|

市场调查报告书

商品编码

1844731

功能添加剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Performance Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

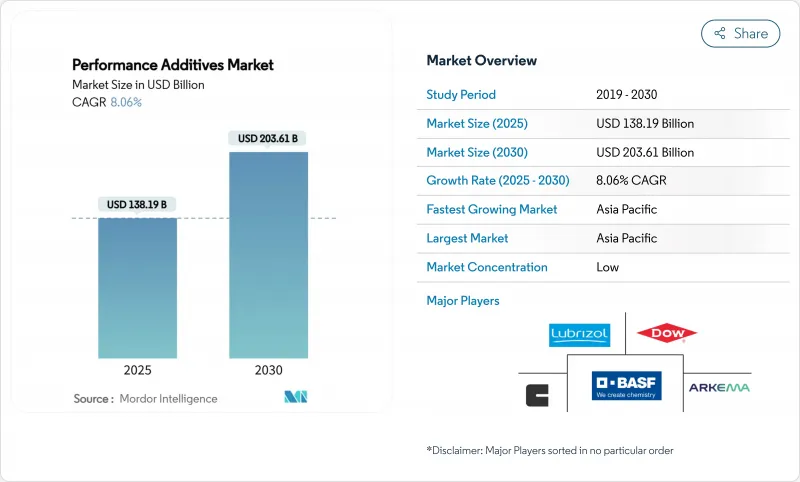

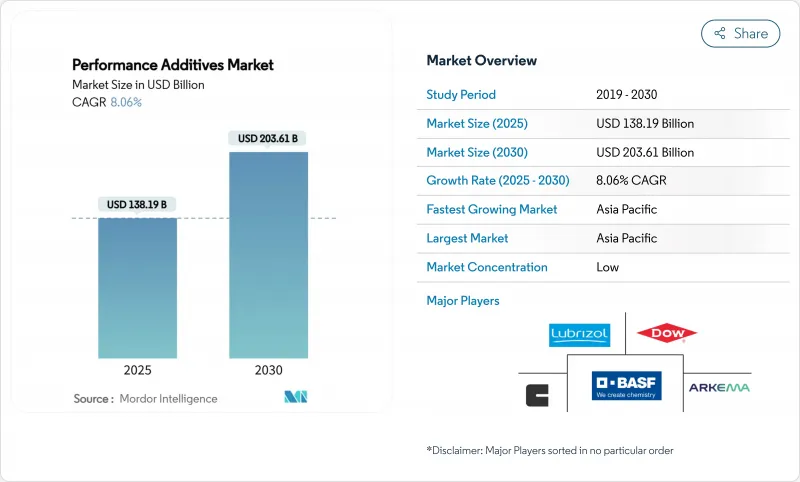

功能添加剂市场规模预计在 2025 年为 1,381.9 亿美元,预计到 2030 年将达到 2,036.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.06%。

市场对用于提升塑胶、润滑剂和涂料的耐久性、永续性和加工效率的特种化学品的需求强劲,推动着高性能添加剂市场呈现扩张态势。成长的利多因素包括:汽车电气化进程加快、全球向水性低VOC涂料的转变,以及支持添加剂驱动的化学回收解决方案的循环经济政策的加强。儘管原油衍生原料的不确定性导致短期成本压力,但亚太地区的快速工业化仍在支撑产量和价值的成长,生产商也正在利用该地区的基础设施项目。对阻燃性、紫外线稳定性和增强阻隔性能的需求不断增长,进一步巩固了高性能添加剂市场作为现代材料解决方案关键要素的地位。

全球功能添加剂市场趋势与洞察

终端使用领域以塑胶取代传统材料

在汽车、建筑和消费品製造业中,对轻质、耐腐蚀且易于成型的塑胶的需求逐渐取代金属、木材和玻璃。每种替代材料都需要热稳定剂、紫外线吸收剂和阻燃剂,以在日益严苛的环境中保持性能。BASF用于高压电动车零件的阻燃材料Ultramid聚邻苯二甲酰胺展现了其先进的添加剂特性,使塑胶能够承受-40°C至150°C的温度波动,同时满足严格的介电常数阈值。随着塑胶逐渐渗透到引擎盖下部件、车身外板和模组化建筑部件中,对多功能添加剂包的产量需求也将相应增加,从而为功能性添加剂市场奠定长期增长的基础。

新兴经济体塑胶需求快速成长

都市化、可支配收入的增加以及基础设施项目的激增,正在推动亚太和非洲部分地区的塑胶消费。大型公路、铁路和住房计划需要地聚合物、管道和隔热材料,而这些材料又依赖抗氧化剂、加工助剂和抗衝改质剂。在印度,随着国内水泥产量以每年6-8%的速度成长,特种化学品製造商正在扩大产能,以满足对建筑添加剂的激增需求。东南亚的消费包装产业也呈现类似的势头,刺激了高性能分散剂和增滑剂的进口。这些动态将巩固新兴地区在2030年之前作为高性能添加剂市场主要销售驱动力的地位。

对一次性塑胶和有害物质的严格监管

监管部门禁止在食品接触和包装材料中使用某些添加剂,这促使配方师采取成本更高的配方调整和生态标籤。加州将于2027年禁止在食品包装中使用四种传统塑胶添加剂,这为其他司法管辖区树立了榜样。欧盟2025年食品接触法规更新规定了严格的过渡限制,要求进行全面的产品组合审核。科莱恩等公司已于2023年12月完成从稳定剂中逐步淘汰PFAS的工作。虽然这些措施加强了环保合规性,但也会导致短期成本增加和资格认证延迟,从而削弱功能性添加剂市场的成长点。

細項分析

到2024年,塑胶添加剂将占据功能性添加剂市场的43.15%,占功能性添加剂市场总收益的大部分。到2030年,塑胶添加剂的复合年增长率将达到9.72%,这主要得益于电子产品更严格的可燃性法规以及电动车对抗紫外线、轻量化零件的需求。随着加工商寻求在不牺牲强度的情况下减轻重量,先进的分散剂、抗氧化剂和无卤阻燃剂的价格也随之上涨。

在轮胎和输送机製造领域,橡胶添加剂的产量保持稳定;而随着出行方式转向青睐轻质聚合物复合材料的电动车平台,塑胶添加剂的成长则有所滞后。由于水性涂料的转型,油漆和涂料添加剂的需求有所增长,尤其是在除生物剂和流变控製剂组合中。

功能添加剂报告按添加剂类别(塑胶添加剂、橡胶添加剂、油漆和涂料添加剂、燃料添加剂等)、形式(固体/粉末、液体、母粒/颗粒、微胶囊)、最终用户行业(包装、汽车和运输、建筑和施工等)和地区(亚太地区、北美、欧洲、南美、中东和非洲)细分。

区域分析

预计到 2024 年,亚太地区将在功能添加剂市场占据 47.12% 的主导份额,到 2030 年收益的复合年增长率将达到 8.84%。铁路、公路和数位基础设施的大量公共投资正在推动对建筑级分散剂、高效塑化剂和防护被覆剂的需求。

受严格的燃油经济性标准和对在地采购特种化学品日益增长的偏好推动,北美市场呈现缓慢但持续的成长态势。汽车製造商和航太企业正利用与添加剂供应商的密切合作,以达到生命週期碳排放目标,并维持先进分散剂和润滑调节剂的优质利润率。

欧洲正面临动盪的宏观环境:能源成本压力将在2024年抑制化学品生产,但气候变迁和循环经济的政策主导将促进新的添加剂需求。企业正在加速开发不含PFAS的阻燃剂和低迁移稳定剂,以符合欧盟化学品永续性策略。

中东和非洲虽然在高性能添加剂市场中仍占较小份额,但其基础设施被覆剂、管道树脂和润滑油基料添加剂的需求成长高于平均水准。碳氢化合物原料的供应推动了波湾合作理事会国家后后向整合添加剂生产线的扩张,而撒哈拉以南非洲地区都市化进程的加速则推动了对耐候涂料和包装的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 终端使用领域以塑胶取代传统材料

- 新兴经济体塑胶需求快速成长

- 全球范围内更严格的燃油经济性和排放法规推动了高性能润滑油和燃料添加剂的发展

- 向水性和低VOC涂料的转变将推动特种添加剂的采用

- 基于添加剂的化学回收和循环聚合物计划将引领潮流

- 市场限制

- 对一次性塑胶和有害物质的严格监管

- 原油衍生原料价格波动

- 微塑胶立法针对包装中的功能性添加剂

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按添加剂类别

- 塑胶添加剂

- 润滑剂

- 加工助剂(氟树脂类)

- 流动改进剂

- 滑爽添加剂

- 抗静电添加剂

- 颜料润湿剂

- 填料分散剂

- 防雾添加剂

- 塑化剂

- 稳定剂

- 阻燃剂

- 抗衝击改质剂

- 橡胶添加剂

- 加速器

- 抗降解剂

- 发泡和黏合剂

- 涂料添加剂

- 除生物剂

- 分散剂和润湿剂

- 消泡剂和脱泡剂

- 流变改性剂

- 表面改质剂

- 稳定剂

- 流动和流平添加剂

- 其他涂料添加剂

- 燃料添加剂

- 存款控制

- 十六烷改良剂

- 润滑性促进剂

- 抗氧化剂

- 防锈剂

- 燃料染料

- 低温操作改善剂

- 抗爆剂

- 其他燃料添加剂

- 油墨添加剂

- 流变改性剂

- 滑爽/摩擦剂

- 消泡剂

- 分散剂

- 抗氧化剂

- 螯合剂

- 其他油墨添加剂

- 皮革添加物

- 整理加工剂

- 脂肪液体

- 新滩

- 其他皮革添加剂

- 润滑油添加剂

- 分散剂和乳化剂

- 黏度指数增进剂

- 清洁剂

- 腐蚀抑制剂

- 抗氧化剂

- 极压添加剂

- 摩擦改进剂

- 其他润滑油添加剂

- 黏合剂和密封剂添加剂

- 抗氧化剂

- 光稳定剂

- 增黏剂

- 其他添加物

- 塑胶添加剂

- 按形状

- 固体/粉末

- 液体

- 母粒/颗粒

- 微胶囊化

- 按最终用户产业

- 包装

- 汽车和运输

- 建筑/施工

- 电气和电子

- 工业机械

- 消费品

- 能源和电力(包括石油和天然气)

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Afton Chemical

- Akzo Nobel NV

- Albemarle Corporation

- Arkema

- Ashland

- Baerlocher GmbH

- BASF

- Chevron Oronite Company LLC

- Clariant

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Honeywell International Inc.

- Huntsman International LLC

- Lanxess

- Mitsui & Co.(Asia Pacific)Pte. Ltd.

- Performance Additives

- Songwon

- The Lubrizol Corporation

- Univar Solutions LLC

- WR Grace & Co

第七章 市场机会与未来展望

The Performance Additives Market size is estimated at USD 138.19 billion in 2025, and is expected to reach USD 203.61 billion by 2030, at a CAGR of 8.06% during the forecast period (2025-2030).

Strong demand for specialty chemicals that boost durability, sustainability, and processing efficiency across plastics, lubricants, and coatings keeps the performance additives market on an expansion track. Growth tailwinds include accelerating automotive electrification, the global pivot toward waterborne low-VOC coatings, and intensified circular-economy policies that elevate additive-enabled chemical recycling solutions. Producers are also capitalizing on infrastructure programs in Asia-Pacific, where rapid industrialization supports both volume and value growth despite short-term cost pressure from volatile crude-derived feedstocks. Heightened requirements for flammability resistance, UV stability, and enhanced barrier properties further anchor the performance additives market as an essential enabler of modern materials solutions.

Global Performance Additives Market Trends and Insights

Replacement of Conventional Materials by Plastics Across End-Use Sectors

Demand for light, corrosion-resistant, and easily formable plastics displaces metals, wood, and glass across automotive, construction, and consumer-goods manufacturing. Each substitution requires thermal stabilizers, UV absorbers, and flame retardants that preserve performance under harsher operating envelopes. BASF's flame-retardant Ultramid polyphthalamide for high-voltage electric-vehicle components illustrates how advanced additives permit plastics to withstand temperature swings from -40 °C to 150 °C while meeting stringent dielectric thresholds. As plastics penetrate under-the-hood parts, exterior body panels, and modular building components, volume requirements for multi-functional additive packages climb in tandem, anchoring a long-run growth vector for the performance additives market.

Rapid Plastics Demand Growth in Emerging Economies

Urbanization, rising disposable incomes, and pervasive infrastructure programs are accelerating plastics consumption in Asia-Pacific and parts of Africa. Large-scale highway, rail, and housing projects demand geosynthetics, pipes, and insulation that rely on antioxidants, processing aids, and impact modifiers. In India, specialty-chemical producers are adding capacity to meet surging demand for construction additives that align with national cement output growing 6 to 8% annually. Similar momentum in Southeast Asia's consumer-packaging sector is stimulating imports of high-performance dispersants and slip agents. These dynamics solidify emerging regions as the principal volume engine of the performance additives market through 2030.

Stringent Restrictions on Single-Use Plastics and Hazardous Substances

Regulatory bans on selected additives in food contact and packaging push formulators toward costlier reformulations and eco-labels. California's 2027 prohibition on four legacy plastic additives in food packaging establishes a template for other jurisdictions. The European Union's 2025 update to food-contact regulations imposes tighter migration limits that force comprehensive portfolio audits. Companies like Clariant completed a phased elimination of PFAS from stabilizer ranges by December 2023. While these moves enhance environmental compliance, they introduce short-term cost spikes and qualification delays that shave growth points from the performance additives market.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Global Fuel-Economy and Emissions Norms

- Shift Toward Water-Borne and Low-VOC Coatings

- Volatile Crude-Derived Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic additives commanded 43.15% of the performance additives market share in 2024, contributing the lion's share of revenue to the overall performance additives market. Their 9.72% CAGR through 2030 is propelled by dual imperatives: tighter flammability rules in electronics and the need for UV-stable lightweight parts in electric vehicles. Cutting-edge dispersants, antioxidants, and halogen-free flame retardants capture premium pricing as processors target weight savings without compromising strength.

Rubber additives uphold steady volumes in tire and conveyor-belt manufacturing, but growth lags plastics as mobility shifts to EV platforms that favor lightweight polymer composites. Paints and coatings additives enjoy a lift from waterborne migration, especially for biocide and rheology-control packages.

The Performance Additives Report is Segmented by Additive Category (Plastic Additives, Rubber Additives, Paints and Coatings Additives, Fuel Additives, and More), Form (Solid/Powder, Liquid, Masterbatch/Pellet, and Micro-Encapsulated), End-User Industry (Packaging, Automotive and Transportation, Building and Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific retained a commanding 47.12% share of the performance additives market in 2024 and is forecast to lift revenues at an 8.84% CAGR to 2030. High public spending on rail, highways, and digital infrastructure multiplies demand for construction-grade dispersants, superplasticizers, and protective coatings.

North America exhibits moderate yet durable expansion underpinned by stringent fuel-economy standards and a growing preference for locally sourced specialty chemicals. Auto OEMs and aerospace primes leverage close collaboration with additive suppliers to meet lifecycle-carbon targets, sustaining premium margins for advanced dispersants and lubricity modifiers.

Europe navigates mixed macro conditions: energy-cost pressures curtailed chemical output in 2024, but policy leadership on climate and circularity nurtures new additive demand. Companies fast-track PFAS-free flame retardants and low-migration stabilizers to comply with the EU Chemicals Strategy for Sustainability.

Middle East and Africa, while still representing a smaller slice of the performance additives market size, register above-average growth in additives for infrastructure coatings, pipe resins, and lubricant basestocks. Hydrocarbon feedstock availability positions Gulf Cooperation Council members to expand backward-integrated additive lines, while sub-Saharan Africa's urbanization lifts demand for weather-resistant paints and packaging.

- Afton Chemical

- Akzo Nobel N.V.

- Albemarle Corporation

- Arkema

- Ashland

- Baerlocher GmbH

- BASF

- Chevron Oronite Company LLC

- Clariant

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Honeywell International Inc.

- Huntsman International LLC

- Lanxess

- Mitsui & Co. (Asia Pacific) Pte. Ltd.

- Performance Additives

- Songwon

- The Lubrizol Corporation

- Univar Solutions LLC

- W. R. Grace & Co

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Replacement of Conventional Materials by Plastics Across End-Use Sectors

- 4.2.2 Rapid Plastics Demand Growth in Emerging Economies

- 4.2.3 Tightening Global Fuel-Economy and Emissions Norms Driving High-Performance Lubricant and Fuel Additives

- 4.2.4 Shift Toward Water-Borne and Low-VOC Coatings Boosts Specialty Additive Uptake

- 4.2.5 Additive-Enabled Chemical-Recycling and Circular-Polymer Initiatives Gain Traction

- 4.3 Market Restraints

- 4.3.1 Stringent Restrictions on Single-Use Plastics and Hazardous Substances

- 4.3.2 Volatile Crude-Derived Feedstock Prices

- 4.3.3 Pending Micro-Plastics Legislation Targeting Functional Additives in Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Additive Category

- 5.1.1 Plastic Additives

- 5.1.1.1 Lubricants

- 5.1.1.2 Processing Aids (Fluoropolymer-based)

- 5.1.1.3 Flow Improvers

- 5.1.1.4 Slip Additives

- 5.1.1.5 Antistatic Additives

- 5.1.1.6 Pigment Wetting Agents

- 5.1.1.7 Filler Dispersants

- 5.1.1.8 Antifog Additives

- 5.1.1.9 Plasticizers

- 5.1.1.10 Stabilizers

- 5.1.1.11 Flame Retardants

- 5.1.1.12 Impact Modifiers

- 5.1.2 Rubber Additives

- 5.1.2.1 Accelerators

- 5.1.2.2 Antidegradants

- 5.1.2.3 Blowing and Adhesive Agents

- 5.1.3 Paints and Coatings Additives

- 5.1.3.1 Biocides

- 5.1.3.2 Dispersants and Wetting Agents

- 5.1.3.3 Defoamers and De-aerators

- 5.1.3.4 Rheology Modifiers

- 5.1.3.5 Surface Modifiers

- 5.1.3.6 Stabilizers

- 5.1.3.7 Flow and Leveling Additives

- 5.1.3.8 Other Paint and Coating Additives

- 5.1.4 Fuel Additives

- 5.1.4.1 Deposit Control

- 5.1.4.2 Cetane Improvers

- 5.1.4.3 Lubricity Improvers

- 5.1.4.4 Antioxidants

- 5.1.4.5 Anticorrosion

- 5.1.4.6 Fuel Dyes

- 5.1.4.7 Cold-Flow Improvers

- 5.1.4.8 Antiknock Agents

- 5.1.4.9 Other Fuel Additives

- 5.1.5 Ink Additives

- 5.1.5.1 Rheology Modifiers

- 5.1.5.2 Slip / Rub Agents

- 5.1.5.3 Defoamers

- 5.1.5.4 Dispersants

- 5.1.5.5 Antioxidants

- 5.1.5.6 Chelating Agents

- 5.1.5.7 Other Ink Additives

- 5.1.6 Leather Additives

- 5.1.6.1 Finishing Agents

- 5.1.6.2 Fat Liquors

- 5.1.6.3 Syntans

- 5.1.6.4 Other Leather Additives

- 5.1.7 Lubricant Additives

- 5.1.7.1 Dispersants and Emulsifiers

- 5.1.7.2 Viscosity-Index Improvers

- 5.1.7.3 Detergents

- 5.1.7.4 Corrosion Inhibitors

- 5.1.7.5 Oxidation Inhibitors

- 5.1.7.6 Extreme-Pressure Additives

- 5.1.7.7 Friction Modifiers

- 5.1.7.8 Other Lubricant Additives

- 5.1.8 Adhesives and Sealants Additives

- 5.1.8.1 Antioxidants

- 5.1.8.2 Light Stabilizers

- 5.1.8.3 Tackifiers

- 5.1.8.4 Other Additives

- 5.1.1 Plastic Additives

- 5.2 By Form

- 5.2.1 Solid / Powder

- 5.2.2 Liquid

- 5.2.3 Masterbatch / Pellet

- 5.2.4 Micro-encapsulated

- 5.3 By End-user Industry

- 5.3.1 Packaging

- 5.3.2 Automotive and Transportation

- 5.3.3 Building and Construction

- 5.3.4 Electrical and Electronics

- 5.3.5 Industrial Machinery

- 5.3.6 Consumer Goods

- 5.3.7 Energy and Power (incl. Oil and Gas)

- 5.3.8 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Afton Chemical

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Albemarle Corporation

- 6.4.4 Arkema

- 6.4.5 Ashland

- 6.4.6 Baerlocher GmbH

- 6.4.7 BASF

- 6.4.8 Chevron Oronite Company LLC

- 6.4.9 Clariant

- 6.4.10 Dow

- 6.4.11 Eastman Chemical Company

- 6.4.12 Evonik Industries AG

- 6.4.13 Exxon Mobil Corporation

- 6.4.14 Honeywell International Inc.

- 6.4.15 Huntsman International LLC

- 6.4.16 Lanxess

- 6.4.17 Mitsui & Co. (Asia Pacific) Pte. Ltd.

- 6.4.18 Performance Additives

- 6.4.19 Songwon

- 6.4.20 The Lubrizol Corporation

- 6.4.21 Univar Solutions LLC

- 6.4.22 W. R. Grace & Co

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment