|

市场调查报告书

商品编码

1846179

线对基板连接器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Wire-to-Board Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

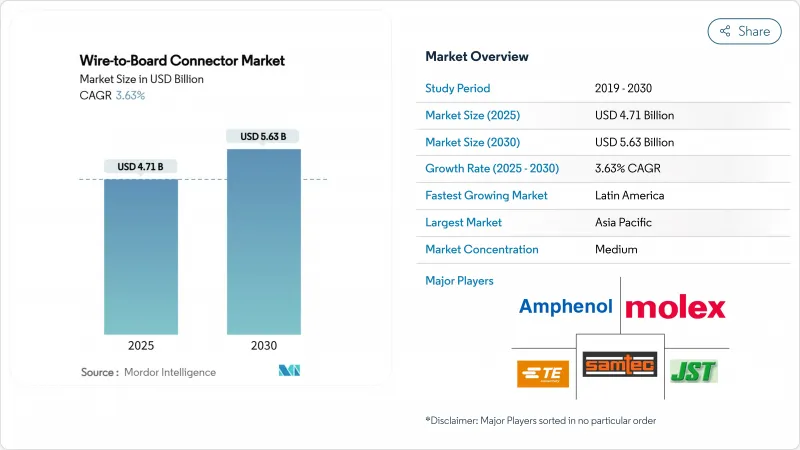

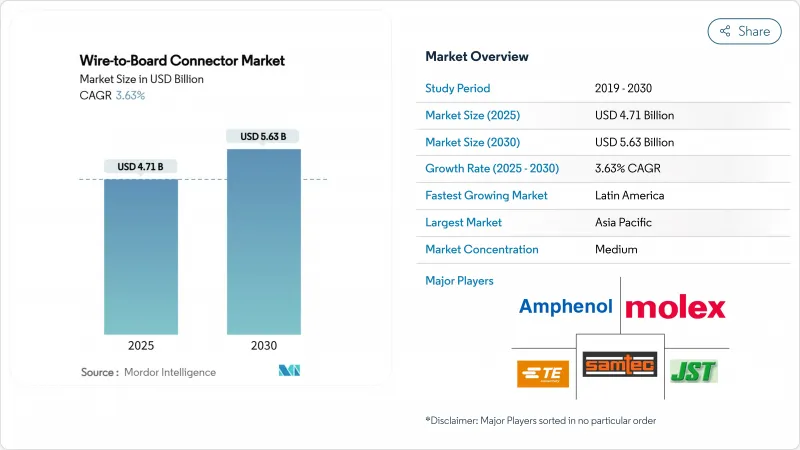

预计到 2025 年,线对基板连接器市场规模将达到 47.1 亿美元,到 2030 年将达到 56.3 亿美元,预测期内复合年增长率为 3.63%。

电动车、小型消费性电子产品、工厂自动化升级以及低地球轨道卫星的需求不断增长,推动了产业的稳定扩张。 2024年上半年订单成长7.0%,营收成长2.7%,证实了儘管面临供应链压力,该产业依然保持韧性。表面黏着技术自动化、2mm以下间距晶片的应用以及6A以上高电流设计持续影响着产品蓝图。亚太地区继续保持其製造业主导,而拉丁美洲已成为成长最快的地区。在竞争方面,现有企业依靠小型化和散热技术而非价格优势来捍卫自身地位,而诸如TE Connectivity以23亿美元收购Richards Manufacturing等选择性收购则表明行业整合仍在继续。

全球线对基板连接器市场趋势及洞察

亚洲超小型穿戴装置推动了对小于2毫米间距元件的需求。

随着健身追踪器和智慧型手錶对尺寸的要求越来越小,尺寸在 2 毫米或以下的连接器目前占据了出货量的绝大部分。 Molex 的 0.175 毫米间距系列展示了交错接点如何克服焊接的限制,同时保持 0.35 毫米的垫片间距。金属射出成型支援高精度超紧凑型外壳的大批量生产。亚太地区的製造商正在集中生产必要的模具,从而巩固其在该地区的领先地位。随着外形规格的不断缩小,多学科团队也同时解决讯号完整性和电磁干扰问题。

电动车电池管理系统(BMS)的快速普及推动了高电流连接器的发展

电动车电池组中的电池管理系统越来越多地采用6A以上的连接器,这是线对基板连接器市场中成长最快的电流等级。 TE Connectivity的HC-Stak连接器可将端子尺寸缩小高达30%,并支援铝线,有助于降低车辆重量。诸如Penn Engineering的ECCB等专用套管即使在铝氧化的情况下也能保持低电阻。中国、欧洲和北美电动车数量的不断增长形成了需求丛集,从而影响了供应商的布局。

缩小基板尺寸限制了垫片的使用

小于 0.4 毫米的连接器垫片对拾取和放置精度提出了挑战,推高了返工成本,并抑制了近期增长。高密度布局会增加串扰和热热点,需要使用昂贵的高 Tg 层压板,抵消了成本优势。较低的产量比率导致一些原始设备製造商 (OEM) 推迟下一代布局的推出,直到组装升级完成。

细分市场分析

2024年,尺寸小于2毫米的连接器将占总收入的48%,推动线对基板连接器市场小型化浪潮。随着智慧型手机、穿戴式音讯设备和植入电路板尺寸的持续缩小,到2030年,该细分市场将以3.7%的复合年增长率成长。 2.1-4毫米尺寸的连接器对于汽车模组仍然至关重要,因为在这些应用中,机械强度比尺寸更重要。尺寸大于4毫米的产品主要满足特定的高电流需求,但其市占率将稳定下降。

80µm间距、电阻值低于50mΩ的触点原型测试表明,未来将出现颠覆性变革。在亚太地区的晶圆厂,小于2mm的模具已成为标准配置,进一步巩固了该地区的市场主导地位。随着间距的减小,设计人员必须协同优化讯号完整性、散热性能和插入力,这使得线对基板连接器市场的这一细分领域成为跨学科合作的中心。

到2024年,表面黏着技术连接器将占总收入的57.3%,这反映了消费性电子和工业应用领域自动化程度的提高。自动化贴片技术降低了每个焊点的成本,并减少了PCB钻孔,从而推动了3.6%的复合年增长率。通孔在电力电子领域仍然非常重要,较大的焊锡槽可以改善散热和抗衝击性。

由于相邻元件会阻碍操作,高密度表面黏着技术基板的重工成本很高。 IPC/WHMA-A-620 标准要求更严格的製程窗口,许多传统生产线难以满足这些要求。虽然亚太地区拥有最强大的表面黏着技术基础设施,但一些北美工厂仍倾向于采用通孔技术,以实现线对基板连接器市场的稳健组装。

区域分析

亚太地区预计到2024年将占全球收入的46.7%,这主要得益于中国、日本和韩国PCB和最终组装能的集中。激励措施正在推动印度建立新的製造地,扩大该地区的市场份额。东南亚国家在半导体封装领域处于领先地位,并将高密度连接器纳入区域供应链。这些基本面将使线对基板连接器市场在整个预测期内牢牢扎根于该地区。

北美地区主要包括墨西哥的汽车组装、美国的先进航太、医疗设备出口。儘管製造业回流计画和倡议的影响正促使部分连接器生产线从亚洲迁回北美,但成本差异仍然存在。加拿大矿业设备产业也为加固型线对基板连接器市场贡献了一部分需求。

欧洲正将连接器创新与电动车动力系统的推广和工业4.0升级结合。德国在汽车高电流连接器开发方面处于领先地位,而北欧公用事业公司则将连接器整合到风力发电和网格储存资产中。严格的RoHS和REACH指令正促使全球供应商采用符合规定的化学品。拉丁美洲的复合年增长率(CAGR)高达5.2%,位居全球之首,这主要得益于巴西汽车产业的成长。中东和非洲的小型太阳能微电网计划正在提升其全球影响力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲超小型穿戴装置推动了对小于2毫米间距元件的需求。

- 电动车电池管理系统(BMS)的快速普及推动了高电流WTB连接器的发展

- 棕地工厂自动化维修推动感测器连接器更新

- 建造需要抗震连接器的低地球卫星星系

- 开放式运算伺服器设计迁移到更快的夹层 WTB 格式

- 扩大低成本微型WTB、一次性医用抛弃式(单次使用内视镜)的数量

- 市场限制

- PCB 安装面积的减少导致连接器焊盘尺寸被限制在 0.4 毫米以下。

- 引擎室内环境温度超过 125°C 时,焊点可靠性令人担忧

- 贸易战关税推高了美国进口商的物料清单价格。

- 高密度连接器供应链仿冒风险

- 生态系分析

- 监理与技术展望

- RoHS/REACH材料趋势

- 技术概览 - 112Gbps PAM4 和 0.175mm 间距蓝图

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模及成长预测(金额)

- 按间距大小

- 2毫米或更小

- 2.1~4 mm

- 4毫米或以上

- 按安装类型

- 表面黏着技术

- 通孔

- 按额定电流

- 小于1A

- 1.1A~3A

- 3.1A~6A

- 6A 或以上

- 按方向

- 垂直的

- 直角

- 按最终用户产业

- 消费性电子产品

- 资讯科技/通讯

- 车

- 工业自动化

- 航太/国防

- 医疗设备

- 其他(能源、照明)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 其他南美

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 其他亚太地区

- 中东和非洲

- 中东

- 波湾合作理事会成员国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- TE Connectivity Ltd.

- Molex LLC

- Amphenol ICC(Amphenol Corp.)

- JST Mfg. Co. Ltd.

- Samtec Inc.

- Hirose Electric Co. Ltd.

- Harting Technology Group

- Phoenix Contact GmbH and Co. KG

- Wago Kontakttechnik GmbH and Co. KG

- ERNI Deutschland GmbH

- Kyocera-AVX Components

- Wurth Elektronik GmbH and Co. KG

- Yazaki Corp.

- Luxshare Precision

- Foxconn Interconnect Technology

- JAE Electronics Inc.

- LEMO SA

- Harwin Plc

- Global Connector Technology(GCT)

- Omron Electronic Components

- Shenzhen Deren Electronics

第七章 市场机会与未来展望

The wire-to-board connector market size stands at USD 4.71 billion in 2025 and is projected to reach USD 5.63 billion by 2030, reflecting a 3.63% CAGR over the forecast period.

Steady expansion stems from rising demand in electric vehicles (EVs), compact consumer devices, factory automation upgrades, and low-earth-orbit (LEO) satellites. Order growth of 7.0% and sales growth of 2.7% in 1H-2024 confirmed the industry's resilience despite supply-chain pressures. Surface-mount automation, sub-2 mm pitch adoption, and higher-current designs above 6 A continue to shape product roadmaps. Asia-Pacific retains manufacturing leadership while Latin America emerges as the fastest-growing region. On the competitive front, incumbents rely on miniaturization and thermal know-how rather than price to defend positions, and selective acquisitions such as TE Connectivity's USD 2.3 billion purchase of Richards Manufacturing signal ongoing consolidation.

Global Wire-to-Board Connector Market Trends and Insights

Ultra-compact Wearables Driving Sub-2 mm Pitch Demand in Asia

Sub-2 mm connectors now dominate shipments because fitness trackers and smartwatches require ever-smaller footprints. Molex's 0.175 mm pitch range illustrates how staggered contacts overcome soldering limits while keeping 0.35 mm pads. Metal Injection Molding supports mass production of microminiature housings with tight tolerances. Asia-Pacific manufacturers concentrate the necessary tooling, reinforcing the region's lead. As form factors shrink, cross-disciplinary teams address signal integrity and electromagnetic interference concurrently.

Rapid EV-Battery BMS Adoption Boosting High-Current Connectors

Battery management systems in EV packs increasingly specify connectors above 6 A, the fastest-growing current class of the wire-to-board connector market. TE Connectivity's HC-Stak cuts terminal size by up to 30% and supports aluminum cabling, easing vehicle mass targets. Specialized bushings such as PennEngineering's ECCB maintain low resistance despite aluminum oxidation. Rising EV volumes in China, Europe, and North America create demand clusters that influence supplier footprints.

PCB Real-Estate Shrink Limiting Landing Pads

Connector pads under 0.4 mm challenge pick-and-place accuracy and raise rework costs, depressing short-term growth. Denser layouts heighten crosstalk and thermal hotspots, forcing expensive high-Tg laminates that erode savings. Yield drops prompt some OEMs to delay next-gen layouts until assembly lines upgrade.

Other drivers and restraints analyzed in the detailed report include:

- Automation Retrofits in Brownfield Factories Raising Sensor Refresh

- LEO-Satellite Constellations Requiring Vibration-Resistant Connectors

- Solder-Joint Reliability at >125 °C Under-Hood

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sub-2 mm connectors captured 48% of 2024 revenue and anchor the wire-to-board connector market's miniaturization wave. The segment expands at a 3.7% CAGR to 2030 as smartphones, hearables, and implantables shrink boards further. The 2.1-4 mm class remains essential in automotive modules where mechanical robustness trumps size. Above-4 mm products cater to specialized high-current needs but steadily lose share.

Research prototyping 80 µm pitch contacts with <50 mΩ resistance hints at future disruption. Asia-Pacific fabs house most sub-2 mm tooling, reinforcing regional dominance. Designers must co-optimize signal integrity, thermal spread, and insertion force as pitches fall, making this slice of the wire-to-board connector market a nexus for cross-discipline collaboration.

Surface-mount connectors owned 57.3% of 2024 sales, reflecting automation's pull across consumer and industrial lines. Automated pick-and-place lowers cost per joint and limits PCB drilling, supporting a 3.6% CAGR. Through-hole remains critical for power electronics, where larger solder barrels aid heat dissipation and shock resistance.

Rework on dense surface-mount boards is costly because neighboring components block access. IPC/WHMA-A-620 calls for tighter process windows that many legacy lines struggle to meet. Asia-Pacific maintains the strongest surface-mount infrastructure, whereas some North American facilities still favor through-hole for rugged assemblies in the wire-to-board connector market.

The Wire-To-Board Connector Market Report is Segmented by Pitch Size (Up To 2 Mm, 2. 1 To 4 Mm, Above 4 Mm), Mounting Type (Surface-Mount, and Through-Hole), Current Rating (Up To 1 A, 1. 1 A To 3 A, and More), Orientation (Vertical, and Right-Angle), End-User Vertical (Consumer Electronics, IT and Telecommunication, Automotive, Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 46.7% of 2024 turnover owing to clustered PCB and final-assembly capacity in China, Japan, and South Korea. Incentives draw supplementary builds to India, widening the regional base. Southeast Asian nations lead semiconductor packaging, pulling high-density connectors into local supply chains. These fundamentals keep the wire-to-board connector market firmly anchored in the region for the forecast horizon.

North America combines automotive assembly in Mexico, advanced aerospace in the United States, and medical device exports across the zone. Reshoring initiatives and tariff exposure are nudging selected connector lines back from Asia, yet cost gaps persist. Canada's mining equipment sector adds pockets of demand for ruggedized variants of the wire-to-board connector market.

Europe aligns connector innovation with EV drivetrain rollouts and Industrie 4.0 upgrades. Germany spearheads high-current development for vehicles, while Nordic utilities integrate connectors into wind and grid-storage assets. Strict RoHS and REACH mandates drive global suppliers to adopt compliant chemistries. Latin America, led by Brazil's automotive growth, posts the fastest 5.2% CAGR as OEMs deepen local content to buffer currency risk. Small but rising African and Middle-Eastern projects in solar micro-grids round out global exposure.

- TE Connectivity Ltd.

- Molex LLC

- Amphenol ICC (Amphenol Corp.)

- J.S.T. Mfg. Co. Ltd.

- Samtec Inc.

- Hirose Electric Co. Ltd.

- Harting Technology Group

- Phoenix Contact GmbH and Co. KG

- Wago Kontakttechnik GmbH and Co. KG

- ERNI Deutschland GmbH

- Kyocera-AVX Components

- Wurth Elektronik GmbH and Co. KG

- Yazaki Corp.

- Luxshare Precision

- Foxconn Interconnect Technology

- JAE Electronics Inc.

- LEMO SA

- Harwin Plc

- Global Connector Technology (GCT)

- Omron Electronic Components

- Shenzhen Deren Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ultra-compact wearables driving sub-2 mm pitch demand in Asia

- 4.2.2 Rapid EV-battery BMS adoption boosting high-current WTB connectors

- 4.2.3 Automation retrofits in brownfield factories raising sensor-connector refresh

- 4.2.4 LEO-satellite constellation build-outs requiring vibration-resistant connectors

- 4.2.5 Open-compute server designs shifting to higher-speed mezzanine WTB formats

- 4.2.6 Medical disposables (single-use endoscopes) scaling volumes of low-cost micro-WTB

- 4.3 Market Restraints

- 4.3.1 PCB real-estate shrink limiting connector landing padsLess than 0.4 mm

- 4.3.2 Solder-joint reliability concerns at Above 125 °C under-hood environments

- 4.3.3 Trade-war tariffs inflating BOM pricing for U S importers

- 4.3.4 Supply-chain counterfeit risk for high-density connectors

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Materials RoHS/REACH compliance trends

- 4.5.2 Technology Snapshot - 112 Gbps PAM4 and 0.175 mm pitch road-maps

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Pitch Size

- 5.1.1 Upto 2 mm

- 5.1.2 2.1 - 4 mm

- 5.1.3 Above 4 mm

- 5.2 By Mounting Type

- 5.2.1 Surface-Mount

- 5.2.2 Through-Hole

- 5.3 By Current Rating

- 5.3.1 Up to 1 A

- 5.3.2 1.1 A - 3 A

- 5.3.3 3.1 A - 6 A

- 5.3.4 Above 6 A

- 5.4 By Orientation

- 5.4.1 Vertical

- 5.4.2 Right-angle

- 5.5 By End-User Vertical

- 5.5.1 Consumer Electronics

- 5.5.2 IT and Telecommunication

- 5.5.3 Automotive

- 5.5.4 Industrial Automation

- 5.5.5 Aerospace and Defense

- 5.5.6 Medical Devices

- 5.5.7 Others (Energy, Lighting)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TE Connectivity Ltd.

- 6.4.2 Molex LLC

- 6.4.3 Amphenol ICC (Amphenol Corp.)

- 6.4.4 J.S.T. Mfg. Co. Ltd.

- 6.4.5 Samtec Inc.

- 6.4.6 Hirose Electric Co. Ltd.

- 6.4.7 Harting Technology Group

- 6.4.8 Phoenix Contact GmbH and Co. KG

- 6.4.9 Wago Kontakttechnik GmbH and Co. KG

- 6.4.10 ERNI Deutschland GmbH

- 6.4.11 Kyocera-AVX Components

- 6.4.12 Wurth Elektronik GmbH and Co. KG

- 6.4.13 Yazaki Corp.

- 6.4.14 Luxshare Precision

- 6.4.15 Foxconn Interconnect Technology

- 6.4.16 JAE Electronics Inc.

- 6.4.17 LEMO SA

- 6.4.18 Harwin Plc

- 6.4.19 Global Connector Technology (GCT)

- 6.4.20 Omron Electronic Components

- 6.4.21 Shenzhen Deren Electronics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment