|

市场调查报告书

商品编码

1844730

氧化镁奈米粉末:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Magnesium Oxide Nanopowder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

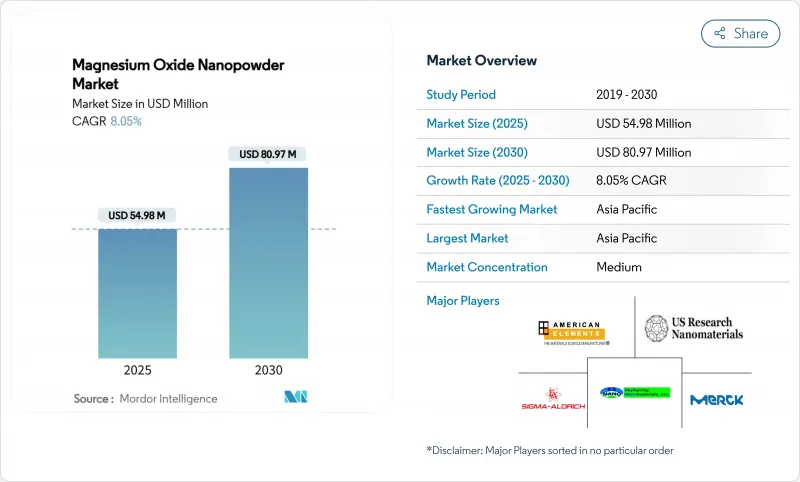

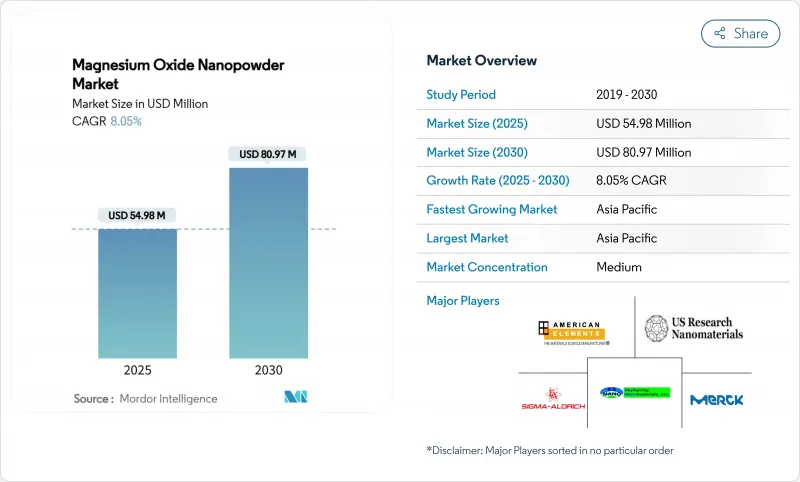

预计 2025 年氧化镁奈米粉末市场规模为 5,498 万美元,到 2030 年将达到 8,097 万美元,预测期内(2025-2030 年)的复合年增长率为 8.05%。

虽然大部分收益仍来自传统的耐火材料需求,但发展势头明显转向更高价值的应用,例如燃料添加剂、电绝缘材料、阻燃聚合物化合物以及早期固态电池原型。到2024年,中国原镁产量的份额将达到52%,这将为亚洲加工商带来成本优势,但也使全球买家面临政策驱动的市场波动。竞争优势越来越依赖专有的合成路线,以实现先进复合材料和电解质所需的窄粒度分布和功能化表面。最后,北美和欧盟对职场接触工程奈米材料的监管日益严格,这增加了合规成本,但有利于拥有认证品质系统的成熟製造商。

全球氧化镁奈米粉市场趋势与洞察

耐火材料产业需求不断成长

添加了奈米氧化镁的镁碳砖在碱性氧气转炉和电弧炉中表现出更高的緻密性,并减少了因孔隙率而导致的破损。中国、日本和韩国的钢铁製造商已将奈米粉末等级标准化,用于钢包、中间包和连铸机的内衬,以承受快速热循环。综合性钢铁製造商之间的整合意味着更少的买家拥有更大的购买力,但他们愿意为避免意外停机的可靠性支付额外费用。随着亚太地区电弧炉产能的扩大,市场对氧化镁奈米粉末的需求与废钢产量的成长密切相关。拥有垂直整合生产和耐火材料配方专业知识的产业供应商能够获得以合作研发协议为基础的长期合约。

电气绝缘应用的成长

含有 1 wt% 氧化镁奈米颗粒的环氧系统在 230 度C时的介电常数为 13,热传导率是未填充树脂的两倍。这些特性解决了碳化硅功率模组和牵引逆变器中散热和电阻率之间长期存在的矛盾。超过 800 V 的电动车传动系统电压加上较小的外形规格,推动了对即使在局部放电条件下也具有化学惰性的高温绝缘填料的需求。亚太地区电缆製造商正在扩大填充冷冻干燥氧化镁泡沫的聚乙烯化合物的规模,这可以抑制空间电荷的积聚。随着风力发电机逆变器容量的增加,欧洲公用事业公司也开始为离岸变电站指定填充奈米颗粒的灌封胶。

製造和精炼成本高

一个日产1,425公斤的溶胶-凝胶工厂需要超过4.5万美元的资本支出,在现行定价结构下,投资回收期超过三年。能源密集的热液和脱碳製程增加了对欧盟和美国某些州碳定价的敏感度。纯度规格严格于99.8 wt%会增加试剂和过滤成本,而这些成本无法在产品产量上摊提。亚太地区以外的小型生产商面临规模劣势,限制了它们竞标大型耐火材料竞标和汽车添加剂供应合约的能力。

細項分析

到2024年,耐火材料将占氧化镁奈米粉末市场规模的42.65%,主要用于镁碳砖以及用于钢和铝熔体加工的中间包衬里。改良的电弧炉技术有利于细颗粒分布,使砖块的微观结构更加緻密。随着废钢在亚洲的普及,节能衬里对生产力仍然至关重要。虽然预计耐火材料市场领导地位将持续到2030年,但随着新应用的扩展,其份额将下降。

到2030年,燃油添加剂类别的复合年增长率将达到8.86%,这反映出前所未有的监管压力,即要求减少公路和非公路车辆的颗粒物和氮氧化物排放。奈米颗粒分散体可改善雾化效果,提高火焰温度均匀性,并减少烟灰前驱物,同时不会影响引擎硬体的保固。欧盟和中国的试点车队测试报告显示,燃油经济性提升超过2%。虽然该细分基准的起步规模较小,但其成长速度正成为那些瞄准寻求即插即用解决方案的汽车客户的製造商的焦点。

区域分析

预计到2024年,亚太地区将占氧化镁奈米粉末市场收益的52.18%,到2030年,复合年增长率将达到8.76%。该地区的需求主要由中国推动,而日本的陶瓷专业知识和韩国的半导体生态系统将进一步推动超高纯度等级的需求。政府针对能源转型硬体的奖励策略将推动电动车温度控管和固态电池中试线产量的增加。

北美面积虽小,但技术含量却十分丰富,其高规格粉末广泛应用于航太、国防和先进电力电子领域。美国已强制要求国内供应安全,像Magratia这样的新兴企业正在试行从海水中提取碳中和中性的镁。加拿大的关键矿产策略包括提供津贴,以降低奈米粉末精加工生产线的资本门槛,这可能会使该地区从特种粉末进口国转变为出口国。

随着建筑法规收紧阻燃标准,以及汽车製造商采用富含镁的电动车零件,欧洲市场保持稳定成长。德国凭藉其汽车和化学工业引领镁的消费,而英国则在航太和国防计划率先推出需要高温隔热。欧盟循环经济法规鼓励使用矿物基阻燃填料而非卤素替代品,这为氧化镁奈米粉末市场提供了监管方面的推动。欧盟能源战略指令也正在推动固态电池联盟的资金投入,而氧化镁在其中扮演关键的介面角色。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 耐火材料产业需求不断成长

- 电气绝缘应用的成长

- 扩大作为燃料添加剂的用途

- 扩大在阻燃聚合物复合材料的应用

- 固态电池电解质的新作用

- 市场限制

- 製造和精炼成本高

- 凝结和絮凝问题

- 加强职场奈米颗粒暴露监管

- 挥发性镁原料供应

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按用途

- 耐火材料

- 电绝缘

- 燃料添加剂

- 阻燃剂

- 磁性设备

- 其他(催化剂、吸附剂、生物医学等)

- 依合成方法

- 物理方法

- 化学沉淀法

- 绿色/生物基合成

- 按最终用户产业

- 冶金

- 建造

- 石油和天然气

- 车

- 电气和电子

- 其他终端用户产业(化学品和石化产品、医疗保健和製药等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Alfa Aesar(Thermo Fisher)

- American Elements

- Ascensus

- Grecian Magnesite

- High Purity Laboratory Chemicals Pvt. Ltd.

- Hongwu International Group Ltd

- Inframat Advanced Materials

- Martin Marietta Magnesia Specialties

- Merck KGaA

- Nanografi Advanced Materials.

- Nanoshel LLC

- Nanostructured & Amorphous Materials, Inc.

- Platonic Nanotech

- Sigma-Aldrich(MilliporeSigma)

- SkySpring Nanomaterials, Inc.

- Tateho Chemical Industries Co.,Ltd.

- US Research Nanomaterials, Inc.

第七章 市场机会与未来展望

The Magnesium Oxide Nanopowder Market size is estimated at USD 54.98 Million in 2025, and is expected to reach USD 80.97 Million by 2030, at a CAGR of 8.05% during the forecast period (2025-2030).

Most revenue still flows from legacy refractory demand, yet momentum is clearly shifting toward high-value applications in fuel additives, electrical insulation, flame-retardant polymer compounds and early solid-state battery prototypes. Supply security is shaped by China's 52% share of primary magnesium production in 2024, which delivers cost advantages for Asian processors but exposes global buyers to policy-driven volatility. Competitive positioning increasingly depends on proprietary synthesis routes that deliver narrow particle-size distributions and functionalized surfaces needed in advanced composites and electrolytes. Finally, tightening workplace-exposure limits for engineered nanomaterials in North America and the EU are raising compliance costs, but they also favour established producers with certified quality systems.

Global Magnesium Oxide Nanopowder Market Trends and Insights

Rising Demand from Refractory Industry

Magnesia-carbon bricks incorporating nanoscale magnesium oxide show higher densification that lowers porosity-induced failure in basic oxygen and electric arc furnaces. Steelmakers in China, Japan and South Korea have standardised nanopowder grades in ladle, tundish and continuous-caster linings to withstand rapid thermal cycling. Consolidation among integrated steel producers means fewer buyers wield greater purchasing power, but they pay premiums for reliability that avoids unplanned shutdowns. As electric arc furnace capacity expands across Asia-Pacific, magnesium oxide nanopowder market demand remains closely correlated with rising scrap-based steel output. Suppliers with vertically integrated production and refractory formulation expertise can capture long-term contracts anchored in joint R&D agreements.

Growth in Electrical Insulation Applications

Epoxy systems loaded with 1 wt% magnesium oxide nanoparticles maintain a dielectric constant of 13 at 230 °C and double the thermal conductivity versus neat resin. These attributes solve the chronic trade-off between heat dissipation and electrical resistivity in silicon carbide power modules and traction inverters. Electric-vehicle drive-train voltages above 800 V, combined with miniaturised form factors, amplify the need for high-temperature insulation fillers that stay chemically inert under partial discharge. Asia-Pacific cable makers are scaling polyethylene compounds filled with freeze-dried magnesium oxide foams that suppress space-charge accumulation. As wind-turbine inverters grow in capacity, European utilities are also specifying nanoparticle-filled potting compounds for offshore substations.

High Production and Purification Costs

Sol-gel plants capable of 1,425 kg day-1 output require capital spending above USD 45,000 and return on investment stretches beyond three years under today's price structure. Energy-intensive hydrothermal and calcination steps heighten sensitivity to carbon-pricing trajectories in the EU and selected US states. Purity specifications tighter than 99.8 wt% raise reagent and filtration costs that cannot be amortised across commodity volumes. Smaller producers outside Asia-Pacific face scale disadvantages, which limits their ability to bid for large refractory tenders or automotive additive supply contracts.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Use as Fuel Additive

- Expanding Adoption in Flame-Retardant Polymer Composites

- Aggregation and Agglomeration Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refractory materials generated 42.65% of the magnesium oxide nanopowder market size in 2024, anchored in magnesia-carbon bricks and tundish linings for steel and aluminium melt processing. Technical upgrades in electric arc furnaces favour finer particle distributions that densify brick microstructures. As scrap-based steel makes deeper inroads across Asia, energy-efficient linings remain critical for productivity. Market leadership is expected to persist through 2030, though its proportional share will slip as newer uses scale.

The fuel-additive category shows an 8.86% CAGR to 2030, reflecting unprecedented regulatory pressure to cut particulate and NOx emissions in both on-road and off-road fleets. Nanoparticle dispersions improve atomisation, raise flame temperature uniformity and reduce soot precursors without compromising engine hardware warranties. Pilot fleet tests in the EU and China report fuel-economy gains above 2%. Although the segment starts from a small baseline, its growth pace makes it a focal point for producers targeting automotive clients seeking drop-in solutions.

The Magnesium Oxide Nanopowder Market Report is Segmented by Application (Refractory Materials, Electric Insulation, Fuel Additive and More), Synthesis Method (Physical Method, Chemical Precipitation, and More), End-User Industry (Auto Metallurgy, Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owned 52.18% of 2024 revenue in the magnesium oxide nanopowder market and is forecast to advance at an 8.76% CAGR through 2030, underpinned by integrated supply chains, cost-advantaged feedstock and dense clusters of steel, electronics and battery manufacturers. China anchors regional demand, yet Japan's ceramics expertise and South Korea's semiconductor ecosystem provide incremental pull for ultra-high-purity grades. Government stimulus aimed at energy-transition hardware drives additional volume in electric-vehicle thermal management and solid-state battery pilot lines.

North America is a smaller but technologically rich arena in which aerospace, defence and advanced power electronics consume high-spec powders. The United States requisitioned domestic supply security measures, and start-ups such as Magrathea are piloting carbon-neutral magnesium extraction from seawater, which could de-risk feedstock procurement and reinforce local value chains by the late 2020s. Canada's critical-minerals strategy includes grants that lower capital hurdles for nanopowder finishing lines, potentially repositioning the region as an exporter of specialty grades rather than an importer.

Europe maintains steady growth as building codes tighten flame-retardancy thresholds and automakers adopt magnesium-rich e-mobility components. Germany leads consumption due to its automotive and chemical base, whereas the United Kingdom taps aerospace and defence projects requiring high-temperature insulation. EU circular-economy regulations encourage mineral-based fire-retardant fillers over halogenated alternatives, offering regulatory tailwinds for magnesium oxide nanopowder market expansion. The bloc's energy-strategy directives also channel funds into solid-state battery consortia where MgO plays a critical interface role.

- Alfa Aesar (Thermo Fisher)

- American Elements

- Ascensus

- Grecian Magnesite

- High Purity Laboratory Chemicals Pvt. Ltd.

- Hongwu International Group Ltd

- Inframat Advanced Materials

- Martin Marietta Magnesia Specialties

- Merck KGaA

- Nanografi Advanced Materials.

- Nanoshel LLC

- Nanostructured & Amorphous Materials, Inc.

- Platonic Nanotech

- Sigma-Aldrich (MilliporeSigma)

- SkySpring Nanomaterials, Inc.

- Tateho Chemical Industries Co.,Ltd.

- US Research Nanomaterials, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from refractory industry

- 4.2.2 Growth in electrical insulation applications

- 4.2.3 Increasing use as fuel additive

- 4.2.4 Expanding adoption in flame-retardant polymer composites

- 4.2.5 Emergent role in solid-state battery electrolytes

- 4.3 Market Restraints

- 4.3.1 High production and purification costs

- 4.3.2 Aggregation and agglomeration issues

- 4.3.3 Tightening workplace exposure regulations for nanoparticles

- 4.3.4 Volatile magnesium feedstock supply

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Refractory Materials

- 5.1.2 Electric Insulation

- 5.1.3 Fuel Additive

- 5.1.4 Fire Retardent

- 5.1.5 Magnetic Devices

- 5.1.6 Others (Catalysts & Adsorbents,Biomedical, etc.)

- 5.2 By Synthesis Method

- 5.2.1 Physical Methods

- 5.2.2 Chemical Precipitation

- 5.2.3 Green/Bio-based Synthesis

- 5.3 By End-user Industry

- 5.3.1 Metallurgy

- 5.3.2 Construction

- 5.3.3 Oil & Gas

- 5.3.4 Automotive

- 5.3.5 Electrical & Electronics

- 5.3.6 Other End-user Industries (Chemical & Petrochemical,Healthcare & Pharmaceuticals, etc.)

- 5.4 By Geography (Value)

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Alfa Aesar (Thermo Fisher)

- 6.4.2 American Elements

- 6.4.3 Ascensus

- 6.4.4 Grecian Magnesite

- 6.4.5 High Purity Laboratory Chemicals Pvt. Ltd.

- 6.4.6 Hongwu International Group Ltd

- 6.4.7 Inframat Advanced Materials

- 6.4.8 Martin Marietta Magnesia Specialties

- 6.4.9 Merck KGaA

- 6.4.10 Nanografi Advanced Materials.

- 6.4.11 Nanoshel LLC

- 6.4.12 Nanostructured & Amorphous Materials, Inc.

- 6.4.13 Platonic Nanotech

- 6.4.14 Sigma-Aldrich (MilliporeSigma)

- 6.4.15 SkySpring Nanomaterials, Inc.

- 6.4.16 Tateho Chemical Industries Co.,Ltd.

- 6.4.17 US Research Nanomaterials, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment