.4.11 WANWEI CHEMICAL SUPPLY CHAIN CO.,LTD

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Innovations in Polyvinyl Alcohol for Packaging and Medical