|

市场调查报告书

商品编码

1846146

流分析:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Streaming Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

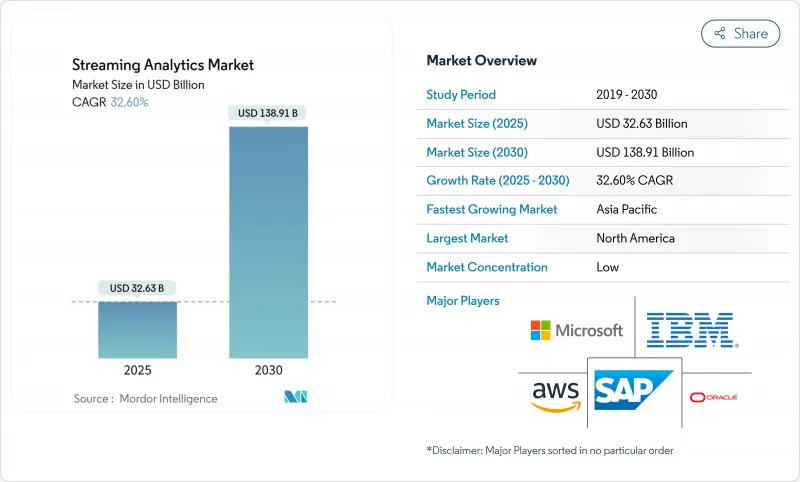

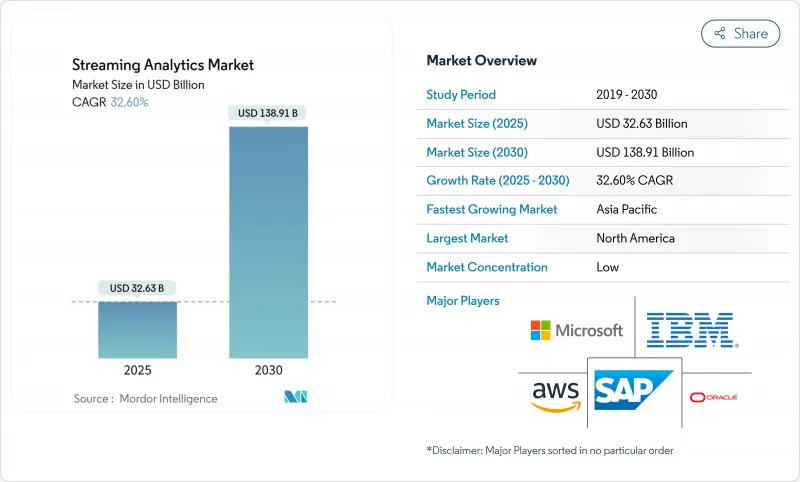

预计到 2025 年流分析市场价值将达到 326.3 亿美元,到 2030 年预计将达到 1,389.1 亿美元,复合年增长率为 33.6%。

随着企业从批次转向响应式、人工智慧驱动的决策循环,从连续资料流中获取近乎即时的洞察正成为董事会的首要任务。直接嵌入资料管道的生成模型、边缘推理晶片的广泛应用以及託管云端服务的兴起,大大缩短了从资料提取到采取行动的时间。供应商正在改进计量收费定价模式,并简化编配,以便在无需配置负担的情况下扩展即时工作负载。虽然早期采用者专注于诈欺侦测和建议引擎,但预计到2025年,工业可靠性用例、远端医疗监控和5G网路优化将实现成长。虽然对资料传输费用的日益敏感以及人才短缺限制了原本强劲的需求,但向事件驱动架构的根本性转变正使流分析市场保持快速增长。

全球流分析市场趋势与洞察

生成式人工智慧驱动的资料管道

与高吞吐量仲介整合的上下文感知模型可在几毫秒内将原始事件转换为规范操作。透过将语言模型与串流遥测相结合,金融机构报告诈骗侦测准确率提高了 40%,同时误报率也降低了。 Confluent Tableflow 和 Databricks Delta Lake 之间的双向连接器可确保模型始终获得最新的、沿袭丰富的数据,从而消除手动刷新周期。零售商可以即时自动调整促销参数,以提高闪购转换率。随着向量搜寻和语意丰富函式库被添加到核心流引擎中,预测性维护和异常分类正在从仪表板转向封闭式自主。因此,企业越来越渴望在不受传统 ETL 延迟影响的情况下实现 AI 的营运。

支援设备端处理的边缘 AI 晶片

NVIDIA Jetson AGX Thor 的运算能力比上一代产品高出 8 倍,记忆体容量高达 128GB,支援从源头进行大规模转换推理。透过将此模组放置在振动感测器旁边,製造商可以在轴承磨损导致代价高昂的停机之前检测到它。医院使用边缘推理在病患生命征像出现异常时提醒护士,并解决限制持续云端上传的隐私法规问题。 Groq 的 LPU 等新型加速器将令牌产生速度提升至每秒 300 个令牌,使对话助理能够在自助服务终端内运作。透过避免回程传输延迟和频宽费用,公司可以在船舶、矿场以及连接不稳定的农村基地台等环境中解锁即时用例。这项技术扩展了流分析市场的地理覆盖范围,同时加强了对资料主权法规的合规性。

卡夫卡技能短缺和薪资通膨加剧

儘管超过 80% 的财富 100 强公司都在使用 Kafka,但招聘网站提供的职位远多于合格工程师的数量。美国工程师的薪资超过 10 万美元,这给中端市场预算带来了压力。仲介、复製元素和语义准确性等高难度的学习曲线阻碍了新人的进入,而云端供应商则会挖走高阶员工,导致人才招募变得困难。託管平台有所帮助,但灵活性是以订阅成本为代价的。咨询合作伙伴正在扩大培训训练营,但推出时间仍落后于计划截止日期。在教育管道跟上之前,人才短缺可能会抑制部署,尤其是在外包受限的受监管行业。

細項分析

鑑于仲介、处理器和互动式查询引擎的广泛采用,解决方案将成为2024年流分析市场的结构性支柱,占总收入的65.4%。然而,随着企业寻求蓝图、迁移协助和全天候SRE支持,到2030年,服务将以33.8%的复合年增长率加速成长。架构评估、资料品质改进和模式管治是新的工作说明书的主导。 Confluent与安永于2025年结成策略联盟,以捆绑实施加速器,凸显了对外部专业知识的需求。随着对可观察性和成本优化的需求不断增长,託管服务将从简单的託管扩展到根据事件速度自动调整容量。

技能短缺甚至促使那些规避风险的行业也将运行时营运外包,将预算从资本支出转向经常性服务。供应商蓝图显示,PCI-DSS 和 HIPAA 合规模块正在预先打包到订阅层级中,从而降低了采用监管措施的门槛。因此,预计流分析专业服务和託管服务的市场规模将超过核心软体收益,从而强化良性循环,即供应商之间的差异化取决于专业知识,而非工具数量。

到2024年,云端运算将占总营收的59.5%,复合年增长率为34.2%。超大规模企业将自动扩展的串流引擎与Lakehouse和向量资料库结合,无需采购硬体即可提取、丰富和提供机器学习功能。谷歌云端透过将Pub/Sub、Dataflow、BigQuery和Vertex AI整合成一个託管的连续体,减轻了缺乏分散式系统人才的公司的负担。本地工作负载的流分析市场规模在国防、金融科技和公共卫生领域仍然很重要,但更新周期和资本支出障碍使其无法赶上云端运算的成长。

混合蓝图透过使用 Azure SQL Edge 在工厂中处理敏感远端检测,然后再将聚合数据传输到云端的机器学习端点,从而降低出口成本。提供者现在支援基于策略的主题放置,确保各个分区位于国家边界内,以满足新兴的主权规则。展望未来,随着买家寻求出口成本保护,涵盖 IAM、沿袭和管治的多重云端联合工具可能会影响供应商的选择。

区域分析

到2024年,北美将占据29.7%的收入,这得益于早期超大规模生态系统和一群成熟的Kafka专家。金融服务、叫车和零售领域的先驱企业已经检验了投资回报率,创建了参考设计,并推动了各行业的采用。然而,市场饱和限制了增量成长,而技术纯熟劳工的瓶颈正在推高薪资溢价,从而影响部署预算。政府对涵盖天气、山火、出行等资讯的即时公共部门仪表板的需求正在稳步增长,儘管合规性要求严格。

受5G部署、智慧工厂专案和主权倡议整合的推动,亚太地区的复合年增长率最高,达34.1%。预计到2030年,中国的人工智慧收入将达到近3,000亿美元,而边缘流技术对于自主製造单元至关重要。印度的公共数位基础设施正在将事件流纳入税务、身分识别和支付管道,东南亚的电商平台则依靠即时个人化来赢得行动用户。本地晶片製造商和通讯业者正在共同创新,以降低硬体成本并加强区域供应商生态系统,保持应用动能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 生成式人工智慧驱动的资料管道

- 支援设备端流处理的边缘AI晶片

- 面向公民开发者的低程式码/无程式码流工作台

- 事件驱动的微服务成为主流

- 中小企业对云端流分析的需求不断增长(共识驱动因素)

- 物联网和工业自动化的扩展(共识驱动因素)

- 市场限制

- Kafka 技能短缺和薪资通膨上升

- 超大规模资料中心业者云端中的出口费用不断上涨

- 限制跨境资料流动的资料主权法规

- 传统的以批次为中心的架构正在减缓迁移速度(共识)

- 供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估影响市场的宏观经济因素

第五章市场规模及成长预测

- 按组件

- 软体

- 按服务

- 按部署

- 本地部署

- 云端基础

- 按最终用户产业

- 媒体与娱乐

- 零售与电子商务

- 製造业

- BFSI

- 医疗保健和生命科学

- 运输/物流

- 通讯业

- 其他的

- 按组织规模

- 大公司

- 小型企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services

- Google(Alphabet)

- Confluent Inc.

- TIBCO Software Inc.

- Software AG

- SAS Institute Inc.

- Striim Inc.

- Impetus Technologies

- Databricks

- Snowflake Inc.

- Apache Software Foundation(Kafka/Flink)

- Cloudera Inc.

- Ververica

- Aiven Ltd.

- Timeplus

- Hazelcast Inc.

- StreamSets Inc.

- Redpanda Data

- Cisco Systems(ThousandEyes)

第七章 市场机会与未来展望

The streaming analytics market is valued at USD 32.63 billion in 2025 and is forecast to reach USD 138.91 billion by 2030, advancing at a 33.6% CAGR.

Near-instant insights generated from continuously flowing data are becoming a board-room priority as enterprises pivot away from batch practices toward responsive, AI-enhanced decision loops. Generative models embedded directly inside data pipelines, wide availability of edge inference chips, and a growing set of managed cloud services collectively compress the time between data capture and action. Vendors are refining pay-as-you-go pricing and simplifying orchestration so that firms can scale real-time workloads without provisioning burdens. While early adopters focused on fraud detection and recommendation engines, 2025 sees an uptick in industrial reliability use cases, telehealth monitoring, and 5G-enabled network optimization. Heightened sensitivity to data-transfer charges and talent scarcity temper otherwise robust demand, yet the fundamental shift toward event-driven architectures keeps the streaming analytics market on a steep growth path.

Global Streaming Analytics Market Trends and Insights

Generative-AI Infused Data Pipelines

Context-aware models integrated with high-throughput brokers turn raw events into prescriptive actions in milliseconds. Financial institutions combining language models with streaming telemetry report 40% gains in fraud-detection accuracy while slashing false positives. Bidirectional connectors between Confluent Tableflow and Databricks Delta Lake keep models supplied with fresh, lineage-rich data, eliminating manual refresh cycles. Retailers now auto-tune promotion parameters in real time, lifting conversion rates during flash sales. As libraries for vector search and semantic enrichment join core stream engines, predictive maintenance and anomaly triage are shifting from dashboards to closed-loop autonomy. The result is a broader enterprise appetite to operationalize AI without the latency penalties of traditional ETL.

Edge AI Chips Enabling On-Device Processing

NVIDIA's Jetson AGX Thor supplies up to 8 times the prior-generation compute, with 128 GB memory supporting hefty transformer inference at source. Manufacturers deploy the module next to vibration sensors so that models flag bearing wear before costly downtime. Hospitals rely on edge inference to trigger nurse alerts when patient vitals deviate, meeting privacy rules that restrict continuous cloud upload . Emerging accelerators like Groq's LPU push token generation to 300 tokens per second, letting conversational assistants run inside teller kiosks. By sidestepping back-haul latency and bandwidth charges, firms unlock real-time use cases in ships, mines, and rural cell towers where connectivity remains inconsistent. The technology thus widens geographic reach for the streaming analytics market while reinforcing compliance with data-sovereignty codes.

Rising Kafka Skill-Set Shortage and Wage Inflation

Eighty-plus percent of Fortune 100 enterprises rely on Kafka, yet job boards list far more openings than qualified engineers. United States salaries top USD 100,000, squeezing budgets for mid-tier firms. The steep learning curve around brokers, replication factors, and exactly-once semantics deters newcomers, while retaining talent proves challenging as cloud vendors poach senior staff. Managed platforms help but trade flexibility for subscription outlays. Consulting partners expand training bootcamps, though ramp-up times still lag project deadlines. Until educational pipelines catch up, talent scarcity will curb some rollouts, particularly in regulated sectors where outsourcing is constrained.

Other drivers and restraints analyzed in the detailed report include:

- Low-Code/No-Code Streaming Workbenches for Citizen Developers

- Mainstream Adoption of Event-Driven Micro-Services

- Escalating Egress Fees on Hyperscaler Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions provided the structural backbone of the streaming analytics market in 2024 with 65.4% revenue, reflecting wide adoption of brokers, processors, and interactive query engines. Yet services are accelerating at 33.8% CAGR through 2030 as enterprises seek design blueprints, migration aid, and 24/7 SRE support. Architecture assessments, data-quality remediation, and schema governance dominate new statements of work. Confluent and EY formed a strategic alliance in 2025 to bundle implementation accelerators, underscoring demand for outside expertise. As observability and cost-optimization mandates rise, managed services extend from simple hosting to auto-tuning capacity based on event velocity.

Skills shortages push even risk-averse sectors to outsource runtime operations, shifting budgets from capital expenditure to recurring services. Vendor roadmaps show pre-packaged compliance modules for PCI-DSS and HIPAA emerging inside subscription tiers, which lowers the barrier for regulated adopters. Consequently, the streaming analytics market size for professional and managed services is projected to outpace core software revenues, reinforcing a virtuous cycle where know-how, not tool count, differentiates providers.

Cloud claimed 59.5% of 2024 revenue, and its 34.2% CAGR signals continued preference for elastic capacity. Hyperscalers pair auto-scaling stream engines with lakehouses and vector databases, letting teams ingest, enrich, and serve ML features without hardware procurement. Google Cloud stitches Pub/Sub, Dataflow, BigQuery, and Vertex AI into a managed continuum, easing burden for firms lacking distributed-systems talent. The streaming analytics market size for on-premise workloads remains meaningful in defense, fintech, and public health, but growth trails cloud due to refresh cycles and capex hurdles.

Hybrid blueprints mitigate egress costs by processing sensitive telemetry in factories with Azure SQL Edge before forwarding aggregates to cloud ML endpoints. Providers now enable policy-based topic placement so that individual partitions stay inside national borders, satisfying emerging sovereignty rules. Over the forecast, multicloud federation tools that span IAM, lineage, and governance will influence vendor selection as buyers seek exit-cost protection.

Streaming Analytics Market Report is Segmented by Component (Software, Services), Deployment (On-Premise, Cloud-Based), End-User Industry (Media and Entertainment, Retail and ECommerce, Manufacturing, BFSI, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), and by Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America captured 29.7% revenue in 2024 owing to early hyperscaler ecosystems and a mature cadre of Kafka specialists. Financial services, ride-hailing, and retail pioneers validated ROI, creating reference designs that spread across sectors. Yet saturation tempers incremental growth, and skilled-labor bottlenecks spark wage premiums that influence deployment budgets. Government push for real-time public-sector dashboards-covering weather, wildfire, and mobility-adds steady demand, albeit at rigorous compliance levels.

Asia-Pacific posts the swiftest 34.1% CAGR as 5G rollouts, smart-factory programs, and sovereign cloud initiatives converge. China's AI revenue projections near USD 300 billion by 2030, with edge streaming deemed vital to autonomous manufacturing cells. India's public-digital-infrastructure drive embeds event streams into tax, identity, and payments rails, while Southeast Asian e-commerce platforms rely on real-time personalization to compete for mobile users. Local chipmakers and telcos co-innovate, reducing hardware costs and boosting regional vendor ecosystems, which keeps adoption momentum high.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services

- Google (Alphabet)

- Confluent Inc.

- TIBCO Software Inc.

- Software AG

- SAS Institute Inc.

- Striim Inc.

- Impetus Technologies

- Databricks

- Snowflake Inc.

- Apache Software Foundation (Kafka/Flink)

- Cloudera Inc.

- Ververica

- Aiven Ltd.

- Timeplus

- Hazelcast Inc.

- StreamSets Inc.

- Redpanda Data

- Cisco Systems (ThousandEyes)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Generative-AI infused data pipelines

- 4.2.2 Edge AI chips enabling on-device stream processing

- 4.2.3 Low-code/no-code streaming workbenches for citizen developers

- 4.2.4 Mainstream adoption of event-driven micro-services

- 4.2.5 Growing SME demand for cloud stream analytics (consensus driver)

- 4.2.6 Expansion of IoT and industrial automation (consensus driver)

- 4.3 Market Restraints

- 4.3.1 Rising Kafka skill-set shortage and wage inflation

- 4.3.2 Escalating egress fees on hyperscaler clouds

- 4.3.3 Data-sovereignty regulations limiting cross-border stream flows

- 4.3.4 Legacy batch-centric architectures delaying migration (consensus)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud-Based

- 5.3 By End-user Industry

- 5.3.1 Media and Entertainment

- 5.3.2 Retail and eCommerce

- 5.3.3 Manufacturing

- 5.3.4 BFSI

- 5.3.5 Healthcare and Life Sciences

- 5.3.6 Transportation and Logistics

- 5.3.7 Telecommunications

- 5.3.8 Others

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Oracle Corporation

- 6.4.4 SAP SE

- 6.4.5 Amazon Web Services

- 6.4.6 Google (Alphabet)

- 6.4.7 Confluent Inc.

- 6.4.8 TIBCO Software Inc.

- 6.4.9 Software AG

- 6.4.10 SAS Institute Inc.

- 6.4.11 Striim Inc.

- 6.4.12 Impetus Technologies

- 6.4.13 Databricks

- 6.4.14 Snowflake Inc.

- 6.4.15 Apache Software Foundation (Kafka/Flink)

- 6.4.16 Cloudera Inc.

- 6.4.17 Ververica

- 6.4.18 Aiven Ltd.

- 6.4.19 Timeplus

- 6.4.20 Hazelcast Inc.

- 6.4.21 StreamSets Inc.

- 6.4.22 Redpanda Data

- 6.4.23 Cisco Systems (ThousandEyes)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment