|

市场调查报告书

商品编码

1846159

指纹模组:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Fingerprint Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

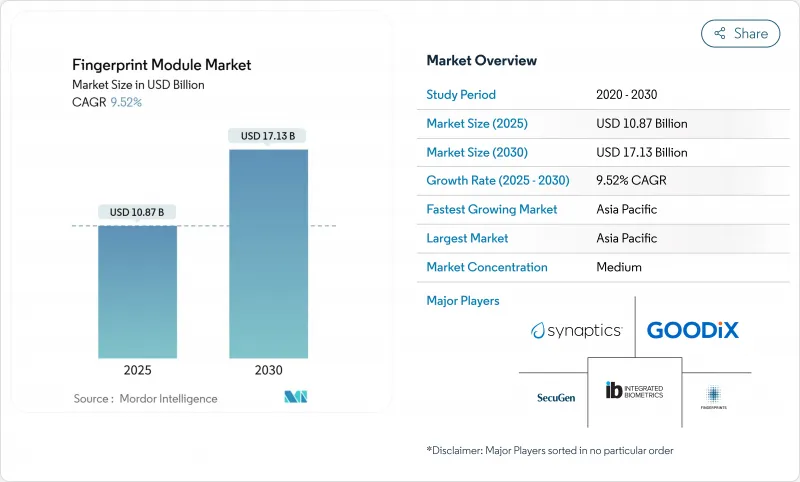

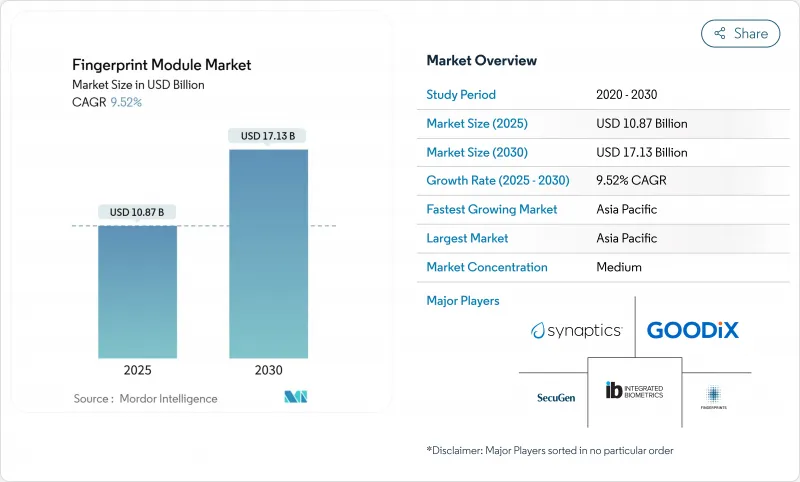

预计到 2025 年,指纹模组市场规模将达到 108.7 亿美元,到 2030 年将达到 171.3 亿美元,复合年增长率为 9.52%。

这一成长动能主要得益于主权数位身分计划、智慧型手机认证技术的快速升级以及生物辨识支付卡的商业化部署。儘管电容式感测器仍占据大部分市场份额,但随着高阶设备对更高防伪性能的需求,超音波技术正以最快的速度扩张。系统晶片(SoC) 整合降低了设备尺寸和物料清单 (BOM) 成本,而屏下模组则有助于推动无边框设备设计。在亚太地区政府专案的大批量采购、平均售价下降以及汽车行业的广泛应用等因素的共同推动下,指纹模组市场保持着多年的成长动能。

全球指纹模组市场趋势与洞察

政府生物辨识身分识别大型企划激增

大规模国家身分识别计画正在重塑基础需求。衣索比亚的「法伊达」(Fayda)计画获得了3.5亿美元的多边资金支持,目标是在2030年前为9,000万人註册。尼日利亚耗资4.3亿美元的数位身分识别计划旨在为超过2亿公民提供全民覆盖。此类合约明确规定使用耐用、长寿命的模组,从而产生多年的持续供货收入。模组的销售远超消费电子设备的周期,确保了供应商的可预测需求,并稳定了整个指纹模组市场的工厂使用率。

智慧型手机与装置端身份验证的爆炸性集成

旗舰和中阶行动电话现在都将指纹生物识别作为标配功能。屏下指纹辨识模组实现了全面屏设计,而超音波单元则透过对皮肤下纹路进行成像来增强安全性。北美和中国的安卓设备製造商正在采用双感应区设计,以加快解锁速度并提高单机平均容量。这一趋势正在推动市场规模的扩大,并迫使供应商在厚度和功耗方面做出更严格的控制。

资料隐私与侵权诉讼风险

基于伊利诺伊州《生物识别资讯隐私法案》(BIPA)等法规的集体诉讼已导致数百万美元的和解金,原因是指纹采集不当,这增加了企业的合规成本。企业买家现在要求设备端储存范本和可撤销的授权流程,这延长了设计週期和监管咨询时间。销售指纹模组解决方案的供应商必须增加加密、安全因素分离和第三方审核,这推高了材料和认证成本。

细分市场分析

超音波辨识器在2025年的收入占比将较小,但成长迅速,预计到2030年将以10.2%的复合年增长率成长,超过所有其他类别。电容式指纹辨识器仍将占据出货量的大部分,到2024年将占指纹模组市场份额的58%。电容式指纹辨识器市场规模的成长得益于低成本安卓手机的普及,而超音波指纹辨识器的应用则与高阶智慧型手机和金融级穿戴装置密切相关。

开发者盛讚超音波技术能够对汗孔和皮下毛细血管结构进行成像,从而避免使用超薄萤幕保护膜和局部污染。高通第三代 3D Sonic 封装技术实现了 Z 轴堆迭高度小于 200 微米,使 OEM 厂商能够实现全萤幕玻璃电容式。电容式感测器不断提升空间分辨率,并将待机功耗降低至 5µA 以下,使其在量贩店行动电话和消费物联网领域保持重要地位。同时,光学模组正被应用于中阶设备中,它们可以重复使用显示引擎的背光,从而降低成本。

到2024年,面积/触控模组将占据61%的市场份额,这主要得益于其在消费性电子设备和企业门锁领域久经考验的可靠性。然而,屏下感测器预计到2030年将以每年11.5%的速度成长,这反映了行动电话製造商竞相开发无缝OLED面板的趋势。指纹模组市场规模,加上萤幕下方设计,将受益于较高的平均售价,从而弥补单一设备指纹模组密度较低的劣势。

滑动式指纹辨识感应器仍应用于销售点终端和窄边框的加强型手持装置。混合式触控加压力感应技术无需增加机身尺寸即可整合到机壳,从而提升了笔记型电脑厂商对该技术的品牌吸引力。多种感测器类型的结合凸显了指纹识别模组产业向隐形生物识别的转变,这与工业设计目标相契合。

区域分析

亚太地区拥有全球最大的生产基地和最大的部署计划,预计2024年将占据全球41%的市场份额,到2030年将维持9.8%的复合年增长率。中国行动电话OEM生态系统每月吸收数千万个感测器,而印度的「数位之旅」(Digi Yatra)计画的扩展和机场电子闸门竞标正在推动国内民用需求的成长。东协致力于建造可互通的数位公共基础设施,这正在协调相关标准,使供应商能够跨多个司法管辖区交付通用模组。

北美市场呈现出成熟且前景良好的态势:手机更换週期、可穿戴设备升级以及企业安全措施的维修,共同支撑着市场销量的稳定;而日益严格的隐私保护法规,则促使消费者倾向于选择设备端模板存储,从而推高了平均售价。指纹模组市场持续受惠于美国汽车生物辨识技术的发展,而北卡罗来纳州石英矿停产事件威胁到晶圆生产后,高端品牌纷纷转向在地采购采购,以避免供应链风险。

欧洲正凭藉符合GDPR的国家电子识别计画和银行主导的生物辨识卡的推出,稳步推进电子身分识别。中东和非洲的潜在需求正日益凸显,例如喀麦隆计划在2025年根据一项为期15年的特许经营推出生物识别卡,这些项目都属于国家识别计划。随着智慧型手机在中产阶级的普及以及各国政府对社会福利发放平台的现代化改造,南美洲也呈现出逐步成长的趋势,但宏观经济波动正在延长采购週期。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府生物辨识身分识别大型企划激增

- 智慧型手机与装置端身份验证的爆炸性集成

- 电容式和光模组平均售价下降推动了其普及

- 汽车和智慧型枪支製造商都采用了指纹启动/触发模组。

- 生物辨识支付卡进入大规模发行阶段

- 市场限制

- 资料隐私和资料外洩诉讼风险

- 后疫情时代,人们对触摸感应器的卫生担忧日益加剧

- MEMS/ IC封装产能紧张限制了供应弹性。

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模与成长预测

- 依技术

- 光学的

- 电容式

- 超音波

- 热

- 频谱

- 依感测器类型

- 区域/触摸

- 滑动

- 在显示幕上

- 混合/组合

- 按外形规格

- 独立模组

- 系统晶片(SoC) 集成

- 嵌入式ASIC/板级

- 按最终用户产业

- 政府和执法部门

- 消费性电子产品

- BFSI

- 卫生保健

- 航空

- 车

- 智慧家庭和物联网

- 其他行业

- 透过使用

- 身分和存取管理

- 支付和交易认证

- 考勤管理

- 边境和移民管制

- 解锁装置

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- APAC

- 中国

- 日本

- 韩国

- 印度

- 澳洲和纽西兰

- ASEAN-5

- 亚太地区的其他国家

- 中东和非洲

- 中东

- UAE

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Fingerprint Cards AB

- GOODIX Technology Inc.

- Synaptics Incorporated

- Integrated Biometrics LLC

- SecuGen Corporation

- HID Global Corporation

- Qualcomm Technologies Inc.

- Suprema Inc.

- Apple Inc.

- NITGEN Co., Ltd.

- NEC Corporation

- NEXT Biometrics ASA

- Anviz Global

- IDEMIA France SAS

- Thales Group

- Egis Technology Inc.

- IDEX Biometrics ASA

- Infineon Technologies AG

- Samsung Electronics Co., Ltd.

- ZKTeco Co., Ltd.

- Precise Biometrics AB

- Shenzhen SYNOCHEM Microelectronics

第七章 市场机会与未来展望

The fingerprint module market size is valued at USD 10.87 billion in 2025 and is forecast to reach USD 17.13 billion by 2030, reflecting a 9.52% CAGR.

Momentum stems from sovereign digital-identity projects, rapid smartphone authentication upgrades, and the commercial roll-out of biometric payment cards. Capacitive sensors still dominate volume demand, yet ultrasonic technology is expanding fastest as premium devices seek higher spoof-resistance. System-on-chip (SoC) integration is shrinking footprint and bill-of-materials costs, while in-display modules underpin the push for bezel-less handset designs. Volume procurement for Asia-Pacific government programs, falling average selling prices, and automotive adoption together keep the fingerprint module market on a multi-year growth arc.

Global Fingerprint Module Market Trends and Insights

Government Biometric ID Megaprojects Surge

Large-scale national identity programs are rewriting baseline demand. Ethiopia's Fayda scheme targets 90 million registrations by 2030, backed by USD 350 million in multilateral funding.Nigeria's USD 430 million digital ID project pursues universal coverage for more than 200 million citizens. Such contracts specify robust, long-life modules and create multi-year replenishment revenue. The volume sheerly outstrips consumer-device cycles, ensuring predictable pull for suppliers and stabilizing factory utilization across the fingerprint module market.

Explosive Smartphone Integration for On-Device Authentication

Flagship and mid-tier handsets now treat fingerprint biometrics as baseline functionality. Under-display modules permit full-screen designs, while ultrasonic units lift security by imaging sub-epidermal ridges. Android handset makers in North America and China have embedded dual sensing zones to quicken unlock speed, raising average content per device. This trend expands addressable volume and pressures suppliers to meet tighter thickness and power-budget envelopes.

Data-Privacy & Breach Litigation Risk

Class actions under statutes such as Illinois' BIPA have generated multimillion-dollar settlements for improper fingerprint capture, raising compliance overheads for enterprises. Corporate buyers now demand on-device template storage and revocable consent flows, extending design-in cycles and regulatory consultations. Vendors marketing the fingerprint module market solutions must add encryption, secure-element isolation, and third-party audits, which inflate the bill-of-materials and certification costs.

Other drivers and restraints analyzed in the detailed report include:

- Falling ASP of Capacitive & Optical Modules Broadens Adoption

- Biometric Payment Cards Reach Mass-Issuance Stage

- Hygiene Backlash on Touch Sensors in Post-Pandemic Settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ultrasonic units contributed a minor yet fast-advancing slice of 2025 revenue and should expand at 10.2% CAGR to 2030, outpacing all other categories. Capacitive solutions still delivered the bulk of shipments, anchoring 58% fingerprint module market share in 2024. The fingerprint module market size for capacitive sensors rose on the back of low-cost Android models, whereas ultrasonic adoption correlated with premium ASP smartphones and finance-grade wearables.

Developers prize ultrasonic technology for its capacity to image sweat pores and sub-dermal capillary structures, defeating thin-film screen protectors and partial contaminants. Qualcomm's third-generation 3D Sonic packages achieve sub-200-micron Z-stack height, freeing OEMs to pursue edge-to-edge glass builds. Capacitive incumbents continue to raise spatial resolution and cut idle power below 5 µA, preserving relevance in mass-market phones and consumer IoT. Optical modules, meanwhile, land in mid-tier devices where backlighting can be reused from display engines to trim costs.

Area/touch modules accounted for 61% of 2024 due to proven reliability across consumer devices and enterprise door locks. Nonetheless, in-display sensors are forecast to climb 11.5% annually to 2030, reflecting handset makers' race for uninterrupted OLED panels. The fingerprint module market size linked to in-display designs will benefit from premium ASPs, offsetting lower density per handset.

Swipe sensors linger in point-of-sale terminals and rugged handhelds where narrow bezels remain. Hybrid touch-plus-pressure packages are gaining brand traction among notebook PC vendors, enabling palm-rest integration without enlarging the chassis. The sensor-type mix underlines the fingerprint module industry shift toward invisible biometrics that harmonize with industrial design goals.

The Fingerprint Module Market is Segmented by Technology (Optical, Capacitive, Ultrasonic, and More), Sensor Type (Area/Touch, Swipe, and More), Form Factor (Stand-Alone Module, System-On-Chip Integrated, and More), End-User Industry (Government and Law Enforcement, Consumer Electronics, and More), Application (Identity and Access Management, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific combined the world's biggest production basin with the largest deployment programs, holding 41% market share in 2024 and tracking a 9.8% CAGR to 2030. China's handset OEM ecosystem absorbs tens of millions of sensors monthly, while India's Digi Yatra expansion and airport e-gate tenders elevate domestic civil demand. ASEAN's commitment to interoperable digital public infrastructure harmonizes standards, letting suppliers ship common module footprints across multiple jurisdictions.

North America shows mature yet lucrative conditions: handset replacement cycles, wearables upgrades, and enterprise security retrofits keep volumes stable, whereas stringent privacy legislation prompts buyers to favor on-device template storage, lifting ASPs. The fingerprint module market continues to profit from U.S. automotive biometrics, where luxury brands localize sourcing to hedge supply-chain risk after North Carolina quartz mine disruptions threatened wafer output.

Europe advances on the back of GDPR-aligned national e-ID plans and bank-driven biometric card launches. Middle East & Africa's latent demand crystallizes in national ID projects such as Cameroon's 2025 biometric card roll-out under a 15-year concession. South America provides incremental gains as smartphones penetrate mid-income cohorts and governments modernize social-benefits disbursement platforms, though macro volatility elongates procurement cycles.

- Fingerprint Cards AB

- GOODIX Technology Inc.

- Synaptics Incorporated

- Integrated Biometrics LLC

- SecuGen Corporation

- HID Global Corporation

- Qualcomm Technologies Inc.

- Suprema Inc.

- Apple Inc.

- NITGEN Co., Ltd.

- NEC Corporation

- NEXT Biometrics ASA

- Anviz Global

- IDEMIA France SAS

- Thales Group

- Egis Technology Inc.

- IDEX Biometrics ASA

- Infineon Technologies AG

- Samsung Electronics Co., Ltd.

- ZKTeco Co., Ltd.

- Precise Biometrics AB

- Shenzhen SYNOCHEM Microelectronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government biometric ID megaprojects surge

- 4.2.2 Explosive smartphone integration for on-device authentication

- 4.2.3 Falling ASP of capacitive and optical modules broadens adoption

- 4.2.4 Automotive and smart-gun makers embed fingerprint start/trigger modules

- 4.2.5 Biometric payment cards reach mass-issuance stage

- 4.3 Market Restraints

- 4.3.1 Data-privacy and breach litigation risk

- 4.3.2 Hygiene backlash on touch sensors in post-pandemic settings

- 4.3.3 Tight MEMS / IC packaging capacity limits supply elasticity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Optical

- 5.1.2 Capacitive

- 5.1.3 Ultrasonic

- 5.1.4 Thermal

- 5.1.5 Multispectral

- 5.2 By Sensor Type

- 5.2.1 Area/Touch

- 5.2.2 Swipe

- 5.2.3 In-display

- 5.2.4 Hybrid/Combo

- 5.3 By Form Factor

- 5.3.1 Stand-alone Module

- 5.3.2 System-on-Chip (SoC) Integrated

- 5.3.3 Embedded ASIC/Board-level

- 5.4 By End-user Industry

- 5.4.1 Government and Law Enforcement

- 5.4.2 Consumer Electronics

- 5.4.3 BFSI

- 5.4.4 Healthcare

- 5.4.5 Aviation

- 5.4.6 Automotive

- 5.4.7 Smart Home and IoT

- 5.4.8 Other Industrial

- 5.5 By Application

- 5.5.1 Identity and Access Management

- 5.5.2 Payment and Transaction Authentication

- 5.5.3 Time and Attendance

- 5.5.4 Border Control and Immigration

- 5.5.5 Device Unlocking

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 ASEAN-5

- 5.6.4.7 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 UAE

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Kenya

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fingerprint Cards AB

- 6.4.2 GOODIX Technology Inc.

- 6.4.3 Synaptics Incorporated

- 6.4.4 Integrated Biometrics LLC

- 6.4.5 SecuGen Corporation

- 6.4.6 HID Global Corporation

- 6.4.7 Qualcomm Technologies Inc.

- 6.4.8 Suprema Inc.

- 6.4.9 Apple Inc.

- 6.4.10 NITGEN Co., Ltd.

- 6.4.11 NEC Corporation

- 6.4.12 NEXT Biometrics ASA

- 6.4.13 Anviz Global

- 6.4.14 IDEMIA France SAS

- 6.4.15 Thales Group

- 6.4.16 Egis Technology Inc.

- 6.4.17 IDEX Biometrics ASA

- 6.4.18 Infineon Technologies AG

- 6.4.19 Samsung Electronics Co., Ltd.

- 6.4.20 ZKTeco Co., Ltd.

- 6.4.21 Precise Biometrics AB

- 6.4.22 Shenzhen SYNOCHEM Microelectronics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment