|

市场调查报告书

商品编码

1844737

陶瓷泡沫:市场份额分析、行业趋势、统计数据和成长预测(2025-2030)Ceramic Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

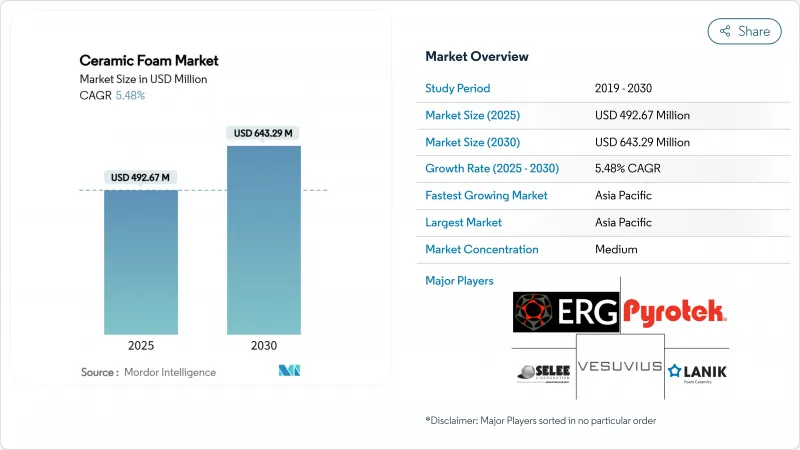

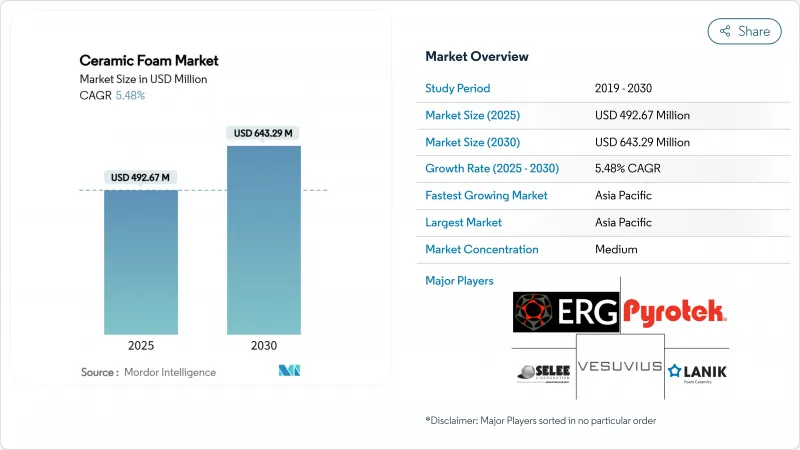

预计 2025 年陶瓷泡沫市场规模为 4.9267 亿美元,到 2030 年将达到 6.4329 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.48%。

由于陶瓷泡沫具有高温稳定性、耐化学性和可控孔隙率,超越了许多传统耐火材料和过滤介质,因此需求正在加速成长。电动车铸造轮毂、氢气设施和循环经济钢铁小型厂的快速成长正在扩大基本客群。先进的复製製程在大批量生产中保持成本优势,而积层製造为复杂的开孔形状开闢了盈利的市场。随着北美和欧洲零能耗建筑标准的收紧,生产商正在寻找新的隔热材料製造机会。同时,原材料价格波动和全自动铸造的脆性挑战正在挤压短期净利率,促使供应商寻求材料强化和供应链对冲策略。

全球泡沫陶瓷市场趋势与洞察

电动车铸造轮圈对低排放金属过滤的需求激增

电动车平台使用大型铝结构铸件,需要极度洁净的熔体才能满足导电性和疲劳性能指标。发泡陶瓷过滤器使电池外壳和马达外壳的熔融金属浓度低于10 ppm。 Vesuvius报告称,与传统汽车生产线相比,电动车专用铸造厂的SEDEX碳化硅过滤器利用率提高了40%。特斯拉上海工厂及亚洲其他类似工厂指定使用碳化硅发泡体进行高压压铸,并推动了区域生产。这些规范提高了产量和可重复性标准,有利于采用改进的复製方法製造坚固的开孔形状。亚太地区供应链的在地化努力进一步巩固了泡沫陶瓷市场的区域主导地位。

氢气生产的快速扩张需要高温触媒撑体

电解槽和蒸气重组的全球扩张推动了对耐火材料材料的需求,这些支撑材料能够承受腐蚀性环境中600-900°C的反覆操作。英国陶瓷联盟检验了一座100%氢燃料窑炉,证实了泡沫陶瓷适用于下一代能源系统。圣戈班集团正在纽约投资4,000万美元,扩大触媒撑体的生产,突显其在北美市场的发展动能。以泡沫陶瓷增强的堇青石整体结构在800°C下可实现最佳选择性,从而延长了重整器和固体氧化物燃料电池的使用寿命。随着越来越多的地区启动氢能蓝图,触媒撑体订单将为泡沫陶瓷市场提供可持续的成长路径。

氧化铝和氧化锆价格波动给利润率带来压力

高纯度氧化铝和氧化锆在陶瓷泡沫製造中占了很大一部分变动成本。价格的快速波动迫使企业不得不进行季度合约重新谈判,并导致昂贵的现货采购。氧化锆增强材料可将抗压强度提高206%,但原物料价格上涨使其经济性下降。摩根先进材料公司指出,儘管其热感陶瓷部门的订单稳定,但销售额仍下降了4.6%。缺乏长期合约的亚洲小型製造商的利润率受到挤压,这推迟了陶瓷泡沫行业的工厂升级和产能扩张。

細項分析

碳化硅凭藉其在 1,500°C 以上的稳定性、耐熔融铝性和优异的导热性,将在 2024 年占据陶瓷泡沫市场的 45.18%。电动车铸件数量的增加和严格的含量限制支持了持续的需求。其他先进成分,如镁铝尖晶石、硼化物陶瓷和混合复合材料,构成了成长最快的丛集,复合年增长率为 7.76%,满足了航太、核能和超高温的需求。虽然其温度上限限制了其在新兴电动车和氢能领域的渗透,但氧化铝由于其成本效益,在通用铸铁应用中仍然具有吸引力。氧化锆在化学腐蚀性熔体中保持利基地位,其延长的使用寿命和增强的耐腐蚀性证明了其高价格是合理的。

第二代硼化物发泡体在1800°C以上温度表现出抗氧化性能,可作为高超音速飞机的热防护部件。研究原型在1000次热循环后质量损失低于5%,这一里程碑可望推动其未来商业化应用。随着材料科学家合成出结合晶鬚增强和氧化皮的多相发泡体,陶瓷泡沫市场或将逐步取代极端环境下的传统氧化铝。

得益于数十年的设备摊销、低废品率和熟悉的品管,复製法或聚合物海绵法在2024年生产了所有泡沫陶瓷出货量的67.24%。此方法擅长生产孔径在10至60 ppi之间的过滤器,有助于大量生产有色金属铸件。儘管占据主导地位,但泡沫陶瓷市场正在转向增材製造,其复合年增长率为7.91%。雷射烧结氧化铝晶格和直接上墨堇青石载体可实现复製路线无法实现的分级孔隙率和拓扑优化。触媒撑体和航太应用领域的早期采用者正在利用设计自由度来增强流动均匀性和机械弹性。

直接发泡是指将气体混入陶瓷浆料中,然后烧结所得泡沫,无需使用聚氨酯模板,也无需燃烧排放。它最常用于生产符合绿色建筑标准的隔热板。凝胶注模成型法适用于需要近净成形精度的应用,例如生物医学植入和半导体晶圆支架,但其相对较长的成型週期限制了其广泛应用。

区域分析

2024年,亚太地区46.82%的收入份额反映了其包括原材料、铸造设施和下游电动车生产的一体化供应链。中国持续的钢铁生产和日本先进的陶瓷研究将维持基准产量,而韩国的氢能经济蓝图将推动未来对催化泡沫的需求。据预测,该地区的陶瓷泡沫市场预计将经历显着成长,预测期内复合年增长率将达到7.42%。政府对智慧製造和能源效率的补贴将推动其在铸造、汽车和建筑业的应用。

北美是一个成熟又富有创新的产业。该地区是增材製造领域的先驱,并受益于联邦政府对氢能和电池供应链的津贴。圣戈班在纽约的扩张凸显了其对国内催化剂支持需求的信心。美国更严格的汽车排放法规将刺激陶瓷排气过滤器的消耗。中西部地区稳定的铸铁业务以及电动车零件铝铸件需求的成长将确保需求保持强劲。

循环经济和碳中和钢铁法规是欧洲的优先事项,推动在短流程钢厂使用可回收耐火发泡体。德国、法国和义大利升级铸造生产线,配备自动过滤系统,推动了对更高强度泡沫配方的研究。欧盟补贴支持积层製造试验生产线,用于生产用于航太和国防的客製化孔隙结构。严格的建筑能源指令刺激了陶瓷隔热板在维修计划中的应用。

南美、中东和非洲规模虽小,但正在成长。巴西和阿根廷的汽车製造商正在采用铝铸过滤器,而沙乌地阿拉伯「2030愿景」中的新钢铁产能将推动耐火材料需求。外国直接投资正在支持先进材料研究机构,从而提升本地研发能力。基础设施缺口和技术专长有限正在减缓应用速度,但本地製造伙伴关係可以释放陶瓷泡沫产业的潜力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电动车铸造中心对低排放过滤金属过滤的需求激增

- 氢气生产的快速扩张需要高温触媒撑体

- 积层製造技术可实现复杂、经济高效的开放气孔发泡形状

- 促进循环经济需要为小型钢铁厂提供可回收的耐火材料衬里

- 政府对零能耗建筑的激励措施推动了陶瓷泡沫隔热板的发展

- 市场限制

- 氧化铝和氧化锆价格波动对利润率造成压力

- 自动化铸造厂的脆弱性导致处理损失

- 聚合物发泡体的出现提供了一种更便宜的隔热材料替代品

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按类型

- 氧化铝(Al2O3)

- 碳化硅(SiC)

- 氧化锆(ZrO2)

- 其他类型(镁铝尖晶石等)

- 按製造工艺

- 复製聚合物海绵法

- 直接发泡法

- 凝胶注模法

- 增材製造

- 按用途

- 过滤金属过滤

- 汽车排气过滤器

- 隔热、隔音材料

- 催化剂支持

- 炉衬

- 其他用途(例如医疗鹰架)

- 按最终用户产业

- 晶圆代工厂

- 汽车产业

- 建造

- 污染防治与化学合成

- 其他终端用户产业(发电、能源等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Altech Alloys India Pvt. Ltd.

- ASK Chemicals

- Carpenter Brothers, Inc.

- Drache Umwelttechnik GmbH

- ERG Aerospace Corporation

- Ferro-Term Sp. z oo

- FILTEC PRECISION CERAMICS CO., LTD.

- Galaxy Enterprise

- Jiangxi Jintai Special Material LLC.

- LANIK sro

- Porvair Filtration Group

- Pyrotek

- SELEE Corp.

- Ultramet

- Vertix Co.

- Vesuvius

第七章 市场机会与未来展望

The Ceramic Foam Market size is estimated at USD 492.67 million in 2025, and is expected to reach USD 643.29 million by 2030, at a CAGR of 5.48% during the forecast period (2025-2030).

Demand is accelerating as ceramic foam delivers high-temperature stability, chemical resistance and well-controlled porosity that outperform many legacy refractory and filtration media. Rapid growth in electric-vehicle casting hubs, hydrogen production facilities and circular-economy steel mini-mills is widening the customer base. Advanced replica processes retain cost advantages in high-volume production, while additive manufacturing opens profitable niches for complex open-cell geometries. Producers also see new insulation opportunities as North American and European zero-energy building codes tighten. Meanwhile, raw-material price volatility and brittleness challenges in fully automated foundries temper near-term margins, prompting suppliers to pursue material toughening and supply-chain hedging strategies.

Global Ceramic Foam Market Trends and Insights

Surging demand for low-emission molten metal filtration in EV casting hubs

Electric-vehicle platforms use large aluminum structural castings that require exceptionally clean melts to meet conductivity and fatigue targets. Ceramic foam filters now enable sub-10 ppm inclusion levels in battery housings and motor casings. Vesuvius reports 40% higher uptake of SEDEX silicon-carbide filters in EV-dedicated foundries compared with conventional automotive lines. Tesla's Shanghai operations and similar Asian facilities specify silicon-carbide foams for high-pressure die casting, driving regional volume. These specifications raise throughput and repeatability criteria that favor robust open-cell geometries produced via improved replica methods. Supply-chain localization efforts in Asia-Pacific further cement regional dominance of the ceramic foam market.

Rapid expansion of hydrogen production requiring high-temperature catalyst supports

Global electrolyzer and steam-reform expansion demands refractory carriers that withstand cyclic 600-900 °C operation in corrosive atmospheres. The Ceramics UK consortium validated 100% hydrogen-fired kilns, confirming ceramic foam suitability for next-generation energy systems. Saint-Gobain is investing USD 40 million in New York to scale catalyst-carrier output, highlighting North American momentum. Cordierite monoliths reinforced with ceramic foam achieve optimal selectivity at 800 °C, extending service intervals for reformers and solid-oxide fuel cells. As more regions publish national hydrogen roadmaps, catalyst support orders provide a durable growth pathway for the ceramic foam market.

Volatile alumina and zirconia prices pressuring profit margins

High-purity alumina and zirconia constitute a significant portion of the variable costs in ceramic foam production. Sharp price swings have forced quarterly contract renegotiations and spot purchases at elevated premiums. Zirconia toughening boosts compressive strength by 206% yet becomes less economical when raw-material indices spike. Morgan Advanced Materials noted a 4.6% revenue dip in its Thermal Ceramics unit despite stable order intake because surcharges lagged cost inflation. Smaller Asian producers, lacking long-term contracts, experienced margin compression that slowed plant upgrades and capacity additions within the ceramic foam industry.

Other drivers and restraints analyzed in the detailed report include:

- Additive manufacturing enabling complex, cost-efficient open-cell foam geometries

- Circular-economy push for recyclable refractory linings in steel mini-mills

- Brittleness leading to handling losses in automated foundries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silicon carbide commanded 45.18% share of the ceramic foam market in 2024 due to its stability above 1,500 °C, resistance to molten aluminum and superior thermal conductivity. Rising EV casting volumes and stringent inclusion limits underpin sustained demand. Other advanced compositions such as magnesium-aluminate spinel, boride ceramics and hybrid composites form the fastest-growing cluster at a 7.76% CAGR, fulfilling aerospace, nuclear and ultra-high-temperature needs. Aluminum oxide remains attractive for general-purpose iron casting thanks to cost-efficiency, though its temperature ceiling constrains penetration into new EV and hydrogen segments. Zirconium oxide retains a niche in chemically aggressive melts, where its premium price is justified by extended service life and enhanced corrosion resistance.

Second-generation boride foams demonstrate oxidation resistance above 1,800 °C, positioning them for hypersonic vehicle thermal-protection components. Research prototypes exhibit less than 5% mass loss after 1,000 thermal cycles, a milestone that could spur future commercialization. As material scientists synthesize multiphase foams combining whisker reinforcement and oxide scales, the ceramic foam market may witness incremental displacement of legacy alumina in extreme environments.

The replica or polymer-sponge process produced 67.24% of all ceramic foams shipped in 2024 owing to decades of equipment amortization, low scrap rates and familiar quality controls. It excels in producing filters with consistent pore sizes from 10 to 60 ppi, serving high-volume non-ferrous foundries. Despite its dominance, the ceramic foam market is pivoting toward additive manufacturing, the fastest-growing process at 7.91% CAGR. Laser-sintered alumina lattices and direct-ink-written cordierite carriers allow graded porosity and topology optimization unattainable with replica routes. Early adopters in catalyst support and aerospace exploit design freedom to enhance flow uniformity and mechanical resilience.

Direct foaming, which mixes gas into ceramic slurry then sinters the resulting froth, eliminates polyurethane templates and their associated burn-out emissions. Uptake is strongest in insulation panels targeting green-building credits. Gel casting endures in applications requiring near-net-shape precision, such as biomedical implants and semiconductor wafer supports, though its relatively long cycle times limit broader diffusion.

The Ceramic Foam Market Report is Segmented by Type (Aluminum Oxide, Silicon Carbide, and More), Manufacturing Process (Replica/Polymer Sponge Method, Direct Foaming, and More), Application (Molten Metal Filtration, Automotive Exhaust Filters, and More), End-User Industry (Foundry, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 46.82% revenue share in 2024 reflects its integrated supply chain encompassing raw materials, casting facilities and downstream EV production. China's continual steel output and Japan's advanced ceramics research sustain baseline volumes, while South Korea's hydrogen-economy roadmap raises future demand for catalyst foams. Forecasts indicate the region's ceramic foam market is projected to witness significant growth, supported by a robust 7.42% CAGR during the forecast period. Government grants for smart manufacturing and energy efficiency amplify adoption across foundry, automotive, and construction sectors.

North America represents a mature yet innovative arena. The region fields additive-manufacturing pioneers and benefits from federal hydrogen and battery-supply-chain funding. Saint-Gobain's New York expansion confirms confidence in domestic catalyst-support demand. Tightening US vehicle emissions rules stimulate ceramic exhaust filter consumption. Stable iron foundry operations in the Midwest and growing aluminum casting for EV parts ensure demand resilience.

Europe prioritizes circular economy mandates and carbon-neutral steel, driving uptake of recyclable refractory foams in mini-mills. Germany, France and Italy upgrade casting lines with automated filter-handling systems, spurring research into tougher foam formulations. EU grants back additive-manufacturing pilot lines that fabricate customized pore architectures for aerospace and defense. Stringent building energy directives stimulate ceramic insulation panel deployment in renovation projects.

South America and Middle East & Africa are smaller but rising. Brazilian and Argentinian automakers adopt aluminum casting filters, while new steel capacity in Saudi Arabia's Vision 2030 bolsters refractory demand. Foreign direct investment underpins advanced-materials institutes that enhance local competence. Infrastructure gaps and limited technical expertise slow adoption, yet localized production partnerships could unlock latent potential for the ceramic foam industry.

- Altech Alloys India Pvt. Ltd.

- ASK Chemicals

- Carpenter Brothers, Inc.

- Drache Umwelttechnik GmbH

- ERG Aerospace Corporation

- Ferro-Term Sp. z o.o.

- FILTEC PRECISION CERAMICS CO., LTD.

- Galaxy Enterprise

- Jiangxi Jintai Special Material LLC.

- LANIK s.r.o.

- Porvair Filtration Group

- Pyrotek

- SELEE Corp.

- Ultramet

- Vertix Co.

- Vesuvius

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for low-emission molten metal filtration in EV casting hubs

- 4.2.2 Rapid expansion of hydrogen production requiring high-temperature catalyst supports

- 4.2.3 Additive manufacturing enabling complex, cost-efficient open-cell foam geometries

- 4.2.4 Circular-economy push for recyclable refractory linings in steel mini-mills

- 4.2.5 Government incentives for zero-energy buildings boosting ceramic-foam insulation panels

- 4.3 Market Restraints

- 4.3.1 Volatile alumina and zirconia prices pressuring profit margins

- 4.3.2 Brittleness leading to handling losses in automated foundries

- 4.3.3 Emerging polymer-derived foams offering cheaper insulation alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Aluminum Oxide (Al2O3)

- 5.1.2 Silicon Carbide (SiC)

- 5.1.3 Zirconium Oxide (ZrO2)

- 5.1.4 Others Types (Magnesium Aluminate Spinel, etc.)

- 5.2 By Manufacturing Process

- 5.2.1 Replica/Polymer Sponge Method

- 5.2.2 Direct Foaming

- 5.2.3 Gel Casting

- 5.2.4 Additive Manufacturing

- 5.3 By Application

- 5.3.1 Molten Metal Filtration

- 5.3.2 Automotive Exhaust Filters

- 5.3.3 Thermal and Acoustic Insulation

- 5.3.4 Catalyst Support

- 5.3.5 Furnace Lining

- 5.3.6 Other Applications (Biomedical Scaffolds, etc.)

- 5.4 By End-User Industry

- 5.4.1 Foundry

- 5.4.2 Automotive

- 5.4.3 Construction

- 5.4.4 Pollution Control and Chemcial Synthesis

- 5.4.5 Other End-user Industries (Power Generation and Energy, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Altech Alloys India Pvt. Ltd.

- 6.4.2 ASK Chemicals

- 6.4.3 Carpenter Brothers, Inc.

- 6.4.4 Drache Umwelttechnik GmbH

- 6.4.5 ERG Aerospace Corporation

- 6.4.6 Ferro-Term Sp. z o.o.

- 6.4.7 FILTEC PRECISION CERAMICS CO., LTD.

- 6.4.8 Galaxy Enterprise

- 6.4.9 Jiangxi Jintai Special Material LLC.

- 6.4.10 LANIK s.r.o.

- 6.4.11 Porvair Filtration Group

- 6.4.12 Pyrotek

- 6.4.13 SELEE Corp.

- 6.4.14 Ultramet

- 6.4.15 Vertix Co.

- 6.4.16 Vesuvius

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technological Advancements in Production Techniques