|

市场调查报告书

商品编码

1844721

薄型添加剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Low Profile Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

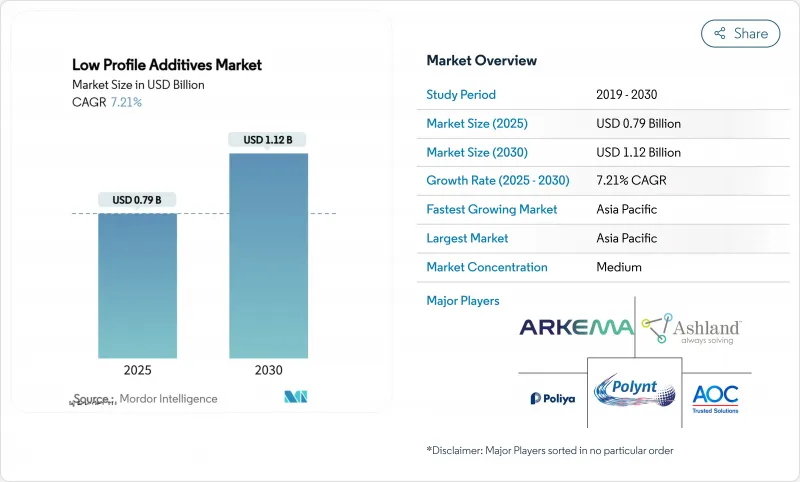

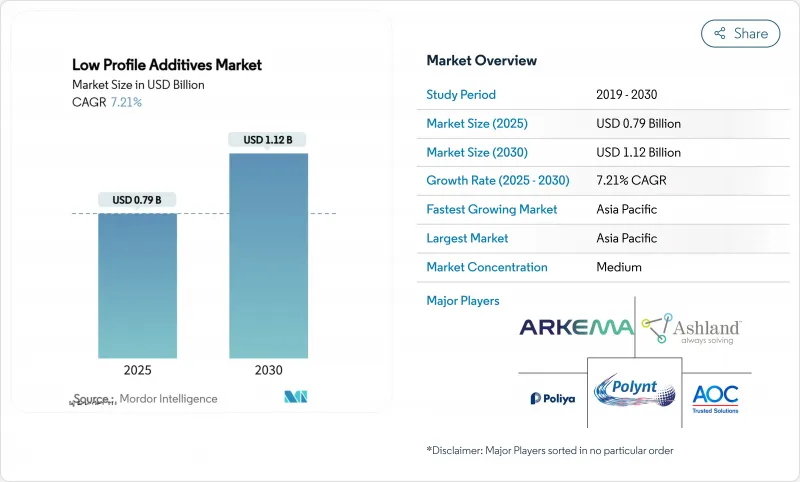

Low profile添加剂市场规模预计在 2025 年为 7.9 亿美元,预计到 2030 年将达到 11.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.21%。

电动车、建筑加固材料和精密工业零件对高性能复合材料的需求不断增长,支撑了这一成长轨迹。汽车製造商正在采用低收缩添加剂来减少收缩,并确保片状模塑胶(SMC) 和块状模料(BMC) 部件达到 A 级表面质量。同时,用纤维增强塑胶取代钢筋的基础设施计划正在蓬勃发展,生物基化学品也正在获得政策支持。随着供应商竞相整合再生原料,并在可再生材料性能和表面美观方面实现差异化,竞争强度逐渐加剧。

全球Low profile添加剂市场趋势与洞察

汽车产业对高性能SMC化合物的需求不断增长

汽车製造商正在扩大SMC的规模,以生产电池外壳、车身面板和结构嵌件,这些零件需要达到A级的完美表面效果。低收缩添加剂可限制体积收缩,并确保热循环下的尺寸稳定性。陶氏的聚氨酯碳纤维梁帽固化效率超过90%,展现了下一代添加剂如何支援高速压机。更大的汽车平臺和更厚的截面部件进一步提高了收缩控制要求,使得先进的低收缩添加剂在亚太地区快速增长的电动车枢纽中至关重要。

加速减轻电动车重量的义务

欧盟二氧化碳排放法规和中国新能源汽车配额制度正在推动纤维增强塑胶的快速应用。低收缩添加剂也能有效防止复合材料组件出现缩痕和波纹,进而增强这些复合材料的性能。维吉尼亚大学的一项研究表明,石墨烯改质水泥复合材料的重量减轻了31%,这表明汽车结构也能达到类似的减重效果。电池续航里程的不断增长预期将继续推动轻量化复合材料的发展,并维持对添加剂的需求。

含可交联苯乙烯单体的不饱和聚酯树脂聚合收缩率高

UPR-苯乙烯系统在固化过程中固有收缩,导致空隙和透印,而薄型添加剂必须克服这些问题。供应商正在尝试使用活性稀释剂和改性交联剂来减少收缩,但这些调整会增加成本和週期复杂性。汽车A级涂料设定了很高的标准,迫使配方师即使在快速移动、大批量的生产线上也必须不断创新。

細項分析

得益于汽车SMC中已证实的性价比优势,聚苯乙烯基Low profile收缩添加剂将在2024年维持39.08%的市占率。随着汽车製造商追求碳减排额度,预计「其他」产品类型(主要是生物基)中低收缩添加剂的市场规模将迅速扩大,到2030年,复合年增长率将达到9.20%。

聚醋酸乙烯酯和聚甲基丙烯酸甲酯 (PMMA) 填补了对衝击强度和光学透明度有较高要求的空白,而高密度聚苯乙烯则适用于经济实惠的零件。聚酯基产品(无论是纯聚酯或聚氨酯改质聚酯)适用于腐蚀性和高温环境。BASF的生物质平衡聚苯乙烯 (EPS) 清楚地展现了成熟供应商如何将永续性与现有製程结合。

区域分析

亚太地区在薄型添加剂市场占据主导地位,2024 年的市占率为 44.81%,预计到 2030 年的复合年增长率为 8.02%。中国电动车的快速成长和政府支持的基础设施建设将推动复合材料的普及,同时本土供应商也在扩大其热固性树脂的产能。印度汽车工业的蓬勃发展和韩国电子产品出口的强劲增长将为其提供量身定制的利好因素。BASF南京工厂的扩建凸显了其对区域製造的战略重点。

北美位居第二,得益于电动车平台的推出、航太重组和风能宣传活动。美国拥有先进的树脂实验室和拉伸生产线,而墨西哥则靠近主机厂,因此零件的本地化程度有所提高。陶氏的Windblade树脂专案凸显了该地区的技术优势。

欧洲对永续性有着严格的要求,正在推动生物基低调添加剂的应用。德国高端汽车品牌正在采用复合材料製造白车身,而北欧国家则将可再生能源投资转向大型涡轮叶片。赢创的木质素计画和毕克化学的无VOC界面活性剂代表了创新的驱动力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 汽车产业对高性能 SMC(片状模塑胶)配方的需求不断增加

- 加速电动车减重

- 钢筋替代品(用于加强水泥建筑物的钢筋)

- 纤维增强塑胶(FRP)的新应用

- 人们对由木质素和蓖麻油製成的生物基 LPA 的兴趣日益浓厚

- 市场限制

- 含可交联苯乙烯单体的不饱和聚酯树脂聚合收缩率高

- 与热塑性复合材料的竞争

- 热固性部件的可修復性有限

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依产品类型

- 聚苯乙烯基底

- 聚醋酸乙烯酯基

- PMMA 基底

- 高密度聚苯乙烯(HDPE)基底

- 聚酯基底

- 纯饱和聚酯

- PU改质饱和聚酯

- 其他产品类型(EVA、SAN、生物基)

- 按用途

- 射出/压缩成型(SMC/BMC)

- 拉挤成型

- 树脂转注成形(RTM)

- 手工积层

- 喷洒

- 按最终用户产业

- 汽车和运输

- 建筑/施工

- 电气和电子

- 工业机械

- 其他(消费品、船舶)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- ALTANA AG

- AOC

- Arkema

- Ashland

- Clariant

- Composites One

- Evonik Industries AG

- INEOS

- Link Composites Pvt. Ltd.

- Mechemco

- Mitsubishi Chemical Group Corporation.

- Monachem

- Poliya

- Polynt SpA

- Scott Bader Company Ltd

- Swancor

- Synthomer Plc

- Wacker Chemie AG

第七章 市场机会与未来展望

The Low Profile Additives Market size is estimated at USD 0.79 billion in 2025, and is expected to reach USD 1.12 billion by 2030, at a CAGR of 7.21% during the forecast period (2025-2030).

Rising demand for high-performance composites in electric vehicles, construction reinforcements, and precision industrial parts is sustaining this growth trajectory. Automakers are adopting low profile additives to control shrinkage in Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) components, ensuring Class A surface quality. Parallel momentum stems from infrastructure projects that replace steel rebar with fiber-reinforced plastics, while bio-based chemistries are gaining policy support. Competitive intensity is moderate yet rising as suppliers race to integrate renewable feedstocks and differentiate on compoundability and surface aesthetics.

Global Low Profile Additives Market Trends and Insights

Increase in Demand for High-performance SMC Formulations from Automotive Industry

Automakers are scaling SMC to mold battery enclosures, body panels, and structural inserts that need flawless Class A finishes. Low profile additives limit volumetric shrinkage, securing dimensional stability under thermal cycling. Dow's polyurethane-carbon fiber spar cap demonstrates cure efficiencies exceeding 90%, exemplifying how next-generation additives support high-speed presses. Larger vehicle platforms and thick-section parts further raise shrinkage control requirements, making advanced low profile additives indispensable across Asia-Pacific's fast-growing electric vehicle hubs.

Accelerated EV Lightweighting Mandates

The European Union's CO2 rules and China's New Energy Vehicle quotas spur rapid fiber-reinforced plastic adoption. Low profile additives underpin these composites by preventing sink marks and waviness even in multi-material assemblies. University of Virginia research shows weight savings of 31% in graphene-modified cement composites, a proxy for similar mass-reduction prospects in auto structures. Rising battery range expectations will continue to pull lightweight composites, sustaining additive demand.

High Polymerization Shrinkage of Unsaturated Polyester Resin with Crosslinking Styrene Monomer

UPR-styrene systems inherently contract during cure, generating voids and print-through that low profile additives must counteract. Suppliers experiment with reactive diluents and modified crosslinkers to curb shrinkage, but such tweaks add cost and cycle-time complexity. Automotive Class A finishes set a high bar, pressuring formulators to keep innovating even in fast-moving, high-volume lines.

Other drivers and restraints analyzed in the detailed report include:

- Replacement of Steel Rebar with Fiber-reinforced Plastics

- Growing Emphasis on Bio-based LPAs from Lignin & Castor Oil

- Competition from Thermoplastic Composites

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polystyrene-based grades retained 39.08% low profile additives market share in 2024 through proven cost-performance balance in automotive SMC. The low profile additives market size for "Other" product types-largely bio-based-should rise swiftly, expanding at 9.20% CAGR to 2030 as OEMs chase carbon reduction credits.

Polyvinyl acetate and PMMA variants occupy niches that demand impact strength or optical clarity, while high-density polyethylene grades suit budget-sensitive parts. Polyester-based offerings, both pure and PU-modified, tackle corrosive or high-temperature environments. BASF's biomass-balance EPS underscores how incumbent suppliers blend sustainability with incumbent processes.

The Low Profile Additives Market Report is Segmented by Product Type (Polystyrene-Based, Polyvinyl Acetate-Based, and More), Application (Injection and Compression Molding, Pultrusion, and More), End-User Industry (Automotive and Transportation, Building and Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the low profile additives market with 44.81% share in 2024 and an 8.02% CAGR outlook to 2030. China's electric vehicle surge and state-backed infrastructure rollouts underpin composite adoption, while local suppliers scale thermoset capacity. India's automotive expansion and South Korea's electronics exports add tailwinds. BASF's Nanjing site enlargement underscores strategic focus on regional production.

North America ranked second, buoyed by EV platform launches, aerospace rebuilds, and wind-repowering campaigns. The United States houses advanced resin labs and pultrusion lines, while Mexico's proximity to OEM plants fuels part localization. Dow's wind-blade resin programs highlight regional technical prowess.

Europe follows, characterized by strict sustainability requirements that hasten bio-based low profile additives uptake. Germany's premium auto brands adopt composites for body-in-white elements, and Nordic nations channel renewables investments into large turbine blades. Evonik's lignin programs and BYK's VOC-free surfactants typify the innovation thrust.

- ALTANA AG

- AOC

- Arkema

- Ashland

- Clariant

- Composites One

- Evonik Industries AG

- INEOS

- Link Composites Pvt. Ltd.

- Mechemco

- Mitsubishi Chemical Group Corporation.

- Monachem

- Poliya

- Polynt S.p.A

- Scott Bader Company Ltd

- Swancor

- Synthomer Plc

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Demand for High-performance SMC (Sheet Molding Compound) Formulations from Automotive Industry.

- 4.2.2 Accelerated EV lightweighting mandates

- 4.2.3 Replacement of Steel Rebar (Reinforcing Bar Employed to Strengthen Concrete Structures)

- 4.2.4 Emerging Applications in Fiber-reinforced Plastics (FRP)

- 4.2.5 Growing emphasis on Bio-based LPAs from lignin & castor oil

- 4.3 Market Restraints

- 4.3.1 High Polymerization Shrinkage of Unsaturated Polyester Resin with the Crosslinking Styrene Monomer

- 4.3.2 Competition from thermoplastic composites

- 4.3.3 Limited repairability of thermoset parts

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Polystyrene-based

- 5.1.2 Polyvinyl Acetate-based

- 5.1.3 PMMA-based

- 5.1.4 High Density Polyethylene (HDPE)

- 5.1.5 Polyester-based

- 5.1.5.1 Pure Saturated Polyester

- 5.1.5.2 PU-modified Saturated Polyester

- 5.1.6 Other Product Types (EVA, SAN, Bio-based)

- 5.2 By Application

- 5.2.1 Injection and Compression Molding (SMC/BMC)

- 5.2.2 Pultrusion

- 5.2.3 Resin Transfer Molding (RTM)

- 5.2.4 Hand Lay-Up

- 5.2.5 Spray-Up

- 5.3 By End-User Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Building and Construction

- 5.3.3 Electrical and Electronics

- 5.3.4 Industrial Machinery

- 5.3.5 Others (Consumer Goods, Marine)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 ALTANA AG

- 6.4.2 AOC

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 Clariant

- 6.4.6 Composites One

- 6.4.7 Evonik Industries AG

- 6.4.8 INEOS

- 6.4.9 Link Composites Pvt. Ltd.

- 6.4.10 Mechemco

- 6.4.11 Mitsubishi Chemical Group Corporation.

- 6.4.12 Monachem

- 6.4.13 Poliya

- 6.4.14 Polynt S.p.A

- 6.4.15 Scott Bader Company Ltd

- 6.4.16 Swancor

- 6.4.17 Synthomer Plc

- 6.4.18 Wacker Chemie AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment