|

市场调查报告书

商品编码

1846152

乙烯-四氟乙烯(ETFE):市场份额分析、产业趋势、统计数据、成长预测(2025-2030)Ethylene Tetrafluoroethylene (ETFE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

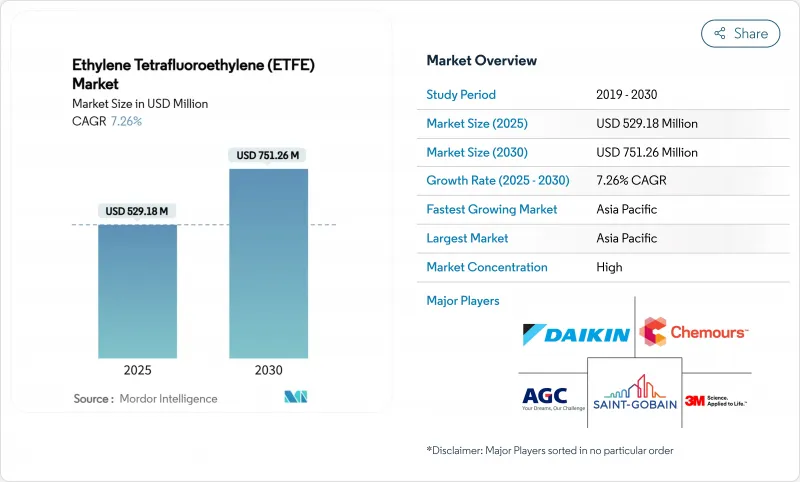

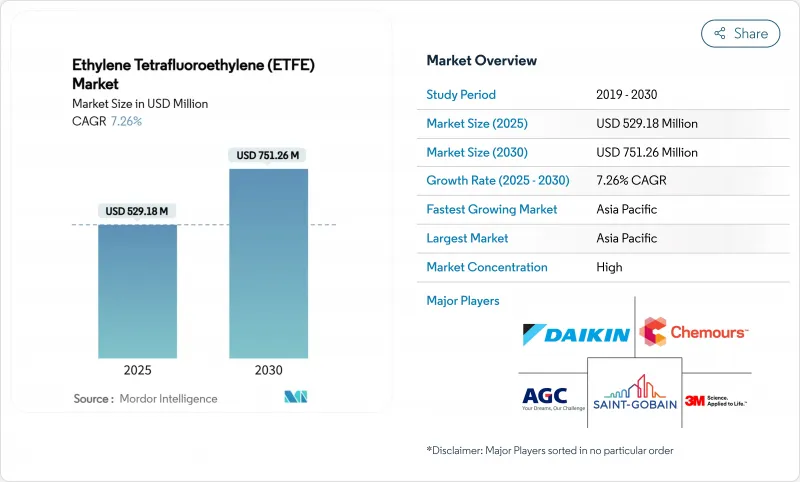

乙烯-四氟乙烯(ETFE) 市场规模预计在 2025 年为 5.2918 亿美元,预计到 2030 年将达到 7.5126 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.26%。

由于 ETFE 比传统玻璃和聚合物替代品具有更出色的透明度、化学惰性和拉伸强度,因此建筑膜、航太布线和透明光伏层压板是关键的成长动力。北美和欧洲的体育场屋顶继续展示 ETFE 的轻质和采光优势,而航空公司和电动垂直起降 (eVTOL) 製造商则指定使用能够承受热循环和液压油侵蚀的 ETFE 绝缘电缆。太阳能电池组件製造商正在采用透明 ETFE 层压板将阳光转化为电能,同时保持建筑幕墙美观,将 ETFE 市场扩展到建筑一体化光伏领域。亚太地区不断提高的生产能力支持了供应安全,而欧洲和北美的全氟烷基物质 (PFAS) 法规也可能推动对更绿色化学和本地化价值链的投资。

全球乙烯-四氟乙烯(ETFE) 市场趋势与洞察

作为体育场类建筑的屋顶覆盖材料越来越受欢迎

体育场设计师越来越多地指定使用 ETFE 屋顶,因为它可以提供自然采光,而不是像传统玻璃座舱罩那样增加结构重量。 Intuit Dome 的 277,000 平方英尺倾斜屋顶结构使用透明的 ETFE 薄膜,可实现自然通风,因此无需在某些区域使用空调,同时还获得了能源与环境设计先锋奖 (LEED) 白金认证。 ETFE 的自熄特性消除了火灾风险,这传统上限制了它在高运转率设施中的应用。除了其功能之外,ETFE 还能散射阳光,防止温室效应,同时保持 95% 的太阳透射率,从而创造出传统屋顶材料无法实现的最佳比赛环境。随着场馆营运商认识到 ETFE 的长期成本优势,这一趋势正在加速,与频繁更换玻璃面板相比,ETFE 的维护只需每两到三年清洁一次。

航太航太布线对乙烯-四氟乙烯(ETFE) 电缆的需求不断增加

航太製造商越来越多地采用 ETFE 电缆,因为它们可以承受极端的温度循环和化学物质的侵蚀,而这些会劣化传统绝缘材料的性能。 《2025 年航太与国防展望》预测,全球航空客运量将成长 11.6%,国防费用将超过 2.4 兆美元,这将对高性能电缆解决方案产生持续的需求。 ETFE 的耐液压油性和热稳定性对于下一代飞机系统至关重要,特别是电动垂直起降 (eVTOL) 飞行器,因为轻量化结构至关重要。军事应用推高了 ETFE 电缆的价格,因为它们符合战斗机和太空船热控製表面的严格规格。向更多电动飞机架构的转变正在将 ETFE 的作用从传统电缆扩展到电源管理系统,在电源管理系统中,它的热稳定性允许高电流密度而不会发生绝缘故障。

环境问题和对全氟烷基物质 (PFAS)/含氟聚合物日益严格的监管

欧盟提案的全氟和多氟烷基物质 (PFAS) 法规可能禁止超过 10,000 种浓度超过规定限值的物质,包括 ETFE,实施时间表延长至 2029 年。这种监管压力迫使製造商制定 PFAS 管理策略,包括供应链审核和采购替代品,但合适的替代品通常性能较低或成本较高。大金已投资超过 3 亿美元用于捕获 PFAS排放,目标是到 2030 年实现製程废水中 99.9% 的 PFAS 回收率,同时过渡到永续製造技术。欧洲环境署强调,PFAS 聚合物占欧盟 (EU) 市场 PFAS 总量的 24-40%,其持久性和潜在毒性会在从生产到处置的整个生命週期中造成污染。欧洲的集中式方法与美国各州法规之间的监管分散增加了营运成本并产生了合规复杂性,限制了 ETFE 产品的市场准入。

細項分析

到2024年,挤出成型将占总收入的61.76%,凸显了连续薄膜、片材和电线涂层的效率。随着体育场馆和温室计划的推进,ETFE挤出级产品的市场规模预计将稳定成长。射出成型的复合年增长率为8.09%,反映了对精密零件(例如复杂缆线连接器和半导体腔体组件)日益增长的需求。由于加工商希望在不拥有多项固定资产的情况下满足航太航天和电子行业的利基订单,能够同时进行挤出和射出成型的混合成型机正日益普及。

NEOFLON ETFE-TX 等优化树脂等级可增强两种製程的拉伸性能,从而实现更薄的壁厚和更轻的零件重量,且不影响其耐用性。製程设备製造商正在推出针对 ETFE 高熔点特性而客製化的螺桿几何和热流道系统,以帮助加工商避免劣化和表面缺陷。

到2024年,颗粒材料将占据56.14%的市场份额,因为颗粒状材料能够确保挤出和注射过程中的稳定流动。电线电缆製造商更青睐颗粒材料,因为它们能够实现精确计量,从而最大限度地减少介电缺陷。粉末材料市场以8.57%的复合年增长率成长,适用于需要薄而均匀涂层的喷涂和积层製造应用。随着航太为粉末床熔合和冷喷涂修復做好准备,粉末ETFE的市场份额将持续上升。

製造商正在将奈米填料添加到粉末等级中,以提高製程管道和燃料装置的表面硬度。混合形式、微粒和高堆积密度粉末弥补了传统颗粒和超细颗粒之间的差距,使转换器能够灵活地在挤出和涂层生产线之间切换,并最大限度地减少转换。

区域分析

预计到2024年,亚太地区将占全球市场收益的47.24%,到2030年,复合年增长率将达到8.66%,这得益于中国乙烯产能的不断扩大以及日本在高纯度氟聚合物领域的专业技术。 ETFE屋顶材料常用于政府支持的体育场和高铁站,推动了该地区的建设。当地加工商正为半导体和锂电池工厂扩建粉末涂料生产线,深化国内价值取得。

北美仍然是ETFE的主要消费市场,美国国家橄榄球联盟(NFL)和美国职业足球大联盟的场馆都使用ETFE膜来获得清晰的视野并全年保护草坪。从华盛顿州到魁北克省的航太丛集正在推动电线绝缘材料的需求,而墨西哥湾沿岸的可再生燃料炼油厂则使用ETFE管材进行防腐。区域清洁能源激励措施正在推动BIPV(建筑一体化光伏)建筑幕墙的资金投入,这些外墙充分利用了ETFE的光学特性。

在欧洲应对PFAS监管举步维艰之际,ETFE正被用于标誌性建筑和离岸风力发电电缆。德国汽车製造商正在800V动力传动系统中使用ETFE线束,北欧国家正在温室中安装ETFE层压农业太阳能屋顶,以延长日照时间有限的生产週期。乙烯的合理化调整导致供应紧张,但特种ETFE牌号仍保持定价优势。

虽然南美、中东和非洲仍在发展中,但即将举行的锦标赛的体育场维修和机场扩建已开始使用ETFE建筑幕墙。儘管当地树脂短缺促使进口,但区域工程公司正在与现有供应商合作,以促进技术转移和建筑专业知识的累积。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 作为体育场类建筑的屋顶覆盖材料越来越受欢迎

- 航太航太布线对乙烯-四氟乙烯(ETFE) 电缆的需求不断增加

- 传统玻璃建筑幕墙的轻盈耐用替代品

- 推出透明乙烯-四氟乙烯(ETFE) 太阳能电池层压板

- 可再生航空燃料工厂所需的耐化学腐蚀管路

- 市场限制

- 环境问题以及对全氟和多氟烷基物质 (PFAS)/含氟聚合物的更严格监管

- 单层乙烯-四氟乙烯(ETFE) 垫的防火安全要求更加严格

- 全球乙烯-四氟乙烯(ETFE)树脂产能已达极限

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依技术

- 挤压成型

- 射出成型

- 依产品类型

- 粉末

- 颗粒

- 其他产品类型(例如颗粒)

- 按用途

- 薄膜和片材

- 电线电缆

- 管子

- 涂层

- 其他应用(例如 3D 列印零件)

- 按最终用途行业

- 建筑/施工

- 航太/国防

- 汽车和电动交通

- 电气和电子

- 太阳能发电

- 工业和化学加工

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- 3M

- AGC Inc.

- Arkema

- DAIKIN INDUSTRIES, Ltd.

- Denise Chemical Co., Limited

- Everflon Fluoropolymers

- Ganzhou Lichang New Materials Co., Ltd.

- Guarniflon SpA

- HaloPolymer, OJSC

- NOWOFOL Kunststoffprodukte GmbH & Co. KG

- SABIC

- Saint-Gobain

- The Chemours Company

- Vector Foiltec

- Zeus Company LLC

第七章 市场机会与未来展望

The Ethylene Tetrafluoroethylene Market size is estimated at USD 529.18 Million in 2025, and is expected to reach USD 751.26 Million by 2030, at a CAGR of 7.26% during the forecast period (2025-2030).

Architectural membranes, aerospace wiring, and transparent photovoltaic laminates are the principal growth engines, as the material's clarity, chemical inertness, and tensile strength outperform conventional glass and polymer alternatives. Stadium roofing projects across North America and Europe continue to showcase ETFE's weight savings and daylighting advantages, while airlines and Electric Vertical Take-off and Landing (eVTOL) manufacturers specify ETFE-insulated cables to withstand thermal cycling and hydraulic-fluid exposure. Solar module producers are deploying transparent ETFE laminates that preserve facade aesthetics and convert sunlight into power, expanding the ETFE market into building-integrated photovoltaics. Regional production capacity additions in Asia-Pacific underpin supply security, although Per- and polyfluoroalkyl substances (PFAS) regulations in Europe and North America could redirect investment toward greener chemistries and localized value chains.

Global Ethylene Tetrafluoroethylene (ETFE) Market Trends and Insights

Gaining Popularity as Roof-cover Material for Stadium-type Structures

Stadium architects are increasingly specifying ETFE roofing systems because they deliver natural lighting while eliminating the structural weight penalties of traditional glass canopies. The Intuit Dome's 277,000 square foot diagrid roof structure incorporates clear ETFE membranes that allow natural airflow, eliminating air conditioning requirements in certain areas while achieving Leadership in Energy and Environmental Design (LEED) Platinum certification. The material's self-extinguishing properties address fire safety concerns that have historically limited membrane adoption in high-occupancy venues. Beyond functionality, ETFE's ability to scatter sunlight prevents greenhouse effects while maintaining 95% daylight transmission, creating optimal playing conditions that traditional roofing cannot match. This trend is accelerating as venue operators recognize ETFE's long-term cost advantages, with maintenance requirements limited to cleaning every 2-3 years compared to frequent glass panel replacements.

Rising Demand for Ethylene Tetrafluoroethylene (ETFE) Cables in Aerospace Wiring

Aerospace manufacturers are expanding ETFE cable adoption because the material withstands extreme temperature cycles and chemical exposure that would degrade conventional insulation materials. The 2025 Aerospace and Defense Industry Outlook projects 11.6% growth in global air passenger traffic, with defense spending surpassing USD 2.4 Trillion, creating sustained demand for high-performance wiring solutions. ETFE's resistance to hydraulic fluids and thermal stability make it essential for next-generation aircraft systems, particularly in electric vertical takeoff and landing (eVTOL) aircraft where weight reduction is critical. Military applications drive premium pricing, as ETFE cables meet stringent specifications for combat aircraft and spacecraft thermal control surfaces. The shift toward more electric aircraft architectures is expanding ETFE's role beyond traditional wiring to power management systems, where its thermal stability enables higher current densities without insulation failure.

Environmental Concerns and Stricter Per- and Polyfluoroalkyl Substances (PFAS)/Fluoropolymer Regulations

The European Union's proposed Per- and Polyfluoroalkyl Substances (PFAS) restrictions could ban over 10,000 substances, including ETFE, in concentrations exceeding specified limits, with implementation timelines extending to 2029. This regulatory pressure is forcing manufacturers to develop PFAS management strategies, including supply chain audits and sourcing alternatives, though suitable replacements often underperform or carry higher costs. Daikin has responded by investing over USD 300 Million to capture PFAS emissions, targeting a 99.9% capture rate in process water discharges while transitioning to sustainable manufacturing technologies by 2030. The European Environment Agency emphasizes that PFAS polymers constitute 24-40% of total PFAS volume in European Union (EU) markets, with their persistence and potential toxicity creating pollution throughout their lifecycle from production to disposal. The regulatory fragmentation between Europe's centralized approach and the United States' (US) state-by-state restrictions creates compliance complexities that increase operational costs and limit market access for ETFE products.

Other drivers and restraints analyzed in the detailed report include:

- Light-weight, Durable Facades Replacing Conventional Glass

- Emergence of Transparent Ethylene Tetrafluoroethylene (ETFE) Photovoltaic Laminates

- Fire-safety Scrutiny on Single-skin Ethylene Tetrafluoroethylene (ETFE) Cushions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Extrusion molding generated 61.76% of 2024 revenue, highlighting its efficiency for continuous films, sheets, and wire coatings. The ETFE market size for extrusion-grade products is set to grow steadily alongside stadium and greenhouse projects. Injection molding's 8.09% CAGR reflects rising demand for precision parts such as complex cable connectors and semiconductor chamber components. Hybrid machines capable of both extrusion and injection are gaining traction as converters aim to serve niche aerospace and electronics orders without multiple capital assets.

Optimized resin grades like NEOFLON ETFE-TX strengthen tensile performance for both processes, enabling thinner walls and lower part weight without sacrificing durability. Processing-equipment makers are introducing screw geometries and hot-runner systems tailored to ETFE's high melt temperature, helping processors avoid degradation and surface defects.

Granules accounted for 56.14% of the 2024 market value share because pelletized form assures consistent flow during extrusion and injection. Wire & cable producers favor granules for precise metering that minimizes dielectric defects. Powder grades, expanding at 8.57% CAGR, cater to spray-coating and additive-manufacturing uses where thin, uniform layers are mandatory. The ETFE market share for powders will rise as aerospace primes qualify powder-bed fusion and cold-spray repairs.

Manufacturers are blending nano-fillers into powder grades to raise surface hardness for process piping and fuel plants. Hybrid formats, micro-granules and high-bulk-density powders bridge the gap between conventional pellets and ultrafine particles, giving converters flexibility to switch between extrusion and coating lines with minimal changeovers.

The Ethylene Tetrafluoroethylene (ETFE) Market Report is Segmented by Technology (Extrusion Molding and Injection Molding), Product Type (Powder, Granule, and More), Application (Coatings, Tubes, and More), End-Use Industry (Aerospace and Defense, Solar Photovoltaics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 47.24% of global market revenue in 2024 and is advancing at an 8.66% CAGR through 2030, benefiting from China's expanding ethylene capacity and Japan's expertise in high-purity fluoropolymers. Government-backed stadium and high-speed-rail stations frequently adopt ETFE roofs, reinforcing regional construction pull. Local converters scale powder-coating lines to serve semiconductor fabs and lithium-battery plants, deepening domestic value capture.

North America remains a prime consumer as National Football League (NFL) and Major League Soccer venues adopt ETFE membranes that deliver clear sightlines and year-round turf protection Axios. The aerospace cluster from Washington State to Quebec drives wire-insulation demand, while renewable-fuel refineries along the Gulf Coast integrate ETFE tubing for corrosion control. Regional clean-energy incentives funnel capital toward Building-Integrated Photovoltaics (BIPV) facades that capitalize on ETFE's optical properties.

Europe grapples with PFAS regulation but still embraces ETFE for iconic structures and offshore wind farm cables. German carmakers deploy ETFE wire harnesses in 800-V drivetrains, whereas Nordic countries integrate ETFE-laminated agrivoltaic roofs across greenhouses to stretch production seasons under limited sunlight. Ethylene rationalization tightens supply, yet specialty ETFE grades retain pricing power.

South America and the Middle East & Africa remain nascent, yet stadium upgrades for upcoming tournaments and airport expansions are beginning to spec ETFE facades. Local resin shortages prompt imports, but regional engineering firms partner with established suppliers to accelerate technology transfer and installation expertise.

- 3M

- AGC Inc.

- Arkema

- DAIKIN INDUSTRIES, Ltd.

- Denise Chemical Co., Limited

- Everflon Fluoropolymers

- Ganzhou Lichang New Materials Co., Ltd.

- Guarniflon S.p.A

- HaloPolymer, OJSC

- NOWOFOL Kunststoffprodukte GmbH & Co. KG

- SABIC

- Saint-Gobain

- The Chemours Company

- Vector Foiltec

- Zeus Company LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Gaining Popularity as Roof-cover Material for Stadium-type Structures

- 4.2.2 Rising Demand for Ethylene Tetrafluoroethylene (ETFE) Cables in Aerospace Wiring

- 4.2.3 Light-weight, Durable Facades Replacing Conventional Glass

- 4.2.4 Emergence of Transparent Ethylene Tetrafluoroethylene (ETFE) Photovoltaic Laminates

- 4.2.5 Chemical-resistant Tubing Demand in Renewable Aviation-fuel Plants

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns and Stricter Per- and polyfluoroalkyl substances (PFAS)/fluoropolymer Regulations

- 4.3.2 Fire-safety Scrutiny on Single-skin Ethylene Tetrafluoroethylene (ETFE) Cushions

- 4.3.3 Limited Global Ethylene Tetrafluoroethylene (ETFE)-resin Capacity

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Extrusion Molding

- 5.1.2 Injection Molding

- 5.2 By Product Type

- 5.2.1 Powder

- 5.2.2 Granule

- 5.2.3 Other Product Types (Pellet, etc.)

- 5.3 By Application

- 5.3.1 Film and Sheet

- 5.3.2 Wire and Cable

- 5.3.3 Tubes

- 5.3.4 Coatings

- 5.3.5 Other Applications (3D-Printed Components, etc.)

- 5.4 By End-use Industry

- 5.4.1 Building and Construction

- 5.4.2 Aerospace and Defense

- 5.4.3 Automotive and E-Mobility

- 5.4.4 Electrical and Electronics

- 5.4.5 Solar Photovoltaics

- 5.4.6 Industrial and Chemical Processing

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 DAIKIN INDUSTRIES, Ltd.

- 6.4.5 Denise Chemical Co., Limited

- 6.4.6 Everflon Fluoropolymers

- 6.4.7 Ganzhou Lichang New Materials Co., Ltd.

- 6.4.8 Guarniflon S.p.A

- 6.4.9 HaloPolymer, OJSC

- 6.4.10 NOWOFOL Kunststoffprodukte GmbH & Co. KG

- 6.4.11 SABIC

- 6.4.12 Saint-Gobain

- 6.4.13 The Chemours Company

- 6.4.14 Vector Foiltec

- 6.4.15 Zeus Company LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Investment in Ethylene Tetrafluoroethylene (ETFE) Recycling Technologies