|

市场调查报告书

商品编码

1846140

复合涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Composite Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

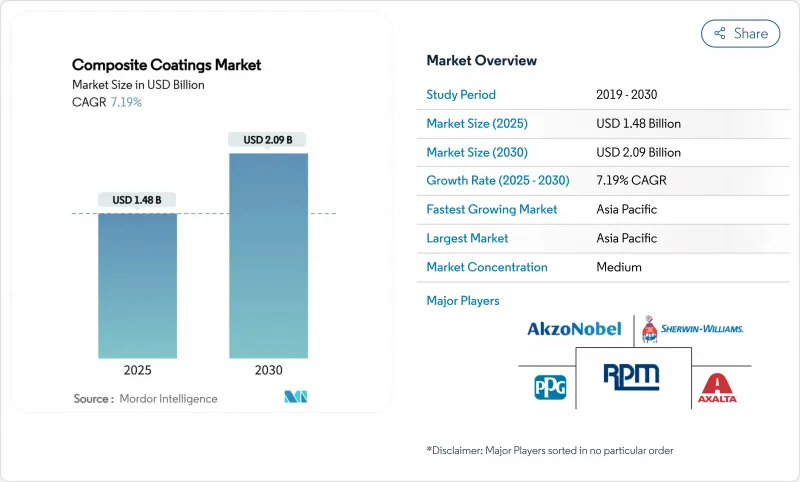

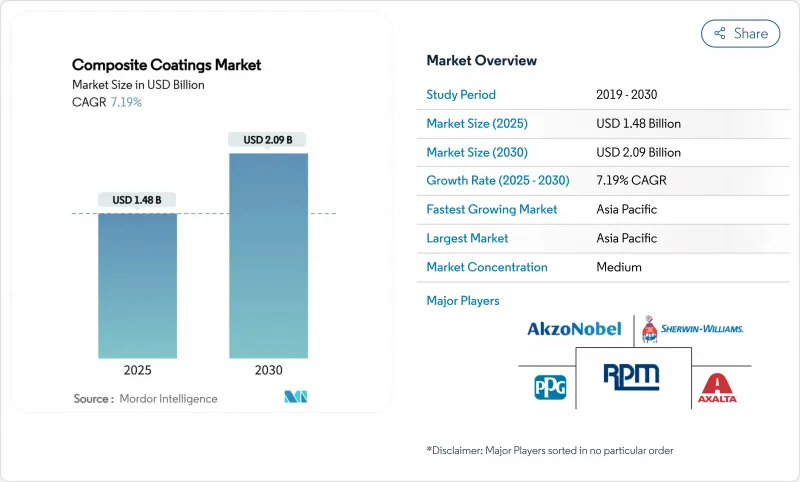

复合涂料市场规模预计在 2025 年为 14.8 亿美元,预计到 2030 年将达到 20.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.19%。

兼具耐腐蚀性、耐磨性和功能性表面特性的多层技术的持续应用预计将推动复合涂层市场的持续扩张。海上石油油气开发的加速、轻量化运输部件的日益普及以及主机厂(OEM)使用寿命规范的日益严格,正在推动需求的成长。氟聚合物、奈米结构和生物基化学领域的技术创新不断涌现,正在开启新的、更具获利能力的用例。同时,区域製造业的转移和大规模可再生能源计划的启动,正在加剧老牌复合材料製造商和专业化新进入者之间的竞争。

全球复合涂料市场趋势与洞察

石油和天然气探勘活动的成长

深水和超深水计划越来越多地指定使用高强度玻璃鳞片增强环氧体系,以承受温度变化、静水压力和海水侵蚀。沙乌地阿拉伯、北海和墨西哥湾的主要海上营运商正在透过改用可抑制阴极剥离和底涂层腐蚀的复合材料屏障,将维护週期从10年延长至15年。在立管、井口和顶部设备上涂抹均匀的涂层可以降低整体拥有成本,儘管初始成本较高。因此,钻机数量的增加和资产寿命延长计画正在推动复合涂层市场销售的持续成长。

对轻质、耐腐蚀运输结构的需求不断增加

寻求延长电动车续航里程的汽车製造商正在用铝和复合材料机壳取代钢製电池机壳,这些外壳需要薄而有弹性的保护。雷射纹理底漆与奈米粒子填充面漆相结合,提高了碳纤维基材的耐磨性和油漆附着力,从而在不牺牲耐用性的情况下减轻了重量。在航太领域,含有微胶囊剂的自修復环氧化学物质可以预警早期腐蚀并自主修復微小缺陷,从而实现预测性维护并缩短飞机週转时间。

加工成本和资本成本高

先进的喷漆室、惰性气体固化区和雷射注射设备会增加资本支出,并延迟小型加工商的投资回报。由于供应紧张,1月欧洲环氧树脂价格上涨,而亚洲库存过剩导致价格下跌。在供应链稳定且设备成本下降之前,一些买家可能会依赖性能较低的传统涂料。

細項分析

预计到2024年,环氧树脂将在复合涂料市场维持45.27%的份额,凸显其在钻探平臺、航太结构和运输零件领域无与伦比的附着力和耐化学性。采用玻璃鳞片和陶瓷微球填充材的快速固化配方可增强阻隔穿透能力并延长维护週期。随着海上投资和船舶电气化需求的成长,环氧复合材料的市场规模预计将稳定成长。

含氟聚合物和新兴生物环氧树脂也同步成长,复合年增长率达8.61%,凸显了该产业正向永续性目标和极端耐候性转型。像Sycomin这样的製造商正在将市场转向其GreenPoxy系列产品,该产品采用废弃甘油和植物油製成,且不影响机械性能。

复合涂层报告按树脂(环氧树脂、聚酯、聚酰胺等)、技术(无电电镀、雷射熔体注射、硬焊等)、终端用户产业(石油天然气、船舶、汽车运输等)和地区(亚太地区、北美、欧洲、南美、中东和非洲)细分。市场预测以美元计算。

区域分析

预计到2024年,亚太地区将占据复合涂料市场的主导地位,达到44.88%,并在2030年维持7.72%的份额。中国大规模的港口扩建、印度的高速公路走廊以及东南亚的石化综合体,共同刺激了重型防护涂料的消费。广东和泰米尔纳德邦沿海的离岸风力发电对防生物污损和防腐蚀系统的需求也日益增加。

受美国职业安全与健康管理局 (OSHA) 和美国环保署( 法规 ) 严格立法的推动,北美地区正大力推广低挥发性有机化合物 (VOC)、高固态化学品。墨西哥湾的深水钻井平台、加拿大油砂平土机以及美国舰队的维修管道,都对陶瓷填充环氧树脂和富锌底漆的需求保持稳定。

欧洲绿色新政蓝图正在推动对生物基和可回收配方的需求,德国汽车製造商和英国航太工厂是萤光和 RFID 自修復透明涂层的早期采用者,北海的离岸风力发电电场正在使用符合国际海事组织环境公约的奈米结构防污膜。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 石油和天然气探勘活动的成长

- 交通运输领域对轻质、耐腐蚀结构的需求不断增加

- 可再生能源硬体向高效能功能表面的转变

- OEM 要求延长涂层寿命并缩短维护週期

- 奈米结构复合面漆可防止离岸风力发电生物污损

- 市场限制

- 加工成本和资本成本高

- 与传统涂料相比,可修復性和可回收性有限

- 多层复合涂层的全球标准不一致

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按树脂

- 环氧树脂

- 聚酯纤维

- 聚酰胺

- 其他(氟树脂、丙烯酸树脂等)

- 依技术

- 无电电镀

- 雷射熔体注射

- 硬焊

- 其他技术(溶胶-凝胶、浸涂等)

- 按最终用户产业

- 石油和天然气

- 海洋

- 汽车和运输

- 基础设施

- 其他最终用户产业(例如航太和国防)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Akzo Nobel NV

- Axalta Coating Systems, LLC

- BEECK Mineral Paints

- Bodycote

- FUSION Mineral Paint

- Hempel A/S

- Henkel AG and Co. KGaA

- Jotun

- KC Jones Plating Company

- KEIM Mineral Coatings of America, Inc.

- Mader Group

- Nippon Paint Holdings Co., Ltd.

- Plasma Coatings Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Socomore

- The Sherwin-Williams Company

第七章 市场机会与未来展望

The Composite Coatings Market size is estimated at USD 1.48 billion in 2025, and is expected to reach USD 2.09 billion by 2030, at a CAGR of 7.19% during the forecast period (2025-2030).

Continuous adoption of multilayer technologies that marry corrosion resistance, wear tolerance, and functional surface attributes positions the composite coatings market for sustained expansion. Accelerating offshore oil and gas developments, widening uptake of lightweight transportation parts, and stricter OEM lifetime specifications are collectively lifting demand. Innovation momentum in fluoropolymer, nano-structured, and bio-based chemistries is unlocking fresh, higher-margin use cases. Meanwhile, regional manufacturing shifts and large-scale renewable-energy projects are intensifying competition among established formulators and specialized newcomers.

Global Composite Coatings Market Trends and Insights

Growth in Oil and Gas Exploration Activities

Deep-water and ultra-deep-water projects are elevating specifications for high-build, glass-flake-reinforced epoxy systems that tolerate temperature swings, hydrostatic pressure, and saline attack. Major offshore operators in Saudi Arabia, the North Sea, and the Gulf of Mexico are extending maintenance cycles toward 10 to 15 years by switching to composite barriers that inhibit cathodic disbondment and under-film corrosion. Uniform coating integrity on risers, wellheads, and topside equipment lowers the total cost of ownership despite higher upfront spend. Rising rig counts and asset-life extension programs, therefore, inject consistent volume growth into the composite coatings market.

Rising Demand for Lightweight, Corrosion-Resistant Structures in Transportation

Automakers pursuing range gains for electric vehicles are replacing steel battery enclosures with aluminum and composite housings that need thin yet resilient protection. Laser-textured primers combined with nanoparticle-filled topcoats elevate wear resistance and paint adhesion on carbon-fiber substrates, supporting weight reductions without compromising durability. In aerospace, self-healing epoxy chemistries incorporating micro-encapsulated agents flag early corrosion onset and autonomously repair micro-scratches, enabling predictive maintenance and shorter aircraft turnaround times.

High Processing and Capital Costs

Sophisticated spray booths, inert-gas curing zones, and laser-injection units raise capital outlays, delaying payback for smaller converters. In January, the prices of epoxy resins rose in Europe amid tight supply, whereas surplus inventory pushed Asian prices lower, illustrating volatility that squeezes margins. Until supply chains stabilize and equipment costs decline, some purchasers will default to lower-performing legacy coatings.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward High-Performance Functional Surfaces for Renewable-Energy Hardware

- OEM Mandates for Extended Coating Life and Reduced Maintenance Cycles

- Limited Repairability and Recyclability Versus Conventional Paints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy maintained a 45.27% composite coatings market share in 2024, underscoring unmatched adhesion and chemical resistance for drilling platforms, aerospace structures, and transportation components. Fast-curing formulations with glass flake or ceramic microsphere fillers reinforce barrier paths, extending maintenance cycles. The composite coatings market size for epoxy systems is projected to grow steadily alongside offshore investments and fleet electrification requirements.

Parallel momentum is building around fluoropolymers and emerging bio-epoxies, whose 8.61% CAGR highlights an industry pivot toward sustainability mandates and extreme weatherability. Manufacturers like Sicomin are moving the market toward GreenPoxy lines incorporating waste glycerol and plant oils without diluting mechanical performance.

The Composite Coatings Report is Segmented by Resin (Epoxy, Polyester, Polyamide, and Others), Technique (Electroless Plating, Laser-Melt Injection, Brazing, and Other Techniques), End-User Industry (Oil and Gas, Marine, Automotive and Transportation, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained a dominant 44.88% share of the composite coatings market in 2024 and is projected to compound at 7.72% through 2030. Massive Chinese port expansions, Indian highway corridors, and Southeast Asian petrochemical complexes collectively fuel the consumption of high-build protective formulations. Offshore wind farms off Guangdong and Tamil Nadu further call for anti-biofouling and erosion-resistant systems.

North America commands substantial adoption driven by rigorous OSHA and EPA statutes that reward low-VOC, high-solids chemistries. The Gulf of Mexico's deep-water rigs, Canada's oil-sands upgraders, and the United States Navy's fleet refurbishment pipeline together underpin steady requisition of ceramic-filled epoxies and zinc-rich primers.

Europe's Green Deal blueprint is steering demand toward bio-derived and recyclable formulations. German automotive producers and UK aerospace plants are early adopters of self-healing clear coats that broadcast integrity status via fluorescence or embedded RFID. Offshore wind foundations across the North Sea rely on nano-structured foul-release films aligned with IMO environmental conventions.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BEECK Mineral Paints

- Bodycote

- FUSION Mineral Paint

- Hempel A/S

- Henkel AG and Co. KGaA

- Jotun

- KC Jones Plating Company

- KEIM Mineral Coatings of America, Inc.

- Mader Group

- Nippon Paint Holdings Co., Ltd.

- Plasma Coatings Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Socomore

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Oil and Gas Exploration Activities

- 4.2.2 Rising Demand for Lightweight, Corrosion-Resistant Structures in Transportation

- 4.2.3 Shift Toward High-Performance Functional Surfaces for Renewable-Energy Hardware

- 4.2.4 OEM Mandates for Extended Coating Life and Reduced Maintenance Cycles

- 4.2.5 Nano-Structured Composite Topcoats Enabling Anti-Biofouling for Offshore Wind

- 4.3 Market Restraints

- 4.3.1 High Processing and Capital Costs

- 4.3.2 Limited Repairability and Recyclability Versus Conventional Paints

- 4.3.3 Inconsistent Global Standards for Multilayer Composite Coatings

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts(Value)

- 5.1 By Resin

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Polyamide

- 5.1.4 Others (Fluoropolymer, Acrylic, etc.)

- 5.2 By Technique

- 5.2.1 Electroless Plating

- 5.2.2 Laser-Melt Injection

- 5.2.3 Brazing

- 5.2.4 Other Techniques (Sol-Gel and Dip-Coating, etc.)

- 5.3 By End-User Industry

- 5.3.1 Oil and Gas

- 5.3.2 Marine

- 5.3.3 Automotive and Transportation

- 5.3.4 Infrastructure

- 5.3.5 Other End-user Industries (Aerospace and Defense, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BEECK Mineral Paints

- 6.4.4 Bodycote

- 6.4.5 FUSION Mineral Paint

- 6.4.6 Hempel A/S

- 6.4.7 Henkel AG and Co. KGaA

- 6.4.8 Jotun

- 6.4.9 KC Jones Plating Company

- 6.4.10 KEIM Mineral Coatings of America, Inc.

- 6.4.11 Mader Group

- 6.4.12 Nippon Paint Holdings Co., Ltd.

- 6.4.13 Plasma Coatings Ltd.

- 6.4.14 PPG Industries, Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 Socomore

- 6.4.17 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment