|

市场调查报告书

商品编码

1844735

聚天冬胺酸涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Polyaspartic Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

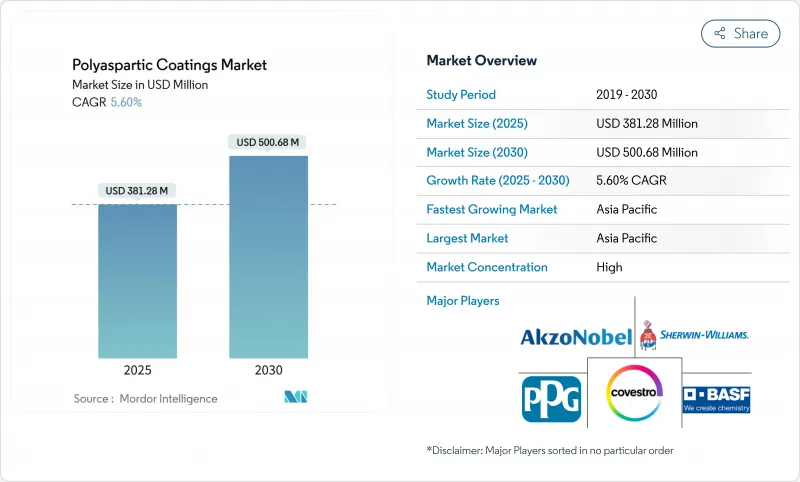

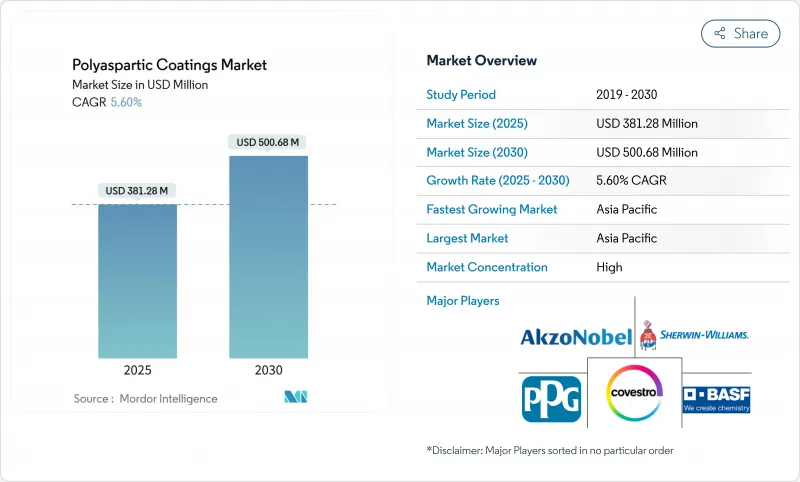

聚天冬胺酸涂料市场规模预计在 2025 年为 3.8128 亿美元,预计到 2030 年将达到 5.0068 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.60%。

随着建筑商、製造商和业主寻求快速固化、低VOC(挥发性有机化合物)体系,以减少停机时间、符合严格的空气品质法规并延长使用寿命,对水性涂料的需求日益增长。地板承包商依靠该技术实现一日恢復运营,以缓解技术纯熟劳工短缺的问题;基础设施业主则指定使用该技术来限制甲板和坡道的交通封闭。水性化学品的性能正在缩小与溶剂型系统的差距,并且由于其简化了法规合规性,其规模化速度更快。亚洲以45%的市占率引领全球水性涂料消费,这得益于中国和印度的大规模建筑工程以及缩短快速推进计划交付前置作业时间的区域供应链。

全球聚天冬胺酸涂料市场趋势与洞察

欧洲绿建筑认证成为强制性要求

欧洲新出台的脱碳法规对建筑产品中的挥发性有机化合物 (VOC) 含量进行了限制,而英国建筑研究院环境评估法 (BREEAM)、德国建筑环境评估委员会 (DGNB) 和欧盟生态标籤计划则对低排放涂料进行奖励。聚天冬胺酸供应商可以透过按照 ISO 标准记录排放情况来确保规范优势。像弗劳恩霍夫 WKI 这样的实验室提供第三方测试,并加快了认证时间。因此,水性和生物基涂料的订单正在增加,配方师正在加速欧洲工厂的规模扩张。跨国公司正在透过在现有的溶剂型产品上使用环保化学品进行标註来扩大市场份额,而当地专家正在与树脂製造商合作推出喷涂套件。

建设产业需求快速成长

与环氧树脂相比,聚天冬胺酸酯地板材料可将计划工期缩短一到两天,使建筑商能够以固定的施工团队每年安装更多面积。在人流量大的零售和物流中心,业主可以获得15年以上的使用寿命,儘管初始材料价格高出30-50%,但仍可降低终身维护成本。劳动力短缺推动了其应用:一日系统使未充分利用的施用器能够立即转入下一项工作。为了兼顾美观和耐用性,建筑公司正在将聚天冬氨酸酯面漆融入装饰性混凝土设计中,并将应用范围从仓库扩展到购物中心和体育场馆大厅。

与其他方案相比高成本

纯聚天冬胺酸涂料比同类环氧涂料贵30-50%,这限制了其在价格敏感的住宅领域的应用。这项溢价反映了胺酯原料成本的上升和加工公差的缩小。缺乏生命週期成本模型的承包商会选择价格较低的体系,儘管这些体系的使用寿命较短。供应商们推出了混合丙烯酸和聚氨酯树脂的混合产品,以保持快速固化和抗紫外线性能,同时将标价降低15-20%。随着经验的增长,供应商正在向纯聚天冬胺酸涂料过渡。

細項分析

到 2024 年,溶剂型涂料的销售额将占到 55%,但随着监管机构降低 VOC 限值,水性产品预计将以 6.10% 的复合年增长率增长,成为所有技术类别中最高的。路博润的 Solsperse W60 等水性分散剂可提高颜料稳定性,实现先前只有使用溶剂载体才能实现的色彩一致性。生产商也正在引进含生物胺以减少二氧化碳排放。在亚洲,市政绿建筑法规正在采用欧洲 VOC 限值,加速了其在没有联邦法规的经济体中的应用。大型承包商重视其水冲洗和低气味的特性,以及降低已占用场地的控製成本,因此将聚天冬胺酸涂料市场视为医院和学校的首选解决方案。

正在进行的树脂研究正在缩小水性和溶剂型系统之间机械性能的差距。与传统的溶剂型系统相比,科思创的 INSQIN 聚氨酯可减少 95% 的製程用水量和 45% 的二氧化碳排放。这些优势使涂料供应商能够推动环境关键性能指标 (KPI) 以及固化速度和硬度的提升。因此,聚天冬胺酸涂料市场目前呈现出层级递进的产品格局:适用于成本敏感型室内装潢的入门级水性混合涂料、适用于商业地板材料的中檔通用体系,以及适用于建筑幕墙和覆层的高端户外水性纯级涂料。

至2024年,纯配方涂料将占销售额的70%,但随着消费者寻求性能与价格的平衡,混合体系预计将以6.50%的复合年增长率成长。 Advanced Polymer Coatings的TriFLEX DTM等产品将聚氨酯的柔韧性与聚天冬胺酸的紫外线耐久性相结合,打造出一种可直接涂覆在金属上的涂层,具有抗盐雾和抗褪色的特性。混合系统通常具有更长的开放时间,有利于在温暖气候下进行大面积施工,并解决了人们对快速纯级凝胶涂料的常见问题。

第二波混合涂料将聚天门冬胺酸与聚硅氧烷混合,以提高烟囱和海洋结构的耐热性。材料科学家正在利用寡聚物设计来客製化固化曲线,使标准无气泵能够取代多组分钻机,并提高承包商的接受度。混合涂料可使每加仑原料成本降低两位数,使聚天冬胺酸涂料产业成为环氧涂料的升级选择,使买家能够轻鬆进入高端市场,而无需承受高昂的价格衝击。

聚天冬胺酸涂料市场报告按技术(溶剂型、水性、粉末、紫外线固化)、类型(纯聚天冬胺酸涂料、混合聚天冬胺酸涂料)、应用(地板、防水/防潮、其他)、最终用户产业(建筑/施工、海洋、基础设施、其他)和地区(亚太地区、北美、欧洲、南美洲、中东和非洲)。

区域分析

随着特大城市对交通、资料中心和智慧製造群的投资,到2024年,亚太地区将占全球涂料市场收入的45%,到2030年,复合年增长率将达到6.90%。在中国,从待开发区项目转向维修工程的趋势正在推动对快速固化桥面维修的需求;而在印度,智慧城市计划正在将公共资金用于人行天桥和地铁站,并指定使用低维护涂料。印尼和越南正在成为二线涂料热点地区,这得益于当地供应商扩大混合涂料的销售,从而减少了对进口的依赖。

在北美,仓库自动化、冷藏容量的扩大以及2022年颁布的1.2兆美元联邦基础设施计画正在推动价值成长。桥樑业主正在利用夜间化学品再利用来最大程度地减少车道关闭。各州运输部部门正在将此纳入其资产管理指南。商业地产业主正在安排夜间地板重新粉刷,以避免业务中断,从而在新建筑市场放缓的时期支撑售后市场的需求。承包商认证计划的广泛采用正在推动加拿大和美国的聚天冬胺酸涂料市场的发展。

欧洲严格的空气品质法规和成熟的绿建筑认证生态系统为水性涂料的应用奠定了稳定的基础。德国正在透过工业地坪维修来确保区域销量,而斯堪地那维亚则在木结构建筑上采用聚天冬氨酸膜,以延长在严酷的冻融气候条件下的维护週期。南欧正在试验将聚天冬胺酸黏合剂与红外线反射颜料结合的冷屋顶配方,以降低建筑能耗。在欧盟一体化基金的支持下,东欧国家正在指定使用快速固化桥樑涂料,以缩短严苛的施工工期,从而增强市场渗透率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 欧洲强制性绿建筑认证加速低VOC聚天门冬胺酸系统的采用

- 建设产业需求快速成长

- 新兴经济体基础建设活性化

- 优于传统涂料

- 市场限制

- 与其他方案相比高成本

- 亚太地区原物料价格波动

- 新兴市场认知度较低

- 价值链分析

- 监理展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 依技术

- 溶剂型

- 水性

- 粉末

- UV固化型

- 按类型

- 纯聚天门冬胺酸涂层

- 杂化聚天冬胺

- 按用途

- 地板材料

- 防水防潮

- 防锈面漆

- 按行业

- 建筑/施工

- 海洋

- 基础设施

- 发电

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- ADVACOAT

- Akzo Nobel NV

- BASF SE

- Carboline Company

- Citadel Floors

- Covestro AG

- Crown Polymers

- Duraamen Engineered Products Inc.

- Enviro Epoxy Products Inc.

- Flexmar Polyaspartics

- Hempel A/S

- Henkel AG & Co. KGaA

- Iron Man Coatings

- LATICRETE International Inc.

- Polyval Coatings Inc.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

- The VersaFlex Companies

第七章 市场机会与未来展望

The Polyaspartic Coatings Market size is estimated at USD 381.28 million in 2025, and is expected to reach USD 500.68 million by 2030, at a CAGR of 5.60% during the forecast period (2025-2030).

Demand is expanding as builders, manufacturers, and asset owners search for fast-curing, low-VOC systems that reduce downtime, meet tightening air-quality rules, and prolong service life. Flooring contractors rely on the technology's one-day return-to-service to mitigate skilled-labor shortages, while infrastructure owners specify it to limit traffic closures on decks and ramps. Water-borne chemistries are narrowing the performance gap with solvent-borne systems and are scaling faster because they simplify regulatory compliance. Asia leads global consumption with a 45% share, propelled by high-volume construction in China and India and by regional supply chains that shorten lead times for fast-moving projects.

Global Polyaspartic Coatings Market Trends and Insights

Green-Building Certification Mandates in Europe

Europe's new decarbonization rules cap VOC content in construction products and reward low-emission coatings within BREEAM, DGNB, and EU Ecolabel schemes. Polyaspartic suppliers that document ISO-compliant emissions secure specification advantages because developers use certifications as marketing assets to command rent premiums. Laboratories such as Fraunhofer WKI provide third-party testing, shortening time to proof. The resulting pull-through boosts orders for water-borne and bio-content grades, prompting formulators to accelerate scale-up at European plants. Multinationals re-label existing solvent-based lines with greener chemistries to defend share, while regional specialists partner with resin producers to launch ready-to-spray kits.

Rapidly Increasing Demand from Building and Construction Industry

Builders embrace polyaspartic flooring because it cuts project schedules by one to two days over epoxy, enabling contractors to complete more square footage annually with fixed crews. Owners gain 15-plus-year service life in heavy-traffic retail and logistics centers, reducing lifetime maintenance costs even when initial material prices run 30-50% higher. Labor scarcity intensifies adoption: single-day systems free scarce applicators for the next job sooner. Architectural firms integrate polyaspartic topcoats into decorative concrete designs to meet both aesthetic and durability targets, expanding use cases from warehouses to shopping malls and stadium concourses.

High Cost Compared to Alternatives

Pure polyaspartic coatings cost 30-50% more than comparable epoxy, constraining penetration in price-sensitive housing segments. The premium reflects higher amine ester feedstock prices and tighter processing tolerances. Contractors without lifecycle-cost models default to cheaper systems despite shorter service life. Suppliers answer with hybrid lines that blend acrylic or polyurethane resins to shave 15-20% off list prices while retaining fast cure and UV resistance, planting a migration path toward pure grades as experience deepens.

Other drivers and restraints analyzed in the detailed report include:

- Rising Infrastructure Development in Emerging Economies

- Superior Performance over Traditional Coatings

- Feedstock Price Volatility in Asia-Pacific

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solvent-borne grades held a 55% revenue share in 2024; however, water-borne products are forecast to register a 6.10% CAGR, the highest among technology categories, as regulators impose lower VOC ceilings. Water-based dispersants such as Lubrizol's Solsperse W60 improve pigment stability, delivering color consistency once achievable only with solvent carriers. Producers also introduce bio-content amines to cut carbon footprints. In Asia, municipal green-building codes adopt European VOC limits, accelerating specification even in economies without federal mandates. Large contractors appreciate water clean-up and lower odor, which reduces containment costs on occupied sites, turning the polyaspartic coatings market into a preferred solution in hospitals and schools.

Continuous resin research has narrowed mechanical-property gaps between water-borne and solvent-borne systems. Covestro's INSQIN polyurethane reduces process-water use by 95% and CO2 emissions by 45% compared with legacy solvent routes. These gains enable coating suppliers to promote environmental key-performance indicators alongside cure speed and hardness. As a result, the polyaspartic coatings market sees tiered product ladders: entry water-borne hybrids for cost-sensitive interiors, mid-tier universal systems for commercial flooring, and premium exterior water-borne pure grades for facade cladding.

Pure formulations generated 70% of 2024 sales, yet hybrid systems are projected to grow at 6.50% CAGR as applicators seek balanced performance and price. Products such as Advanced Polymer Coatings' TriFLEX DTM merge polyurethane flexibility with polyaspartic UV durability to create a direct-to-metal coating that withstands salt spray and color fade. Hybrids often lengthen open time to ease large-area application in warm climates, resolving a common complaint about rapid pure-grade gel.

A second hybrid wave blends polyaspartic with polysiloxane to improve heat resistance in flue-gas stacks and offshore structures. Material scientists leverage oligomer design to tune cure profiles, enabling use of standard airless pumps instead of plural-component rigs, thus broadening contractor acceptance. Because hybrids cut raw-material cost per gallon by double-digit percentages, the polyaspartic coatings industry positions them as step-up options from epoxy, easing buyers into the premium category without sticker shock.

The Polyaspartic Coatings Market Report is Segmented by Technology (Solvent-Borne, Water-Borne, Powder, and UV-Cured), Type (Pure Polyaspartic Coatings and Hybrid Polyaspartic), Application (Flooring, Waterproofing and Moisture-Barrier, and More), End-User Industry (Building and Construction, Marine, Infrastructure, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 45% of global revenue in 2024 and is tracking a 6.90% CAGR through 2030 as megacities invest in transit, data centers, and smart manufacturing clusters. China's shift to renovation over greenfield builds sustains demand for rapid-cure deck refurbishment, while India's Smart Cities Mission channels public funds into pedestrian bridges and metro stations that specify low-maintenance coatings. Indonesia and Vietnam emerge as second-tier hotspots, aided by local suppliers scaling blended hybrids that lower import dependence.

North America's value is driven by warehouse automation, expansions in cold-storage capacity, and the USD 1.2 trillion federal infrastructure program enacted in 2022. Bridge owners exploit the chemistry's overnight return-to-service to minimize lane closures; state departments of transportation incorporate it into asset-management guidelines. Commercial real-estate owners schedule overnight floor recoats to sidestep business interruptions, which sustains aftermarket demand even during new-build slowdowns. High adoption of contractor certification programs accelerates the polyaspartic coatings market across Canada and the United States.

Europe's stringent air-quality statutes and mature green-building certification ecosystem create a stable platform for water-borne adoption. Germany anchors regional volume through industrial floor upgrades, while Scandinavia deploys polyaspartic membranes on timber structures to lengthen maintenance cycles in harsh freeze-thaw climates. Southern Europe experiments with cool-roof formulations that combine polyaspartic binders with infrared-reflective pigments to curb building energy use. Eastern European countries, encouraged by EU cohesion funds, specify rapid-cure bridge coatings to compress tight construction seasons, bolstering market penetration.

- ADVACOAT

- Akzo Nobel N.V.

- BASF SE

- Carboline Company

- Citadel Floors

- Covestro AG

- Crown Polymers

- Duraamen Engineered Products Inc.

- Enviro Epoxy Products Inc.

- Flexmar Polyaspartics

- Hempel A/S

- Henkel AG & Co. KGaA

- Iron Man Coatings

- LATICRETE International Inc.

- Polyval Coatings Inc.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

- The VersaFlex Companies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Green-Building Certification Mandates in Europe Accelerating Adoption of Low-VOC Polyaspartic Systems

- 4.2.2 Rapidly Increasing Demand from the Building and Construction Industry

- 4.2.3 Rising Infrastructure Development in Emerging Economies

- 4.2.4 Superior Performance over Traditional Coatings

- 4.3 Market Restraints

- 4.3.1 High Cost Compared to Alternatives

- 4.3.2 Feedstock Price Volatility in Asia-Pacific

- 4.3.3 Limited Awareness in Developing Markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Solvent-borne

- 5.1.2 Water-borne

- 5.1.3 Powder

- 5.1.4 UV-Cured

- 5.2 By Type

- 5.2.1 Pure Polyaspartic Coatings

- 5.2.2 Hybrid Polyaspartic

- 5.3 By Application

- 5.3.1 Flooring

- 5.3.2 Waterproofing and Moisture-Barrier

- 5.3.3 Anti-Corrosive Top-Coat

- 5.4 By End-Use Industry

- 5.4.1 Building and Construction

- 5.4.2 Marine

- 5.4.3 Infrastructure

- 5.4.4 Power Generation

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia

- 5.5.1.6 New Zealand

- 5.5.1.7 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle east and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADVACOAT

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 BASF SE

- 6.4.4 Carboline Company

- 6.4.5 Citadel Floors

- 6.4.6 Covestro AG

- 6.4.7 Crown Polymers

- 6.4.8 Duraamen Engineered Products Inc.

- 6.4.9 Enviro Epoxy Products Inc.

- 6.4.10 Flexmar Polyaspartics

- 6.4.11 Hempel A/S

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Iron Man Coatings

- 6.4.14 LATICRETE International Inc.

- 6.4.15 Polyval Coatings Inc.

- 6.4.16 PPG Industries Inc.

- 6.4.17 RPM International Inc.

- 6.4.18 Sika AG

- 6.4.19 The Sherwin-Williams Company

- 6.4.20 The VersaFlex Companies

7 Market Opportunities and Future Outlook

- 7.1 Increasing Demand for Bio-based Products

- 7.2 White-space and Unmet-need Assessment