|

市场调查报告书

商品编码

1844738

有机硅添加剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Silicone Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

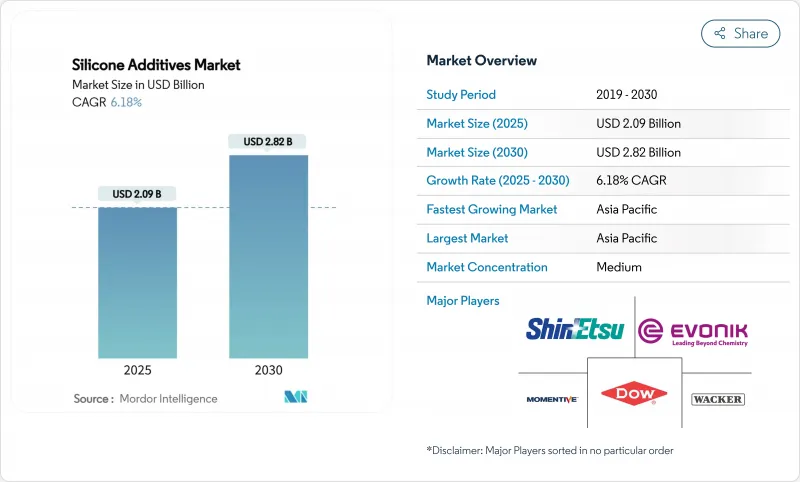

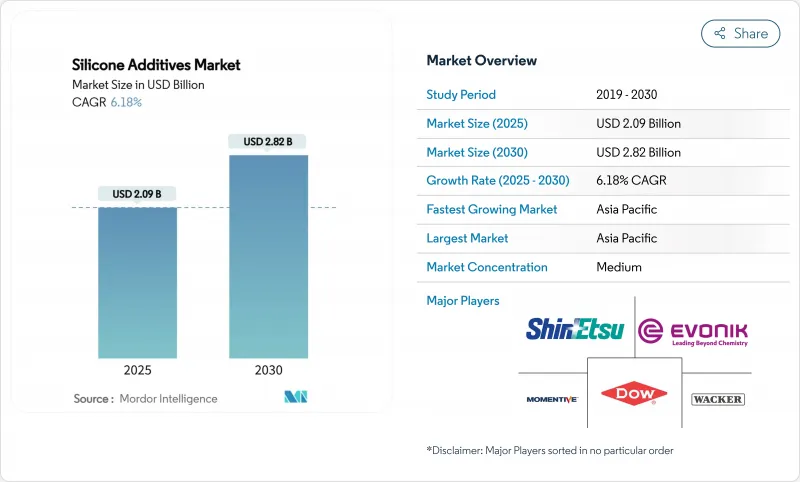

预计 2025 年有机硅添加剂市场规模为 20.9 亿美元,到 2030 年预计将达到 28.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.18%。

强劲的需求源自于製造商寻求能够保持被覆剂、聚合物和流体在高温、化学品和恶劣天气条件下稳定的添加剂。减少挥发性有机化合物 (VOC)排放的监管压力正推动配方师转向兼顾性能和合规性的富含有机硅的系统。成长动能也体现在电动车的温度控管、生物基个人保健产品的推出以及新兴经济体食品加工自动化程度的提高。产业整合,尤其是 KCC 于 2024 年收购迈图 (Momentive),标誌着产业向规模优势、垂直整合和更快创新管道的转变。

全球有机硅添加剂市场趋势与洞察

个人护理行业的需求不断增长

随着消费者越来越青睐无油轻盈的质地,配方师开始转向硅油,寻求其丝滑的延展性和持久的保湿效果。例如,信越化学的油包弹性体产品系列能够生产稳定的油包水乳化,在保持理想肤感的同时,满足区域性环状硅氧烷禁令。供应商正在部署植物来源C13-15烷烃载体,例如埃肯的PURESIL ORG Gel,这证明了感官性能与天然定位可以共存。亚太地区的化妆品製造商正在利用这些特性来弥补与全球高端品牌的差距,并拓展彩妆品和防晒产品中有机硅添加剂的市场。

油漆和涂料中低VOC产品日益受到关注

欧洲和北美的立法已对允许的溶剂含量作出限制,使低VOC合规性成为先决条件而非一项特性。赢创的TEGO Guard 9000可为外墙涂料提供早期耐候性,且不违反生态标章的阈值。 Siltec公司证明,长链烷基有机硅可以提高固态含量,同时降低VOC,使配方设计师在保持耐久性的同时达到绿色印章和LEED标准。这种连锁反应也蔓延到了新兴市场,建筑商正在指定使用添加了有机硅表面添加剂的水性涂料,以实现耐污性和持久的色彩。

高温下的添加剂迁移

温度超过200 度C时,低分子量硅氧烷会渗出到表面,降低光学透明度,并可能削弱附着力。高苯基硅橡胶的研究表明,其热稳定性有所提高,在478 度C时重量损失仅为5%,但优质等级会增加成本。电动车牵引马达和航太管路需要降低挥发性的配方,这会对研发预算造成压力。

細項分析

2024年,硅油将占有机硅添加剂市场收入的39.44%,这得益于其在涂料、个人护理和润滑剂等领域的广泛应用,例如增滑剂、流平剂和传热剂。低表面张力和宽温度稳定性支撑了强劲的需求。乳化和树脂可作为硅油的补充,用于水性系统和结构饰面,尤其是在建筑密封胶领域。相较之下,弹性体则服务于需要持久弹性的细分领域,例如垫圈、密封件和医用导管。

粉末和颗粒占总收入的不到四分之一,但到2030年,其复合年增长率最高,可达7.65%。干粉形状可用于配製3D列印原料和母粒,使配方师能够实现精细的流变控制和无尘配料。新型紫外光固化聚硅氧烷粉末简化了快速原型製造的按需交联,缩短了从设计到零件的週期,并拓展了增材製造领域有机硅添加剂的市场。随着印表机的应用范围从航太扩展到牙科和消费品,粉末有机硅将开闢新的成长途径。

区域分析

亚太地区将在2024年引领有机硅添加剂市场,营收份额将达47.34%,预计到2030年复合年增长率将达到7.10%。中国张家港和南京丛集为瓦克和埃肯的上游硅氧烷产能提供支持,确保其能够接近性供应主要电子和电动汽车电池公司。印度的「印度製造」计画正在刺激国内对高品质被覆剂和黏合剂的需求,鼓励国内复合材料生产商加入有机硅添加剂,以实现优质的表面处理和耐用性。日本和韩国也在推动有机硅添加剂在高频电子、光电和特殊薄膜领域的先进研发。

北美是一个成熟且蓬勃发展的创新地区。美国凭藉着符合FDA/USP标准的硅胶体系,在医疗设备和航太复合材料的应用方面处于领先地位。陶氏在密西根州开展的硅胶回收试点计画旨在将聚二甲基硅氧烷(PDMS)的碳排放减少50%,这与ESG(环境、社会和治理)要求下的买家产生了共鸣。加拿大对电动车电池的投资以及墨西哥的汽车产业丛集正在推动温度控管添加剂的进一步应用。

欧洲规模位居第三,但在永续性严格程度方面位居第一。 REACH法规和即将出台的PFAS禁令将加强对不含环状化合物的生物基有机硅替代品的研发。赢创的Smart Effects业务线将硅氧烷与有机特殊产品结合,以满足轻量化、电动车和数位健康市场的需求。德国和法国正致力于汽车电气化补贴,而英国则专注于生命科学领域的涂料。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 个人护理行业的需求不断增长

- 低VOC油漆和涂料日益受到关注

- 食品加工产业的需求不断增长

- 拓展医疗保健领域的应用

- 汽车业的高使用率

- 市场限制

- 高温下的添加剂迁移

- 原物料成本不稳定

- 迁移和黏附问题等技术挑战

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按产品形态

- 液体和油

- 弹性体和橡胶

- 树脂

- 粉末/颗粒

- 乳剂

- 按用途

- 消泡剂

- 流变改质剂

- 界面活性剂

- 润湿剂和分散剂

- 润滑剂

- 附着力促进剂

- 其他用途(例如脱模剂)

- 按最终用户产业

- 饮食

- 塑胶和复合材料

- 油漆和涂料

- 个人护理

- 黏合剂和密封剂

- 纸和纸浆

- 石油和天然气

- 其他终端用户产业(电子、半导体等)

- 地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- AB Specialty Silicones

- Altana AG

- Bluestar Silicones

- BRB International

- Clariant AG

- Dow

- Elkem ASA

- Evonik Industries AG

- Jiangsu Maysta Chemical

- KCC SILICONE CORPORATION

- Momentive

- Shin-Etsu Chemical Co., Ltd.

- Silibase Silicone

- Siltech Corporation

- Supreme Silicones India Pvt. Ltd.

- The Lubrizol Corporation

- Wacker Chemie AG

第七章 市场机会与未来展望

The Silicone Additives Market size is estimated at USD 2.09 billion in 2025, and is expected to reach USD 2.82 billion by 2030, at a CAGR of 6.18% during the forecast period (2025-2030).

Robust demand stems from manufacturers seeking additives that keep coatings, polymers, and fluids stable under heat, chemicals, and harsh weather. Regulatory pressure to cut volatile-organic-compound (VOC) emissions is steering formulators toward silicone-rich systems that match performance with compliance . Growth momentum also reflects deeper penetration in thermal management for electric vehicles, bio-based personal-care launches, and rising food-processing automation across emerging economies. Industry consolidation-most notably KCC's take-over of Momentive in 2024-signals a shift toward scale advantages, vertical integration, and faster innovation pipelines.

Global Silicone Additives Market Trends and Insights

Increase in Demand from Personal Care Industry

Consumers gravitate toward light, non-oily textures, prompting formulators to favor silicone fluids for silky spread and lasting moisture. Shin-Etsu's elastomer-in-oil line, for example, builds stable oil-in-water emulsions that meet regional bans on cyclic siloxanes while sustaining the desired skin-feel. Suppliers are rolling out plant-origin C13-15 alkane carriers such as Elkem's PURESIL ORG gels, proving that sensory performance and natural positioning can coexist. Asia-Pacific labels are leveraging these attributes to bridge gaps with global premium brands, widening the silicone additives market in color cosmetics and sun care.

Growing Focus on Low-VOC Products in Paints and Coatings

Legislators in Europe and North America cap allowable solvent content, making low-VOC compliance a prerequisite rather than a feature. Evonik's TEGO Guard 9000 delivers early-rain resistance in exterior coatings without breaching eco-label thresholds. Siltech has shown that long-chain alkyl silicones lift solids content yet cut VOC totals, letting formulators maintain durability while meeting Green Seal or LEED targets. The ripple effect extends to emerging markets, where builders increasingly specify water-based paints fortified with silicone surface additives for stain repellence and long-term color retention.

Additive Migration at High Temperatures

Above 200 °C, low-molecular-weight siloxanes can bleed to surfaces, dulling optical clarity or weakening adhesion. Studies on high-phenyl silicone rubbers reveal improved thermal stability, with only 5% weight loss at 478 °C, yet premium grades raise costs. EV traction motors and aerospace ducting need formulations that curb volatilization, pressuring R&D budgets.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand from Food-Processing Industry

- Increasing Usage in Medical and Healthcare Applications

- Volatile Raw-Material Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silicone fluids accounted for 39.44% of the silicone additives market in 2024 by revenue, riding on wide use as slip, leveling, and heat-transfer agents in coatings, personal care, and lubricants. Their low surface tension and broad temperature stability underpin a resilient demand base. Emulsions and resins complement fluids by enabling water-borne systems and structural finishes, particularly in construction sealants. In contrast, elastomers address gasket, seal, and medical-tube niches needing lasting elasticity.

Powders and granules, although less than one-quarter of sales, post the fastest 7.65% CAGR through 2030. Their dry format aids 3D printing feedstocks and masterbatch compounding, granting formulators fine rheology control and dust-free dosing. Emerging UV-curable polysiloxane powders simplify on-demand cross-linking for rapid prototypes, shrinking design-to-part cycles and enlarging the silicone additives market size for additive manufacturing. As printer fleets spread beyond aerospace into dental and consumer goods, powdered silicones capture fresh avenues for growth.

The Silicone Additives Market Report is Segmented by Product Form (Fluids and Oils, Elastomers and Gums, and More), Application (Defoamers, Rheology Modifiers, and More), End-User Industry (Food and Beverage, Plastics and Composites, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific sat atop the silicone additives market with 47.34% revenue share in 2024 and is marching at a 7.10% CAGR toward 2030. China's Zhangjiagang and Nanjing clusters anchor upstream siloxane capacity for Wacker and Elkem, ensuring supply proximity to electronics and EV battery giants. India's "Make in India" policy stokes domestic demand for quality-driven coatings and adhesives, compelling local formulators to incorporate silicone additives for premium finish and durability. Japan and South Korea each foster advanced R&D, channeling silicone additives into high-frequency electronics, photonics, and specialty films.

North America follows as a mature but innovation-rich arena. The United States leads adoption in medical devices and aerospace composites, relying on FDA/USP compliant silicone systems. Dow's silicone recycling pilot in Michigan aims to trim polydimethylsiloxane (PDMS) carbon footprints by 50% and resonates with buyers under ESG mandates. Canada's EV-battery investments and Mexico's automotive clusters promise incremental pull-through for thermal-management additives.

Europe ranks third in size yet first in sustainability stringency. REACH and impending PFAS bans intensify R&D for cyclic-free and bio-based silicone alternatives. Evonik's Smart Effects business line combines siloxane and organic specialties to tackle lightweighting, e-mobility, and digital health markets. Germany and France concentrate vehicle electrification grants, while the United Kingdom emphasizes life-science coatings, collectively protecting a steady flow of high-margin orders.

- AB Specialty Silicones

- Altana AG

- Bluestar Silicones

- BRB International

- Clariant AG

- Dow

- Elkem ASA

- Evonik Industries AG

- Jiangsu Maysta Chemical

- KCC SILICONE CORPORATION

- Momentive

- Shin-Etsu Chemical Co., Ltd.

- Silibase Silicone

- Siltech Corporation

- Supreme Silicones India Pvt. Ltd.

- The Lubrizol Corporation

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Demand from Personal Care Industry

- 4.2.2 Growing Focus on Low-VOC Products in Paints and Coatings

- 4.2.3 Growing Demand from Food-Processing Industry

- 4.2.4 Increasing Usage in Medical and Healthcare Applications

- 4.2.5 High Utilization from the Automotive Industry

- 4.3 Market Restraints

- 4.3.1 Additive Migration at High Temperatures

- 4.3.2 Volatile Raw-material Costs

- 4.3.3 Technical Challenges such as Migration and Adhesion Issues

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Product Form

- 5.1.1 Fluids and Oils

- 5.1.2 Elastomers and Gums

- 5.1.3 Resins

- 5.1.4 Powders and Granules

- 5.1.5 Emulsions

- 5.2 By Application

- 5.2.1 Defoamers

- 5.2.2 Rheology Modifiers

- 5.2.3 Surfactants

- 5.2.4 Wetting and Dispersing Agents

- 5.2.5 Lubricating Agents

- 5.2.6 Adhesion Promoters

- 5.2.7 Other Applications (Release Agents, etc.)

- 5.3 By End-User Industry

- 5.3.1 Food and Beverage

- 5.3.2 Plastics and Composites

- 5.3.3 Paints and Coatings

- 5.3.4 Personal Care

- 5.3.5 Adhesives and Sealants

- 5.3.6 Paper and Pulp

- 5.3.7 Oil and Gas

- 5.3.8 Other End-User Industries (Electronics and Semiconductor, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AB Specialty Silicones

- 6.4.2 Altana AG

- 6.4.3 Bluestar Silicones

- 6.4.4 BRB International

- 6.4.5 Clariant AG

- 6.4.6 Dow

- 6.4.7 Elkem ASA

- 6.4.8 Evonik Industries AG

- 6.4.9 Jiangsu Maysta Chemical

- 6.4.10 KCC SILICONE CORPORATION

- 6.4.11 Momentive

- 6.4.12 Shin-Etsu Chemical Co., Ltd.

- 6.4.13 Silibase Silicone

- 6.4.14 Siltech Corporation

- 6.4.15 Supreme Silicones India Pvt. Ltd.

- 6.4.16 The Lubrizol Corporation

- 6.4.17 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Analysis

- 7.2 Growing Research and Development to Improve the Sustainability of Silicones